| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Thermoplastic Polyurethane Adhesive Market Size 2023 |

USD 331.87 Million |

| Asia Pacific Offsite Medical Case Management Market, CAGR |

6.1% |

| Asia Pacific Offsite Medical Case Management Market Size 2032 |

USD 566.63 Million |

Market Overview

Asia Pacific Thermoplastic Polyurethane Adhesive Market size was valued at USD 331.87 million in 2023 and is anticipated to reach USD 566.63 million by 2032, at a CAGR of 6.1% during the forecast period (2023-2032).

The Asia Pacific Thermoplastic Polyurethane (TPU) Adhesive market is primarily driven by the expanding automotive, footwear, and electronics industries, which demand high-performance bonding solutions. The growing preference for lightweight, flexible, and durable adhesives in automotive manufacturing significantly contributes to market growth. Additionally, the rise in construction activities and infrastructure development across emerging economies boosts the demand for TPU adhesives in flooring and panel bonding applications. The market also benefits from increasing environmental awareness, leading manufacturers to adopt solvent-free and eco-friendly formulations. Technological advancements in TPU adhesive formulations, offering enhanced heat resistance and bonding strength, further propel market expansion. Moreover, rapid urbanization and increasing disposable incomes drive the consumption of consumer goods, fostering greater application of TPU adhesives in packaging and wearable electronics. These factors, combined with supportive government regulations for sustainable materials, are shaping the growth trajectory of the Asia Pacific TPU adhesive market during the forecast period.

The Asia Pacific thermoplastic polyurethane (TPU) adhesive market demonstrates significant geographical diversity, with strong demand emerging from countries such as China, India, Japan, South Korea, and Southeast Asian nations including Vietnam, Indonesia, and Thailand. These regions are witnessing rapid industrial growth, rising infrastructure development, and expanding automotive and electronics sectors, all of which contribute to the increasing adoption of TPU adhesives. China remains a manufacturing hub for multiple industries, while India and Southeast Asia are evolving into key production bases due to favorable policies and lower operating costs. Prominent players operating in the regional market include Wanhua, DIC Corporation, Huafon, NANPAO Resins Chemical Group, Shandong INOV Polyurethane Co., Ltd., Great Eastern Resins Industrial Co. Ltd., Dongsung, Sundow Polymers Co., Ltd., Taiwan PU Corporation, and Miracll Chemicals Co. Ltd. These companies focus on product innovation, sustainable adhesive solutions, and strategic collaborations to strengthen their market presence and cater to the region’s growing industrial demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific thermoplastic polyurethane adhesive market was valued at USD 331.87 million in 2023 and is projected to reach USD 566.63 million by 2032, growing at a CAGR of 6.1% during the forecast period.

- The global thermoplastic polyurethane adhesive market was valued at USD 945.51 million in 2023 and is projected to reach USD 1,624.75 million by 2032, growing at a CAGR of 6.2% during the forecast period.

- Rising demand for lightweight, durable, and flexible bonding solutions in automotive and electronics sectors is a key market driver.

- Growing preference for sustainable, low-VOC adhesives is shaping product innovation and influencing purchase decisions.

- Rapid industrialization in countries like India, Vietnam, and Indonesia is creating favorable growth conditions across multiple end-use industries.

- Competition is intensifying with regional and global players focusing on product quality, environmental compliance, and tailored adhesive solutions.

- Stringent environmental regulations and high production costs act as challenges for manufacturers in certain economies.

- China, India, Japan, and Southeast Asian nations are major contributors to market growth due to expanding manufacturing bases and increasing infrastructure development.

Report Scope

This report segments the Asia Pacific Thermoplastic Polyurethane Adhesive Market as follows:

Market Drivers

Rising Demand from Automotive and Transportation Sector

The growing automotive industry in Asia Pacific plays a pivotal role in driving the demand for thermoplastic polyurethane adhesives. As automotive manufacturers strive to enhance fuel efficiency and reduce vehicle weight, they increasingly adopt lightweight materials and advanced adhesives for component assembly. For instance, the Ministry of Industry and Information Technology (MIIT) in China has emphasized the role of TPU adhesives in supporting lightweight vehicle designs to improve fuel efficiency. Similarly, India’s Automotive Research Association has highlighted the use of TPU adhesives in wire harnessing and interior trims as critical for meeting modern automotive standards.

Expansion of Construction and Infrastructure Projects

Robust infrastructure development and urbanization across Asia Pacific are contributing significantly to the demand for TPU adhesives. These adhesives are increasingly utilized in construction applications such as flooring, insulation panels, and wall coverings due to their excellent adhesion properties and resistance to moisture, abrasion, and chemicals. For instance, the Indian Ministry of Housing and Urban Affairs has promoted the use of environmentally friendly adhesives like TPU in smart city projects to align with green building standards. Additionally, Vietnam’s Ministry of Construction has supported initiatives to incorporate high-performance adhesives in residential and commercial infrastructure development.

Growth in Footwear and Apparel Manufacturing

The Asia Pacific region serves as a global hub for footwear and apparel manufacturing, making it a key contributor to the TPU adhesive market. Thermoplastic polyurethane adhesives are widely employed in footwear production due to their ability to provide strong yet flexible bonding for various shoe components such as soles, uppers, and linings. As demand for sportswear, fashion footwear, and casual shoes continues to rise—driven by changing consumer lifestyles, increasing disposable incomes, and e-commerce growth—the use of TPU adhesives is expected to grow in parallel. Major manufacturing bases in countries like China, Vietnam, and Bangladesh are continually adopting advanced adhesive technologies to improve product quality and production efficiency, thereby supporting market expansion.

Technological Advancements and Sustainable Adhesive Solutions

Innovations in adhesive technologies are playing a critical role in expanding the application scope of TPU adhesives across various industries. Manufacturers are investing in research and development to produce enhanced formulations that offer improved temperature resistance, faster curing times, and compatibility with a wide range of substrates. Furthermore, the increasing emphasis on sustainability and regulatory compliance is encouraging the shift from traditional solvent-based adhesives to environmentally friendly TPU variants. These adhesives are typically low in volatile organic compounds (VOCs) and meet stringent environmental regulations, making them ideal for use in industries focused on green manufacturing. As awareness about environmental impact rises among both manufacturers and end-users, the demand for sustainable TPU adhesives is expected to gain further momentum in the Asia Pacific region.

Market Trends

Growing Adoption of Eco-Friendly and Solvent-Free Adhesives

A key trend shaping the Asia Pacific TPU adhesive market is the increasing demand for environmentally friendly and solvent-free adhesive solutions. As regulatory bodies across the region enforce stricter norms regarding volatile organic compound (VOC) emissions and environmental sustainability, manufacturers are shifting toward green adhesive alternatives. TPU adhesives, known for their low VOC content and non-toxic composition, are becoming a preferred choice across industries including packaging, electronics, and construction. The growing awareness of climate change and the circular economy is pushing both manufacturers and end-users to opt for adhesives that align with sustainable development goals. This trend is expected to gain further momentum as consumer preferences increasingly lean toward eco-conscious products.

Expansion of Application Scope in the Medical Sector

The increasing application of TPU adhesives in the medical industry is emerging as a significant market trend in the Asia Pacific region. These adhesives are valued for their biocompatibility, flexibility, and ability to bond dissimilar materials, making them suitable for use in wearable medical devices, surgical tapes, wound dressings, and medical tubing. For instance, India’s Ministry of Health and Family Welfare has promoted the use of TPU adhesives in home healthcare devices to improve patient comfort and safety. Similarly, Japan’s Ministry of Health, Labour, and Welfare has supported initiatives to integrate TPU adhesives into advanced medical technologies, including diagnostic tools and surgical equipment.

Shift Toward High-Performance Adhesives for Industrial Applications

Industries across Asia Pacific are increasingly demanding high-performance adhesives that can withstand harsh operating environments, which is propelling the use of TPU adhesives. These adhesives offer excellent resistance to chemicals, abrasion, and extreme temperatures, making them ideal for industrial and heavy-duty applications. For instance, the Ministry of Economy, Trade, and Industry (METI) in Japan has funded projects to develop TPU adhesives for aerospace and automotive applications, emphasizing their durability and reliability. Additionally, China’s Ministry of Industry and Information Technology (MIIT) has highlighted the role of TPU adhesives in supporting automation and advanced manufacturing practices across various sectors.

Integration of TPU Adhesives in Wearable Electronics and Consumer Devices

The proliferation of wearable electronics and smart consumer devices is contributing to a rising trend in the application of TPU adhesives. These adhesives are particularly suited for bonding flexible substrates and components within compact electronic devices, offering strong adhesion, elasticity, and resistance to heat and moisture. With the Asia Pacific region being a major manufacturing base for consumer electronics—especially in countries like China, South Korea, and Taiwan—the integration of TPU adhesives in this sector is witnessing rapid growth. The shift toward miniaturized and multifunctional electronic products is further driving the need for high-performance adhesives that can meet the complex bonding requirements of modern devices.

Market Challenges Analysis

High Production Costs and Raw Material Price Volatility

One of the primary challenges facing the Asia Pacific TPU adhesive market is the high production cost associated with thermoplastic polyurethane formulations. TPU adhesives require advanced processing technologies and high-quality raw materials such as diisocyanates and polyols, which are often derived from petrochemicals. For instance, the Ministry of Industry and Information Technology (MIIT) in China has reported that fluctuations in crude oil prices significantly impact the cost of petrochemical-based inputs like polyols, increasing production expenses for TPU adhesives. Similarly, India’s Ministry of Commerce and Industry has highlighted the challenges faced by small and mid-sized enterprises in maintaining competitive pricing amidst volatile raw material costs.

Limited Awareness and Technical Expertise in Emerging Economies

Despite the rising demand for high-performance adhesives, the market in some emerging Asia Pacific economies is constrained by limited awareness and technical know-how regarding TPU adhesive applications. Many small- and medium-scale enterprises (SMEs) continue to rely on traditional adhesives due to a lack of exposure to advanced materials and bonding technologies. Additionally, end-users in sectors such as construction, textiles, and packaging may hesitate to switch to TPU adhesives due to perceived complexity in application or lack of skilled workforce trained to handle these products effectively. The absence of adequate training and technical support further hinders widespread adoption. To overcome this challenge, manufacturers need to invest in educational initiatives, technical partnerships, and localized training programs to build user confidence and facilitate a smoother transition to TPU adhesive solutions across the region.

Market Opportunities

The Asia Pacific thermoplastic polyurethane (TPU) adhesive market presents significant growth opportunities driven by rapid industrialization and ongoing infrastructure development across emerging economies. As countries like India, Indonesia, Vietnam, and the Philippines invest heavily in transportation, real estate, and smart city projects, the demand for advanced adhesive solutions is poised to rise. TPU adhesives, known for their flexibility, durability, and resistance to environmental stress, are ideally suited for use in construction, automotive, and consumer electronics applications. Additionally, the regional shift toward lightweight and fuel-efficient vehicles is creating new avenues for TPU adhesive usage in automotive interiors, exterior trims, and bonding components. With electric vehicle (EV) adoption gaining traction, particularly in China and Southeast Asia, the need for high-performance adhesives that ensure both safety and energy efficiency will likely further boost market growth.

Furthermore, the increasing emphasis on sustainable and eco-friendly manufacturing practices across the region offers another promising opportunity for TPU adhesive manufacturers. As governments implement stricter environmental regulations and consumers become more environmentally conscious, the demand for solvent-free and low-VOC adhesives is on the rise. TPU adhesives align well with these requirements, positioning them as a preferred solution for companies aiming to meet both performance and sustainability goals. Moreover, the expansion of the medical device and wearable electronics industries in Asia Pacific is expected to drive new applications for TPU adhesives in sensitive and high-precision environments. Growing investments in research and development, along with advancements in material science, will enable manufacturers to introduce innovative TPU adhesive formulations tailored to specific industry needs. These factors collectively create a fertile ground for growth and product diversification in the Asia Pacific TPU adhesive market.

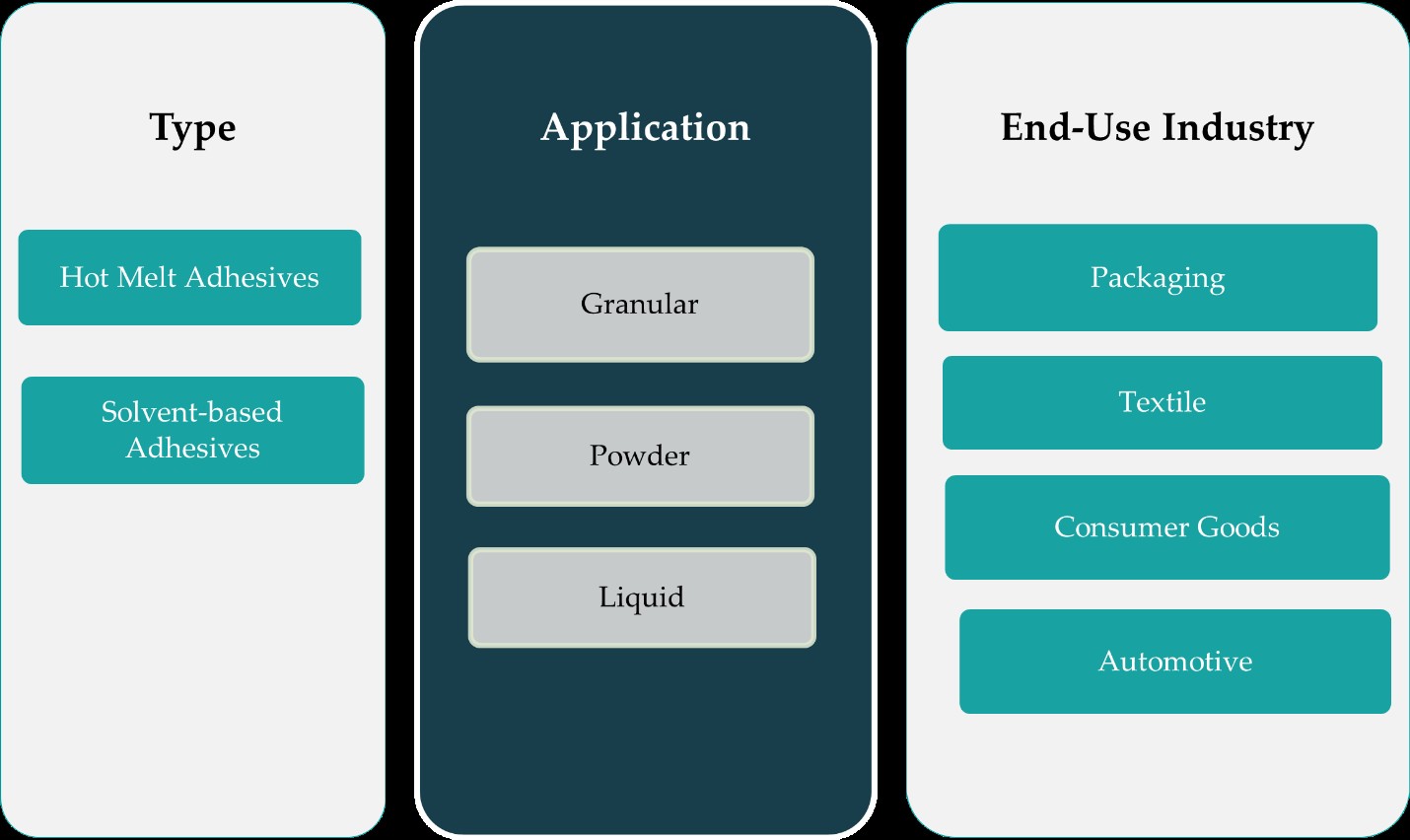

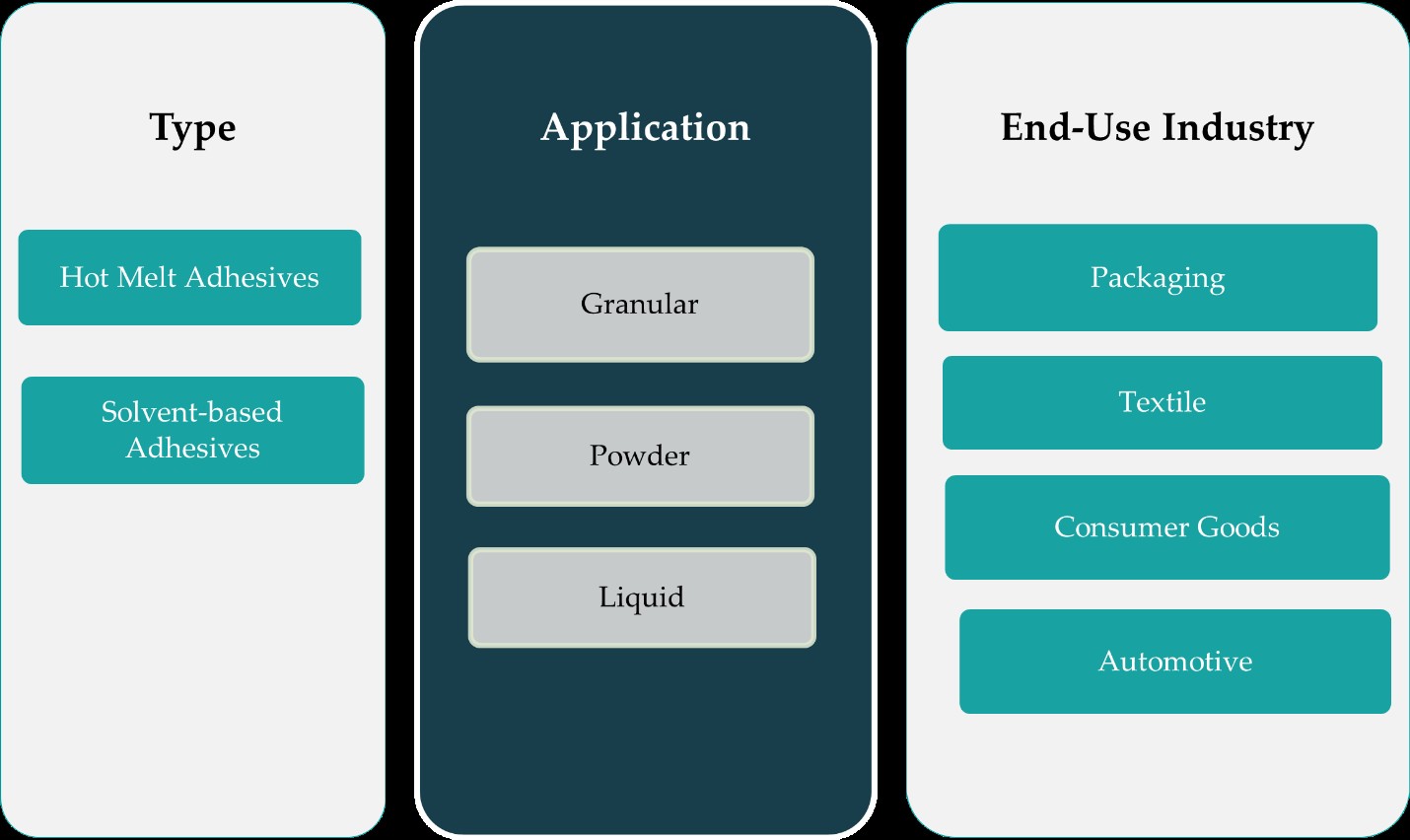

Market Segmentation Analysis:

By Type:

The Asia Pacific TPU adhesive market is segmented by type into hot melt adhesives and solvent-based adhesives, each offering unique performance advantages across different industrial applications. Hot melt TPU adhesives are gaining significant traction due to their fast-setting properties, high bonding strength, and eco-friendly nature, making them suitable for industries that demand efficiency and environmental compliance, such as automotive, textiles, and packaging. Their solvent-free formulation aligns well with increasingly stringent environmental regulations and growing preferences for sustainable materials. Meanwhile, solvent-based TPU adhesives continue to be favored in specialized applications that require superior chemical resistance, flexibility, and durability. These adhesives are commonly used in footwear, electronics, and medical device manufacturing, where bonding performance under varying conditions is critical. Despite rising environmental concerns, the solvent-based segment maintains a steady presence due to its established reliability and effectiveness. However, with technological advancements and stricter regulatory frameworks, hot melt adhesives are expected to outpace solvent-based adhesives in growth during the forecast period across the Asia Pacific region.

By Application:

Based on application, the Asia Pacific TPU adhesive market is segmented into granular, powder, and liquid forms, each offering tailored solutions depending on end-user requirements. The liquid form segment holds a significant share due to its versatility and ease of application in bonding complex surfaces, especially in automotive interiors, textiles, and electronics assembly. Liquid TPU adhesives provide excellent adhesion and are ideal for high-speed manufacturing lines that demand precise application. The granular form is widely used in injection molding and extrusion processes, particularly in footwear and industrial applications, where consistent material flow and thermal stability are essential. Powder TPU adhesives, though representing a smaller segment, are gaining attention for their clean processing and potential use in textile lamination and composite materials. Their ability to provide uniform coatings and reduced material waste supports their growing adoption in environmentally conscious manufacturing environments. As end-users seek customized adhesive solutions based on processing methods and application efficiency, each form of TPU adhesive is expected to witness tailored demand growth in the regional market.

Segments:

Based on Type:

- Hot Melt Adhesives

- Solvent-based Adhesives

Based on Application:

Based on End- User:

- Packaging

- Textile

- Consumer Goods

- Automotive

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

China

China dominated the Asia Pacific thermoplastic polyurethane adhesive market in 2023, accounting for over 43% of the regional market share. The country’s robust manufacturing base, large-scale industrial output, and growing emphasis on lightweight automotive components significantly contribute to its leadership position. With an expanding electric vehicle (EV) sector and a strong presence in footwear and consumer electronics manufacturing, China continues to witness rising demand for high-performance adhesive solutions. Additionally, China’s government-driven initiatives to promote sustainable and energy-efficient technologies have accelerated the adoption of eco-friendly TPU adhesives in automotive, construction, and electronics industries. The continued shift toward solvent-free adhesives and rapid technological advancements in bonding applications are expected to support the country’s dominance in the years ahead.

India

India holds the second-largest share in the regional market, contributing approximately 17% in 2023. The market is driven by increasing urbanization, infrastructure investments, and a growing domestic manufacturing sector. With government-backed programs like “Make in India” and increasing foreign direct investment (FDI), several end-use industries—such as automotive, textiles, and construction—are expanding operations, thereby boosting the demand for thermoplastic polyurethane adhesives. The footwear industry, one of India’s largest export sectors, also significantly contributes to TPU adhesive consumption. Additionally, India’s growing middle class, rising consumer awareness about product quality, and shift toward sustainable adhesives provide further growth prospects. However, limited technical knowledge among small manufacturers and pricing sensitivity may slightly restrain the pace of adoption in some rural or price-competitive markets.

Japan

Japan accounted for around 11% of the Asia Pacific TPU adhesive market in 2023. The country’s advanced manufacturing ecosystem, combined with a strong focus on innovation, precision engineering, and sustainable production, continues to drive demand for specialized adhesive technologies. Japan’s electronics and automotive sectors are key consumers of TPU adhesives, especially as manufacturers emphasize lightweight designs and high-performance bonding materials. The country also demonstrates high standards for environmental safety and industrial efficiency, encouraging the use of low-VOC and solvent-free adhesives. Although Japan’s market size is smaller compared to China and India, its strong technological base and commitment to quality maintain consistent demand across industrial and consumer applications.

Southeast Asia

Southeast Asia including countries such as Indonesia, Vietnam, Thailand, and Malaysia—collectively contributed nearly 19% of the Asia Pacific TPU adhesive market in 2023. This subregion benefits from growing foreign investments, low labor costs, and an expanding manufacturing base, particularly in electronics, textiles, and footwear industries. Vietnam and Indonesia, in particular, have emerged as key manufacturing hubs due to favorable trade policies and infrastructure development. The rising demand for consumer goods, coupled with increasing adoption of sustainable adhesives in construction and automotive sectors, is expected to further strengthen TPU adhesive consumption in this subregion. As these economies continue to industrialize and urbanize, the demand for thermoplastic polyurethane adhesives is projected to rise steadily.

Key Player Analysis

- Wanhua

- DIC Corporation

- Huafon

- NANPAO Resins Chemical Group

- Shandong INOV Polyurethane Co., Ltd.

- Great Eastern Resins Industrial Co. Ltd.

- Dongsung

- Sundow Polymers Co., Ltd.

- Taiwan PU Corporation

- Miracll Chemicals Co. Ltd.

- Coating P. Materials Co. Ltd.

- Guangdong SUNTIP New Material Co., Ltd.

- Others

Competitive Analysis

The Asia Pacific thermoplastic polyurethane (TPU) adhesive market is characterized by strong competition among both regional and multinational players who focus on innovation, cost-effectiveness, and sustainability. Leading companies such as Wanhua, DIC Corporation, Huafon, NANPAO Resins Chemical Group, Shandong INOV Polyurethane Co., Ltd., Great Eastern Resins Industrial Co. Ltd., Dongsung, Sundow Polymers Co., Ltd., Taiwan PU Corporation, and Miracll Chemicals Co. Ltd. play a vital role in shaping the competitive landscape. These players prioritize product diversification and invest significantly in research and development to meet the evolving needs of automotive, electronics, footwear, and construction industries. With increasing regulatory pressure to minimize environmental impact, companies are developing solvent-free and low-VOC adhesive formulations to align with sustainability goals. Furthermore, strategic collaborations, mergers, and geographic expansion are common among market leaders seeking to strengthen their distribution networks and customer base across emerging markets such as India and Southeast Asia. Innovation in heat-resistant, high-bonding strength, and fast-curing TPU adhesives continues to be a key differentiator, allowing companies to maintain a competitive edge while addressing the growing demand for performance-driven solutions.

Recent Developments

- In March 2025, Huntsman secured ISCC+ certification for its TPU production sites in Jinshan, China, and Osnabrück, Germany, enabling the production of mass balance-certified products to support sustainability goals.

- In February 2025, Covestro showcased its stretchable TPU films for medical wearables at MD&M West 2025, emphasizing applications in healthcare and electronics.

- In February 2025, Henkel inaugurated a new Application Engineering Center in Chennai, India, to accelerate adhesive product development for electronics.

- In January 2025, H.B. Fuller launched Advantra 9217 adhesive for mono cartons at PrintPack India 2025, designed for high-speed operations with enhanced weather resistance.

- In August 2024, Huntsman launched the AVALON® GECKO TPU range, offering slip resistance for footwear applications while incorporating circularity principles.

Market Concentration & Characteristics

The Asia Pacific thermoplastic polyurethane (TPU) adhesive market exhibits a moderately concentrated structure, with a mix of established global players and regional manufacturers actively competing for market share. The market is characterized by rapid innovation, a growing emphasis on sustainable formulations, and increasing customization to cater to specific industrial needs. Leading companies maintain their dominance through strong R&D capabilities, diversified product portfolios, and extensive distribution networks. However, the presence of several mid-sized and emerging players has intensified competition, particularly in price-sensitive markets. The market’s dynamic nature is influenced by factors such as evolving regulatory standards, rising demand from end-use industries like automotive, electronics, and textiles, and the shift toward environmentally friendly adhesive solutions. Flexibility, heat resistance, and bonding efficiency remain critical product characteristics, prompting manufacturers to continuously upgrade performance parameters. Additionally, proximity to manufacturing hubs and raw material availability contribute to regional competitiveness, shaping a market driven by performance, compliance, and cost-effectiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rapid industrialization and urbanization in countries like China, India, and Vietnam are boosting demand for TPU adhesives in construction and infrastructure projects.

- The automotive sector’s shift towards lightweight and electric vehicles is increasing the adoption of TPU adhesives for component bonding and weight reduction.

- Expansion of the electronics industry, particularly in South Korea and Japan, is driving the need for TPU adhesives in device assembly due to their flexibility and durability.

- Growing consumer awareness and regulatory pressures are leading manufacturers to develop eco-friendly, low-VOC, and bio-based TPU adhesives.

- Advancements in 3D printing technologies are opening new applications for TPU adhesives in customized manufacturing processes.

- The medical industry’s expansion is creating opportunities for TPU adhesives in medical devices and wearable technology applications.

- Intensifying competition among key players is fostering innovation and strategic partnerships to enhance product offerings and market reach.

- The footwear industry’s growth, especially in China, continues to be a significant driver for TPU adhesive consumption.

- Emerging economies in Southeast Asia are becoming lucrative markets due to increasing manufacturing activities and foreign investments.

- Ongoing research and development efforts are expected to yield high-performance TPU adhesives with enhanced properties, catering to diverse industrial needs.