Market Overview

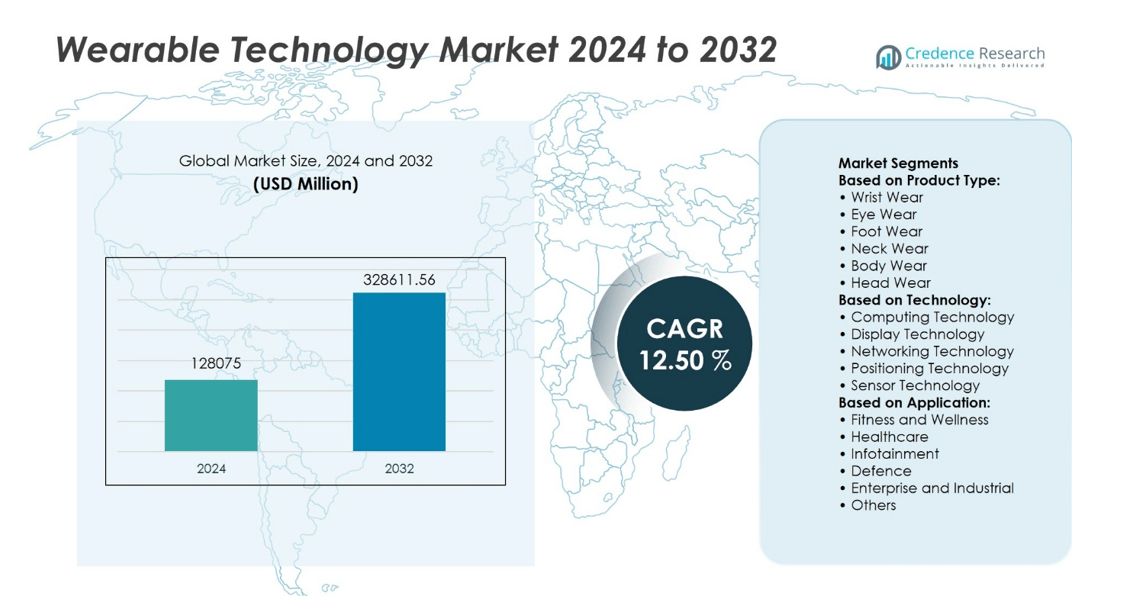

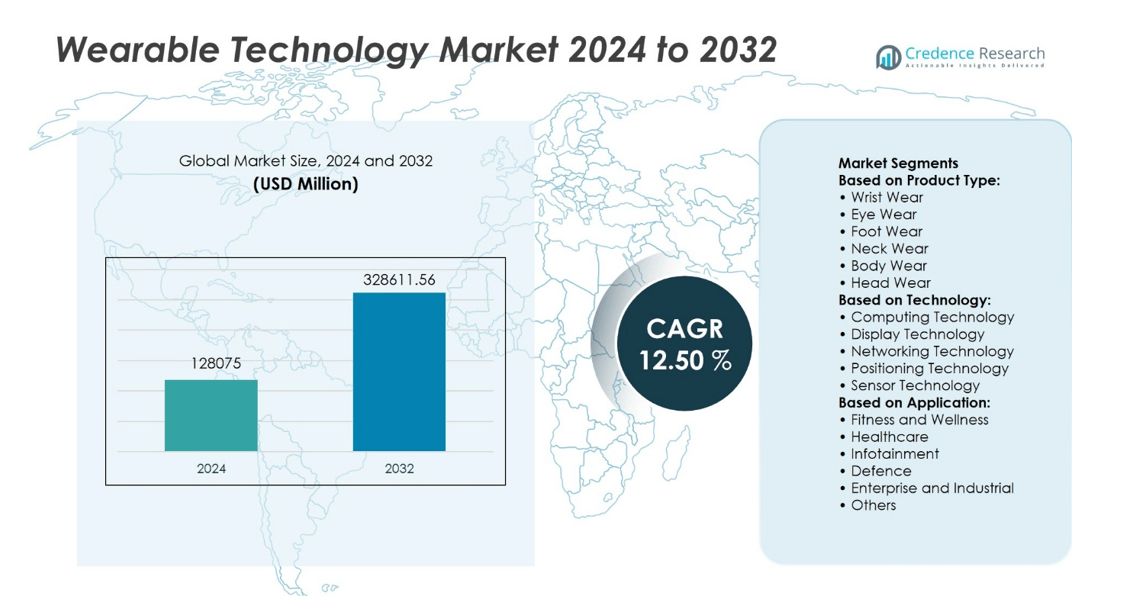

Wearable Technology Market size was valued at USD 128075 million in 2024 and is anticipated to reach USD 328611.56 million by 2032, at a CAGR of 12.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wearable Technology Market Size 2024 |

USD 128075 million |

| Wearable Technology Market, CAGR |

12.50% |

| Wearable Technology Market Size 2032 |

USD 328611.56 million |

The Wearable Technology Market is driven by rising consumer demand for health monitoring, fitness tracking, and seamless connectivity with digital ecosystems. Advanced infrastructure in sensors, miniaturized electronics, and AI-powered analytics supports broader adoption across healthcare, lifestyle, and enterprise applications. It benefits from growing interest in remote healthcare, telemedicine, and preventive wellness solutions. Key trends include the integration of AR/VR for immersive experiences, expansion of smart clothing and fashion-focused designs, and stronger linkage with IoT and 5G platforms. Sustainability, data privacy, and personalization also shape the industry, reinforcing its transition toward multifunctional and consumer-centric innovations.

The Wearable Technology Market shows strong geographical presence, with North America leading adoption through advanced healthcare integration and high consumer spending, Europe emphasizing preventive health and enterprise applications, and Asia-Pacific expanding rapidly with affordable devices and large-scale manufacturing. Emerging markets in Latin America and the Middle East also display rising interest, driven by urbanization and digital adoption. Key players influencing the market include Apple Inc., Fitbit, Garmin Ltd., Samsung Electronics, Huawei Technologies, Xiaomi, Sony, Fossil Group, Suunto, and Polar Electro.

Market Insights

- The Wearable Technology Market was valued at USD 128075 million in 2024 and is projected to reach USD 328611.56 million by 2032, growing at a CAGR of 12.50%.

- Rising consumer demand for health monitoring, fitness tracking, and connected lifestyle devices drives strong adoption.

- Integration of AR/VR, smart clothing, and AI-powered analytics highlights key industry trends shaping innovation.

- Competition intensifies as global brands expand ecosystems while niche players focus on specialized wearable solutions.

- High device costs, limited battery efficiency, and data privacy concerns act as restraints on growth.

- North America leads adoption through healthcare integration, Europe emphasizes preventive health and enterprise use, while Asia-Pacific grows rapidly with affordable devices.

- Emerging regions such as Latin America and the Middle East show rising demand supported by digital adoption and urbanization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Adoption of Health and Fitness Monitoring

The Wearable Technology Market is strongly driven by the rising demand for health and fitness tracking solutions. Consumers increasingly rely on smartwatches, fitness bands, and biosensors to monitor vital signs such as heart rate, blood oxygen levels, and physical activity. It enhances personal healthcare by enabling early detection of anomalies and supporting preventive care. Healthcare providers also integrate wearable devices into remote patient monitoring programs, improving chronic disease management. The emphasis on wellness and lifestyle optimization continues to fuel consumer interest. Expanding integration of AI-driven analytics further strengthens the role of wearables in health applications.

- For instance, Apple disclosed that in the Apple Heart Study (2019), irregular pulse notifications from the Apple Watch were confirmed with atrial fibrillation of cases validated through ambulatory ECG patches, and the study enrolled 419,297 participants in just 8 months in collaboration with Stanford Medicine.

Rising Consumer Demand for Smart Connectivity

Wearable devices are gaining traction due to their seamless integration with smartphones, IoT ecosystems, and cloud-based platforms. The market benefits from growing consumer preference for real-time notifications, voice assistance, and hands-free operations. It supports improved convenience for users across work, fitness, and lifestyle activities. Smart glasses, earbuds, and connected apparel extend functionality beyond fitness into productivity and entertainment. Demand for multi-functionality in a single device drives innovation in compact design and energy efficiency. Enhanced connectivity through 5G networks strengthens the performance of wearable devices across multiple applications.

- For instance, Huawei reported that its FreeBuds Pro 2 earbuds integrated with 11 mm dual-driver units and supported over 7,000 frequency responses, while maintaining connectivity latency as low as 94 milliseconds on 5G-enabled devices, enhancing both entertainment and productivity use cases.

Technological Advancements and Innovation

Continuous technological innovation propels the Wearable Technology Market toward broader adoption. Advancements in miniaturized sensors, flexible electronics, and advanced batteries enable lighter and more efficient devices. It allows manufacturers to design wearables with longer battery life, higher precision, and greater comfort. Integration of biometric authentication, augmented reality, and AI-driven insights expands product functionality. Companies invest heavily in R&D to create differentiated offerings that attract both consumer and enterprise customers. Growing patent activity in wearable innovations reflects strong competition and accelerated technological progress.

Expanding Enterprise and Industrial Applications

The adoption of wearable devices extends beyond consumer markets into enterprise and industrial use cases. The Wearable Technology Market benefits from increasing demand in sectors such as manufacturing, logistics, and defense, where smart wearables improve safety and productivity. It supports functions like hands-free communication, real-time tracking, and worker health monitoring. Enterprises adopt augmented and virtual reality headsets for training and operational efficiency. Industrial-grade wearables provide data-driven insights that enhance decision-making and reduce operational risks. Expansion into enterprise applications opens new revenue streams and strengthens long-term growth potential.

Market Trends

Increasing Shift Toward Health-Centric Wearables

The Wearable Technology Market reflects a strong trend toward health-focused devices that track physical and medical data. Consumers demand advanced features such as continuous glucose monitoring, blood pressure tracking, and sleep quality analysis. It enables users to take control of personal health and supports preventive healthcare. Hospitals and clinics are also adopting wearables for remote patient monitoring to reduce hospital visits. Integration of medical-grade sensors enhances accuracy and reliability, creating new opportunities for healthcare applications. The trend highlights a growing convergence between consumer electronics and digital health solutions.

- For instance, Dexcom launched the G7 Continuous Glucose Monitoring (CGM) system, which delivers glucose readings every 5 minutes, has a sensor life of 10 days, and demonstrated a mean absolute relative difference (MARD) in clinical trials.

Expansion of Smart Clothing and AR/VR Wearables

Smart textiles and augmented or virtual reality devices are expanding the scope of wearables beyond watches and bands. The Wearable Technology Market is witnessing the rise of smart apparel with embedded sensors for sports, rehabilitation, and defense applications. It supports advanced data collection, improving athletic performance and injury prevention. AR and VR headsets gain traction in gaming, training, and industrial operations, offering immersive experiences. Integration of haptic feedback and lightweight design improves usability across multiple sectors. Growing adoption of AR/VR wearables demonstrates the market’s evolution toward multifunctional solutions.

- For instance, Meta’s Quest Pro headset was released with 10 sensors for full-color mixed reality, delivering a display resolution of 1800 × 1920 pixels per eye at 90 Hz refresh rate, and shipped with a memory capacity of 12 GB RAM and 256 GB storage, demonstrating its technological advancement in AR/VR wearables.

Growing Integration with IoT and AI Ecosystems

The trend toward connected ecosystems drives deeper integration of wearables with IoT and AI platforms. Devices are increasingly designed to interact with smart homes, connected vehicles, and enterprise systems. It improves efficiency by enabling predictive analytics, contextual alerts, and personalized recommendations. AI enhances user experience through adaptive features that learn behavior patterns. Seamless synchronization across multiple devices expands consumer convenience and enterprise functionality. This integration strengthens the value proposition of wearables across both personal and professional domains.

Rising Focus on Fashion and Personalization

Consumer expectations are shifting toward wearables that balance function with style. The Wearable Technology Market is responding with customizable designs, luxury collaborations, and fashionable form factors. It encourages adoption among users who view wearables as lifestyle accessories rather than purely functional tools. Personalization options, including interchangeable straps, smart jewelry, and modular designs, increase user engagement. Companies invest in premium materials and aesthetic appeal to target fashion-conscious consumers. The trend demonstrates how design innovation influences adoption alongside technological advancement.

Market Challenges Analysis

High Costs and Limited Battery Efficiency

The Wearable Technology Market faces persistent challenges linked to high production costs and limited battery performance. Advanced sensors, miniaturized components, and premium materials increase device prices, making adoption difficult for cost-sensitive consumers. It creates barriers in emerging economies where affordability strongly influences purchasing decisions. Limited battery life also reduces user satisfaction, particularly in multifunctional devices requiring continuous monitoring and connectivity. Frequent charging undermines convenience and restricts device potential for enterprise and healthcare applications. Overcoming these issues demands greater investment in cost-efficient manufacturing and advanced energy solutions.

Data Privacy Concerns and Regulatory Hurdles

The Wearable Technology Market is also challenged by growing concerns over data privacy and regulatory compliance. Wearables collect sensitive health, location, and biometric data that expose users to security risks if not adequately protected. It raises concerns about unauthorized access, misuse of personal information, and lack of transparency in data handling. Stricter regulatory requirements across regions increase compliance costs for manufacturers. Enterprises and healthcare providers adopting wearables must navigate complex data protection frameworks, adding operational challenges. Ensuring secure data management and gaining user trust remain critical to sustaining long-term adoption.

Market Opportunities

Expanding Healthcare and Wellness Applications

The Wearable Technology Market holds significant opportunities in healthcare and wellness, driven by rising demand for personalized health monitoring. Integration of medical-grade sensors enables real-time tracking of vital signs, supporting chronic disease management and preventive care. It creates opportunities for partnerships between technology firms and healthcare providers to deliver remote patient monitoring and telemedicine solutions. Growing interest in fitness optimization also expands the scope for consumer-focused devices that track performance metrics. The ability to merge wearable data with electronic health records strengthens healthcare outcomes. Continuous innovation in biosensors and AI-driven diagnostics will further unlock value across wellness and medical applications.

Enterprise Adoption and Emerging Markets Growth

Enterprise and industrial adoption offers strong opportunities for wearables, supported by applications in safety, training, and productivity. The Wearable Technology Market benefits from growing deployment of AR/VR headsets in manufacturing, logistics, and defense to enhance operational efficiency. It provides workers with real-time data access, hands-free communication, and immersive training environments. Expansion into emerging markets also creates growth potential, where rising incomes and digital adoption drive wearable demand. Localization strategies, including affordable product lines, can capture untapped segments. Broader integration with IoT ecosystems and 5G connectivity further enhances enterprise and consumer adoption opportunities.

Market Segmentation Analysis:

By Product Type

The Wearable Technology Market demonstrates strong growth across diverse product categories, with wrist wear such as smartwatches and fitness bands dominating due to their widespread adoption for health tracking and daily convenience. Eye wear, including augmented and virtual reality headsets, is expanding rapidly in gaming, enterprise training, and defense applications. It also shows promise in healthcare for surgical assistance and remote diagnostics. Foot wear embedded with sensors supports athletic performance monitoring and rehabilitation programs. Neck wear and body wear, such as smart clothing, provide opportunities in fitness, healthcare, and professional sports. Head wear, including smart helmets, finds demand in industrial safety and defense environments.

- For instance, Garmin reported that its Forerunner 965 smartwatch integrates 30 built-in activity modes, offers up to 31 hours of continuous GPS tracking, and features an AMOLED display with demonstrating the advanced performance of wrist wear in health and sports monitoring.

By Technology

Technological innovation plays a central role in shaping the Wearable Technology Market, with computing technology enabling advanced processing capabilities for multi-functional devices. Display technology enhances immersive experiences in AR/VR and supports real-time visualization of data. Networking technology integrates wearables with IoT and 5G platforms, allowing seamless connectivity and faster data transfer. It supports applications in smart homes, enterprise systems, and healthcare monitoring. Positioning technology, through GPS and advanced tracking systems, strengthens applications in fitness, logistics, and defense. Sensor technology remains at the core, powering health monitoring, biometric tracking, and contextual awareness across various product types.

- For instance, The Apple Watch Series 9 exemplifies the integration of advanced technologies in a wearable device. Its S9 SiP chip, boasting 5.6 billion transistors and a 4-core Neural Engine.

By Application

Applications of wearables continue to diversify, with fitness and wellness leading adoption through activity tracking, performance optimization, and lifestyle management. Healthcare represents a rapidly growing segment, where wearables support chronic disease management, telemedicine, and remote monitoring. It provides real-time data integration with healthcare systems, enhancing preventive and personalized medicine. Infotainment devices deliver immersive entertainment and interactive experiences through smart glasses, earbuds, and AR/VR headsets. Defense applications expand through smart helmets, tactical AR gear, and biometric monitoring for soldiers. Enterprise and industrial sectors increasingly adopt wearables for safety, worker productivity, and immersive training. Other applications, including education and consumer lifestyle products, further reinforce the broad potential of wearable technology.

Segments:

Based on Product Type:

- Wrist Wear

- Eye Wear

- Foot Wear

- Neck Wear

- Body Wear

- Head Wear

Based on Technology:

- Computing Technology

- Display Technology

- Networking Technology

- Positioning Technology

- Sensor Technology

Based on Application:

- Fitness and Wellness

- Healthcare

- Infotainment

- Defence

- Enterprise and Industrial

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for around 38% of the market share, making it the largest region in the Wearable Technology Market. The dominance is driven by strong consumer demand for smartwatches, fitness trackers, and AR/VR headsets, supported by high disposable incomes and advanced digital adoption. The region benefits from the presence of major global players that consistently launch innovative products with advanced health and fitness monitoring features. It also leads in enterprise adoption, with industries such as defense, healthcare, and manufacturing integrating wearables for safety and productivity. The growing use of wearables in remote healthcare monitoring and telemedicine further strengthens North America’s leadership. Strong investment in R&D, coupled with favorable regulatory frameworks, ensures continuous innovation and sustained market growth in this region.

Europe

Europe holds around 27% of the market share, supported by strong demand across healthcare, fitness, and enterprise applications. Countries such as Germany, the United Kingdom, and France drive adoption through advanced healthcare infrastructure and rising focus on preventive health solutions. It benefits from increasing consumer awareness of wellness tracking and fashion-driven adoption of smart wearables. AR/VR wearables also find growing demand in industrial training, logistics, and defense sectors across the region. Regulatory emphasis on data privacy and compliance adds complexity but enhances consumer trust in wearable adoption. Strong investments in sustainable technology and collaborations between healthcare providers and tech firms position Europe as a key growth region for the market.

Asia-Pacific

Asia-Pacific contributes around 24% of the market share, with rapid expansion fueled by rising disposable incomes, urbanization, and growing smartphone penetration. China, Japan, South Korea, and India lead adoption, with strong demand for affordable fitness bands, smartwatches, and healthcare wearables. It benefits from large-scale manufacturing capabilities that reduce costs and enable mass adoption across diverse income groups. Healthcare applications gain momentum as governments encourage digital health initiatives and remote monitoring solutions. AR/VR devices also expand in gaming, education, and industrial training across the region. The combination of affordability, innovation, and rising health awareness positions Asia-Pacific as one of the fastest-growing regions in the market.

Latin America

Latin America accounts for around 7% of the market share, reflecting steady adoption driven by growing urban populations and rising interest in fitness and lifestyle products. Brazil and Mexico lead the region with strong demand for smartwatches, fitness trackers, and low-cost wearables that align with consumer affordability. It benefits from increasing smartphone penetration, which facilitates wearable integration with mobile applications. Healthcare providers are gradually adopting wearables for monitoring chronic diseases and improving patient outcomes. Limited infrastructure and economic instability in some countries pose challenges, but opportunities remain strong in metropolitan areas. Expansion of e-commerce platforms also supports greater accessibility of wearable devices to consumers across the region.

Middle East and Africa

The Middle East and Africa together contribute around 4% of the market share, representing an emerging opportunity for wearable technology. Wealthier markets such as the United Arab Emirates and Saudi Arabia drive demand for premium and luxury smart wearables. It reflects consumer preference for high-end lifestyle products integrated with fitness and health-tracking capabilities. Africa shows early-stage adoption, constrained by affordability and infrastructure gaps, but mobile connectivity growth creates potential for future expansion. Wearables for healthcare monitoring and wellness management are gradually being introduced through partnerships with regional healthcare systems. Rising awareness of digital health and investments in technology hubs in cities such as Dubai, Riyadh, and Johannesburg will support adoption in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Apple Inc.

- Fitbit (a Google company)

- Garmin Ltd.

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co. Ltd.

- Xiaomi Corporation

- Sony Corporation

- Fossil Group, Inc.

- Suunto (part of Amer Sports)

- Polar Electro Oy

Competitive Analysis

The Wearable Technology Market players include Apple Inc., Fitbit (a Google company), Garmin Ltd., Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., Xiaomi Corporation, Sony Corporation, Fossil Group, Inc., Suunto (part of Amer Sports), and Polar Electro Oy. The Wearable Technology Market is characterized by intense competition, rapid innovation, and continuous product diversification. Companies focus on developing devices that integrate advanced health monitoring, seamless connectivity, and user-friendly designs to strengthen consumer adoption. It reflects growing emphasis on ecosystem integration, where wearables connect with smartphones, IoT platforms, and cloud services to enhance functionality. Competitive strategies center on expanding healthcare applications, improving battery life, and introducing fashionable yet functional designs to attract wider demographics. The market also shows strong momentum in enterprise adoption, where wearables improve worker safety, training, and productivity. Sustainability, data privacy, and personalization are emerging as critical factors that influence competitive positioning across the sector.

Recent Developments

- In June 2025, Polar announced it will launch a new wearable device in September 2025, introducing a brand-new product category—a screen-free wrist device that offers fitness, health, and sleep tracking without constant notifications or distractions.

- In March 2024, Garmin launched new features and software updates for its popular epix Gen 2 and fēnix 7 series smartwatches. These updates included enhanced health tracking capabilities, improved GPS navigation, and additional workout modes.

- In July 2023, adidas AG revealed SWITCH FWD, a premium shoe collection designed using shoe engineering and a cutting-edge design process. The new collection featured windows placed strategically on the midfoot and forefoot for enhanced breathability.

- In June 2023, Apple Inc. unveiled Apple Vision Pro, a technologically advanced spatial computer that blends digital content into the physical world smoothly. Apple Vision Pro features an advanced, dual-chip design and an ultra-high-resolution display to ensure a real-world digital experience.

Market Concentration & Characteristics

The Wearable Technology Market demonstrates a moderately concentrated structure, with global technology leaders driving innovation and shaping consumer preferences through ecosystem integration and advanced product portfolios. It is characterized by rapid technological evolution, where continuous improvements in sensors, connectivity, and battery life expand applications across fitness, healthcare, enterprise, and entertainment. The market reflects strong competition, with established brands leveraging scale and R&D investments while niche players focus on specialized performance wearables and fashion-oriented designs. It shows high entry barriers due to the need for advanced technological expertise, regulatory compliance, and strong distribution networks. Growing emphasis on healthcare adoption, data-driven insights, and integration with IoT ecosystems defines the industry’s trajectory. Sustainability, personalization, and data privacy also emerge as key characteristics that influence consumer trust and long-term adoption. The balance of global scale, regional demand diversity, and fast-paced innovation highlights the market’s competitive yet opportunity-rich environment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stronger demand for health and fitness monitoring devices.

- Integration with healthcare systems will grow through remote patient monitoring and telemedicine.

- AR and VR wearables will gain wider adoption in gaming, training, and industrial applications.

- AI-driven features will enhance personalization, predictive analytics, and user experience.

- Battery efficiency improvements will extend device usage and reduce charging frequency.

- Fashion and design innovation will increase adoption among style-conscious consumers.

- Enterprise demand will rise for wearables in safety, logistics, and productivity management.

- Affordable devices will drive higher adoption in emerging markets.

- Data privacy and regulatory compliance will remain central to consumer trust.

- Sustainability initiatives will encourage eco-friendly materials and energy-efficient wearables.