Market Overview:

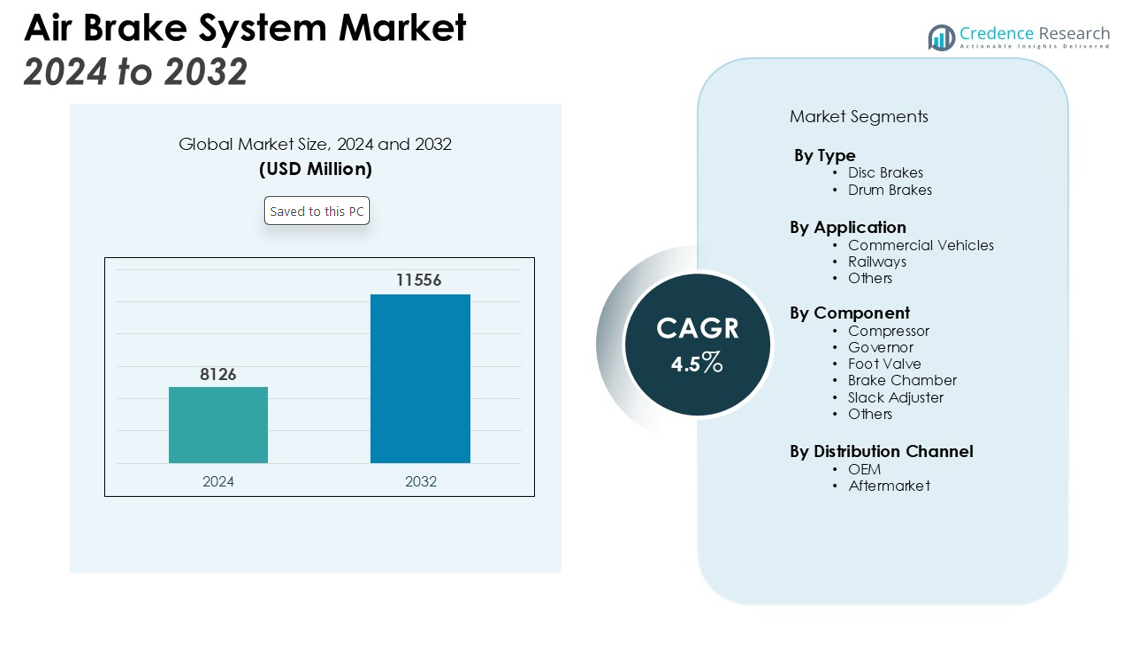

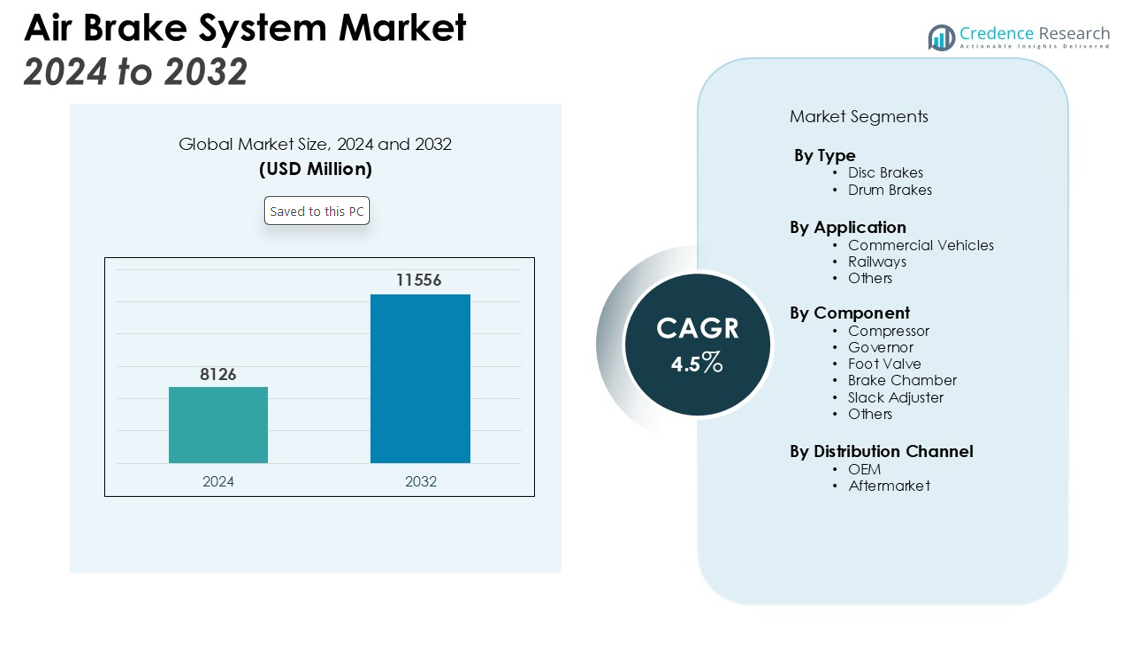

The Air Brake System Market size was valued at USD 8126 million in 2024 and is anticipated to reach USD 11556 million by 2032, at a CAGR of 4.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Brake System Market Size 2024 |

USD 8126 million |

| Air Brake System Market, CAGR |

4.5% |

| Air Brake System Market Size 2032 |

USD 11556 million |

Growth is driven by increasing demand for commercial transportation, particularly in logistics and long-haul freight, along with advancements in air brake technologies tailored for high-speed rail and lighter vehicle applications. Stricter safety regulations worldwide are pushing manufacturers to develop electropneumatic and electronically controlled braking systems that deliver enhanced performance, precision, and compatibility with advanced driver assistance systems. Environmental and operational efficiency considerations are further supporting the adoption of systems with greater durability and reduced maintenance needs.

The Asia Pacific region leads the market, supported by large-scale commercial vehicle production, rapid infrastructure development, and expanding rail networks. North America and Europe continue to hold strong positions, benefiting from stringent regulatory standards, technologically advanced fleets, and a robust aftermarket sector that enables continuous system upgrades and replacements. The growing integration of predictive maintenance and IoT-enabled brake monitoring solutions is further enhancing operational safety and fleet efficiency worldwide.

Market Insights:

- The Air Brake System Market is valued at USD 8126 million in 2024 and is projected to reach USD 11556 million by 2032, growing at a CAGR of 4.5%, driven by steady demand across commercial and rail applications.

- Increasing production of heavy-duty trucks, buses, and trailers for logistics, construction, and mining sectors is boosting the need for high-performance braking solutions.

- Stricter global safety regulations are accelerating the adoption of electropneumatic and electronically controlled braking systems with enhanced precision and integration capabilities.

- Technological advancements, including IoT-enabled monitoring and predictive maintenance, are improving operational efficiency and reducing downtime for fleet operators.

- Asia Pacific holds 45 % market share, supported by strong commercial vehicle production, expanding rail networks, and government-led safety mandates.

- North America accounts for 28 % market share, benefiting from stringent safety norms, advanced fleet technologies, and robust aftermarket activity.

- Europe holds 20 % market share, driven by innovation in lightweight, energy-efficient braking systems and the expansion of high-speed rail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Commercial Vehicles and Freight Transportation

The Air Brake System Market benefits significantly from the increasing production and sales of commercial vehicles across global markets. Expanding logistics, construction, and mining sectors require heavy-duty trucks, buses, and trailers equipped with reliable braking solutions to ensure operational safety. It supports long-haul and high-load applications where braking efficiency is critical to performance and regulatory compliance. The continued rise in e-commerce and cross-border trade is amplifying fleet expansion and driving greater adoption of advanced air brake technologies.

- For instance, Knorr-Bremse has achieved a significant production milestone, with more than 45 million of its disc brakes now in operation on commercial vehicles globally.

Stringent Safety Regulations and Compliance Standards

Governments and regulatory bodies are enforcing strict safety norms for commercial and rail vehicles, directly influencing the adoption of advanced air brake systems. Compliance with braking performance standards such as FMVSS in the U.S. and UNECE regulations in Europe pushes manufacturers to integrate technologies like anti-lock braking and electronic brake control. It encourages investment in precision-engineered systems capable of delivering consistent stopping power under varied operating conditions. This regulatory environment ensures sustained demand for innovative and compliant braking solutions.

- For instance, in response to regulations like FMVSS No. 121, manufacturers have developed technologies to meet enhanced safety benchmarks.

Technological Advancements and Integration with Smart Systems

Continuous innovation in braking technology is a key driver for the Air Brake System Market. Integration of electropneumatic controls, electronic stability programs, and compatibility with advanced driver assistance systems enhances braking precision and vehicle safety. It enables better coordination between braking components, reducing response times and improving operational reliability. The adoption of IoT-enabled monitoring allows predictive maintenance, minimizing downtime and improving fleet efficiency.

Expansion of Rail Networks and Infrastructure Development

Growing investments in high-speed rail projects and freight rail networks are expanding the scope for air brake system applications. Rail operators demand braking solutions that ensure safety, reliability, and efficiency under heavy load and high-speed conditions. It supports both passenger and cargo rail segments, where robust braking is essential for operational performance. Ongoing infrastructure development in emerging economies further strengthens market growth prospects by creating sustained demand across transportation sectors.

Market Trends:

Adoption of Advanced Electronic and Automated Braking Technologies

The Air Brake System Market is witnessing a strong shift toward advanced electronic and automated braking solutions that enhance vehicle safety, precision, and operational efficiency. Manufacturers are integrating electronic braking systems, anti-lock braking, and electronic stability control to meet stringent safety norms and improve braking response times. It is also benefiting from the growing demand for systems compatible with advanced driver assistance systems, enabling improved coordination between braking and other vehicle safety functions. The rise of electropneumatic brakes in both rail and commercial vehicle segments reflects the market’s move toward faster, more reliable, and maintenance-efficient solutions. IoT-enabled diagnostic and monitoring features are gaining traction, enabling real-time performance tracking and predictive maintenance. These developments are improving operational reliability for fleet operators and reducing life-cycle costs.

- For instance, with its Integrated Brake Control (IBC) system, ZF has the ability to reduce emergency braking distances by up to nine meters.

Focus on Lightweight Materials and Sustainable Manufacturing Practices

A notable trend in the Air Brake System Market is the emphasis on lightweight components and sustainable manufacturing to meet fuel efficiency and emission reduction targets. Manufacturers are increasingly adopting composite materials, aluminum alloys, and advanced polymers to reduce overall system weight without compromising durability or performance. It aligns with industry-wide efforts to enhance energy efficiency, particularly in electric and hybrid commercial vehicles. The adoption of eco-friendly production processes and recyclable materials is also growing, driven by environmental regulations and corporate sustainability goals. Integration of regenerative braking in hybrid and electric platforms is influencing system design and performance specifications. These shifts are setting the stage for next-generation braking systems that balance high performance with environmental responsibility.

- For instance, the regenerative braking system in a Tesla Model S can capture energy at a rate of 60 kilowatts when decelerating from highway speeds.

Market Challenges Analysis:

High Maintenance Costs and Complex System Requirements

The Air Brake System Market faces challenges from the high maintenance costs and technical complexities associated with advanced braking systems. Frequent inspections, component replacements, and specialized servicing increase operational expenses for fleet operators. It requires skilled technicians to manage repairs and diagnostics, which can be a constraint in regions with limited technical expertise. The integration of electronic controls and advanced components further raises system costs, making affordability a concern for small-scale operators. These factors can delay adoption in cost-sensitive markets, despite the long-term safety and performance benefits.

Supply Chain Disruptions and Raw Material Price Volatility

Unstable raw material prices and supply chain disruptions are affecting the Air Brake System Market, influencing both production schedules and final product costs. It relies on high-quality metals, alloys, and composite materials, which are subject to global price fluctuations. Geopolitical tensions, trade restrictions, and transportation delays can disrupt timely availability of key components. Such instability impacts manufacturing continuity and may limit the ability of suppliers to meet growing demand. These challenges emphasize the need for strategic sourcing, diversified supplier networks, and localized manufacturing to ensure market stability.

Market Opportunities:

Rising Demand from Emerging Markets and Infrastructure Expansion

The Air Brake System Market holds strong growth potential in emerging economies where rapid urbanization and infrastructure development are boosting demand for commercial vehicles and rail networks. Governments are investing heavily in transportation projects, creating opportunities for manufacturers to supply advanced braking solutions. It benefits from fleet expansions in logistics, mining, and public transportation sectors, where safety and reliability are priorities. Growing adoption of high-speed rail in countries like China and India further strengthens the market outlook. These regions present long-term prospects for both OEM sales and aftermarket services.

Integration with Electric and Autonomous Vehicle Platforms

Advancements in electric and autonomous vehicle technology are opening new avenues for the Air Brake System Market. It supports the development of lightweight, energy-efficient, and electronically controlled braking systems tailored for next-generation vehicles. Autonomous transportation requires precision braking, creating demand for integrated systems with advanced sensors and real-time control capabilities. The shift toward electric buses and trucks in urban fleets is accelerating interest in regenerative and low-maintenance brake designs. Manufacturers that align product innovations with these technological shifts can secure a competitive edge in evolving mobility markets.

Market Segmentation Analysis:

By Type

The Air Brake System Market, when segmented by type, includes disc brakes and drum brakes, each serving distinct performance and application needs. Disc brakes are gaining wider adoption due to superior heat dissipation, shorter stopping distances, and compatibility with advanced electronic control systems. Drum brakes maintain strong demand in heavy-duty commercial vehicles and rail applications, where durability and lower maintenance frequency are critical.

- For instance, after a software update to its braking system, a Tesla Model 3 was able to achieve a stopping distance of 133 feet from 60 miles per hour.

By Application

By application, the market is divided into commercial vehicles, railways, and other specialized transportation segments. Commercial vehicles dominate due to expanding logistics, mining, and construction activities that require reliable braking under heavy loads. Railways form a significant segment, with high-speed and freight networks driving the need for robust and responsive braking systems. It benefits from rising infrastructure investments in both passenger and freight transport.

By Component

In terms of components, the market includes compressor, governor, foot valve, brake chamber, slack adjuster, and others. The compressor remains a key element, ensuring adequate air pressure for braking performance. Brake chambers and slack adjusters are critical for translating air pressure into mechanical braking force, while foot valves provide precise driver control. It continues to see innovation in component design to enhance efficiency, reduce weight, and improve system integration with smart vehicle technologies.

- For instance, ZF’s e-comp Scroll air compressor for electric commercial vehicles uses interlocking scrolls that limit operational noise to just 67 dB(A).

Segmentations:

- By Type:

- By Application:

- Commercial Vehicles

- Railways

- Others

- By Component:

- Compressor

- Governor

- Foot Valve

- Brake Chamber

- Slack Adjuster

- Others

- By Distribution Channel:

- By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia Pacific Dominance with Rapid Industrial and Infrastructure Growth

Asia Pacific holds 45% of the Air Brake System Market, maintaining its position as the leading regional segment. The region’s growth is driven by strong commercial vehicle production and expanding rail infrastructure in China, India, and Japan. It benefits from large-scale manufacturing capabilities and increasing adoption of safety-compliant systems in both OEM and aftermarket segments. The presence of major automotive and rail equipment manufacturers enhances supply capacity and technology uptake. Government safety mandates and emission regulations are accelerating the use of modern, efficient braking technologies.

Steady Demand and Regulatory Influence in North America

North America accounts for 28% of the Air Brake System Market, supported by stringent safety standards and advanced fleet technologies. The region’s focus on high-performance braking systems for heavy-duty trucks, buses, and freight rail boosts demand for innovative solutions. It gains from strong aftermarket activity, as fleet operators invest in system upgrades to meet compliance and operational efficiency targets. The adoption of electronic braking systems and integration with driver assistance technologies is advancing rapidly. Continued investment in freight and passenger rail infrastructure adds further growth momentum.

Technological Advancements Driving Growth in Europe

Europe represents 20% of the Air Brake System Market, reflecting a mature yet steadily expanding regional segment. Regional manufacturers are at the forefront of innovations in lightweight, energy-efficient, and electronically controlled braking systems. It benefits from high adoption of advanced driver assistance systems, driving demand for compatible braking technologies. Expansion of high-speed rail projects and modernization of freight operations are strengthening growth prospects. The region’s emphasis on sustainability is supporting the shift toward eco-friendly materials and low-maintenance system designs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Knorr-Bremse (Germany)

- Wabco (Belgium)

- Meritor (U.S.)

- SORL Auto Parts, Inc. (China)

- Wichita Clutch (U.S.)

- Bludot Manufacturing (U.S.)

- Continental AG (Germany)

- Maxcess (U.S.)

- Cojali S.L. (Spain)

- Haldex (Sweden)

- Federal-Mogul Holdings Corporation (U.S.)

- Airmaster Brake Systems (South Africa)

Competitive Analysis:

The Air Brake System Market is characterized by the presence of established global manufacturers and regional players competing on technology, product quality, and service capabilities. Leading companies focus on developing advanced electropneumatic and electronically controlled systems to meet evolving safety and efficiency standards. It emphasizes R&D investments to integrate IoT-based diagnostics, lightweight materials, and compatibility with advanced driver assistance systems. Strategic partnerships with OEMs, expansion into emerging markets, and strengthening aftermarket networks are key competitive approaches. Major players leverage their manufacturing scale and global distribution channels to maintain market presence and capture new contracts in both commercial vehicle and rail sectors. Competitive intensity remains high, with innovation, cost efficiency, and regulatory compliance serving as primary differentiators.

Recent Developments:

- In June 2025, Knorr-Bremse announced it would showcase its new Sand Flow Detection technology for the UK rail market at the Rolling Stock Networking (RSN) 2025 event on July 3rd.

- In September 2024, Maxcess International announced its acquisition of International Cutting Die (ICD), a manufacturer of precision cutting dies.

- In April 2025, SAF-Holland SE acquired the remaining 40% of the shares in its Indian joint venture, Haldex ANAND India Private Limited, from its partner, the ANAND Group.

Market Concentration & Characteristics:

The Air Brake System Market displays a moderate to high level of concentration, with a few dominant players holding significant market share alongside a range of regional manufacturers. It is characterized by strong technological requirements, high regulatory compliance, and substantial capital investment for production and testing facilities. Leading companies differentiate through innovation in electropneumatic controls, lightweight materials, and integration with advanced driver assistance systems. The market demonstrates stable long-term demand driven by commercial vehicle and rail applications, with OEM contracts and aftermarket services forming critical revenue streams. Competitive dynamics are shaped by global supply chain capabilities, product reliability, and the ability to meet diverse regional standards.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Component, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of electropneumatic and electronically controlled braking systems will enhance precision, safety, and integration with advanced vehicle technologies.

- Demand for IoT-enabled brake monitoring and predictive maintenance solutions will expand, improving fleet efficiency and reducing operational downtime.

- Rising investment in high-speed rail projects across emerging and developed economies will strengthen demand for advanced rail braking solutions.

- Growing focus on lightweight materials and energy-efficient designs will support the shift toward fuel-efficient and low-emission vehicle platforms.

- Integration of braking systems with advanced driver assistance systems will become a standard feature in commercial vehicles.

- Expansion of urban mass transit networks will create new opportunities for braking system suppliers in passenger rail and metro projects.

- Increasing replacement and upgrade demand in the aftermarket will support steady revenue streams for manufacturers.

- Technological advancements in regenerative braking will gain momentum, particularly in electric and hybrid commercial vehicles.

- Stricter safety regulations worldwide will accelerate innovation and compliance-focused product development.

- Strategic partnerships between global suppliers and regional OEMs will drive localization of production and expand market penetration in emerging economies.