Market Overview

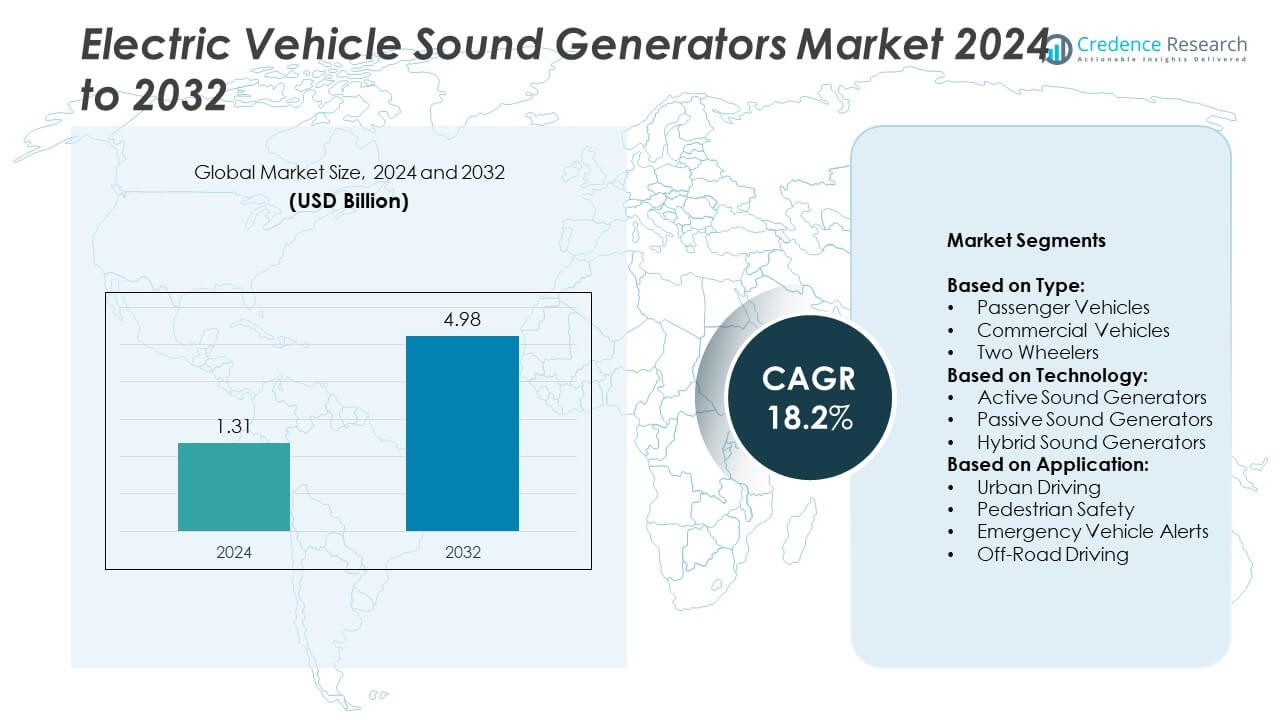

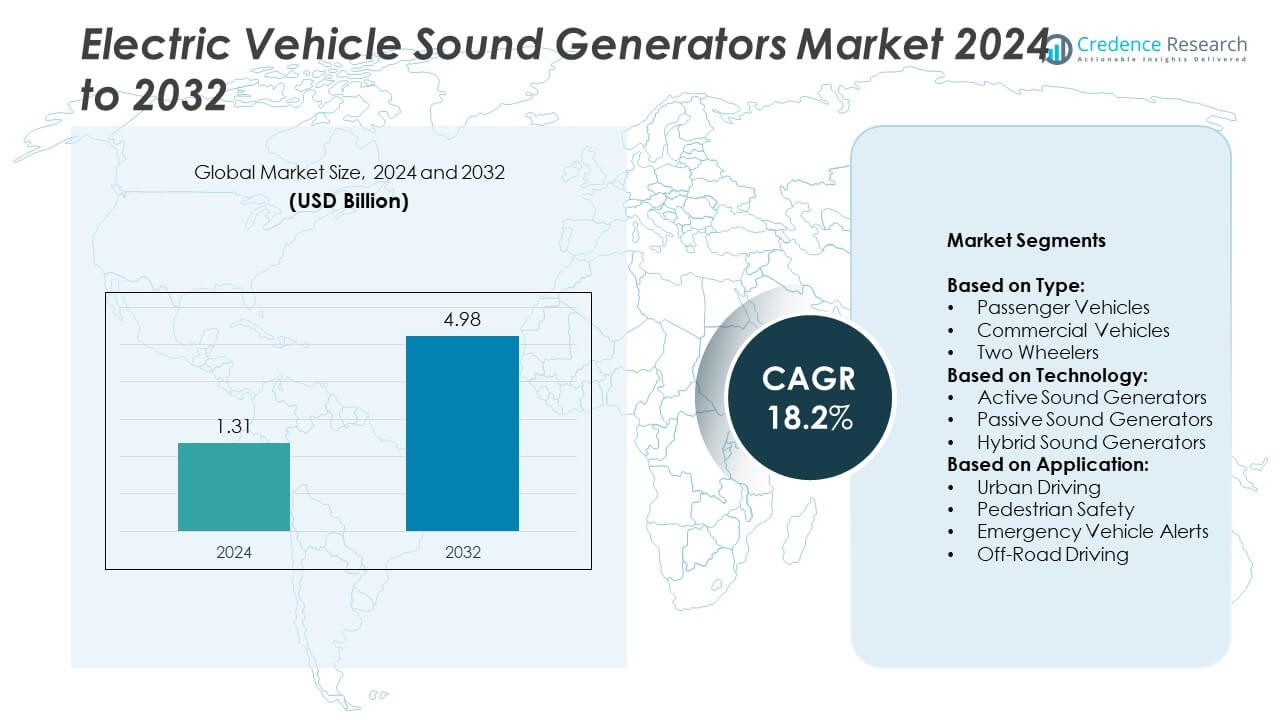

Electric Vehicle Sound Generators market size was valued USD 1.31 Billion in 2024 and is anticipated to reach USD 4.98 Billion by 2032, at a CAGR of 18.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Sound Generators Market Size 2024 |

USD 1.31 Billion |

| Electric Vehicle Sound Generators Market, CAGR |

18.2% |

| Electric Vehicle Sound Generators Market Size 2032 |

USD 4.98 Billion |

BMW, Hyundai, Ford, Renault, Porsche, General Motors, Mercedes-Benz, Audi, Nissan, Tesla, Toyota, Volkswagen, Benz, Honda, and Volvo are the leading players in the electric vehicle sound generators market. These companies are actively integrating advanced active and hybrid sound systems into their EV portfolios to meet global AVAS regulations and enhance pedestrian safety. They are investing in R&D to deliver customizable sound profiles that strengthen brand identity and improve user experience. Asia-Pacific leads the market with 40.6% share in 2024, supported by high EV production and regulatory mandates, followed by North America with 35.2% share and Europe with 28.7%, reflecting strong regional adoption and compliance efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric vehicle sound generators market was valued at USD 1.31 billion in 2024 and is expected to reach USD 4.98 billion by 2032, growing at a CAGR of 18.2%.

- Regulatory mandates such as UNECE R138 and NHTSA AVAS rules are driving adoption across passenger vehicles, commercial fleets, and two-wheelers, making passenger vehicles the largest segment with over 50% share in 2024.

- Trends include the rise of active sound generators with customizable sound profiles and integration with ADAS and V2X technologies for enhanced pedestrian safety and driver experience.

- Competition is intensifying with leading players focusing on R&D investments, partnerships with technology providers, and regional production expansion to meet compliance and reduce costs.

- Asia-Pacific leads with 40.6% share due to strong EV production and adoption, followed by North America at 35.2% and Europe at 28.7%, while Latin America and Middle East & Africa show gradual growth.

Market Segmentation Analysis:

By Type

Passenger vehicles dominate the electric vehicle sound generators market, holding over 50% share in 2024. This leadership is driven by rising adoption of electric passenger cars in urban areas and stricter regulatory mandates on acoustic vehicle alerting systems (AVAS) for low-speed operations. Automakers are integrating advanced sound generators to enhance pedestrian safety and comply with UNECE R138 and NHTSA standards. Growing demand for premium EVs with customizable sound profiles also boosts this segment. Commercial vehicles and two-wheelers follow, supported by rising electrification of fleets and demand for safety solutions in densely populated regions.

- For instance, in 2024, BYD recorded global sales of 4,272,145 new energy vehicles (NEVs). This total includes 1,764,992 battery-electric vehicles (BEVs) and 2,485,378 plug-in hybrid electric vehicles (PHEVs). The remaining sales were comprised of commercial NEVs.

By Technology

Active sound generators lead the market, accounting for more than 55% share in 2024. Their ability to produce customizable, high-fidelity sounds that adapt to vehicle speed and surroundings drives adoption among leading EV manufacturers. Growing consumer focus on brand-specific acoustic signatures and immersive driving experiences further fuels growth. Passive sound generators remain relevant for cost-sensitive models, while hybrid solutions combining active and passive systems are gaining traction for mid-range EVs. OEMs are prioritizing active systems to ensure compliance with international safety standards and to enhance the user experience across premium and mass-market segments.

- For instance, in 2023, Tesla delivered a record 1,808,581 vehicles globally. All of these were Battery Electric Vehicles (BEVs), representing a 38% increase in deliveries compared to 2022. The delivery total was primarily composed of Model 3/Y vehicles, which accounted for 1,739,707 units, while other models, including the Model S and Model X, made up the remaining 68,874.

By Application

Pedestrian safety is the dominant application, capturing over 60% share in 2024. Increasing government regulations mandating minimum external sound levels for electric vehicles below 20 km/h significantly support this segment. Urban areas with high foot traffic are driving demand, as sound generators help reduce collision risks with visually impaired pedestrians and cyclists. Emergency vehicle alerts and off-road driving applications are niche but growing steadily, supported by rising deployment of electric ambulances and utility vehicles. Urban driving solutions also see expansion as automakers introduce sound profiles tailored for city commuting and residential noise compliance requirements.

Key Growth Drivers

Regulatory Mandates for Acoustic Vehicle Alerting Systems

Stringent global regulations such as UNECE R138 and NHTSA’s AVAS rules mandate electric vehicles to emit artificial sounds at low speeds, driving strong adoption of sound generators. These rules aim to reduce pedestrian accidents, especially in urban areas with heavy foot traffic. Automakers are rapidly integrating compliant systems across their EV lineups to avoid penalties and enhance road safety. This regulatory push remains the most significant growth driver, ensuring steady demand across passenger vehicles, commercial fleets, and two-wheelers during the forecast period.

- For instance, in 2023, Volkswagen Group delivered 771,062 battery-electric vehicles (BEVs) globally. This figure represents a substantial increase of approximately 34.7% compared to the 572,500 BEVs delivered by the company in 2022.

Rising Electric Vehicle Adoption

Rapid growth in EV sales worldwide supports demand for sound generators, as each new EV model requires acoustic systems to meet safety standards. Government incentives, falling battery costs, and growing charging infrastructure are accelerating EV penetration, especially in Asia-Pacific and Europe. Automakers are focusing on integrating advanced sound solutions as part of their product differentiation strategies, creating a large addressable market. Increasing adoption in commercial fleets and two-wheelers further expands installation volumes, fueling consistent market expansion across all vehicle categories.

- For instance, the GMC Hummer EV (2022) uses Bose EV Sound Enhancement (EVSE) tech with a 14-speaker Bose surround sound system. The system adapts propulsion sounds for different drive modes: Normal, Terrain, Off-Road, and the launch-control mode “Watts to Freedom.

Advancements in Sound Design Technology

Technological innovation is driving the evolution of sound generator systems with customizable, dynamic sound profiles that change based on speed and driving mode. Leading suppliers are developing software-driven solutions enabling automakers to create brand-specific acoustic signatures, improving user experience. Integration with connected vehicle systems allows real-time updates and performance optimization. These advancements enhance consumer appeal while ensuring compliance with safety regulations. The ability to deliver both safety and premium auditory experiences positions advanced sound generators as a strategic feature in future EV designs.

Key Trends & Opportunities

Customizable Acoustic Signatures

Automakers are increasingly offering unique, brand-specific sound profiles to differentiate their EVs in the market. This trend is supported by consumer demand for enhanced personalization and emotional connection with vehicles. Companies are leveraging advanced digital signal processing to design distinctive sound experiences that reflect brand identity. This approach not only complies with AVAS regulations but also adds a premium value proposition for buyers, particularly in luxury and performance EV segments, fostering higher adoption of active and hybrid sound generator technologies.

- For instance, NVIDIA’s DRIVE Thor system delivers up to 1,000 trillion operations per second (TOPS) of AI compute power, specifically using 8-bit integer (INT8) precision. Magna and NVIDIA announced a collaboration in March 2025 to integrate the DRIVE Thor platform into Magna’s next-generation ADAS and autonomous driving solutions, with Magna planning a working demonstration platform in Q4 2025. This platform is being developed for use in Level 2+ to Level 4 ADAS systems.

Integration with Advanced Driver Assistance Systems (ADAS)

Integration of sound generators with ADAS platforms presents significant growth opportunities. Systems can work in tandem with pedestrian detection, collision avoidance, and vehicle-to-everything (V2X) communication technologies to deliver context-aware alerts. This synergy improves safety outcomes and supports the development of smart mobility ecosystems. OEMs adopting such integrated solutions can offer enhanced safety features, helping meet urban mobility and smart city goals. This opportunity is particularly strong in markets with aggressive adoption of connected and autonomous vehicle technologies.

- For instance, Luminar Technologies shipped 9,000 LiDAR units in 2024 for OEM production programs, notably with Volvo, Polestar, and SAIC’s Rising Auto brand.

Key Challenges

High System Costs for Mass-Market EVs

The cost of advanced active sound generator systems can be a barrier for low-cost EV manufacturers. Integrating high-quality speakers, controllers, and software increases vehicle production costs, limiting adoption in price-sensitive markets. Many budget EV models rely on simpler passive solutions, reducing overall market penetration of active systems. Suppliers face pressure to innovate cost-effective solutions without compromising compliance or performance, a challenge that may slow adoption in emerging economies with strong demand for affordable electric mobility options.

Noise Pollution Concerns in Dense Urban Areas

While sound generators enhance pedestrian safety, excessive noise from a growing EV fleet could lead to urban noise pollution issues. Regulators must balance safety needs with environmental noise limits, especially in cities aiming to reduce overall noise levels. Automakers face the challenge of designing systems that are loud enough for safety but unobtrusive for residents. Failure to address these concerns may result in stricter noise regulations, requiring redesigns and additional compliance efforts, potentially slowing the deployment of louder or more intrusive sound profiles.

Regional Analysis

North America

North America holds 35.2% share of the electric vehicle sound generators market in 2024, driven by NHTSA’s AVAS mandate. Strong EV adoption across the United States and Canada supports rising installations across passenger and commercial vehicles. Automakers are focusing on compliance and offering premium, customizable sound profiles. Presence of leading EV manufacturers and suppliers accelerates innovation and deployment. Government incentives, along with rapid expansion of charging infrastructure, further strengthen the market outlook. Growing preference for high-performance EV models also fuels demand for advanced active sound generators, ensuring sustained market growth during the forecast period.

Europe

Europe accounts for 28.7% market share in 2024, driven by strict UNECE R138 regulations and robust EV adoption in Germany, France, and the UK. Automakers are actively deploying sound generators across vehicle portfolios to meet pedestrian safety standards. Strong adoption of electric two-wheelers in urban areas supports further growth. European incentives under the Green Deal continue to encourage EV sales, boosting sound generator demand. Luxury carmakers are leading in offering customized acoustic signatures, improving consumer engagement. The region benefits from a mature EV ecosystem and strong R&D initiatives, supporting steady market growth across both mass and premium segments.

Asia-Pacific

Asia-Pacific leads with 40.6% share of the market in 2024, with China, Japan, and South Korea as key contributors. Supportive government policies, including mandatory pedestrian alert systems, drive widespread adoption. The region’s large EV production base ensures high integration rates across vehicle categories. Urbanization and high traffic density heighten the need for safety solutions, pushing automakers to adopt advanced sound technologies. Affordable sound generator solutions targeted at mass-market EVs are boosting penetration rates. Rapid growth of electric two-wheelers in India and Southeast Asia further accelerates demand, making Asia-Pacific the fastest-growing region over the forecast period.

Latin America

Latin America represents 3.5% share of the global market in 2024, showing steady growth led by Brazil, Mexico, and Chile. Government-backed programs promoting electrification and improving charging infrastructure are key enablers. Market demand is focused on urban areas where pedestrian safety concerns are prominent. Automakers are beginning to equip EV models with standard sound generators to align with global safety requirements. Although limited availability of premium EV models constrains growth, imports of international EV brands and incentives for clean mobility are expected to accelerate adoption, gradually increasing regional market share over the next few years.

Middle East and Africa

Middle East and Africa hold 2.0% share of the electric vehicle sound generators market in 2024. Growth is concentrated in the UAE, Saudi Arabia, and South Africa, supported by government initiatives promoting sustainable transportation. Sound generators are largely integrated in imported luxury EVs as standard features. Limited local EV production and slower charging infrastructure rollout restrict rapid adoption. However, investments in smart city projects and road safety measures are expected to create opportunities. As EV adoption gains pace, demand for compliant and cost-efficient sound generator solutions will rise across both passenger and commercial vehicles in the region.

Market Segmentations:

By Type:

- Passenger Vehicles

- Commercial Vehicles

- Two Wheelers

By Technology:

- Active Sound Generators

- Passive Sound Generators

- Hybrid Sound Generators

By Application:

- Urban Driving

- Pedestrian Safety

- Emergency Vehicle Alerts

- Off-Road Driving

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

BMW, Hyundai, Ford, Renault, Porsche, General Motors, Mercedes-Benz, Audi, Nissan, Tesla, Toyota, Volkswagen, Benz, Honda, and Volvo are the leading players in the electric vehicle sound generators market. These companies are focusing on integrating advanced active sound generator systems across their EV portfolios to comply with global AVAS regulations. They invest heavily in R&D to develop customizable, software-based sound profiles that enhance pedestrian safety and create unique brand identities. Partnerships with technology suppliers are enabling the development of hybrid solutions combining active and passive systems. Manufacturers are prioritizing scalable, cost-efficient designs to meet the needs of both premium and mass-market EVs. Continuous innovation, regulatory compliance, and expanding EV production capacity are strengthening their competitive positions. Strategic collaborations and investments in regional production facilities also help reduce costs and accelerate time-to-market, ensuring these players remain at the forefront of the industry’s rapid transition toward safer and more connected mobility solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BMW

- Hyundai

- Ford

- Renault

- Porsche

- General Motors

- Mercedes-Benz

- Audi

- Nissan

- Tesla

- Toyota

- Volkswagen

- Benz

- Honda

- Volvo

Recent Developments

- In 2025, BMW unveiled Panoramic iDrive for its Neue Klasse vehicles, incorporating 43 distinct sound signals and special driving sounds for “Personal Mode” and “Sport Mode”. This new sound experience HypersonX is designed to adapt according to driving conditions.

- In 2025, Toyota integrated the Acoustic Vehicle Alerting System (AVAS) into the hybrid variants of the 2025 Innova Hycross model to enhance pedestrian safety.

- In 2024, Hyundai Motor is developing a new EREV under its Hyundai Dynamic Capabilities strategy aiming to bridge the gap to full electrification by combining the benefits of EVs and internal combustion engines, with the engine used solely for battery charging.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to global regulations mandating AVAS in all electric vehicles.

- Adoption of active sound generators will rise as automakers focus on brand-specific sound profiles.

- Integration of sound systems with ADAS and V2X communication will enhance pedestrian safety features.

- Demand will increase in urban areas with dense traffic where pedestrian protection is a priority.

- Two-wheeler electrification will open new opportunities for compact and cost-efficient sound solutions.

- Advances in digital signal processing will enable more customizable and dynamic sound generation.

- Suppliers will focus on reducing system costs to support adoption in mass-market EV models.

- Regional production and localization will grow to meet regulatory compliance efficiently.

- Luxury and performance EV segments will drive demand for premium, immersive sound experiences.

- Collaborative efforts between automakers and technology providers will accelerate innovation and market penetration.