Market Overview

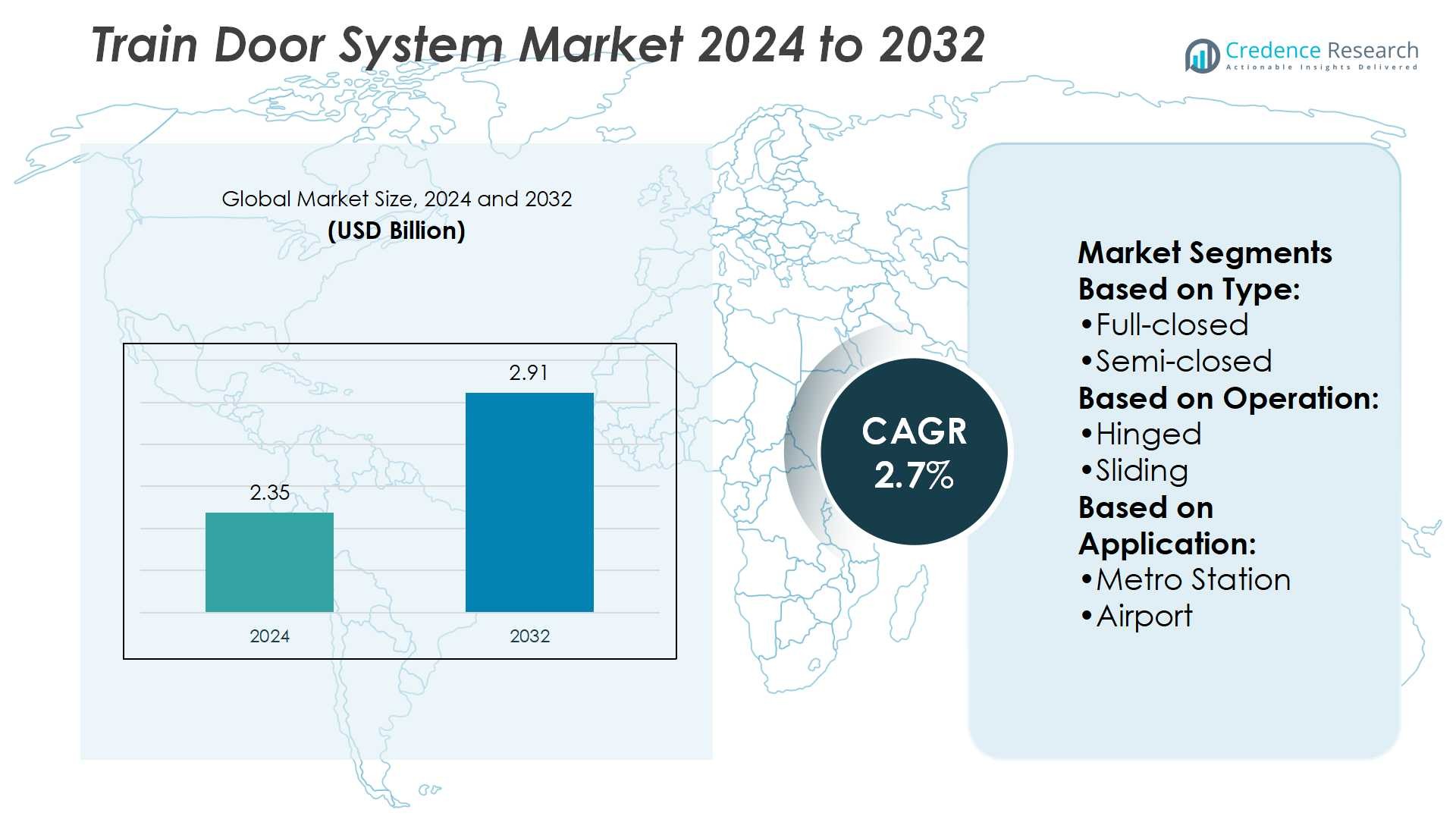

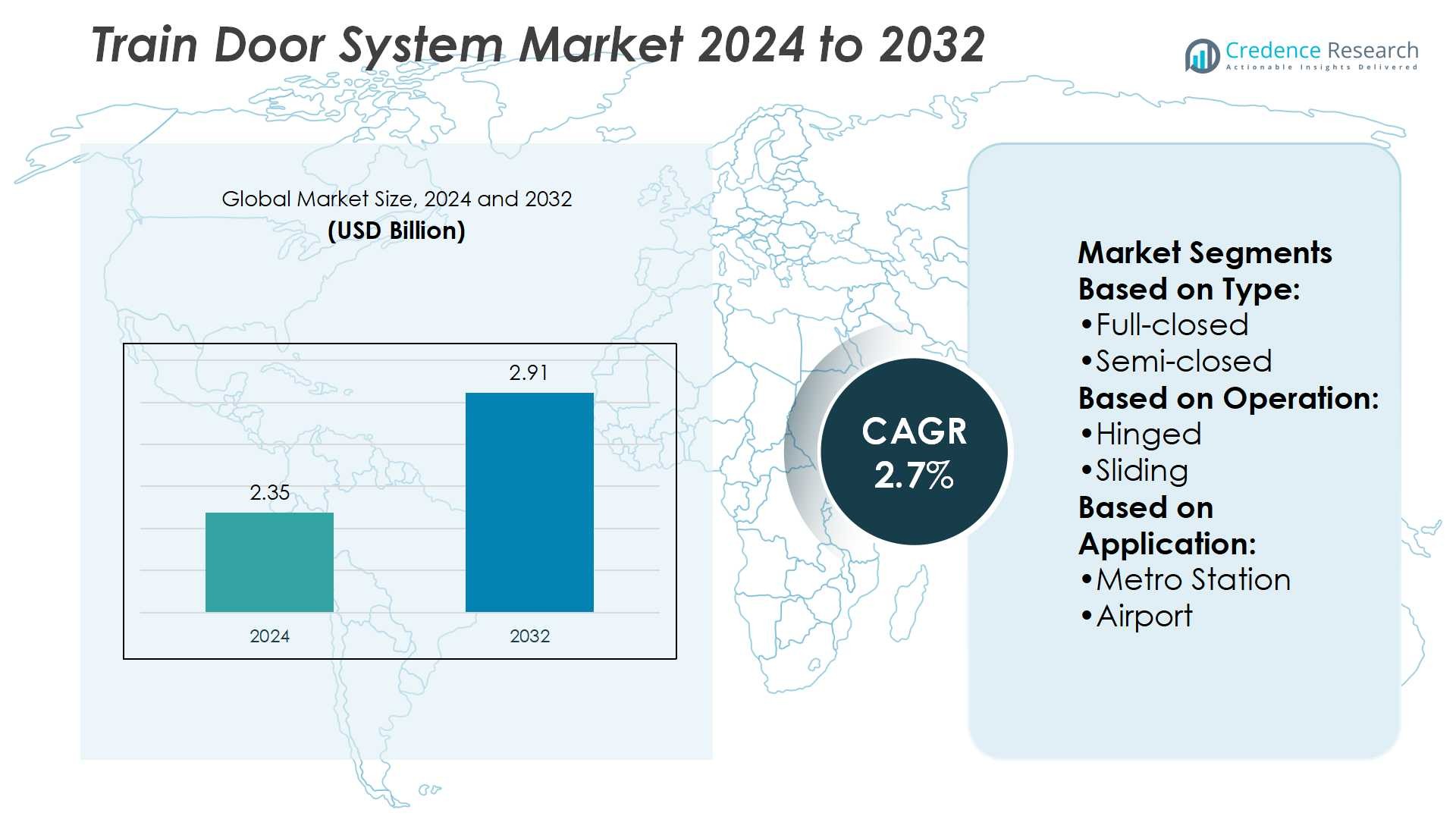

Train Door System Market size was valued USD 2.35 billion in 2024 and is anticipated to reach USD 2.91 billion by 2032, at a CAGR of 2.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Train Door System Market Size 2024 |

USD 2.35 Billion |

| Train Door System Market, CAGR |

2.7% |

| Train Door System Market Size 2032 |

USD 2.91 Billion |

The Train Door System Market is dominated by major players focusing on technological innovation, safety, and efficiency. Companies emphasize automated sliding, hinged, and retractable doors with advanced sensors, predictive maintenance, and energy-efficient designs to meet modern transit requirements. Strategic investments in R&D, fleet modernization projects, and smart rail integration strengthen their market positions. Asia Pacific emerges as the leading region, accounting for 35% of the global market share, driven by rapid urbanization, large-scale metro expansions, and high-speed rail developments in China, India, Japan, and South Korea. High passenger density and government-backed smart city initiatives further accelerate demand, providing manufacturers with opportunities to deploy modular, scalable, and technologically advanced door systems. The combination of fleet modernization, regulatory compliance, and digital integration reinforces Asia Pacific’s dominance in the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Train Door System Market was valued at USD 2.35 billion in 2024 and is projected to reach USD 2.91 billion by 2032, growing at a CAGR of 2.7%.

- Market growth is driven by modernization of transit fleets, rising urbanization, and demand for automated sliding, hinged, and retractable doors with safety features.

- Adoption of smart rail solutions, IoT-enabled predictive maintenance, and energy-efficient designs is a key trend shaping the market across metro, high-speed, and suburban rail segments.

- Competition is intense with players focusing on R&D, modular designs, and digital integration to enhance operational efficiency and safety compliance.

- Asia Pacific leads with 35% market share, followed by Europe at 28% and North America at 22%, while metro train doors dominate the segment share due to high passenger density and fleet expansions.

Market Segmentation Analysis:

By Type

The Train Door System Market, segmented by type, includes Full-closed, Semi-closed, and Half-height doors. Full-closed doors dominate the market, accounting for 52% of the share, driven by increasing safety regulations and passenger demand for secure boarding in high-speed and metro trains. Semi-closed doors are gaining traction in regional and commuter trains due to cost-effectiveness and moderate safety requirements. Half-height doors are primarily used in lightweight transit systems where ventilation and visibility are prioritized. Overall, the type segmentation reflects a growing focus on passenger safety, energy efficiency, and operational reliability.

- For instance, Hitachi’s Class 395 high-speed trains feature sliding-pocket full-closed doors positioned at one-third and two-thirds along each carriage, offering secure seal integrity in tunnels under high pressure-differential conditions.

By Operation

The market, segmented by operation, comprises Hinged, Sliding, and Retractable systems. Sliding doors hold the largest share at 58%, propelled by their smooth operation, space-saving design, and suitability for high-density metro and airport rail systems. Hinged doors remain relevant in low-speed commuter and regional trains due to lower maintenance costs and simple mechanisms. Retractable doors are emerging in modern, high-end train fleets for enhanced aesthetics and wider accessibility. Adoption trends indicate a shift toward automated, low-maintenance systems that enhance passenger convenience and operational efficiency.

- For instance, Doorson’s “300 thales” automatic sliding door system offers a clear opening width between 800 mm and 2000 mm for a single leaf and between 800 mm and 3000 mm for a two-leaf configuration.

By Application

Application-wise, the market includes Metro Stations, Airports, and Bus Stops. Metro stations dominate with 60% market share, driven by rapid urbanization, rising public transport usage, and government investments in mass transit infrastructure. Airports are increasing demand for advanced door systems in airport transit and shuttle trains to improve safety, reduce boarding time, and enhance passenger experience. Bus stop applications are limited to feeder transit services with half-height or semi-closed door systems. Overall, market growth is fueled by urban mobility expansion, passenger safety regulations, and integration of automated transit solutions.

Key Growth Drivers

Rising Urbanization and Public Transit Expansion

Increasing urban population and government investments in metro, light rail, and suburban train networks drive demand for advanced train door systems. Modern transit authorities prioritize efficiency, passenger safety, and operational reliability. Automatic sliding and retractable doors are being widely adopted in new rolling stock to enhance boarding speed and reduce dwell time. Upgrades in existing fleets further support market growth, particularly in Asia Pacific and Europe, where urban transit expansion is accelerating and safety regulations are becoming more stringent.

- For instance, Huawei LTE-M deployment in Shenyang Metro uses base stations with a coverage radius of 1.2 kilometers per station, reducing number of trackside devices by over 80% compared to the WiFi + TETRA system.

Technological Advancements and Smart Integration

Integration of smart technologies, including sensors, IoT connectivity, and predictive maintenance, enhances train door reliability and safety. Advanced diagnostics allow operators to monitor door performance, reduce downtime, and optimize energy consumption. Automated and semi-automated systems with fail-safe mechanisms meet evolving safety standards and passenger expectations. These technological improvements are particularly favored in high-speed rail networks and metro systems, creating significant growth opportunities for manufacturers focusing on innovation-driven solutions.

- For instance, in tests of Toshiba’s GoA2.5 automatic train operation, a test train stopped with accuracy within 50 centimeters of the target platform edge, even when operating at 70 km/h with obstacle detection out to 200 meters ahead.

Safety and Regulatory Compliance Requirements

Stringent safety standards by authorities such as the European Union Agency for Railways (ERA) and Indian Railways promote adoption of advanced door systems. Features like obstacle detection, emergency egress, and interlocking mechanisms reduce accidents and passenger injuries. Compliance with fire, anti-pinch, and anti-collision regulations compels transit operators to upgrade conventional doors. Regulatory pressure, combined with increasing passenger safety awareness, ensures that modern, automated door solutions remain a core requirement across urban, intercity, and high-speed rail projects globally.

Key Trends & Opportunities

Electrification and Energy-Efficient Designs

Train door systems are increasingly adopting low-power motors, regenerative braking, and energy-efficient materials. Lightweight aluminum and composite frames reduce energy consumption and maintenance costs. The shift toward green rail initiatives presents opportunities for manufacturers to supply sustainable solutions. In addition, integration with smart train management systems enhances overall efficiency, positioning energy-efficient door systems as a differentiating factor for transit authorities focusing on operational sustainability.

- For instance, Siemens’ SIDOOR automatic door control system offers a versatile range of solutions that, depending on the specific motor and controller, can move door leaves weighing up to 700 kg.

Growing Adoption in High-Speed and Metro Rail

High-speed and metro rail networks are driving demand for precision-engineered doors with rapid opening/closing cycles. Sliding and retractable doors are preferred for reduced noise, enhanced passenger comfort, and optimized station dwell times. Urbanization in Asia Pacific and expansion of metro networks in North America and Europe provide significant adoption opportunities. Manufacturers offering scalable and modular door solutions are gaining traction as transit authorities invest in both new lines and fleet modernization projects.

Digitalization and Predictive Maintenance Opportunities

Integration of sensors and IoT-enabled monitoring enables predictive maintenance, minimizing service disruptions and repair costs. Real-time analytics help operators detect faults, schedule preventive servicing, and optimize spare parts management. This trend offers a recurring revenue opportunity for service providers and strengthens long-term customer relationships. Digital solutions also allow for customization and remote troubleshooting, increasing adoption in both urban and intercity transit systems, while supporting government smart city initiatives globally.

Key Challenges

High Initial Capital Investment

Advanced train door systems involve significant upfront costs due to automation, safety features, and technology integration. Smaller transit authorities may face budget constraints, delaying modernization projects. High installation and integration expenses can reduce short-term adoption rates, particularly in developing regions. Manufacturers must balance affordability with performance and safety, often offering financing options or phased deployment strategies to overcome financial barriers and encourage fleet-wide upgrades.

Maintenance Complexity and Operational Downtime

Automated and sensor-equipped doors require specialized maintenance and skilled technicians. Malfunctioning doors can lead to service delays, affecting operational efficiency and passenger satisfaction. Retrofitting older train fleets with modern door systems presents additional technical challenges. High maintenance complexity and potential downtime increase operational expenditure for rail operators. Market players need to provide robust after-sales support, training, and predictive maintenance services to mitigate these challenges and ensure system reliability.

Regional Analysis

North America

North America holds 22% of the global Train Door System Market, driven by extensive metro networks, suburban rail expansions, and high-speed rail projects in the U.S. and Canada. Government initiatives to modernize public transit and enhance passenger safety promote automated and semi-automated door adoption. Technological advancements, including sensor-based obstacle detection and predictive maintenance systems, are widely integrated across metro and intercity fleets. Strong regulations on safety and accessibility, combined with increasing urban transit ridership, create demand for energy-efficient, low-maintenance door systems. Investments in fleet upgrades further support market growth across the region.

Europe

Europe accounts for 28% of the Train Door System Market, supported by advanced rail networks in Germany, France, and the UK. Stringent safety and accessibility regulations drive adoption of automated sliding and retractable doors. Urbanization and expansion of metro networks in major cities boost demand for energy-efficient and reliable door systems. High-speed rail networks, particularly in France and Spain, require precision-engineered doors with rapid opening/closing cycles. Strong focus on passenger safety, environmental sustainability, and technological innovation ensures steady market growth, creating opportunities for manufacturers offering advanced, modular, and smart door solutions.

Asia Pacific

Asia Pacific dominates with 35% market share, fueled by rapid urbanization, industrialization, and large-scale metro and high-speed rail projects in China, India, Japan, and South Korea. Government investments in public transit, smart city initiatives, and fleet modernization programs drive demand for automated train doors. Rising population density in urban centers necessitates fast, safe, and energy-efficient door systems to optimize boarding and reduce dwell time. Manufacturers are expanding local production and service capabilities to cater to regional requirements, while technological integration, including IoT-based predictive maintenance, strengthens adoption across metro, intercity, and high-speed rail networks.

Latin America

Latin America accounts for 8% market share, led by metro expansions and suburban rail upgrades in Brazil, Mexico, and Chile. Increasing urban population and traffic congestion drive investments in modern transit infrastructure, creating demand for automated sliding, hinged, and semi-closed door systems. Safety and energy efficiency are key focus areas, prompting adoption of sensor-enabled doors and predictive maintenance systems. While limited budget allocation in some countries restricts rapid adoption, government-backed modernization programs and public-private partnerships present growth opportunities. Manufacturers focusing on cost-effective, low-maintenance solutions benefit from rising transit modernization initiatives across the region.

Middle East & Africa

The Middle East & Africa holds 7% of the market, driven by metro expansions in the UAE, Saudi Arabia, and Egypt. Urban transit projects in major cities emphasize automated, high-reliability door systems to enhance safety and efficiency. Investments in rail infrastructure, particularly in high-speed rail and metro networks, encourage adoption of sliding and retractable doors with advanced sensors. Government-backed projects promoting smart urban mobility create opportunities for modern door solutions. Limited but growing adoption, combined with the introduction of technological and safety standards, positions this region as a niche but strategic market for global players.

Market Segmentations:

By Type:

By Operation:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Train Door System Market companies such as ABB, Alstom, Cisco Systems, Hitachi Rail, Huawei Technologies, IBM, Indra Sistemas, Siemens Mobility, Thales, and Toshiba. The Train Door System Market is highly competitive, driven by continuous technological innovation and safety enhancements. Manufacturers focus on developing automated sliding, hinged, and retractable doors with integrated sensors, predictive maintenance, and energy-efficient designs. Companies differentiate through advanced diagnostics, reliability, and compliance with stringent regional safety standards. The market also sees growth from modernization of existing transit fleets, rapid urbanization, and expansion of metro and high-speed rail networks. Adoption of smart rail solutions, digital monitoring, and modular designs enhances operational efficiency and reduces downtime. Strong after-sales support, service contracts, and maintenance programs further strengthen market positioning. High infrastructure investments in Asia Pacific, Europe, and North America intensify competition while fostering opportunities for innovative, cost-effective, and sustainable door system solutions globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Alstom opened its first signaling competence center in Astana, Kazakhstan, to support regional railway digital transformation, offering local engineering, customized solutions, and training for Kazakhstan’s rail network.

- In August 2025, ProRail selects Nokia to modernize the Netherlands’ GSM-Rail core network, transitioning to a fully cloud-native infrastructure that supports future FRMCS deployment, improving uptime, cost-efficiency, and operational agility.

- In October 2024, Hitachi Rail was selected to implement a Mobility-as-a-Service (MaaS) solution for Etihad Rail, which is responsible for developing and operating the UAE’s National Railway Network. This initiative will cover a 900-kilometer railway stretching from Ghuwaifat, near the Saudi border, to Fujairah, providing an integrated digital platform aimed at enhancing passenger mobility.

- In September 2024, Indra entered into a collaboration with Lithuanian Railways to develop a pioneering digital signalling interlocking system. The primary goal is to create a digital interlocking device that adheres to open standards and is compatible with the European ERTMS Level-2 signalling system. This compatibility aims to enhance safety and efficiency across railway networks in Europe.

- In June 2024, ADLINK launched next-generation railway solutions including the AVA-7200 edge AI server, AVA-1000 train to ground gateway, and Passenger Information Display System (PIDS). The AVA-1000 features a fanless design, durability in extended temperature ranges, and advanced TPM 2.0 technology, safeguarding data integrity and privacy.

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated sliding and retractable doors will increase across metro and high-speed rail networks.

- Integration of IoT and predictive maintenance will enhance reliability and reduce operational downtime.

- Energy-efficient and lightweight door designs will gain preference in new and retrofitted fleets.

- Safety regulations will drive continuous upgrades and modernization of existing train doors.

- Expansion of urban transit systems in Asia Pacific and Latin America will boost market demand.

- Modular and scalable door solutions will support diverse train configurations and reduce installation time.

- Smart monitoring systems will enable real-time diagnostics and improve operational efficiency.

- Digitalization and data-driven maintenance will create recurring service and aftermarket opportunities.

- Passenger comfort and accessibility features will become standard in future train door systems.

- Collaboration between transport authorities and manufacturers will accelerate innovation and adoption globally.