Market Overview

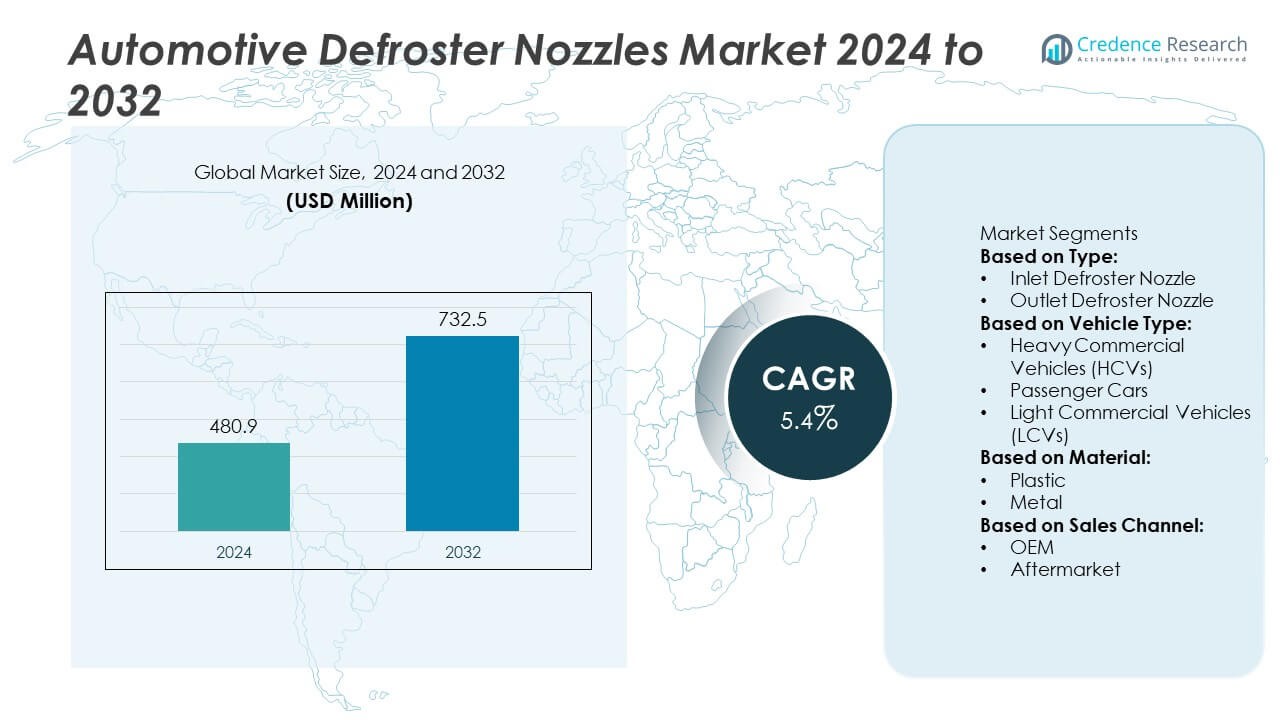

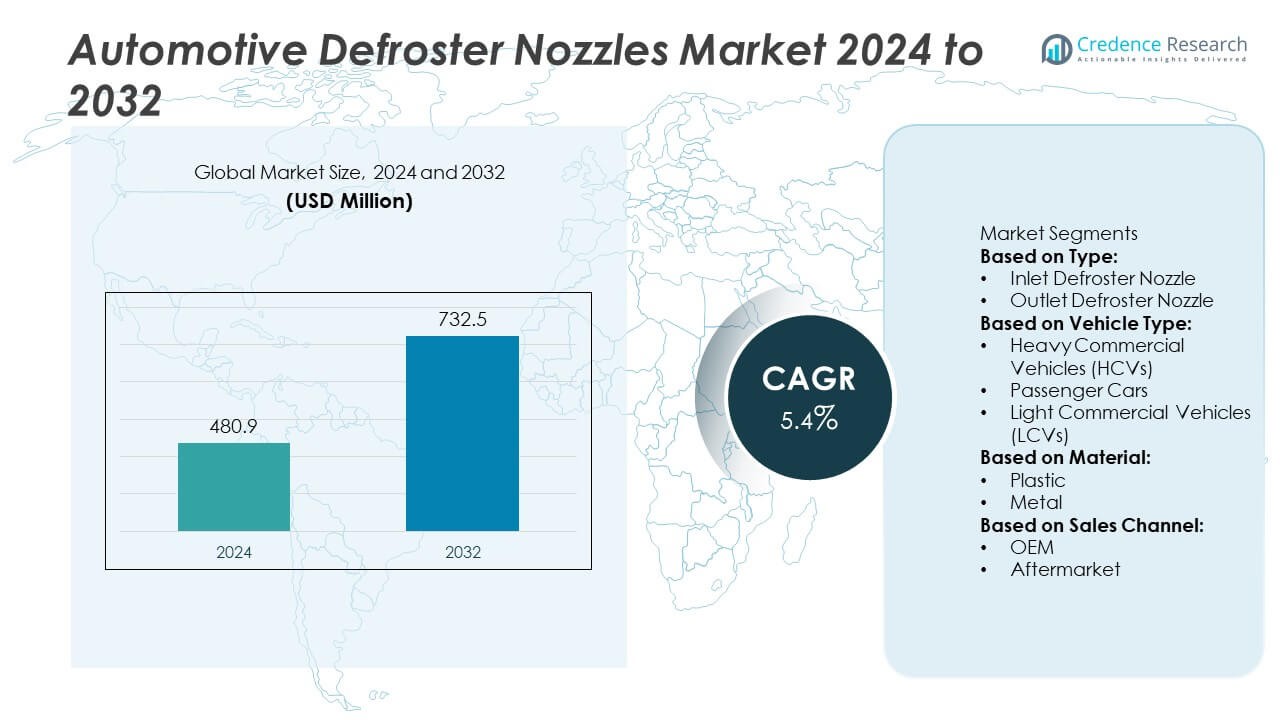

The Automotive Defroster Nozzles Market was valued at USD 480.9 million in 2024 and is projected to reach USD 732.5 million by 2032, expanding at a CAGR of 5.4% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Defroster Nozzles Market Size 2024 |

USD 480.9 Million |

| Automotive Defroster Nozzles Market, CAGR |

5.4% |

| Automotive Defroster Nozzles Market Size 2032 |

USD 732.5 Million |

The Automotive Defroster Nozzles Market grows on strong drivers such as rising global vehicle production, stricter safety regulations mandating clear visibility, and increasing adoption of advanced HVAC systems across passenger and commercial vehicles. It benefits from technological innovations that enhance airflow efficiency and durability while supporting lightweight design for fuel savings.

The Automotive Defroster Nozzles Market demonstrates strong geographical presence, with North America leading adoption due to extreme winter conditions and well-established automotive OEMs, while Europe emphasizes advanced engineering and regulatory compliance driving premium vehicle integration. Asia-Pacific emerges as the most dynamic region, supported by large-scale vehicle production in China, India, Japan, and South Korea, along with growing demand for electric vehicles that require efficient HVAC systems. Latin America and the Middle East & Africa show steady growth, supported by rising automotive infrastructure and aftermarket replacement demand. Key players such as DENSO Corporation, Valeo S.A., MAHLE GmbH, and Bergstrom Inc. play a pivotal role by investing in material innovation, precision airflow designs, and strategic partnerships with OEMs. Their focus on energy-efficient, lightweight, and durable nozzle technologies strengthens competitive positioning, ensuring alignment with evolving vehicle architectures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Defroster Nozzles Market was valued at USD 480.9 million in 2024 and is projected to reach USD 732.5 million by 2032, growing at a CAGR of 5.4% during the forecast period.

- Strong market drivers include rising global vehicle production, stricter road safety regulations that mandate clear windshield visibility, and growing adoption of advanced HVAC systems across passenger and commercial vehicles.

- Market trends highlight the increasing use of lightweight polymers and composites in nozzle manufacturing, integration with smart HVAC and sensor-based climate control systems, and rising demand from electric and hybrid vehicles that require energy-efficient defrosting solutions.

- Competitive dynamics are shaped by leading players such as DENSO Corporation, Valeo S.A., MAHLE GmbH, and Bergstrom Inc., who invest in material innovation, precise airflow designs, and strategic collaborations with automotive OEMs to strengthen market presence.

- Key restraints include the high cost of advanced raw materials, complexity in integrating defroster nozzles with modern HVAC architectures, and challenges in ensuring performance reliability across diverse climatic conditions.

- Regional growth patterns reflect strong demand in North America driven by harsh winters and advanced OEM adoption, Europe’s focus on regulatory compliance and premium vehicles, and Asia-Pacific’s large-scale vehicle production and expanding EV adoption.

- Long-term opportunities arise from the growing aftermarket demand for replacement parts, increasing vehicle lifespans in colder regions, and supplier expansion into developing markets with rising automotive infrastructure.

Market Drivers

Rising Focus on Road Safety and Regulatory Compliance

The Automotive Defroster Nozzles Market gains momentum from stricter safety regulations that mandate clear driver visibility. Governments across North America, Europe, and Asia enforce rules requiring effective defrosting systems in all vehicle categories. It ensures that windshields remain free of fog and frost, reducing the risk of accidents in adverse weather. Automotive OEMs integrate advanced nozzle designs to comply with these regulations while improving efficiency. The push for occupant safety continues to raise awareness about the critical role of HVAC components. These dynamic places defroster nozzles as a vital part of safety-focused automotive engineering.

- For instance, Betterfrost is developing with DENSO an innovative low energy defrost and defog system for use in electric vehicles (EVs) that will use 20 times less energy than current solutions.

Growth in Global Vehicle Production and Sales

Expanding vehicle production across passenger and commercial categories drives strong demand for defroster nozzles. Rising urbanization, improved consumer spending, and growing transportation needs support steady growth in vehicle sales. It creates significant opportunities for OEMs to scale supply chains for advanced HVAC systems. Premium and mid-segment vehicles increasingly integrate defroster nozzles as standard features, expanding their adoption beyond luxury models. The trend highlights the alignment of HVAC system growth with automotive market expansion. This driver strengthens both original equipment and aftermarket demand worldwide.

- For instance, MAHLE GmbH supplied over 4 million HVAC modules in 2023 globally, many of which incorporated precision airflow technologies designed to improve windshield defrosting efficiency in both passenger and commercial vehicles.

Increasing Integration of Advanced HVAC Technologies

Automotive manufacturers focus on developing efficient HVAC systems that improve performance and comfort while optimizing energy use. Defroster nozzles play a central role in directing airflow with precision to maintain visibility. It aligns with the industry’s shift toward smart climate control systems that use sensors and automated adjustments. Automakers adopt lightweight, durable materials in nozzle design to reduce system weight without compromising efficiency. Rapid innovation enhances the durability and responsiveness of HVAC components. This trend elevates the market’s role in enabling comfort and safety in modern vehicles.

Rising Adoption of Electric and Hybrid Vehicles

The global transition toward electric and hybrid vehicles creates fresh demand for efficient thermal management systems. The Automotive Defroster Nozzles Market benefits from this transition, as EVs require advanced nozzles to manage cabin comfort with lower energy consumption. It drives manufacturers to innovate in energy-efficient designs compatible with battery-powered platforms. Growing government incentives and consumer interest accelerate EV adoption across key regions. Nozzle suppliers align their offerings with the evolving architecture of EV HVAC systems. This transformation expands the addressable market and supports long-term growth in sustainable mobility solutions.

Market Trends

Shift Toward Lightweight and Durable Materials

Manufacturers increasingly adopt advanced polymers and composites to design defroster nozzles that reduce weight and improve durability. It supports the automotive industry’s drive for fuel efficiency and compliance with emission standards. Lightweight materials also enable flexible design options that enhance airflow efficiency. Suppliers invest in materials that withstand extreme temperature variations without compromising performance. The trend strengthens product reliability and aligns with sustainability goals in automotive manufacturing. It reinforces the importance of material innovation in driving market competitiveness.

- For instance, BASF introduced its Ultramid® Advanced N polyphthalamide, which reduces component weight by up to 25% compared to conventional metals while withstanding continuous service temperatures of 120°C, leading to adoption in more than 2.5 million automotive air management parts annually.

Integration with Smart HVAC Systems

The Automotive Defroster Nozzles Market evolves with the integration of smart HVAC technologies that enhance vehicle comfort and efficiency. Automakers implement sensors and automated airflow controls to regulate windshield defrosting under varying environmental conditions. It ensures optimal visibility while reducing energy consumption, particularly in electric vehicles. Advanced nozzle designs are engineered to distribute airflow precisely and respond faster to cabin demands. This trend positions defroster nozzles as essential components of intelligent thermal management systems. It reflects the broader move toward connected and adaptive automotive technologies.

- For instance, Valeo developed its Smart Thermal System, deployed in more than 450,000 electric vehicles globally, which uses predictive sensors to optimize nozzle defrosting while lowering energy draw by up to 30%.

Expansion of Electric Vehicle Applications

The growing adoption of electric and hybrid vehicles drives innovation in defroster nozzle design. It requires solutions that deliver efficient airflow without drawing excessive energy from limited battery reserves. Manufacturers develop compact and energy-efficient nozzles tailored to EV platforms. The shift accelerates investment in nozzle technologies compatible with sustainable mobility trends. Partnerships between EV makers and HVAC component suppliers shape the future of product development. This direction strengthens the long-term growth outlook for defroster nozzles across global EV markets.

Rising Demand in Aftermarket Replacement

The replacement of aging HVAC components stimulates aftermarket demand for defroster nozzles across multiple vehicle categories. It reflects the long operating life of vehicles in regions with severe climates. Consumers and fleet operators seek cost-effective and durable replacements to maintain safety and performance. Suppliers expand distribution networks and introduce standardized products for varied vehicle models. The trend broadens access to quality components while boosting aftermarket revenues. It highlights the dual opportunity in OEM supply and aftermarket replacement channels.

Market Challenges Analysis

High Cost of Advanced Materials and Manufacturing

The Automotive Defroster Nozzles Market faces challenges related to the rising cost of advanced polymers and composites used in nozzle production. It creates pressure on manufacturers to balance product performance with cost competitiveness. Complex manufacturing processes required for precision airflow designs increase production expenses. OEMs often seek cost-effective alternatives, making it difficult for suppliers to maintain margins while meeting performance standards. Global supply chain fluctuations in raw materials further intensify pricing volatility. This challenge restrains broader adoption of high-performance nozzles, especially in price-sensitive markets.

Technical Integration and Performance Limitations

Integration of defroster nozzles into advanced HVAC systems presents design and engineering difficulties. It requires precise calibration to deliver effective airflow without reducing overall system efficiency. Performance limitations emerge in extreme climates, where nozzles must handle rapid temperature shifts and high humidity levels. Ensuring long-term durability while maintaining lightweight construction remains a constant hurdle. Variations in vehicle architectures across OEMs complicate the development of standardized solutions. These challenges highlight the need for continuous innovation and collaboration between component suppliers and automotive manufacturers.

Market Opportunities

Rising Demand from Electric and Hybrid Vehicles

The Automotive Defroster Nozzles Market benefits from the accelerating shift toward electric and hybrid vehicles that require energy-efficient thermal management systems. It creates opportunities for suppliers to design nozzles that minimize power consumption while maintaining effective defrosting performance. EV manufacturers seek compact and lightweight nozzle solutions that align with battery efficiency goals. Partnerships between HVAC component suppliers and EV makers support product innovation and market penetration. Growth in government-backed EV adoption programs across major regions further expands the demand base. These dynamic positions defroster nozzles as critical components in sustainable mobility platforms.

Expansion of Aftermarket and Replacement Channels

The growing need to replace aging HVAC components opens strong opportunities in the aftermarket segment. The Automotive Defroster Nozzles Market leverages extended vehicle lifespans in regions with harsh winters where nozzle durability is frequently tested. It allows suppliers to capture recurring revenue streams by offering standardized and customizable replacement parts. Increased digital retail platforms enhance accessibility and expand aftermarket reach to consumers and fleet operators. Manufacturers that invest in distribution partnerships and localized supply networks strengthen competitiveness in this space. The aftermarket channel provides long-term growth potential alongside OEM integration.

Market Segmentation Analysis:

By Type

The Automotive Defroster Nozzles Market is segmented by type into fixed nozzles and adjustable nozzles. Fixed nozzles dominate in mass-produced vehicles due to their cost efficiency and straightforward design, ensuring reliable performance across standard HVAC systems. It provides consistent airflow distribution and meets regulatory safety standards, making it a preferred option for OEM integration. Adjustable nozzles gain traction in premium and mid-range vehicles where consumer demand for comfort and customization is strong. These nozzles allow drivers to control airflow direction, enhancing user experience in varying climates. The segment reflects a balance between affordability and innovation, catering to diverse vehicle categories.

- For instance, Red Dot Corporation produced over 250,000 HVAC systems in 2023 for commercial and off-highway vehicles, many of which included fixed nozzle assemblies designed for consistent airflow distribution under rugged conditions.

By Vehicle Type

Passenger cars remain the largest consumer of defroster nozzles due to high global production volumes and strict safety regulations. The Automotive Defroster Nozzles Market benefits from strong demand in this category, particularly in regions with cold climates where defrosting is critical. Light commercial vehicles contribute steadily as fleet operators prioritize safety and efficiency for daily operations. It also finds opportunities in heavy commercial vehicles, where advanced HVAC systems are increasingly integrated to enhance driver visibility and reduce downtime in challenging weather conditions. Each vehicle type reinforces nozzle demand, ensuring widespread market penetration across mobility segments.

- For instance, Ford’s Transit van line surpassed 1 million units in cumulative production since 2014, with each model incorporating defroster nozzles optimized for large cabin visibility.

By Material

The choice of material plays a critical role in nozzle performance and durability. The Automotive Defroster Nozzles Market includes plastic-based nozzles, which dominate due to their lightweight nature, cost-effectiveness, and design flexibility. It enables manufacturers to optimize airflow efficiency while supporting fuel economy targets. Metal-based nozzles occupy a niche segment where higher durability and resistance to wear are prioritized, particularly in heavy-duty or specialized vehicles. Innovations in composite and polymer blends further expand opportunities, offering heat resistance and long service life without adding weight. The material segment underscores the industry’s shift toward lightweight, durable, and energy-efficient designs.

Segments:

Based on Type:

- Inlet Defroster Nozzle

- Outlet Defroster Nozzle

Based on Vehicle Type:

- Heavy Commercial Vehicles (HCVs)

- Passenger Cars

- Light Commercial Vehicles (LCVs)

Based on Material:

Based on Sales Channel:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 27% of the Automotive Defroster Nozzles Market, supported by strong vehicle production and a high rate of HVAC system integration in passenger and commercial vehicles. The region’s harsh winter conditions in the United States and Canada create sustained demand for reliable defrosting solutions to maintain driver safety. It benefits from well-established automotive OEMs that prioritize advanced HVAC technologies across models. The rise of electric vehicles in the U.S. further accelerates the need for energy-efficient defroster nozzles compatible with battery platforms. Strong aftermarket networks and consumer awareness about vehicle safety also strengthen market growth. Continuous innovation in lightweight and durable nozzle materials adds momentum to long-term adoption.

Europe

Europe holds 24% of the Automotive Defroster Nozzles Market, driven by strict regulatory standards on safety and emissions. Countries such as Germany, France, and the United Kingdom lead adoption due to high vehicle production and advanced automotive engineering. It thrives on the region’s emphasis on premium and mid-range vehicles equipped with advanced HVAC systems. Cold climate conditions across Northern and Eastern Europe amplify demand for effective defrosting technology. European automakers focus on precision-engineered nozzles that balance performance with energy efficiency, aligning with sustainability goals. Aftermarket demand also grows in this region due to extended vehicle life cycles and widespread adoption of replacement parts.

Asia-Pacific

Asia-Pacific represents the largest share at 31%, supported by rapid vehicle production in China, India, Japan, and South Korea. Strong demand for passenger cars in emerging economies contributes significantly to this region’s dominance. It also benefits from a growing commercial vehicle fleet that requires durable HVAC components for daily operations. Rising urbanization and income levels drive consumer demand for vehicles with advanced comfort and safety features, including defroster nozzles. Regional suppliers invest heavily in material innovation and production capacity to meet growing demand. Government policies encouraging electric and hybrid vehicles create additional opportunities for energy-efficient nozzle integration across Asia-Pacific markets.

Latin America

Latin America accounts for 9% of the Automotive Defroster Nozzles Market, with growth centered in Brazil, Mexico, and Argentina. Vehicle production in these countries provides a stable base for OEM adoption of HVAC systems, including defroster nozzles. It faces challenges from varying climates, as tropical regions have lower defrosting needs, while Southern areas with cooler conditions show stronger adoption. Increasing safety awareness and regulatory enforcement create demand for improved windshield visibility solutions. Expanding aftermarket channels further contribute to growth, as older vehicles in the region require replacement parts. Partnerships between international suppliers and local assemblers support broader availability of advanced nozzle technologies.

Middle East & Africa

The Middle East & Africa region holds 9% of the Automotive Defroster Nozzles Market, with moderate adoption levels. Harsh desert climates limit natural demand for defroster systems, but regions with seasonal cold weather, such as South Africa and parts of the Middle East, sustain niche requirements. It gains traction through increasing imports of vehicles equipped with advanced HVAC technologies as standard. Rising urbanization and development of automotive infrastructure support gradual adoption. The aftermarket segment contributes to growth as imported vehicles require maintenance and replacement components. While demand remains smaller compared to other regions, it reflects steady opportunities tied to vehicle modernization and diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Red Dot Corporation

- Interdynamics Research & Development

- DENSO Corporation

- Full Vision, Inc.

- MAHLE GmbH

- Proair, LLC

- SGM Company

- Valeo S.A.

- Bergstrom Inc.

- Thermo King Corporation

Competitive Analysis

The Automotive Defroster Nozzles Market is highly competitive, with leading players including DENSO Corporation, Valeo S.A., MAHLE GmbH, Bergstrom Inc., Red Dot Corporation, Thermo King Corporation, Proair LLC, SGM Company, Full Vision Inc., and Interdynamics Research & Development driving innovation and market growth. DENSO Corporation and Valeo S.A. maintain dominance through strong OEM partnerships and advanced HVAC portfolios, focusing on energy-efficient nozzle designs tailored to evolving vehicle architectures. MAHLE GmbH emphasizes precision airflow solutions that align with stringent safety and emission standards, while Bergstrom Inc. and Red Dot Corporation specialize in durable systems for heavy-duty and commercial vehicles operating in extreme conditions. Thermo King Corporation and Proair LLC serve niche applications by offering customized climate control components for specialty and fleet vehicles, while SGM Company, Full Vision Inc., and Interdynamics Research & Development strengthen aftermarket presence with tailored solutions and broad distribution. Competition is driven by the need for lightweight, durable, and energy-efficient nozzles, pushing continuous R&D investment across the sector. Companies that innovate in alignment with electrification trends, regulatory compliance, and aftermarket expansion are best positioned to secure long-term growth and reinforce their competitive edge.

Recent Developments

- In July 2025, MAHLE continued its internal cost-efficiency program “Back on Track 2025,” aimed at improving performance and plant operations

- In January 2025, At CES 2025, MAHLE showcased its latest advancements in electrification and thermal management technologies—highlighting efficiency‑focused solutions that implicitly benefit HVAC components like defroster nozzles.

- In February 2024, DENSO partnered with Betterfrost to develop an innovative low-energy defrost and defog system for electric vehicles.

Market Concentration & Characteristics

The Automotive Defroster Nozzles Market reflects moderate concentration with a mix of established global manufacturers and regional suppliers competing for OEM and aftermarket demand. Leading players such as DENSO Corporation, Valeo S.A., MAHLE GmbH, and Bergstrom Inc. hold strong positions due to their advanced HVAC expertise, extensive partnerships with automakers, and continuous investment in energy-efficient technologies. It remains characterized by steady innovation in lightweight polymers, precision airflow designs, and integration with smart climate control systems to meet rising safety and comfort standards. Smaller companies like Red Dot Corporation, Proair LLC, and SGM Company strengthen competition by focusing on niche segments, durable solutions, and aftermarket distribution. The market demonstrates resilience through consistent replacement demand, regulatory enforcement on visibility, and alignment with electrification trends, making it a dynamic space where technological advancement and cost optimization drive long-term competitiveness.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Material, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with growing adoption of electric and hybrid vehicles requiring energy-efficient HVAC systems.

- Manufacturers will focus on lightweight materials to improve airflow efficiency and reduce overall vehicle weight.

- Smart HVAC integration will strengthen as vehicles adopt sensor-based climate control for safety and comfort.

- Aftermarket sales will expand due to longer vehicle lifespans and higher replacement needs in cold regions.

- OEM collaborations will increase to align nozzle designs with advanced vehicle architectures and safety standards.

- Innovation in polymers and composites will create durable, heat-resistant nozzle solutions.

- Regional growth will intensify in Asia-Pacific, supported by high vehicle production and electrification initiatives.

- Companies will invest more in R&D to balance cost efficiency with performance in extreme climates.

- Regulatory focus on visibility and passenger safety will continue to drive mandatory adoption in all vehicle categories.

- Competition will deepen as global players and regional suppliers expand their footprint in both OEM and aftermarket channels.