Market Overview:

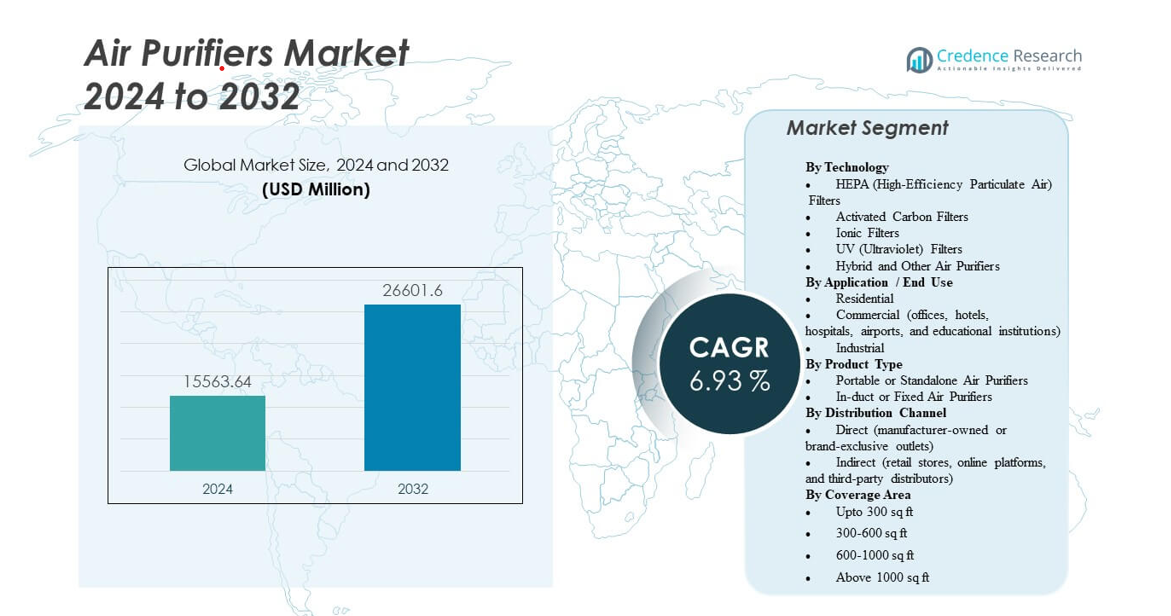

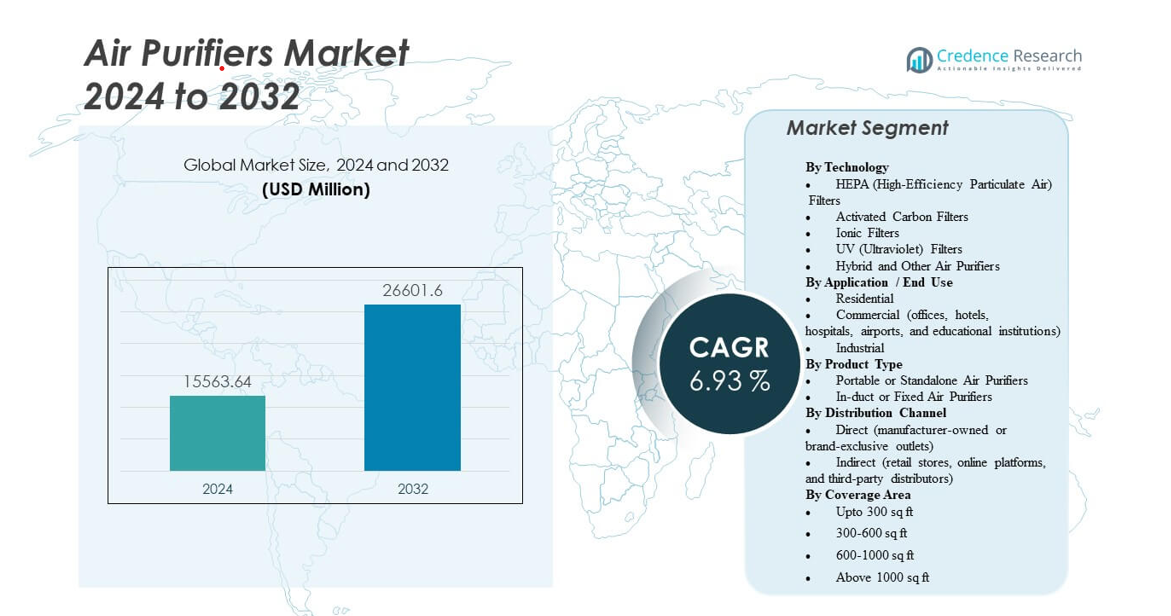

The Air Purifiers Market is projected to grow from USD 15,563.64 million in 2024 to an estimated USD 26,601.6 million by 2032, with a compound annual growth rate (CAGR) of 6.93% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Purifiers Market Size 2024 |

USD 15,563.64 million |

| Air Purifiers Market, CAGR |

6.93% |

| Air Purifiers Market Size 2032 |

USD 26,601.6 million |

The market growth is driven by rising health concerns linked to air pollution, growing urbanization, and an increase in airborne diseases. Consumers are prioritizing clean indoor air, encouraging the use of advanced air purifiers with HEPA and activated carbon filters. The introduction of smart, energy-efficient models with real-time monitoring is boosting product adoption across residential, commercial, and industrial applications. It also benefits from stricter environmental regulations and awareness campaigns promoting cleaner air solutions.

Asia Pacific leads the market due to high pollution levels, population density, and growing middle-class income in countries like China, India, and Japan. North America follows with strong adoption of smart and premium models. Europe shows steady growth supported by environmental regulations, while Latin America and the Middle East are emerging markets with increasing awareness of health and air quality improvement.

Market Insights:

- The Air Purifiers Market is projected to grow from USD 15,563.64 million in 2024 to USD 26,601.6 million by 2032, at a CAGR of 6.93%.

- Growing health awareness and rising pollution levels are fueling strong demand for air purification systems globally.

- Urbanization and lifestyle changes are increasing adoption across residential and commercial sectors.

- High product and maintenance costs remain key restraints limiting widespread consumer adoption.

- Technological advancements such as smart sensors and IoT connectivity are driving product innovation.

- Asia Pacific leads the global market, supported by dense populations and poor air quality levels.

- Emerging regions in Latin America and the Middle East are witnessing rising awareness of indoor air quality.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Awareness of Indoor Air Quality and Health Protection

The growing awareness of indoor air pollution and its health effects is a major driver for the Air Purifiers Market. Urban populations face increased exposure to allergens, smoke, and volatile organic compounds. Consumers are becoming more conscious of chronic respiratory diseases such as asthma and COPD. Demand for home and workplace purification solutions has grown due to health-focused lifestyles. It benefits from public health campaigns and environmental programs encouraging clean air initiatives. Manufacturers are improving filter technology to meet higher consumer standards. Air purifiers with HEPA and activated carbon filters are gaining strong traction. Awareness of air quality monitoring apps and IoT integration further enhances product adoption.

Government Regulations and Environmental Policies Encouraging Cleaner Living Spaces

Strict regulations on indoor air quality standards are driving widespread product demand. Governments in developed and emerging nations have launched programs promoting healthier living environments. These policies push manufacturers to meet certified emission and purification criteria. The Air Purifiers Market aligns with these sustainability goals through innovations in eco-friendly and energy-efficient models. Health ministries and urban authorities are also endorsing air purification in public spaces. Manufacturers respond by improving product performance and ensuring regulatory compliance. It leads to improved consumer confidence in product reliability. Continuous policy support creates long-term market stability and innovation potential.

- For instance, Panasonic’s nanoe X Generator Mark 3 air purifiers, certified under European VDI 6022 and Japan’s HACCP International standards, use nanoe X technology with corrosion-resistant titanium electrodes to inhibit airborne and surface bacteria and viruses effectively, offering maintenance-free operation and expanded deployment across global food facility environments in 2024.

Growing Urbanization and Industrial Expansion Increasing Air Pollution Levels

Rapid industrialization and urban growth have significantly degraded air quality in major cities. Increasing emissions from transportation, factories, and construction activities raise particulate matter concentration. This rise in pollutants pushes households and businesses to adopt advanced purification systems. The Air Purifiers Market gains momentum due to rising concern for personal well-being. Governments are introducing emission control initiatives, yet air quality remains a key concern. Rising disposable income in developing economies fuels adoption among middle-class households. It drives companies to diversify product ranges for both high-end and budget-friendly segments. Commercial facilities and healthcare institutions are emerging as major adopters of purification systems.

Technological Advancements and Smart Features Enhancing Consumer Convenience

Integration of smart technologies is reshaping consumer preferences in the market. Modern air purifiers now feature sensors, real-time air quality indicators, and app-based control systems. These innovations enable users to monitor air quality remotely and customize purification levels. The Air Purifiers Market benefits from automation and IoT integration, improving user engagement. Manufacturers are introducing energy-saving modes and noise reduction systems for better comfort. It encourages adoption among tech-savvy consumers seeking convenience and control. The trend also aligns with smart home ecosystem growth in developed regions. Increasing consumer preference for connected appliances supports continued innovation in this field.

- For instance, the Dyson Purifier Big+Quiet Formaldehyde features automatic sensing and smart control that adjusts airflow in real time based on detected pollutant levels, supports remote operation and digital diagnostics, and delivers nearly double the clean air delivery rate per watt compared to earlier Dyson purifier models.

Market Trends

Shift Toward Sustainable and Energy-Efficient Purification Technologies

Consumers increasingly prefer air purifiers designed with low energy consumption and recyclable materials. Companies are adopting sustainable practices by minimizing plastic components and introducing biodegradable filters. The Air Purifiers Market is adapting to stricter global sustainability guidelines through eco-friendly manufacturing. Governments support energy efficiency through incentive programs for certified products. It encourages firms to integrate renewable energy sources into production. Green product labeling boosts brand credibility among environmentally aware buyers. Manufacturers emphasize long product life and minimal carbon footprint to attract eco-conscious users. This shift builds trust and expands consumer reach across mature and emerging regions.

Expansion of Smart and Connected Air Purifiers with IoT Integration

IoT-enabled purifiers allow users to control air quality through smartphones and voice assistants. Real-time monitoring and automatic adjustment features provide higher user satisfaction. The Air Purifiers Market is witnessing strong demand for connected devices across households and offices. Integration with smart home ecosystems enhances comfort and convenience. It helps manufacturers differentiate their offerings in competitive markets. Predictive maintenance features and data analytics improve operational efficiency and lifespan. AI-based solutions detect pollutants and automatically adjust airflow to maintain optimal quality. Connectivity and automation are becoming core product attributes across leading global brands.

- For instance, the Xiaomi Smart Air Purifier 4 Pro includes dual-effect laser sensors that monitor PM2.5 and PM10 levels in real time, achieving a CADR of up to 400 m³/h with 360° air purification coverage, and integrates with Google Assistant and Alexa for seamless smart home control.

Increasing Demand for Compact and Portable Air Purification Devices

Modern consumers seek portable and lightweight air purifiers suitable for personal and travel use. Compact systems are being introduced for small apartments, vehicles, and offices. The Air Purifiers Market benefits from growing interest in flexible and space-efficient designs. Rising work-from-home trends have accelerated demand for personal air treatment systems. It motivates brands to develop USB-powered and rechargeable devices with long battery life. Compact purifiers combine mobility with high filtration capacity, appealing to urban professionals. These models are gaining preference among younger demographics with mobile lifestyles. Manufacturers are focusing on performance consistency and noise control in smaller units.

- For instance, the Philips GoPure GP5212 automotive air purifier uses SelectFilter Plus multi-stage technology to remove up to 90% of airborne pollen, achieving a CADR of 16 m³/hour for PM2.5 pollutants, and is independently certified by Airmid Healthgroup while operating automatically through a 12V car outlet in a compact 1.7 lb design.

Growth of Commercial and Healthcare Applications of Air Purifiers

Commercial spaces such as hospitals, hotels, and educational institutions increasingly rely on air purification. The COVID-19 pandemic raised awareness about the importance of clean air circulation. The Air Purifiers Market is expanding its focus beyond residential use toward large-scale facilities. Air filtration systems now play a vital role in infection prevention and odor control. It supports safer environments for patients, guests, and employees. Advanced models with UV-C sterilization and plasma filters are replacing traditional purifiers. Businesses view clean air as a productivity and safety investment. Rising hygiene standards are reinforcing product demand in commercial infrastructure sectors.

Market Challenges Analysis

High Product and Maintenance Costs Limiting Mass Adoption

High upfront investment continues to hinder widespread adoption across low-income markets. Premium air purifiers with multi-layer filtration systems remain expensive for price-sensitive consumers. The Air Purifiers Market faces resistance in regions where consumers prioritize affordability over technology. Regular filter replacement and maintenance further increase operational expenses. It creates a barrier to ownership among large population segments. Limited awareness of long-term health benefits reduces willingness to spend. Manufacturers face pressure to lower costs without compromising efficiency. Market penetration in rural and semi-urban regions remains limited due to price disparities and maintenance concerns.

Limited Standardization and Lack of Consumer Awareness Affecting Market Growth

Absence of universal performance standards complicates consumer decision-making. Competing brands often use inconsistent certification methods, reducing trust in product claims. The Air Purifiers Market is affected by misinformation regarding filtration performance and air quality levels. Consumers often struggle to differentiate genuine HEPA-certified systems from low-quality imitations. It leads to slower adoption and weaker brand loyalty. Poor awareness of indoor air pollution severity also affects rural markets. Manufacturers and governments must strengthen education campaigns to inform consumers. Standardization across regions would improve transparency, foster trust, and promote long-term market maturity.

Market Opportunities

Growing Demand for Air Purification in Emerging Economies and Public Infrastructure

Expanding urbanization and industrialization are generating new opportunities in developing nations. Countries in Asia, Latin America, and the Middle East are witnessing rising health consciousness. The Air Purifiers Market has significant potential in public buildings, schools, and transport hubs. Governments are integrating air quality improvement into urban development projects. It creates a foundation for large-scale procurement of purification systems. Local manufacturers are forming partnerships with public agencies to increase accessibility. Growing investment in smart city infrastructure supports long-term demand growth. Companies entering these markets early can secure strong brand positioning and distribution networks.

Innovation in Filter Technologies and Hybrid Systems Driving New Product Demand

Technological progress is opening new avenues for product differentiation and value creation. Hybrid purifiers combining HEPA, ionization, and UV-C technologies offer enhanced air sanitation. The Air Purifiers Market benefits from continuous research into self-cleaning and reusable filters. It reduces long-term maintenance costs and enhances product life. Manufacturers are developing AI-driven diagnostic systems for automatic filter replacement alerts. Integration of nanomaterials boosts filtration efficiency and neutralizes microscopic pollutants. Research collaborations between universities and industry players accelerate innovation cycles. Future product designs are likely to focus on energy optimization and improved airflow dynamics.

Market Segmentation Analysis:

By Technology

The Air Purifiers Market is segmented by technology into HEPA filters, activated carbon filters, ionic filters, UV filters, and hybrid variants. HEPA filters dominate due to their proven efficiency in removing fine particulate matter and allergens. Activated carbon filters gain demand for their ability to absorb odors and chemical pollutants. Ionic and UV filters are preferred for sterilization and microbial control in medical and industrial environments. Hybrid systems combining multiple filtration methods are expanding adoption in premium models. It benefits from innovation focused on high efficiency, low maintenance, and quiet operation.

- For instance, the Dyson Purifier Big+Quiet Formaldehyde features a three-stage filtration system with a HEPA H13-grade filter made from 21 meters of borosilicate microfibres pleated 459 times, capturing 99.95% of particles as small as 0.1 microns while operating at only 56 decibels.

By Application / End Use

Applications include residential, commercial, and industrial segments. Residential use leads due to growing consumer health awareness and demand for cleaner indoor environments. Commercial installations are expanding across hotels, hospitals, and offices where air quality standards are critical. The industrial sector adopts advanced purifiers for emission control and employee safety. The Air Purifiers Market caters to these diverse needs through customized filtration systems. It emphasizes energy-efficient solutions suitable for high-traffic spaces. Demand in healthcare and hospitality remains especially strong due to regulatory requirements.

By Product Type

Product segmentation includes portable or standalone air purifiers and in-duct or fixed systems. Portable units dominate due to easy installation, affordability, and suitability for small spaces. In-duct purifiers are gaining traction in commercial and industrial applications requiring continuous air treatment. The Air Purifiers Market continues to evolve with hybrid product designs integrating flexibility and scalability. It focuses on enhancing air delivery rates while reducing operational noise. Both categories are seeing innovation in smart controls and remote monitoring.

- For instance, the Honeywell HPA8350B Professional Series uses a certified True HEPA filter that captures 99.97% of airborne particles as small as 0.3 microns and features Bluetooth Smart v4.0 connectivity for remote control through a mobile app, offering a CADR suitable for rooms up to 465 sq ft with automated scheduling and filter alerts.

By Distribution Channel

Distribution channels are divided into direct and indirect sales. Direct channels include manufacturer-owned outlets and brand stores that provide personalized solutions. Indirect channels such as online retail and third-party distributors drive significant global sales volume. The Air Purifiers Market benefits from growing e-commerce penetration and digital marketing strategies. It enables customers to compare products and reviews before purchase. Online visibility enhances brand reach across price-sensitive regions. Manufacturers also partner with large retailers to strengthen brand accessibility.

By Coverage Area

Coverage area segments include up to 300 sq ft, 300–600 sq ft, 600–1000 sq ft, and above 1000 sq ft. Small coverage models are popular in urban homes and personal spaces. Medium-range purifiers cater to apartments and office rooms with moderate air volume. Large coverage systems serve industrial sites, hospitals, and commercial halls. The Air Purifiers Market addresses each segment through tailored airflow and filter capacity designs. It encourages manufacturers to focus on modular scalability. Rising demand for large-capacity purifiers supports product diversification across multiple end-use environments.

Segmentation:

By Technology

- HEPA (High-Efficiency Particulate Air) Filters

- Activated Carbon Filters

- Ionic Filters

- UV (Ultraviolet) Filters

- Hybrid and Other Air Purifiers

By Application / End Use

- Residential

- Commercial (offices, hotels, hospitals, airports, and educational institutions)

- Industrial

By Product Type

- Portable or Standalone Air Purifiers

- In-duct or Fixed Air Purifiers

By Distribution Channel

- Direct (manufacturer-owned or brand-exclusive outlets)

- Indirect (retail stores, online platforms, and third-party distributors)

By Coverage Area

- Upto 300 sq ft

- 300-600 sq ft

- 600-1000 sq ft

- Above 1000 sq ft

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific dominates the global Air Purifiers Market, accounting for 41% of total revenue share. Rising urbanization, industrial emissions, and poor air quality drive strong consumer adoption in countries such as China, India, Japan, and South Korea. Governments are enforcing stricter environmental regulations and promoting indoor air quality awareness. Rapid expansion of the residential and commercial sectors supports growing sales of both portable and smart air purifiers. It benefits from technological innovation, domestic manufacturing, and affordable pricing models. Increasing disposable income and health-conscious lifestyles strengthen long-term market growth. Regional brands are expanding their presence through partnerships and localized product designs.

North America

North America holds 27% of the Air Purifiers Market share, supported by widespread consumer awareness and strong technology adoption. The United States leads the region due to high indoor pollution levels from heating systems and volatile organic compounds. Commercial buildings, hospitals, and schools are key consumers due to stringent air quality standards. It emphasizes advanced filtration systems such as HEPA and UV-based technologies. The market gains momentum from growing demand for smart, connected air purifiers integrated with home automation. Strong presence of global brands and high purchasing power sustain regional growth. Increasing preference for energy-efficient and certified products reinforces market stability.

Europe and Other Regions

Europe accounts for 20% of the market, with Germany, France, and the United Kingdom leading adoption driven by environmental sustainability initiatives. European consumers favor eco-friendly and low-noise purifiers that meet regional emission standards. It benefits from continuous investment in air quality improvement programs. Latin America and the Middle East & Africa collectively represent 12% share, supported by rising awareness of pollution-related health risks. Industrial development in Brazil, Mexico, and the UAE drives commercial adoption. Expansion of e-commerce platforms enhances accessibility for global brands across these emerging economies. Strengthening healthcare infrastructure further supports long-term opportunities in these developing regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Honeywell International, Inc.

- Daikin Industries, Ltd.

- LG Electronics, Inc.

- Unilever PLC (Blueair)

- Koninklijke Philips N.V.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Whirlpool Corporation

- Sharp Corporation

- IQAir

- Dyson

- Coway Co., Ltd.

- Camfil AB

- Hamilton Beach Brands, Inc.

- Xiaomi Corporation

Competitive Analysis:

The Air Purifiers Market is highly competitive, with leading players focusing on innovation, energy efficiency, and smart connectivity. Major companies such as Honeywell International, Daikin Industries, LG Electronics, Panasonic Corporation, and Koninklijke Philips dominate through advanced filtration and IoT-enabled solutions. It emphasizes continuous R&D to enhance performance and reduce maintenance costs. Emerging brands like Xiaomi and Coway strengthen competition with affordable, tech-driven models targeting urban consumers. Premium brands such as Dyson and Blueair position themselves through design excellence and superior air quality certifications. Industrial specialists like Camfil focus on large-scale filtration for commercial and manufacturing sectors. The market is witnessing strategic collaborations, product diversification, and expansion into untapped regions to gain a competitive edge.

Recent Developments:

- In March 2025, Daikin Industries announced a strategic investment in Poppy, a leader in advanced air technologies, to enhance Daikin’s portfolio and support customers’ decarbonization goals. This partnership focuses on providing intelligent HVAC systems that optimize energy efficiency and indoor air quality, validated by extensive field trials across multiple sectors.

- In February 2025, LG Electronics launched the PuriCare AeroHit, a compact air care solution designed for small living spaces. It features a multi-layer 360-degree Aero Series H Filter capable of reducing dust, odors, viruses, and allergens, and includes a particulate matter sensor detecting ultrafine dust particles as small as 0.01 micrometers. The AeroHit also adjusts purification performance automatically and comes in variants including a pet-friendly model.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application / End Use, Product Type, Distribution Channel and Coverage Area. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising health awareness and pollution levels will continue driving strong residential adoption.

- Integration of AI and IoT will enhance air purifier performance and user control across devices.

- Demand for energy-efficient and eco-friendly models will shape future product innovations.

- Expanding smart home ecosystems will create new opportunities for connected air purification.

- Manufacturers will focus on hybrid filter systems offering multifunctional purification and sterilization.

- Growing urbanization in developing countries will strengthen demand for compact air purifiers.

- Industrial and commercial installations will rise with stricter air quality compliance standards.

- Online retail platforms will expand global accessibility, improving consumer reach and awareness.

- Strategic collaborations and R&D investments will drive technology differentiation among key players.

- Premium air purifiers with advanced features will gain higher traction among health-conscious consumers.