Market Overview

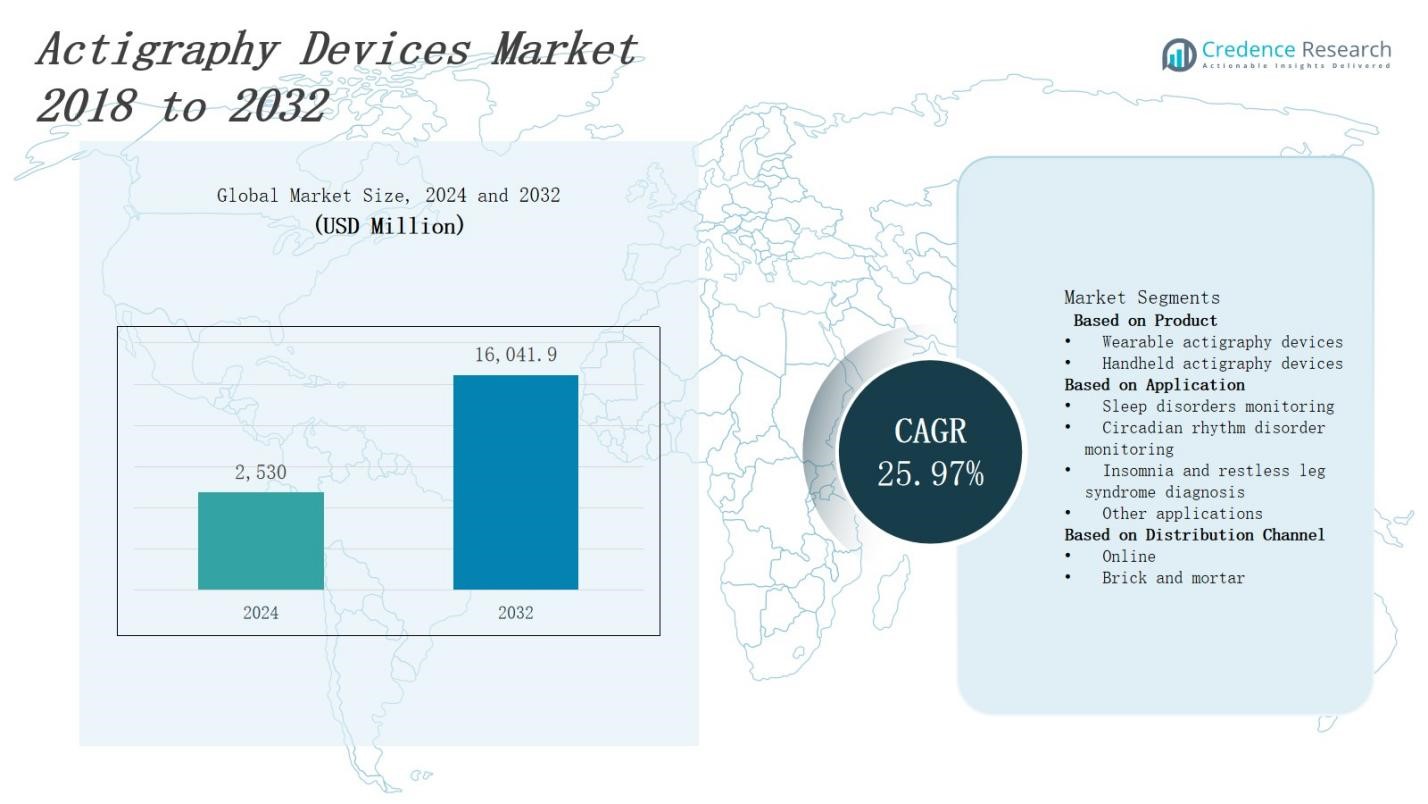

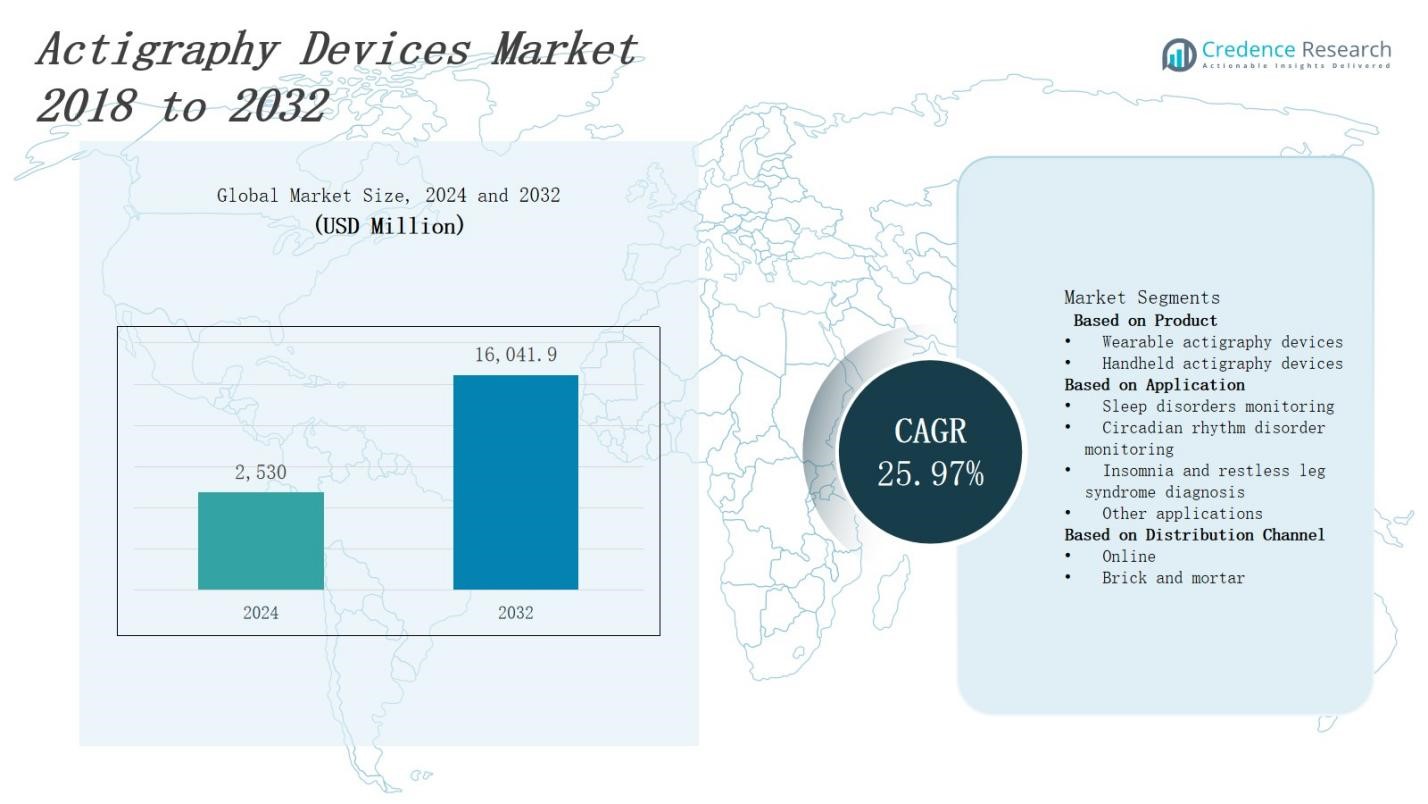

The actigraphy devices market is projected to grow from USD 2,530 million in 2024 to USD 16,041.9 million by 2032, expanding at a CAGR of 25.97%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Actigraphy Devices Market Size 2024 |

USD 2,530 Million |

| Actigraphy Devices Market, CAGR |

25.97% |

| Actigraphy Devices Market Size 2032 |

USD 16,041.9 Million |

The actigraphy devices market grows driven by rising prevalence of sleep disorders and increasing demand for non-invasive, continuous sleep monitoring solutions. Growing awareness of sleep health and advancements in wearable technology further boost adoption. Integration with smartphones and health apps enhances user convenience and data accessibility. Expanding applications in clinical research and remote patient monitoring support market growth. Manufacturers focus on improving device accuracy, battery life, and comfort to meet consumer needs. Increasing investments in healthcare infrastructure and rising geriatric population also contribute to market expansion. These factors collectively propel innovation and widespread use of actigraphy devices globally.

The actigraphy devices market spans key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads with the largest market share, followed by Europe and Asia Pacific, which show strong growth due to healthcare advancements and rising sleep disorder awareness. Latin America and the Middle East & Africa present emerging opportunities despite infrastructure challenges. Key players in the market include Fitbit, Apple, Garmin, Philips Healthcare, ResMed, Samsung, ActiGraph, CamNtech, Nox Medical, Cleveland Medical Devices, neurocare, Cidelec, and Advanced Brain Monitoring, driving innovation and expansion globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The actigraphy devices market is expected to grow from USD 2,530 million in 2024 to USD 16,041.9 million by 2032, with a CAGR of 25.97%.

- Rising prevalence of sleep disorders and demand for non-invasive, continuous monitoring solutions drive market expansion.

- Advancements in wearable technology and integration with smartphones improve user convenience and data accessibility.

- Expanding clinical research and remote patient monitoring applications boost adoption across healthcare sectors.

- Increasing healthcare infrastructure investments and aging populations create new growth opportunities globally.

- North America leads with 35% market share, followed by Europe at 28% and Asia Pacific at 22%, while Latin America and Middle East & Africa account for 10% and 5%, respectively.

- Challenges include accuracy limitations, high costs, and limited awareness in emerging markets, requiring technological improvements and targeted education to enhance penetration.

Market Drivers

Rising Prevalence of Sleep Disorders

The increasing incidence of sleep disorders globally drives the actigraphy devices market. Conditions such as insomnia, sleep apnea, and restless leg syndrome create strong demand for accurate and continuous sleep monitoring. It provides a non-invasive method to track sleep-wake patterns and circadian rhythms, supporting better diagnosis and treatment. Healthcare providers increasingly recommend actigraphy for patients, boosting adoption. Growing patient awareness about the health impacts of poor sleep further accelerates market growth. Early diagnosis and effective management of sleep disorders depend heavily on reliable monitoring solutions.

- For instance, ActiGraph’s wGT3X-BT device, widely used in clinical research, includes ambient light and gyroscope sensors alongside accelerometry, offering up to 25-32 days of battery life and FDA 510(k) clearance.

Advancements in Wearable Technology

Technological innovation in wearables significantly fuels the actigraphy devices market. Manufacturers improve device accuracy, battery life, and comfort, meeting consumer expectations. Integration with smartphones and health applications allows users to easily monitor and analyze sleep data. It enables real-time feedback and personalized health insights, increasing user engagement. Miniaturization and wireless connectivity enhance portability and convenience. These improvements broaden the market by attracting health-conscious individuals and clinical researchers seeking precise, user-friendly monitoring tools.

- For instance, Fitbit’s latest models leverage multi-sensor data integration to improve the precision of sleep stage detection.

Growing Applications in Healthcare and Research

The actigraphy devices market benefits from expanding applications in clinical research and healthcare monitoring. Researchers utilize these devices for large-scale sleep studies and to assess treatment efficacy. Remote patient monitoring programs incorporate actigraphy to track sleep patterns in chronic disease management. It supports telemedicine by providing continuous, objective data outside clinical settings. Healthcare providers adopt it to complement polysomnography and other diagnostic tests. These diverse applications increase demand and highlight its role in modern healthcare.

Increasing Healthcare Infrastructure and Aging Population

Expansion of healthcare infrastructure worldwide boosts the actigraphy devices market. Improved access to diagnostic tools in emerging economies creates new opportunities. Rising geriatric populations experience higher rates of sleep disturbances, increasing demand for effective monitoring solutions. It aids elderly care by tracking sleep quality and detecting abnormalities early. Government initiatives promoting digital health solutions further support market growth. Investment in advanced medical devices and patient monitoring systems strengthens its adoption across various healthcare settings.

Market Trends

Integration of Artificial Intelligence and Data Analytics

The actigraphy devices market experiences a significant trend of incorporating artificial intelligence (AI) and advanced data analytics to enhance device functionality. It leverages AI algorithms to analyze sleep patterns more accurately and predict potential disorders. Real-time data processing improves personalized health recommendations and user experience. Developers focus on machine learning models to refine sleep stage detection and identify anomalies. This trend increases clinical relevance and attracts tech-savvy consumers seeking precise, actionable insights. Enhanced data interpretation supports broader adoption in both healthcare and consumer segments.

Expansion of Wearable and Consumer-Friendly Devices

The shift toward wearable, consumer-friendly actigraphy devices drives market growth and accessibility. It includes lightweight, wrist-worn devices with improved battery life and comfortable designs. Manufacturers emphasize seamless integration with smartphones and health platforms, enabling users to monitor sleep and overall wellness conveniently. The trend toward multi-functional wearables combining fitness and sleep tracking expands its market reach. User-centric designs and customizable features appeal to a broader demographic beyond clinical use, supporting sustained demand and innovation in the market.

- For instance, the Oura Ring Gen4 offers improved heart rate sensors and a comfortable, stylish design available in multiple sizes, allowing users to accurately monitor their sleep and health metrics discreetly.

Rising Adoption in Telehealth and Remote Monitoring

Telehealth and remote patient monitoring gain momentum, positively impacting the actigraphy devices market. It supports continuous, real-time sleep monitoring outside traditional clinical settings, aligning with growing telemedicine trends. Healthcare providers utilize actigraphy data to remotely assess patients, improving chronic disease management and treatment personalization. Remote monitoring reduces hospital visits and healthcare costs, enhancing patient convenience. This adoption trend strengthens the role of actigraphy devices in integrated digital health ecosystems, driving innovation and investment.

- For instance, BioIntelliSense’s BioButton offers 60-day continuous remote monitoring of vital signs and sleep parameters with real-time algorithmic alerts, supporting chronic disease management outside clinical settings and making telehealth monitoring more effective and scalable

Focus on Regulatory Approvals and Standardization

The actigraphy devices market reflects an increasing emphasis on obtaining regulatory approvals and achieving standardization. Manufacturers prioritize compliance with medical device regulations to enhance product credibility and market acceptance. It encourages innovation while ensuring safety and accuracy in sleep monitoring. Efforts to standardize data collection and reporting improve comparability and reliability of results across clinical trials and healthcare applications. This trend supports market expansion by building trust among healthcare professionals and end users, fostering broader adoption worldwide.

Market Challenges Analysis

Accuracy Limitations and Data Interpretation Challenges

The actigraphy devices market faces challenges related to accuracy and data interpretation. It relies primarily on movement data, which may not fully capture complex sleep disorders compared to polysomnography, the clinical gold standard. False positives and negatives can affect diagnostic confidence, limiting its standalone use in some cases. Variability in device algorithms and lack of universal standards create inconsistencies in sleep analysis. Healthcare professionals may require supplementary diagnostic tools to confirm findings. These factors restrict wider clinical acceptance and highlight the need for ongoing technological improvements.

High Cost and Limited Awareness in Emerging Markets

High device costs and limited awareness hinder the actigraphy devices market expansion in emerging regions. The upfront investment and maintenance expenses restrict adoption among smaller clinics and individual consumers. Lack of education about sleep health and the benefits of actigraphy reduces demand. Limited healthcare infrastructure and reimbursement policies in these areas further slow market penetration. It faces competition from traditional sleep monitoring methods, which remain more affordable and familiar. Overcoming these barriers requires targeted awareness campaigns and cost-effective solutions to expand the user base globally.

Market Opportunities

Growing Demand for Remote Patient Monitoring and Digital Health Solutions

The actigraphy devices market presents significant opportunities through the rising demand for remote patient monitoring and digital health technologies. It supports continuous, real-time sleep tracking outside clinical environments, aligning with telehealth expansion. Healthcare providers seek reliable, non-invasive tools to monitor chronic conditions and improve patient outcomes remotely. Integration with mobile apps and cloud platforms enhances data accessibility and care coordination. Increasing investments in digital health infrastructure create favorable conditions for market growth. The market can capitalize on this trend by developing user-friendly, connected devices that meet evolving healthcare needs.

Expansion into Emerging Markets and New Application Areas

Emerging markets offer substantial growth potential for the actigraphy devices market due to rising healthcare awareness and infrastructure development. It can address unmet needs in regions with growing prevalence of sleep disorders and limited access to advanced diagnostic tools. New applications in mental health, pediatrics, and athletic performance monitoring expand its use cases beyond traditional sleep assessment. Collaborations with healthcare providers and research institutions enable customized solutions tailored to diverse populations. Market players can leverage these opportunities by focusing on cost-effective devices and targeted educational campaigns to increase adoption globally.

Market Segmentation Analysis:

By Product Type

The actigraphy devices market segments into wearable and handheld devices. Wearable actigraphy devices dominate due to their convenience, continuous monitoring capability, and user comfort. It supports real-time sleep tracking with seamless integration into daily life. Handheld devices serve clinical settings where controlled, short-term assessments are necessary. Both product types cater to diverse user needs, but wearable devices gain faster adoption in consumer health and remote monitoring due to technological advancements and ease of use.

- For instance, the Actiwatch 2 by Philips Respironics is widely used for continuous wrist-worn sleep monitoring, employing internal accelerometers to estimate movement and sleep patterns in both clinical and research settings.

By Application

Sleep disorders monitoring leads the actigraphy devices market applications, addressing insomnia, sleep apnea, and related conditions. It also plays a critical role in circadian rhythm disorder monitoring, helping regulate biological clocks. Diagnosis of insomnia and restless leg syndrome represents a growing segment due to increasing prevalence. Other applications include mental health assessments and performance optimization. These varied uses expand the market’s relevance across healthcare and wellness sectors, driving broader acceptance.

By Distribution Channel

Online distribution channels gain prominence in the actigraphy devices market, offering convenience, wider reach, and direct consumer access. It allows manufacturers to provide product information, support, and software updates efficiently. Brick-and-mortar stores remain important for clinical buyers and consumers preferring in-person consultations. Both channels complement each other, ensuring market penetration across different customer segments. The combined distribution strategy enhances accessibility and drives sales growth globally.

- For instance, companies like ActiGraph LLC leverage online platforms to launch advanced wearables such as the ActiGraph LEAP, enabling direct access and timely software updates for continuous health monitoring.

Segments:

Based on Product

- Wearable actigraphy devices

- Handheld actigraphy devices

Based on Application

- Sleep disorders monitoring

- Circadian rhythm disorder monitoring

- Insomnia and restless leg syndrome diagnosis

- Other applications

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North America region holds the largest share of the actigraphy devices market with 35% of the global revenue. It benefits from advanced healthcare infrastructure and high adoption of wearable health technologies. Growing awareness about sleep disorders and widespread availability of reimbursement schemes support market expansion. It experiences strong demand from both clinical and consumer segments, driven by increasing prevalence of sleep-related health issues. Presence of leading manufacturers and ongoing research further enhance market growth. The region’s focus on digital health and remote patient monitoring boosts product innovation and adoption.

Europe

Europe accounts for 28% of the actigraphy devices market revenue, driven by strong healthcare systems and government support for digital health initiatives. It features extensive clinical research activities and increasing investments in sleep disorder diagnostics. Rising geriatric population and growing focus on preventive healthcare stimulate demand. It adopts stringent regulatory frameworks that encourage product standardization and safety. The presence of established healthcare providers facilitates rapid market penetration. Growing consumer interest in health tracking devices expands the market beyond traditional clinical use.

Asia Pacific

The Asia Pacific region captures 22% of the global actigraphy devices market, fueled by rising healthcare infrastructure development and increasing awareness of sleep disorders. It benefits from expanding telehealth services and growing disposable incomes in key countries such as China and India. It faces challenges related to cost and limited awareness, but rapid urbanization and government initiatives support growth opportunities. The region sees increasing adoption in both clinical and homecare settings. Emerging local manufacturers contribute to market diversification and competitive pricing.

Latin America

Latin America holds 10% of the actigraphy devices market share, driven by improving healthcare facilities and growing investments in medical technology. It experiences increasing prevalence of sleep-related conditions and rising demand for remote monitoring tools. It focuses on expanding access to diagnostic devices in urban and semi-urban areas. Limited reimbursement policies and cost constraints slow growth, but awareness campaigns promote adoption. The market benefits from partnerships between international manufacturers and local distributors, enhancing product availability.

Middle East and Africa

The Middle East and Africa region accounts for 5% of the actigraphy devices market revenue, supported by gradual healthcare modernization and increasing focus on chronic disease management. It experiences growing interest in wearable health technologies and telemedicine services. Market growth faces challenges from limited infrastructure and affordability issues. Efforts to improve healthcare access and digital health adoption provide new opportunities. The region’s diverse demographic profile and rising health awareness contribute to steady market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fitbit

- Apple

- Cleveland Medical Devices

- ResMed

- Garmin

- CamNtech

- Nox Medical

- Philips Healthcare

- Samsung

- neurocare

- Cidelec

- Advanced Brain Monitoring

- ActiGraph

Competitive Analysis

The actigraphy devices market features intense competition among established technology and healthcare companies. Key players focus on product innovation, enhancing device accuracy, battery life, and user comfort to differentiate their offerings. It sees frequent collaborations and partnerships to expand distribution networks and integrate advanced features like AI and cloud connectivity. Companies invest in research and development to meet evolving regulatory standards and consumer preferences. Competitive pricing and strategic marketing strengthen brand presence globally. Market leaders emphasize multi-functional devices combining fitness and sleep tracking to capture broader consumer segments. Continuous software updates and customer support contribute to maintaining competitive advantage. These efforts collectively drive rapid technological advancements and market growth worldwide.

Recent Developments

- In January 2025, ActiGraph announced its acquisition of Biofourmis Connect, the life sciences division of Biofourmis, aiming to unify software and data platforms to modernize clinical research across multiple therapeutic areas.

- In February 2025, PranaQ received U.S. FDA 510(k) clearance for TipTraQ, a compact home sleep apnea test (HSAT) wearable that employs advanced biosensors and AI algorithms to detect sleep apnea events and analyze sleep architecture with clinical-grade accuracy; TipTraQ is worn on the fingertip.

- In September 2024, Apple launched new health features for the Apple Watch, including sleep apnea notifications, strengthening its capabilities in sleep monitoring.

- In July 2025, Fitbit released an update for the Charge 6, adding new watch faces and expanding compatibility with fitness equipment such as Peloton and iFit.

Market Concentration & Characteristics

The actigraphy devices market demonstrates a moderately concentrated landscape with a mix of established technology giants and specialized healthcare companies competing for market share. It features key players who focus on innovation, product differentiation, and strategic partnerships to strengthen their global presence. The market exhibits rapid technological advancements, particularly in wearable design, sensor accuracy, and data analytics capabilities. It caters to diverse end-users including clinical researchers, healthcare providers, and individual consumers. Competitive pricing and expanding distribution networks further define market dynamics. Companies invest heavily in research and development to comply with regulatory standards and meet evolving consumer demands. The market’s growth potential attracts new entrants, increasing competition while fostering innovation. This blend of characteristics drives continuous product improvement and market expansion across various regions worldwide.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The actigraphy devices market will expand due to growing awareness of sleep health worldwide.

- Advancements in wearable sensor technology will enhance device accuracy and user comfort.

- Integration with mobile apps and cloud platforms will improve data accessibility and personalized health insights.

- Remote patient monitoring and telehealth adoption will increase demand for actigraphy devices.

- Manufacturers will focus on developing multi-functional devices combining fitness and sleep tracking.

- Emerging markets will present new growth opportunities as healthcare infrastructure improves.

- Regulatory approvals and standardization efforts will boost clinical acceptance and trust.

- Collaboration between technology firms and healthcare providers will accelerate innovation.

- Increased investment in digital health solutions will support market expansion globally.

- Consumer preference for non-invasive, continuous monitoring tools will drive widespread adoption.