Market Overview:

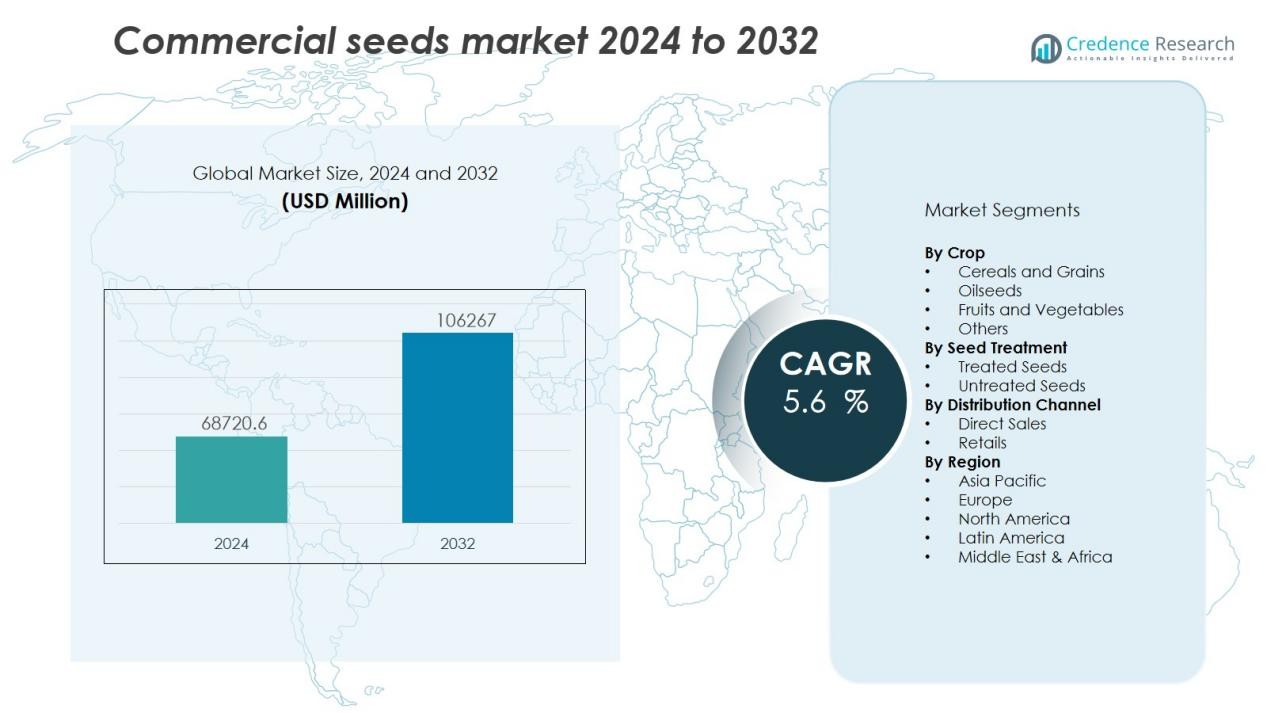

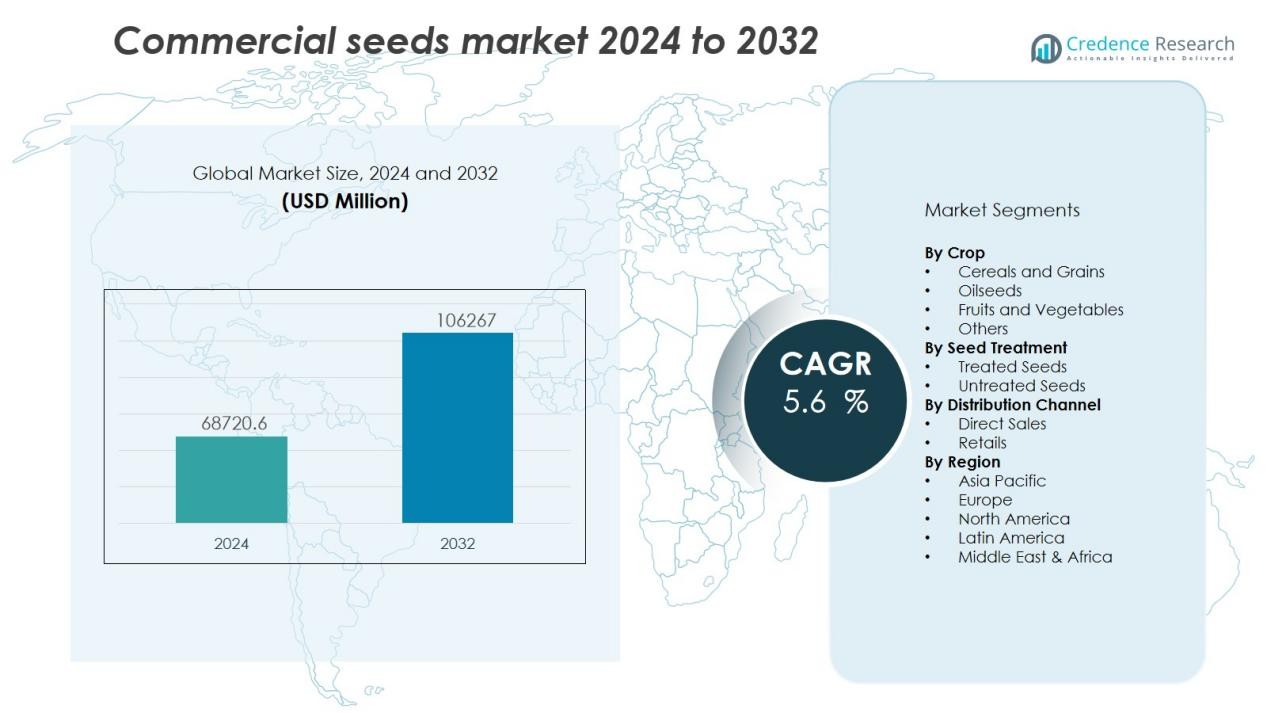

The commercial seeds market size was valued at USD 68720.6 million in 2024 and is anticipated to reach USD 106267 million by 2032, at a CAGR of 5.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Seeds Market Size 2024 |

USD 68720.6 Million |

| Commercial Seeds Market, CAGR |

5.6 % |

| Commercial Seeds Market Size 2032 |

USD 106267 Million |

Key drivers include the rising global population, which intensifies the need for enhanced agricultural productivity, and growing concerns over food security. Farmers are increasingly investing in quality seeds that offer higher yields, better resistance to pests and diseases, and tolerance to adverse climatic conditions. Supportive government policies, expanding agri-tech solutions, and rising awareness about the benefits of improved seeds are further propelling market growth. The integration of advanced biotechnologies, such as CRISPR gene-editing and seed coating innovations, is also contributing to product differentiation and market competitiveness.

Regionally, North America holds a leading share due to high adoption of biotech seeds, advanced farming practices, and strong R&D investment. Asia-Pacific is expected to witness the fastest growth, driven by expanding agricultural output in India and China, rising farm mechanization, and increasing seed replacement rates. Europe maintains steady growth, supported by sustainable agriculture initiatives and stringent quality regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The commercial seeds market was valued at USD 68,720.6 million in 2024 and is projected to reach USD 106,267 million by 2032, growing at a CAGR of 5.6% from 2024 to 2032.

- Rising global population and food security concerns are driving demand for high-yield, climate-resilient seed varieties.

- Adoption of genetically modified and hybrid seeds is increasing due to their pest resistance, disease tolerance, and ability to optimize land use.

- Government subsidies, tax incentives, and sustainable agriculture policies are boosting certified seed adoption and improving seed replacement rates.

- High seed costs and limited access for smallholder farmers remain key barriers, alongside regulatory complexities and GMO-related concerns.

- North America holds 33% market share, Europe holds 27%, and Asia-Pacific accounts for 30%, with Asia-Pacific expected to grow fastest due to mechanization and subsidies.

- Technological integration, including biotechnology, precision agriculture, and e-commerce platforms, is enhancing seed innovation, accessibility, and market competitiveness.

Market Drivers:

Rising Global Food Demand and Need for Higher Crop Yields:

The commercial seeds market benefits from the continuous increase in global population, which drives the demand for greater agricultural output. It enables farmers to access high-quality seed varieties that deliver improved productivity and better adaptability to diverse climatic conditions. Advancements in seed breeding and hybridization techniques further enhance crop performance, ensuring consistent yields. This growing need for efficient food production continues to stimulate investment in innovative seed technologies.

- For instance, Syngenta’s NK501VIP3 corn hybrid expanded production from 450,000 bags in 2023-24 to an estimated 810,000 bags for 2025-26, demonstrating a direct impact on increased yield and adaptation to diverse climates in Brazil and other regions.

Adoption of Genetically Modified and Hybrid Seed Varieties:

The commercial seeds market experiences strong growth through the adoption of genetically modified (GM) and hybrid seeds. These varieties offer enhanced resistance to pests, diseases, and environmental stress, reducing dependency on chemical inputs. It provides farmers with the ability to optimize land use while maintaining crop quality and profitability. Continuous R&D efforts expand the range of traits available, aligning with evolving agricultural demands.

- For instance, Syngenta’s hybrid tomato variety Heemsohna achieved yield potential of 25-30 metric tons per acre with strong disease resistance capabilities, while Mahyco International’s pest-resistant cotton seeds delivered an average doubling of yields for farmers in Africa according to trial data.

Government Initiatives and Supportive Agricultural Policies:

Government programs supporting modern farming practices contribute significantly to the expansion of the commercial seeds market. Subsidies, tax incentives, and awareness campaigns promote the adoption of certified seeds over traditional varieties. It improves seed replacement rates, ensuring better yield performance and higher farm incomes. Policy measures that encourage sustainable farming also increase the use of climate-resilient seed varieties.

Technological Integration in Seed Development and Distribution:

The commercial seeds market benefits from advancements in biotechnology, precision agriculture, and digital farming platforms. It enables the development of seed varieties with targeted traits such as drought tolerance, nutrient efficiency, and early maturity. Enhanced distribution networks and e-commerce platforms improve seed accessibility for farmers in remote areas. This technological integration supports faster adoption rates and strengthens overall market competitiveness.

Market Trends:

Increasing Focus on Sustainable and Climate-Resilient Seed Varieties:

The commercial seeds market is witnessing a growing shift toward the development of sustainable and climate-resilient seed varieties. It addresses the rising challenges of climate change, soil degradation, and unpredictable weather patterns that affect agricultural productivity. Seed companies are investing in advanced breeding techniques to create varieties with traits such as drought tolerance, flood resistance, and low water requirements. Demand for organic and non-GMO seeds is also increasing, driven by consumer preference for healthier and environmentally friendly food. Governments and international bodies are promoting sustainable agriculture practices, which further accelerates the adoption of such seed varieties. This trend strengthens food security while reducing the environmental footprint of farming.

- For instance, ICRISAT developed ICPV 25444, the world’s first extreme heat-tolerant pigeonpea cultivar that tolerates temperatures of 45°C and matures in just 125 days, demonstrating yields of 2 tons per hectare.

Integration of Digital Technologies and Data-Driven Agriculture:

The commercial seeds market is evolving through the integration of digital technologies, precision farming tools, and data analytics. It enables farmers to make informed decisions on seed selection, planting schedules, and resource allocation. E-commerce platforms are expanding seed accessibility, allowing direct purchase from manufacturers with detailed product information. Seed companies are adopting blockchain technology for traceability, ensuring quality assurance and supply chain transparency. Advanced genetic mapping and AI-driven predictive modeling are optimizing seed performance and reducing time-to-market for new varieties. These technological advancements are transforming the seed industry into a more efficient, data-driven ecosystem that enhances productivity and profitability.

- For instance, Gro Alliance adopted Folio3 AgTech’s crop and seed management software, enabling real-time monitoring of field operations and optimized hybrid activities, driving measurable improvements in efficiency and scalability for large-scale operations.

Market Challenges Analysis:

High Seed Costs and Limited Access for Smallholder Farmers:

The commercial seeds market faces the challenge of high seed prices, which restricts access for smallholder and resource-poor farmers. It often requires significant investment in research, biotechnology, and quality assurance, leading to premium pricing. In many developing regions, limited financing options and inadequate distribution networks further reduce adoption rates. Farmers may continue using saved seeds, which can result in lower yields and reduced crop resilience. Addressing affordability and accessibility is essential to achieving wider market penetration.

Regulatory Hurdles and Environmental Concerns:

The commercial seeds market is impacted by complex regulatory frameworks and public concerns over genetically modified organisms (GMOs). It must navigate strict compliance requirements that can delay product approvals and increase development costs. Environmental activists and consumer groups raise issues regarding biodiversity loss and the long-term ecological effects of intensive seed use. Climate change also adds uncertainty, as unpredictable conditions can reduce seed performance despite genetic advancements. Balancing innovation with regulatory and environmental considerations remains a critical challenge for market players.

Market Opportunities:

Expansion into Emerging Agricultural Markets:

The commercial seeds market has significant growth potential in emerging economies where agricultural modernization is accelerating. It can leverage rising seed replacement rates, increasing mechanization, and growing awareness of high-yield varieties. Expanding distribution networks and strategic partnerships with local agribusinesses can strengthen market presence. Government-led rural development programs and subsidies for certified seeds create favorable conditions for adoption. Increasing demand for export-quality crops in these regions further supports premium seed sales.

Advancement in Biotechnology and Precision Agriculture:

The commercial seeds market can capitalize on advancements in biotechnology and precision farming to deliver highly targeted seed solutions. It allows the development of varieties with improved nutrient efficiency, pest resistance, and adaptability to specific microclimates. Integration with digital farming platforms enhances farmer decision-making and optimizes input usage. Opportunities exist for companies to expand into niche segments such as organic seeds, specialty crops, and climate-resilient varieties. Growing interest in sustainable agriculture practices aligns with consumer demand and global food security goals.

Market Segmentation Analysis:

By Crop:

The commercial seeds market is segmented into cereals and grains, oilseeds, fruits and vegetables, and others. Cereals and grains hold the dominant share, driven by high global demand for wheat, rice, and maize. It benefits from extensive adoption of hybrid and genetically modified varieties to improve yield and pest resistance. Oilseeds such as soybean and canola register steady growth, supported by rising demand in food processing and biofuel production. Fruits and vegetables represent a high-value segment, driven by consumer preference for nutrient-rich diets and export-oriented farming.

- For instance, Cargill’s upcoming soybean processing facility in Missouri will have the capacity to process 62million bushels annually, directly addressing rising demand from food and fuel sectors.

By Seed Treatment:

The market includes treated and untreated seeds, with treated seeds capturing a larger share. It is favored for offering enhanced protection against pests, diseases, and adverse soil conditions. Chemical seed treatments remain widely used due to their effectiveness and cost efficiency, while biological treatments gain traction for their eco-friendly benefits. Untreated seeds continue to serve niche markets, especially in organic and heritage crop production.

- For instance, BASF introduced Flo Rite Pro 02 plantability polymer in November 2023, which improved seed flow and reduced dust levels on corn to less than 0.2 grams per 100,000 seeds.

By Distribution Channel:

Distribution is divided into direct sales and retail. Direct sales dominate, supported by large-scale procurement by commercial farms and institutional buyers. It ensures consistent supply, customized seed solutions, and technical support. The retail segment, including agro-dealers and e-commerce platforms, is expanding rapidly, driven by smallholder farmer demand and improved last-mile delivery networks. Digital platforms are further enhancing accessibility, product information, and traceability.

Segmentations:

By Crop:

- Cereals and Grains

- Oilseeds

- Fruits and Vegetables

- Others

By Seed Treatment:

- Treated Seeds

- Untreated Seeds

By Distribution Channel:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds 33% market share in the commercial seeds market, driven by advanced farming practices and high adoption of genetically modified (GM) seeds. The region benefits from strong R&D investment, extensive use of precision agriculture, and well-developed distribution networks. It has a favorable regulatory environment for biotech seed approvals, supporting rapid commercialization of new varieties. The United States dominates the market with high seed replacement rates and strong demand for corn, soybean, and vegetable seeds. Canada contributes significantly through canola and wheat seed production, supported by export-oriented agriculture. Growing demand for organic and specialty seeds further diversifies the market in this region.

Europe:

Europe accounts for 27% market share in the commercial seeds market, supported by strict quality regulations and a strong focus on sustainable agriculture. The region prioritizes non-GMO and organic seed varieties, aligning with consumer preferences and environmental policies. It benefits from advanced breeding programs in countries such as France, Germany, and the Netherlands, which serve both domestic and export markets. Climate-resilient seed varieties are gaining traction due to shifting weather patterns. Governments promote biodiversity and conservation farming, creating demand for certified and heritage seed varieties. Adoption of digital farming tools is also enhancing seed utilization efficiency.

Asia-Pacific:

Asia-Pacific captures 30% market share in the commercial seeds market, driven by large agricultural output and rapid adoption of hybrid seeds. The region’s growth is fueled by rising seed replacement rates in India, China, and Southeast Asia, supported by government subsidies and rural development programs. It benefits from expanding mechanization and growing awareness of improved seed technologies. High demand for rice, maize, and horticultural crops strengthens seed industry revenues. Cross-border trade and increasing investment from multinational seed companies are accelerating market expansion. The region is emerging as a key innovation hub for cost-effective, high-performance seed varieties.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Takii Co., Ltd.

- Land O’Lakes

- Beijing Dabeinong Technology Group Co., Ltd

- Sakata Seed Corporation

- Bayer

- Secobra Group

- Syngenta Group

- Groupe Roullier

- KWS SAAT SE Co. KGaA

- BASF

- Corteva Agriscience

- Nongwoo Bio Co., Ltd.

- Limagrain

Competitive Analysis:

The commercial seeds market is characterized by strong competition among global and regional players focusing on innovation, product diversification, and market expansion. Key companies include Takii Co., Ltd., Land O’Lakes, Beijing Dabeinong Technology Group Co., Ltd., Sakata Seed Corporation, Bayer, Secobra Group, and Syngenta Group. It emphasizes research and development to introduce high-yield, pest-resistant, and climate-resilient seed varieties tailored to diverse agricultural needs. Strategic partnerships, mergers, and acquisitions are common approaches to expand geographical reach and strengthen product portfolios. Companies are leveraging biotechnology, precision agriculture, and digital platforms to enhance customer engagement and seed performance. Strong distribution networks, both direct and retail, support consistent supply to large-scale farms and smallholder farmers alike. Sustainability initiatives and compliance with regulatory standards are increasingly integral to competitive positioning.

Recent Developments:

- In April 2025, Sakata Seed America launched the “Bimi” brand of baby broccoli in the United States and Canada, introducing new proprietary genetics to retail and foodservice markets.

- In April 2025, Bayer launched An Hai Long, its first high-activity seaweed biostimulant product, at the Bayer Innovation Hub in Danyang, Jiangsu.

- In February 2025, Syngenta Group acquired the Novartis repository of natural compounds and genetic strains for agricultural use, including R&D teams and facility leases in Basel, Switzerland.

Market Concentration & Characteristics:

The commercial seeds market is moderately consolidated, with leading global players holding significant influence through extensive product portfolios, advanced R&D capabilities, and strong distribution networks. It is characterized by intense competition among multinational corporations and regional seed companies, focusing on innovation, trait development, and strategic partnerships. High entry barriers exist due to the capital-intensive nature of seed breeding, stringent regulatory requirements, and the need for advanced biotechnology expertise. Product differentiation is achieved through hybridization, genetic modification, and tailored seed solutions for specific climatic and soil conditions. The market demonstrates steady growth potential, driven by rising global food demand, increasing seed replacement rates, and expanding adoption of precision agriculture technologies.

Report Coverage:

The research report offers an in-depth analysis based on Crop, Seed Treatment, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for high-yield and climate-resilient seed varieties will continue to rise, driven by global food security needs.

- Biotechnology and advanced breeding techniques will accelerate the development of seeds with enhanced pest and disease resistance.

- Precision agriculture and data-driven farming will increase adoption of seed varieties optimized for specific soil and climate conditions.

- Expansion in emerging markets will create opportunities for companies to strengthen distribution networks and local partnerships.

- Consumer demand for organic and non-GMO crops will boost investment in certified organic seed production.

- Digital platforms and e-commerce channels will enhance accessibility and transparency in seed purchasing.

- Governments will expand subsidy programs and policy support for certified and improved seeds, increasing replacement rates.

- Integration of blockchain technology will improve traceability, ensuring quality assurance in the seed supply chain.

- Companies will diversify into specialty crop seeds to cater to niche markets with higher profitability potential.

- Collaboration between public research institutions and private seed companies will accelerate innovation and market adoption of new varieties.