Market Overview:

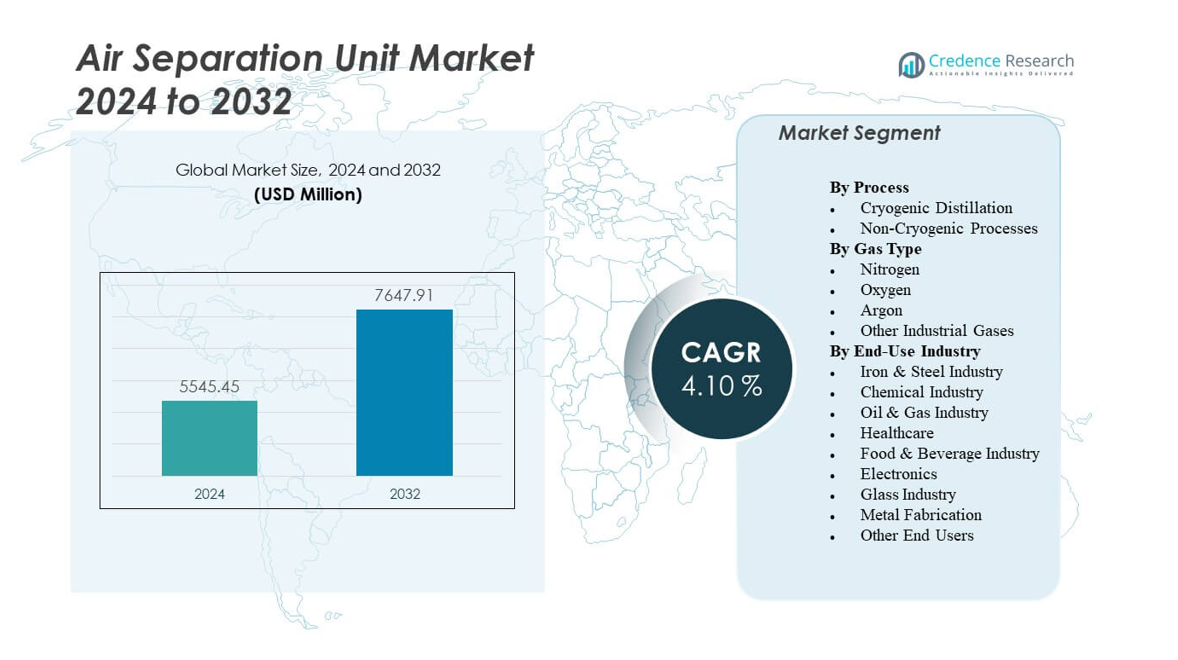

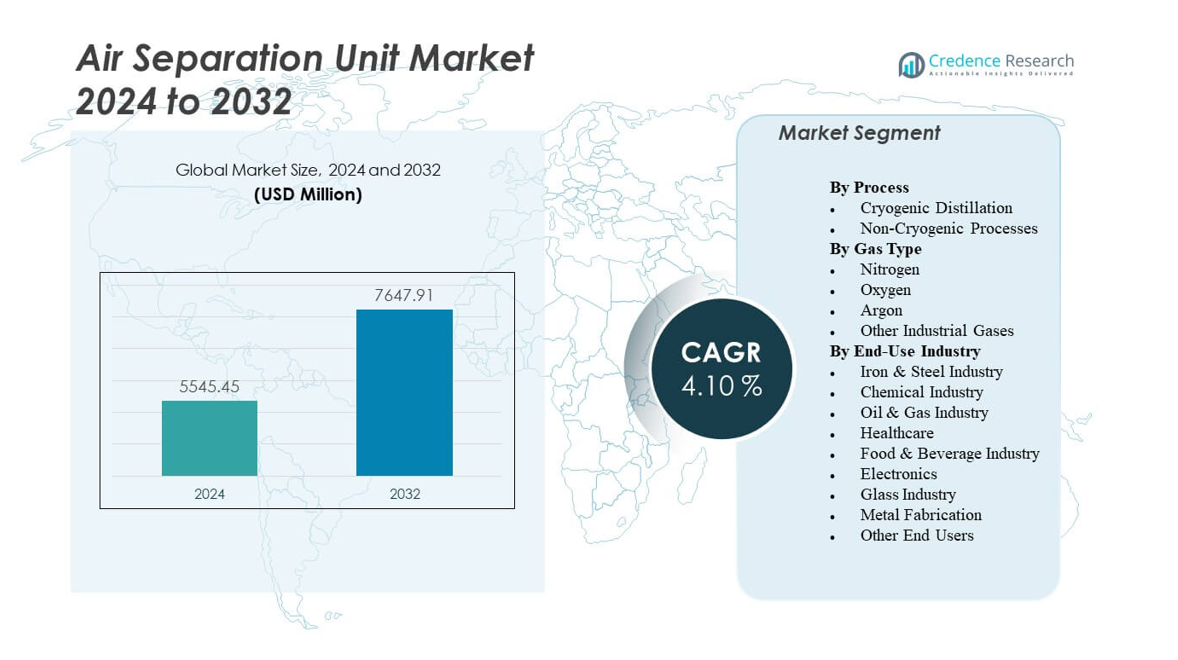

The Air Separation Unit Market is projected to grow from USD 5545.45 million in 2024 to an estimated USD 7647.91 million by 2032, with a compound annual growth rate (CAGR) of 4.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Separation Unit Market Size 2024 |

USD 5545.45 million |

| Air Separation Unit Market, CAGR |

4.1% |

| Air Separation Unit Market Size 2032 |

USD 7647.91 million |

Rising industrialization and rapid infrastructure development are driving strong demand for industrial gases across multiple sectors. Steel and chemical industries depend heavily on air separation units for process optimization and safety operations. The healthcare sector’s rising need for medical-grade oxygen is another major driver. Increasing focus on energy efficiency and clean production technologies encourages the adoption of advanced cryogenic and non-cryogenic systems, enhancing productivity and reducing operational costs.

Asia-Pacific leads the market due to large-scale industrial growth in China, India, and South Korea. These nations show robust manufacturing output and rising energy demand, promoting significant air separation investments. North America and Europe maintain steady growth through modernization and integration of low-carbon technologies. The Middle East is emerging as a strategic region with expanding hydrogen and gas-based projects, while Latin America continues to grow through industrial diversification and improved access to industrial gases.

Market Insights:

- The Air Separation Unit Market is valued at USD 5545.45 million in 2024 and projected to reach USD 7647.91 million by 2032, growing at a CAGR of 4.1%.

- Expanding steel, chemical, and healthcare sectors are boosting the global demand for oxygen, nitrogen, and argon.

- Industrial modernization and energy-efficient technologies are enhancing operational performance and reducing power consumption.

- High installation and maintenance costs remain key restraints for small-scale manufacturers.

- Rapid industrialization in Asia-Pacific positions it as the leading regional market.

- North America and Europe show stable growth driven by sustainability and low-carbon gas initiatives.

- Emerging economies in the Middle East and Latin America are investing in gas-based infrastructure and hydrogen projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Industrial Demand for Process and Specialty Gases Across Core Industries

The Air Separation Unit Market is experiencing strong demand due to rising consumption of oxygen, nitrogen, and argon in steelmaking, petrochemicals, and electronics manufacturing. These gases are essential for combustion, refining, and inerting applications. The steel industry remains the largest end-user, driven by continuous capacity expansion in Asia. The chemical sector uses nitrogen for blanketing and purging, enhancing process safety. Growth in semiconductor and flat-panel manufacturing also supports nitrogen-based applications. The healthcare industry’s demand for medical oxygen further adds to market strength. The need for uninterrupted gas supply drives investment in large-scale on-site air separation plants.

Technological Innovation in Cryogenic and Non-Cryogenic Separation Processes

Continuous advancements in cryogenic distillation and pressure swing adsorption (PSA) technologies are enhancing production efficiency and purity levels. Manufacturers are developing modular air separation systems to improve scalability and reduce installation time. Digital control and automation are improving system reliability and predictive maintenance. Energy recovery systems integrated into air compressors help lower power consumption. Companies focus on improving heat exchanger design to optimize cooling cycles. New generation molecular sieves and membranes improve selectivity and operational lifespan. It benefits from the adoption of digital twins for monitoring energy use and equipment health in real time.

- For example, AirSep Corporation (a division of CAIRE Inc.) launched the N2WAVE™ Twin Tower and Modular Series pressure-swing-adsorption (PSA) nitrogen generators on May 5 2025.

Expansion of Green Hydrogen Projects Driving Air Separation Investments

Rising global investment in green hydrogen production is stimulating demand for advanced oxygen generation systems. Hydrogen plants require high-purity oxygen for efficient electrolysis. Governments in Europe, Japan, and the Middle East are promoting large-scale hydrogen facilities. This creates new opportunities for air separation unit suppliers with low-carbon technology portfolios. Energy-efficient air separation designs help reduce overall plant emissions. Integration of renewable energy sources in gas production supports sustainability goals. The market benefits from collaboration between industrial gas firms and energy developers to build long-term supply partnerships.

- For instance, in September 2025, Siemens Energy delivered the first nine of twelve PEM electrolyzers to Air Liquide SA’s 200 MW Normand’Hy hydrogen project in France, supporting one of Europe’s largest renewable hydrogen plants.

Growing Need for Onsite Gas Generation in Emerging Economies

Industrial expansion in Asia-Pacific and Latin America is fueling demand for localized gas generation systems. Onsite air separation units offer cost efficiency and continuous supply, reducing dependency on bulk gas transport. Companies in sectors like glass manufacturing, pulp and paper, and refining are adopting compact and skid-mounted systems. It supports decentralized industrial clusters with consistent gas availability. Government incentives for infrastructure and energy-intensive projects enhance adoption. Manufacturers are focusing on plant automation and remote control to reduce manpower costs. The market grows as industrial players prioritize self-sufficient production ecosystems.

Market Trends

Integration of Digital Technologies and IoT-Based Monitoring Systems

Digitalization is transforming operational performance through smart sensors, real-time analytics, and predictive diagnostics. IoT-based air separation units help track purity levels, flow rates, and energy use. AI-driven control systems optimize compressor efficiency and minimize downtime. Remote monitoring enables centralized supervision of multiple sites, improving response time to equipment issues. Cloud-based platforms enhance asset management and performance visualization. The Air Separation Unit Market benefits from predictive maintenance that reduces operational costs. Data-driven insights are now central to improving plant efficiency and sustainability goals.

Shift Toward Modular and Skid-Mounted System Architectures

Industries are preferring modular designs that simplify installation and reduce project lead times. Compact air separation units allow scalability based on changing production needs. Standardized designs enhance manufacturing speed and lower engineering costs. Modular systems also support relocation flexibility, beneficial for remote or temporary operations. The packaging of systems into transportable skids ensures faster commissioning. It aligns with the growing trend toward flexible production facilities. The shift reflects user demand for quick deployment, minimal downtime, and lower capital expenditure in industrial projects.

- For example, according to Linde PLC’s official product literature, its SPECTRA™ modular air separation units offer capacities “from 7,000 Nm³/h to 70,000 Nm³/h” for ultra-high-purity nitrogen-generation, specifically targeting electronics and semiconductor applications.

Rising Focus on Energy-Efficient and Low-Carbon Production Technologies

Energy consumption accounts for a significant portion of operating costs in air separation plants. Manufacturers are adopting energy-efficient compressors, advanced turbines, and optimized distillation columns. Integration of variable frequency drives reduces power usage during part-load operations. Waste heat recovery systems contribute to sustainability targets and cost reduction. Companies are exploring renewable-powered operations, integrating solar or wind sources into process utilities. The Air Separation Unit Market sees strong alignment with global decarbonization targets. Innovation in process optimization continues to redefine competitive advantage in energy efficiency.

- For instance, Messer Group reported in its 2023 Environmental and Climate Protection statement that the global energy coefficient for its air separation units stood at 103.2, compared to 102.5 in the previous year, reflecting variations in energy consumption linked to operational utilization and process optimization across its facilities.

Strategic Collaborations and Long-Term Industrial Gas Supply Agreements

Leading gas companies are entering long-term supply contracts with steelmakers, refineries, and chemical producers. These partnerships ensure stable revenue streams and production continuity. Joint ventures between equipment manufacturers and energy firms strengthen market presence in emerging regions. Strategic collaborations support localization of production and maintenance services. It enables faster technology transfer and improved after-sales support. The trend is creating regional hubs for gas supply reliability and technology access. Companies leverage partnerships to secure long-term competitiveness and client retention.

Market Challenges Analysis

High Energy Consumption and Operating Cost Constraints in Air Separation

Energy intensity remains a major barrier to profitability in the Air Separation Unit Market. Power consumption accounts for nearly 60–70% of total production cost. High electricity prices in developing economies strain operational margins. Fluctuating energy availability impacts plant reliability and productivity. Meeting carbon reduction goals while maintaining efficiency adds complexity. Retrofitting existing systems with modern energy-saving technologies involves high investment. It requires continuous innovation to balance performance with cost sustainability. Companies must adopt hybrid systems and renewable integration to mitigate long-term risks.

Complex Supply Chain and Capital-Intensive Project Deployment

Large-scale air separation projects demand significant upfront capital and long lead times. Supply chain disruptions, especially in critical components like heat exchangers and compressors, delay project execution. Global logistics challenges impact delivery schedules and cost structures. Regulatory clearances and safety compliance processes extend commissioning periods. It adds complexity to project management and financial planning. Dependence on skilled operators and maintenance specialists remains another bottleneck. The industry faces pressure to standardize procurement and project models to ensure timely delivery and cost control.

Market Opportunities

Rising Adoption of Industrial Gases in Green Energy and Hydrogen Economy

The transition toward cleaner energy sources is creating vast growth opportunities. Green hydrogen and carbon capture projects rely heavily on oxygen and nitrogen production. Governments are funding decarbonization programs, expanding opportunities for air separation unit suppliers. Integration with renewable-based electrolyzers strengthens the role of these systems in future energy networks. It benefits from innovation in low-emission process design and hybrid configurations. Strategic collaborations with renewable developers will help gas manufacturers secure long-term growth. Expanding clean energy initiatives across Asia and Europe strengthens market outlook.

Expanding Industrial Infrastructure and Localization of Gas Production Facilities

Developing regions are investing heavily in industrial clusters and manufacturing zones. Localized gas production offers cost savings and enhanced supply reliability for end users. Demand from metallurgy, refining, and electronics sectors supports new installations. Governments promoting industrial self-sufficiency encourage local gas plant setups. Technological innovation in compact and modular systems enables small industries to access reliable gas supply. The Air Separation Unit Market benefits from public–private partnerships for infrastructure enhancement. Long-term growth depends on the ability to provide efficient, scalable, and low-cost gas generation solutions.

Market Segmentation Analysis:

By Process

The Air Separation Unit Market is divided into cryogenic distillation and non-cryogenic processes. Cryogenic distillation dominates due to its ability to produce large volumes of high-purity gases required in steel, chemical, and healthcare industries. It remains the preferred technology for bulk gas production and long-term industrial contracts. Non-cryogenic processes, including pressure swing adsorption and membrane separation, are gaining attention for small to mid-scale applications. These systems offer lower operational costs, quicker setup, and flexibility for on-site gas generation. The segment benefits from industries seeking modular and energy-efficient systems.

- For instance, Air Liquide commissioned a next-generation cryogenic air separation unit in Zhangjiagang, China in late 2023, designed for a total capacity of up to 3,800 tonnes of oxygen per day, directly supplying steel and chemical manufacturers in the region.

By Gas Type

Nitrogen holds the largest share owing to its extensive use in chemical processing, electronics manufacturing, and metal fabrication. Oxygen follows closely due to strong demand from steelmaking, refining, and healthcare. Argon finds widespread use in welding, semiconductor production, and specialty metal applications. Other industrial gases, such as hydrogen, helium, and carbon dioxide, contribute niche demand from high-precision and research-based industries. It demonstrates steady growth driven by advancements in gas separation and purification technologies.

- For instance, in April 2025, Linde announced it would build, own, and operate its eighth on-site air separation unit at Samsung Electronics’ Pyeongtaek semiconductor complex in South Korea to supply high-purity nitrogen, oxygen, and argon, supporting the company’s advanced chip manufacturing expansion.

By End-Use Industry

The iron and steel industry remains the leading end user, relying on oxygen and nitrogen for combustion and cooling operations. The chemical and oil and gas sectors drive significant demand for nitrogen and argon in refining and process safety applications. Healthcare shows rapid adoption due to rising need for medical oxygen. The food and beverage, electronics, glass, and metal fabrication industries continue to expand consumption through packaging, inerting, and process optimization. It supports diversified growth across industrial and commercial sectors globally.

Segmentation:

By Process

- Cryogenic Distillation

- Non-Cryogenic Processes

By Gas Type

- Nitrogen

- Oxygen

- Argon

- Other Industrial Gases

By End-Use Industry

- Iron & Steel Industry

- Chemical Industry

- Oil & Gas Industry

- Healthcare

- Food & Beverage Industry

- Electronics

- Glass Industry

- Metal Fabrication

- Other End Users

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

Asia-Pacific dominates the Air Separation Unit Market with a market share of 41%. The region’s strong presence is driven by high demand from steelmaking, electronics, and petrochemical industries. China, India, Japan, and South Korea are major contributors, supported by large-scale manufacturing and infrastructure expansion. Rapid industrialization and rising energy demand encourage investment in air separation facilities. Governments are promoting cleaner industrial operations and expanding healthcare infrastructure, strengthening the need for industrial gases. It continues to attract international players through joint ventures and localized production strategies that reduce import dependency.

North America

North America holds a 26% market share, supported by mature industrial gas networks and strong adoption of energy-efficient technologies. The United States leads regional growth, followed by Canada, driven by the oil and gas, chemical, and healthcare sectors. The region emphasizes modernization of aging air separation units with advanced control systems and renewable integration. Increasing investment in green hydrogen and carbon capture projects supports new installations. It benefits from technological innovation, regulatory support for decarbonization, and rising industrial automation adoption. The presence of key industry players and established distribution infrastructure ensures reliable market performance.

Europe and Rest of the World (RoW)

Europe accounts for 21% of the global market, led by Germany, France, and the United Kingdom. The region focuses on sustainable industrial practices and low-carbon gas production to align with EU emission targets. It sees growing integration of air separation systems in hydrogen and renewable projects. The Rest of the World, including the Middle East, Africa, and Latin America, represents 12% of the market share. Emerging economies such as Brazil, Saudi Arabia, and the UAE are expanding industrial capacity and investing in on-site gas generation. These regions provide strong long-term opportunities supported by economic diversification and industrial policy reforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Linde AG / Linde Plc

- Air Liquide SA

- Air Products and Chemicals Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- SIAD Macchine Impianti Spa

- Universal Industrial Gases, Inc.

- Hangzhou Hangyang Co., Ltd.

- Yingde Gases Group Co., Ltd.

- Daesung Industrial Co., Ltd.

- Air Water Inc.

Competitive Analysis:

The Air Separation Unit Market is characterized by strong competition among global industrial gas and equipment manufacturers. Key players such as Linde plc, Air Liquide, Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation, and Messer Group dominate with extensive product portfolios and global supply networks. It emphasizes technological innovation in cryogenic systems, modular design, and energy efficiency to maintain competitiveness. Companies are expanding production capacity, forming strategic partnerships, and investing in green hydrogen and carbon capture projects. Regional players focus on cost optimization and localized service support to strengthen their presence. Competitive differentiation is driven by plant reliability, customization, and integration with digital control systems that improve operational efficiency and customer satisfaction.

Recent Developments:

- In October 2025, Pryce Corporation announced an investment of PHP 6 billion to construct three new air separation plants in the Philippines, specifically targeting the Davao, Bacolod, and Pangasinan regions. This initiative aims to increase Pryce’s production capacity of oxygen and nitrogen to meet rising industrial and medical gas needs across various sectors in these locations.

- In October 2025, Linde commissioned a new air separation unit in Eastern Tennessee, United States, further enhancing its supply capability in the region. This new facility bolsters Linde’s presence and ability to deliver critical gases for local steelmaking, healthcare, and chemical production, reflecting the company’s ongoing expansion strategy in North America.

- In September 2025, Air Products and Chemicals, Inc. announced that its new air separation facility in Cleveland, Ohio, is now onstream and supplying customers. The new plant increases the reliability and flexibility of oxygen and nitrogen supply in the region and demonstrates Air Products’ ongoing investments in North American ASU infrastructure.

Report Coverage:

The research report offers an in-depth analysis based on Process, Gas Type and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing investments in clean energy and hydrogen production will accelerate the demand for new air separation units worldwide.

- Industrial expansion across Asia-Pacific will continue driving installations, particularly for oxygen and nitrogen supply in steel and chemical sectors.

- Ongoing advancements in cryogenic and non-cryogenic technologies will improve process efficiency and system reliability.

- Integration of digital monitoring, IoT, and predictive maintenance tools will enhance plant performance and reduce downtime.

- Energy-efficient and low-carbon air separation systems will gain traction under tightening environmental regulations.

- Strategic partnerships and long-term supply contracts will strengthen the competitive positioning of key industry players.

- Expansion of healthcare and electronics manufacturing will increase the demand for high-purity gases globally.

- Modular and skid-mounted units will attract mid-scale industries seeking quick installation and cost-effective operations.

- Government initiatives for industrial self-sufficiency and infrastructure growth will boost localized gas production.

- Continuous R&D in membrane and adsorption technologies will shape future innovation and market differentiation