Market overview

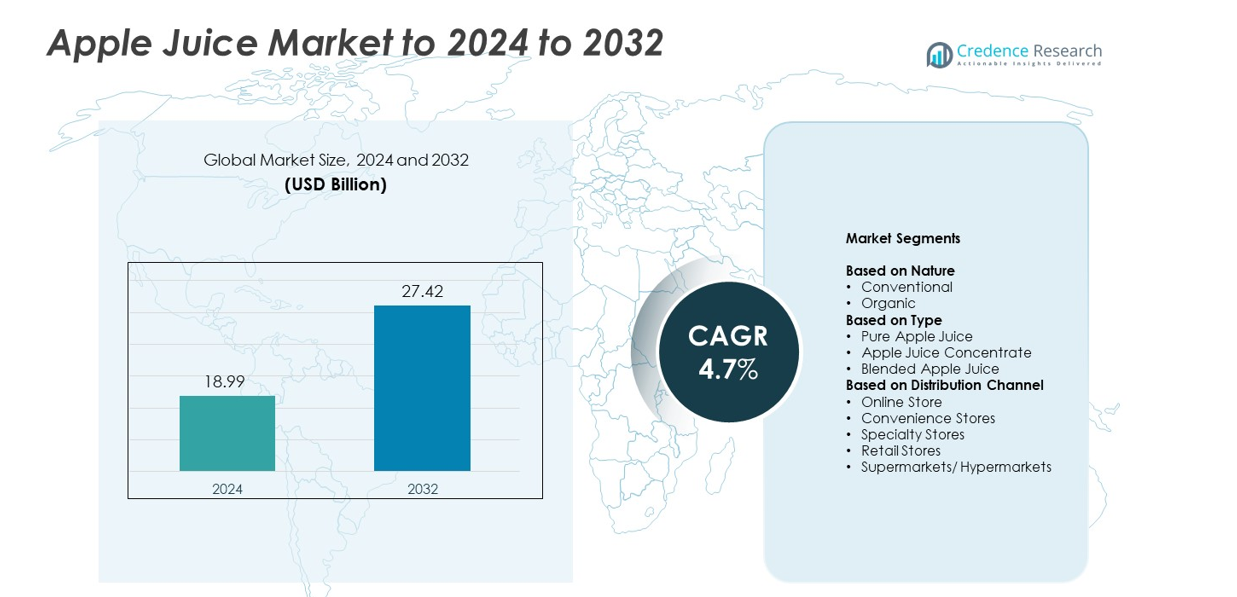

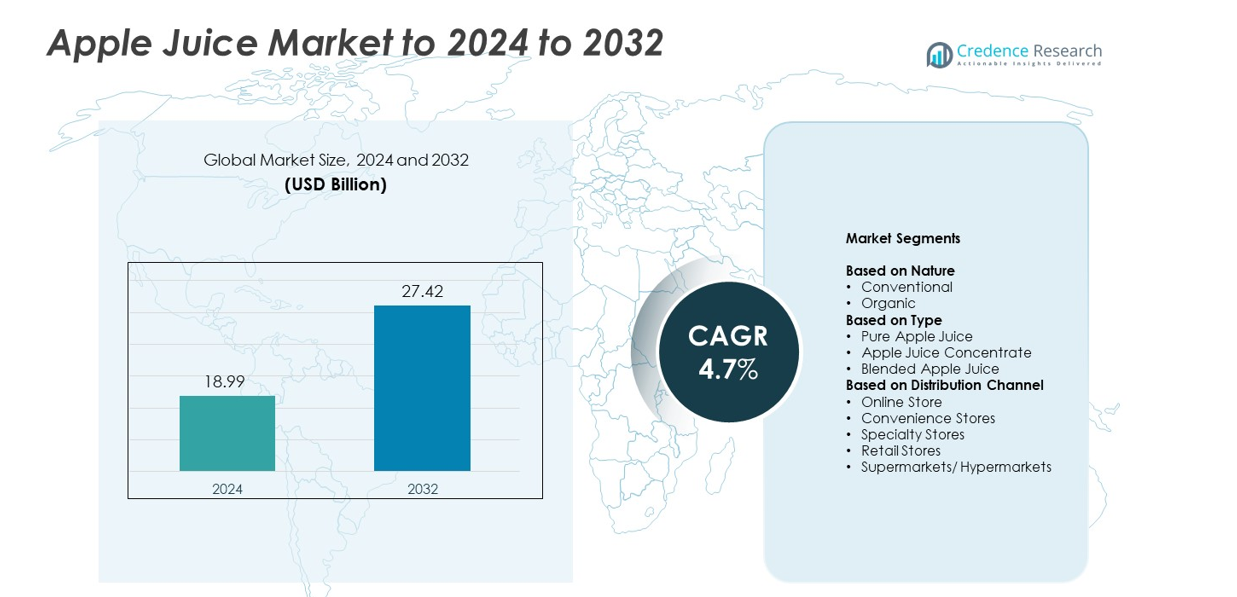

Apple Juice Market size was valued at USD 18.99 Billion in 2024 and is anticipated to reach USD 27.42 Billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Apple Juice Market Size 2024 |

USD 18.99 Billion |

| Apple Juice Market, CAGR |

4.7% |

| Apple Juice Market Size 2032 |

USD 27.42 Billion |

The apple juice market includes major companies such as Martinelli’s & Company, Ocean Spray Cranberries, Inc., PepsiCo, Inc., Welch’s, Rauch Fruchtsäfte GmbH & Co OG, Tree Top, Inc., Eden Foods, Inc., The Coca-Cola Company, Mott’s LLP, and The Kraft Heinz Company, all of which strengthen competition through wide product portfolios and strong retail reach. North America led the market in 2024 with about 32% share, followed by Europe at roughly 29%, supported by high consumption of natural fruit beverages. Asia Pacific held nearly 26% share and continued to grow quickly due to rising demand for convenient packaged drinks across urban regions.

Market Insights

- The apple juice market reached USD 18.99 Billion in 2024 and is projected to hit USD 27.42 Billion by 2032, expanding at a CAGR of 4.7% during the forecast period.

• Strong demand for natural beverages, rising focus on clean-label drinks, and growing use of apple juice in blended and functional formulations continued to drive market expansion across global retail channels.

• Key trends include rising adoption of organic products, fast growth of reduced-sugar variants, and increasing demand for convenient single-serve packaging formats in both online and offline distribution.

• Competition intensified as major brands expanded product lines, improved processing technologies, and strengthened presence in supermarkets, where the leading distribution channel held about 46% share, while pure apple juice remained dominant with nearly 54% share.

• North America led the market with about 32% share, followed by Europe at 29% and Asia Pacific at 26%, while conventional variants accounted for nearly 81% of total demand across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Nature

Conventional apple juice led the market in 2024 with about 81% share. This category remained dominant due to lower production cost, wide availability, and strong demand in mass-market retail. Consumers preferred conventional juice for its stable pricing and consistent taste profile. Growth stayed steady as manufacturers improved filtration and pasteurization methods. Organic apple juice continued to expand as health-focused buyers increased, yet higher price points limited broader adoption across several regions.

- For instance, Tree Top, Inc., a prominent fruit processing cooperative headquartered in Selah, Washington, processes over 800 million pounds of fruit every year.

By Type

Pure apple juice dominated the market in 2024 with nearly 54% share. Buyers chose this type for its clean label, natural flavor, and strong presence in household consumption. Its dominance increased as brands promoted no-added-sugar formulations and transparent ingredient sourcing. Apple juice concentrate gained traction due to extended shelf life, while blended apple juice targeted younger consumers seeking flavored mixes. Pure variants maintained leadership as retailers expanded their private-label offerings across global markets.

- For instance, in the $2.63 billion U.S. chilled juice sector, Tropicana held a commanding 44 % share around that time

By Distribution Channel

Supermarkets and hypermarkets held the largest share in 2024 with around 46%. These outlets stayed dominant because buyers preferred convenient access, wide brand choices, and regular discount programs. Strong shelf visibility and frequent product rotations helped maintain category leadership. Retail stores and specialty stores also captured demand through premium and organic offerings. Online store sales grew fast with rising home delivery use, but supermarkets kept their lead due to higher footfall and established trust among family buyers.

Key Growth Drivers

Rising Demand for Natural and Ready-to-Drink Beverages

Growing preference for clean-label drinks strengthened apple juice demand across global markets. Families and young consumers shifted toward beverages with simple ingredients and no artificial additives. This trend gained support as brands marketed healthier drink options with improved transparency. Ready-to-drink formats expanded quickly due to ease of use and strong placement in supermarkets and convenience stores. The focus on natural flavor and perceived health value helped reinforce sustained volume growth in both developed and emerging regions.

- For instance, The Coca-Cola Company reports around 2.2 billion servings of its beverages are consumed every day worldwide, showing the massive global penetration of ready-to-drink drinks.

Expansion of Retail and E-Commerce Distribution

Wider access through supermarkets, specialty stores, and digital platforms boosted apple juice consumption. Retailers increased shelf space for pure and blended juice variants, while private-label products grew in visibility. Online platforms supported fast growth by offering home delivery, user reviews, and targeted promotions. Improved cold-chain logistics ensured better product quality across long distances. Strong distribution reach allowed brands to capture new consumer groups and expand their presence in competitive markets.

- For instance, in a recent fiscal period (specifically, over the 12 months preceding May 2024 earnings call), Walmart’s U.S. division delivered 4.4 billion items with either same-day or next-day shipping speeds.

Increasing Use in Blended and Functional Beverage Formulations

Food and beverage companies increased apple juice use in value-added drinks such as functional blends, flavored juices, and low-sugar mixes. These new offerings attracted health-aware buyers seeking variety and lighter flavor profiles. Manufacturers also adopted innovative processing methods that improved taste consistency and nutrition retention. Growing interest in fruit-based hydration products further supported demand. Product diversification enabled brands to reach younger consumers and expand usage occasions, strengthening the market’s long-term growth outlook.

Key Trends & Opportunities

Shift Toward Organic and Premium Juice Lines

Higher interest in chemical-free and sustainably sourced products accelerated the shift toward organic apple juice. Premium variants with cold-pressed processing and reduced sugar gained attention among urban consumers. Brands highlighted orchard-to-bottle traceability and eco-friendly packaging to build trust. Rising disposable income in Asia-Pacific and Europe created room for premium positioning. This trend opened new opportunities for producers who focused on quality differentiation and ethical farming practices.

- For instance, Ocean Spray is a grower-owned cooperative with more than 700 cranberry farms and roughly 2,000 employees, illustrating how premium, origin-focused fruit beverage brands can build scale around traceable agriculture.

Growth of Convenient Packaging and On-the-Go Formats

Demand for portable drink formats increased with busy lifestyles and rising travel frequency. Lightweight bottles, single-serve packs, and recyclable materials gained popularity in retail. Manufacturers redesigned packaging to improve shelf appeal and support better portion control. These formats aligned well with consumer needs in school snacks, workplace beverages, and quick hydration moments. Expanded packaging innovation encouraged category growth across both mass and premium segments.

- For instance, Capri Sun sells about 6 billion juice pouches globally each year, demonstrating how single-serve, portable packs can dominate family and on-the-go consumption occasions.

Product Innovation with Reduced Sugar and Natural Ingredients

Consumers showed strong interest in low-sugar and naturally sweetened options. Brands responded by reformulating products using advanced filtration and gentle processing to retain flavor without added sweeteners. Innovations in fruit blending created balanced taste profiles and supported wider appeal among health-conscious groups. This shift created long-term opportunity for companies that invest in healthier, transparent, and ingredient-focused product lines.

Key Challenges

Fluctuating Raw Material Prices and Supply Uncertainty

Unstable apple crop yields caused by climate shifts and weather extremes created supply volatility. Variability in harvesting seasons influenced juice extraction costs and affected pricing across regions. Producers faced challenges maintaining consistent quality and volume, especially during poor cultivation cycles. These uncertainties pressured margins for brands dependent on large-scale sourcing. Managing long-term contracts and diversified supplier networks became essential to minimize production risks.

Rising Competition from Alternative Health Drinks

The market faced strong pressure from expanding categories such as flavored water, herbal drinks, and vitamin-enriched beverages. These alternatives attracted young buyers seeking lighter and lower-calorie hydration choices. Marketing campaigns by competing segments weakened apple juice’s position in certain urban markets. Brands needed to innovate and highlight nutritional value to maintain relevance. Increased differentiation became vital as consumer preferences continued shifting toward varied functional drink options.

Regional Analysis

North America

North America held about 32% share of the apple juice market in 2024. Strong consumption in the U.S. and Canada supported steady demand, driven by preference for pure and blended juice varieties. Retail expansion and high penetration of ready-to-drink beverages strengthened overall growth. Health-aware families continued choosing natural fruit drinks, while private-label offerings boosted affordability. Innovation in reduced-sugar formulations and convenient packaging formats helped brands maintain engagement across supermarkets and online channels.

Europe

Europe captured nearly 29% share in 2024, supported by high fruit consumption and strong adoption of organic juice options. Countries such as Germany, France, and the U.K. showed strong interest in cold-pressed and premium variants. Strict quality regulations improved product consistency and strengthened consumer trust. Growing demand for sustainable packaging and clean-label drinks supported long-term expansion. Retail chains widened shelf space for both pure and concentrate-based juices, helping maintain stable category performance.

Asia Pacific

Asia Pacific accounted for around 26% share in 2024 and remained one of the fastest-expanding regions. Rising urbanization and increasing disposable income encouraged higher consumption of packaged fruit beverages. China, Japan, South Korea, and India drove significant demand with strong interest in flavored blends and convenient on-the-go formats. E-commerce played a major role by increasing access to domestic and imported brands. Growing youth population and lifestyle shifts further supported broad market growth.

Latin America

Latin America held close to 8% share in 2024, driven by growing acceptance of packaged juices and expanding retail networks. Brazil, Mexico, and Argentina experienced rising demand for affordable pure and concentrate-based apple juice options. Consumers adopted bottled fruit beverages as daily refreshment choices, supported by improved distribution in supermarkets and convenience stores. Local producers introduced cost-effective formats to appeal to value-focused buyers. Regional growth remained modest but steady due to improving supply chains.

Middle East and Africa

Middle East and Africa accounted for about 5% share in 2024. Demand grew as consumers increased preference for packaged juices over traditional homemade drinks. Countries such as Saudi Arabia, UAE, and South Africa showed rising interest in premium and imported apple juice varieties. Expanding hypermarket chains and higher tourism activity supported stronger visibility for global brands. Growth remained supported by rising youth population and wider adoption of ready-to-drink beverages.

Market Segmentations:

By Nature

By Type

- Pure Apple Juice

- Apple Juice Concentrate

- Blended Apple Juice

By Distribution Channel

- Online Store

- Convenience Stores

- Specialty Stores

- Retail Stores

- Supermarkets/ Hypermarkets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the apple juice market features major players such as Martinelli’s & Company, Ocean Spray Cranberries, Inc., PepsiCo, Inc., Welch’s, Rauch Fruchtsäfte GmbH & Co OG, Tree Top, Inc., Eden Foods, Inc., The Coca-Cola Company, Mott’s LLP, and The Kraft Heinz Company. Market competition intensified as brands focused on strong distribution networks, diverse product portfolios, and steady innovation in pure, concentrate, and blended juice lines. Companies strengthened their retail presence through targeted promotions, improved packaging designs, and shelf optimization across supermarkets, convenience outlets, and online platforms. Many producers expanded their organic and reduced-sugar offerings to match rising consumer interest in healthier beverages. Investment in advanced processing and cold-pressed technologies helped enhance product quality and extend shelf life. Firms also prioritized sustainability through eco-friendly bottling and responsible sourcing practices. Competitive intensity remained high as private-label ranges gained popularity, pushing established brands to maintain differentiation through quality, flavor innovation, and marketing initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, PepsiCo completed the acquisition of poppi, a functional soda brand made with prebiotics, fruit juice, and apple cider vinegar.

- In 2025, Tree Top completed a brand refresh with a new logo and packaging design aimed at enhancing shelf appeal and consumer attraction for its apple juices and sauces.

- In 2024, Mott’s launched Mott’s Active, a new apple juice blend combined with coconut water and electrolytes, targeting hydration for children without added sugars.

Report Coverage

The research report offers an in-depth analysis based on Nature, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as consumers continue choosing natural fruit-based beverages.

- Demand for organic and clean-label apple juice will rise across major regions.

- Brands will expand reduced-sugar and functional juice blends to attract health-focused buyers.

- Convenience packaging and single-serve formats will gain stronger shelf presence.

- E-commerce platforms will play a larger role in global distribution and product discovery.

- Manufacturers will invest more in sustainable farming and eco-friendly packaging.

- Premium cold-pressed and minimally processed juice lines will expand in urban markets.

- Private-label products will strengthen competition in retail channels.

- Supply-chain efficiency will improve as producers adopt advanced processing technologies.

- Emerging markets will drive new consumption due to rising incomes and lifestyle shifts.