Market Overview

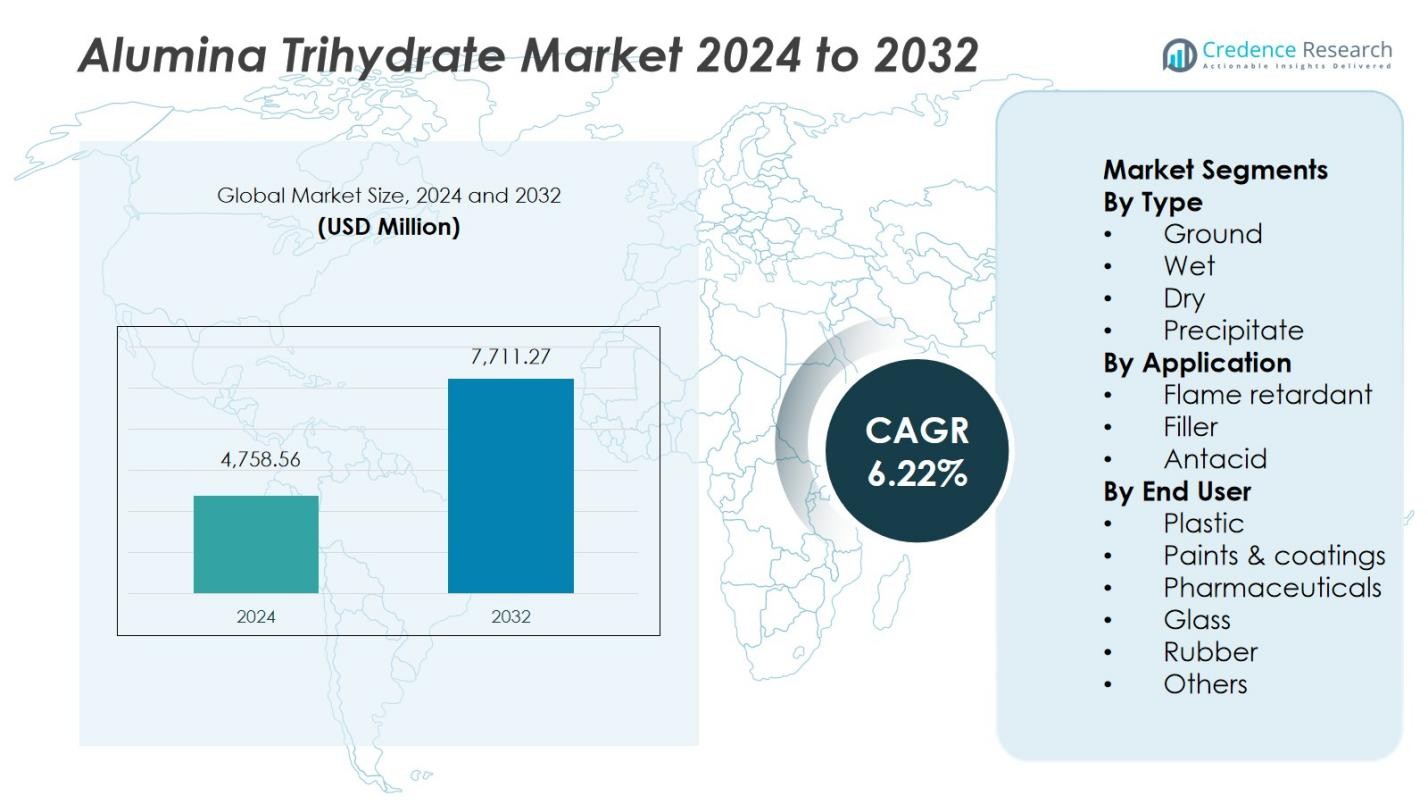

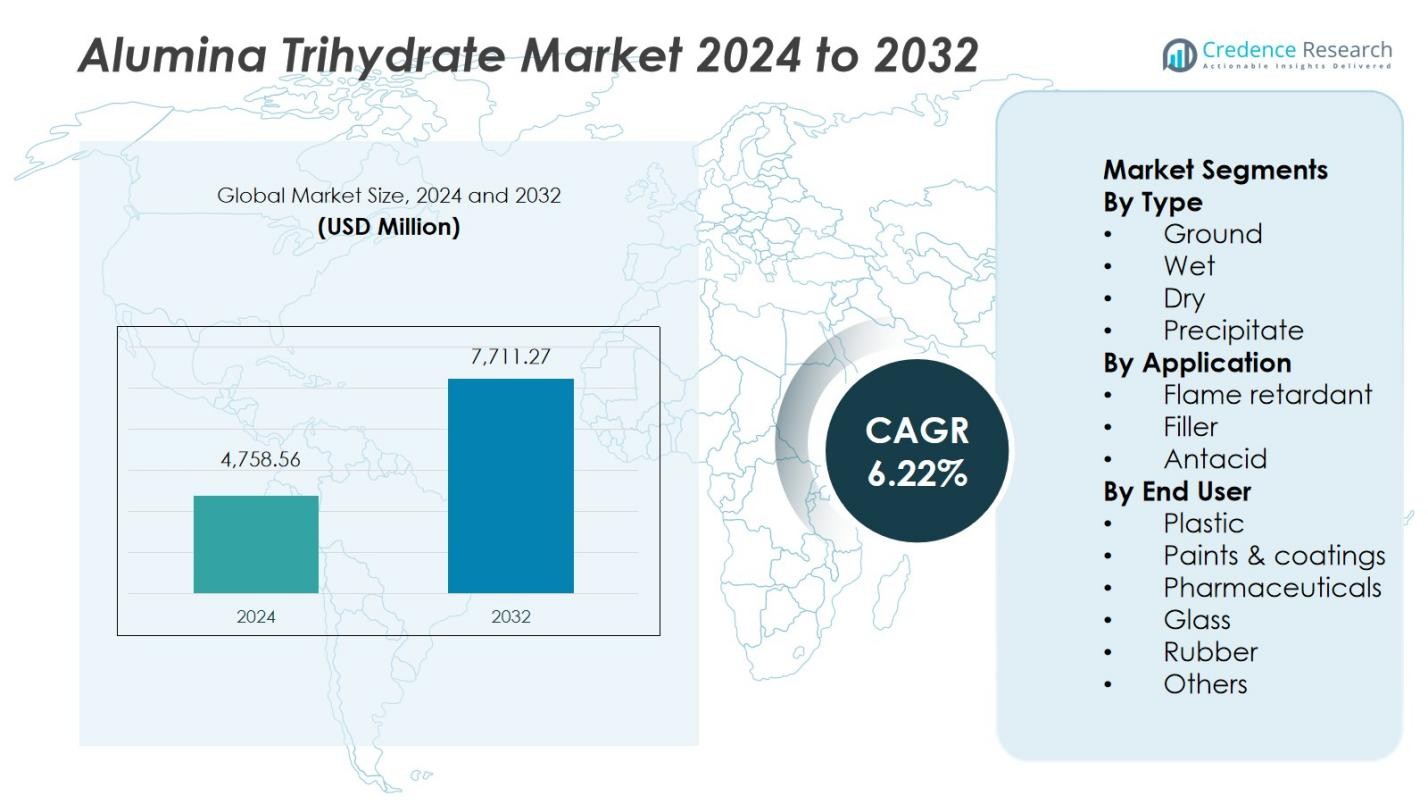

The Alumina Trihydrate Market size was valued at USD 4,758.56 million in 2024 and is anticipated to reach USD 7,711.27 million by 2032, at a CAGR of 6.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alumina Trihydrate Market Size 2024 |

USD 4,758.56 Million |

| Alumina Trihydrate Market, CAGR |

6.22% |

| Alumina Trihydrate Market Size 2032 |

USD 7,711.27 Million |

The Alumina Trihydrate Market is characterized by strong competition among major players such as Nabaltec AG, Albemarle Corporation, Almatis, Huber Engineered Materials, Aluminium Corporation of China (Chalco), Chemours Company, ICL Group, Nippon Light Metal Company, Ltd., Alumina Limited, and Alfa Aesar. These companies focus on expanding their production capacities, developing eco-friendly grades, and enhancing product purity to maintain a competitive edge. Strategic mergers, acquisitions, and regional partnerships enable them to strengthen supply chains and expand geographic reach. Continuous R&D investments support innovations in surface modification, refining, and dispersion technologies, improving product performance in flame retardant and filler applications. Growing emphasis on sustainability and regulatory compliance has prompted companies to align with green manufacturing standards. Asia-Pacific remains the leading region, accounting for a 35% share in 2024, driven by industrial expansion, cost-effective production, and strong demand from plastics, construction, and electrical industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Alumina Trihydrate Market was valued at USD 4,758.56 million in 2024 and is projected to reach USD 7,711.27 million by 2032, growing at a CAGR of 6.22% during the forecast period.

- Market growth is driven by rising demand for flame-retardant materials, especially in plastics, rubber, and cable applications, supported by stricter fire safety regulations worldwide.

- Key trends include the shift toward halogen-free and eco-friendly compounds, along with technological advancements in refining and surface-modification processes.

- The competitive landscape features players such as Nabaltec AG, Albemarle Corporation, Almatis, and Huber Engineered Materials, focusing on sustainable production and regional expansion.

- Asia-Pacific leads the market with a 35% share, followed by North America (28%) and Europe (24%), while the flame retardant segment holds around 45% share, making it the most dominant application area globally.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Ground alumina trihydrate dominates the market, accounting for over 40% share in 2024. Its fine particle size, high purity, and excellent dispersion make it ideal for flame retardant and filler applications. The wet and dry types follow, used in coatings and plastics where moisture control is critical. Precipitate grade holds a smaller portion due to higher processing costs but is favored for pharmaceutical and specialty uses. Growing use of ground alumina trihydrate in polymer compounding and cable insulation drives its demand, supported by increasing safety standards across industries.

For instance, Huber Engineered Materials expanded its fine precipitated alumina hydrate production to meet demand for high-quality processing and flame retardant applications globally.

By Application

The flame retardant segment leads the market with nearly 45% share in 2024. Alumina trihydrate releases water molecules upon heating, effectively reducing flammability in polymers, rubber, and textiles. The filler segment follows closely, driven by demand in paints, coatings, and plastics for improved surface finish and durability. Antacid applications hold a smaller share but remain steady due to pharmaceutical consumption. The rise in fire safety regulations and construction activities continues to strengthen the flame retardant segment’s dominance across industrial applications.

For instance, Hindalco Industries offers alumina trihydrate (ATH) products used extensively as halogen-free flame retardant additives in cables, composites, and paints, meeting stringent fire safety standards like UL94 V0.

By End User

The plastics industry represents the largest end-user, capturing over 38% share in 2024. Alumina trihydrate is widely used in thermoplastics and cable compounds for its flame-retardant and reinforcing properties. Paints and coatings follow, supported by their use in decorative and protective applications. Pharmaceuticals, glass, and rubber industries collectively contribute moderate shares through specific formulations and product uses. The steady growth of the electrical, automotive, and construction sectors sustains demand for plastic-grade alumina trihydrate, emphasizing its role in enhancing product safety and mechanical performance.

Key Growth Drivers

Rising Demand for Flame-Retardant Materials Across Industries

The growing use of flame-retardant materials in construction, automotive, and electrical applications drives the Alumina Trihydrate Market. Its non-toxic and halogen-free properties make it a preferred additive in polymer and rubber formulations. Stringent fire safety regulations in residential and commercial buildings further boost adoption. The demand for safer, environmentally compliant flame retardants strengthens market growth, particularly in developed regions. Manufacturers are expanding production capacities to meet rising consumption in cable insulation, flooring, and composite materials.

For instance, Huber Advanced Materials offers Martinal® alumina trihydrate, a halogen-free flame retardant specifically engineered for wire and cable compounds, meeting stringent industry standards for fire safety and smoke suppression in electrical applications.

Expansion of Plastic and Polymer Manufacturing

Rapid industrialization and the expansion of plastic manufacturing industries support market growth for alumina trihydrate. The compound enhances durability, thermal stability, and mechanical strength in polymer-based products. It is widely integrated into thermoplastics and elastomers used in packaging, transportation, and consumer goods. Increasing investment in lightweight, high-performance materials continues to elevate its demand. The plastics sector’s shift toward eco-friendly formulations also favors alumina trihydrate due to its recyclability and chemical inertness.

For instance, Huber Engineered Materials introduced Hydral Coat 2 Ultrafine Alumina Trihydrate, a specialized ATH grade designed for high-performance coating applications like coil coatings, enhancing durability and thermal stability in plastics.

Growing Pharmaceutical Applications and Antacid Production

The pharmaceutical sector increasingly relies on alumina trihydrate as an active ingredient in antacids. Its ability to neutralize gastric acid safely makes it valuable in oral formulations. Rising gastrointestinal disorder cases and expanding healthcare infrastructure in emerging economies accelerate this demand. Additionally, its role in producing medical-grade glass and controlled-release drug formulations broadens its applications. The compound’s high purity and biocompatibility ensure compliance with regulatory standards, strengthening its position in global pharmaceutical manufacturing.

Key Trends and Opportunities

Shift Toward Eco-Friendly and Halogen-Free Compounds

A major trend shaping the market is the shift toward sustainable, halogen-free flame retardants. Industries seek alternatives to brominated and chlorinated compounds due to environmental regulations. Alumina trihydrate, being naturally derived and non-toxic, fits these criteria well. Manufacturers are developing advanced grades with improved dispersion and thermal properties to meet performance needs. The trend aligns with global sustainability goals, creating opportunities in green construction materials and electronics manufacturing.

For instance, Clariant’s Exolit™ OP Terra line uses renewable-based raw materials to deliver halogen-free flame retardants with approximately 20% lower carbon footprint, aligning with circular economy principles.

Technological Advancements in Processing and Applications

Innovation in processing technologies enhances the quality and functionality of alumina trihydrate products. Advanced grinding and surface-modification techniques improve particle uniformity and compatibility with various polymers. These improvements enable broader applications in paints, coatings, and composites. Companies are investing in research to produce high-performance grades for specialized industrial uses. Such technological progress fosters product differentiation and market expansion, especially in high-value sectors like automotive and aerospace.

For instance, Alcoa has developed innovative surface modification methods that increase ATH’s compatibility with polymers, which benefits applications in flame-retardant coatings.

Key Challenges

High Energy Costs and Processing Complexity

The production of alumina trihydrate involves energy-intensive refining and calcination processes, leading to high operational costs. Fluctuating energy prices and raw material expenses add pressure on manufacturers. Maintaining product purity while optimizing production efficiency remains challenging. Companies are exploring alternative energy sources and automation to mitigate these constraints. However, the capital investment required for modernization can limit profitability for small-scale producers, affecting overall market competitiveness.

Competition from Alternative Flame Retardants

Increasing availability of alternative flame-retardant additives such as magnesium hydroxide and phosphorus-based compounds poses a challenge. These substitutes offer comparable or superior performance in specific applications at lower costs. Industries focusing on high-temperature resistance often opt for these alternatives. To remain competitive, alumina trihydrate suppliers must emphasize its non-toxic, eco-friendly nature and versatility. Strategic collaborations and product innovation are crucial to retain market share against growing competition.

Regional Analysis

North America

North America holds a significant position in the Alumina Trihydrate Market, capturing around 28% share in 2024. The region’s growth is driven by high demand for flame-retardant additives in construction, automotive, and electrical applications. The United States dominates regional consumption due to strong regulatory standards and advanced polymer production. Expanding applications in paints, coatings, and pharmaceuticals also support market stability. Investments in sustainable material innovation and the growing focus on fire safety compliance continue to strengthen alumina trihydrate adoption across industrial sectors.

Europe

Europe accounts for 24% share of the global alumina trihydrate market in 2024. Strict environmental regulations promoting halogen-free flame retardants fuel its demand in building, electronics, and transportation industries. Germany, France, and the United Kingdom lead consumption with well-established chemical manufacturing infrastructure. Rising adoption in paints, coatings, and plastic formulations supports sustained growth. Ongoing efforts toward circular economy goals and eco-friendly product development further enhance market prospects, making Europe a mature yet innovation-focused regional hub for alumina trihydrate applications.

Asia-Pacific

Asia-Pacific dominates the global market with 35% share in 2024, driven by rapid industrialization and expanding manufacturing capacities. China, India, and Japan are the key consumers, supported by rising demand in plastics, rubber, and cable industries. Government initiatives promoting fire safety and infrastructure development bolster market growth. Increasing pharmaceutical and construction activities also create new opportunities. The region benefits from abundant raw material availability and cost-effective production, positioning Asia-Pacific as the fastest-growing and most competitive regional market for alumina trihydrate.

Latin America

Latin America contributes 8% share to the alumina trihydrate market in 2024. Growth is supported by expanding building and construction sectors, particularly in Brazil and Mexico. The demand for flame-retardant materials and filler compounds in plastics and coatings is rising steadily. Industrialization and infrastructure investments enhance market penetration. However, limited local production and dependency on imports affect price stability. Increasing awareness of fire safety and sustainability standards is expected to gradually strengthen regional market participation and manufacturing capacity.

Middle East & Africa

The Middle East & Africa region holds 5% share in the global alumina trihydrate market in 2024. Market growth is influenced by expanding construction, cable manufacturing, and paints industries in countries such as the UAE, Saudi Arabia, and South Africa. Ongoing industrial diversification initiatives and infrastructure projects fuel material demand. Limited production facilities and higher logistics costs remain key challenges. However, the growing shift toward non-toxic and eco-safe flame retardants presents opportunities for regional development and strategic partnerships with global producers.

Market Segmentations:

By Type

- Ground

- Wet

- Dry

- Precipitate

By Application

- Flame retardant

- Filler

- Antacid

By End User

- Plastic

- Paints & coatings

- Pharmaceuticals

- Glass

- Rubber

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Alumina Trihydrate Market includes key players such as Almatis GmbH, Huber Engineered Materials, Nabaltec AG, Showa Denko K.K., MAL Zrt., Hindalco Industries Ltd., Alfa Aesar, Sumitomo Chemical Co., Ltd., and Albemarle Corporation. The market is moderately consolidated, with these companies focusing on expanding production capacity, enhancing product purity, and developing eco-friendly flame-retardant grades. Strategic collaborations and technological innovations are central to gaining a competitive edge. Leading manufacturers are investing in advanced refining and grinding technologies to improve particle size distribution and dispersion in polymer applications. Many players emphasize sustainable production to align with environmental regulations. Regional expansion through mergers, acquisitions, and partnerships also strengthens global supply networks. Continuous R&D efforts to introduce high-performance grades for plastics, coatings, and pharmaceuticals ensure sustained competitiveness in an evolving industrial and regulatory environment.

Key Player Analysis

- Nabaltec AG

- Showa Denko K.K.

- Aluminium Corporation of China (Chalco)

- Albemarle Corporation

- Chemours Company

- Sumitomo Chemical Co.

- Nippon Light Metal Company, Ltd.

- Almatis

- Alumina Limited

- Alfa Aesar

Recent Developments

- In May 2025, J.M. Huber Corporation acquired The R.J. Marshall Company’s alumina trihydrate (ATH), antimony-free flame retardant, and molybdate-based smoke suppressant assets to expand its specialty chemical portfolio.

- In August 2025, VINACOMIN of Vietnam partnered with Daejoo KC Group of South Korea to explore production of super-fine alumina trihydrate and boehmite for lithium-ion battery applications, aiming to strengthen the regional value chain in advanced materials.

- In April 2023,Alcoa has expanded its EcoSource™ low-carbon alumina brand to include non-metallurgical grades, alongside its original smelter-grade offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The alumina trihydrate market will experience steady growth driven by rising flame-retardant demand.

- Increasing use in plastics, rubber, and cable compounds will sustain long-term consumption.

- Expansion of construction and electrical industries will strengthen product adoption globally.

- Technological advancements in refining and particle processing will enhance material performance.

- Demand for halogen-free and eco-safe additives will drive innovation across industries.

- Pharmaceutical applications will expand due to growing use in antacid formulations.

- Asia-Pacific will remain the dominant region with strong industrial and infrastructure growth.

- Strategic collaborations among key manufacturers will improve supply chain efficiency.

- Rising focus on sustainability will encourage recycling and low-emission production methods.

- Continuous research on advanced grades will open new opportunities in high-end applications.

Market Segmentation Analysis:

Market Segmentation Analysis: