Market Overview:

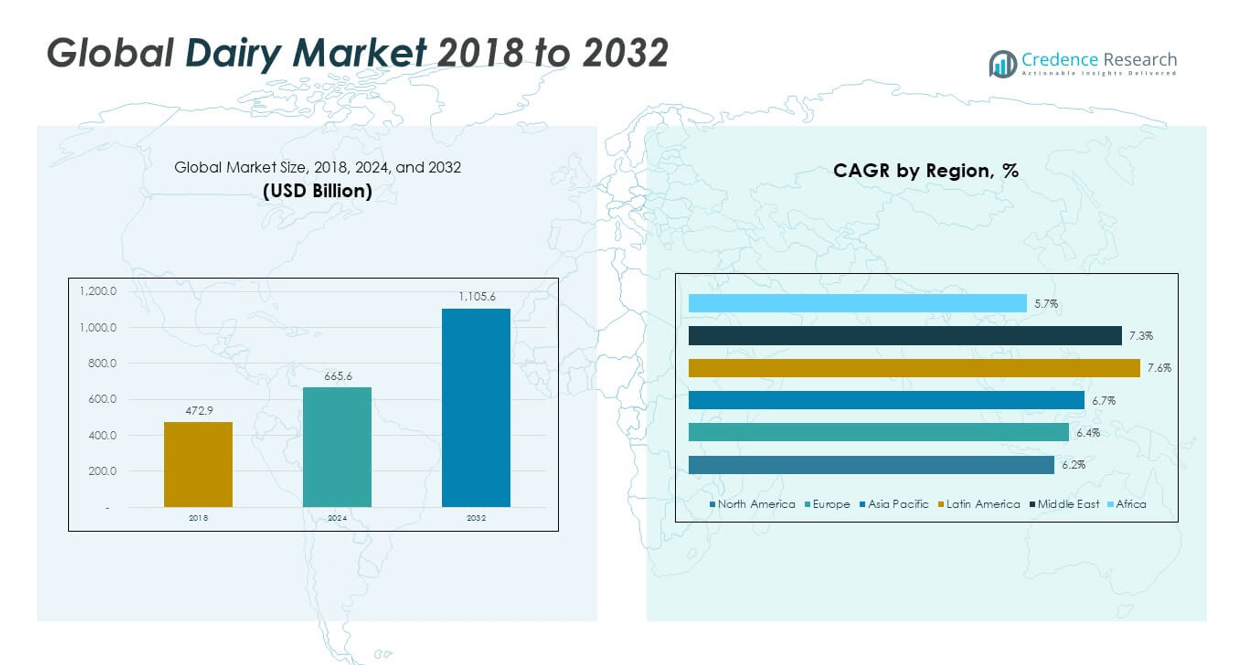

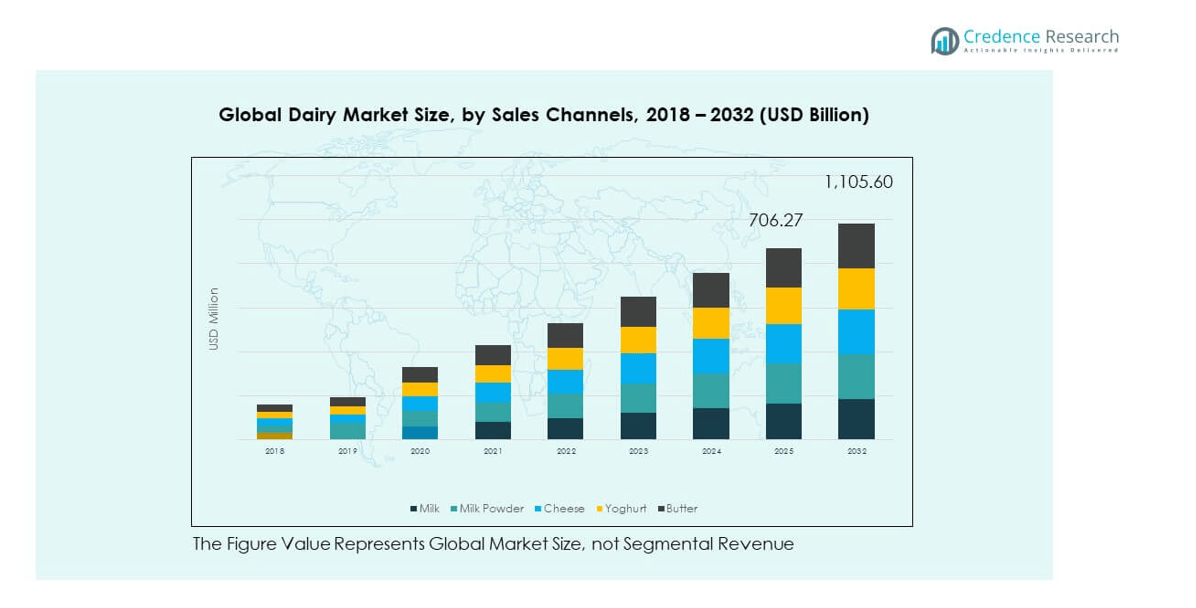

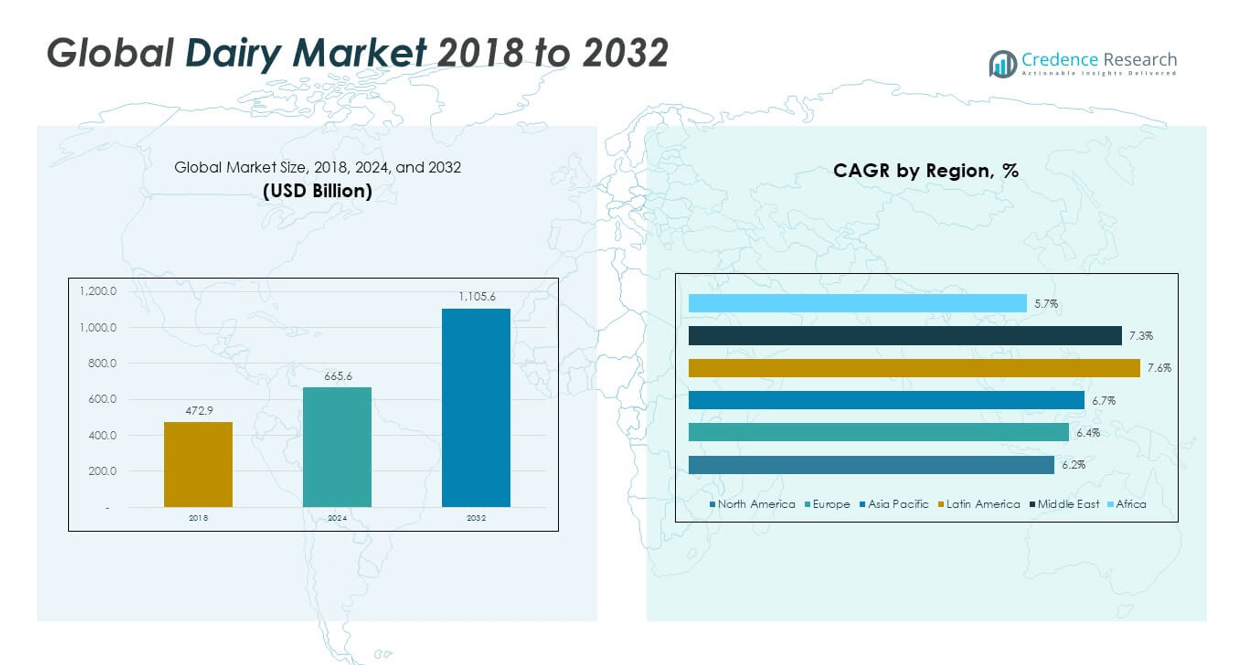

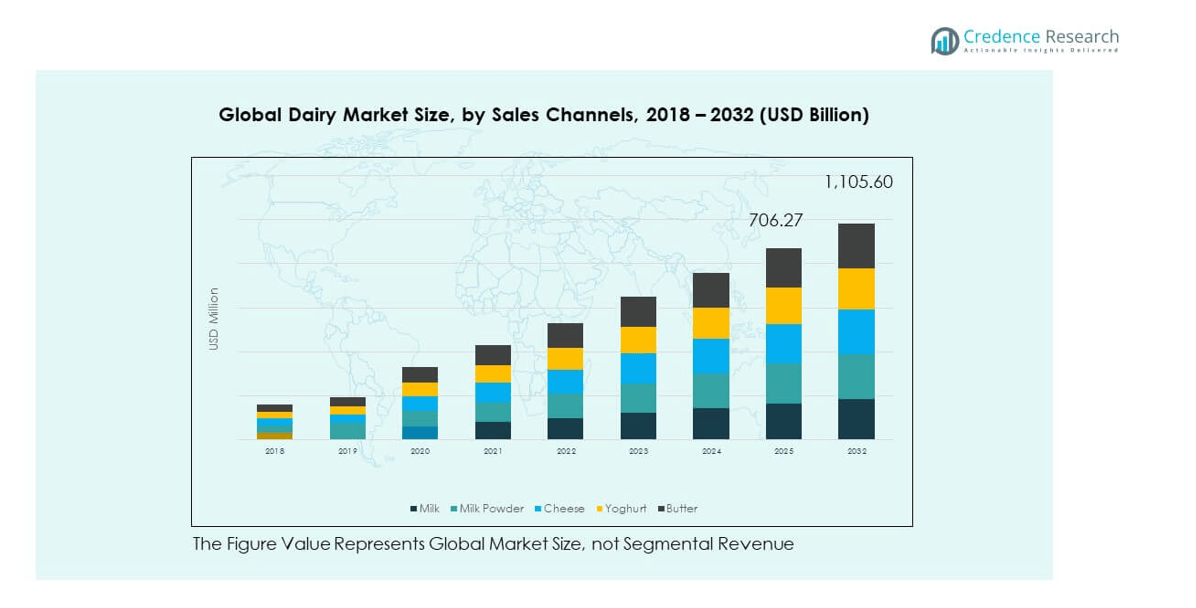

The Global Dairy Market size was valued at USD 472.9 million in 2018 to USD 665.6 million in 2024 and is anticipated to reach USD 1,105.6 million by 2032, at a CAGR of 6.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dairy Market Size 2024 |

USD 665.6 million |

| Dairy Market , CAGR |

6.61% |

| Dairy Market Size 2032 |

SD 1,105.6 million |

The market growth is driven by rising global demand for nutrient-rich food products, increasing health awareness, and evolving dietary patterns that emphasize protein and calcium intake. Expanding product innovation, such as lactose-free and plant-blended dairy, is attracting health-conscious consumers. Strong supply chain networks, investments in processing technologies, and the popularity of ready-to-consume dairy beverages are enhancing market penetration. Rapid urbanization and changing lifestyles continue to fuel demand for convenient and value-added dairy offerings.

Geographically, North America and Europe dominate due to well-established dairy industries, advanced processing infrastructure, and high per capita consumption. Asia-Pacific is emerging as the fastest-growing region, driven by population growth, rising incomes, and urban dietary shifts, particularly in China and India. The Middle East and Africa show potential due to expanding cold chain logistics and growing consumer preference for packaged dairy products.

Market Insights:

- The Global Dairy Market was valued at USD 472.9 million in 2018, reached USD 665.6 million in 2024, and is projected to hit USD 1,105.6 million by 2032, growing at a CAGR of 6.61% during the forecast period.

- Rising demand for nutrient-rich food, supported by increasing health awareness, drives steady consumption of milk, cheese, yogurt, and other dairy products.

- Expanding product innovation, including lactose-free, fortified, and functional dairy, caters to evolving dietary preferences and wider consumer segments.

- Volatile raw milk prices and supply chain disruptions pose significant challenges to maintaining profitability and consistent supply.

- Regulatory pressures, environmental concerns, and growing competition from plant-based alternatives limit traditional dairy market expansion.

- North America and Europe lead the market due to advanced processing infrastructure, high per capita consumption, and strong quality standards.

- Asia-Pacific emerges as the fastest-growing region, fueled by rising incomes, urban dietary shifts, and increasing adoption of packaged dairy products.

Market Drivers:

Rising Global Consumption Driven by Nutritional Benefits and Diverse Dairy Offerings:

The Global Dairy Market experiences sustained growth due to increasing global consumption of nutrient-rich dairy products. Consumers value dairy for its high-quality protein, calcium, and essential vitamins, making it a staple in daily diets. Rising health awareness encourages individuals to include milk, yogurt, and cheese as part of balanced nutrition. The diversification of product ranges, including organic, fortified, and functional dairy items, expands its appeal across demographic segments. Urban lifestyles support higher demand for ready-to-consume dairy products, which save time while offering nutrition. Strong marketing campaigns emphasize the health advantages of dairy, boosting consumer trust. Export opportunities grow as developing nations embrace dairy in modern diets. The sector continues to benefit from global population growth and increased dietary sophistication.

- For instance, Danone S.A. reported introducing over 150 fortified yogurt SKUs globally by 2023, incorporating probiotics and extra protein content meeting dietary preferences, which contributed to a 22% growth in its functional dairy portfolio volume that year.

Technological Advancements in Processing and Preservation Techniques:

The Global Dairy Market benefits from technological innovations that enhance product quality, extend shelf life, and maintain nutritional integrity. Advanced pasteurization methods reduce microbial risks while preserving natural taste. Ultra-high temperature (UHT) processing supports long-distance distribution without compromising safety. Innovative packaging solutions maintain freshness and enable better storage options. Automation in production facilities improves efficiency and reduces operational costs. Cold chain enhancements ensure optimal product conditions from processing to final delivery. These advancements enable wider market penetration, including remote regions with limited infrastructure. The sector continues to invest in research to improve processing methods and meet evolving consumer preferences.

- For instance, Nestlé S.A. invested in precision fermentation and introduced Orgain Better Whey in 2024, produced using advanced fermentation technology that reduces microbial load by over 98% compared to traditional whey and extends shelf life by 30% without refrigeration, supporting global distribution efficiency.

Product Diversification Meeting Evolving Consumer Lifestyles and Preferences:

The Global Dairy Market adapts to changing consumer demands by offering a broader range of products tailored to health, taste, and convenience. Lactose-free dairy options cater to individuals with intolerance, expanding the customer base. Low-fat and fortified dairy products appeal to health-conscious consumers. Flavored milk, probiotic-rich yogurt, and functional beverages align with wellness trends. Single-serve and on-the-go packaging formats target busy urban populations. Traditional dairy staples see renewed interest through premium and artisanal positioning. Innovation in flavor profiles supports increased consumption in younger demographics. Dairy brands leverage consumer feedback to fine-tune offerings for diverse global markets.

Government Support and Trade Expansion Strengthening Dairy Supply Chains:

The Global Dairy Market benefits from strong governmental policies and trade agreements that facilitate dairy exports and imports. Subsidies and incentives for dairy farmers improve production capabilities. International trade agreements reduce tariffs, enabling easier cross-border movement of dairy goods. Regulatory standards for quality and safety build consumer confidence. Market access expands through participation in global trade fairs and promotional programs. Support for dairy cooperatives enhances farmer incomes and production scale. Infrastructure investments in rural regions boost milk collection and processing capacity. Strategic trade partnerships help diversify export destinations, reducing dependence on single markets.

Market Trends:

Growing Popularity of Plant-Based Dairy Alternatives in Hybrid Product Portfolios:

The Global Dairy Market incorporates plant-based elements into traditional dairy offerings to meet diverse dietary choices. Blended milk products combine dairy with almond, oat, or soy ingredients, attracting flexitarian consumers. Hybrid dairy maintains the taste and texture of traditional milk while offering alternative nutrition benefits. The trend reduces environmental impact concerns, appealing to eco-conscious buyers. Brands innovate in flavor and texture to match consumer expectations. Plant-based integration expands market reach into vegan and lactose-intolerant segments. Cross-category innovation encourages experimentation in new product lines. This blended approach positions dairy producers to remain competitive in evolving markets.

- For instance, Arla Foods amba launched its “Grow” hybrid milk range in 2025, which blends 40% oat milk with cow’s milk, resulting in a 25% reduction in carbon emissions during production, while achieving 12% faster shelf turnover through improved taste acceptance in Nordic markets.

Premiumization and Artisanal Positioning Elevating Consumer Perception:

The Global Dairy Market sees a rise in premium and artisanal dairy products that command higher consumer loyalty. Specialty cheeses, heritage butter, and small-batch yogurts cater to discerning tastes. Consumers associate artisanal dairy with authenticity, craftsmanship, and superior quality. Premium packaging enhances brand image and supports higher price points. Local sourcing stories and regional heritage claims strengthen product appeal. Luxury hotels and fine dining establishments drive demand for specialty dairy items. Seasonal and limited-edition releases generate excitement and repeat purchases. This trend reinforces the value proposition of dairy beyond basic nutrition.

- For example, Lactalis has introduced premium cheese varieties with enhanced protein content and flavor profiles, targeting luxury foodservice sectors including fine dining and high-end hotels.

Digital Commerce and Direct-to-Consumer Channels Boosting Accessibility:

The Global Dairy Market benefits from expanding e-commerce and direct delivery models. Online platforms offer subscription-based fresh milk and dairy product services. Digital marketplaces allow smaller producers to reach national and international audiences. Contactless delivery models enhance convenience and safety. Brands use online channels to promote seasonal products and exclusive launches. Social media campaigns and influencer partnerships amplify brand engagement. Data analytics guide targeted promotions and personalized product recommendations. This trend reshapes distribution strategies and builds stronger consumer connections.

Sustainability and Ethical Sourcing Influencing Purchase Decisions:

The Global Dairy Market witness’s stronger consumer demand for sustainably produced and ethically sourced products. Dairy producers adopt carbon reduction measures in production and transportation. Sustainable packaging, including biodegradable and recyclable materials, becomes standard. Ethical sourcing programs ensure fair treatment and compensation for farmers. Renewable energy integration in processing facilities gains traction. Water conservation practices improve operational efficiency. Certifications such as organic and fair-trade enhance brand credibility. Transparency in sourcing builds consumer trust and brand loyalty. This trend aligns with broader environmental and social responsibility movements.

Market Challenges Analysis:

Volatile Raw Milk Prices and Supply Chain Vulnerabilities Impacting Profitability:

The Global Dairy Market faces significant challenges from fluctuations in raw milk prices, which directly affect production costs. Climatic variations influence milk yields, causing unpredictability in supply. Feed cost inflation adds further strain to dairy farmers’ margins. Global supply chains remain vulnerable to disruptions from geopolitical tensions, pandemics, and transportation delays. Dependence on imported feed and ingredients in some regions increases exposure to global commodity price shifts. Market volatility can lead to inconsistent product availability and affect export commitments. Processors must balance quality maintenance with cost control. These issues necessitate strategic procurement and inventory management.

Regulatory Pressures and Shifting Dietary Preferences Limiting Growth Potential:

The Global Dairy Market contends with complex regulatory requirements regarding food safety, labeling, and environmental impact. Compliance with varied international standards increases operational complexity. Stricter emission and waste management laws raise production costs. Public health campaigns promoting reduced dairy consumption challenge traditional demand. Growing adoption of plant-based diets poses competition in key urban markets. Misinformation about dairy’s health effects influences consumer choices. Producers must invest in education campaigns to counter negative perceptions. The sector requires continuous innovation to remain relevant amid evolving dietary landscapes.

Market Opportunities:

Expanding Functional Dairy Segment Catering to Health and Wellness-Oriented Consumers:

The Global Dairy Market can leverage the surging demand for functional and fortified products to capture new consumer segments. Dairy enriched with probiotics, omega-3, and added vitamins aligns with preventive health trends. Specialized products targeting digestion, immunity, and bone health appeal to aging populations. Sports nutrition lines utilizing high-protein dairy beverages gain traction among fitness enthusiasts. Customized dairy solutions for children and seniors expand brand reach. Collaboration with health professionals enhances product credibility. This opportunity supports premium pricing strategies and brand differentiation.

Emerging Markets Offering Untapped Potential Through Infrastructure and Lifestyle Shifts:

The Global Dairy Market can expand rapidly in emerging economies experiencing rising incomes and urbanization. Growing middle-class populations seek convenient and safe packaged dairy options. Investment in cold chain logistics enhances product accessibility in rural and semi-urban areas. Localized product development tailored to regional taste preferences strengthens brand acceptance. Educational campaigns on dairy’s nutritional benefits increase consumption rates. Partnerships with local distributors improve market penetration. These conditions create fertile ground for sustained growth in underdeveloped dairy markets.

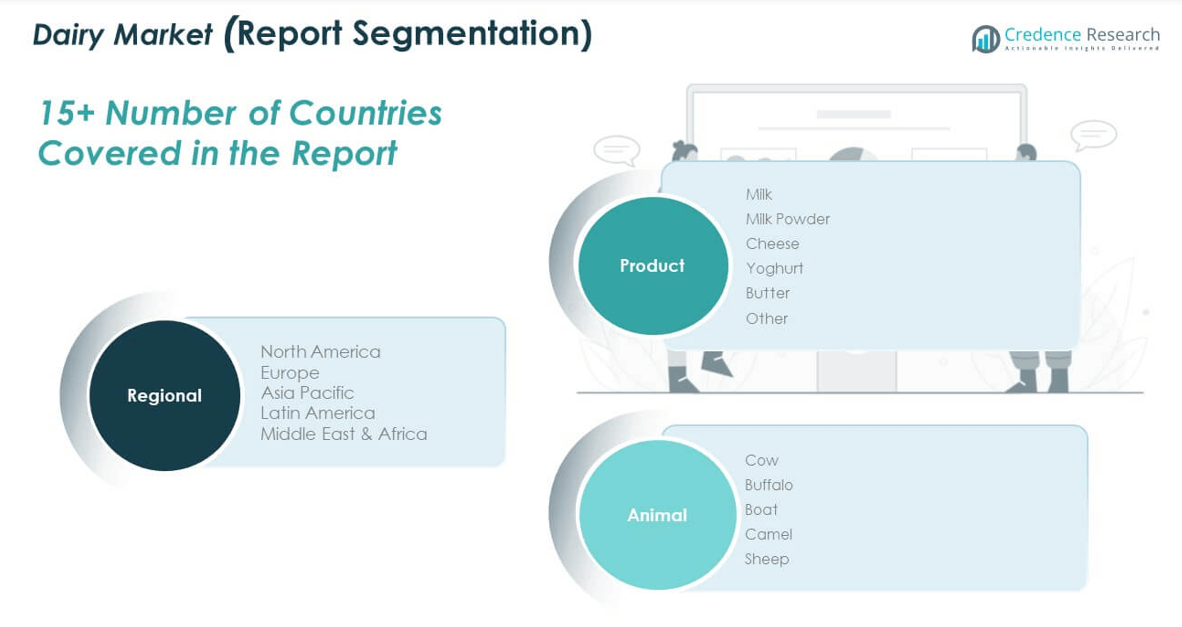

Market Segmentation Analysis:

By Product

The Global Dairy Market is segmented into milk, milk powder, cheese, yoghurt, butter, and other dairy-based offerings. Milk holds the dominant share, driven by its widespread consumption and versatility across culinary and beverage applications. Milk powder supports long shelf life and ease of transport, making it vital for export markets and regions with limited cold chain infrastructure. Cheese maintains strong growth momentum, supported by rising demand in both retail and foodservice sectors. Yoghurt benefits from health-oriented consumption patterns, with probiotic-rich varieties gaining popularity. Butter sees steady demand due to its role in baking, cooking, and premium food production. Other dairy products, including cream and specialty items, cater to niche and gourmet markets, enhancing product diversity.

- For example, Yoghurt benefits from health-oriented consumption, especially probiotic-rich and functional varieties. Danone leads with scientific-backed probiotic launches targeting gut health and immunity enhancement, leveraging extensive R&D and local dairy sourcing for product authenticity.

By Animal

The market is divided into cow, buffalo, goat, camel, and sheep dairy sources. Cow milk dominates due to established production systems, broad consumer acceptance, and consistent supply across global markets. Buffalo milk holds a significant position in regions such as South Asia, valued for its richer fat content and nutritional profile. Goat milk appeals to health-conscious consumers and those with lactose sensitivities, offering digestibility advantages. Camel milk experiences niche growth in arid regions and premium health-focused segments. Sheep milk, with its high protein and mineral content, is used extensively in specialty cheese production. This segmentation allows producers to target diverse consumer preferences and adapt to regional dietary traditions while supporting sustained market expansion.

- For example, Buffalo milk holds strong regional importance, especially in South Asia, valued for its higher fat content (up to 8% fat vs. 3.5-4% in cow milk) and richer nutrient profile, supporting both traditional markets and premium product lines.

Segmentation:

By Product

- Milk

- Milk Powder

- Cheese

- Yoghurt

- Butter

- Other

By Animal

- Cow

- Buffalo

- Goat

- Camel

- Sheep

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Dairy Market size was valued at USD 81.49 million in 2018 to USD 111.82 million in 2024 and is anticipated to reach USD 179.44 million by 2032, at a CAGR of 6.2% during the forecast period. North America accounts for approximately 16.8% of the global market share. The region’s growth is driven by high per capita dairy consumption, advanced processing technologies, and strong demand for value-added dairy products such as flavored milk, organic yogurt, and specialty cheese. It benefits from well-established cold chain logistics, ensuring consistent product quality. Consumer focus on protein-rich diets sustains milk and whey-based product sales. Government support for dairy farmers and favorable trade agreements strengthen export capabilities. Premium and artisanal dairy categories gain traction in urban markets. The market’s maturity is balanced by continuous innovation, enabling sustained growth despite competition from plant-based alternatives.

Europe

The Europe Global Dairy Market size was valued at USD 116.86 million in 2018 to USD 162.46 million in 2024 and is anticipated to reach USD 265.46 million by 2032, at a CAGR of 6.4% during the forecast period. Europe holds around 24.4% of the global market share. The region’s dairy industry is characterized by diverse product offerings, from traditional milk to premium artisanal cheese. Strong dairy heritage and high consumer trust in domestic brands support consistent demand. Regulations emphasizing quality, sustainability, and traceability enhance product competitiveness. Export strength is notable, with Europe supplying specialty dairy to multiple global markets. Organic and grass-fed dairy products see growing adoption. Innovation in lactose-free and fortified segments caters to evolving health-conscious preferences. The market remains resilient due to stable production capacities and well-developed infrastructure.

Asia Pacific

The Asia Pacific Global Dairy Market size was valued at USD 164.63 million in 2018 to USD 232.22 million in 2024 and is anticipated to reach USD 386.96 million by 2032, at a CAGR of 6.7% during the forecast period. Asia Pacific represents approximately 34.9% of the global market share. Rapid urbanization, rising incomes, and growing health awareness drive dairy consumption in the region. Countries like China, India, and Japan lead growth through expanding domestic production and imports. Demand for packaged and ready-to-drink dairy beverages rises alongside busy urban lifestyles. Product innovation tailored to local taste preferences supports wider acceptance. Cold chain infrastructure improvements enable better distribution in rural areas. Government nutrition programs encourage milk consumption among schoolchildren. Strong e-commerce penetration accelerates market access for dairy producers.

Latin America

The Latin America Global Dairy Market size was valued at USD 48.29 million in 2018 to USD 72.12 million in 2024 and is anticipated to reach USD 129.02 million by 2032, at a CAGR of 7.6% during the forecast period. Latin America accounts for roughly 11.7% of the global market share. The market’s growth is fueled by increasing demand for affordable and nutritious dairy products. Countries such as Brazil, Argentina, and Mexico dominate production and consumption. Dairy cooperatives play a significant role in supply stability and farmer income. The rise in middle-class households boosts demand for packaged milk and yogurt. Flavored and fortified dairy products gain popularity among younger consumers. Export opportunities to neighboring regions support revenue growth. Challenges remain in upgrading processing infrastructure and expanding rural market penetration.

Middle East

The Middle East Global Dairy Market size was valued at USD 34.62 million in 2018 to USD 50.69 million in 2024 and is anticipated to reach USD 88.56 million by 2032, at a CAGR of 7.3% during the forecast period. The Middle East holds about 8% of the global market share. Demand is driven by population growth, urbanization, and increasing awareness of dairy’s nutritional value. Reliance on imports for certain dairy segments creates opportunities for local production expansion. Premium dairy products, including cheese and yogurt, are popular among affluent consumers. Investments in advanced processing facilities improve domestic supply capabilities. Government initiatives aim to reduce dependency on imports and enhance food security. Distribution through modern retail and e-commerce channels strengthens market accessibility. The hot climate drives strong demand for chilled dairy beverages.

Africa

The Africa Global Dairy Market size was valued at USD 27.05 million in 2018 to USD 36.24 million in 2024 and is anticipated to reach USD 56.16 million by 2032, at a CAGR of 5.7% during the forecast period. Africa represents nearly 6.2% of the global market share. Population growth, urbanization, and rising disposable incomes support gradual increases in dairy consumption. Traditional dairy products maintain strong cultural significance, while packaged dairy sees slow but steady adoption. Limited cold chain infrastructure challenges product distribution in rural areas. Government and private sector initiatives focus on improving dairy farming efficiency. Import dependency remains high for processed dairy goods. Educational campaigns on nutrition aim to expand milk consumption. Growth opportunities lie in affordable, shelf-stable dairy solutions tailored to local markets.

Key Player Analysis:

- Nestlé S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- Danone S.A.

- Lactalis Group

- Ausnutria Dairy Corporation Ltd.

- Emmi Group

- Goat Partners International Inc.

- Holle baby food AG

- St Helen’s Farm

- Hewitt’s Dairy

- Woolwich Dairy Inc.

- Xi’an Baiyue Goat Dairy Group Co. Ltd.

- Courtyard Farms

- Other Key Players

Competitive Analysis:

The Global Dairy Market features a competitive landscape dominated by multinational corporations, regional leaders, and specialized niche producers. It is characterized by strong brand portfolios, advanced production capabilities, and extensive distribution networks. Companies focus on product innovation, sustainability initiatives, and strategic partnerships to strengthen market positioning. Leading players invest heavily in R&D to develop functional, fortified, and value-added dairy products catering to evolving consumer preferences. Private labels gain traction in certain markets by offering affordable yet quality alternatives. Competition intensifies in premium segments, where artisanal and organic products differentiate brands. Digital platforms and direct-to-consumer models enhance brand reach and engagement.

Recent Developments:

- In February 2024, Nestlé S.A. launched its first precision fermentation dairy protein product called Orgain Better Whey, an animal-free and lactose-free whey protein isolate. This launch aligns with Nestlé’s commitment to reducing the carbon footprint of its dairy portfolio as well as expanding offerings in functional nutrition.

- In July 2025, Lactalis Group received approval from the Australian Competition and Consumer Commission (ACCC) to acquire Fonterra Co-operative Group’s consumer business. This acquisition facilitated Lactalis’s expansion in Australia by consolidating its position alongside Fonterra in key regions such as Victoria and Tasmania.

- Danone S.A. introduced a new line of plant-based dairy alternatives in 2024, which resulted in a 10% market share increase in Europe. Similarly, Arla Foods amba expanded its sustainable dairy farming initiatives in 2025, achieving an 18% reduction in carbon emissions, thus strengthening its market competitiveness and commitment to sustainability.

Market Concentration & Characteristics:

The Global Dairy Market demonstrates moderate to high concentration, with a few multinational players controlling significant market shares alongside strong regional brands. It benefits from established supply chains, stringent quality standards, and high brand loyalty. It is driven by diverse product offerings across multiple price points, catering to both mass-market and premium segments. Seasonal demand fluctuations, regulatory compliance, and raw material availability influence market dynamics. Innovation, sustainability, and geographic expansion remain central strategies for competitive advantage.

Report Coverage:

The research report offers an in-depth analysis based on product and animal segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for functional and fortified dairy products catering to health-conscious consumers.

- Growth in hybrid dairy offerings blending traditional milk with plant-based alternatives.

- Expanding cold chain infrastructure in emerging economies to improve distribution.

- Increasing adoption of sustainable packaging and environmentally friendly production.

- Premiumization trends fueling demand for artisanal and specialty dairy products.

- E-commerce and direct-to-consumer models reshaping dairy sales channels.

- Greater focus on lactose-free and low-fat variants to meet dietary needs.

- Strategic mergers and partnerships driving global market consolidation.

- Growth in value-added dairy exports from high-production regions.

- Advancements in dairy processing technology enhancing efficiency and quality.