Market Overview

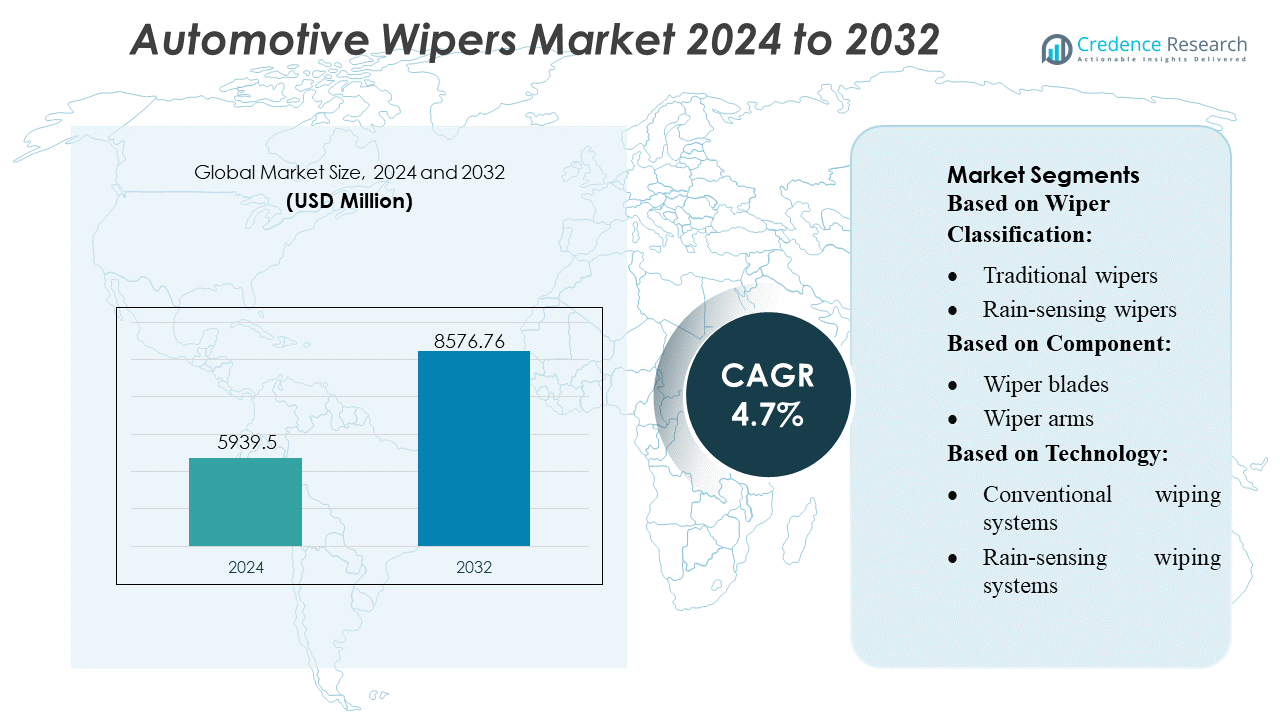

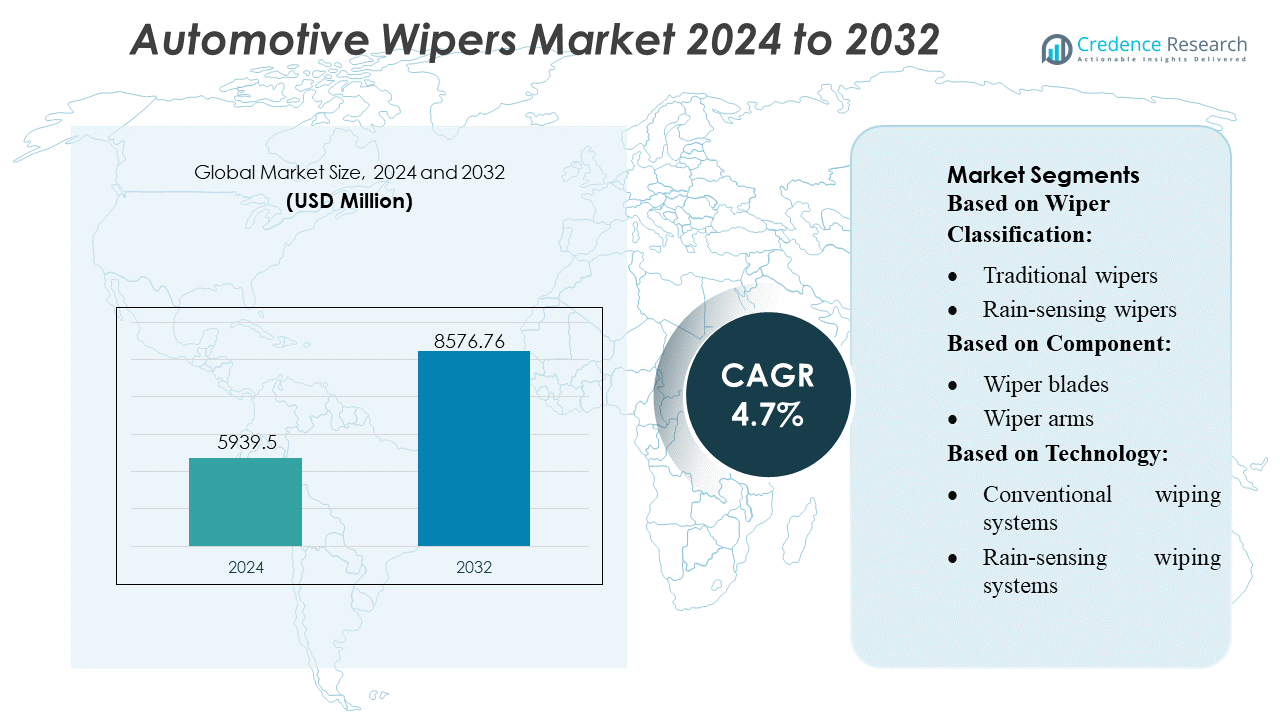

Automotive Wipers Market size was valued USD 5939.5 million in 2024 and is anticipated to reach USD 8576.76 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Wipers Market Size 2024 |

USD 5939.5 Million |

| Automotive Wipers Market, CAGR |

4.7% |

| Automotive Wipers Market Size 2032 |

USD 8576.76 Million |

The automotive wipers market is shaped by globally established OEM suppliers and specialized component manufacturers that compete through advancements in blade materials, motor efficiency, and sensor-enabled wiping technologies. Leading companies strengthen their portfolios with aerodynamic beam blades, all-weather durability, and ADAS-compatible systems that support evolving vehicle safety requirements. Strategic priorities include regional production expansion, aftermarket penetration, and integration of energy-efficient components suitable for electric vehicles. Asia-Pacific remains the dominant regional market with an exact 42% share, driven by high vehicle production, expanding mobility demand, and rapid adoption of advanced visibility solutions across both passenger and commercial vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 5,939.5 million in 2024 and is projected to attain USD 8,576.76 million by 2032, expanding at a 4.7% CAGR.

- Advancements in aerodynamic beam blades, efficient wiper motors, and ADAS-integrated rain-sensing systems drive demand, while OEMs and component specialists compete through durability, noise reduction, and EV-optimized wiping solutions.

- Rain-sensing wipers hold the dominant technology share at approximately 48–50%, supported by rising installation in mid-range passenger vehicles and visibility-safety regulations.

- Asia-Pacific leads with an exact 42% regional share, driven by high-volume automotive manufacturing, rapid urban mobility growth, and strong aftermarket replacement cycles; Europe follows with elevated adoption of premium ADAS-ready wiper assemblies.

- Supply-chain constraints in rubber compounds and rising raw material costs restrain margins, while competitors expand regional production and aftermarket offerings to enhance resilience and maintain performance consistency across varied climatic conditions.

Market Segmentation Analysis:

By Wiper Classification

Traditional wipers dominate the automotive wipers market with an estimated 58–60% share, driven by their lower cost, straightforward installation, and wide compatibility across passenger and commercial vehicles. Their proven reliability in varied climates and ease of replacement strengthen their continued preference among OEMs and aftermarket suppliers. Rain-sensing wipers gain adoption in mid- to high-end vehicles as automakers integrate ADAS features, while rear wipers remain standard in hatchbacks and SUVs to enhance rear visibility. Headlight wipers serve a niche role in premium models requiring enhanced illumination performance.

- For instance, TI offers automotive-qualified motor driver ICs such as DRV8245HQPWPRQ1 which can deliver up to 32 A output current, operate over a wide supply range (4.5–35 V, up to 40 V absolute max), and function across a temperature range of –40 °C to +125 °C.

By Component

Wiper blades hold the largest share, accounting for around 52–54% of the market, supported by frequent replacement cycles, material advancements, and growing consumer focus on driving visibility. Their demand increases with the adoption of beam and hybrid blade designs that improve wipe quality and durability. Wiper arms and motors maintain consistent OEM-driven demand, while washer pumps and nozzles benefit from vehicle production growth. Rain sensors expand rapidly as manufacturers incorporate smart visibility features into connected and semi-autonomous vehicle platforms.

- For instance, Infineon’s high-precision Hall-effect sensor ICs, such as the TLE493D-W2B6, offer linear magnetic sensing with resolution down to 65 µT and operate over temperatures from –40 °C to +125 °C.

By Technology

Conventional wiping systems remain the dominant technology with an estimated 62–64% share, sustained by their affordability, mechanical simplicity, and established presence across mass-market vehicles. Their reliability and ease of service reinforce broad OEM utilization, especially in entry-level and mid-range models. Rain-sensing wiping systems continue to scale with increasing penetration of ADAS and comfort features in new vehicles. Heated wiper blades gain traction in cold-climate regions as they enhance defrosting efficiency and prevent ice accumulation, aligning with safety and winter-performance requirements.

Key Growth Drivers

- Rising Vehicle Production and Expanding Global Car Parc

The automotive wipers market grows steadily as global vehicle production increases and the active car parc expands, particularly across emerging economies. Automakers integrate more durable, high-performance wiper systems to meet safety standards and consumer expectations for improved visibility in diverse climates. Growth in SUVs and crossovers further strengthens demand, as these models require larger blade assemblies with stronger motors. The expanding fleet of passenger and commercial vehicles continuously fuels aftermarket sales, reinforcing long-term revenue stability for component manufacturers and integrated OEM suppliers.

- For instance, Infineon’s silicon MOSFETs provide low on-resistance (R_DS(on) around 9.9 mΩ) and continuous current handling of up to 33 A at 25 °C, operating over a wide supply range, enabling high-efficiency motor drives in applications where energy management is critical.

- Advancements in Sensor-Based and Automated Wiper Technologies

Technological innovation accelerates market expansion as manufacturers adopt rain-sensing systems, adaptive speed control, and AI-supported visibility enhancement solutions. Modern vehicles increasingly feature optical and infrared rain sensors, enabling automated wiping functions that improve driver convenience and safety. Integration with advanced driver-assistance systems (ADAS) also supports growth, as wiper systems must synchronize with cameras, lidar, and radar to maintain clear sensor fields. OEMs prioritize intelligent wiper modules with microprocessor-based control, strengthening premium segment adoption and creating new opportunities for component-level electronics suppliers.

- For instance, Analog Devices’ ADT7420 high-precision digital temperature sensor IC offers ±0.25 °C accuracy from –40 °C to +125 °C, making it suitable for heated wiper blade systems that prevent icing in cold climates.

- Increasing Adoption of All-Weather and High-Durability Materials

Demand rises for advanced wiper blades engineered with silicone rubber, graphite-coated edges, and aerodynamic beam structures that deliver superior performance in extreme weather. These materials extend product lifespan, reduce noise, and ensure consistent wiping efficiency, appealing to both OEM and aftermarket customers. Regions with heavy rainfall or snowfall increasingly prefer winter-optimized blades and heated wiper solutions. Manufacturers invest in precision molding, corrosion-resistant wiper arms, and enhanced motor torque to meet durability expectations, strengthening market growth through product upgrades and long-term replacement cycles.

Key Trends & Opportunities

- Expansion of Smart, Connected, and ADAS-Compatible Wiper Systems

A major trend involves the shift toward smart wiper systems that integrate with vehicle connectivity platforms and ADAS features. Automakers explore self-adjusting wiping patterns, diagnostic alerts, and systems that communicate blade wear status to the driver or service centers. Camera-assisted vision modules require consistently clean windshields, opening opportunities for automated defogging, hydrophobic coatings, and intelligent wiper synchronization. As autonomous vehicles scale, the need for ultra-reliable visibility maintenance systems becomes a key innovation frontier for suppliers.

- For instance, STMicroelectronics provides VND5T100 and VND5T035AK high-side smart power switches, which feature a current limitation (typical) of 22 A and 42 A, respectively. They operate over voltage ranges of 8–36 V and include integrated overcurrent and thermal protection.

- Growth in Aftermarket Personalization and Premium Blade Upgrades

Rising consumer preference for premium beam blades, hybrid structures, and all-season variants creates strong aftermarket opportunities. Retailers report growing adoption of silicone-based blades known for extended durability and quieter operation. Drivers increasingly replace traditional rubber blades with aerodynamic, high-performance designs that enhance wiping stability at higher speeds. E-commerce accelerates product visibility, enabling brands to promote fitment-specific kits and subscription-based replacement services. This trend benefits companies offering differentiated designs, corrosion-proof arm materials, and easy-installation mechanisms.

- For instance, NXP’s H‑bridge driver IC MC33887 is designed for controlling automotive DC motors, making it a technically appropriate building block for systems such as windshield‑wiper motors.

- Rising Focus on Energy-Efficient and Low-Noise Wiper Systems

Manufacturers increasingly design low-noise, low-power wiper motors using improved magnetic circuits, compact gear assemblies, and friction-optimized components. Electric vehicles drive this opportunity, as their silent cabins require acoustic-optimized systems and energy-efficient wiper operation to preserve driving range. Lightweight wiper arms and motors also support sustainability targets by reducing vehicle mass. Suppliers invest in simulations, CFD-informed blade profiles, and vibration-dampened housings to reduce operational noise and wind lift, aligning with OEM requirements for enhanced cabin comfort.

Key Challenges

- High Price Sensitivity and Intense Competition in the Aftermarket

The aftermarket segment faces intense price competition, particularly in developing regions where consumers often prioritize low-cost replacements over premium-quality products. This dynamic pressures manufacturers to balance performance enhancements with cost optimization. Unorganized sector players producing low-cost blades further challenge branded suppliers, limiting margins and slowing adoption of advanced materials. OEMs also negotiate aggressively on component pricing, compelling suppliers to streamline operations while sustaining innovation. These competitive dynamics create persistent profitability constraints for blade and motor manufacturers.

- Durability Issues in Extreme Weather and Limitations in Material Performance

Despite advancements, wiper systems continue to face performance degradation in harsh climates characterized by extreme heat, freezing temperatures, and heavy precipitation. Rubber materials may harden, crack, or lose elasticity, reducing wiping effectiveness and requiring frequent replacements. Ice accumulation can strain motors and damage blade frames, while UV exposure shortens blade life in hot regions. These limitations push manufacturers to invest in advanced polymers, coatings, and reinforced structures, yet material cost inflation and technical constraints hinder rapid scalability of highly durable solutions.

Regional Analysis

North America

North America accounts for around 28% of the automotive wipers market, supported by a large vehicle parc, high adoption of SUVs and pickup trucks, and frequent wiper-related replacements due to diverse weather conditions. The region benefits from strong OEM integration of rain-sensing and heated wiper technologies, particularly in premium and electric vehicle segments. Aftermarket demand remains robust as consumers prefer high-durability silicone and beam blades for enhanced performance in snow and heavy rainfall. Regulatory emphasis on road safety, along with continuous model launches by major automakers, reinforces stable product demand across the United States and Canada.

Europe

Europe secures nearly 25% of the global market, driven by stringent vehicle safety norms, widespread installation of advanced driver-assistance systems, and strong demand for premium wiper technologies. Countries in Northern and Central Europe experience extended winter seasons, boosting adoption of heated wiper blades and high-torque motors. OEMs in Germany, France, and the UK increasingly prioritize energy-efficient, low-noise wiper systems aligned with electric mobility trends. The region also shows strong aftermarket demand as drivers frequently replace blades due to snow, ice accumulation, and road salt exposure, reinforcing steady revenue growth for component suppliers.

Asia-Pacific

Asia-Pacific leads the market with an estimated 42% share, supported by high vehicle production volumes in China, Japan, India, and South Korea. Rapid urbanization, expanding middle-class ownership, and strong OEM manufacturing ecosystems accelerate large-scale demand for cost-efficient wiper systems. Rising adoption of compact SUVs and premium vehicles strengthens interest in rain-sensing and aerodynamic beam blades. Aftermarket growth is fueled by climatic variance—from heavy monsoons in Southeast Asia to snowfall in Japan—driving frequent replacements. Investments in local component manufacturing, combined with rising EV adoption, position the region as the most influential market for future wiper innovations.

Latin America

Latin America holds roughly 3% of the global market, with growth influenced by expanding automotive assembly in Brazil, Mexico, and Argentina. The region experiences steady aftermarket sales due to tropical climates, seasonal rainfall, and rising import availability of mid-range wiper blades. Economic fluctuations, however, constrain premium wiper adoption and keep replacement cycles price-sensitive. Demand strengthens as OEMs increase production of small and mid-sized vehicles tailored for urban use. Gradual introduction of rain-sensing systems in high-end models and growing e-commerce distribution for aftermarket parts create opportunities, although overall penetration remains lower than in developed regions.

Middle East & Africa

The Middle East & Africa region represents nearly 2% of the automotive wipers market, shaped by modest vehicle production, growing urban mobility, and expanding aftermarket distribution networks. Hot climates dominate much of the region, which accelerates rubber degradation and drives repeated blade replacements. South Africa and GCC nations contribute most to OEM-level demand, particularly for SUVs and commercial fleets. Although advanced wiper technologies show limited penetration, premium imports gradually gain traction among luxury vehicle owners. Economic diversification, infrastructure development, and expanding passenger car sales support incremental market growth across key regional clusters.

Market Segmentations:

By Wiper Classification:

- Traditional wipers

- Rain-sensing wipers

By Component:

By Technology:

- Conventional wiping systems

- Rain-sensing wiping systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Automotive Wipers Market include DENSO Corporation, DOGA Group, HELLA GmbH & Co. KGaA, Magneti Marelli S.p.A., Mitsuba Corporation, PEWAG Schneeketten GmbH, Robert Bosch GmbH, Tenneco Inc., TRICO Products Corporation, and Valeo SA. The automotive wipers market features a balanced mix of global Tier-1 suppliers, specialized component manufacturers, and rapidly expanding aftermarket brands competing on technology, durability, and cost efficiency. Companies focus on advancing beam blade aerodynamics, enhancing motor torque performance, and integrating intelligent rain-sensing modules to support the growing adoption of ADAS-equipped vehicles. The competitive environment increasingly rewards suppliers capable of delivering lightweight, energy-efficient, and low-noise systems aligned with electric vehicle requirements. Manufacturers also strengthen market positioning through regional production expansion, material innovation, and digitalized quality control. Meanwhile, aftermarket brands emphasize value-driven replacement cycles, corrosion-resistant designs, and wider e-commerce penetration to capture recurring demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsuba Corporation

- TRICO Products Corporation

- DOGA Group

- Tenneco Inc.

- Valeo SA

- HELLA GmbH & Co. KGaA

- Robert Bosch GmbH

- PEWAG Schneeketten GmbH

- Magneti Marelli S.p.A.

- DENSO Corporation

Recent Developments

- In June 2025, Petra Automotive launched PetraBlades Premium Beam Wiper Blades targeting superior performance, durability in tough weather, and enhanced visibility, aligning with trends for advanced automotive products in the growing market, as confirmed by industry reports and Petra Automotive’s social media.

- In May 2025, Tata Motors has launched the All-New Altroz in India at a starting price of around, positioning it as a premium hatchback with a bold design, luxurious interiors, and advanced features. The vehicle now includes segment-first features such as flush door handles, Infinity LED tail lamps, Luminate LED headlamps with DRLs, and a 3D front grille.

- In April 2025, KIMBLADE innovated KIMBLADE X, the latest features with a multi-joint rectangular blade that eliminates reverse noise. Inspired by vehicle suspension systems, it stays evenly balanced and maintains steady contact with the windshield, resulting in a quieter, longer-lasting, higher-performing wipe.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward intelligent, sensor-integrated wiper systems that enhance visibility and support advanced driver-assistance features.

- Manufacturers will increase adoption of durable silicone and composite materials to extend blade life and improve performance in extreme climates.

- Electric vehicle expansion will drive demand for low-noise, energy-efficient wiper motors and aerodynamic blade designs.

- OEMs will integrate automated wiping functions that self-adjust based on rainfall intensity, windshield clarity, and driving conditions.

- The aftermarket will grow as consumers prefer premium beam blades and easy-installation replacement solutions.

- Digital monitoring technologies will gain traction, enabling predictive maintenance and blade-wear alerts.

- Automakers will use lightweight wiper components to support vehicle efficiency and emissions-reduction targets.

- Heated wiper systems will see wider adoption in cold regions due to improved winter performance.

- Suppliers will expand regional manufacturing capabilities to meet localized OEM sourcing requirements.

- Collaboration between wiper manufacturers and ADAS sensor developers will accelerate development of next-generation visibility systems.