Market Overview

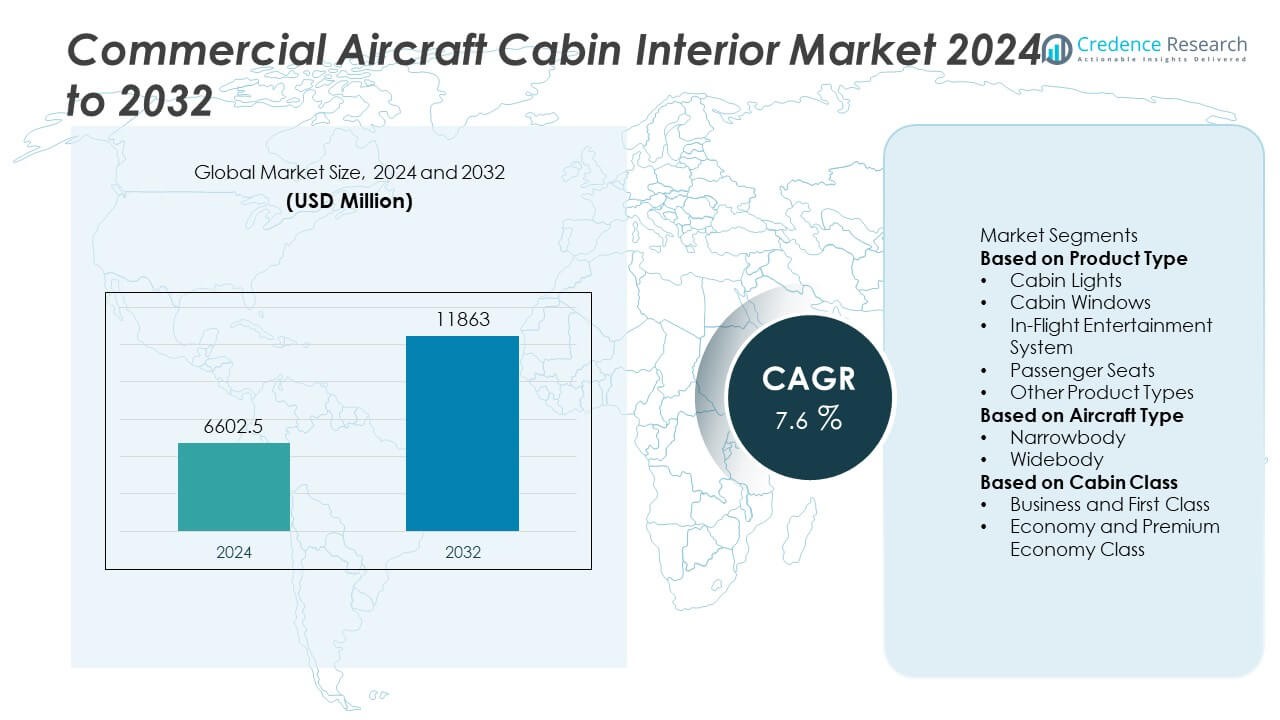

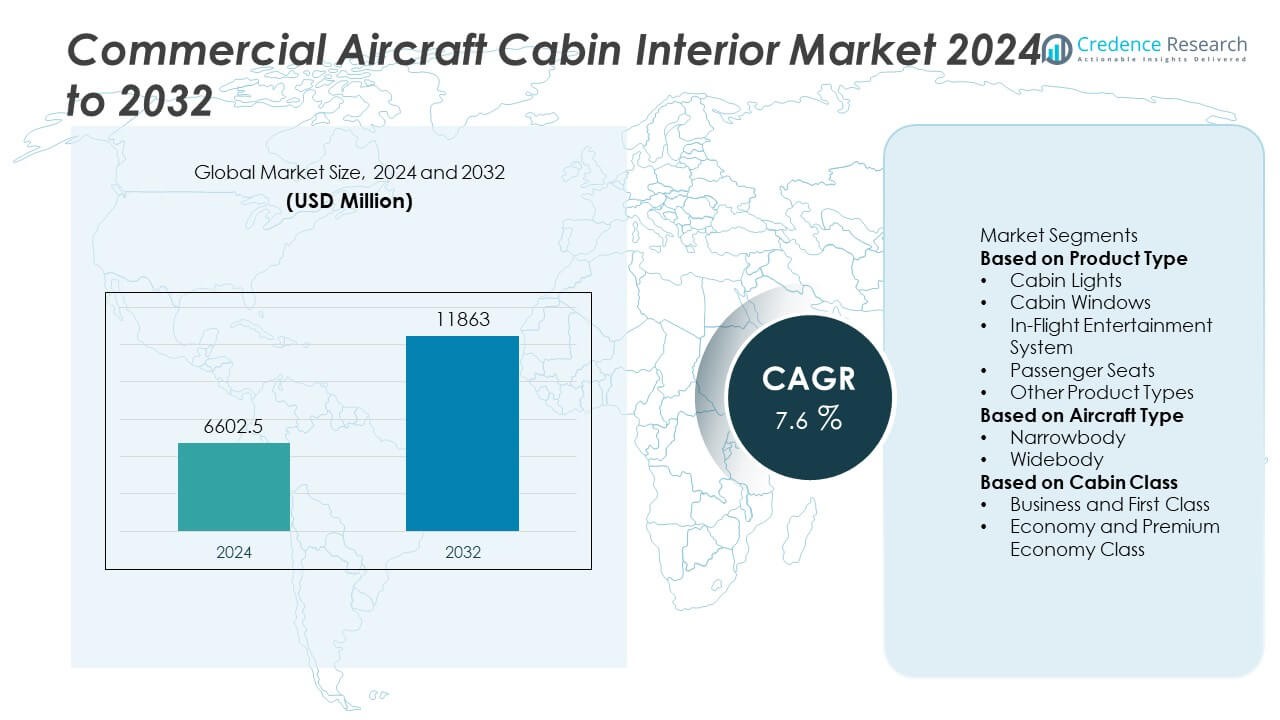

The Commercial Aircraft Cabin Interior Market was valued at USD 6,602.5 million in 2024. It is projected to grow to USD 11,863 million by 2032, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Aircraft Cabin Interior Market Size 2024 |

USD 6,602.5 Million |

| Commercial Aircraft Cabin Interior Market, CAGR |

7.6% |

| Commercial Aircraft Cabin Interior Market Size 2032 |

USD 11,863 Million |

The Commercial Aircraft Cabin Interior Market grows driven by increasing demand for enhanced passenger comfort and advanced cabin technologies. Airlines prioritize lightweight, sustainable materials to improve fuel efficiency and meet regulatory standards. Rising air travel, fleet modernization, and expansion of low-cost carriers stimulate market growth. Smart cabin solutions, including IoT-enabled systems and personalized interiors, gain traction to elevate passenger experience and operational efficiency. Trends highlight a shift toward modular, customizable designs and heightened focus on health and hygiene features post-pandemic.

The Commercial Aircraft Cabin Interior Market spans key regions including North America, Europe, Asia-Pacific, the Middle East, and Latin America, each offering distinct growth opportunities. Asia-Pacific leads with rapid air travel expansion and fleet modernization, while North America benefits from established aviation infrastructure and advanced technology adoption. Europe focuses on regulatory compliance and sustainable cabin solutions, supported by major aerospace hubs. The Middle East drives demand through luxury airline investments, and Latin America shows gradual growth with increasing regional connectivity. Leading companies shaping this market include Collins Aerospace, Honeywell International Inc., Panasonic Corporation, and The Boeing Company.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Aircraft Cabin Interior Market was valued at USD 6,602.5 million in 2024 and is projected to reach USD 11,863 million by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising passenger demand for enhanced comfort and airlines’ focus on improving in-flight experiences drive market growth globally.

- The market trends indicate increasing adoption of lightweight and sustainable materials, alongside integration of smart cabin technologies to improve operational efficiency and passenger satisfaction.

- Intense competition among key players like Collins Aerospace, Honeywell International Inc., Panasonic Corporation, and The Boeing Company fuels continuous innovation and product development.

- High costs related to advanced materials and customization, combined with complex regulatory compliance, restrict rapid market expansion.

- Asia-Pacific leads growth due to rising air travel demand and fleet modernization, while North America and Europe maintain strong positions through technological advancements and regulatory adherence.

- The Middle East and Latin America show emerging opportunities, supported by expanding airline fleets and improving airport infrastructure despite facing economic and geopolitical challenges.

Market Drivers

Rising Demand for Enhanced Passenger Comfort and Experience Drives Market Growth

The growing focus on passenger comfort and in-flight experience significantly fuels the Commercial Aircraft Cabin Interior Market. Airlines invest heavily in upgrading cabin interiors to differentiate their services and attract premium travelers. Innovations in seat design, lighting systems, and entertainment options improve passenger satisfaction and loyalty. Increasing long-haul flights and premium economy class offerings push airlines to adopt advanced cabin solutions. Comfort-enhancing features such as noise reduction materials and ergonomic seats gain prominence. The demand for personalized cabin environments encourages continuous development of interior components.

- For instance, Collins Aerospace introduced its AirLounge seat, which weighs approximately 15 kilograms and offers 60% more reclining range compared to traditional economy seats, enhancing passenger comfort on long-haul flights.

Stringent Regulatory Standards on Safety and Environmental Compliance Boost Market Expansion

Strict regulations governing fire safety, material quality, and environmental sustainability drive the adoption of advanced cabin interior materials. It must comply with certification requirements set by aviation authorities globally, ensuring passenger safety and reducing environmental impact. Airlines prioritize lightweight and fire-resistant materials to meet regulatory standards while improving fuel efficiency. Eco-friendly cabin components and recycling practices gain momentum in line with environmental policies. Compliance requirements encourage manufacturers to innovate and provide certified solutions. This regulatory environment directly supports the market’s steady expansion.

- For instance, data from the European Aviation Safety Agency (EASA) shows that over 85% of newly certified aircraft since 2022 incorporate fire-retardant composite materials that meet stringent smoke and toxicity standards.

Growth in Aircraft Deliveries and Fleet Modernization Strengthens Market Demand

The increasing number of commercial aircraft deliveries worldwide fuels demand for cabin interior components. Airlines replace aging fleets with modern aircraft equipped with state-of-the-art interiors. Fleet modernization programs include retrofitting existing aircraft with upgraded cabins to enhance operational efficiency and passenger experience. Rising air traffic and expanding routes contribute to new aircraft orders, indirectly boosting the cabin interior market. It stimulates investments in research and development to design adaptable, modular interior solutions. The steady growth in the aviation sector sustains long-term market opportunities.

Technological Advancements in Materials and Smart Cabin Solutions Enhance Market Potential

Innovations in lightweight composite materials and smart cabin technologies propel market growth by improving performance and reducing operational costs. It incorporates IoT-enabled systems, advanced lighting, and intelligent seating arrangements to enhance passenger convenience and energy efficiency. These technologies help airlines optimize cabin management and maintenance processes. The integration of digital interfaces and connectivity services meets increasing passenger expectations. Research in durable, sustainable materials supports longer service life and lower maintenance needs. Technological progress remains a critical factor driving the market’s evolution.

Market Trends

Increasing Adoption of Lightweight and Sustainable Materials Shapes Industry Developments

The Commercial Aircraft Cabin Interior Market experiences a strong shift toward lightweight and environmentally sustainable materials. Airlines and manufacturers prioritize materials that reduce overall aircraft weight, improving fuel efficiency and lowering emissions. The use of advanced composites and recycled materials gains traction to meet stringent environmental regulations. It drives innovation in interior components like seats, panels, and flooring. Sustainability initiatives push the industry to minimize waste through circular economy practices. This trend aligns with broader industry efforts to enhance eco-friendliness without compromising safety or comfort.

- For instance, Toray Industries developed a carbon fiber composite material with a tensile strength of 5,800 MPa and a density of 1.6 g/cm³, which is used in seat structures and interior panels. This material reduces component weight by over 30% compared to aluminum while maintaining FAA certification for fire safety and durability standards.

Integration of Smart Cabin Technologies Enhances Passenger Experience and Operational Efficiency

The incorporation of smart cabin technologies continues to influence market dynamics significantly. It includes connected seating, real-time monitoring systems, and personalized lighting solutions that improve passenger comfort and cabin management. Airlines leverage IoT and data analytics to optimize maintenance and reduce downtime. Passenger demand for seamless connectivity and interactive entertainment leads to widespread adoption of smart systems. The evolving cabin technology ecosystem supports efficient resource management. This trend positions the market toward increasingly digital and intelligent cabin environments.

- For instance, Collins Aerospace’s Connected Cabin platform collects and analyzes over 1,000 data points per flight, enabling real-time diagnostics and predictive maintenance. This system has reduced unscheduled maintenance events by 15%, significantly improving operational efficiency and passenger experience.

Customization and Modular Cabin Designs Gain Traction Among Airlines Globally

Customization and modularity emerge as key trends shaping the Commercial Aircraft Cabin Interior Market’s future. Airlines seek flexible cabin layouts that accommodate varying passenger needs and maximize space utilization. It allows for rapid reconfiguration between flights, supporting diverse travel classes and cargo requirements. Modular components reduce refurbishment time and costs while extending cabin lifecycle. The trend reflects growing airline focus on operational agility and cost efficiency. Tailored cabin solutions also respond to regional preferences and brand differentiation strategies.

Rising Demand for Health and Hygiene-Focused Cabin Features Influences Market Trends

Health and hygiene considerations gain prominence in cabin interior design and development. It drives demand for antimicrobial surfaces, improved air filtration systems, and easy-to-clean materials. Airlines integrate touchless technologies and UV sanitation to enhance passenger safety. It reflects growing passenger awareness and post-pandemic expectations. The trend pushes manufacturers to innovate in cabin materials and layouts to support wellness. Enhanced hygiene features become standard components in new aircraft and retrofitting projects.

Market Challenges Analysis

High Costs of Advanced Materials and Customization Limit Market Penetration

The Commercial Aircraft Cabin Interior Market faces challenges related to the high costs associated with advanced materials and bespoke cabin solutions. Manufacturers invest heavily in research and development to create lightweight, durable, and compliant components, which increases production expenses. Airlines often hesitate to adopt expensive cabin upgrades due to budget constraints and uncertain returns on investment. Customization demands further raise costs because of complex design and manufacturing processes. It restricts market growth, especially among low-cost carriers focused on minimizing operational expenditures. Cost pressures also impact the speed of innovation adoption within the industry.

Complex Regulatory Compliance and Supply Chain Disruptions Hinder Market Expansion

Strict regulatory requirements pose significant challenges for the Commercial Aircraft Cabin Interior Market. It must navigate diverse international standards related to safety, fire resistance, and environmental impact, which complicates product development and certification. Manufacturers spend considerable time and resources ensuring compliance, delaying time-to-market. Supply chain disruptions caused by geopolitical tensions, raw material shortages, and logistics bottlenecks add to operational difficulties. These disruptions affect production schedules and increase costs, impacting overall market stability. Managing these challenges requires robust risk mitigation strategies and strong collaboration among stakeholders.

Market Opportunities

Expansion of Emerging Markets and Growth in Low-Cost Carriers Present Significant Growth Potential

The Commercial Aircraft Cabin Interior Market benefits from rapid air travel growth in emerging economies, creating new opportunities for cabin interior providers. Increasing disposable incomes and expanding middle-class populations in regions like Asia-Pacific and Latin America drive demand for both new aircraft and cabin upgrades. Low-cost carriers continue to expand their fleets, requiring cost-effective and durable interior solutions tailored to budget-conscious operations. It opens avenues for manufacturers to develop innovative, affordable cabin components. The growing number of regional airports and air connectivity improvements further stimulate market demand. This trend supports long-term growth potential across diverse market segments.

Advancements in Digitalization and Customization Technologies Offer New Avenues for Market Innovation

Technological progress in digital cabin design and customization opens new opportunities for the Commercial Aircraft Cabin Interior Market. It enables rapid prototyping, virtual simulations, and customer-specific configurations that reduce design cycles and enhance product precision. Integration of augmented reality (AR) and virtual reality (VR) technologies assists airlines and manufacturers in visualizing and modifying cabin layouts effectively. The rising interest in personalized passenger experiences motivates further innovation in customizable interior solutions. Digital tools also improve collaboration across the supply chain, boosting efficiency and reducing costs. These technological advancements position the market to capitalize on evolving airline and passenger expectations.

Market Segmentation Analysis:

By Product Type

This segment includes seating, galleys, lavatories, flooring, lighting systems, and in-flight entertainment systems. Seating holds the largest share due to its direct impact on passenger comfort and airline brand differentiation. Lightweight, ergonomic, and modular seats attract significant investment from manufacturers. Galleys and lavatories also register steady growth as airlines seek functional and space-efficient designs. Innovations in LED lighting and entertainment systems enhance the passenger experience while reducing energy consumption. The demand for integrated cabin management systems supports growth across multiple product categories.

- For instance, Recaro Aircraft Seating’s BL3520 seat weighs approximately 11.5 kilograms, making it one of the lightest business-class seats certified under EASA CS-25 standards. It features a modular design that reduces installation time by up to 25%, significantly lowering aircraft downtime during cabin refurbishment.

By Aircraft Type

The market classifies aircraft into narrow-body, wide-body, and regional jets. Narrow-body aircraft dominate due to their extensive use in short to medium-haul routes and higher production volumes. It benefits from consistent demand driven by low-cost carriers and regional airlines expanding their fleets. Wide-body aircraft, used for long-haul flights, contribute substantially through demand for premium cabin interiors and advanced passenger amenities. Regional jets witness steady growth, fueled by increasing regional connectivity and point-to-point travel preferences. Each aircraft type requires tailored interior solutions based on operational requirements and passenger expectations.

- For instance, Airbus developed its Airspace cabin for the A320neo family (narrow-body), which includes weight-saving overhead bins reducing 20 kilograms per aircraft and incorporates LED lighting systems capable of producing 16.7 million colors to improve passenger well-being on short- and medium-haul flights.

By Cabin Class

Cabin class segmentation comprises economy, premium economy, business, and first class. Economy class represents the largest volume segment given the majority of passengers travel in this category. It prioritizes durability, space optimization, and cost efficiency. Premium economy shows rapid growth as airlines target travelers seeking enhanced comfort at moderate prices. Business and first-class cabins emphasize luxury, personalized services, and cutting-edge technology to attract high-paying customers. The Commercial Aircraft Cabin Interior Market continuously evolves to meet the differing demands across these classes, balancing passenger comfort with operational efficiency.

Segments:

Based on Product Type

- Cabin Lights

- Cabin Windows

- In-Flight Entertainment System

- Passenger Seats

- Other Product Types

Based on Aircraft Type

Based on Cabin Class

- Business and First Class

- Economy and Premium Economy Class

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia-Pacific

The Asia-Pacific region leads the Commercial Aircraft Cabin Interior Market due to rising passenger traffic, urbanization, and increased disposable incomes in countries such as China, India, and Southeast Asia. Airlines aggressively expand their fleets to meet soaring demand, especially among low-cost carriers and regional airlines. This growth stimulates demand for lightweight, comfortable, and technologically advanced cabin interiors. Governments invest in airport infrastructure and support eco-friendly aviation initiatives, further encouraging market expansion. It remains a critical region for new product introductions and pilot projects for cabin innovations. The increasing number of new aircraft deliveries ensures sustained demand in the foreseeable future.

North America

North America maintains a strong position in the Commercial Aircraft Cabin Interior Market, accounting for approximately 28% of the global share. The presence of leading aircraft manufacturers and airlines with modern fleets drives demand for advanced cabin interior solutions. Airlines in the region focus on upgrading interiors to enhance passenger experience and comply with evolving safety and environmental regulations. The United States, Canada, and Mexico serve as key markets with significant investments in research, development, and adoption of smart cabin technologies. The market benefits from a stable regulatory environment and a mature aviation ecosystem that supports frequent fleet upgrades and refurbishments.

Europe

Europe accounts for around 22% of the Commercial Aircraft Cabin Interior Market. The region’s market growth relies heavily on compliance with stringent safety and environmental regulations imposed by the European Union Aviation Safety Agency (EASA) and other authorities. Airlines in Europe emphasize cabin upgrades that improve fuel efficiency and passenger comfort while meeting regulatory standards. The presence of major aircraft manufacturers and suppliers also contributes to the region’s market strength. Increasing focus on sustainable materials and lightweight designs drives innovation within cabin interiors. Strong air traffic volumes and well-developed airline networks support steady demand for both new aircraft interiors and retrofitting projects.

Middle East & Africa

The Middle East & Africa region captures close to 10% of the Commercial Aircraft Cabin Interior Market. The area benefits from strategic geographic positioning that connects international flight routes between Europe, Asia, and Africa. Airlines based in the Middle East, such as Emirates, Qatar Airways, and Etihad, invest heavily in luxury cabin interiors to maintain competitive advantages. Expanding tourism and business travel foster demand for premium cabin features and innovative in-flight entertainment systems. Infrastructure development in airports and maintenance hubs supports cabin interior upgrades. Political and economic stability variations pose challenges but ongoing investments help sustain market growth.

Latin America

Latin America holds an estimated 5% market share in the Commercial Aircraft Cabin Interior Market. It experiences gradual growth driven by increasing air travel demand and modernization efforts in countries like Brazil, Mexico, and Argentina. Regional airlines focus on fleet renewal and cabin refurbishments to improve service quality and comply with international standards. Infrastructure improvements in airports facilitate this growth. The market faces challenges from economic fluctuations but shows potential for expansion through low-cost carrier growth and increasing regional connectivity. It remains a developing but promising market segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panasonic Corporation

- The Boeing Company

- Honeywell International Inc.

- Collins Aerospace

- JCB Aero

- Astronics Corporation

- Thales Group

- Cobham PLC

- Gogo, Inc

- Hong Kong Aircraft Engineering Company Limited

Competitive Analysis

The Commercial Aircraft Cabin Interior Market features intense competition among leading players such as Collins Aerospace, Honeywell International Inc., Panasonic Corporation, The Boeing Company, Thales Group, Astronics Corporation, Cobham PLC, Gogo, Inc., Hong Kong Aircraft Engineering Company Limited, and JCB Aero. These companies invest significantly in research and development to introduce innovative cabin solutions that enhance passenger comfort, safety, and operational efficiency. Collins Aerospace and Honeywell International Inc. lead through advanced integrated cabin systems and lightweight materials, focusing on fuel efficiency and regulatory compliance. Panasonic Corporation excels in in-flight entertainment and connectivity solutions, driving passenger engagement with cutting-edge technology. The Boeing Company leverages its aircraft manufacturing expertise to offer fully integrated cabin interiors tailored to airline specifications. Thales Group and Astronics Corporation compete by providing modular and customizable interior components that allow airlines flexibility in design and refurbishment. Cobham PLC and Gogo, Inc. focus on communication and connectivity products, responding to increasing passenger demand for seamless digital experiences.

Recent Developments

- In June 2024, Panasonic Avionics launched its new advanced in-flight entertainment system, featuring enhanced connectivity and customizable passenger interfaces designed to improve user experience and operational efficiency.

- In March 2024, Honeywell introduced a next-generation environmental control system for aircraft cabins, improving air quality and reducing energy consumption, aligning with stricter environmental regulations.

- In February 2024, JCB Aero secured a contract with a major airline to supply ergonomic seating solutions featuring lightweight composites and improved durability for their upcoming fleet upgrades.

Market Concentration & Characteristics

The Commercial Aircraft Cabin Interior Market demonstrates a moderately concentrated structure dominated by a few key global players such as Collins Aerospace, Honeywell International Inc., Panasonic Corporation, and The Boeing Company. These companies hold substantial market shares due to their extensive product portfolios, strong technological capabilities, and established relationships with major airlines and aircraft manufacturers. It relies heavily on continuous innovation, including lightweight materials, smart cabin technologies, and customizable designs, to maintain competitive advantage. The market demands high compliance with stringent safety and environmental regulations, which creates significant entry barriers for new competitors. Collaboration between manufacturers, suppliers, and airline operators plays a critical role in developing integrated cabin solutions that meet evolving passenger expectations and operational efficiency. Smaller niche players contribute by focusing on specialized components or services, but large incumbents dominate major contracts and global supply chains. The market’s competitive landscape encourages strategic partnerships, mergers, and acquisitions to expand capabilities and geographic reach.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Aircraft Type, Cabin Class and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by increasing global air travel demand.

- Airlines will prioritize lightweight and sustainable materials to improve fuel efficiency.

- Smart cabin technologies will become standard to enhance passenger comfort and operational efficiency.

- Customizable and modular cabin interiors will gain popularity for flexibility and cost savings.

- Regulatory requirements on safety and environmental standards will continue shaping product development.

- Expansion of low-cost carriers will boost demand for durable yet affordable cabin components.

- Health and hygiene-focused cabin features will see greater adoption post-pandemic.

- Technological innovations like IoT and AI will improve cabin management and maintenance processes.

- Emerging markets, particularly in Asia-Pacific, will offer significant growth opportunities.

- Strategic collaborations among manufacturers, airlines, and technology providers will accelerate innovation.