Market Overview

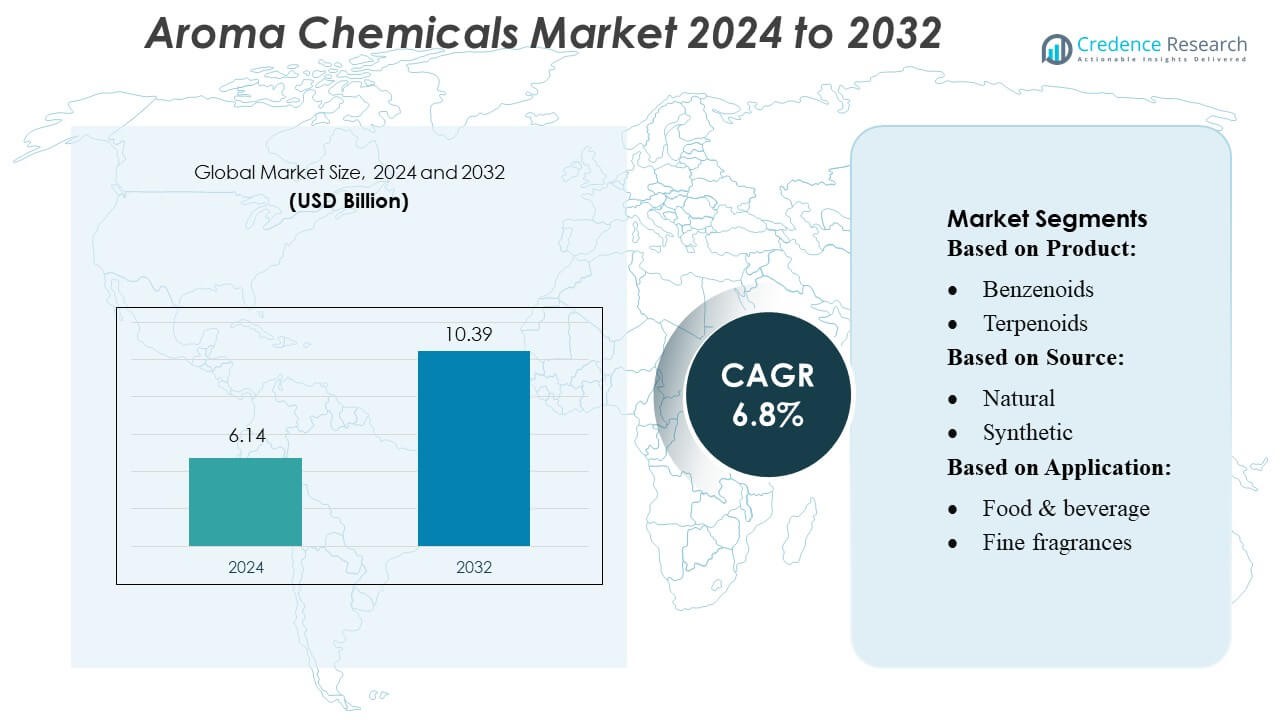

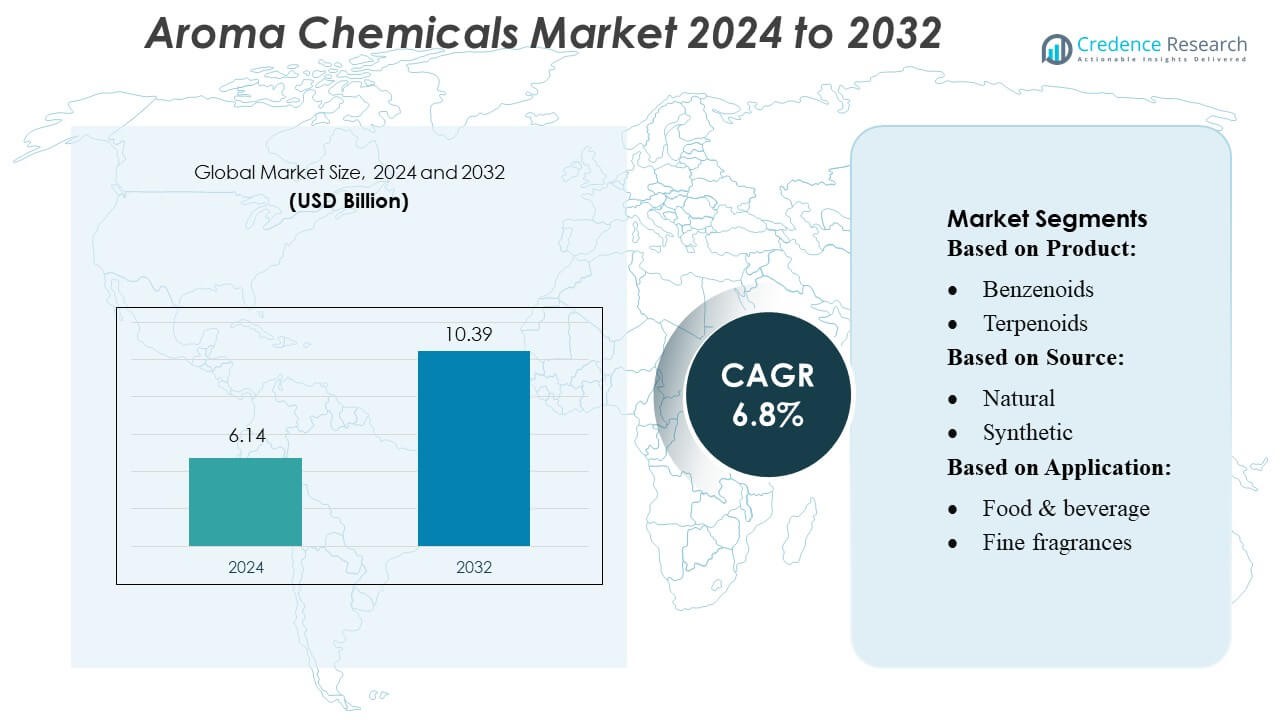

Aroma Chemicals Market size was valued USD 6.14 billion in 2024 and is anticipated to reach USD 10.39 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aroma Chemicals Market Size 2024 |

USD 6.14 Billion |

| Aroma Chemicals Market, CAGR |

6.8% |

| Aroma Chemicals Market Size 2032 |

USD 10.39 Billion |

The aroma chemicals market is highly competitive, with leading firms such as Kemira Oyj, Solvay, Croda International Plc, Akzo Nobel N.V., Lanxess, Huntsman International LLC, Evonik Industries AG, The Lubrizol Corporation, Clariant AG, and DuPont aggressively innovating to capture value. These companies differentiate themselves by investing heavily in R&D, scaling sustainable and bio-based production, and developing high-purity aroma compounds tailored to beauty, food, and household applications. The Asia-Pacific region dominates the market, holding approximately 38.95% of global market share, driven by booming demand in China and India, expanding middle-class consumption, and growing manufacturing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The aroma chemicals market was valued at USD 6.14 billion in 2024 and is projected to reach USD 10.39 billion by 2032, registering a CAGR of 6.8% during the forecast period.

- Market growth is driven by rising demand for premium fragrances, expanding use of aroma compounds in personal care and household products, and strong adoption of bio-based ingredients across major consumer brands.

- Key trends include increased investment in sustainable production, rapid development of high-purity synthetic molecules, and growing integration of biotechnology to create novel aroma profiles.

- Competitive intensity remains high as major companies expand R&D capabilities, optimize manufacturing efficiency, and strengthen product portfolios to meet evolving consumer preferences.

- Asia-Pacific leads the market with 95% share, followed by Europe and North America, while the fragrance segment continues to dominate overall consumption due to its extensive use in beauty, home care, and fine fragrances.

Market Segmentation Analysis:

By Product

The aroma chemicals market includes benzenoids, terpenoids, musk chemicals, and other specialty compounds, with terpenoids holding the dominant position. Terpenoids account for the largest share because they offer strong versatility in fragrance creation and are widely sourced from natural materials such as citrus, mint, and pine. Their broad functional range allows manufacturers to use them in perfumes, personal care items, and flavored products. Growing interest in natural-toned scents and expanding applications in wellness and aromatherapy continue to strengthen the demand for terpenoids, reinforcing their leadership within the product category.

- For instance, DS Smith’s chemical-industry packaging design supports dynamic stacking of 1,300 kg per container during transport of hazardous and bulk materials, and includes RFID‐enabled corrugated solutions that permit tracking of each unit throughout the supply chain.

By Source

Aroma chemicals are classified into natural and synthetic sources, with the synthetic segment leading the market due to its stable supply, cost efficiency, and high formulation flexibility. Synthetic aroma chemicals allow manufacturers to achieve consistent performance, longer-lasting scents, and large-scale output, making them ideal for high-volume categories like detergents and household products. While natural aroma chemicals are gaining traction due to rising clean-label preferences, their higher cost and limited availability keep their share smaller. However, premium fragrance brands increasingly incorporate naturals, creating a gradual growth path for this segment.

- For instance, Hoover CS’s 10-gauge 304 stainless-steel IBC models support maximum gross weights of up to 13,456 lbs (approximately 6,104 kg) in its 793-gallon (3,000 L) unit, as described in its handling manual.

By Application

Key application areas include food & beverage, fine fragrances, cosmetics & toiletries, soaps & detergents, household products, and other uses, with fine fragrances and personal care forming the dominant category. This segment leads because fragrance houses and cosmetic brands consistently demand high-performance aroma molecules to create sophisticated, long-lasting, and consumer-appealing scent profiles. Growth in premium perfumes, niche fragrances, and wellness-focused aromatic formulations further drives demand. Additionally, global lifestyle shifts, rising disposable incomes, and the expansion of e-commerce-driven beauty sales continue to support the strong position of fragrance-related applications in the market.

Key Growth Drivers

- Rising Demand for Flavors and Fragrances in Consumer Goods

The aroma chemicals market grows significantly due to their expanding use in packaged foods, beverages, personal care products, and home care formulations. Manufacturers adopt synthetic and natural aroma chemicals to improve product differentiation and sensory appeal, especially in high-volume categories such as detergents, shampoos, and confectionery. Rapid urbanization and rising disposable incomes in developing economies increase consumption of fragranced products, accelerating demand for aroma compounds. Additionally, brand owners rely on signature scents to build identity, further boosting the integration of advanced aroma molecules.

- For instance, Codefine provides Flexible Intermediate Bulk Containers (FIBCs), also known as bulk bags, for agrochemicals and fertilizers, offering a Safe Working Load (SWL) of up to 2,000 kg.

- Expansion of Natural and Bio-Based Aroma Ingredients

Growing consumer preference for clean-label, plant-derived ingredients drives adoption of natural aroma chemicals sourced from essential oils, fermentation, and biotech processes. Regulatory pressure on synthetic chemicals encourages companies to shift toward environmentally responsible and sustainable options. Biotechnology advancements enable cost-efficient production of molecules like vanillin and ambrettolide through fermentation, reducing reliance on limited natural resources. This transition aligns with global sustainability commitments and supports manufacturers in meeting stringent safety and environmental standards while appealing to eco-conscious consumers across global markets.

- For instance, Champion Plastics offers polyethylene film and bags with width ranges from 2 inches up to 200 inches, and gauges from 0.0005″ to 0.010″, enabling high-precision containment for industrial and chemical applications.

- Innovation in Chemical Synthesis and Formulation Technologies

Technological advancements in synthesis pathways, purification techniques, and molecular engineering enhance the performance, stability, and odor profiles of aroma chemicals. Companies invest in R&D to develop high-impact, long-lasting, and more stable aroma molecules suitable for complex formulations in perfumes and functional products. Microencapsulation, controlled-release technologies, and solvent-free extraction methods improve formulation efficiency and broaden application areas. These innovations enable suppliers to deliver specialized aroma compounds that meet evolving customer expectations for premium quality, longevity, and product safety.

Key Trends & Opportunities

1. Growing Market for Functional and Wellness-Focused Fragrances

Consumers increasingly seek fragrances that provide therapeutic or mood-enhancing benefits, creating strong opportunities for aroma chemicals used in aromatherapy, stress-relief products, and wellness-focused home care. The rise of functional fragrances in candles, diffusers, and air purifiers encourages demand for natural and synthetic molecules with proven physiological effects. Companies explore bioactive aroma compounds that improve sleep quality, promote relaxation, or enhance energy levels, enabling brands to differentiate their offerings in the fast-growing wellness segment.

- For instance, DoverPac® High Containment FIBC System meets containment levels of < 0.5 µg/m³, and is built using ArmorFlex® film for robust static-dissipative and solvent-resistant performance.

2. Advances in Biotech-Driven Aroma Molecule Production

The industry witnesses a shift toward fermentation-derived aroma chemicals produced using genetically engineered microorganisms. This approach offers consistent quality, supply stability, and reduced environmental impact. Startups and established players collaborate to commercialize bio-based molecules like nootkatone, valencene, and vanillin. These innovations unlock opportunities to replace costly or scarce natural sources while meeting regulatory standards and consumer expectations for sustainability. Biotech platforms also enable the development of novel aroma profiles previously unattainable through traditional extraction.

- For instance, CDF launched a new Form-Fit IBC liner manufacturing line in Lienen, Germany, that supports bulk packaging volumes ranging from 220 litres to 1,500 litres.

3. Rising Adoption of Sustainable and Ethical Sourcing Practices

Manufacturers increasingly implement transparent supply chains, responsible sourcing of botanical raw materials, and carbon-neutral production practices. Brands adopt sustainability certifications and life-cycle assessments to strengthen credibility. This trend presents opportunities for suppliers offering traceable, eco-friendly aroma ingredients that support global ESG goals. Investment in green chemistry and renewable feedstocks positions companies to meet future regulations while tapping into premium markets seeking ethically sourced fragrance components.

Key Challenges

1. Fluctuating Raw Material Prices and Limited Availability

Volatile prices of petrochemical feedstocks and natural raw materials pose major challenges for aroma chemical producers. Factors such as climate change, geopolitical issues, crop failures, and supply chain disruptions can restrict the availability of essential oils, citrus derivatives, and other plant-based ingredients. These fluctuations affect production costs, pricing strategies, and supply reliability. Companies must secure diversified sourcing networks and invest in synthetic or biotech alternatives to minimize risk and maintain market competitiveness.

2. Stringent Regulatory Frameworks and Compliance Requirements

The aroma chemicals industry faces strict global regulations related to safety, allergenicity, environmental impact, and permissible usage levels. Compliance with frameworks such as REACH, IFRA standards, and regional chemical safety laws increases operational complexity and often requires reformulation of existing products. Meeting documentation, testing, and certification requirements elevates costs and slows time-to-market for new aroma molecules. Manufacturers must invest in robust R&D, toxicological studies, and regulatory expertise to navigate evolving global standards.

Regional Analysis

North America

North America holds about 20–25% of the aroma chemicals market. Growth in this region comes mainly from strong demand for fragrances, personal care products, and household cleaners. The United States leads consumption because major FMCG brands and fragrance manufacturers operate large production facilities and invest in new formulations. Consumers in this region prefer high-quality, long-lasting scents, which increases the use of both synthetic and natural aroma chemicals. Stable regulations and advanced technology also help the market grow steadily.

Europe

Europe accounts for roughly 30% of the global aroma chemicals market, making it one of the largest regional contributors. The region benefits from a long-established fragrance industry, especially in countries like France, Germany, and Switzerland. Strict environmental and safety regulations encourage manufacturers to adopt cleaner and more sustainable production methods. Demand is strong for premium perfumes, fine fragrances, and high-quality personal care products. Europe also leads in innovation, with companies focusing on eco-friendly and allergen-controlled aroma ingredients.

Asia-Pacific

Asia-Pacific is the largest regional market, holding about 38–40% of global share. Rapid urbanization, rising incomes, and higher spending on cosmetics and household products drive strong regional growth. China and India lead in consumption as well as production, supported by expanding manufacturing and growing interest in affordable fragrances. The region also sees rising demand for natural aroma chemicals due to increased consumer awareness. Large population size, strong retail expansion, and growing exports continue to support the Asia-Pacific market’s dominant position.

Latin America

Latin America represents around 5% of the aroma chemicals market. Brazil and Mexico are the key contributors because of their strong beauty and personal care industries. Growing interest in fragrances, especially citrus and tropical scent profiles, supports demand in both consumer products and food flavoring. Although the market is smaller, it shows steady growth as international fragrance brands expand their presence. Limited production capacity leads to high imports, but improving local manufacturing is slowly helping the region diversify.

Middle East & Africa

The Middle East & Africa region holds about 5–10% of the market. Demand is mainly driven by strong preferences for luxury perfumes, attars, and long-lasting fragrance products, especially in Gulf countries such as the UAE and Saudi Arabia. Although most aroma chemicals are imported, the region is seeing gradual growth in local fragrance blending and packaging. Rising urbanization, higher disposable incomes, and strong cultural use of fragrances support market expansion. However, the market remains smaller due to limited production infrastructure.

Market Segmentations:

By Product:

By Source:

By Application:

- Food & beverage

- Fine fragrances

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aroma chemicals market features major participants such as Kemira Oyj, Solvay, Croda International Plc, Akzo Nobel N.V., Lanxess, Huntsman International LLC, Evonik Industries AG, The Lubrizol Corporation, Clariant AG, and DuPont. The aroma chemicals market remains highly dynamic, shaped by continuous innovation, stringent regulatory frameworks, and evolving consumer preferences for premium and sustainable fragrances. Companies compete by expanding their portfolios of synthetic and natural aroma molecules, investing heavily in R&D to develop cleaner, safer, and higher-performance compounds. Sustainability has become a core differentiator, leading to increased adoption of bio-based feedstocks, green chemistry processes, and energy-efficient manufacturing. Market participants also prioritize cost optimization and supply chain stability through strategic partnerships, capacity expansions, and regional diversification. Competition intensifies as manufacturers focus on improving product purity, enhancing olfactory profiles, and ensuring compliance with global safety standards. With increasing demand across personal care, household care, and food applications, the market favors organizations capable of rapid formulation development, regulatory agility, and large-scale production efficiency. Overall, the landscape is characterized by technological advancement, environmental responsibility, and strong market-driven innovation.

Key Player Analysis

- Kemira Oyj

- Solvay

- Croda International Plc

- Akzo Nobel N.V.

- Lanxess

- Huntsman International LLC

- Evonik Industries AG

- The Lubrizol Corporation

- Clariant AG

- DuPont

Recent Developments

- In June 2025, LANXESS showcased its variety of high-purity and nature-identical aroma chemicals at SIMPPAR 2025 in Paris, France. The company’s presentation emphasized innovative and sustainable fragrance solutions, featuring various grades of its Kalama® benzyl benzoate.

- In June 2025, dsm-firmenich began construction on a new production facility in Parma, Italy, which is expected to be completed in Q1 2027. This facility will expand the company’s capabilities in concentrated powder flavors, reaction flavors, culinary blends, and functional blends to meet growing demand in the aroma chemicals market.

- In April 2025, BASF Aroma Ingredients rolled out L-Menthol FCC, its first aroma product tagged with a reduced Product Carbon Footprint, offering 10–15% lower emissions relative to conventional equivalents. This initiative is expected to accelerate the adoption of sustainable practices in the aroma chemicals market.

- In October 2024, Prigiv started operating at its newly established Mahad Fragrance Ingredients plant as a joint venture between Givaudan and Privi. Privi has the majority ownership of 51% in the joint venture, while Givaudan holds the remaining 49%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward bio-based and sustainable aroma ingredients due to rising environmental awareness.

- Demand for high-purity aroma molecules will grow as consumers prefer premium fragrances and personal care products.

- Manufacturers will continue adopting green chemistry and low-emission production methods to meet regulatory expectations.

- Emerging economies will drive strong consumption as urbanization and lifestyle changes boost fragrance and cosmetics use.

- Advanced biotechnology will support the development of novel aroma compounds with improved performance.

- Companies will expand regional manufacturing to strengthen supply security and reduce dependency on imports.

- Digitalization and AI-driven formulation tools will accelerate product development and customization.

- The food and beverage sector will increasingly use aroma chemicals to enhance natural flavor profiles.

- Collaborations between fragrance houses and chemical producers will rise to meet evolving scent preferences.

- Continuous R&D investment will support innovations that improve efficiency, safety, and sustainability in aroma chemical production.