| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Haptic Feedback System Market Size 2024 |

USD 3,051.82 Million |

| Automotive Haptic Feedback System Market, CAGR |

8.92% |

| Automotive Haptic Feedback System Market Size 2032 |

USD 6,344.38 Million |

Market Overview

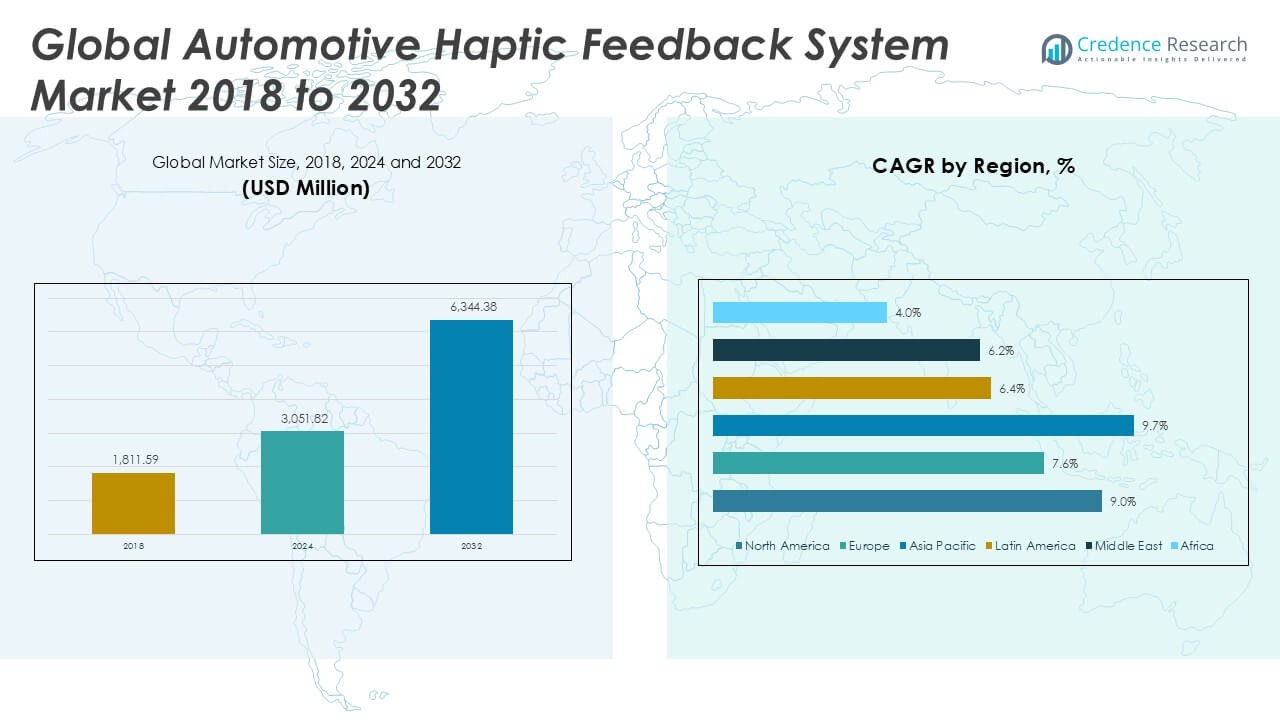

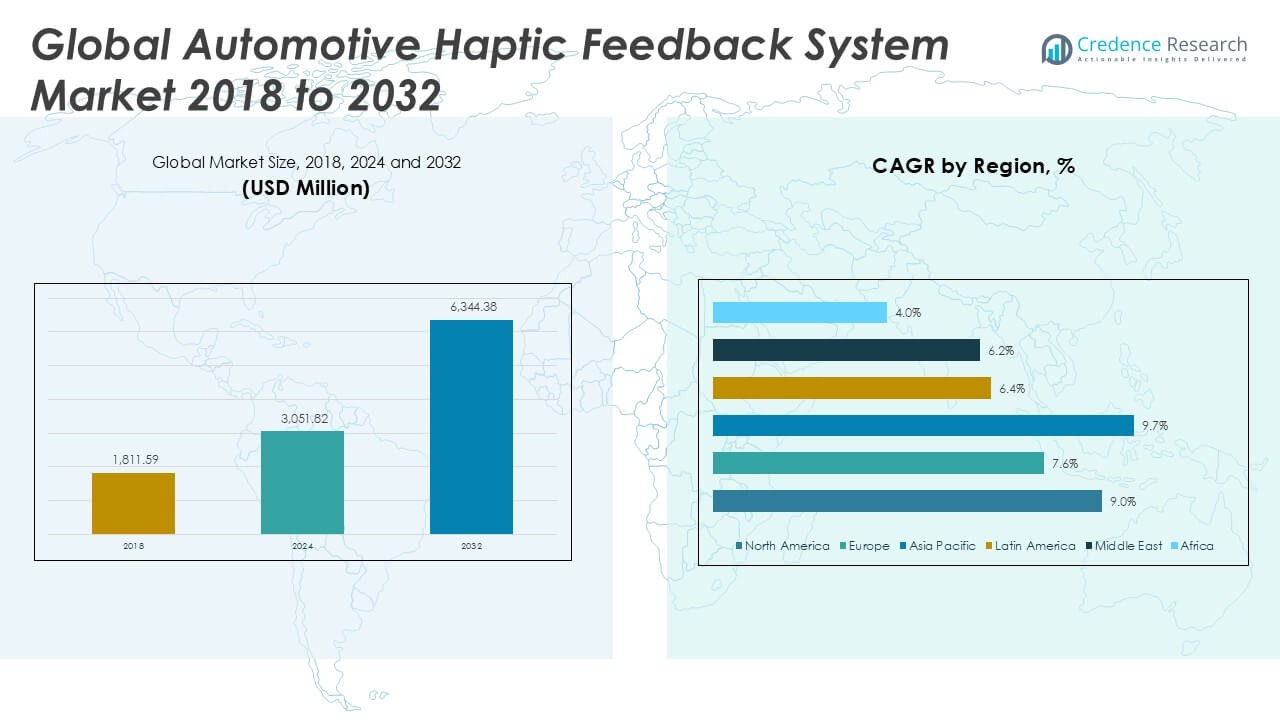

The Automotive Haptic Feedback System Market size was valued at USD 1,811.59 million in 2018, reached USD 3,051.82 million in 2024, and is anticipated to reach USD 6,344.38 million by 2032, at a CAGR of 8.92% during the forecast period.

The Automotive Haptic Feedback System Market is driven by rising demand for enhanced in-vehicle user experiences, increasing adoption of advanced driver assistance systems (ADAS), and the growing integration of touch-based interfaces in modern vehicles. Automakers are prioritizing intuitive controls and improved safety features, prompting wider deployment of haptic technologies in dashboards, steering wheels, and infotainment systems. Stringent safety regulations and the push for distraction-free driving further fuel market growth, as haptic feedback enables drivers to receive tactile alerts without diverting attention from the road. Key trends shaping the market include rapid advancements in sensor technology, increasing investment in human-machine interface (HMI) innovations, and the shift toward electric and autonomous vehicles, which rely on sophisticated control interfaces. As consumer expectations for connectivity and personalization continue to rise, manufacturers are focusing on delivering immersive, responsive, and reliable haptic solutions to differentiate their offerings and capture a competitive edge.

The geographical analysis of the Automotive Haptic Feedback System Market highlights significant growth across North America, Europe, and Asia Pacific, with countries such as the United States, Germany, China, and Japan leading in adoption due to their advanced automotive industries and focus on user experience innovation. Demand rises rapidly in Asia Pacific, driven by strong automotive manufacturing capabilities and increasing integration of digital technologies in vehicles. Key players shaping this market include ALPS Alpine, known for its advanced haptic technologies and global reach; Denso, which leverages deep automotive expertise and partnerships; and Immersion Corporation, a leader in haptic feedback solutions for user interfaces. Continental and Bosch also play major roles by integrating haptic feedback into their broader automotive systems portfolios. These companies drive continuous innovation, ensuring reliable, responsive, and immersive in-vehicle experiences for a diverse, global customer base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Haptic Feedback System Market was valued at USD 3,051.82 million in 2024 and is projected to reach USD 6,344.38 million by 2032, registering a CAGR of 8.92% during the forecast period.

- Growing demand for enhanced user experiences and safer, distraction-free driving is a major driver, pushing automakers to integrate haptic feedback into vehicle interfaces, controls, and infotainment systems.

- Increasing adoption of advanced driver assistance systems and the shift toward electric and autonomous vehicles fuel the need for intuitive haptic solutions that deliver tactile alerts and improve human-machine interaction.

- Market trends show a rapid expansion of touch-based and multi-modal interfaces, with manufacturers focusing on miniaturization, cost-effective integration, and personalized, connected in-cabin experiences.

- Leading companies such as ALPS Alpine, Denso, Immersion, Bosch, and Continental drive the competitive landscape, leveraging technological innovation, global partnerships, and broad automotive expertise.

- High development costs, technical integration challenges, and user acceptance issues restrain market growth, requiring continued investment in research, quality assurance, and consumer education.

- Asia Pacific leads in market growth and adoption, supported by China, Japan, and South Korea, while North America and Europe maintain strong demand driven by technological advancement and regulatory focus on safety; other regions like Latin America, the Middle East, and Africa show steady but moderate expansion.

Market Drivers

Rising Demand for Enhanced Driver Safety and Experience

Automotive manufacturers are increasingly prioritizing driver safety and user experience, making haptic feedback systems integral to new vehicle designs. The Automotive Haptic Feedback System Market benefits from the growing emphasis on reducing driver distraction by enabling tactile alerts through steering wheels, seats, and touchscreens. Haptic feedback systems help drivers receive critical notifications and navigation cues without taking their eyes off the road, supporting regulatory efforts focused on accident prevention. Growing adoption of advanced driver assistance systems (ADAS) amplifies the need for intuitive and responsive feedback mechanisms. Vehicle OEMs recognize that enhancing driver awareness and minimizing cognitive load contributes to both road safety and customer satisfaction. Consumer demand for seamless interaction and intuitive control interfaces drives further integration of haptic technology into mainstream models.

- For instance, ALPS Alpine equipped over 4.2 million vehicles globally in 2022 with its tactile haptic steering modules, enabling drivers to receive lane departure and collision alerts directly through their hands.

Integration with Next-Generation Infotainment and Control Systems

The shift toward digital dashboards and multifunctional touch displays has created a strong market pull for sophisticated haptic feedback solutions. The Automotive Haptic Feedback System Market leverages innovation in touch interfaces, offering tactile responses that replicate mechanical buttons and improve user control accuracy. Automakers are deploying haptic feedback across infotainment, climate control, and navigation systems to simplify complex menu navigation. Consumers expect responsive and reliable interfaces that maintain engagement and reduce the risk of operational errors. The move toward minimalistic interiors with fewer physical controls accelerates demand for advanced haptic technology. User-centric design trends reinforce the importance of haptic feedback in delivering premium vehicle experiences.

- For instance, Continental integrated its patented haptic touch technology into over 250,000 digital dashboards in European vehicles in 2023, offering real-time vibration cues for more than 30 unique virtual control functions per vehicle.

Technological Advancements and Human-Machine Interface Innovations

Rapid progress in sensor technology, microcontrollers, and actuator performance supports new capabilities for haptic feedback systems. The Automotive Haptic Feedback System Market benefits from research investments and collaborations between OEMs and technology firms. It leverages improved precision, response time, and customization features to enable differentiated product offerings. Innovations such as multi-modal feedback, localized vibration, and force-feedback enable richer, more nuanced interactions. Automakers pursue partnerships to stay ahead in delivering state-of-the-art human-machine interfaces. Consumers expect consistent and immersive tactile feedback, pushing market players to invest in R&D.

Influence of Electric and Autonomous Vehicle Development

The rise of electric and autonomous vehicles accelerates the adoption of haptic feedback technologies. The Automotive Haptic Feedback System Market aligns with the trend toward highly automated, digital-first vehicle architectures. Haptic systems play a crucial role in driver-vehicle communication in semi-autonomous and autonomous modes, delivering tactile cues for manual intervention or situational awareness. EV manufacturers leverage haptic feedback to enhance infotainment and climate control systems, meeting consumer expectations for innovative interfaces. The competitive landscape evolves rapidly as new entrants and established OEMs integrate haptic technology to differentiate their models. Regulatory bodies and industry standards encourage further adoption, ensuring safety and usability in future mobility solutions.

Market Trends

Increasing Adoption in Electric and Autonomous Vehicles

Electric and autonomous vehicles are driving the adoption of advanced haptic feedback systems, reflecting a shift toward digital and intuitive in-cabin experiences. The Automotive Haptic Feedback System Market adapts to the changing vehicle landscape by embedding tactile interfaces in steering wheels, control panels, and seats to enhance driver communication and safety. Haptic feedback allows seamless transition between manual and autonomous driving modes by providing clear, non-visual cues to occupants. Manufacturers seek to distinguish their models with advanced, responsive touch-based systems that appeal to tech-savvy consumers. The rise in EV platforms, which often feature large digital displays and minimalistic interiors, amplifies the need for innovative haptic solutions. Tactile feedback technologies support safer interactions, especially in hands-free and automated environments.

- For instance, Immersion Corporation partnered with a major EV automaker in 2023 to supply more than 600,000 vehicles with haptic-enabled infotainment systems that deliver over 20 unique tactile responses for automated driving scenarios.

Expansion of Touch-Based and Multi-Modal Interfaces

Touch-based interfaces continue to expand across automotive cockpits, replacing traditional mechanical controls with sleek digital displays. The Automotive Haptic Feedback System Market benefits from growing demand for multi-modal feedback, combining vibration, force, and motion to deliver immersive and intuitive user experiences. Automakers introduce haptic feedback in infotainment systems, climate control, and gear shifters to create a sense of control and realism. Multi-modal solutions increase user confidence by providing physical confirmation of virtual actions. User interface design evolves to incorporate subtle but distinct tactile cues, supporting both functionality and aesthetics. Manufacturers compete to offer personalized and adaptive haptic responses tailored to driver preferences.

- For instance, Bosch deployed its multi-modal haptic cockpit solutions in over 320,000 vehicles in 2023, each featuring up to 40 configurable tactile cues across touchscreens, gear shifters, and steering controls.

Advances in Miniaturization and Cost-Effective Integration

Technological advances enable miniaturization of haptic actuators and components, supporting integration into thinner, lighter vehicle displays and surfaces. The Automotive Haptic Feedback System Market leverages scalable and energy-efficient hardware to reduce production costs and expand adoption in mid-range and entry-level vehicles. Automakers and suppliers collaborate to create standardized platforms that streamline integration while maintaining performance. Cost-effective solutions allow broader market penetration and encourage OEMs to deploy haptic feedback beyond luxury segments. Enhanced durability and lower power consumption contribute to the appeal of these systems for long-term reliability. This trend supports the democratization of haptic technology in the automotive industry.

Growing Emphasis on Personalization and Connected Experiences

Manufacturers are focusing on delivering personalized, connected in-vehicle experiences, fueling innovation in haptic feedback applications. The Automotive Haptic Feedback System Market evolves to meet consumer expectations for adaptive and context-aware tactile responses that reflect individual preferences and driving scenarios. Integration with connected car ecosystems allows haptic systems to sync with smartphones, navigation, and entertainment platforms. OEMs invest in software-driven customization, enabling over-the-air updates for haptic profiles and feature enhancements. Personalization drives higher customer engagement, making haptic feedback a differentiator in competitive automotive markets. The trend toward connected and intelligent vehicles accelerates the development of advanced, user-centric haptic solutions.

Market Challenges Analysis

Complexity of Integration and High Development Costs

Automotive manufacturers face significant challenges when integrating haptic feedback systems into modern vehicle architectures. The Automotive Haptic Feedback System Market encounters technical barriers related to compatibility with diverse infotainment platforms, touchscreens, and advanced driver assistance systems. Customizing haptic technology for different vehicle models and brands often requires substantial engineering resources, specialized components, and extensive testing. These factors contribute to high development costs and longer time-to-market for new solutions. Limited standardization across the industry complicates supply chain coordination and creates inefficiencies for OEMs and suppliers. The complexity of delivering seamless, reliable haptic feedback in various environments remains a key hurdle for market expansion.

Reliability Concerns and User Acceptance Issues

Ensuring the long-term reliability and consistent performance of haptic feedback systems presents ongoing challenges for automakers. The Automotive Haptic Feedback System Market addresses concerns over system durability under extreme temperatures, vibration, and heavy use typical in automotive environments. Technical malfunctions or inconsistent tactile responses can reduce driver trust and hinder widespread adoption. Some consumers may find haptic feedback distracting or unfamiliar, creating a learning curve that impacts user acceptance. OEMs must balance the sensitivity and strength of haptic cues to meet diverse user expectations while maintaining safety and usability. Overcoming these challenges requires continuous investment in quality assurance, user testing, and consumer education.

Market Opportunities

Expansion into Electric and Autonomous Vehicle Segments

The shift toward electric and autonomous vehicles presents significant opportunities for haptic feedback technology providers. The Automotive Haptic Feedback System Market can leverage the growing demand for intuitive, non-visual communication between the vehicle and occupants. Electric vehicles, with their digital-first interiors and advanced control systems, require innovative interfaces that enhance user experience and safety. Autonomous vehicles, in particular, benefit from haptic systems that alert passengers to mode changes or prompt manual intervention. This transition allows technology companies to develop tailored solutions for next-generation vehicle platforms. The evolution of mobility concepts drives interest in more sophisticated and adaptive haptic feedback systems.

Customization and Connectivity for Enhanced User Experience

Rising consumer expectations for personalized and connected driving experiences offer new growth avenues for market players. The Automotive Haptic Feedback System Market can respond by developing customizable haptic profiles that adapt to individual preferences and changing driving scenarios. Integration with connected car technologies enables over-the-air updates, remote diagnostics, and feature enhancements, creating continuous value for users. Automakers seeking to differentiate their models are investing in advanced haptic solutions that align with smart device ecosystems. This environment fosters collaboration between OEMs, technology providers, and software developers to deliver seamless, user-centric interfaces. The growing importance of digital interaction in vehicles increases demand for innovative and responsive haptic feedback systems.

Market Segmentation Analysis:

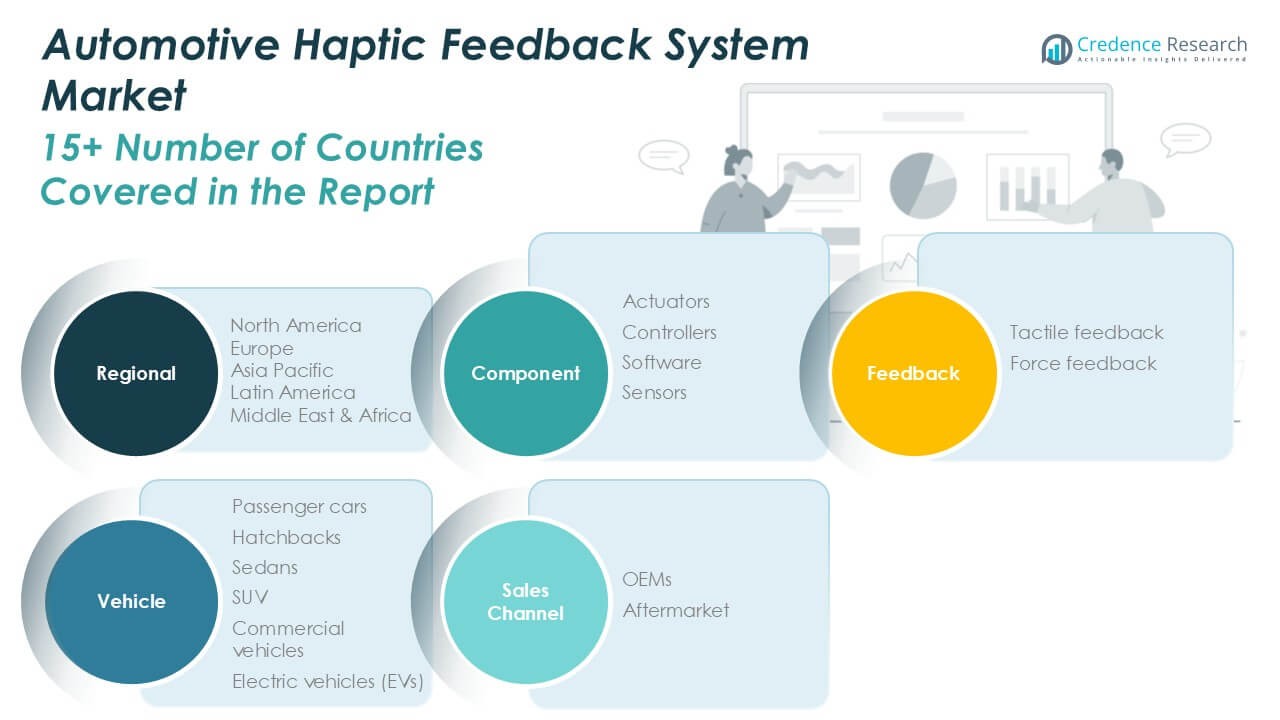

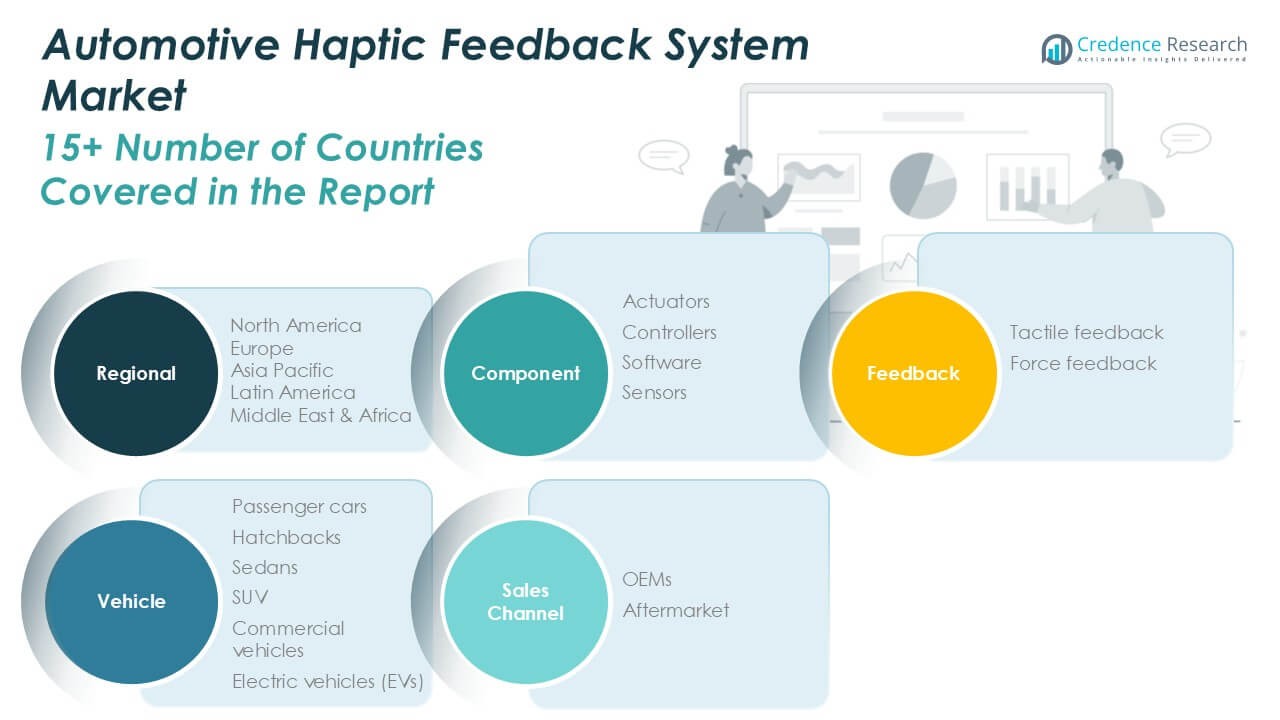

By Component:

The market covers actuators, controllers, software, and sensors. Actuators form the backbone of haptic systems, translating electronic signals into precise tactile sensations for the user. Controllers manage input data and coordinate actuator responses, ensuring seamless operation across multiple functions. Software provides the intelligence behind haptic feedback, adapting responses to user behavior and specific driving situations. Sensors detect user inputs and environmental changes, supporting the system’s responsiveness and safety.

- For instance, TDK shipped over 17 million piezoelectric actuators in 2023, which are critical for delivering high-definition tactile feedback in automotive touch interfaces.

By Feedback:

The market is segmented into tactile feedback and force feedback. Tactile feedback dominates the industry, delivering subtle vibrations or pulses that guide driver interaction with touchscreens and control panels. Force feedback offers more advanced capabilities by simulating resistance or pressure, creating a realistic feel for physical buttons, steering wheels, or pedals. This segment supports immersive and intuitive control experiences, appealing to both drivers and manufacturers looking to differentiate their vehicles through enhanced interfaces.

- For instance, ZF Friedrichshafen developed a force feedback steering system for over 100,000 luxury vehicles, allowing drivers to experience up to 6 Nm of variable resistance for real-time adaptive road feel.

By Vehicle:

The Automotive Haptic Feedback System Market is further categorized by vehicle type, encompassing passenger cars, hatchbacks, sedans, SUVs, commercial vehicles, and electric vehicles (EVs). Passenger cars, sedans, and hatchbacks represent a large share of adoption due to high demand for advanced infotainment and driver assistance features in these segments. SUVs increasingly feature haptic feedback systems to enhance premium in-cabin experiences and meet consumer expectations for safety and convenience. Commercial vehicles are integrating haptic solutions to support safer, more ergonomic operations in demanding environments. Electric vehicles (EVs) offer significant growth potential, leveraging haptic technologies to complement their digital-first interiors and reinforce brand differentiation.

Segments:

Based on Component:

- Actuators

- Controllers

- Software

- Sensors

Based on Feedback:

- Tactile feedback

- Force feedback

Based on Vehicle:

- Passenger cars

- Hatchbacks

- Sedans

- SUV

- Commercial vehicles

- Electric vehicles (EVs)

Based on Sales Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Haptic Feedback System Market

North America Automotive Haptic Feedback System Market grew from USD 540.87 million in 2018 to USD 897.31 million in 2024 and is projected to reach USD 1,873.02 million by 2032, reflecting a compound annual growth rate (CAGR) of 9.0%. North America is holding a 30% market share. The United States and Canada lead regional demand due to their advanced automotive industries and high adoption of premium vehicles equipped with cutting-edge user interfaces. Regulatory standards focused on driver safety and technological integration encourage investment in haptic feedback solutions. Leading automakers and technology innovators in the region drive development, fostering a competitive and innovative environment. The market continues to expand with increased deployment of electric and autonomous vehicles, particularly in the U.S.

Europe Automotive Haptic Feedback System Market

Europe Automotive Haptic Feedback System Market grew from USD 339.58 million in 2018 to USD 540.85 million in 2024 and is projected to reach USD 1,022.86 million by 2032, at a CAGR of 7.6%. Europe holds a 16% market share, with Germany, France, and the United Kingdom as key contributors. Automakers in the region focus on integrating haptic feedback into advanced driver assistance and infotainment systems to meet stringent safety and user experience standards. The presence of leading luxury vehicle manufacturers accelerates adoption of innovative interfaces. Investments in research and development, along with a strong emphasis on user-centric design, support sustained market growth. Regulatory pressures for improved road safety and connected vehicle technology further enhance market prospects.

Asia Pacific Automotive Haptic Feedback System Market

Asia Pacific Automotive Haptic Feedback System Market grew from USD 810.60 million in 2018 to USD 1,414.78 million in 2024 and is anticipated to reach USD 3,116.52 million by 2032, registering the highest CAGR of 9.7%. Asia Pacific dominates with a 49% market share. China, Japan, and South Korea drive demand, supported by large-scale automotive manufacturing, rapid adoption of electric vehicles, and growing middle-class consumer base. Regional manufacturers emphasize digital cockpit solutions and smart infotainment, integrating haptic feedback for differentiation. Strong government initiatives to promote EV adoption fuel technology investments. The region experiences high demand for innovative, affordable in-vehicle experiences.

Latin America Automotive Haptic Feedback System Market

Latin America Automotive Haptic Feedback System Market grew from USD 58.79 million in 2018 to USD 97.24 million in 2024 and is forecast to reach USD 168.14 million by 2032, reflecting a CAGR of 6.4%. Latin America accounts for a 3% market share. Brazil and Mexico represent the primary markets, benefiting from automotive sector modernization and growing demand for safety-enhanced vehicles. OEMs expand portfolios with advanced infotainment and safety features, supporting gradual market growth. Economic volatility and cost-sensitive buyers influence the pace of technology adoption. Partnerships with global suppliers help introduce advanced haptic feedback systems in mid-range models.

Middle East Automotive Haptic Feedback System Market

Middle East Automotive Haptic Feedback System Market grew from USD 43.90 million in 2018 to USD 66.61 million in 2024 and is expected to reach USD 113.10 million by 2032, with a CAGR of 6.2%. The Middle East holds a 2% market share. Key countries include the United Arab Emirates and Saudi Arabia, where luxury and premium vehicle sales drive demand for advanced haptic technologies. Strong consumer interest in innovative automotive features supports moderate market growth. Regional OEMs focus on enhancing vehicle safety and user experience through technology partnerships. The market benefits from investment in smart mobility and connected vehicle solutions.

Africa Automotive Haptic Feedback System Market

Africa Automotive Haptic Feedback System Market grew from USD 17.86 million in 2018 to USD 35.03 million in 2024 and is anticipated to reach USD 50.74 million by 2032, at a CAGR of 4.0%. Africa accounts for a 1% market share. South Africa leads regional adoption, supported by the presence of international automotive brands and gradual modernization of vehicle fleets. Cost sensitivity and limited access to advanced technology slow the market’s growth. International partnerships and targeted investments in urban mobility may expand the adoption of haptic feedback systems. OEMs focus on building awareness and demonstrating the value of advanced interfaces to gain traction in this emerging market.

Key Player Analysis

- ALPS Alpine

- Denso

- Immersion

- Panasonic Automotive

- TDK

- ZF Friedrichshafen

- Bosch

- Continental

- Texas Instruments

- Aptiv

Competitive Analysis

The competitive landscape of the Automotive Haptic Feedback System Market features a mix of established technology firms and leading automotive suppliers, each leveraging innovation, global reach, and strategic partnerships to gain market share. Key players such as ALPS Alpine, Denso, Immersion, Bosch, Continental, Panasonic Automotive, ZF Friedrichshafen, TDK, Texas Instruments, and Aptiv hold strong positions through their advanced product portfolios and deep integration capabilities. These companies invest heavily in research and development to deliver highly responsive and reliable haptic feedback solutions, focusing on precision, durability, and compatibility with evolving vehicle architectures. The market’s key differentiators include integration capabilities, software innovation, and the ability to scale products across multiple vehicle segments, from premium to mass-market models. Strategic partnerships with original equipment manufacturers (OEMs) and technology firms play a critical role in expanding product reach and ensuring seamless compatibility with evolving automotive architectures. Companies emphasize end-to-end system solutions that combine haptic feedback with broader safety, infotainment, and connectivity platforms. Continuous advancements in actuator technology, miniaturization, and user interface design contribute to sustained market growth. The competitive environment ensures a steady flow of new features and performance improvements, supporting the automotive industry’s pursuit of safer, more intuitive, and engaging in-vehicle experiences.

Recent Developments

- In May 2025, Vishay Intertechnology introduced four new AEC-Q200 qualified IHPT solenoid-based haptic actuators for automotive applications. These actuators, featuring Immersion Corporation licenses, are designed for dashboards, touchscreens, and center consoles, streamlining the design process by eliminating the need for separate licenses to implement sophisticated haptic effects.

- In April 2025, Boreas Technologies announced that NIO has incorporated its advanced piezo-based haptic module into the TUI Bar of the NIO ET9 luxury electric vehicle. This integration enhances tactile responsiveness in the vehicle’s touch interface, aiming to improve driver interaction and safety.

- In January 2025, At CES 2025, BMW showcased its new iDrive operating system, featuring a heads-up display spanning the entire windshield and a redesigned steering wheel equipped with haptic feedback buttons. This system aims to enhance connectivity between the driver, vehicle, and road, improving the overall driving experience.

- In October 2024, Tesla introduced the refreshed Model 3 “Highland” featuring capacitive haptic buttons on the steering wheel, replacing traditional physical buttons for functions like turn signals and cruise control. This marks a growing trend in adopting solid-state haptic feedback controls in vehicle interiors to enhance driver interaction and safety.

Market Concentration & Characteristics

The Automotive Haptic Feedback System Market demonstrates moderate to high market concentration, with a select group of established technology providers and automotive suppliers controlling a significant share of global revenue. It exhibits characteristics of high entry barriers due to the need for advanced engineering expertise, significant research and development investments, and complex integration requirements with existing vehicle systems. The market favors companies with strong technical capabilities and global manufacturing footprints, allowing them to serve both premium and mass-market automotive segments. It places emphasis on innovation, reliability, and seamless user interface design, with OEMs seeking solutions that enhance safety, comfort, and in-cabin experiences. Continuous collaboration between suppliers and vehicle manufacturers supports ongoing product development and adaptation to regulatory changes. The Automotive Haptic Feedback System Market continues to evolve, driven by technological advancements, rising consumer expectations, and the automotive industry’s broader push toward connected, electric, and autonomous vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Feedback, Vehicle, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Automotive Haptic Feedback System Market will expand further with increasing adoption of electric and autonomous vehicles.

- Future development will include more refined multi-modal feedback combining force, vibration, and texture simulation.

- OEMs will integrate haptic solutions deeply with driver assistance and safety systems for more proactive alerts.

- Haptic technology will become more energy-efficient and compact, enabling use in slimmer, digital-first cabin designs.

- Over-the-air haptic profile updates will allow drivers to customize feedback preferences remotely.

- Collaboration between automotive suppliers and tech firms will accelerate innovation in sensor-actuator integration.

- Continued R&D will improve actuator durability to withstand harsh vehicle environments and ensure longevity.

- Haptic feedback will expand beyond cockpit controls to seats, doors, and steering wheels for immersive experiences.

- Regulatory emphasis on driver distraction reduction will drive wider integration of tactile alert systems.

- Future vehicles will offer context-aware haptic responses adjusted in real time based on driving conditions and user behavior.