Market Overview:

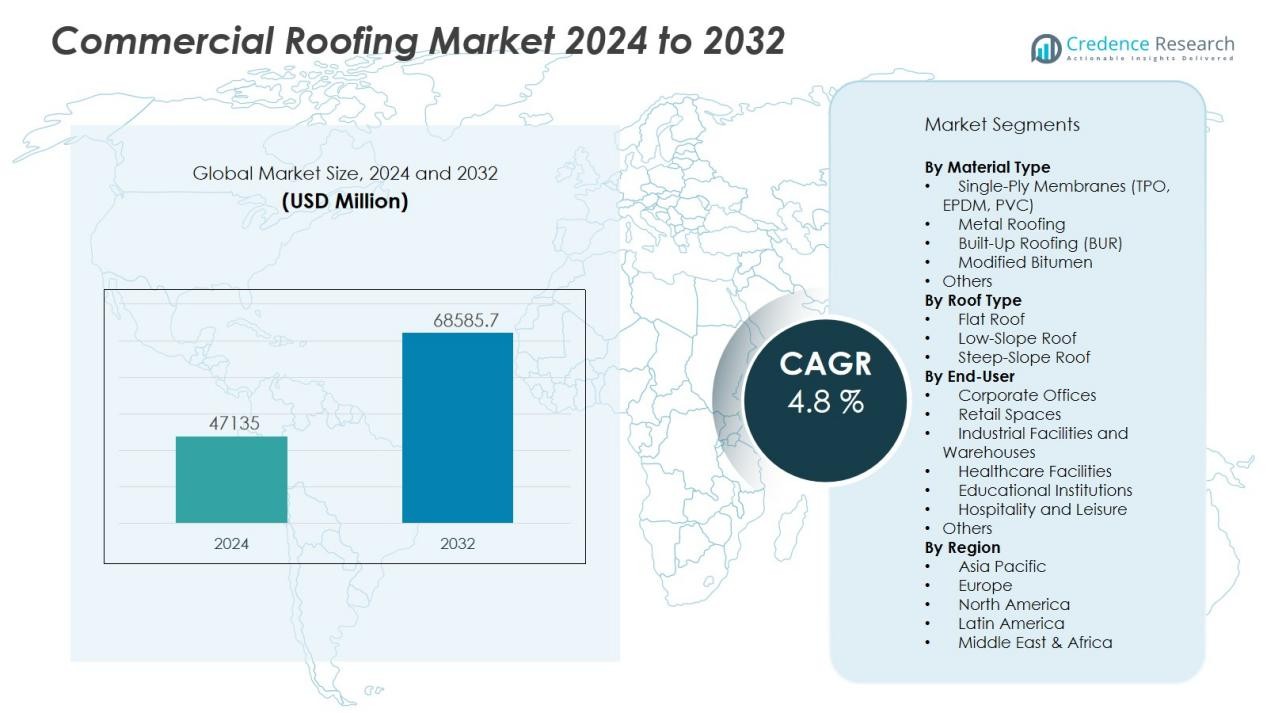

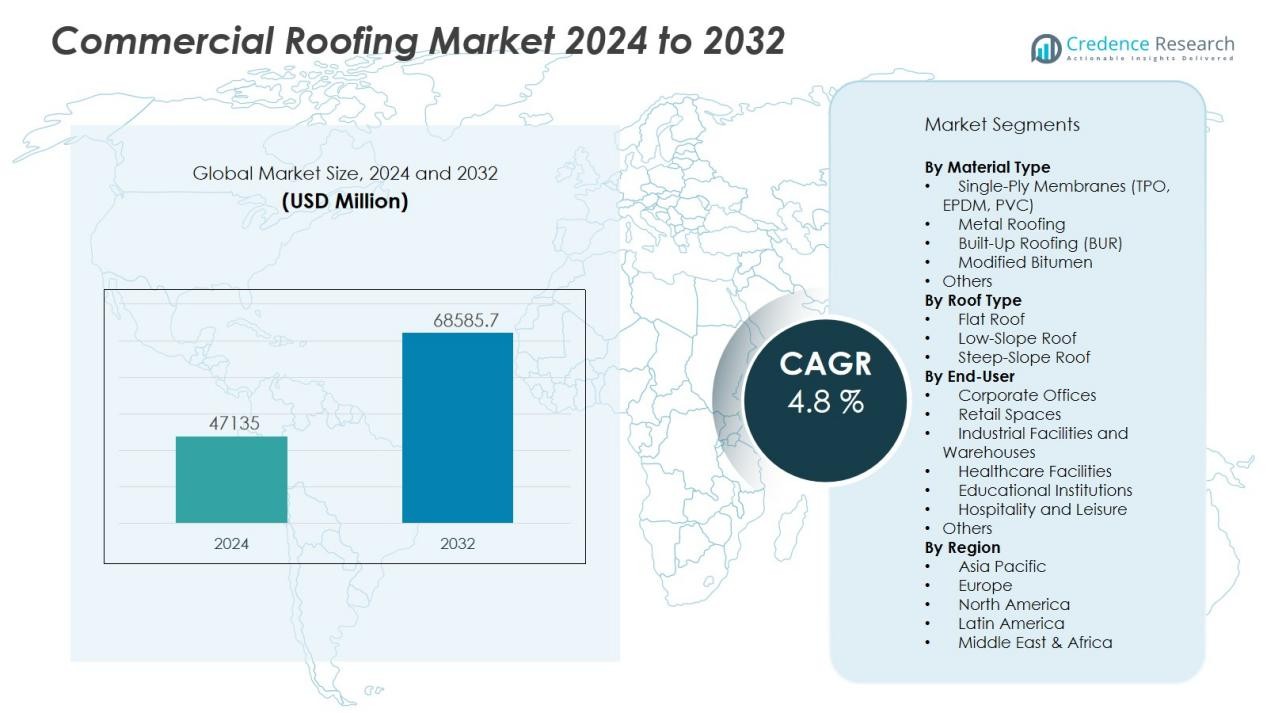

The Commercial Roofing Market size was valued at USD 47135 million in 2024 and is anticipated to reach USD 68585.7 million by 2032, at a CAGR of 4.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Roofing Market Size 2024 |

USD 47135 Million |

| Commercial Roofing Market, CAGR |

4.8 % |

| Commercial Roofing Market Size 2032 |

USD 68585.7 Million |

Growth in the market is primarily fueled by the rising adoption of energy-efficient and sustainable roofing systems, stricter building codes, and heightened awareness of lifecycle cost benefits. Innovations in cool roofing, green roofing, and solar-integrated systems are attracting building owners seeking to reduce operational expenses and meet environmental compliance. Increasing frequency of severe weather events has also elevated demand for impact-resistant and weatherproof roofing solutions, prompting a shift toward advanced materials like single-ply membranes and metal roofing.

Regionally, North America and Europe dominate the market, supported by robust construction activity, high re-roofing rates, and stringent energy efficiency regulations. Asia-Pacific is poised for the fastest growth due to rapid urbanization, expanding commercial infrastructure, and rising investments in modern building technologies, particularly in China, India, and Southeast Asia. Latin America and the Middle East & Africa are witnessing gradual growth, supported by improving economic conditions and infrastructure development projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The commercial roofing market was valued at USD 47,135 million in 2024 and is projected to reach USD 68,585.7 million by 2032, reflecting a CAGR of 4.8% during 2024–2032.

- Rising adoption of energy-efficient and sustainable roofing systems, driven by stricter building codes and environmental regulations, is a key growth driver.

- Innovations in cool roofing, green roofing, and solar-integrated systems are attracting building owners aiming to cut operational costs and meet compliance requirements.

- North America holds 38% market share and Europe 27%, supported by strong re-roofing activity, mature construction sectors, and incentives for energy-efficient installations.

- Asia-Pacific, with 22% market share, is the fastest-growing region, propelled by rapid urbanization, industrial expansion, and large-scale infrastructure projects in China, India, and Southeast Asia.

- High installation costs, raw material price volatility, and skilled labor shortages remain significant challenges, impacting project timelines and budgets.

- Demand for impact-resistant and weatherproof roofing solutions is increasing due to more frequent extreme weather events, creating opportunities for advanced material adoption.

Market Drivers:

Rising Demand for Energy-Efficient and Sustainable Roofing Solutions:

The commercial roofing market is expanding due to increasing demand for energy-efficient and environmentally sustainable building solutions. Building owners and developers prioritize roofing systems that reduce energy consumption, lower cooling costs, and meet green building certifications. Cool roofs, reflective coatings, and green roof installations are gaining traction for their ability to improve insulation and reduce heat island effects. It benefits from stricter environmental regulations and incentives that encourage adoption of eco-friendly materials.

- For instance, GAF’s EverGuard® TPO roofing membrane achieved an Energy Star reflectivity rating of 0.79, which helps reduce building cooling costs.

Growth in Commercial Construction and Infrastructure Development:

Rapid growth in commercial construction projects is a major driver for the commercial roofing market. Expanding office complexes, retail spaces, warehouses, and industrial facilities create consistent demand for high-performance roofing systems. Governments and private investors continue to fund large-scale infrastructure and urban development projects, particularly in emerging economies. It is further supported by re-roofing activities in mature markets where aging commercial buildings require modernization.

- For instance, Amazon has planned over 16 million square feet of new warehouse space across the US in 2024, including at least 170 distribution facilities.

Advancements in Roofing Materials and Installation Technologies:

Continuous innovation in roofing materials and installation methods strengthens the commercial roofing market. Manufacturers develop lightweight, durable, and weather-resistant products that extend service life and reduce maintenance costs. Prefabricated roofing components and improved installation equipment help contractors achieve faster project completion with enhanced safety. It gains momentum from smart roofing systems that integrate sensors for performance monitoring and predictive maintenance.

Impact of Climate Change and Extreme Weather Events:

Increasing frequency of extreme weather events drives demand for resilient roofing systems. Commercial building owners seek roofing solutions that withstand high winds, heavy rainfall, hail, and extreme temperature fluctuations. The commercial roofing market benefits from materials designed for superior impact resistance and waterproofing. It also aligns with insurance and safety requirements, making robust roofing systems a critical investment for long-term asset protection.

Market Trends:

Adoption of Advanced Roofing Technologies and Smart Solutions:

The commercial roofing market is witnessing a shift toward advanced technologies that enhance performance, durability, and operational efficiency. Smart roofing systems equipped with IoT sensors enable real-time monitoring of structural integrity, moisture levels, and thermal performance. These systems support predictive maintenance, reducing repair costs and extending service life. Demand is also increasing for prefabricated roofing components that shorten installation timelines and improve quality control. Integration of drone technology for inspection and 3D modeling for project planning further streamlines operations. It is benefiting from contractors and facility managers seeking data-driven insights to optimize roofing asset management.

- For instance, Airteam’s cloud-based Fusion Platform uses drones to create 3D roof models with centimeter-level accuracy in under 10 minutes, enabling roofing professionals to complete measurements three times faster than manual processes on over 5,000 projects annually.

Rising Popularity of Eco-Friendly and Energy-Generating Roofing Solutions:

Sustainability continues to shape trends in the commercial roofing market, with growing adoption of eco-friendly and energy-generating systems. Green roofs, reflective coatings, and solar-integrated roofing are gaining traction among businesses aiming to meet environmental regulations and reduce operational costs. Building owners increasingly view roofing systems as functional energy assets, leveraging photovoltaic panels to produce renewable power. Demand for recyclable and low-VOC materials is also increasing, aligning with global green building standards. Urban developments are incorporating living roofs to improve insulation, enhance aesthetics, and manage stormwater. It reflects a broader market shift toward multifunctional roofing solutions that combine protection, energy efficiency, and environmental benefits.

- For instance, Over Easy Solar supplied the world’s largest vertical rooftop solar installation at Ullevaal Stadion, Norway, delivering strong year-round performance and supporting the venue’s ambition by generating energy from over 13 separate rooftop installations across Europe in 2024–2025.

Market Challenges Analysis:

High Installation Costs and Budget Constraints:

The commercial roofing market faces challenges from high installation and material costs, which can limit adoption among budget-conscious clients. Premium roofing systems with advanced features often require significant upfront investment, making them less accessible for small businesses and certain markets. Fluctuations in raw material prices, particularly for metals and petroleum-based products, add uncertainty to project budgeting. It is further impacted by rising labor expenses due to skilled worker shortages. Delays in project approvals and financing can slow market growth in both developed and emerging regions.

Weather-Related Risks and Maintenance Demands:

Frequent exposure to extreme weather events creates long-term performance challenges for the commercial roofing market. Harsh climates accelerate wear and tear, increasing the need for regular maintenance and repairs. Water infiltration, thermal expansion, and wind uplift remain persistent concerns for building owners. It can lead to higher lifecycle costs, especially for poorly maintained or low-quality installations. Meeting evolving building codes and safety standards requires constant product innovation, which can increase development costs for manufacturers. This dynamic places pressure on contractors to balance durability, compliance, and affordability.

Market Opportunities:

Expansion of Green and Solar Roofing Solutions;

The commercial roofing market has significant opportunities in the growing demand for green and solar-integrated roofing systems. Businesses are increasingly investing in solutions that reduce energy consumption, support sustainability goals, and comply with environmental regulations. Green roofs improve insulation, manage stormwater, and enhance urban aesthetics, while solar roofs generate renewable energy and lower operational costs. Governments and municipalities are offering incentives and subsidies to encourage adoption of such technologies. It can leverage this trend to expand product portfolios and strengthen market presence in eco-conscious sectors.

Rising Demand in Emerging Economies and Urban Infrastructure Projects:

Rapid urbanization and infrastructure development in emerging economies create strong growth prospects for the commercial roofing market. Expanding commercial hubs, industrial parks, and transportation facilities require modern, durable, and efficient roofing systems. Growing foreign investments and public-private partnerships are driving large-scale construction projects across Asia-Pacific, Latin America, and the Middle East. It stands to benefit from offering cost-effective, high-performance solutions tailored to regional climatic conditions. Increasing focus on upgrading aging infrastructure in these regions further supports long-term demand for advanced commercial roofing products.

Market Segmentation Analysis:

By Material Type:

The commercial roofing market is segmented into single-ply membranes, metal roofing, built-up roofing, modified bitumen, and others. Single-ply membranes, including TPO and EPDM, hold a leading position due to their durability, ease of installation, and energy efficiency. Metal roofing is gaining traction for its long lifespan, fire resistance, and recyclability. Built-up roofing remains relevant in applications requiring multi-layer protection, while modified bitumen offers flexibility and weather resistance for diverse climates.

- For instance, Carlisle SynTec Systems expanded its Sure-Weld TPO production capacity in 2023 to over 1.1 billion square feet annually, making it one of the largest single-ply membrane producers in North America.

By Roof Type:

Flat roofs dominate the market due to their suitability for large commercial buildings and compatibility with solar and green roof systems. Low-slope roofs are also widely used in warehouses, manufacturing facilities, and retail complexes, providing cost-effective installation and maintenance. Steep-slope roofs have a smaller share, typically serving aesthetic and design-specific commercial projects such as hotels or high-end retail spaces. It benefits from advancements in waterproofing and insulation technologies that improve performance across roof types.

- For instance, the Los Angeles Convention Center features a 2.21-megawatt solar array on its flat roof spanning over 346,000 square feet, installed by PermaCity Construction in partnership with the City of Los Angeles.

By End-User:

The market serves sectors such as corporate offices, retail, industrial facilities, healthcare, education, and hospitality. Industrial facilities and warehouses represent a significant share, driven by expansion in manufacturing and logistics. Retail and corporate segments show strong demand for energy-efficient and visually appealing roofing systems. The healthcare and education sectors prioritize durable, low-maintenance solutions to ensure operational continuity. It is supported by diverse end-user requirements that drive innovation in materials, design, and installation methods.

Segmentations:

By Material Type:

- Single-Ply Membranes (TPO, EPDM, PVC)

- Metal Roofing

- Built-Up Roofing (BUR)

- Modified Bitumen

- Others (Green Roofing, Solar-Integrated Roofing)

By Roof Type:

- Flat Roof

- Low-Slope Roof

- Steep-Slope Roof

By End-User:

- Corporate Offices

- Retail Spaces

- Industrial Facilities and Warehouses

- Healthcare Facilities

- Educational Institutions

- Hospitality and Leisure

- Others (Government, Public Infrastructure)

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America and Europe :

North America holds 38% market share in the commercial roofing market, supported by high re-roofing activity and strict energy efficiency regulations. Europe follows with 27% market share, driven by stringent building codes and adoption of sustainable roofing systems. Both regions benefit from mature construction sectors, well-established supply chains, and advanced manufacturing capabilities. Government incentives for energy-efficient and solar-integrated roofs further stimulate market growth. It gains strength from the replacement of aging commercial building infrastructure and the expansion of green building certifications. The presence of leading global roofing manufacturers ensures a competitive and innovation-driven environment.

Asia-Pacific :

Asia-Pacific accounts for 22% market share in the commercial roofing market, with growth fueled by rapid urbanization and industrial expansion. China, India, and Southeast Asian countries are witnessing increased investments in commercial infrastructure such as retail complexes, office parks, and manufacturing hubs. Rising adoption of advanced roofing materials supports demand in regions with diverse climatic conditions. Government-led smart city and infrastructure development projects accelerate market penetration. It benefits from the growing construction sector, rising disposable incomes, and the shift toward modern, energy-efficient buildings. Expanding domestic manufacturing capabilities enhance regional supply and cost competitiveness.

Middle East & Africa and Latin America :

The Middle East & Africa hold 8% market share in the commercial roofing market, while Latin America accounts for 5%. Growth in these regions is driven by economic diversification projects, tourism-related commercial developments, and infrastructure upgrades. Harsh climate conditions in the Middle East create demand for heat-resistant and weatherproof roofing systems. In Latin America, urban development and government investments in public infrastructure sustain steady demand. It is supported by increasing adoption of modern roofing technologies and growing interest in energy-efficient construction practices. Strategic partnerships with local contractors strengthen market presence in both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The commercial roofing market is highly competitive, with global and regional players focusing on innovation, quality, and sustainability to strengthen their market position. Key companies include GAF, Inc., CertainTeed, LLC, Owens Corning, Johns Manville, Crown Building Products LLC, Wienerberger AG, and Atlas Roofing Corporation. These firms invest in advanced materials, energy-efficient solutions, and durable roofing systems to meet evolving building codes and customer demands. It is characterized by a strong emphasis on R&D to develop products with improved weather resistance, ease of installation, and extended lifespans. Competitive strategies involve mergers, acquisitions, and partnerships to expand geographic reach and distribution networks. Leading players maintain robust contractor relationships and provide comprehensive warranty programs to enhance customer trust. Market competition is further intensified by the growing presence of regional manufacturers offering cost-effective, tailored solutions.

Recent Developments:

- In August 2025, CertainTeed, LLC (via parent Saint-Gobain) advanced its product range by integrating Building Products of Canada Corp., expanding its portfolio with innovative roofing and siding solutions for the Canadian market.

- In July 2025, Wienerberger AG increased its stake in GSE Intégration SAS to 100% by acquiring the remaining 49%, strengthening its position in the European market for integrated photovoltaic roof solutions.

- In May 2025, Atlas Roofing Corporation acquired Groupe Expan and its subsidiaries, strengthening its North American manufacturing footprint.

Market Concentration & Characteristics:

The commercial roofing market is moderately concentrated, with a mix of global manufacturers and regional players competing through product innovation, quality, and service capabilities. It is characterized by diverse product offerings, including single-ply membranes, metal roofing, built-up roofing, and green or solar-integrated systems. Leading companies focus on research and development to introduce energy-efficient, durable, and cost-effective solutions that meet evolving building codes and sustainability standards. Competitive strategies often involve mergers, acquisitions, and strategic partnerships to expand geographic reach and enhance distribution networks. Strong brand presence, advanced manufacturing capabilities, and long-term contractor relationships provide a competitive edge for established players, while niche providers compete through customization and specialized applications.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Roof Type, End-User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The commercial roofing market will experience sustained demand driven by ongoing commercial construction and infrastructure modernization projects.

- Energy-efficient and environmentally sustainable roofing systems will gain greater adoption due to stricter building codes and green certification requirements.

- Advancements in materials such as lightweight composites, high-performance membranes, and recycled products will enhance durability and reduce maintenance needs.

- Integration of solar panels and green roofing solutions will expand as businesses prioritize renewable energy generation and environmental impact reduction.

- Smart roofing technologies with IoT-enabled sensors for real-time monitoring will become more common in asset management strategies.

- Rapid urbanization in emerging economies will create significant growth opportunities for cost-effective and climate-adapted roofing systems.

- Increased frequency of extreme weather events will drive investment in resilient, impact-resistant, and waterproof roofing solutions.

- Manufacturers will focus on prefabrication and faster installation techniques to reduce labor costs and project timelines.

- Strategic partnerships between manufacturers, contractors, and technology providers will strengthen innovation and market competitiveness.

- Expansion of government incentives for sustainable building practices will accelerate the adoption of advanced commercial roofing solutions worldwide.