Market Overview

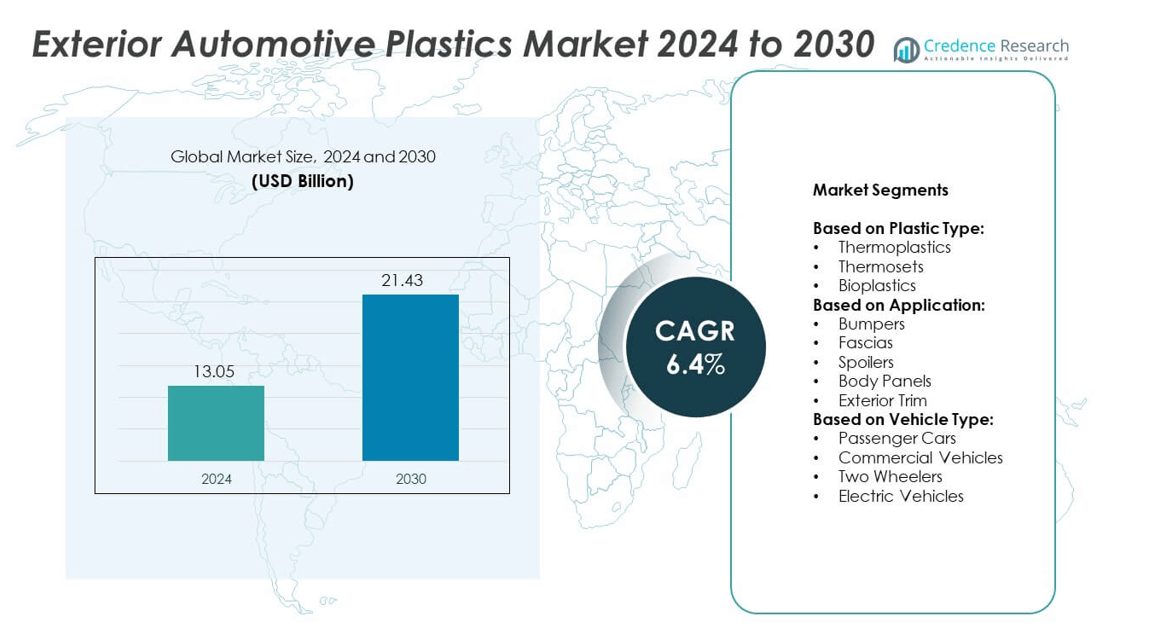

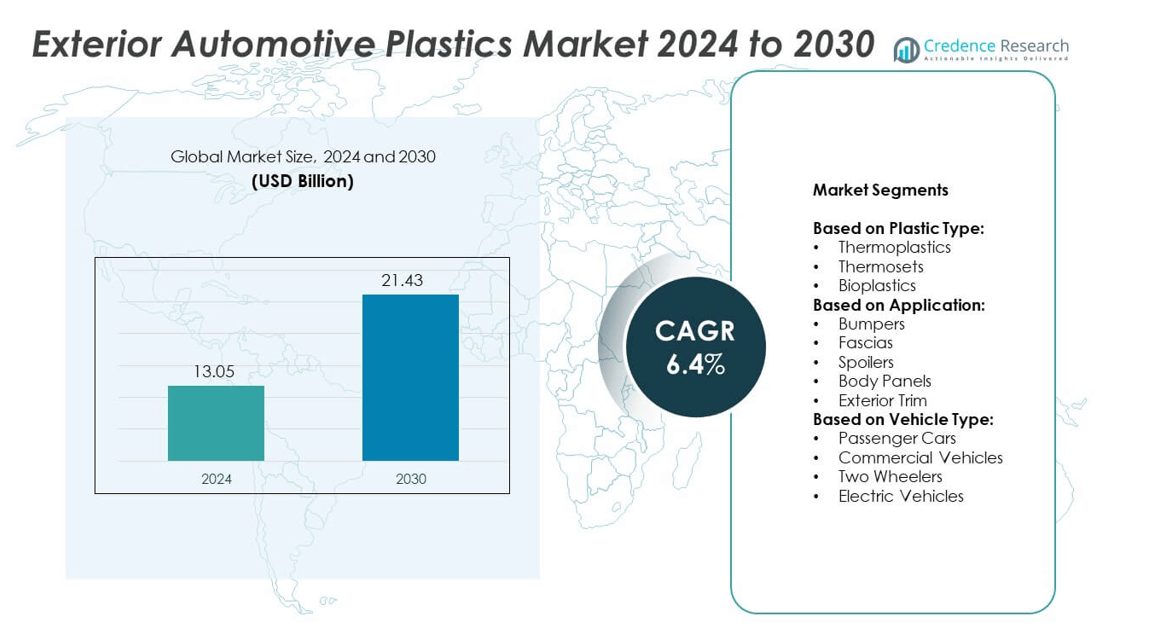

The exterior automotive plastics market size was valued at USD 13.05 billion in 2024 and is anticipated to reach USD 21.43 billion by 2030, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Exterior Automotive Plastics Market Size 2024 |

USD 13.05 Billion |

| Exterior Automotive Plastics Market, CAGR |

6.4% |

| Exterior Automotive Plastics Market Size 2032 |

USD 21.43 Billion |

The exterior automotive plastics market grows with rising demand for lightweight vehicles and fuel efficiency. Automakers use plastics in bumpers, fascias, and body panels to reduce weight and meet emission standards. It supports design flexibility, corrosion resistance, and cost-effective manufacturing. Electric vehicle production boosts demand for advanced thermoplastics to offset battery weight and improve range. Innovation in recyclable and bio-based plastics aligns with sustainability goals. Advanced coatings and surface finishes enhance aesthetics and durability, driving adoption across passenger and commercial vehicles.

North America and Europe drive demand with strict emission regulations and advanced manufacturing capabilities. Asia-Pacific leads growth with large-scale vehicle production in China, India, and Japan. It benefits from rising adoption of electric and hybrid vehicles that require lightweight solutions. Latin America and Middle East & Africa show steady growth with expanding automotive assembly plants. Key players in the exterior automotive plastics market include LG Chem Ltd., BASF SE, Covestro AG, and SABIC, focusing on innovation and sustainable material development.

Market Insights

- The exterior automotive plastics market was valued at USD 13.05 billion in 2024 and is projected to reach USD 21.43 billion by 2030, growing at a CAGR of 6.4%.

- Rising demand for lightweight vehicles and strict emission standards drive adoption of plastics in bumpers, fascias, and body panels.

- Trends show a shift toward recyclable and bio-based plastics, along with increased use of thermoplastics and composites for enhanced durability and weight reduction.

- Leading players such as LG Chem Ltd., BASF SE, Covestro AG, SABIC, and Evonik Industries invest in R&D and expand production capacities to meet growing demand.

- Market growth faces challenges from fluctuating raw material prices, limited large-scale recycling infrastructure, and high development costs for sustainable solutions.

- Asia-Pacific leads demand with high vehicle production in China, India, and Japan, while North America and Europe adopt advanced polymers to meet regulatory targets.

- Electric and hybrid vehicle production continues to create strong opportunities for plastic use in exterior components to reduce weight and improve efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Lightweight Vehicles Driving Material Adoption

The exterior automotive plastics market benefits from growing demand for lightweight vehicles to improve fuel efficiency. Automakers replace metals with plastics in bumpers, fenders, and body panels to reduce overall vehicle weight. It helps manufacturers meet strict emission regulations and performance standards. Plastics support design flexibility, enabling complex shapes and aesthetic finishes. The material’s corrosion resistance extends vehicle life and reduces maintenance costs. Global OEMs invest in lightweight solutions to improve energy efficiency and lower production costs.

- For instance, Stellantis along with BASF and L&L Products developed a composite tunnel reinforcement (CTR) for the 2021 Jeep Grand Cherokee L that reduced subsystem mass by 2.08 kg per vehicle.

Stringent Emission Norms Encouraging Material Innovation

Regulatory bodies enforce strict emission norms, encouraging automakers to adopt weight-reducing materials. The exterior automotive plastics market responds with advanced polymers that meet durability and safety requirements. It supports compliance with EU CO₂ standards, U.S. CAFE targets, and other global regulations. Automakers rely on these materials to balance performance and environmental responsibility. Manufacturers focus on developing recyclable and sustainable plastic grades. Innovation improves strength-to-weight ratio, enabling use in structural exterior components.

- For instance, according to Knauf Automotive, polymers currently account for approximately 20% of a 1,500 kg vehicle’s weight, which translates to roughly 300 kg of plastics distributed across around 2,000 parts. This aligns with other reports stating that plastics make up approximately 15-20% of a vehicle’s total weight and are used in over 2,000 parts and components.

Growing Electric Vehicle Production Boosting Plastic Usage

Electric vehicle production growth creates strong opportunities for plastic adoption. The exterior automotive plastics market sees increasing use in EV body parts to offset heavy battery packs. It contributes to extended driving range and improved aerodynamics. Lightweight materials help lower energy consumption per kilometer. Plastics also provide design freedom for futuristic styling and aerodynamic optimization. Leading EV makers collaborate with suppliers to develop thermoplastic composites for exterior modules.

Cost Efficiency and Design Flexibility Supporting Market Growth

Plastics offer cost advantages through lower tooling and manufacturing expenses compared to metals. The exterior automotive plastics market benefits from shorter production cycles and easy part integration. It allows automakers to reduce assembly complexity and improve production speed. Thermoplastic materials support painting, coating, and surface texturing for premium finishes. The ability to integrate multiple functions into a single part enhances efficiency. Automakers adopt plastics to achieve cost savings while maintaining design appeal.

Market Trends

Increasing Focus on Sustainable and Recyclable Materials

The exterior automotive plastics market shows a clear shift toward sustainable solutions. Automakers seek bio-based and recycled plastics to meet environmental goals. It helps reduce carbon footprint and comply with circular economy initiatives. Suppliers develop polymers that can be reused without losing mechanical strength. OEMs integrate sustainable materials into bumpers, trims, and fascias to improve brand image. Demand for closed-loop recycling systems grows among major automotive manufacturers.

- For instance, BMW has achieved series maturity with natural fiber composites (flax-based) replacing carbon-fiber composites for roof structures. This change leads to about 40% CO₂e reduction in production for those components.

Rising Integration of Advanced Polymer Composites

Manufacturers adopt advanced polymer composites to enhance strength and reduce weight. The exterior automotive plastics market benefits from innovations such as carbon-fiber-reinforced thermoplastics. It enables higher impact resistance and longer component life. These materials allow complex mold designs that support aerodynamic efficiency. Automakers use them in bumpers, grille guards, and rocker panels for premium models. Suppliers invest in R&D to scale production and lower composite costs.

- For instance, BASF + L&L Products + Stellantis created a composite tunnel reinforcement. The Jeep Grand Cherokee L subsystem mass dropped by 2.08 kg per vehicle.

Shift Toward Electric and Autonomous Vehicle Design

Electrification and autonomous technologies influence exterior component choices. The exterior automotive plastics market gains from growing demand for aerodynamic, lightweight panels. It supports better energy efficiency and integration of sensors. Plastic parts allow seamless housing for cameras, radar units, and lidar systems. Automakers design smooth exterior surfaces to optimize vehicle range. EV startups and established OEMs work with suppliers to meet functional and styling needs.

Advancement in Surface Finishing and Coating Technologies

New finishing techniques enhance the visual appeal and durability of plastic parts. The exterior automotive plastics market benefits from UV-resistant coatings and self-healing paints. It helps maintain color stability and scratch resistance in extreme weather. Matte and metallic finishes create differentiation in vehicle design. Advanced coatings also support radar transparency for ADAS-equipped models. Suppliers offer customizable textures to meet diverse OEM specifications.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Constraints

The exterior automotive plastics market faces challenges from fluctuating raw material prices. Petroleum-based resins remain vulnerable to crude oil price swings, impacting production costs. It forces manufacturers to adjust pricing strategies and manage profit margins carefully. Global supply chain disruptions create delays in resin availability and delivery schedules. Shortages of specialty additives further strain production timelines. OEMs seek alternative sourcing strategies to reduce risk and maintain consistent supply.

Stringent Regulations and Recycling Limitations

Compliance with environmental regulations increases development and testing costs for new materials. The exterior automotive plastics market must meet strict standards for recyclability and emissions during manufacturing. It pressures suppliers to invest in sustainable formulations and advanced recycling technologies. Limited infrastructure for large-scale plastic recycling adds complexity to waste management efforts. Automakers face challenges integrating eco-friendly materials without compromising performance. Balancing regulatory compliance with cost efficiency remains a major industry concern.

Market Opportunities

Growth Potential in Electric and Hybrid Vehicle Segment

The exterior automotive plastics market holds significant opportunities in the electric and hybrid vehicle segment. Automakers require lightweight materials to offset battery weight and improve range. It supports design of aerodynamic body panels that enhance energy efficiency. Plastics provide flexibility for integrating sensors and charging ports seamlessly. EV manufacturers collaborate with suppliers to create advanced thermoplastic solutions for hoods, fenders, and bumpers. Rising EV adoption worldwide drives demand for innovative and durable plastic components.

Advancement in High-Performance and Recyclable Polymers

Technological progress in polymer science creates new opportunities for sustainable product lines. The exterior automotive plastics market benefits from development of bio-based and fully recyclable polymers. It enables automakers to meet environmental targets while maintaining quality standards. Advanced materials with better thermal stability and UV resistance expand usage in harsh conditions. Coating and surface treatment innovations offer improved aesthetics and durability. OEMs explore new partnerships with material innovators to bring these solutions to mass production.

Market Segmentation Analysis:

By Plastic Type:

The exterior automotive plastics market is segmented by plastic type into thermoplastics, thermosets, and bioplastics. Thermoplastics dominate due to their ease of molding, recyclability, and cost efficiency. It is widely used in bumpers, body panels, and trims because of its lightweight and impact resistance. Thermosets serve applications requiring high heat resistance and dimensional stability, such as structural exterior components. Bioplastics gain traction as automakers focus on reducing environmental impact. The use of renewable raw materials in bioplastics supports sustainability goals and aligns with stricter emission regulations.

- For instance, Magna International supplies a thermoplastic liftgate for the 2014 Nissan Rogue. The use of this thermoplastic olefin material resulted in a 30% weight reduction for the liftgate assembly compared to the previous steel version. This new liftgate assembly, weighing 24 kg, also integrates multiple components (including inner trim, reinforcements, running lights, and electronics) into a single molded assembly

By Application:

Bumpers account for a significant share, driven by their universal installation across all vehicle types. The exterior automotive plastics market benefits from plastics that offer crash resistance and cost-effective production. It enables manufacturers to integrate styling and safety features into a single molded component. Fascias and spoilers see strong demand in premium vehicles, supporting aerodynamics and design aesthetics. Body panels adopt lightweight plastics to reduce overall vehicle weight and improve fuel efficiency. Exterior trim components such as grilles and moldings utilize plastics for weather resistance and customization flexibility.

- For instance, Kingfa composite door modules cut vehicle mass by >5 kg versus steel designs. Sheets are pre-cut for one-shot molding to minimize scrap.

By Vehicle Type:

Passenger cars lead the segment due to high production volumes and consumer demand for enhanced styling. The exterior automotive plastics market gains from plastics that support complex shapes and premium finishes. It helps carmakers meet emission standards while improving performance and fuel economy. Commercial vehicles adopt durable plastics to lower maintenance costs and extend service life. Two-wheelers use plastic components for lightweight frames, mudguards, and panels, supporting maneuverability and cost efficiency. Electric vehicles create a strong growth avenue, as lightweight plastics offset battery weight and extend driving range.

Segments:

Based on Plastic Type:

- Thermoplastics

- Thermosets

- Bioplastics

Based on Application:

- Bumpers

- Fascias

- Spoilers

- Body Panels

- Exterior Trim

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- Electric Vehicles

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 28.5%, driven by high production of SUVs, pickup trucks, and luxury vehicles. The exterior automotive plastics market in this region benefits from consumer demand for lightweight, fuel-efficient models that meet stringent CAFE standards. It allows automakers to incorporate thermoplastics into bumpers, fascias, and body panels to reduce overall weight. The presence of major OEMs such as General Motors, Ford, and Stellantis accelerates adoption of innovative plastic components. Suppliers in the U.S. and Canada invest in advanced molding and recycling technologies to meet sustainability goals. The region also experiences growth in electric and hybrid vehicle production, increasing the need for lightweight materials to offset battery weight and improve driving range. Collaboration between Tier 1 suppliers and OEMs continues to support development of next-generation exterior parts with improved durability and design flexibility.

Europe

Europe accounts for 26.3% of the global market, supported by stringent CO₂ emission targets and strong regulatory frameworks. The exterior automotive plastics market benefits from the region’s focus on reducing vehicle weight to meet EU fleet-wide emission requirements. It encourages automakers like Volkswagen, BMW, and Mercedes-Benz to use advanced polymers for bumpers, trims, and panels. Lightweight materials help manufacturers comply with Euro 6 standards while enhancing aerodynamics. The presence of established automotive clusters in Germany, France, and Italy drives R&D investment in recyclable thermoplastics and composite materials. Automakers prioritize sustainable solutions, including bio-based plastics, to meet circular economy targets. Demand for premium cars and electric vehicles further strengthens the use of exterior plastics across multiple vehicle segments.

Asia-Pacific

Asia-Pacific dominates with a market share of 33.8%, making it the largest regional market. The exterior automotive plastics market benefits from rapid industrialization, growing middle-class population, and expanding automotive production in China, India, and Japan. It supports large-scale manufacturing of passenger cars, two-wheelers, and commercial vehicles using cost-efficient plastic components. Regional OEMs invest in modernizing production facilities to integrate lightweight solutions that meet global standards. Rising demand for electric vehicles across China and South Korea fuels adoption of aerodynamic plastic body parts. The availability of raw materials and competitive labor costs create a favorable manufacturing environment for plastic suppliers. Governments support electric mobility initiatives, boosting the demand for high-performance, recyclable plastics in exterior applications.

Latin America

Latin America holds a market share of 6.9%, driven by steady growth in vehicle production and sales in Brazil and Mexico. The exterior automotive plastics market grows as OEMs expand local assembly operations to meet rising demand. It enables cost-effective sourcing and faster supply chain response for plastic components. Regional automakers use lightweight materials to improve vehicle efficiency and meet evolving emission regulations. Demand for small and mid-sized passenger cars supports use of thermoplastics in bumpers and trims. Suppliers invest in capacity expansion to cater to regional demand and support export markets. Government incentives for local manufacturing further encourage adoption of advanced plastics in exterior parts.

Middle East & Africa

Middle East & Africa contribute 4.5% of the global share, with growth supported by infrastructure development and rising disposable incomes. The exterior automotive plastics market sees demand from growing SUV and pickup sales in Gulf countries. It helps OEMs deliver vehicles that meet durability requirements for harsh climate conditions. Lightweight plastic components provide resistance to heat, corrosion, and UV exposure, extending vehicle life. Local assembly plants in South Africa and Morocco adopt modern production techniques for cost-efficient plastic parts. The region also witnesses gradual growth in electric vehicle introduction, creating opportunities for advanced polymer solutions. International suppliers partner with regional distributors to strengthen aftermarket availability of exterior plastic components.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LG Chem Ltd.

- Evonik Industries AG

- BASF SE

- Toray Industries, Inc.

- Mitsubishi Chemical Corporation

- INEOS Styrolution Group GmbH

- Celanese Corporation

- Teijin Limited

- Covestro AG

- SABIC

- Asahi Kasei Corporation

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- SABIC Innovative Plastics

- DSM

Competitive Analysis

The exterior automotive plastics market is highly competitive, with key players including LG Chem Ltd., Evonik Industries AG, BASF SE, Toray Industries, Inc., Mitsubishi Chemical Corporation, INEOS Styrolution Group GmbH, Celanese Corporation, Teijin Limited, Covestro AG, SABIC, Asahi Kasei Corporation, LyondellBasell Industries Holdings B.V., Borealis AG, SABIC Innovative Plastics, and DSM. These companies focus on product innovation, expanding production capacities, and developing sustainable polymer solutions to meet the automotive industry’s growing need for lightweight and recyclable materials. They invest heavily in R&D to enhance impact resistance, thermal stability, and surface finish of plastic components used in bumpers, body panels, and trims. Strategic collaborations with OEMs allow suppliers to co-develop custom solutions that integrate seamlessly into modern vehicle designs. Regional manufacturing expansions and joint ventures strengthen supply chains and ensure consistent material availability. Leading players also work on circular economy initiatives, emphasizing recycling technologies to lower carbon footprints. Competitive differentiation is achieved through advanced composite materials, cost-effective production processes, and compliance with global emission standards. Market competition is expected to intensify with the rising adoption of electric and autonomous vehicles, encouraging suppliers to deliver innovative and high-performance plastics tailored to future mobility needs.

Recent Developments

- In 2025, BASF announced at K 2025 trade fair that it will present plastic products made with renewable feedstock under its Biomass Balance approach.

- In 2025, Covestro introduced a new line of post-consumer recycled polycarbonates made from end-of-life automotive headlamps, containing 50% recycled content, TÜV Rheinland-certified, and commercially available for new automotive applications.

- In 2024, LG Chem developed a new PFAS-free flame-retardant PC/ABS material made from recycled plastics; it earned a V-0 rating under UL 94 testin

Report Coverage

The research report offers an in-depth analysis based on Plastic Type, Application, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The exterior automotive plastics market will grow with rising demand for lightweight vehicles.

- Automakers will adopt more recyclable and bio-based plastics to meet sustainability targets.

- Electric vehicle production will increase use of thermoplastics to offset battery weight.

- Advanced composites will gain traction for exterior body panels and structural components.

- OEMs will focus on aerodynamic designs that require precision-molded plastic parts.

- Coating and surface technology innovations will enhance durability and appearance.

- Regional suppliers will expand capacity to meet growing demand from Asia-Pacific markets.

- Collaboration between material innovators and automakers will accelerate product development.

- Regulations will push adoption of low-emission and fully recyclable plastic grades.

- Integration of sensors and ADAS systems will drive demand for radar-transparent plastics.