Market Overview

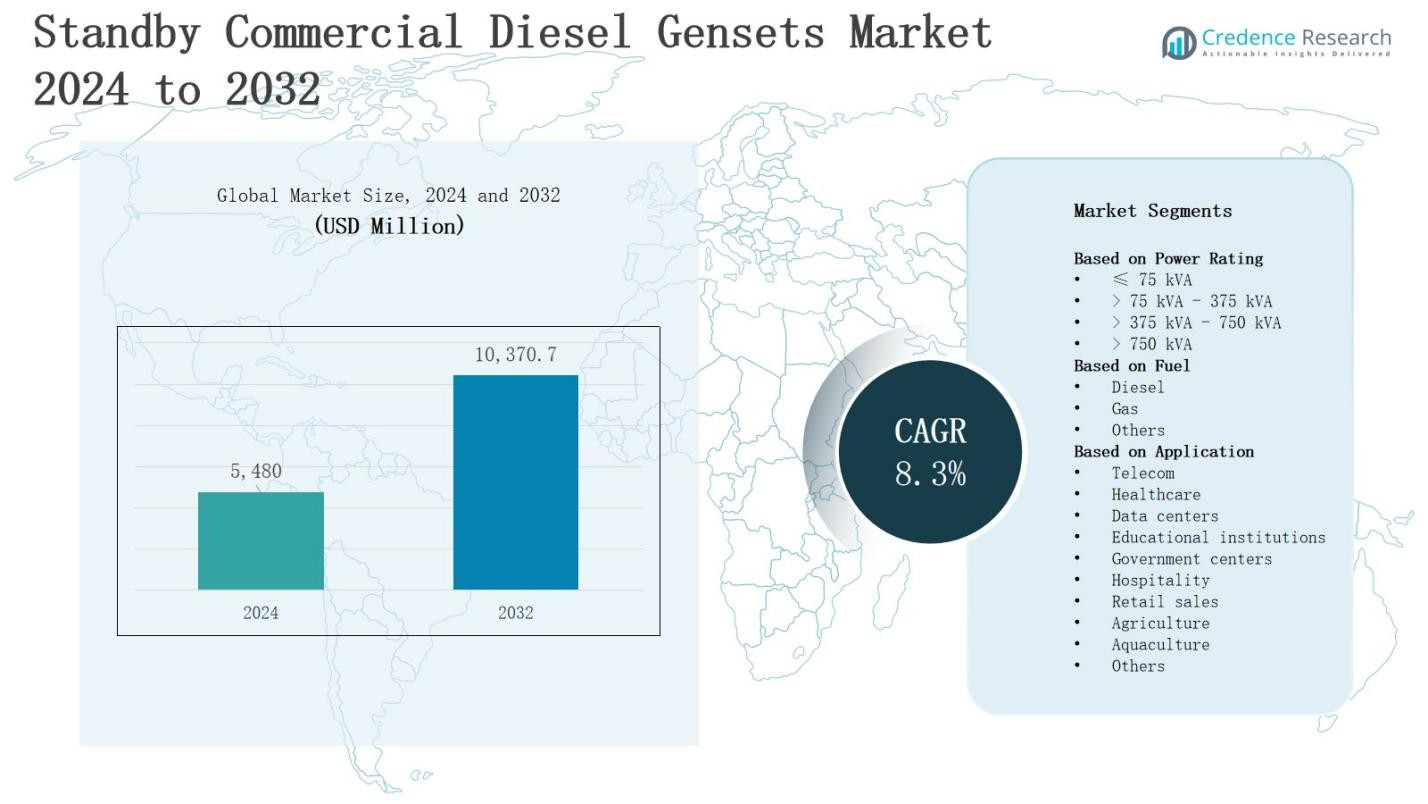

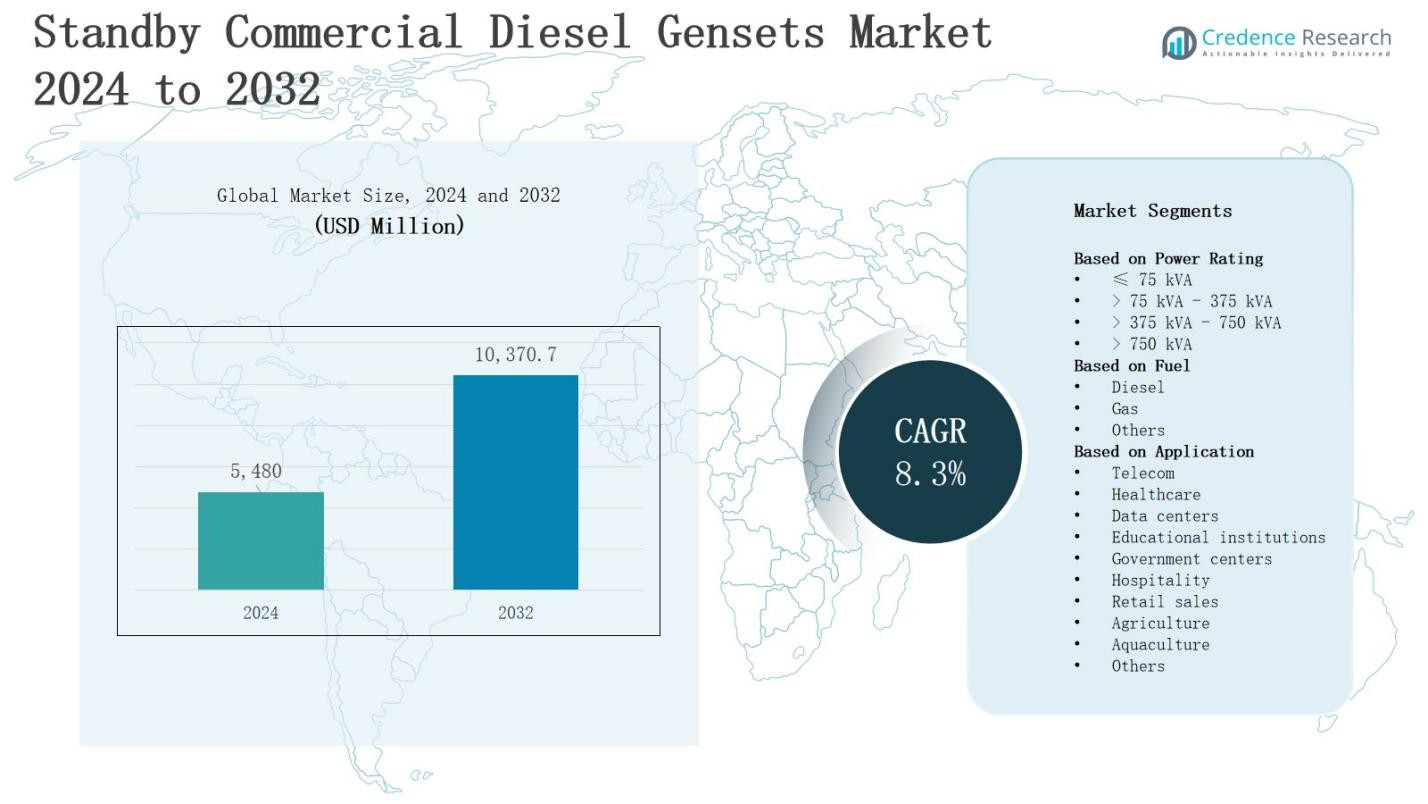

The Standby commercial diesel gensets market was valued at USD 5,480 million in 2024 and is projected to reach USD 10,370.7 million by 2032, expanding at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Standby commercial diesel gensets market Size 2024 |

USD 5,480 Million |

| Standby commercial diesel gensets market, CAGR |

8.3% |

| Standby commercial diesel gensets market Size 2032 |

USD 10,370.7 Million |

The standby commercial diesel gensets market is driven by rising demand for reliable backup power solutions across commercial facilities, data centers, and healthcare institutions, where uninterrupted operations are critical. Increasing frequency of power outages, grid instability, and expansion of industrial and commercial infrastructure further fuel adoption. Stricter regulations on energy security and disaster preparedness also support growth. Key trends shaping the market include advancements in fuel-efficient engines, integration of digital monitoring and remote control systems, and growing adoption of hybrid genset solutions that combine diesel with renewable energy sources to reduce emissions and enhance overall operational efficiency.

The standby commercial diesel gensets market demonstrates diverse geographical growth with Asia Pacific holding the largest share, driven by industrialization and data center expansion. North America shows strong demand from healthcare, data centers, and government facilities, while Europe emphasizes energy security and hybrid adoption. Latin America relies on gensets due to grid instability, and the Middle East & Africa witness rising demand from infrastructure and hospitality projects. Key players include Caterpillar, Cummins, Kohler, Generac Power Systems, Mitsubishi Heavy Industries, Atlas Copco, Kirloskar, Genesal Energy, ASHOK LEYLAND, and MAHINDRA POWEROL.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The standby commercial diesel gensets market was valued at USD 5,480 million in 2024 and is projected to reach USD 10,370.7 million by 2032, expanding at a CAGR of 8.3%.

- Rising demand for uninterrupted power in critical sectors such as data centers, hospitals, and financial institutions strengthens adoption.

- Frequent power outages, grid failures, and natural disasters drive reliance on diesel gensets across developed and emerging economies.

- Technological advancements in fuel-efficient engines, IoT-enabled monitoring, and predictive maintenance enhance system reliability.

- Stringent environmental regulations and fuel price volatility challenge manufacturers, pushing them toward hybrid and cleaner solutions.

- Asia Pacific leads with 34% share, followed by North America at 27% and Europe at 21%, while Latin America and Middle East & Africa each hold 9%.

- Key players include Caterpillar, Cummins, Kohler, Generac Power Systems, Mitsubishi Heavy Industries, Atlas Copco, Kirloskar, Genesal Energy, ASHOK LEYLAND, and MAHINDRA POWEROL.

Market Drivers

Rising Demand for Uninterrupted Power Supply in Critical Sectors

The standby commercial diesel gensets market experiences strong demand from industries where uninterrupted power is non-negotiable, including data centers, hospitals, and financial institutions. It ensures operational continuity during outages and prevents costly downtime. Growing reliance on digital infrastructure has elevated the importance of reliable backup power. Urbanization and industrial expansion further intensify demand. Increasing use of sensitive electronic equipment amplifies the requirement for stable and immediate backup solutions.

Increasing Frequency of Power Outages and Grid Failures

The standby commercial diesel gensets market gains momentum due to rising instances of power outages and grid instability across emerging and developed regions. It addresses vulnerabilities in power infrastructure by delivering immediate response during disruptions. Industrialization in remote and semi-urban areas adds to the dependence on diesel gensets. Demand rises in regions with unreliable transmission systems. Growing concerns about business continuity and safety strengthen adoption. Natural disasters and climatic events increase deployment rates globally.

- For instance, Mahindra Powerol installed robust diesel gensets in remote industrial sites across India with unreliable grid infrastructure, successfully minimizing production downtime and safeguarding operational continuity during frequent power outages.

Technological Advancements in Engine Efficiency and Monitoring Systems

The standby commercial diesel gensets market benefits from advancements in engine design and fuel efficiency, making systems more cost-effective and environmentally acceptable. It incorporates digital monitoring, IoT-based diagnostics, and predictive maintenance features. These innovations enhance reliability, reduce operational costs, and improve compliance with emission norms. Manufacturers invest heavily in R&D to optimize performance. Growing customer preference for intelligent, connected systems drives adoption. Enhanced durability and flexibility in power output strengthen market appeal.

- For instance, Trinetra Sense offers an IoT-based real-time diesel generator monitoring system compatible with Perkins, Kirloskar, and Cummins generators, providing remote visibility across multiple sites with predictive alerts, fuel theft detection, and performance analytics to optimize fuel efficiency and uptime.

Regulatory Pressure and Growing Need for Energy Security

The standby commercial diesel gensets market is influenced by strict regulatory frameworks emphasizing energy security and emergency preparedness. It supports compliance with disaster recovery requirements across commercial facilities. Governments promote backup power installations for essential services, ensuring public safety and economic stability. Businesses adopt gensets to meet mandated standards. Rising threats of cyberattacks on grids increase awareness about decentralized backup solutions. Market growth aligns with policies focused on infrastructure resilience and sustainability.

Market Trends

Adoption of Hybrid Power Solutions Integrating Renewable Energy

The standby commercial diesel gensets market is witnessing a clear trend toward hybrid solutions that integrate diesel engines with renewable energy sources such as solar and wind. It reduces fuel consumption and lowers operational emissions while maintaining high reliability. Businesses adopt hybrid gensets to align with sustainability goals and regulatory compliance. Growing emphasis on green power solutions drives innovation in system design. Hybrid systems provide flexibility by balancing renewable input with diesel backup during fluctuating grid supply.

- For instance, Jakson Group offers hybrid diesel generator systems that integrate solar power to reduce load on diesel gensets during sunlight hours, leading to significant fuel savings.

Integration of Digital Monitoring and Remote Management Systems

The standby commercial diesel gensets market benefits from rising adoption of digital monitoring platforms that enable real-time performance tracking, predictive maintenance, and remote control. It supports operational efficiency by reducing downtime and maintenance costs. IoT-enabled gensets provide data insights to optimize fuel use and engine health. Remote management enhances reliability in multi-site operations. Increasing digitalization across industries accelerates demand for intelligent power systems. Customers prefer solutions that combine automation with advanced diagnostic capabilities.

- For instance, Apollo Power Systems provides a smart diesel monitoring system with GPS and geofencing technology that tracks generator location and detects irregularities like low fuel or overheating, delivering real-time warnings via text or email to prevent failures.

Shift Toward Low-Emission and Cleaner Engine Technologies

The standby commercial diesel gensets market is experiencing a trend toward engines that comply with stricter global emission standards. It reflects rising environmental concerns and regulatory enforcement. Manufacturers invest in cleaner combustion technologies, advanced filters, and fuel optimization systems. Demand grows for gensets with reduced noise levels and improved emission profiles. Businesses prefer sustainable solutions to meet ESG commitments. Transition toward eco-friendly gensets strengthens market competitiveness by balancing operational reliability with environmental responsibility.

Growing Demand from Expanding Data Center Infrastructure Worldwide

The standby commercial diesel gensets market is strongly influenced by the expansion of global data centers that require uninterrupted power. It ensures seamless operation of servers and storage facilities critical for cloud computing, AI, and digital services. Rising internet penetration and 5G deployment accelerate demand. Large-scale data centers invest heavily in redundant power systems to avoid downtime. The surge in energy-intensive workloads positions diesel gensets as essential infrastructure. Growing colocation facilities worldwide amplify this trend.

Market Challenges Analysis

Stringent Environmental Regulations and Rising Sustainability Concerns

The standby commercial diesel gensets market faces significant challenges due to tightening global emission regulations and increasing environmental scrutiny. It is under pressure to adopt cleaner technologies, which often raise costs for manufacturers and end-users. Governments enforce stricter compliance on particulate matter and greenhouse gas emissions, limiting widespread adoption in urban centers. Customers demand sustainable alternatives, pushing suppliers to invest in advanced filtration systems and hybrid solutions. Meeting these expectations requires innovation and capital-intensive upgrades that slow adoption rates in price-sensitive regions.

High Operational Costs and Dependence on Volatile Fuel Prices

The standby commercial diesel gensets market encounters obstacles linked to high operational and maintenance costs, coupled with volatility in global diesel prices. It requires constant fuel supply, making total cost of ownership unpredictable for businesses. Frequent servicing, engine overhauls, and spare parts add financial burden to operators. Growing reliance on imported fuels further increases risk in emerging economies. Price-sensitive customers explore alternatives such as gas-based or renewable-backed gensets. These cost challenges restrict market growth, especially among small and medium-sized enterprises.

Market Opportunities

Expanding Infrastructure Development and Growing Data Center Investments

The standby commercial diesel gensets market presents strong opportunities from rapid infrastructure development and the global surge in data center construction. It supports critical industries such as healthcare, telecommunications, and finance that demand uninterrupted operations. The proliferation of cloud computing, AI applications, and 5G networks intensifies reliance on reliable backup power. Emerging economies invest heavily in commercial complexes, industrial parks, and transport hubs, creating sustained demand. Rising urbanization and modernization of outdated power grids amplify opportunities for large-capacity gensets.

Technological Advancements and Rising Adoption of Hybrid Systems

The standby commercial diesel gensets market benefits from opportunities driven by advancements in engine efficiency, digital integration, and hybrid configurations. It leverages IoT-enabled monitoring systems, predictive analytics, and automation to improve reliability and reduce lifecycle costs. The integration of renewable energy with diesel gensets creates hybrid models that meet sustainability goals while ensuring dependable power supply. Demand rises for low-emission, fuel-efficient systems tailored for regulatory compliance. Manufacturers gain growth potential by offering scalable, eco-friendly, and intelligent genset solutions that appeal to modern commercial users.

Market Segmentation Analysis:

By Power Rating

The standby commercial diesel gensets market is segmented into ≤75 kVA, >75 kVA–375 kVA, >375 kVA–750 kVA, and >750 kVA categories. It shows strong demand for ≤75 kVA units in small commercial establishments and retail outlets requiring compact and affordable solutions. The >75 kVA–375 kVA segment dominates medium-sized applications such as telecom towers and educational institutions. Large-scale data centers, hospitals, and government facilities increasingly prefer >375 kVA–750 kVA and >750 kVA units for uninterrupted high-capacity power backup.

- For instance, Mahindra Powerol offers diesel gensets ranging from 5 kVA to 625 kVA, catering to small and medium enterprises and telecom sectors with reliable and fuel-efficient solutions.

By Fuel

The standby commercial diesel gensets market is classified into diesel, gas, and others. Diesel remains the most widely used fuel type due to its reliability, availability, and cost efficiency. It dominates backup power in critical sectors such as healthcare, data centers, and government centers. Gas-based gensets are gaining traction in urban locations driven by emission norms and cleaner fuel preference. Other fuel options cater to niche applications in agriculture and aquaculture where flexibility and sustainability are prioritized.

- For instance, DATOMS, working with Mahindra and Cummins diesel sets, implemented an IoT-based diesel generator monitoring system that helped reduce operational expenses by 25% through real-time monitoring of fuel usage, engine performance, and predictive maintenance scheduling.

By Application

The standby commercial diesel gensets market serves diverse applications, including telecom, healthcare, data centers, educational institutions, government centers, hospitality, retail sales, agriculture, aquaculture, and others. Data centers and healthcare facilities represent major growth drivers, requiring consistent backup power to safeguard operations. Telecom and government facilities maintain steady adoption supported by expanding infrastructure. Hospitality and retail segments increasingly deploy gensets to ensure customer service continuity. Agriculture and aquaculture applications adopt gensets to protect production cycles from grid instability.

Segments:

Based on Power Rating

- ≤ 75 kVA

- > 75 kVA – 375 kVA

- > 375 kVA – 750 kVA

- > 750 kVA

Based on Fuel

Based on Application

- Telecom

- Healthcare

- Data centers

- Educational institutions

- Government centers

- Hospitality

- Retail sales

- Agriculture

- Aquaculture

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The standby commercial diesel gensets market in North America holds a 27% share, driven by strong demand from data centers, healthcare institutions, and government facilities. It benefits from frequent weather-related outages and the need for resilient backup systems. The United States leads adoption with widespread use in financial hubs and large-scale commercial complexes. Canada contributes steadily, supported by investments in telecom and public infrastructure. Rising digitization and reliance on critical IT infrastructure sustain long-term growth momentum.

Europe

Europe accounts for 21% of the standby commercial diesel gensets market, influenced by stringent energy security regulations and modernization of commercial infrastructure. It finds strong applications in healthcare, hospitality, and government sectors where continuity is essential. Germany, the UK, and France dominate adoption due to industrial expansion and dense urban networks. Energy transition policies drive hybrid genset deployment with cleaner fuel integration. Businesses emphasize backup power for critical services to meet regulatory compliance and sustainability goals.

Asia Pacific

Asia Pacific leads the standby commercial diesel gensets market with a commanding 34% share, supported by rapid urbanization, industrialization, and expanding telecom infrastructure. China, India, and Japan are major contributors, driven by heavy demand from data centers, hospitals, and large commercial facilities. It benefits from fast-growing digital ecosystems and rising power grid instability in emerging economies. Government investments in smart cities and commercial development accelerate adoption. Strong reliance on diesel for reliable and immediate backup sustains dominance.

Latin America

The standby commercial diesel gensets market in Latin America represents 9% of global share, primarily driven by unreliable grid networks and frequent power disruptions. Brazil and Mexico lead installations across commercial, healthcare, and telecom sectors. It gains traction from rising retail and hospitality investments across urban regions. Businesses depend on gensets to maintain operational efficiency during prolonged outages. Growth opportunities expand with ongoing infrastructure development and increasing adoption across agriculture and aquaculture applications.

Middle East & Africa

Middle East & Africa hold a combined 9% share of the standby commercial diesel gensets market, fueled by large-scale infrastructure projects and rising power demand. The Gulf nations invest heavily in backup systems for hospitality, government centers, and financial hubs. Africa experiences adoption across healthcare, agriculture, and telecom sectors where grid instability is persistent. It benefits from growth in retail and construction industries. Rising emphasis on energy security ensures gensets remain an integral part of regional development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genesal Energy

- Caterpillar

- MAHINDRA POWEROL

- Kohler

- Kirloskar

- Atlas Copco

- Green Power International

- Generac Power Systems

- J C Bamford Excavators

- Mitsubishi Heavy Industries

- Cooper

- Cummins

- ASHOK LEYLAND

Competitive Analysis

The standby commercial diesel gensets market is highly competitive, with global and regional players focusing on technological innovation, fuel efficiency, and regulatory compliance to strengthen their positions. It is shaped by established manufacturers such as Caterpillar, Cummins, Generac Power Systems, Kohler, and Mitsubishi Heavy Industries, which dominate through extensive product portfolios and global distribution networks. Companies including Atlas Copco, Kirloskar, Genesal Energy, Cooper, Green Power International, and J C Bamford Excavators target niche segments with customized solutions. ASHOK LEYLAND and MAHINDRA POWEROL maintain strong presence in emerging economies by offering cost-effective and robust products. Players invest in hybrid technologies integrating diesel with renewable power, alongside IoT-enabled monitoring systems to address growing demand for efficiency and sustainability. Strategic moves such as mergers, partnerships, and regional expansions are common as companies compete for market share across data centers, healthcare, telecom, and commercial facilities. The competitive landscape reflects a balance between global leaders driving innovation and regional firms leveraging cost competitiveness and localized service networks to remain relevant.

Recent Developments

- On June 25, 2025, Cummins Power Generation announced the launch of its new 17-liter engine platform generator set, delivering up to 1 megawatt of power, marking a significant step in advancing power density and reliability in the standby commercial diesel gensets market.

- In February 2025, Rolls-Royce (mtu brand) introduced an enhanced 50 Hz mtu Series 1600 genset, delivering up to 40% more power with outputs ranging from 590 to 996 kVA. The upgraded units support synthetic diesel fuels and are suited for data centers, healthcare, microgrids, and hybrid power systems.

- In August 2025, Generac launched a new diesel generator product line for the Indian market, designed for dependable, efficient, and uninterrupted power across residential, commercial, and industrial applications.

- In 2024, Cummins Power Generation expanded its Centum Series with the launch of two new high-capacity generator models, the C3000D6EB and C2750D6E powered by Cummins’ proven QSK78 engine.

Market Concentration & Characteristics

The standby commercial diesel gensets market reflects a moderately concentrated structure, with global leaders and strong regional players competing across diverse applications. It is characterized by high entry barriers due to capital requirements, strict emission regulations, and the need for advanced technological expertise. Established players such as Caterpillar, Cummins, Generac Power Systems, Kohler, and Mitsubishi Heavy Industries dominate through extensive product portfolios and strong distribution networks, while regional firms like Kirloskar, MAHINDRA POWEROL, and ASHOK LEYLAND leverage localized manufacturing and cost competitiveness. The market shows strong dependence on reliability, fuel efficiency, and compliance with energy security regulations, which shape customer preferences. It exhibits steady demand from critical industries including healthcare, data centers, telecom, and government facilities, where power continuity is non-negotiable. Growing adoption of IoT-based monitoring, hybrid configurations, and eco-friendly solutions highlights a shift toward smarter and sustainable genset systems, reinforcing the balance between operational resilience and environmental responsibility.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for standby commercial diesel gensets will rise with expanding data center infrastructure worldwide.

- Healthcare institutions and government facilities will continue to drive steady adoption for critical backup power.

- Hybrid gensets combining diesel with renewable energy will gain traction to meet sustainability goals.

- Digital monitoring and IoT-enabled solutions will become standard features across modern gensets.

- Manufacturers will focus on low-emission engines to comply with tightening environmental regulations.

- Emerging economies will fuel growth through rapid industrialization and urban infrastructure projects.

- Hospitality, retail, and telecom sectors will expand deployment to ensure service continuity.

- Volatility in diesel prices will push innovation toward fuel-efficient and flexible models.

- Strategic collaborations and regional expansions will intensify competition among global and local players.

- Adoption of intelligent, scalable, and eco-friendly gensets will shape the market’s long-term direction.