| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Book Paper Market Size 2024 |

USD 2,944.29 Million |

| Asia Pacific Book Paper Market, CAGR |

5.6% |

| Asia Pacific Book Paper Market Size 2032 |

USD 4,552.72 Million |

Market Overview:

The Asia Pacific Book Paper Market is projected to grow from USD 2,944.29 million in 2024 to an estimated USD 4,552.72 million by 2032, with a compound annual growth rate (CAGR) of 5.6% from 2024 to 2032.

The growth of the Asia Pacific book paper market is primarily driven by several key factors. The region’s rapid expansion in education, coupled with a rising literacy rate, is one of the main drivers, particularly in emerging economies like India and China. These nations are experiencing increasing enrollment in educational institutions, leading to higher demand for textbooks, academic materials, and educational publications. In addition, cultural factors in countries like Japan, South Korea, and India continue to sustain a preference for printed materials, with physical books being favored for their tactile experience. Furthermore, the rise of e-commerce platforms and self-publishing has provided new avenues for printed books, driving demand for book paper. Technological advancements in printing and paper production processes also contribute to market growth, improving the quality and efficiency of book paper production and offering enhanced customization options for publishers.

Regionally, Asia Pacific dominates the global book paper market, with China, India, and Japan emerging as key contributors. China’s large-scale manufacturing capabilities make it a significant player in the production and export of book paper, while India’s rapidly expanding educational sector creates a strong demand for textbooks and other printed materials. Japan, with its high per capita consumption of paper, maintains a robust market for book paper due to a strong cultural preference for physical books. The region’s market dynamics are shaped by various factors, including government policies supporting educational growth, economic development, and a deep cultural value placed on reading and printed materials. This combination of educational, cultural, and technological influences solidifies Asia Pacific as a leading region in the global book paper market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Asia Pacific Book Paper Market is projected to grow from USD 2,944.29 million in 2024 to USD 4,552.72 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.6%.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- The rapid expansion of education, particularly in emerging economies like India and China, is a major driver, fueling demand for textbooks, academic materials, and educational publications.

- Cultural preferences in countries like Japan, South Korea, and India, where physical books are highly valued, continue to sustain the demand for printed materials, despite the rise of digital media.

- The rise of e-commerce platforms and self-publishing has opened new avenues for printed books, increasing demand for book paper, especially with print-on-demand services gaining traction.

- Technological advancements in digital and on-demand printing have enhanced production efficiency, lowered costs, and allowed for greater customization, benefiting the book paper market.

- The rising cost of raw materials, such as wood pulp, has become a significant challenge for manufacturers, potentially increasing the price of book paper.

- The shift toward digital media and e-books is impacting the traditional book paper market as younger generations gravitate toward digital formats, presenting a challenge for printed book demand.

- Stricter environmental regulations and the growing demand for eco-friendly paper products are pressuring manufacturers to adopt sustainable practices, which could increase operational costs.

- China’s large-scale manufacturing and export capabilities position it as a dominant player in the market, while India’s expanding educational sector contributes significantly to regional demand.

- The high per capita consumption of paper in Japan, combined with a strong cultural affinity for printed books, ensures sustained demand in the country, solidifying its position in the Asia Pacific book paper market.

Market Drivers:

Educational Growth and Increased Literacy Rates

The increasing emphasis on education across Asia Pacific is a primary driver for the book paper market in the region. Nations such as India, China, and Southeast Asian countries are seeing significant improvements in literacy rates and expanding enrollment in educational institutions. As the demand for textbooks, workbooks, and other educational materials continues to grow, so too does the need for book paper. Governments in many countries are investing in educational infrastructure, which further fuels the demand for printed academic content. This trend is especially prominent in emerging economies where the education sector is experiencing rapid growth, creating a steady requirement for paper products used in textbooks, journals, and academic publications.

Cultural Preference for Printed Materials

The strong cultural affinity for printed materials across many Asia Pacific countries continues to drive the demand for book paper. For instance, companies like Shogakukan and Kodansha in Japan, and Yali Books in China, play pivotal roles in sustaining the market for physical books, particularly in genres such as literature, educational materials, and children’s books. While digital media is on the rise, physical books remain an integral part of daily life in nations like Japan, South Korea, and India. Reading is deeply ingrained in the cultural practices of these countries, and there is a strong market for various types of printed books, including literature, educational materials, and children’s books. In countries such as Japan, which has a high per capita consumption of printed materials, the demand for book paper is sustained by this preference for physical formats. Consumers value the tactile experience of holding a physical book, contributing to the continued success of the book paper market.

Growth of E-commerce and Self-Publishing

The rise of e-commerce platforms and self-publishing in the Asia Pacific region has also bolstered the book paper market. As online retailing continues to expand, more authors and publishers are turning to digital platforms to publish and distribute their works, many of which require printed versions. For instance, online platforms like Alibaba’s Tmall, JD.com, and Amazon have revolutionized book sales in China, India, and Japan, offering consumers convenient access to a wide array of printed titles. The self-publishing trend has become particularly popular in countries like India and China, where individuals are looking for affordable and efficient ways to bring their works to print. This has increased demand for book paper, as both large publishing houses and independent authors rely on paper products for printing physical books. The growth of print-on-demand services has further contributed to the rise in demand for book paper, offering new opportunities for both large and small-scale printing operations.

Technological Advancements in Printing and Paper Production

Technological innovations in printing technologies and paper production processes have had a profound impact on the book paper market in Asia Pacific. Advanced printing methods, including digital and on-demand printing, have allowed publishers to meet the growing demand for customized and high-quality printed materials. These advancements have improved production efficiency, reduced costs, and allowed for greater flexibility in publishing. Innovations in paper manufacturing, such as the development of more sustainable and eco-friendly paper options, also cater to the rising consumer demand for environmentally conscious products. As printing and paper production technologies continue to evolve, the Asia Pacific book paper market benefits from enhanced capabilities in production quality, cost-effectiveness, and environmental sustainability.

Market Trends:

Sustainability and Eco-Friendly Paper Products

In recent years, sustainability has become a significant trend in the Asia Pacific book paper market. As consumers become increasingly aware of environmental issues, there is a growing demand for eco-friendly paper options. Publishers and paper manufacturers are responding by adopting sustainable practices, such as using recycled paper and implementing energy-efficient production processes. For instance, companies like KPP Group Holdings have implemented concrete sustainability initiatives, such as publishing catalogs of products with reduced environmental impact (Green Products & Solutions, Environs) and developing the Green Star System™ to promote eco-friendly practices. Countries like Japan, South Korea, and Australia are leading the way in sustainability efforts, with regulations encouraging the use of environmentally friendly materials in the production of book paper. This trend is expected to continue as both publishers and consumers prioritize sustainability, prompting the adoption of greener paper production methods and recycled content to reduce the environmental impact.

Digital Printing and On-Demand Publishing

The rise of digital printing technologies has had a transformative effect on the Asia Pacific book paper market. The ability to print books on-demand, rather than in large volumes, is reshaping how publishers and authors approach book production. This trend is particularly prevalent in markets like India and China, where digital platforms for self-publishing are thriving. Print-on-demand services allow for the production of smaller quantities of books, reducing waste and increasing cost-efficiency. Moreover, digital printing technology enables high-quality production at lower costs, making it a more viable option for both large publishing houses and independent authors. For instance, Canon launched the ProStream 3000 series in February 2023, this high-speed, web-fed inkjet press is designed for commercial printing applications, offering consistent offset print quality at industrial speeds. It supports a wide range of substrates, including heavyweight paper up to 300 gsm, enabling ultra-fast digital production of various commercial print jobs such as direct mail, books, postcards, posters, and calendars. As the demand for personalized and niche books increases, the adoption of digital printing is expected to grow, driving a shift in the book paper market towards more flexible and customizable production methods.

Increased Adoption of Hybrid Publishing Models

The growth of hybrid publishing models is another trend gaining momentum in the Asia Pacific region. Hybrid publishing, which combines elements of traditional publishing and self-publishing, allows authors to retain more control over their content while benefiting from professional production and distribution services. This model has become increasingly popular in countries like India and the Philippines, where authors seek to reach both digital and print markets. Hybrid publishing typically requires a steady supply of book paper for the production of physical books, thereby driving demand in the market. The flexibility and accessibility offered by hybrid publishing platforms are encouraging more authors to publish their works, which, in turn, contributes to the growing need for printed book materials.

Rise in Educational Content and Children’s Books

Another notable trend in the Asia Pacific book paper market is the increasing demand for educational content and children’s books. As education becomes a priority in many Asia Pacific countries, particularly in Southeast Asia and India, there is a surge in the production of educational textbooks, workbooks, and children’s literature. This trend is closely tied to the region’s expanding middle class, which places a high value on education. The demand for children’s books, in particular, is growing as parents seek high-quality educational materials to supplement their children’s learning. This trend is contributing to the steady growth of the book paper market, as publishers focus on producing engaging and informative materials for young readers. Additionally, the increasing production of language learning materials and interactive educational books is driving further demand for specialized book paper.

Market Challenges Analysis:

Rising Costs of Raw Materials

One of the primary challenges facing the Asia Pacific book paper market is the increasing cost of raw materials, particularly wood pulp. As demand for paper continues to rise, the cost of sourcing quality wood pulp has escalated, directly affecting paper production costs. For instance, Bilt Graphic Paper Products Limited (BGPPL) reported that hardwood pulp prices have surged to over $620 per ton and softwood pulp to $890 per ton as of February 2025, marking the third consecutive price increase within just 60 days. The supply chain for raw materials has also been disrupted due to factors such as environmental regulations, reduced forest cover, and global supply chain constraints. These rising costs often translate into higher prices for book paper, which can be a significant restraint for publishers, particularly small and independent ones, who face tighter profit margins.

Shift Towards Digital Media

The shift towards digital media and e-books presents a notable challenge for the traditional book paper market in Asia Pacific. As digital content consumption grows, especially among younger generations, the demand for printed books is gradually being impacted. E-books and digital publications offer convenience, lower costs, and immediate access, which makes them an attractive alternative to physical books. While print media remains popular in certain segments, such as educational and cultural books, the increasing prevalence of digital formats in the region limits the growth potential of the book paper market. This shift towards digital media poses a challenge for paper manufacturers as they must adapt to changing consumer behaviors and the growing popularity of e-commerce platforms for e-books.

Environmental Regulations and Sustainability Pressures

Increasing environmental regulations across Asia Pacific are another challenge facing the book paper market. Governments are implementing stricter rules related to deforestation, carbon emissions, and waste management, pushing manufacturers to adopt more sustainable practices. While sustainability is a growing trend, the shift to eco-friendly paper production can increase operational costs for paper mills, which may, in turn, affect paper prices. The pressure to maintain compliance with environmental standards while managing costs effectively remains a key challenge for book paper producers in the region.

Market Opportunities:

The Asia Pacific book paper market presents significant opportunities driven by the region’s expanding educational sector and increasing literacy rates. As countries like India, China, and Southeast Asia continue to experience educational growth, the demand for textbooks, academic publications, and educational materials is expected to rise. Governments are investing heavily in education, leading to a continuous need for printed materials in schools, universities, and educational institutions. Additionally, the rise in government-backed initiatives to improve literacy rates and the focus on expanding educational infrastructure in developing countries further supports the sustained demand for book paper. This expanding educational market offers significant opportunities for book paper manufacturers to meet the growing need for high-quality, affordable paper products.

Another key opportunity lies in the increasing cultural preference for physical books in the Asia Pacific region. While digital media is on the rise, physical books remain an important part of the reading culture, particularly in countries like Japan, South Korea, and India. With a strong demand for children’s books, literature, and specialized publications, there is continued growth potential for the book paper market. Moreover, technological advancements in printing, such as digital and on-demand printing, offer flexibility and cost-effectiveness for publishers and authors. These advancements are enabling smaller runs and greater customization, which enhances market opportunities for both established publishers and self-publishing authors. As a result, the Asia Pacific book paper market is well-positioned to capitalize on these trends and continue its growth trajectory.

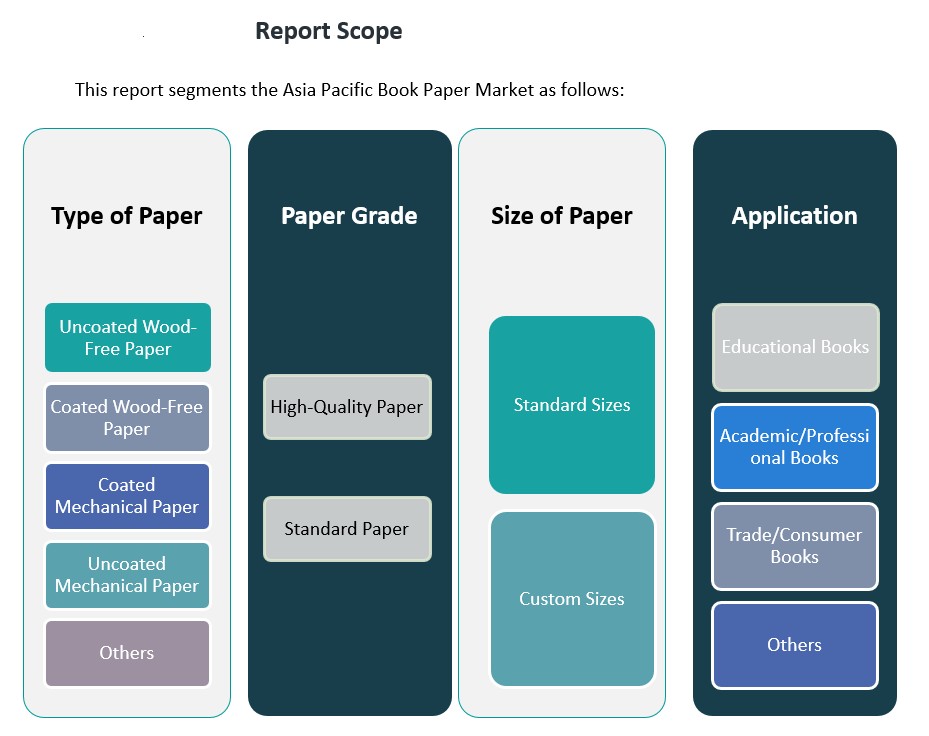

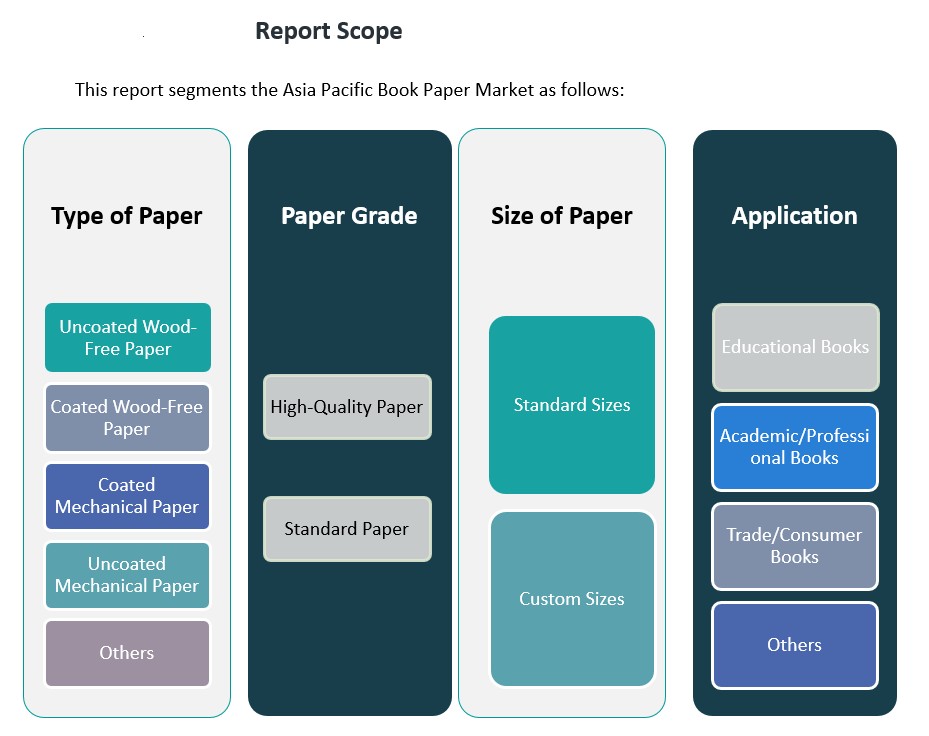

Market Segmentation Analysis:

The Asia Pacific book paper market is segmented across several dimensions, including type of paper, paper grade, size of paper, and application, each catering to specific demands within the region.

By Type of Paper, the market is divided into various categories, with Uncoated Wood-Free Paper and Coated Wood-Free Paper leading due to their use in high-quality book printing. Coated Mechanical Paper and Uncoated Mechanical Paper are also widely used for cost-effective book production, especially in academic and trade publications. The Others category includes specialty papers used in niche applications, such as art books and limited edition prints.

By Paper Grade, the market is categorized into High-Quality Paper and Standard Paper. High-quality paper is preferred for premium publications, educational books, and luxury editions, offering superior durability and print quality. In contrast, standard paper is commonly used for mass-market books and publications that require more cost-effective solutions.

By Size of Paper, the segment is divided into Standard Sizes and Custom Sizes. Standard sizes dominate the market, particularly for mass-market publications, while custom sizes are preferred for specialized formats such as educational books, art books, and professional publications that require tailored dimensions.

By Application, the market is segmented into Educational Books, Academic/Professional Books, Trade/Consumer Books, and Others. Educational books are the largest segment, driven by the growing demand for textbooks and learning materials in the expanding educational sectors across Asia Pacific. Academic and professional books also show steady growth, supported by the rise in academic publishing and research activities in the region.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The Asia Pacific region is the largest market for book paper globally, with significant contributions from key countries such as China, India, Japan, and South Korea. The demand for book paper is driven by educational growth, cultural preferences for printed materials, and the evolving publishing industry in these countries.

China is the dominant player in the Asia Pacific book paper market, accounting for over 40% of the market share in the region. The country’s extensive manufacturing capabilities and vast consumer base make it a key driver of growth. China’s strong educational sector, coupled with the growing demand for textbooks, academic publications, and children’s books, has created a steady need for book paper. Additionally, China’s well-established paper manufacturing industry has enabled the country to become both a leading producer and consumer of book paper in the region. The government’s focus on expanding literacy rates and educational infrastructure further supports the ongoing demand for printed materials.

India is another rapidly growing market within Asia Pacific, expected to experience significant growth in the coming years. With a large population and an increasing emphasis on education, India accounts for approximately 20% of the region’s market share. The rise in educational institutions, coupled with a growing middle class that values physical books, has bolstered the demand for book paper in the country. India’s expanding self-publishing sector, driven by the rise of e-commerce and digital platforms, has also increased the demand for book paper, particularly for academic and educational materials.

Japan follows as a mature and stable market for book paper in Asia Pacific, holding a market share of around 15%. Japan’s strong cultural affinity for reading and its high per capita consumption of printed books drive consistent demand for book paper. Despite the growing trend of digital reading, the country’s high-quality publishing standards and preference for physical books continue to sustain the demand for book paper.

Southeast Asia, including countries such as Indonesia, the Philippines, and Vietnam, is also seeing steady growth in the book paper market. These countries collectively hold a market share of about 10%. With increasing educational initiatives and a rising middle class, the demand for textbooks, academic books, and trade publications is expected to grow significantly in the coming years. Southeast Asia’s growing publishing industry is supported by favorable government policies and a burgeoning digital publishing sector that drives demand for printed materials.

Key Player Analysis:

- Asia Pulp & Paper

- Oji Paper Company

- JK Paper Ltd.

- Shogakukan Inc.

- Sinar Mas Group

Competitive Analysis:

The Asia Pacific book paper market is highly competitive, with numerous local and international players driving market growth. Leading companies such as Stora Enso, Sappi, and UPM-Kymmene dominate the region, offering a broad range of high-quality paper products for the publishing industry. These companies leverage their strong supply chains, advanced production technologies, and sustainable practices to maintain a competitive edge. Local players in China, India, and Japan also contribute significantly, often focusing on cost-effective solutions and tailored offerings for the regional market. Additionally, the increasing demand for eco-friendly and sustainable paper products has led to innovation and differentiation within the market. Players that adopt sustainable production methods and offer recycled or biodegradable paper are gaining market share, particularly in countries with stringent environmental regulations. As demand for digital and on-demand printing grows, smaller and niche players are emerging to cater to specialized needs in the book paper market.

Recent Developments:

- In March 2025, Oji Holdings entered into a partnership with New Forests to establish the Future Forest Innovations Fund, a corporate forestry investment fund aimed at advancing sustainable forestry and climate goals. Oji will invest nearly USD 300 million, targeting new plantation forestry assets across Southeast Asia and other regions, with the dual aim of financial returns and significant carbon sequestration by 2030.

- In February 2025, Nippon Paper Industries, together with Sumitomo Corporation and Green Earth Institute, announced the establishment of a joint venture named Morisora Bio Refinery LLC. The new company, scheduled to be established in March 2025, will focus on the production and sale of bioethanol and other biochemicals derived from woody biomass. The joint venture will construct a semi-commercial plant at Nippon Paper’s Iwanuma Mill, aiming to begin production in 2027, with ambitions to support the adoption of sustainable aviation fuel in Japan by 2030. Additionally, in August 2024, Nippon Paper agreed to transfer all shares of its subsidiary Daishowa Uniboard Co., Ltd. to A&A Material Corporation, with the transaction set for October 1, 2024, as part of its strategy to shift management resources to growth businesses

Market Concentration & Characteristics:

The Asia Pacific book paper market exhibits moderate concentration, with a few large international players and several regional manufacturers competing for market share. Major companies such as Stora Enso, Sappi, and UPM-Kymmene hold significant shares due to their established production capabilities, vast distribution networks, and strong brand presence across the region. These global players are complemented by regional manufacturers in countries like China, India, and Japan, which cater to local demand with more cost-effective solutions. The market is characterized by a blend of traditional large-scale producers and smaller, specialized players focused on niche segments like eco-friendly and customized paper products. The growing demand for sustainable and high-quality paper solutions, along with advances in digital printing technology, has spurred innovation and diversification. The market’s characteristics also reflect strong competition in pricing, product variety, and environmental compliance, making it dynamic and increasingly fragmented.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Asia Pacific book paper market is expected to continue expanding, driven by educational growth and rising literacy rates in emerging economies.

- Demand for high-quality book paper will rise, particularly for educational and academic publications.

- The shift towards sustainable and eco-friendly paper products will gain momentum, with more manufacturers adopting recycled and biodegradable materials.

- Digital printing technology will grow in popularity, facilitating shorter print runs and reducing waste.

- The expansion of e-commerce and self-publishing platforms will further boost demand for book paper, especially for niche markets.

- The region’s growing middle class will increase demand for trade and consumer books, fostering market growth.

- Innovations in paper production technologies will enhance efficiency, reduce costs, and improve product customization.

- Southeast Asia will become an increasingly important market due to growing educational sectors and rising demand for printed materials.

- Japan and China will continue to dominate, with strong cultural preferences for physical books and well-established publishing industries.

- Regulatory pressures on environmental sustainability will lead to more stringent policies affecting paper production practices.