Market Overview:

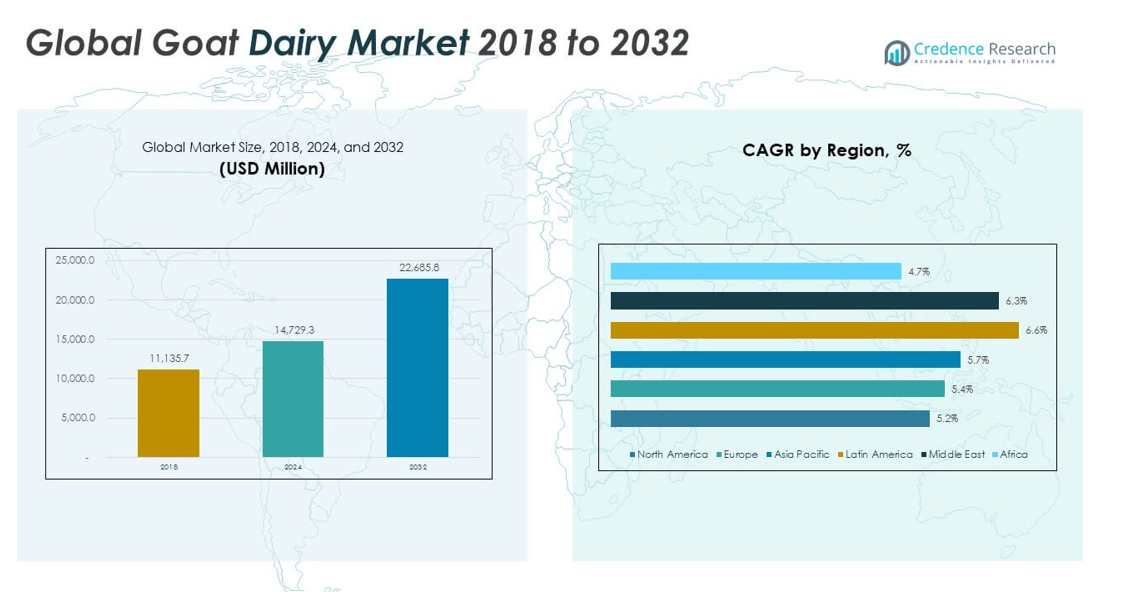

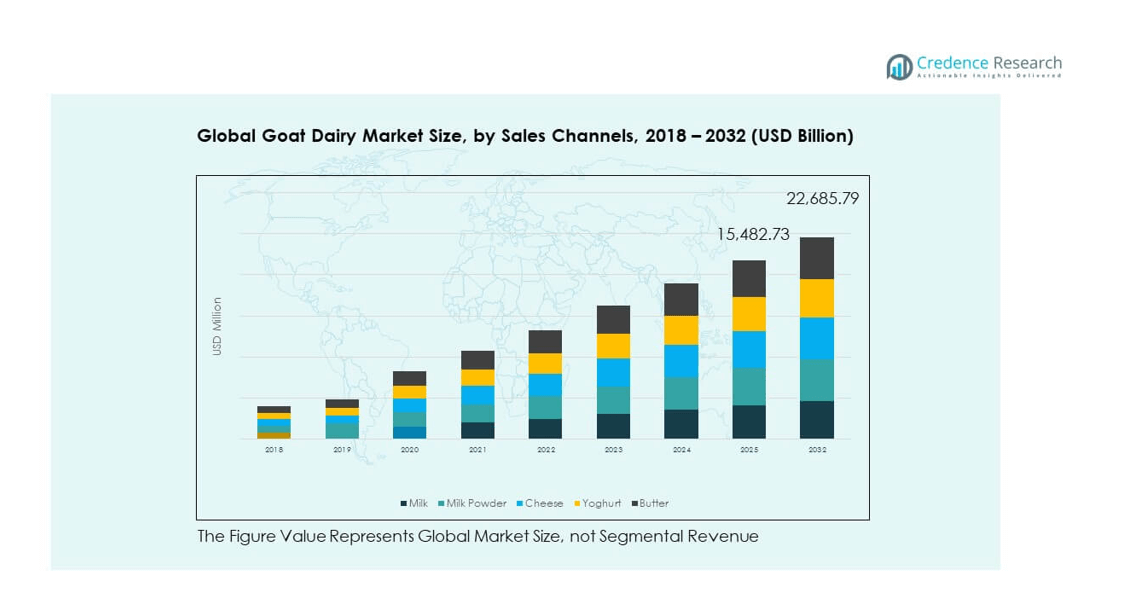

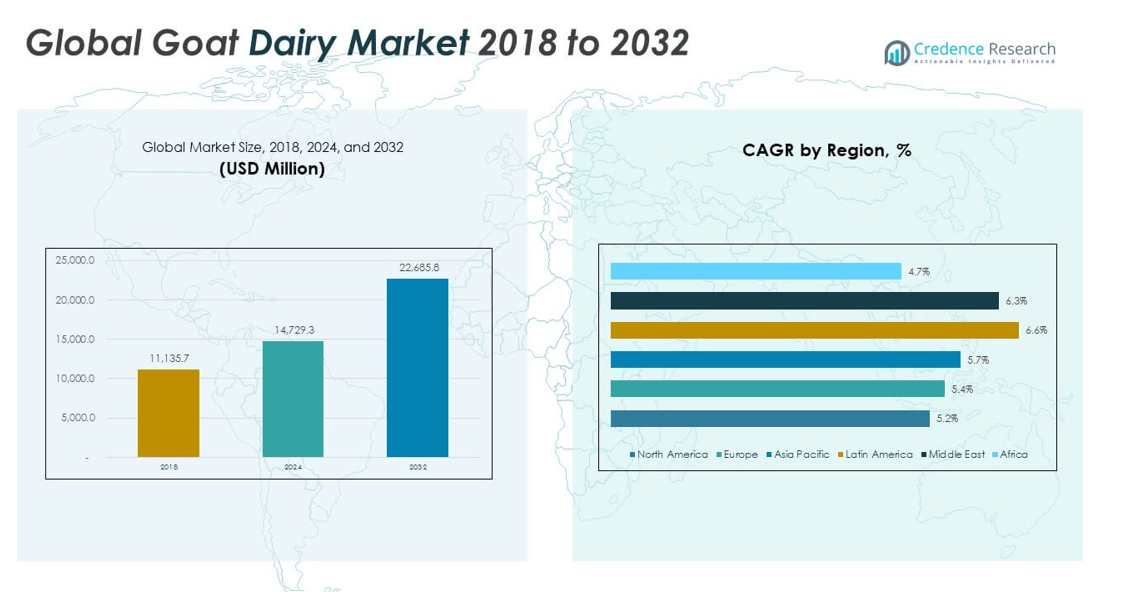

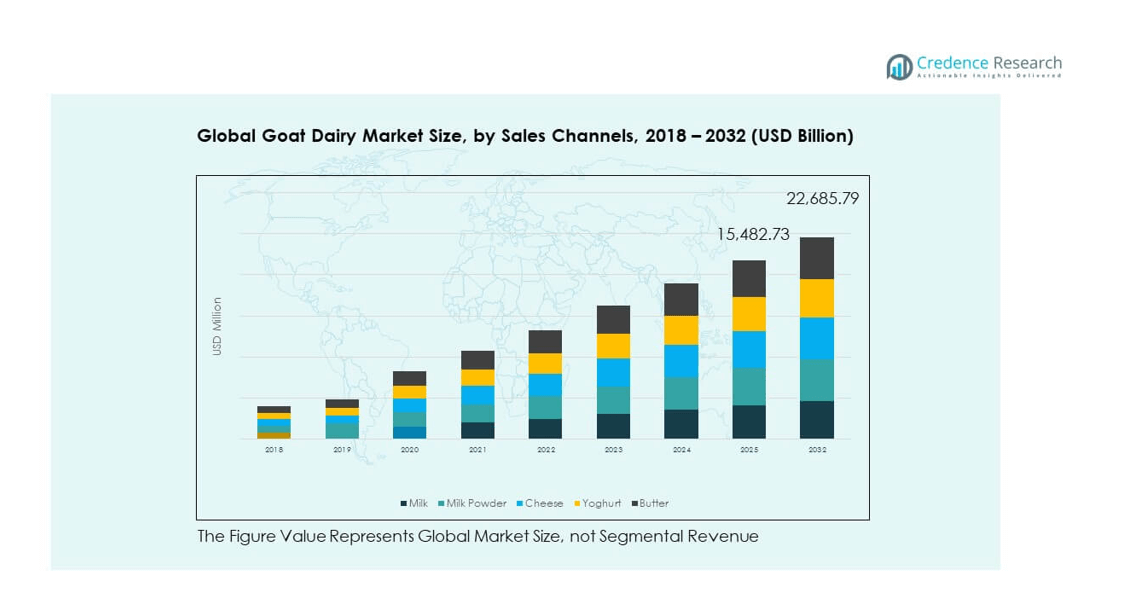

The Global Goat Dairy Market size was valued at USD 11,135.7 million in 2018 to USD 14,729.3 million in 2024 and is anticipated to reach USD 22,685.8 million by 2032, at a CAGR of 5.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Goat Dairy Market Size 2024 |

USD 14,729.3 million |

| Goat Dairy Market, CAGR |

5.61% |

| Goat Dairy Market Size 2032 |

USD 22,685.8 million |

The market is driven by increasing consumer preference for goat milk and related products due to their nutritional benefits, including easier digestibility, lower lactose content, and higher levels of essential fatty acids compared to cow’s milk. Rising awareness of functional and fortified dairy products, coupled with demand from health-conscious consumers, is boosting product innovation in cheese, yogurt, and milk powder categories. Expanding dairy farming practices, supportive government programs, and growth in specialty dairy processing further fuel market expansion globally.

Regionally, Europe holds a strong position due to its established dairy processing infrastructure, traditional goat cheese production, and high per capita dairy consumption. Asia Pacific is emerging as a fast-growing market, driven by expanding goat farming in countries like India and China and increasing middle-class demand for premium dairy products. North America is experiencing steady growth, supported by rising ethnic population segments and specialty dairy imports, while the Middle East & Africa benefits from climatic suitability for goat farmin and growing investment in dairy processing facilities.

Market Insights:

- The Global Goat Dairy Market was valued at USD 14,729.3 million in 2024 and is projected to reach USD 22,685.8 million by 2032, growing at a CAGR of 5.61%.

- Rising demand for lactose-friendly and nutrient-rich dairy products is driving strong adoption of goat milk and its derivatives.

- Expansion of goat farming infrastructure and government support programs is enhancing production capacity and supply stability.

- High production costs and seasonal milk yield fluctuations remain key challenges impacting price competitiveness.

- Asia Pacific leads the market, supported by extensive goat farming and rising urban demand for packaged dairy products.

- Europe maintains strong market share through premium artisanal cheese production and established dairy processing capabilities.

- Growth in online retail and specialty food channels is expanding consumer access to premium and functional goat dairy offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Nutritionally Rich Dairy Alternatives

The Global Goat Dairy Market benefits from growing consumer awareness about the nutritional superiority of goat milk and its derivatives over conventional cow milk. It offers higher calcium, potassium, and vitamin A content, along with a richer concentration of short- and medium-chain fatty acids that support digestive health. It appeals to lactose-sensitive individuals due to its lower lactose content and smaller fat globules that improve digestibility. Consumers seeking functional foods increasingly prefer goat-based dairy for its potential role in boosting immunity and reducing inflammation. Specialty product categories such as goat cheese, yogurt, and infant formula have gained significant traction. Manufacturers are expanding portfolios to cater to this rising preference for nutrient-dense options. This driver continues to position goat dairy as a premium health-focused product segment in global markets.

- For example, Holle, a European leader in organic infant formula, offers goat milk–based formulas that naturally contain a higher diversity and quantity of oligosaccharides than typical cow milk formulas. These prebiotic compounds support healthy gut flora and digestive function in infants, a benefit supported by research on the compositional properties of goat milk.

Expansion of Goat Farming and Dairy Production Infrastructure

The market is fueled by the steady growth of goat farming in both developed and developing economies. It benefits from goat adaptability to diverse climates and lower resource requirements compared to cattle, making it a viable dairy source in regions with limited grazing land. Governments and agricultural bodies provide financial incentives, breeding programs, and veterinary support to strengthen production capacity. Expansion of milking facilities and cold chain logistics ensures product freshness and reduces wastage. Investment in mechanized milking systems and processing plants has improved efficiency and production volume. This infrastructure growth enables consistent supply to meet rising domestic and export demand. The Global Goat Dairy Market gains stability and competitiveness from this expanding agricultural base.

Rising Popularity of Artisanal and Specialty Dairy Products

Premiumization trends in the dairy sector strongly influence goat dairy consumption. It thrives on consumer interest in handcrafted, region-specific, and artisanal dairy products such as PDO-certified goat cheese varieties. Chefs, gourmet retailers, and hospitality sectors promote these products as exclusive and high-quality offerings. The authenticity and unique flavor profile of goat milk products strengthen their appeal in culinary circles. Health-conscious millennials and affluent urban populations increasingly opt for these premium alternatives over mass-market dairy. Specialty food exhibitions, tasting events, and targeted marketing campaigns accelerate this shift toward artisanal consumption. This trend solidifies goat dairy’s position in premium retail segments and export-oriented markets.

- For instance, French dairy cooperative Eurial is recognized as one of the leading producers of goat cheese, supplying PDO-certified and regional specialty varieties to both domestic and international markets through its extensive network of goat milk producers across France.

Innovation in Processing and Product Diversification

The Global Goat Dairy Market is supported by innovations in processing technology and new product development. It benefits from advances in pasteurization, homogenization, and fermentation techniques that enhance product safety, texture, and shelf life. Producers are diversifying offerings to include lactose-free milk, flavored goat yogurts, probiotic drinks, and protein-fortified dairy snacks. Such innovations attract a broader consumer base, including athletes, children, and elderly populations. Packaging developments in resealable pouches and eco-friendly cartons extend convenience and brand differentiation. Strategic collaborations between dairy processors and research institutions foster product enhancements tailored to consumer needs. These innovations ensure goat dairy remains competitive in both traditional and emerging dairy markets.

Market Trends

Growing Adoption of Goat Milk in Infant Nutrition

The Global Goat Dairy Market is witnessing increased demand in the infant nutrition segment, where goat milk formulas are marketed for their digestibility and nutrient profile. It is promoted as a gentler alternative for infants with cow milk sensitivity. Regulatory approvals in several regions have expanded commercial availability of goat milk-based infant formulas. Pediatric recommendations in certain markets have further accelerated adoption. Marketing campaigns highlight the closer protein composition of goat milk to human breast milk. Growth in e-commerce has boosted accessibility of these products to urban and rural consumers alike. This trend reflects a widening consumer base for goat dairy in the early-life nutrition category.

- For example, in June 2024, Kabrita became the first and only goat milk–based infant formula to earn all three of the Clean Label Project’s top certifications—the First 1,000 Day Promise, Purity Award, and Pesticide‑Free Award—highlighting its strict safety and purity standards.

Rising Presence in Functional and Fortified Dairy Categories

Goat dairy products are gaining prominence in the functional foods segment, driven by consumer interest in products that provide specific health benefits. It is increasingly fortified with probiotics, omega-3 fatty acids, and vitamins to enhance health appeal. Product lines featuring immunity-boosting claims or gut health support are becoming common. Retailers dedicate shelf space to functional goat milk beverages and yogurts to meet this demand. Branding strategies emphasize health outcomes to differentiate offerings from conventional dairy. The shift toward preventive health and nutrition sustains momentum in this segment.

- For example, Boss Dog offers a raw goat milk pet supplement that delivers 1 billion probiotics per 2-ounce serving, enriched with DHA Omega‑3 to support cognitive health and taurine to promote heart, vision, and digestive wellness. The formula also includes prebiotics for gut health, anti-inflammatory spices like turmeric and ginger to boost skin and coat health, and adds much‑needed moisture to dry meals enhancing digestion and overall hydration for pets.

Emergence of Plant-Goat Hybrid Dairy Products

A unique trend in the Global Goat Dairy Market is the development of blended dairy products combining goat milk with plant-based ingredients. It allows producers to cater to flexitarian consumers who want dairy benefits alongside plant-based nutrition. Products such as almond-goat yogurt blends and oat-goat milk beverages have entered premium retail channels. These hybrids aim to capture crossover demand between plant-based and dairy categories. Manufacturers highlight flavor balance, improved nutrient density, and sustainability in marketing. This approach expands the consumer base beyond traditional dairy buyers.

Sustainability and Ethical Farming Practices in Goat Dairy Production

Sustainability is shaping procurement and production models across the goat dairy sector. It emphasizes pasture-fed goats, reduced carbon footprints, and minimal use of antibiotics or growth hormones. Certifications for organic and ethically sourced goat dairy are becoming more prevalent. Consumers respond positively to transparency in sourcing and farming methods. Producers invest in renewable energy for processing plants and water-efficient farming systems. This sustainability push enhances brand value and meets evolving regulatory requirements in key markets.

Market Challenges Analysis

Limited Production Volume and Supply Chain Constraints

The Global Goat Dairy Market faces limitations due to relatively low global goat milk production compared to cow milk. It requires robust supply chain management to ensure consistent availability across markets. Seasonal variations in goat lactation impact raw milk supply, affecting product uniformity and pricing. Smallholder farms dominate production in many countries, leading to fragmented supply structures. Logistics challenges, particularly in maintaining cold chain integrity, can increase operational costs. In export markets, stringent import regulations and health certifications can delay shipments. These factors collectively restrict the market’s ability to scale rapidly in response to growing demand.

High Production Costs and Competitive Price Pressures

It encounters cost challenges stemming from smaller yield volumes per animal and the need for specialized processing facilities. Goat dairy often commands a premium price, which can limit accessibility for price-sensitive consumers. Competition from cow dairy and plant-based alternatives intensifies pricing pressure. Scaling production while maintaining product quality remains a complex balancing act. High feed and veterinary care expenses further add to cost burdens. Exchange rate fluctuations can also impact profitability in export-focused businesses. This cost dynamic necessitates strategic investments in efficiency and value-added products to sustain margins.

Market Opportunities

Expansion into Emerging Economies with Untapped Demand

The Global Goat Dairy Market has strong growth potential in emerging economies where goat farming is already prevalent but under-commercialized. It can leverage local familiarity with goat milk while introducing processed and value-added products. Urbanization and rising disposable incomes in these markets support adoption of premium dairy. Strategic partnerships with local cooperatives and modern retail chains can accelerate distribution. Targeted consumer education on nutritional benefits can drive demand across multiple income segments.

Diversification into Niche and Premium Product Categories

It can expand further through diversification into niche segments such as organic goat dairy, artisanal cheese, and sports nutrition products. Premium products with distinct flavor profiles and health-focused formulations can appeal to high-income consumers globally. Online sales channels provide an effective route to reach these niche buyers. Innovations in packaging and flavor customization enhance product attractiveness. By focusing on differentiated offerings, the market can strengthen brand loyalty and capture higher profit margins.

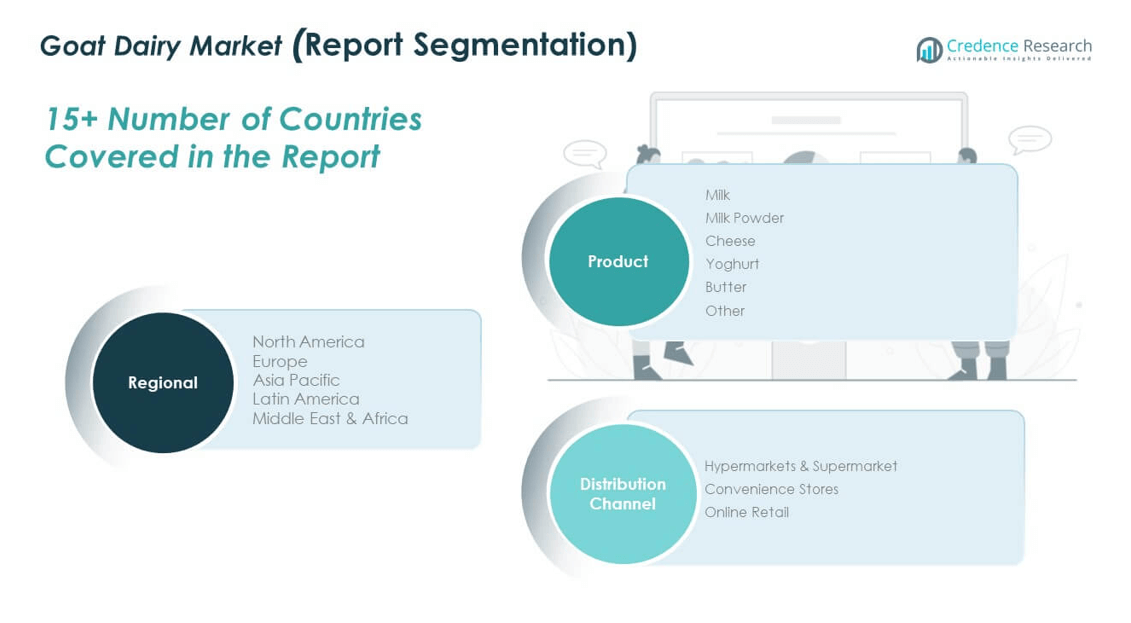

Market Segmentation Analysis:

The Global Goat Dairy Market is segmented

By product into milk, milk powder, cheese, yoghurt, butter, and other derivatives. Milk remains the leading category, driven by its high consumption in both direct drinking and processing applications. Milk powder holds a significant share, supported by its long shelf life and suitability for export. Cheese is a rapidly growing segment, fueled by the rising popularity of artisanal and specialty varieties in premium retail channels. Yoghurt continues to gain traction among health-conscious consumers seeking probiotic-rich dairy options. Butter, though a smaller segment, is experiencing steady demand in niche baking and culinary applications, while other products, including ice creams and desserts, contribute to market diversification.

- For instance, Meyenberg is a leading U.S. brand offering fresh and powdered goat milk, with products available through major retail chains including Whole Foods and Kroger. Fettle markets its goat milk powder with an extended shelf life of up to 18 months, targeting both domestic consumers and international export markets.

By distribution channel, the Global Goat Dairy Market is divided into hypermarkets and supermarkets, convenience stores, and online retail. Hypermarkets and supermarkets dominate due to their broad product offerings and strong brand presence. Convenience stores play an important role in urban areas where consumers prefer quick purchases of dairy essentials. Online retail is expanding at a fast pace, driven by the growth of e-commerce platforms and the increasing demand for home delivery of fresh and specialty goat dairy products.

- For instance, Whole Foods Market, Walmart, and Costco in the United States carry a wide selection of goat milk products, including milk, cheese, yogurt, and butter, ensuring broad accessibility for mainstream consumers.

Segmentation:

By Product

- Milk

- Milk Powder

- Cheese

- Yoghurt

- Butter

- Other

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online Retail

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Goat Dairy Market size was valued at USD 1,918.68 million in 2018 to USD 2,474.73 million in 2024 and is anticipated to reach USD 3,681.90 million by 2032, at a CAGR of 5.2% during the forecast period. It accounts for 16.8% of the global market share in 2024. The market growth is driven by rising demand for specialty dairy products, particularly goat cheese and yogurt, among health-conscious consumers. Strong retail distribution networks and the popularity of ethnic cuisines enhance product penetration. The U.S. leads the market due to high disposable incomes, premium product positioning, and increasing preference for lactose-friendly alternatives. Canada follows with growing artisanal dairy production and supportive agricultural programs. Expanding online retail channels boost accessibility to a diverse range of goat dairy products. Demand for organic and non-GMO goat dairy is also expanding rapidly, supported by evolving consumer lifestyles and dietary preferences.

Europe

The Europe Global Goat Dairy Market size was valued at USD 2,751.63 million in 2018 to USD 3,595.42 million in 2024 and is anticipated to reach USD 5,446.86 million by 2032, at a CAGR of 5.4% during the forecast period. It holds 24.4% of the global market share in 2024. Europe’s dominance stems from its strong tradition of goat cheese production and well-established dairy processing infrastructure. France, Spain, and Greece are key contributors, leveraging centuries-old artisanal practices alongside modern manufacturing efficiencies. PDO-certified goat cheeses strengthen export potential and premium positioning. Rising consumer interest in natural and minimally processed dairy supports demand across major markets. Specialty retail channels and gourmet restaurants further promote product awareness. The integration of sustainable farming practices and certifications has enhanced consumer trust. Growth in functional and fortified goat dairy products is also influencing market dynamics.

Asia Pacific

The Asia Pacific Global Goat Dairy Market size was valued at USD 3,876.33 million in 2018 to USD 5,139.26 million in 2024 and is anticipated to reach USD 7,940.03 million by 2032, at a CAGR of 5.7% during the forecast period. It represents 34.9% of the global market share in 2024, making it the largest regional segment. The region’s growth is fueled by widespread goat farming, particularly in India, China, and Southeast Asia, where goat milk is a staple in rural diets. Rapid urbanization and rising disposable incomes are increasing demand for packaged and processed goat dairy products. Product innovation, including flavored goat milk and probiotic yogurts, is gaining traction in urban markets. Australia and New Zealand contribute significantly through high-quality goat dairy exports. E-commerce platforms are expanding consumer access to niche and premium brands. Government initiatives promoting dairy self-sufficiency also support industry growth.

Latin America

The Latin America Global Goat Dairy Market size was valued at USD 1,136.95 million in 2018 to USD 1,596.02 million in 2024 and is anticipated to reach USD 2,647.43 million by 2032, at a CAGR of 6.6% during the forecast period. It captures 10.8% of the global market share in 2024. Rising awareness of goat milk’s health benefits is boosting consumption across urban and semi-urban populations. Brazil and Argentina lead the market with increasing investments in modern dairy processing facilities. Artisanal goat cheese production is gaining momentum, catering to both domestic and export markets. Expanding supermarket chains and specialty food retailers improve product availability. Growing middle-class populations are driving demand for premium and functional dairy products. Technological advancements in cold chain logistics are enhancing product shelf life. Regional trade agreements are facilitating cross-border dairy product movement.

Middle East

The Middle East Global Goat Dairy Market size was valued at USD 815.13 million in 2018 to USD 1,121.74 million in 2024 and is anticipated to reach USD 1,817.13 million by 2032, at a CAGR of 6.3% during the forecast period. It accounts for 7.6% of the global market share in 2024. The region benefits from a long-standing tradition of goat milk consumption due to cultural preferences and climatic suitability for goat farming. Countries like Saudi Arabia, UAE, and Turkey are leading producers and consumers. Premium goat dairy imports from Europe and Asia are also in high demand. Government-led agricultural programs aim to enhance domestic production capabilities. Growth in the hospitality sector and high-end retail boosts demand for artisanal goat cheese and specialty dairy. Urban consumers are showing rising interest in organic and ethically sourced products. Advances in packaging technology are supporting wider product distribution.

Africa

The Africa Global Goat Dairy Market size was valued at USD 636.96 million in 2018 to USD 802.11 million in 2024 and is anticipated to reach USD 1,152.44 million by 2032, at a CAGR of 4.7% during the forecast period. It contributes 5.5% of the global market share in 2024. The market is supported by the continent’s extensive goat population and reliance on goat milk as a key nutritional source in rural areas. Countries like Nigeria, Kenya, and South Africa are expanding commercial dairy operations to meet urban demand. Growth is driven by improved processing infrastructure and access to refrigeration. Export potential is increasing for premium products such as organic goat cheese. Consumer education campaigns on goat dairy’s health benefits are gaining traction. However, challenges remain in scaling production and improving supply chain efficiency. Urbanization is expected to further boost packaged goat dairy consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- Danone S.A.

- Lactalis Group

- Ausnutria Goat Dairy Corporation Ltd.

- Emmi Group

- Goat Partners International Inc.

- Capra

- St Helen’s Farm

- Hewitt’s Goat Dairy

- Woolwich Goat Dairy Inc.

- Meyenberg Goat Milk

- Courtyard Farms

- Other Key Players

Competitive Analysis:

The Global Goat Dairy Market features a mix of multinational corporations, regional leaders, and niche artisanal producers competing for market share. Leading companies such as Nestlé S.A., Fonterra Cooperative Group, Royal FrieslandCampina N.V., Arla Foods amba, Danone S.A., and Lactalis Group dominate through extensive product portfolios, advanced processing capabilities, and strong distribution networks. It is marked by continuous product innovation, including fortified and flavored offerings, to cater to evolving consumer preferences. Regional players like St Helen’s Farm, Woolwich Goat Dairy, and Meyenberg Goat Milk focus on specialty products and local market penetration. Strategic developments include acquisitions, partnerships, and investments in sustainable farming to enhance brand positioning. Companies are also expanding their presence in high-growth regions through e-commerce channels and premium retail segments.

Recent Developments:

- In June 2025, PT Frisian Flag Indonesia entered into a partnership with SNV to advance climate-smart dairy farming practices. Although the collaboration is primarily based in Indonesia, the broader strategic objective is to create scalable models for sustainable milk production—including goat milk—that can be replicated globally.

- In April 2025, Nestlé launched Bear Brand Milk N’ Soy, a powdered milk‑and‑soy beverage for school‑age children in the Philippines, demonstrating its effort to diversify with goat‑friendly and dairy‑alternative products.

Market Concentration & Characteristics:

The Global Goat Dairy Market is moderately concentrated, with top players holding significant revenue share alongside a fragmented base of small-scale producers. It combines large-scale industrial operations with localized artisanal production, offering both mass-market and premium products. Market leaders leverage global supply chains, advanced processing technologies, and brand equity to maintain competitiveness. The industry is characterized by regional specialization, with Europe excelling in premium cheese production, Asia Pacific in raw milk supply, and North America in innovative dairy formats. Sustainability, product differentiation, and adherence to strict quality standards remain key competitive factors.

Report Coverage:

The research report offers an in-depth analysis based on Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer preference for lactose-friendly and easily digestible dairy products will continue to drive the adoption of goat milk and its derivatives in both developed and developing regions.

- Continuous product innovation, including fortified, probiotic-rich, and functional goat dairy items, will attract health-conscious consumers seeking value-added nutrition.

- Expansion of e-commerce and direct-to-consumer platforms will enhance the availability and reach of specialty and premium goat dairy products.

- Rapid growth in emerging markets will create fresh revenue streams for global and regional players through localized product offerings.

- Technological advancements in processing will improve consistency, safety, and shelf life, strengthening market competitiveness.

- Adoption of sustainable and ethical farming practices will enhance brand positioning and consumer loyalty.

- Premiumization will fuel demand for artisanal cheeses and geographically protected goat dairy specialties.

- Strategic mergers, acquisitions, and partnerships will facilitate entry into untapped markets and strengthen distribution networks.

- Increased marketing focused on the nutritional and health benefits of goat dairy will drive wider consumer acceptance.

- Government initiatives supporting small and medium-scale goat farming will contribute to a more resilient and efficient supply chain.