Market Overview

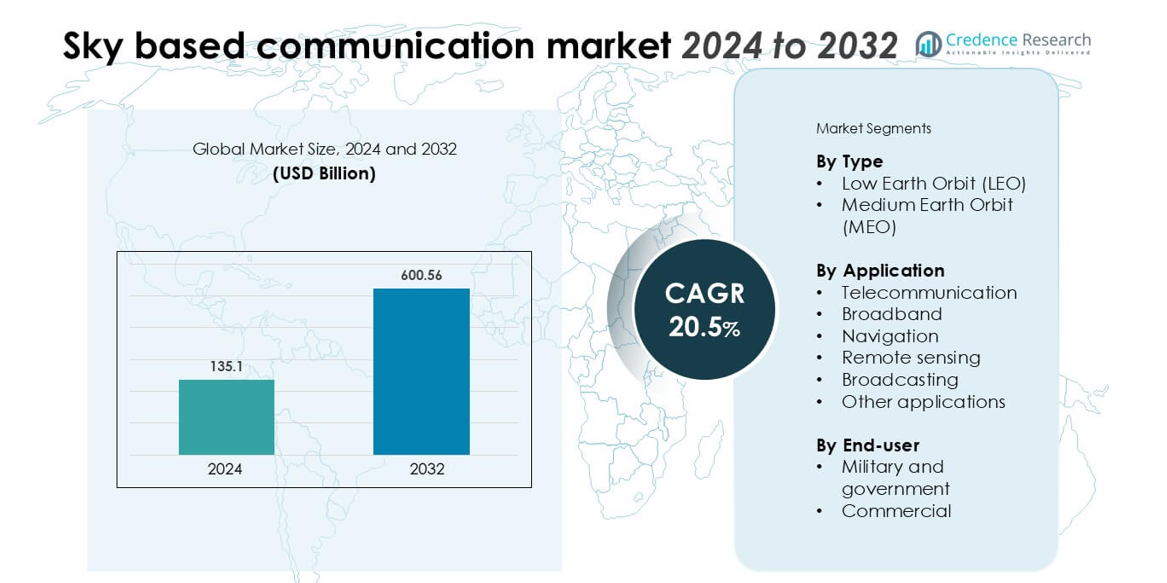

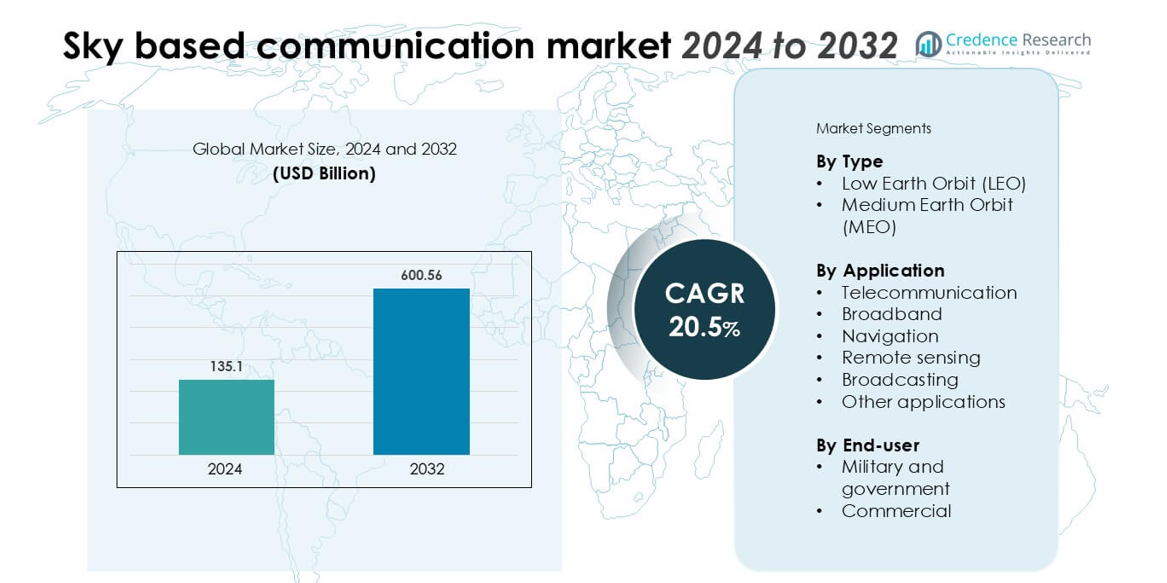

Sky based communication market size was valued USD 135.1 billion in 2024 and is anticipated to reach USD 600.56 billion by 2032, at a CAGR of 20.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sky Based Communication Market Size 2024 |

USD 135.1 billion |

| Sky Based Communication Market, CAGR |

20.5% |

| Sky Based Communication Market Size 2032 |

USD 600.56 billion |

The Sky-Based Communication market is dominated by key players including SpaceX, Thales, Iridium, Honeywell, Viasat, Airbus, Maxar Technologies, Inmarsat, L3Harris, China Aerospace Science and Technology Corporation, Intelsat, Cobham, and Echostar. These companies lead through extensive satellite deployments, advanced technological solutions, and strategic partnerships aimed at enhancing global connectivity. SpaceX and OneWeb are notable for their large Low Earth Orbit (LEO) constellations, providing high-speed internet and low-latency communication worldwide, while Inmarsat and Viasat focus on high-throughput satellite networks for commercial and defense applications. The market is geographically led by North America, which commands the largest share at approximately 35%, driven by substantial investments in satellite infrastructure, strong adoption of next-generation communication technologies, and the presence of major industry players. This leadership positions the region as a central hub for innovation and expansion in the global sky-based communication ecosystem.

Market Insights

- The global sky-based communication market was valued at USD 135.1 billion in 2024 and is projected to reach USD 600.56 billion by 2032, growing at a CAGR of around 20.5%, with North America holding the largest regional share of about 35% and the Low Earth Orbit (LEO) segment dominating by type.

- Market growth is primarily driven by rising demand for global broadband connectivity, expanding IoT networks, and government-backed initiatives to bridge the digital divide in remote and rural regions.

- Emerging trends include the integration of 5G technology with satellite networks, rapid deployment of small satellites and mega constellations, and increasing private sector participation in commercial satellite communication.

- The market faces restraints such as high satellite launch and maintenance costs, complex regulatory frameworks, and concerns over orbital congestion and space debris.

- Regionally, North America leads, followed by Europe (25%) and Asia-Pacific (28%), driven by strong investments in telecommunication and defense applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Low Earth Orbit (LEO) segment dominates the sky-based communication market, holding the largest market share due to its lower latency, high-speed data transfer, and cost-effective deployment. LEO satellites, operating at altitudes between 500 and 2,000 kilometers, enable efficient real-time communication and global broadband coverage. Their growing adoption in telecommunication and remote sensing applications further accelerates demand. The increasing number of satellite constellations launched by private players to enhance connectivity in remote regions serves as a primary driver for LEO’s market leadership over Medium Earth Orbit (MEO) systems.

- For instance, in mid-July 2025, a launch added 24 satellites to the constellation, which at the time brought the total number of satellites in orbit to over 8,000.

By Application:

The telecommunication segment leads the market, accounting for the largest share owing to the rising demand for high-speed internet, voice, and data communication services. Sky-based communication systems play a crucial role in expanding network reach, particularly in underserved and rural areas. The deployment of advanced satellite networks enables enhanced bandwidth, seamless connectivity, and improved resilience for global communications. Growth is further driven by increased investments in satellite broadband infrastructure and the integration of 5G technology, which strengthens satellite communication’s role in supporting next-generation telecommunication services.

- For instance, Inmarsat’s Global Xpress network, operating in the Ka-band, achieved a forward channel throughput rate of 330 Mbps during over-the-air tests conducted in collaboration with VT iDirect, demonstrating the network’s capability to support high-speed mobile broadband services.

By End-user:

The commercial segment dominates the end-user market, capturing the majority share due to extensive applications across broadcasting, broadband services, and enterprise connectivity. Businesses increasingly rely on satellite communication for real-time data exchange, navigation support, and operational efficiency in remote operations such as aviation, maritime, and mining. Rising private sector participation and technological advancements, including high-throughput satellites and low-cost launch services, further fuel commercial adoption. The military and government segment, while substantial, trails due to focused applications in defense communication and surveillance rather than widespread service deployment.

Key Growth Drivers

Rising Demand for Global Connectivity

The expanding need for seamless, high-speed internet access across remote and underserved regions is a major driver of the sky-based communication market. With growing dependence on real-time data transfer and digital communication, satellite networks have become crucial for bridging connectivity gaps where terrestrial infrastructure is limited or non-existent. Governments and private operators are investing heavily in satellite constellations to enhance global broadband access. Moreover, the surge in remote work, online education, and IoT applications has further intensified the need for reliable satellite-based communication, driving steady market growth worldwide.

- For instance, as of October 2025, SpaceX has launched over 10,000 Starlink satellites into low Earth orbit, with approximately 8,600 currently operational, providing internet services to more than 7 million customers worldwide.

Technological Advancements in Satellite Systems

Continuous innovation in satellite technology, such as miniaturization, reusable launch vehicles, and high-throughput satellites (HTS), significantly boosts market expansion. Modern Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellites offer lower latency, higher data capacity, and cost efficiency, improving overall communication performance. The integration of artificial intelligence, edge computing, and inter-satellite links enhances network flexibility and data processing capabilities. These advancements not only reduce operational costs but also expand the scope of satellite communication across diverse sectors, including defense, telecommunication, and remote sensing.

- For instance, each individual V3 satellite is designed to provide over 1 Tbps of downlink capacity to users on the ground.

Increasing Investment by Private Sector and Governments

Rising capital investments from both government agencies and private players are accelerating market development. Governments are supporting satellite infrastructure to strengthen national communication networks, disaster management, and defense capabilities. Meanwhile, private companies are investing in large-scale satellite constellations to expand global broadband services. Partnerships between public and private entities have led to rapid advancements in satellite deployment and operational efficiency. This collaborative approach ensures faster network expansion, stimulates competition, and drives innovation, making satellite-based communication more accessible and affordable globally.

Key Trends & Opportunities

Integration of 5G with Satellite Networks

The convergence of 5G technology with satellite communication presents a transformative opportunity for the market. This integration enables enhanced connectivity, low-latency communication, and broader coverage across rural and maritime regions. Satellite-5G hybrid networks are critical for supporting autonomous systems, smart cities, and advanced IoT applications. As telecom providers increasingly partner with satellite operators, new service models and network architectures are emerging. The synergy between terrestrial and space-based networks enhances overall communication efficiency, positioning satellite systems as an essential enabler of next-generation global communication.

- For instance, Viasat has joined the 5G Automotive Association to expand satellite-enabled vehicle communications technology for autonomous transport systems.

Growth of Small Satellites and Mega Constellations

The proliferation of small satellites and large satellite constellations is reshaping the market landscape. Companies are deploying hundreds of small satellites in LEO to provide continuous global coverage and high data throughput. This trend significantly reduces launch costs and accelerates deployment timelines. The use of standardized, modular satellite designs allows for scalability and flexible service delivery. These constellations support various applications, including broadband, navigation, and Earth observation, creating lucrative opportunities for satellite manufacturers, service providers, and launch vehicle operators.

- For instance, as of October 2025, the European Space Agency estimates that nearly 24,000 satellites have been launched in Earth’s orbit since 1957. However, only a fraction of those is still in operation. As of late 2022, data from the Union of Concerned Scientists (UCS) indicated that about half of all satellites in space were non-operational.

Key Challenges

High Initial Investment and Maintenance Costs

Despite technological progress, the sky-based communication market faces substantial cost barriers. The development, launch, and maintenance of satellite systems require significant capital investment, making entry difficult for smaller players. Additionally, expenses related to satellite tracking, repair, and ground infrastructure add to long-term operational costs. Fluctuating launch prices and component shortages further impact profitability. These financial constraints often slow project timelines and limit adoption in emerging markets, challenging the sector’s growth potential despite strong demand for global connectivity.

Space Debris and Regulatory Complexity

The increasing number of satellites launches has intensified concerns over orbital congestion and space debris. The accumulation of inactive satellites and debris fragments poses collision risks, threatening operational satellites and mission safety. Moreover, complex international regulations governing satellite licensing, spectrum allocation, and orbital coordination create administrative hurdles. Compliance with evolving policies and environmental standards increases operational burdens for satellite operators. These challenges necessitate global cooperation and stringent space governance to ensure sustainable and safe development of the sky-based communication ecosystem.

Regional Analysis

North America:

North America holds the largest market share in the sky-based communication market, accounting for over 35% of global revenue. The region’s dominance stems from strong investments in satellite infrastructure, advanced technological adoption, and the presence of key market players such as SpaceX and Iridium Communications. The U.S. leads in deploying Low Earth Orbit (LEO) constellations to enhance broadband and defense communication capabilities. Additionally, supportive government initiatives and defense modernization programs drive demand. Growing integration of satellite networks with 5G and IoT applications further strengthens North America’s leadership position in the global market.

Europe:

Europe accounts for approximately 25% of the global sky-based communication market, supported by active government participation and major space programs under the European Space Agency (ESA). Countries like the United Kingdom, France, and Germany are investing heavily in satellite broadband and navigation projects. The region emphasizes sustainable space operations and environmental responsibility, encouraging the development of smaller, energy-efficient satellites. Growing demand for reliable communication in maritime, aviation, and defense sectors also drives market growth. The increasing collaboration between public agencies and private satellite operators further strengthens Europe’s market presence.

Asia-Pacific:

Asia-Pacific represents around 28% of the global market share and is the fastest-growing region in the sky-based communication market. Rapid digitalization, increasing broadband penetration, and rising demand for rural connectivity propel regional growth. China, India, and Japan are leading contributors, investing heavily in LEO satellite constellations and navigation systems. Government-led initiatives to expand satellite-based telecommunication and defense infrastructure enhance the region’s competitive edge. Expanding commercial applications across agriculture, transportation, and disaster management further stimulate demand, positioning Asia-Pacific as a key growth hub in the global satellite communication industry.

Latin America:

Latin America holds nearly 7% of the global sky-based communication market, driven by rising demand for broadband services in remote and underserved regions. Countries such as Brazil, Mexico, and Argentina are expanding satellite-based telecommunication networks to support economic development and digital inclusion. The region benefits from partnerships with international satellite operators and growing government initiatives aimed at improving connectivity infrastructure. However, high deployment costs and limited local manufacturing capacity pose challenges. Continued investments in LEO satellites and affordable broadband solutions are expected to drive steady market growth across the region.

Middle East & Africa:

The Middle East & Africa region captures roughly 5% of the global sky-based communication market, with steady growth driven by increasing adoption in defense, navigation, and broadcasting applications. Governments are investing in satellite programs to enhance national security, communication resilience, and remote sensing capabilities. Countries like the UAE and South Africa are leading regional advancements through space exploration and telecommunication projects. Expanding demand for broadband connectivity in rural and maritime areas, coupled with emerging private sector involvement, is expected to strengthen market performance despite infrastructural and regulatory constraints.

Market Segmentations:

By Type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

By Application

- Telecommunication

- Broadband

- Navigation

- Remote sensing

- Broadcasting

- Other applications

By End-user

- Military and government

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sky-based communication market is characterized by the presence of several global and regional players competing through technological innovation, strategic partnerships, and large-scale satellite deployments. Key participants such as SpaceX, Thales, Iridium, Honeywell, and Viasat are focusing on expanding their satellite networks and enhancing connectivity solutions to strengthen their market position. Companies like Airbus, Maxar Technologies, and L3Harris are investing in advanced satellite manufacturing and data services, while Inmarsat, Intelsat, and Echostar continue to lead in broadband and broadcasting applications. Additionally, China Aerospace Science and Technology Corporation is bolstering its presence through extensive national satellite programs. The market is witnessing increased collaboration between private and government entities to accelerate network expansion and improve service affordability. Continuous advancements in Low Earth Orbit (LEO) constellations, high-throughput satellites, and 5G integration are intensifying competition, driving innovation, and reshaping the global sky-based communication ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SpaceX

- Thales

- Iridium

- Honeywell

- Viasat

- Airbus

- Maxar Technologies

- Inmarsat

- L3Harris

- China Aerospace Science and Technology Corporation

- Intelsat

- Cobham

- Echostar

Recent Developments

- In November 2023, electronics manufacturer Foxconn launched its first two communications satellites into low Earth orbit via SpaceX’s rideshare program. The company, known for producing Apple’s iPhones, will test these prototype satellites for its broadband and smart vehicle initiatives. The satellites were part of a larger SpaceX mission that carried over 100 small satellites into orbit.

- In August 2023, Intelsat launched its Galaxy 37/Horizons-4 satellite, achieving a milestone by placing eight geostationary satellites in orbit within 10 months. The company runs one of the world’s largest satellite networks, offering in-flight connectivity services.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to exceed USD 600.56 billion by 2032, driven by increasing global demand for high-speed, reliable satellite connectivity.

- Low Earth Orbit (LEO) constellations will dominate future deployments, offering low-latency communication and global broadband coverage.

- 5G–satellite integration will play a pivotal role in expanding connectivity for autonomous systems, IoT, and smart infrastructure.

- The commercial sector will experience rapid growth, particularly in aviation, maritime, and remote enterprise operations.

- Rising government and defense investments will strengthen secure communication networks and space-based surveillance systems.

- Miniaturized and reusable satellites will reduce costs, improving accessibility for small and medium enterprises.

- Asia-Pacific will emerge as the fastest-growing regional market due to expanding telecommunication and digital initiatives.

- Enhanced AI and edge computing integration will optimize data processing and satellite network management.

- Growing sustainability initiatives will encourage responsible satellite launches and debris management.

- Increased public-private partnerships will accelerate innovation, network expansion, and global connectivity infrastructure.