1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Research Methodology

1.3.1. Phase I – Secondary Research

1.3.2. Phase II – Primary Research

1.3.3. Phase III – Expert Panel Review

1.3.4. Approach Adopted

1.3.4.1. Top-Down Approach

1.3.4.2. Bottom-Up Approach

1.3.5. Assumptions

1.4. Market Segmentation

2. Executive Summary

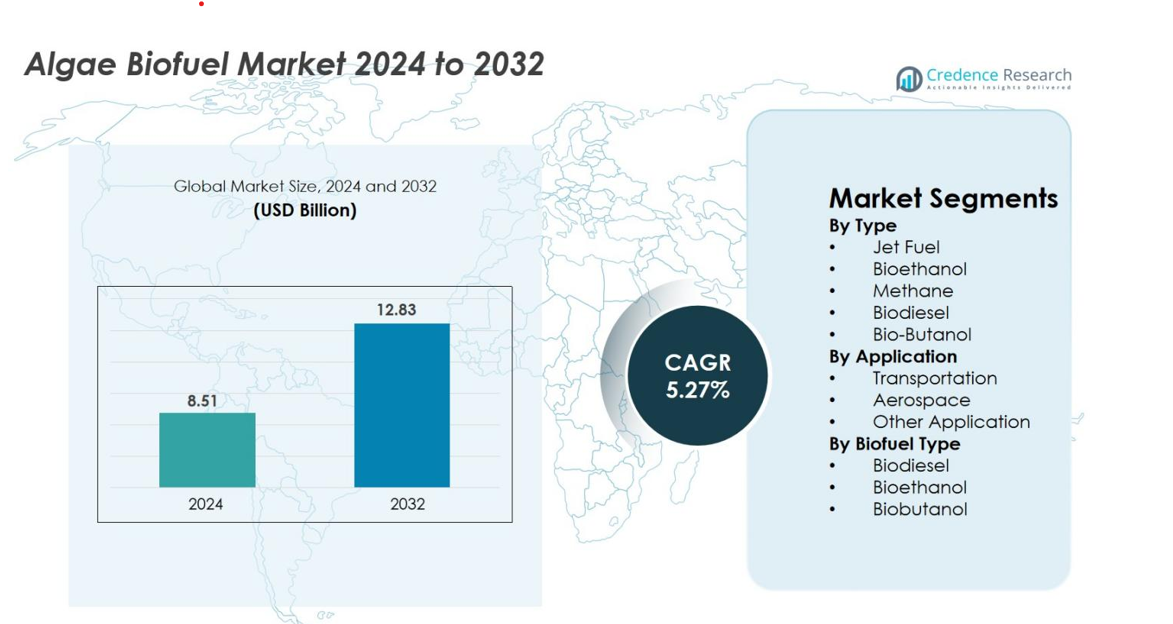

2.1. Market Snapshot: Global Algae Biofuel Market

2.2. Global Algae Biofuel Market, By Type

2.3. Global Algae Biofuel Market, By Application

2.4. Global Algae Biofuel Market, By Region

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Global Algae Biofuel Market Value, 2016-2028, (US$ Bn)

3.2. Market Dynamics

3.2.1. Key Growth Trends

3.2.2. Market Drivers

3.2.3. Market Restraints

3.2.4. Market Opportunities

3.2.5. Major Industry Challenges

3.3. Attractive Investment Proposition,2021

3.3.1. Type

3.3.2. Application

3.3.3. Geography

4. Premium Insights

4.1. STAR (Situation, Task, Action, Results) Analysis

4.2. Porter’s Five Forces Analysis

4.2.1. Threat of New Entrants

4.2.2. Bargaining Power of Buyers/Consumers

4.2.3. Bargaining Power of Suppliers

4.2.4. Threat of Substitute Types

4.2.5. Intensity of Competitive Rivalry

4.3. Value Chain Analysis

4.4. Technology Analysis

4.5. Marketing Strategy Analysis

4.5.1. Direct Marketing

4.5.2. Indirect Marketing

4.5.3. Marketing Channel Development Trend

5. Market Positioning of Key Players, 2021

5.1. Company market share of key players, 2021

5.2. Competitive Benchmarking

5.3. Market Positioning of Key Vendors

5.4. Geographical Presence Analysis

5.5. Major Strategies Adopted by Key Players

5.5.1. Key Strategies Analysis

5.5.2. Mergers and Acquisitions

5.5.3. Partnerships

5.5.4. Product Launch

5.5.5. Geographical Expansion

5.5.6. Others

6. COVID 19 Impact Analysis

6.1. Global Algae Biofuel Market Pre Vs Post COVID 19, 2019 – 2028

6.2. Impact on Import & Export

6.3. Impact on Demand & Supply

7. Global Algae Biofuel Market

7.1. Global Algae Biofuel Market, by Type, 2016-2028(US$ Bn)

7.1.1. Overview

7.1.2. Global Algae Biofuel Market, By Type, 2021 vs 2028 (in%)

7.1.3. Global Algae Biofuel Market, By Bioethanol, 2016-2028 (US$ Bn)

7.1.4. Global Algae Biofuel Market, By Biodiesel, 2016-2028 (US$ Bn)

7.1.5. Global Algae Biofuel Market, By Methane, 2016-2028 (US$ Bn)

7.1.6. Global Algae Biofuel Market, By Jet Fuel, 2016-2028 (US$ Bn)

7.1.7. Global Algae Biofuel Market, By Biobutanol, 2016-2028 (US$ Bn)

7.1.8. Global Algae Biofuel Market, By Biogasoline, 2016-2028 (US$ Bn)

7.1.9. Global Algae Biofuel Market, By Green Diesel, 2016-2028 (US$ Bn)

7.1.10. Global Algae Biofuel Market, By Others, 2016-2028 (US$ Bn)

7.2. Global Algae Biofuel Market, by Organization Size, 2016-2028(US$ Bn)

7.2.1. Overview

7.2.2. Global Algae Biofuel Market, By Application, 2021 vs 2028 (in%)

7.2.3. Global Algae Biofuel Market, By Transportation, 2016-2028 (US$ Bn)

7.2.4. Global Algae Biofuel Market, By Aerospace, 2016-2028 (US$ Bn)

7.2.5. Global Algae Biofuel Market, By Other Applications, 2016-2028 (US$ Bn)

8. North America Algae Biofuel Market Analysis

8.1. North America Algae Biofuel Market, by Type, 2016-2028(US$ Bn)

8.1.1. Overview

8.1.2. SRC Analysis

8.2. North America Algae Biofuel Market, by Application, 2016-2028(US$ Bn)

8.2.1. Overview

8.2.2. SRC Analysis

8.3. North America Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

8.3.1. U.S.

8.3.1.1. U.S. Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

8.3.1.2. U.S. Algae Biofuel, By Type, 2016-2028 (US$ Bn)

8.3.1.3. U.S. Algae Biofuel, By Application, 2016-2028 (US$ Bn)

8.3.2. Canada

8.3.2.1. Canada Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

8.3.2.2. Canada Algae Biofuel, By Type, 2016-2028 (US$ Bn)

8.3.2.3. Canada Algae Biofuel, By Application, 2016-2028 (US$ Bn)

9. Europe Algae Biofuel Market Analysis

9.1. Europe Algae Biofuel Market, by Type, 2016-2028(US$ Bn)

9.1.1. Overview

9.1.2. SRC Analysis

9.2. Europe Algae Biofuel Market, by Application, 2016-2028(US$ Bn)

9.2.1. Overview

9.2.2. SRC Analysis

9.3. Europe Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

9.3.1. Germany

9.3.1.1. Germany Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

9.3.1.2. Germany Algae Biofuel, By Type, 2016-2028 (US$ Bn)

9.3.1.3. Germany Algae Biofuel, By Application, 2016-2028 (US$ Bn)

9.3.2. France

9.3.2.1. France Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

9.3.2.2. France Algae Biofuel, By Type, 2016-2028 (US$ Bn)

9.3.2.3. France Algae Biofuel, By Application, 2016-2028 (US$ Bn)

9.3.3. UK

9.3.3.1. UK Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

9.3.3.2. UK Algae Biofuel, By Type, 2016-2028 (US$ Bn)

9.3.3.3. UK Algae Biofuel, By Application, 2016-2028 (US$ Bn)

9.3.4. Italy

9.3.4.1. Italy Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

9.3.4.2. Italy Algae Biofuel, By Type, 2016-2028 (US$ Bn)

9.3.4.3. Italy Algae Biofuel, By Application, 2016-2028 (US$ Bn)

9.3.5. Spain

9.3.5.1. Spain Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

9.3.5.2. Spain Algae Biofuel, By Type, 2016-2028 (US$ Bn)

9.3.5.3. Spain Algae Biofuel, By Application, 2016-2028 (US$ Bn)

9.3.6. Rest of Europe

9.3.6.1. Rest of Europe Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

9.3.6.2. Rest of Europe Algae Biofuel, By Type, 2016-2028 (US$ Bn)

9.3.6.3. Rest of Europe Algae Biofuel, By Application, 2016-2028 (US$ Bn)

10. Asia Pacific Algae Biofuel Market Analysis

10.1. Asia Pacific Algae Biofuel Market, by Type, 2016-2028(US$ Bn)

10.1.1. Overview

10.1.2. SRC Analysis

10.2. Asia Pacific Algae Biofuel Market, by Application, 2016-2028(US$ Bn)

10.2.1. Overview

10.2.2. SRC Analysis

10.3. Asia Pacific Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

10.3.1. China

10.3.1.1. China Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

10.3.1.2. China Algae Biofuel, By Type, 2016-2028 (US$ Bn)

10.3.1.3. China Algae Biofuel, By Application, 2016-2028 (US$ Bn)

10.3.2. Japan

10.3.2.1. Japan Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

10.3.2.2. Japan Algae Biofuel, By Type, 2016-2028 (US$ Bn)

10.3.2.3. Japan Algae Biofuel, By Application, 2016-2028 (US$ Bn)

10.3.3. India

10.3.3.1. India Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

10.3.3.2. India Algae Biofuel, By Type, 2016-2028 (US$ Bn)

10.3.3.3. India Algae Biofuel, By Application, 2016-2028 (US$ Bn)

10.3.4. South Korea

10.3.4.1. South Korea Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

10.3.4.2. South Korea Algae Biofuel, By Type, 2016-2028 (US$ Bn)

10.3.4.3. South Korea Algae Biofuel, By Application, 2016-2028 (US$ Bn)

10.3.5. South-East Asia

10.3.5.1. South-East Asia Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

10.3.5.2. South-East Asia Algae Biofuel, By Type, 2016-2028 (US$ Bn)

10.3.5.3. South-East Asia Algae Biofuel, By Application, 2016-2028 (US$ Bn)

10.3.6. Rest of Asia Pacific

10.3.6.1. Rest of Asia Pacific Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

10.3.6.2. Rest of Asia Pacific Algae Biofuel, By Type, 2016-2028 (US$ Bn)

10.3.6.3. Rest of Asia Pacific Algae Biofuel, By Application, 2016-2028 (US$ Bn)

11. Latin America Algae Biofuel Market Analysis

11.1. Latin America Algae Biofuel Market, by Type, 2016-2028(US$ Bn)

11.1.1. Overview

11.1.2. SRC Analysis

11.2. Latin America Algae Biofuel Market, by Application, 2016-2028(US$ Bn)

11.2.1. Overview

11.2.2. SRC Analysis

11.3. Latin America Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

11.3.1. Brazil

11.3.1.1. Brazil Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

11.3.1.2. Brazil Algae Biofuel, By Type, 2016-2028 (US$ Bn)

11.3.1.3. Brazil Algae Biofuel, By Application, 2016-2028 (US$ Bn)

11.3.2. Mexico

11.3.2.1. Mexico Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

11.3.2.2. Mexico Algae Biofuel, By Type, 2016-2028 (US$ Bn)

11.3.2.3. Mexico Algae Biofuel, By Application, 2016-2028 (US$ Bn)

11.3.3. Rest of Latin America

11.3.3.1. Rest of Latin America Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

11.3.3.2. Rest of Latin America Algae Biofuel, By Type, 2016-2028 (US$ Bn)

11.3.3.3. Rest of Latin America Algae Biofuel, By Application, 2016-2028 (US$ Bn)

12. Middle East and Africa Algae Biofuel Market Analysis

12.1. Middle East and Africa Algae Biofuel Market, by Type, 2016-2028(US$ Bn)

12.1.1. Overview

12.1.2. SRC Analysis

12.2. Middle East and Africa Algae Biofuel Market, by Application, 2016-2028(US$ Bn)

12.2.1. Overview

12.2.2. SRC Analysis

12.3. Middle East and Africa Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

12.3.1. GCC Countries

12.3.1.1. GCC Countries il Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

12.3.1.2. GCC Countries Algae Biofuel, By Type, 2016-2028 (US$ Bn)

12.3.1.3. GCC Countries Algae Biofuel, By Application, 2016-2028 (US$ Bn)

12.3.2. South Africa

12.3.2.1. South Africa Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

12.3.2.2. South Africa Algae Biofuel, By Type, 2016-2028 (US$ Bn)

12.3.2.3. South Africa Algae Biofuel, By Application, 2016-2028 (US$ Bn)

12.3.3. Rest of Middle East and Africa

12.3.3.1. Rest of Middle East and Africa Algae Biofuel Market Estimates and Forecast, 2016-2028 (US$ Bn)

12.3.3.2. Rest of Middle East and Africa Algae Biofuel, By Type, 2016-2028 (US$ Bn)

12.3.3.3. Rest of Middle East and Africa Algae Biofuel, By Application, 2016-2028 (US$ Bn)

13. Company Profiles

13.1. Algenol

13.1.1. Company Overview

13.1.2. Products/Methane Portfolio

13.1.3. Geographical Presence

13.1.4. Financial Summary

13.1.4.1. Market Revenue and Net Profit (2019-2021)

13.1.4.2. Business Segment Revenue Analysis

13.1.4.3. Geographical Revenue Analysis

13.2. Blue Marble Production

13.3. Solazyme Inc.

13.4. Sapphire Energy

13.5. Culture Biosystems

13.6. Origin Oils Inc.

13.7. Proviron

13.8. Genifuels

13.9. Algae Systems

13.10. Solix Biofuels

13.11. Reliance Life Sciences

13.12. Others

List of Figures

FIG. 1 Global Algae Biofuel Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Global Algae Biofuel Market Segmentation

FIG. 4 Global Algae Biofuel Market, by Type, 2021 (US$ Bn)

FIG. 5 Global Algae Biofuel Market, by Application, 2021 (US$ Bn)

FIG. 6 Global Algae Biofuel Market, by Geography, 2021 (US$ Bn)

FIG. 7 Attractive Investment Proposition, by Type, 2021

FIG. 8 Attractive Investment Proposition, by Application, 2021

FIG. 9 Attractive Investment Proposition, by Geography, 2021

FIG. 10 Global Market Share Analysis of Key Algae Biofuel Market Manufacturers, 2021

FIG. 11 Global Market Positioning of Key Algae Biofuel Market Manufacturers, 2021

FIG. 12 Global Algae Biofuel Market Value Contribution, By Type, 2021 & 2028 (Value %)

FIG. 13 Global Algae Biofuel Market, by Bioethanol, Value, 2016-2028 (US$ Bn)

FIG. 14 Global Algae Biofuel Market, by Biodiesel, Value, 2016-2028 (US$ Bn)

FIG. 15 Global Algae Biofuel Market, by Methane, Value, 2016-2028 (US$ Bn)

FIG. 16 Global Algae Biofuel Market, by Jet Fuel, Value, 2016-2028 (US$ Bn)

FIG. 17 Global Algae Biofuel Market, by Biobutanol, Value, 2016-2028 (US$ Bn)

FIG. 18 Global Algae Biofuel Market, by Biogasoline, Value, 2016-2028 (US$ Bn)

FIG. 19 Global Algae Biofuel Market, by Green Diesel, Value, 2016-2028 (US$ Bn)

FIG. 20 Global Algae Biofuel Market, by Others, Value, 2016-2028 (US$ Bn)

FIG. 21 Global Algae Biofuel Market Value Contribution, By Application, 2021 & 2028 (Value %)

FIG. 22 Global Algae Biofuel Market, by Transportation, Value, 2016-2028 (US$ Bn)

FIG. 23 Global Algae Biofuel Market, by Aerospace, Value, 2016-2028 (US$ Bn)

FIG. 24 Global Algae Biofuel Market, by Other Applications, Value, 2016-2028 (US$ Bn)

FIG. 25 U.S. Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 26 Canada Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 27 Germany Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 28 France Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 29 U.K. Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 30 Italy Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 31 Spain Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 32 Rest of Europe Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 33 China Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 34 Japan Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 35 India Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 36 South Korea Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 37 Southeast Asia Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 38 Rest of Asia Pacific Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 39 Latin America Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 40 Brazil Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 41 Mexico Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 42 Rest of Latin America Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 43 Middle East & Africa Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 44 GCC Countries Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 45 South Africa Algae Biofuel Market, 2016-2028 (US$ Bn)

FIG. 46 Rest of Middle East and Africa Algae Biofuel Market, 2016-2028 (US$ Bn)

List of Tables

TABLE 1 Market Snapshot: Global Algae Biofuel Market

TABLE 2 Global Algae Biofuel Market, by Competitive Benchmarking, 2021

TABLE 3 Global Algae Biofuel Market, by Geographical Presence Analysis, 2021

TABLE 4 Global Algae Biofuel Market, by Key Strategies Analysis, 2021

TABLE 5 Global Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 6 Global Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 7 Global Algae Biofuel Market, by Geography, 2016-2028 (US$ Bn)

TABLE 8 North America Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 9 North America Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 10 North America Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

TABLE 11 US Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 12 US Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 13 Canada Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 14 Canada Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 15 Europe Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 16 Europe Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 17 Europe Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

TABLE 18 Germany Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 19 Germany Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 20 France Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 21 France Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 22 UK Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 23 UK Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 24 Italy Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 25 Italy Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 26 Spain Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 27 Spain Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 28 Rest of Europe Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 29 Rest of Europe Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 30 Asia Pacific Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 31 Asia Pacific Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 32 Asia Pacific Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

TABLE 33 China Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 34 China Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 35 Japan Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 36 Japan Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 37 India Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 38 India Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 39 South Korea Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 40 South Korea Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 41 South East Asia Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 42 South East Asia Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 43 Rest of Asia Pacific Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 44 Rest of Asia Pacific Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 45 Latin America Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 46 Latin America Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 47 Latin America Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

TABLE 48 Brazil Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 49 Brazil Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 50 Mexico Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 51 Mexico Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 52 Rest of Latin America Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 53 Rest of Latin America Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 54 Middle East and Africa Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 55 Middle East and Africa Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 56 Middle East and Africa Algae Biofuel Market, by Country, 2016-2028 (US$ Bn)

TABLE 57 GCC Countries Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 58 GCC Countries Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 59 South Africa Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 60 South Africa Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)

TABLE 61 Rest of Middle East and Africa Algae Biofuel Market, by Type, 2016-2028 (US$ Bn)

TABLE 62 Rest of Middle East and Africa Algae Biofuel Market, by Application, 2016-2028 (US$ Bn)