Market Overview

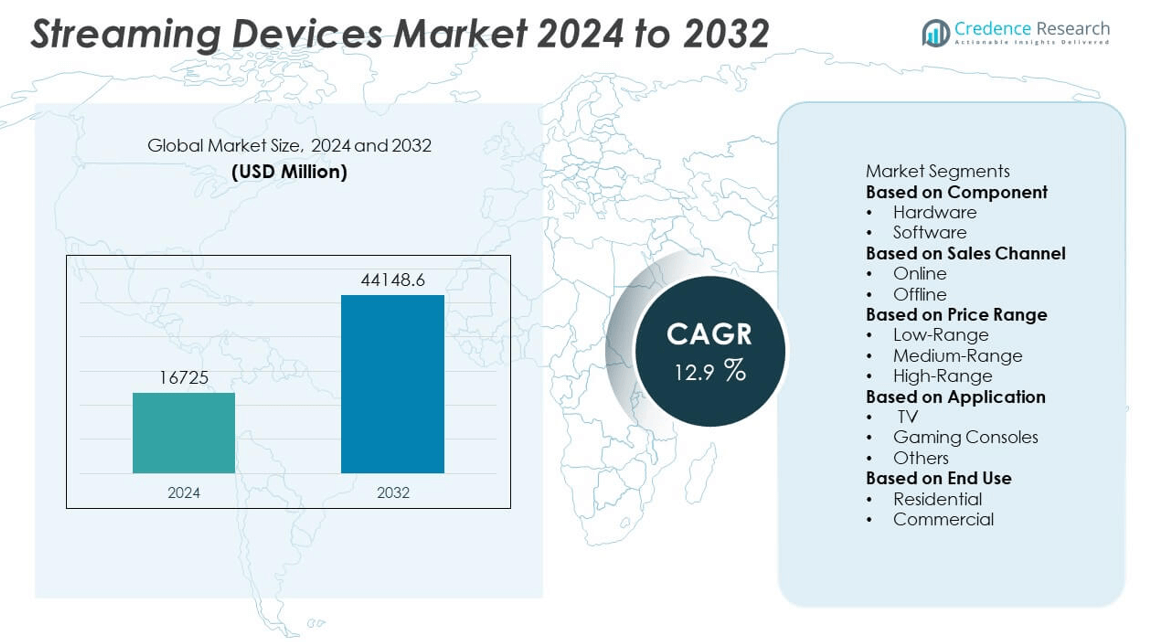

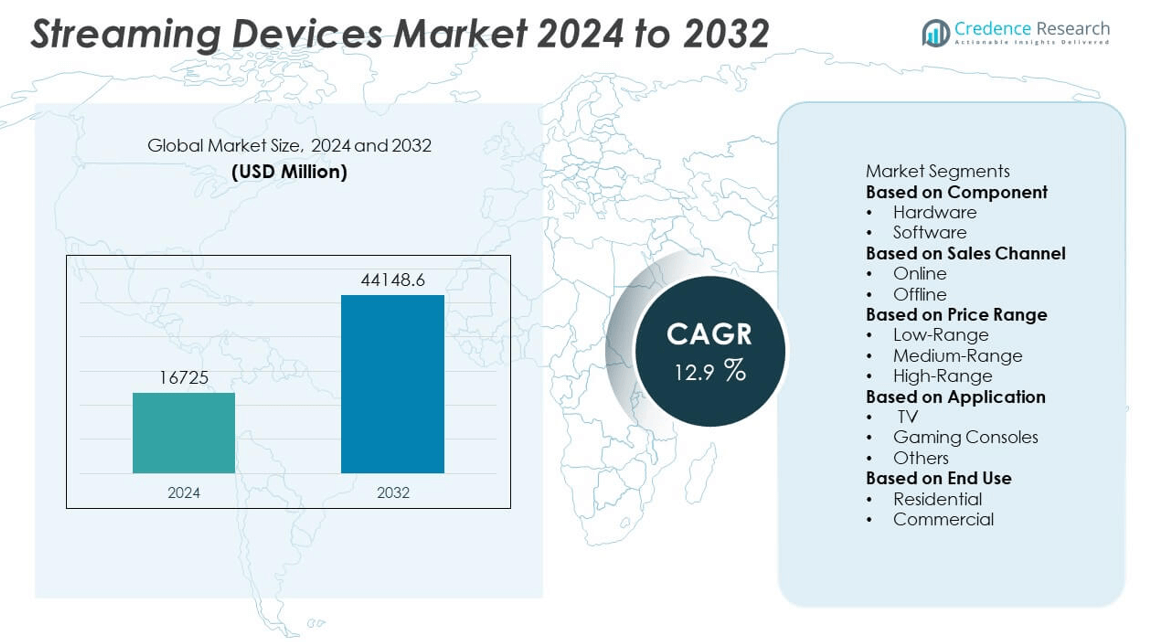

The Streaming Devices Market was valued at USD 16,725 million in 2024 and is anticipated to reach USD 44,148.6 million by 2032, growing at a CAGR of 12.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Streaming Devices Market Size 2024 |

USD 16,725 million |

| Streaming Devices Market, CAGR |

12.9% |

| Streaming Devices Market Size 2032 |

USD 44,148.6 million |

The Streaming Devices Market is driven by the growing demand for on-demand entertainment, rising internet penetration, and the increasing shift from traditional cable to digital streaming platforms. Consumers seek cost-effective and flexible viewing experiences, encouraging the adoption of smart TVs and portable streaming devices.

The Streaming Devices Market shows strong regional dynamics, with North America leading in technology adoption and home entertainment infrastructure, followed by Europe and the Asia Pacific. High-speed internet access, widespread use of smart TVs, and strong presence of streaming service providers support market expansion in these regions. Asia Pacific presents significant growth potential due to rising disposable incomes, rapid urbanization, and increasing smartphone and smart TV penetration. Countries like China and India are emerging as key demand centers driven by a tech-savvy consumer base. Latin America and the Middle East & Africa are also witnessing gradual adoption supported by improving internet access. Key players shaping the market landscape include Amazon.com with its Fire TV lineup, Google Inc. offering Chromecast, and Apple Inc. with its Apple TV platform.

Market Insights

- The Streaming Devices Market was valued at USD 16,725 million in 2024 and is projected to reach USD 44,148.6 million by 2032, growing at a CAGR of 12.9% during the forecast period.

- Growing demand for on-demand content, rising preference for cord-cutting, and increasing adoption of smart TVs are driving the market globally.

- Advancements in streaming technology, integration of voice assistants, and rising partnerships between streaming device manufacturers and content providers are shaping market trends.

- Companies such as Apple Inc., Google Inc., Amazon.com, and Sony Corporation dominate the competitive landscape, focusing on device innovation, bundled content services, and user interface improvements.

- High initial costs of advanced streaming devices and limited internet access in remote areas restrain market growth, especially in developing economies.

- North America leads in adoption due to robust digital infrastructure and consumer preference for premium content experiences, while Asia Pacific shows strong growth potential supported by rising digital penetration and affordable streaming solutions.

- Europe shows stable adoption driven by demand for multilingual content and integration with smart home systems, whereas Latin America and the Middle East & Africa are gradually expanding due to improved broadband access and mobile streaming.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for On-Demand Content is Reshaping Consumer Viewing Preferences

The rapid transition from traditional broadcast TV to on-demand content consumption has created a strong growth driver for the Streaming Devices Market. Consumers now expect flexible, personalized, and ad-free viewing experiences, which these devices support through direct access to popular platforms. It caters to the increasing appetite for binge-worthy series, movies, and niche channels across all age groups. The convenience of accessing content anytime across various applications enhances user engagement. Consumers prefer devices that offer a seamless experience with intuitive user interfaces and multi-platform compatibility. This shift continues to support device adoption across both urban and semi-urban regions.

- For instance, Amazon’s Fire TV ecosystem surpassed 250 million devices sold globally by November 2024, reflecting immense consumer uptake for flexible, content-rich streaming access.

Technological Advancements are Driving Innovation in Streaming Hardware

The integration of advanced technologies such as 4K and 8K resolution support, Dolby Atmos, voice control, and AI-based recommendations plays a vital role in driving product upgrades. The Streaming Devices Market benefits from constant improvements in device efficiency, compactness, and multi-functional performance. It allows users to convert traditional TVs into smart TVs, eliminating the need for full hardware replacements. Device manufacturers are focusing on enhancing connectivity features, low-latency performance, and cross-platform usability. These upgrades attract tech-savvy users and support the long-term growth of the market. Enhanced device capabilities continue to strengthen brand loyalty and fuel market expansion.

- For instance, Apple’s third‑generation Apple TV 4K, introduced in October 2022, features an A15 Bionic chip delivering up to 50 percent faster CPU and 30 percent faster GPU performance over the preceding model, along with power-efficient, fanless design supporting HDR10+ and Dolby Vision formats.

Expansion of High-Speed Internet and 5G is Supporting Market Penetration

The widespread availability of high-speed broadband and the global rollout of 5G networks have significantly increased streaming quality and accessibility. The Streaming Devices Market benefits from the improved bandwidth and lower latency that support uninterrupted high-definition content delivery. It opens new opportunities for streaming in remote or underserved regions where conventional cable services are limited. Improved connectivity infrastructure encourages consumers to invest in streaming hardware. Telecom providers and ISPs are also bundling streaming services with broadband packages, making these devices more affordable and accessible. This infrastructure expansion continues to accelerate global market adoption.

Smart Home Integration and IoT Adoption are Boosting Device Usage

The growing trend of smart home ecosystems has increased the demand for connected devices that integrate seamlessly with other home technologies. The Streaming Devices Market gains momentum from consumers seeking centralized control of media, lighting, and appliances through voice-enabled assistants. It enhances user convenience by enabling hands-free content browsing and playback. Device compatibility with platforms like Amazon Alexa, Google Assistant, and Apple HomeKit supports broader ecosystem participation. Consumers are increasingly valuing inter-device synchronization, which drives purchasing decisions in favor of smart-enabled streaming solutions. This convergence of media and automation continues to influence market dynamics.

Market Trends

Rising Integration of Voice-Controlled Assistants into Streaming Devices

The incorporation of voice assistants into streaming devices reflects a growing trend toward hands-free operation and user convenience. Devices such as Amazon Fire TV Stick and Apple TV now integrate Alexa and Siri, allowing users to search, control playback, and adjust settings through voice commands. This trend aligns with increasing demand for smart home compatibility. Manufacturers focus on enhancing natural language processing capabilities to support multilingual and contextual interactions. It supports a seamless entertainment experience and reduces reliance on traditional remotes. The Streaming Devices Market is witnessing product development cycles that prioritize voice-first user interfaces.

- For instance, Amazon’s Fire TV Cube (3rd Gen), released in late 2022, features an eight‑microphone array designed to detect voice commands from up to 10 meters away, even while TV audio plays, demonstrating Amazon’s emphasis on far‑field voice recognition.

Adoption of 4K and 8K Streaming Capabilities for High-Resolution Content Delivery

Streaming devices now support ultra-high-definition (UHD) formats, including 4K and 8K resolution, responding to consumer demand for enhanced visual experiences. Brands like Roku Ultra and NVIDIA Shield TV offer 4K HDR support with Dolby Vision and Dolby Atmos, meeting quality expectations for both video and audio. Content platforms increasingly optimize libraries for UHD streaming, prompting device makers to match performance needs. It leads to stronger hardware configurations with faster processing and improved connectivity standards. HDMI 2.1 support and advanced upscaling technologies are also becoming standard features. The trend reflects growing user expectations around cinematic quality in home entertainment.

- For instance, the NVIDIA Shield TV Pro delivers 4K upscaling using AI-enhanced algorithms running on a 256-core GPU, capable of upscaling 720p to 4K in real-time with latency under 16 milliseconds.

Growing Demand for Multi-Platform Compatibility and Cross-Device Streaming

Consumers seek uninterrupted access to streaming services across multiple devices, driving demand for cross-platform compatibility. Streaming devices now support seamless integration with smartphones, tablets, and PCs to ensure synchronized viewing experiences. Google Chromecast with Google TV, for example, enables casting and control from Android or iOS devices. It addresses user preferences for content continuity and accessibility. Device ecosystems increasingly rely on shared user profiles and content recommendations based on multi-device consumption patterns. Compatibility with both Android and iOS ecosystems remains a key design focus.

Emphasis on Energy-Efficient and Compact Device Design

Streaming device manufacturers emphasize portability and energy efficiency to meet changing consumer preferences. Compact form factors like the Amazon Fire TV Stick or Chromecast appeal to users seeking minimalistic and space-saving solutions. It also aligns with sustainability goals, with manufacturers incorporating low-power chipsets and energy-saving modes. USB-powered designs eliminate the need for bulky adapters, enhancing mobility. Regulatory compliance around energy standards further accelerates this trend. Companies optimize both hardware and software to reduce idle power consumption while maintaining performance.

Market Challenges Analysis

High Competition and Market Saturation Pressures Margins

The Streaming Devices Market faces intense competition from a wide array of global and regional players. This saturation limits pricing flexibility and puts pressure on profit margins. Continuous innovation becomes necessary to differentiate products, but it increases R&D expenditures. Companies must balance offering high-performance devices with cost-efficiency to maintain consumer interest. The presence of tech giants like Amazon, Apple, and Google intensifies competitive dynamics, making market entry challenging for newer firms. Rapid product cycles and evolving user expectations force brands to regularly upgrade device capabilities, creating a demanding development environment.

Privacy Concerns and Regulatory Compliance Create Barriers

Privacy issues and growing regulatory scrutiny pose significant hurdles in the Streaming Devices Market. Consumers are increasingly concerned about how their personal viewing data is collected, stored, and shared. Regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and evolving policies in North America and Asia require strict compliance. Ensuring device security and data protection adds complexity to product design and increases operational costs. Companies that fail to meet compliance standards risk facing legal penalties and losing consumer trust. These regulatory pressures demand robust internal controls and transparent communication with users, which complicates market growth strategies.

Market Opportunities

Expansion Across Emerging Economies with Growing Digital Penetration

The Streaming Devices Market presents strong growth opportunities across emerging economies where internet penetration and smart TV adoption are rising rapidly. Countries in Asia-Pacific, Latin America, and Africa are witnessing a surge in mobile broadband access, enabling broader access to streaming services. Consumers in these regions are shifting away from traditional cable TV toward flexible, on-demand digital content. This shift opens avenues for streaming device manufacturers to offer affordable and region-specific solutions. Localized content and language integration can further drive product adoption. Companies that form strategic alliances with regional content providers can strengthen their foothold and scale operations in untapped areas.

Technological Advancements Supporting Enhanced User Experiences

The adoption of technologies such as artificial intelligence, voice control, and 4K and 8K resolutions offers new potential within the Streaming Devices Market. These innovations enhance user experience and increase the perceived value of devices. Integration with smart home ecosystems also positions streaming devices as essential components of connected living. Consumers now demand seamless, intuitive interfaces that support multitasking and personalization. Companies that invest in user-focused features and cloud-based platforms stand to gain competitive advantages. Upgrades in processing speed, memory, and energy efficiency can further support global expansion efforts.

Market Segmentation Analysis:

By Component

The Streaming Devices Market, segmented by component, includes hardware and software. Hardware holds the dominant share due to continuous innovations in media players, streaming sticks, and smart TVs. Consumers prefer compact and cost-effective devices that support high-definition streaming and fast connectivity. Software, while secondary in market share, plays a critical role in enhancing device functionality through user interfaces, voice control integration, and compatibility with various platforms. Streaming service providers invest in proprietary software solutions to improve performance, content accessibility, and personalization. Companies focusing on seamless software-hardware integration tend to offer more competitive products.

- For instance, Amazon Fire OS, used in over 200 million Fire TV devices as of 2023, integrates Alexa voice control and supports over 10,000 streaming apps, ensuring high user engagement and platform stickiness.

By Sales Channel

Based on sales channel, the market includes online and offline retail distribution. Online channels account for a significant share due to convenience, broader product selection, and attractive pricing. E-commerce platforms support rapid product comparisons and enable direct-to-consumer strategies. Offline retail still holds relevance in regions with limited digital infrastructure, offering physical demos and in-store support. Consumer electronics outlets and brand-exclusive stores contribute to offline sales by enabling hands-on experience and instant purchase. Hybrid distribution models that combine online and offline presence offer manufacturers a balanced approach to reaching diverse consumer segments.

- For instance, Amazon reported in internal Q4 2023 data that its Fire TV Stick lines experienced over one million units sold during Prime Day events across global online channels—indicating strong digital demand and promotional effectiveness.

By Price Range

The Streaming Devices Market, by price range, spans low, medium, and high-end categories. The low-price segment attracts budget-conscious consumers and first-time buyers, particularly in emerging markets. These devices typically offer basic features, sufficient for standard streaming needs. The medium range balances performance and cost, appealing to a broad customer base seeking reliability and upgraded functions like voice control or dual-band Wi-Fi. High-end devices cater to tech-savvy users demanding features such as 4K/8K streaming, smart assistant integration, and premium build quality. Manufacturers target this segment to showcase innovation and brand strength while driving higher profit margins.

Segments:

Based on Component

Based on Sales Channel

Based on Price Range

- Low-Range

- Medium-Range

- High-Range

Based on Application

- TV

- Gaming Consoles

- Others

Based on End Use

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Streaming Devices Market, securing approximately 40 % to 44 % of global revenue in 2024. Consumers in the United States and Canada lead adoption of streaming sticks, set-top boxes, and smart TVs. It benefits from mature broadband infrastructure, high disposable income, and early embrace of OTT platforms like Netflix, Amazon Prime, and Hulu. Firms such as Roku, Amazon Fire TV, and Apple TV see strong household penetration, with Roku alone installed in roughly half of U.S. streaming households. Cloud platforms and AI-powered content recommendations further support widespread adoption and premium feature integration.

Europe

Europe captures approximately 20 % to 25 % of the global market share. Regions like the U.K., Germany, and France rely on fiber-optic broadband and widespread smart TV ownership. Consumers increasingly shift from scheduled broadcasting to on-demand viewing, driving demand for device compatibility and localized content. Regulatory frameworks around net neutrality and data protection (e.g. GDPR) influence product design and feature inclusion. Telecom operators and electronics brands collaborate on bundled offers and local OTT services to support adoption among cost-conscious segments.

Asia Pacific

Asia Pacific holds approximately 20 % to 30 % of market share. Rapid urbanization, rising middle-class incomes, and expanding broadband connectivity are fueling demand in countries such as China, India, South Korea, and Australia. It presents a mix of high-end smart TV usage and ultrabudget streaming dongles. Local content platforms like Hotstar, iQIYI, and Tencent Video drive ecosystem growth. Brands such as Xiaomi and Hisense succeed in delivering affordable streaming devices tailored for regional content consumption patterns. The region shows high growth potential through entry-level devices in high-population economies.

Latin America

Latin America represents roughly 7 % to 10 % of global market share. Device adoption rises in countries like Brazil, Mexico, and Argentina, where young demographic cohorts embrace OTT services on both mobile and connected TVs. The region’s affordability constraints promote usage of ad-supported and basic streaming devices. Local operators like Claro Video and Blim partner with OEMs to expand reach. Urban populations with increasing internet access favor devices that work with limited-bandwidth networks.

Middle East & Africa

The Middle East & Africa together contribute around 3 % to 8 % of the global market share. Markets such as UAE, Saudi Arabia, and South Africa increasingly incorporate streaming platforms for smart city and entertainment use cases. Internet infrastructure expansion and SVOD uptake support device adoption in urban areas. However, penetration remains modest in rural zones due to infrastructure gaps and affordability challenges. Local content and regional partnerships drive pilot deployments and future multiyear growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the streaming devices market is defined by the presence of several dominant players, including Apple Inc., Google Inc., Amazon.com, Microsoft Corporation, Sony Corporation, Philips Electronics, Huawei Technologies, D-Link Corporation, HiMedia Technology, and Arris Group Inc. These companies are actively competing on the basis of innovation, pricing strategies, platform compatibility, and content integration. Apple Inc. continues to lead with its Apple TV, leveraging ecosystem integration and strong brand loyalty. Google Inc. maintains a solid position through its Chromecast series, which is known for affordability and seamless mobile-to-TV casting. Amazon.com’s Fire TV line remains a key player, offering a competitive mix of pricing, Alexa voice integration, and bundled content services through Prime. Sony Corporation and Microsoft Corporation capitalize on their gaming consoles, PlayStation and Xbox, which double as streaming hubs, providing multi-functional value to consumers. Companies like Philips Electronics and Huawei are strengthening their positions in emerging markets by offering cost-effective devices with smart features. D-Link and HiMedia Technology focus on hardware flexibility and customization for tech-savvy users, while Arris Group Inc. serves both enterprise and consumer markets with scalable streaming hardware. Collectively, these players are shaping a highly dynamic and innovation-driven market, aiming to capture an increasingly digital-first consumer base.

Recent Developments

- In July 2025, D-Link released a new line of 2.5G multi-gigabit unmanaged switches: the DMS-108P, DMS-1016, and DMS-1024. These switches are designed to support high-bandwidth networking for home and small office/home office (SOHO) users.

- In May 2025, D-Link’s AQUILA PRO AI M95 BE9500 Wi-Fi 7 Smart Mesh Router was awarded the prestigious Red Dot Design Award. This recognition highlights the router’s exceptional design, which incorporates a sleek, eagle-inspired aesthetic with four omnidirectional antennas designed to resemble wings.

- In August 2024, Google discontinued the Chromecast and introduced the Google TV Streamer, a more powerful, full-featured device. The Google TV Streamer boasts a faster CPU, more RAM, and a built-in Thread border router, transitioning from a dongle to a more robust, set-top box-like design.

Market Concentration & Characteristics

The Streaming Devices Market exhibits a moderately concentrated landscape, characterized by the strong presence of major global players such as Apple Inc., Google Inc., Amazon.com, and Sony Corporation. These companies hold significant influence over market dynamics through technological innovation, integrated ecosystems, and strong brand recognition. It benefits from increasing internet penetration, smart TV adoption, and consumer demand for on-demand entertainment content. The market displays fast-paced technological evolution, with players consistently upgrading device compatibility, user interface, and resolution standards. Strategic alliances, product differentiation, and pricing play critical roles in competitive positioning. While larger companies dominate through economies of scale and proprietary platforms, several regional and emerging players contribute to diversification. The Streaming Devices Market caters to varied consumer preferences across different price points, creating a competitive balance between premium and budget-friendly devices. Product life cycles remain relatively short, and companies compete by launching updated models and expanding their streaming service partnerships

Report Coverage

The research report offers an in-depth analysis based on Component, Sales Channel, Price Range, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumer demand for high-definition and 4K streaming will drive innovation in device resolution capabilities.

- Integration with smart home ecosystems will become a standard feature in streaming devices.

- Voice control and AI-enabled search functionalities will see wider adoption across devices.

- Subscription bundling with streaming services will emerge as a key competitive strategy.

- Cloud gaming support through streaming devices will expand to attract gaming audiences.

- Growth in emerging markets will increase due to affordable internet access and mobile-first behavior.

- Companies will focus on energy-efficient and compact designs to meet sustainability goals.

- Security and privacy enhancements will gain importance as user data becomes more valuable.

- Open-source operating systems may see increased adoption among new entrants.

- Continuous partnerships with content providers will shape the device compatibility and user experience.