Market Overview:

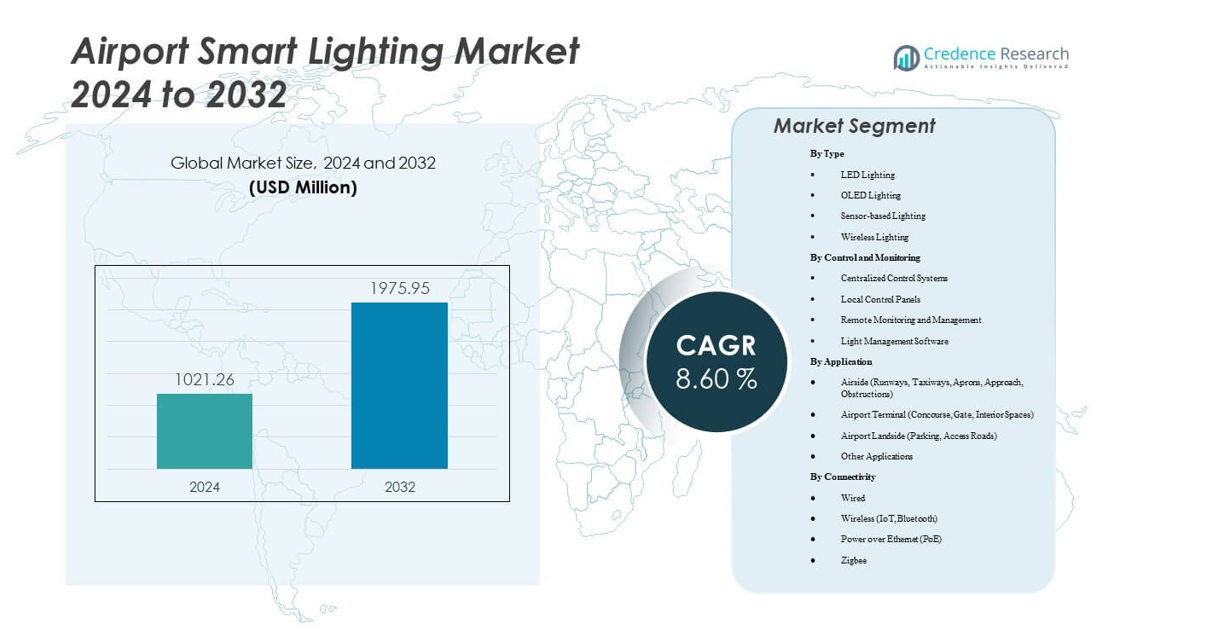

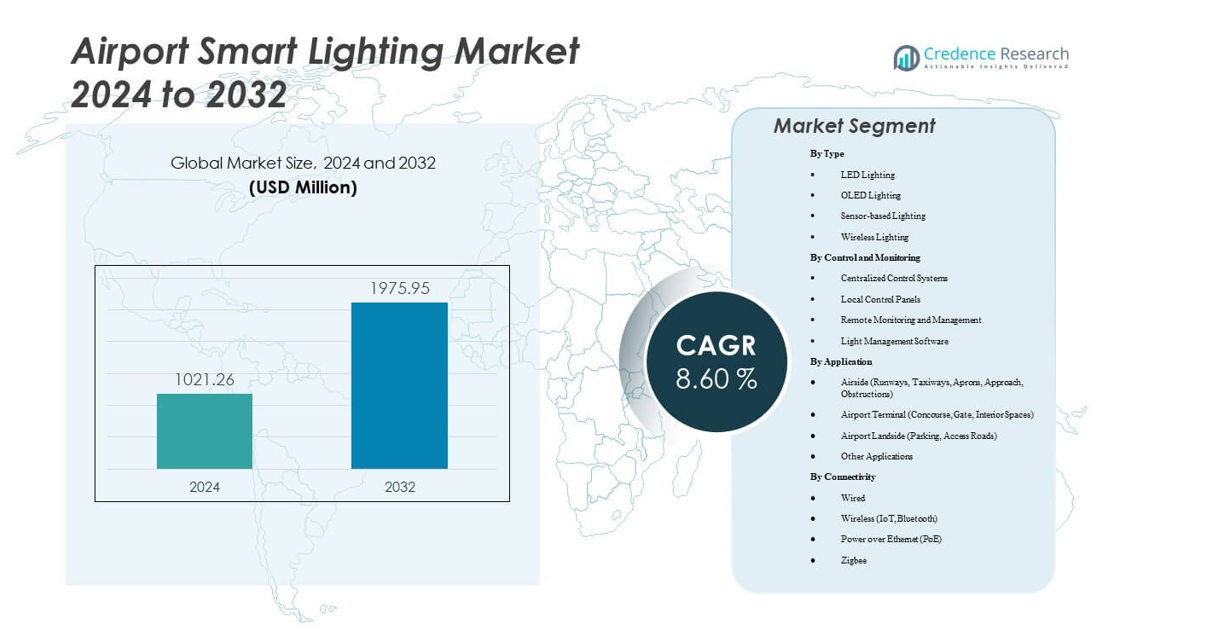

The Airport Smart Lighting Market is projected to grow from USD 1,021.26 million in 2024 to an estimated USD 1,975.95 million by 2032, with a compound annual growth rate (CAGR) of 8.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Airport Smart Lighting Market Size 2024 |

USD 1,021.26 million |

| Airport Smart Lighting Market, CAGR |

8.6% |

| Airport Smart Lighting Market Size 2032 |

USD 1,975.95 million |

The market growth is driven by increasing airport modernization initiatives, rising passenger traffic, and the adoption of energy-efficient technologies. Airports worldwide are investing in LED-based and sensor-controlled lighting systems to enhance visibility, safety, and operational efficiency. Integration of automation, IoT, and AI-based control systems further improves performance by enabling real-time monitoring and predictive maintenance, lowering energy costs while supporting sustainability goals.

North America leads the market due to its advanced airport infrastructure and early adoption of smart technologies. Europe follows with strong regulatory emphasis on sustainable airport development and energy efficiency. The Asia-Pacific region is emerging rapidly, supported by expanding air traffic, infrastructure investments, and large-scale airport construction projects in China, India, and Southeast Asia.

Market Insights:

- The Airport Smart Lighting Market is valued at USD 1,021.26 million in 2024 and expected to reach USD 1,975.95 million by 2032, growing at a CAGR of 8.6%.

- Rising airport modernization and infrastructure expansion projects are driving the adoption of advanced lighting systems.

- Increasing demand for energy-efficient and automated solutions supports the shift toward LED and sensor-based lighting.

- Integration of IoT and AI enhances safety, visibility, and real-time control across airside and terminal areas.

- High installation costs and integration challenges with legacy systems act as key restraints for market growth.

- North America dominates the market due to strong regulatory standards and early technology adoption.

- Asia-Pacific is witnessing rapid growth driven by large-scale airport developments in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Focus on Energy Efficiency and Sustainable Airport Operations

The Airport Smart Lighting Market is gaining traction due to the rising demand for energy-efficient airport infrastructure. Smart lighting systems reduce power consumption through motion sensors, adaptive dimming, and real-time control mechanisms. Airports adopt LED-based lighting solutions to meet sustainability goals and lower carbon emissions. Governments and regulatory bodies mandate green certification standards, encouraging airports to upgrade legacy systems. Advanced monitoring tools help optimize energy usage without compromising visibility or safety. These innovations align with global sustainability targets, supporting long-term operational efficiency.

Increasing Air Traffic and Expansion of Global Airport Infrastructure

Rapid growth in air passenger traffic and new airport construction projects drive technology adoption. Airport authorities implement intelligent lighting to manage complex operations effectively and ensure runway visibility. The rise of mega-airports in developing economies strengthens the need for automated lighting systems. Continuous modernization of existing airports encourages replacement of conventional lights with smart alternatives. It also supports safety improvements and reduces operational downtime during peak hours. Integration of IoT-enabled lighting enhances communication between control systems and airfield lighting.

- For instance, Beijing Daxing International Airport integrates IoT-based smart lighting systems across its terminals, using adaptive LED controls to enhance energy efficiency and operational management within its large terminal complex.

Integration of IoT and Smart Control Systems for Optimized Management

The integration of IoT platforms enhances control precision and maintenance efficiency in airport environments. Advanced communication protocols enable seamless monitoring of lighting networks from centralized systems. Predictive analytics allow maintenance teams to detect faults early and minimize disruptions. Cloud-based dashboards support real-time data visualization for better operational decisions. The Airport Smart Lighting Market benefits from automation, which ensures uniform illumination and quick response during emergencies. Adoption of these solutions improves energy management and supports scalable infrastructure.

Stringent Safety Regulations and Emphasis on Operational Reliability

Regulatory authorities impose strict safety standards for runway and taxiway illumination. Airports rely on intelligent systems to ensure compliance and minimize risks during takeoff and landing. Adaptive lighting solutions enhance visibility during adverse weather or low-light conditions. They help reduce pilot errors and ensure safe aircraft navigation. Governments invest in technology upgrades to maintain international aviation standards. It encourages widespread implementation of automated airfield lighting systems that deliver long-term reliability and operational safety.

- For instance, OCEM Airfield Technology’s INFINITE Airfield Lighting Control and Management System is ICAO Category III compliant and features single lamp control, fault detection, and preventive maintenance functions designed to enhance runway safety and operational reliability.

Market Trends

Rising Adoption of LED and Adaptive Lighting Technologies

The Airport Smart Lighting Market experiences a shift toward LED-based adaptive systems. LED technology offers longer lifespan, faster illumination response, and reduced maintenance requirements. Adaptive lights automatically adjust brightness according to ambient conditions and aircraft presence. These features enhance energy efficiency while maintaining optimal visibility. Manufacturers design modular lighting units compatible with smart control systems. The trend supports both cost efficiency and sustainability in airport operations, aligning with evolving global energy mandates.

- For instance, in 2025, ADB SAFEGATE introduced its AXON High-Intensity Elevated LED lighting solution designed to cut energy use by up to 80% compared to halogen systems, supporting sustainable airfield operations through modular design and advanced performance features.

Integration of Advanced Sensors and Real-Time Monitoring Capabilities

Smart lighting systems now integrate sensors for motion, temperature, and visibility detection. These sensors collect data that supports automated decision-making in control systems. Real-time monitoring ensures consistent illumination performance across runways, aprons, and terminals. It enables predictive maintenance and lowers downtime caused by manual inspections. The trend promotes digital transformation and operational transparency in airport management. Growing reliance on AI-driven analytics further refines performance and energy optimization.

Development of Smart Airports and Digital Infrastructure Initiatives

Governments and airport authorities prioritize smart airport development projects. Digital infrastructure investments include advanced lighting systems with automation and analytics integration. The Airport Smart Lighting Market aligns with this vision, supporting safety, comfort, and efficiency. Smart terminals employ connected lighting to improve passenger experience and guide movement. Automation enables faster response to operational changes like weather or traffic variations. The trend reflects the aviation sector’s commitment to innovation and sustainable modernization.

- For instance, Singapore Changi Airport’s Terminal 2 expansion features around 5,500 ERCO Compar linear LED downlights, designed to provide efficient ambient lighting and support the airport’s sustainability goal of achieving zero carbon growth by 2030 while capping emissions at 2018 levels.

Focus on Sustainable Construction and Green Airport Certifications

Airports increasingly pursue LEED and other sustainability certifications. Smart lighting systems play a key role in meeting green infrastructure goals. Energy-efficient lighting reduces power use and aligns with carbon reduction targets. The use of renewable energy sources to power airfield lighting gains importance. It promotes a circular economy approach through recyclable materials and low-emission manufacturing. The trend encourages airports to adopt smart technologies that combine performance with sustainability.

Market Challenges Analysis

High Initial Investment and Integration Complexity in Smart Systems

Implementing intelligent lighting systems requires substantial upfront investment in equipment, networking, and software. The Airport Smart Lighting Market faces cost-related constraints, particularly in smaller airports. Integration with legacy infrastructure increases installation complexity and downtime risks. Limited budgets hinder modernization in developing regions. Specialized technical expertise is necessary to ensure proper configuration and calibration. The need for interoperability across different manufacturers’ systems adds further complications. It creates barriers for widespread adoption despite long-term cost savings.

Cybersecurity Risks and Maintenance Challenges in Connected Lighting Systems

Smart lighting relies on connected networks that expose airports to cybersecurity threats. Unauthorized access to control systems can disrupt critical runway operations. The market must address vulnerabilities through secure communication protocols and encryption. Continuous software updates are essential to protect against evolving threats. Maintenance of advanced lighting systems requires trained personnel and timely diagnostics. It demands consistent monitoring to ensure reliability and prevent service interruptions. Airports prioritize resilience strategies to safeguard both operational integrity and passenger safety.

Market Opportunities

Expansion of Smart City and Smart Airport Initiatives Worldwide

The global push for smart infrastructure creates significant opportunities in airport modernization. The Airport Smart Lighting Market benefits from integration with wider smart city frameworks. Airports adopt connected lighting to support intelligent navigation and energy optimization. Public-private partnerships promote investment in sustainable technology upgrades. The rise of regional aviation hubs in emerging economies accelerates adoption of these systems. Government incentives and sustainability programs encourage innovation and large-scale deployment.

Adoption of Renewable Energy and Hybrid Power Systems in Lighting Infrastructure

The shift toward renewable energy presents growth avenues for lighting solutions powered by solar and hybrid systems. It reduces dependency on grid electricity and improves operational resilience during outages. Hybrid airfield lighting systems combine solar panels and battery storage for continuous performance. These innovations appeal to airports targeting carbon neutrality and cost efficiency. Manufacturers focus on modular, self-sustaining solutions adaptable to different airport sizes. Growing awareness of environmental responsibility enhances long-term investment in such technologies.

Market Segmentation Analysis:

By Type

The Airport Smart Lighting Market is driven by strong adoption of LED lighting, which dominates due to its energy efficiency, long lifespan, and reduced maintenance costs. OLED lighting gains attention for terminal interiors where design flexibility and soft illumination are valued. Sensor-based lighting supports automation by adjusting brightness according to aircraft movement and ambient conditions. Wireless lighting enhances control and simplifies installation across large airfields. It ensures operational reliability, reduces wiring complexity, and supports real-time monitoring essential for modern airport infrastructure.

- For instance, at Amsterdam Airport Schiphol, Signify (formerly Philips Lighting) installed over 3,700 LED luminaires, achieving a 50% reduction in electricity consumption for terminal lighting and extending fixture lifespan by 75%, which lowered maintenance costs and environmental impact.

By Control and Monitoring

Centralized control systems hold a major share, providing unified oversight of all airside and landside lighting networks. They ensure seamless operation and compliance with aviation standards. Local control panels remain critical for smaller airports requiring manual adjustments. Remote monitoring and management systems improve maintenance efficiency by detecting faults instantly and minimizing downtime. Light management software supports data-driven decisions through energy analytics and scheduling features. It allows operators to optimize illumination performance and ensure safety with minimal resource use.

By Application

Airside applications lead due to the safety and precision required on runways, taxiways, and aprons. High-intensity lighting ensures clear visibility in all weather conditions. Airport terminal lighting emphasizes passenger comfort and energy optimization within concourses and gates. Landside lighting focuses on security and accessibility in parking areas and access roads. Other applications include perimeter and obstacle lighting that enhance safety compliance. It continues to evolve with smart technologies improving visibility, efficiency, and environmental performance.

- For instance, Honeywell installed over 8,200 LED lights and 1,300 km of cabling at Dubai International Airport during runway upgrades, replacing legacy fixtures with energy-efficient systems that significantly reduced overall power consumption and enhanced airfield lighting reliability.

By Connectivity

Wired lighting systems dominate in large international airports for their reliability and stable data transmission. Wireless systems using IoT and Bluetooth enhance operational flexibility and lower installation costs. Power over Ethernet (PoE) simplifies cabling by combining data and power transmission through a single line. Zigbee technology supports mesh networking for real-time communication and energy control. It enables scalable smart lighting networks that enhance monitoring accuracy and reduce operational complexity in airport environments.

Segmentation:

By Type

- LED Lighting

- OLED Lighting

- Sensor-based Lighting

- Wireless Lighting

By Control and Monitoring

- Centralized Control Systems

- Local Control Panels

- Remote Monitoring and Management

- Light Management Software

By Application

- Airside (Runways, Taxiways, Aprons, Approach, Obstructions)

- Airport Terminal (Concourse, Gate, Interior Spaces)

- Airport Landside (Parking, Access Roads)

- Other Applications

By Connectivity

- Wired

- Wireless (IoT, Bluetooth)

- Power over Ethernet (PoE)

- Zigbee

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America leads the Airport Smart Lighting Market with a market share of 34%. The region’s dominance stems from advanced airport infrastructure, early adoption of LED-based airfield lighting, and strong regulatory mandates for energy efficiency. The United States invests heavily in smart airport development projects, supported by the Federal Aviation Administration (FAA) initiatives to modernize lighting systems. Canada follows similar trends with sustainable airport expansion projects across major cities. It benefits from integration of IoT-enabled lighting networks and predictive maintenance systems that enhance operational efficiency and safety standards.

Europe holds a market share of 29%, driven by strict environmental regulations and adoption of green airport certification programs. Countries such as Germany, the United Kingdom, and France focus on energy-efficient upgrades under the European Green Deal framework. Smart lighting deployment aligns with regional goals for carbon neutrality and reduced operational costs. Airport operators invest in adaptive lighting for runways and terminals to improve visibility and passenger experience. It benefits from government-led digitalization initiatives, reinforcing modernization across both primary and secondary airports.

Asia-Pacific captures a market share of 27% and is the fastest-growing regional segment due to large-scale airport construction in China, India, and Southeast Asia. The region witnesses heavy investment in smart infrastructure under national aviation expansion programs. Smart lighting adoption increases with growing passenger traffic and demand for safe, automated systems. Rising urbanization and government funding for smart city integration contribute to market acceleration. It continues to attract global manufacturers expanding partnerships and deploying advanced airfield lighting technologies across emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ADB Safegate BVBA

- Eaton Corporation plc

- Honeywell International Inc.

- OSRAM GmbH

- HELLA GmbH & Co. KGaA

- Carmanah Technologies Corp.

- Schreder Group

- Koninklijke Philips N.V. (Signify)

- AIRPORT LIGHTING SPECIALISTS

- C2 SmartLight Oy

- Cree Inc.

- ATG Airports Ltd

Competitive Analysis:

The Airport Smart Lighting Market features strong competition among global and regional players focusing on technology innovation and energy efficiency. Key companies such as ADB Safegate BVBA, Eaton Corporation plc, Honeywell International Inc., and Koninklijke Philips N.V. (Signify) lead through advanced LED and IoT-enabled lighting solutions. OSRAM GmbH, HELLA GmbH & Co. KGaA, and Carmanah Technologies Corp. strengthen their positions with smart control systems and solar-powered designs. Schreder Group and ATG Airports Ltd emphasize sustainable and modular infrastructure for large airports. It continues to witness strategic alliances, product upgrades, and digital integration to enhance visibility, safety, and operational control. Competitors invest in automation, remote monitoring, and connected infrastructure to align with the global shift toward sustainable airport modernization.

Recent Developments:

- In October 2025, ADB Safegate launched “AI: Airside Intelligence,” an advanced platform designed to transform airport operations with real-time data-driven airport management. This innovation leverages artificial intelligence to optimize lighting, guidance, and airside processes, enhancing efficiency and sustainability for airports worldwide.

- In June 2025, Eaton Corporation was awarded contracts worth approximately $25 million to upgrade the electrical infrastructure at Hartsfield-Jackson Atlanta International Airport as part of the $12.8 billion ATLNext expansion.

- In October 2024, Honeywell Automation India secured a contract to supply and install its advanced Airfield Ground Lighting (AGL) system for Noida International Airport. The Honeywell system features intelligent lighting controls for enhanced safety and efficient aircraft operations on runways and taxiways, leveraging automation and real-time data integration.

Report Coverage:

The research report offers an in-depth analysis based on Type, Control and Monitoring, Application and Connectivity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing airport modernization programs will boost demand for automated and energy-efficient lighting systems.

- Integration of IoT platforms will improve predictive maintenance and enhance operational safety.

- Expansion of air traffic in emerging economies will drive large-scale smart lighting installations.

- Shift toward renewable-powered lighting systems will support sustainability goals and cost reduction.

- Development of AI-based monitoring tools will strengthen efficiency in runway and terminal management.

- Governments will continue mandating safety and efficiency standards, accelerating smart technology adoption.

- Wireless and Power over Ethernet systems will gain traction for flexible and scalable deployment.

- LED technology will remain the dominant source, supported by innovation in adaptive brightness control.

- Smart airport projects in Asia-Pacific and the Middle East will open high-growth opportunities.

- Collaboration between lighting manufacturers and digital solution providers will define the next phase of market evolution.