Market Overview:

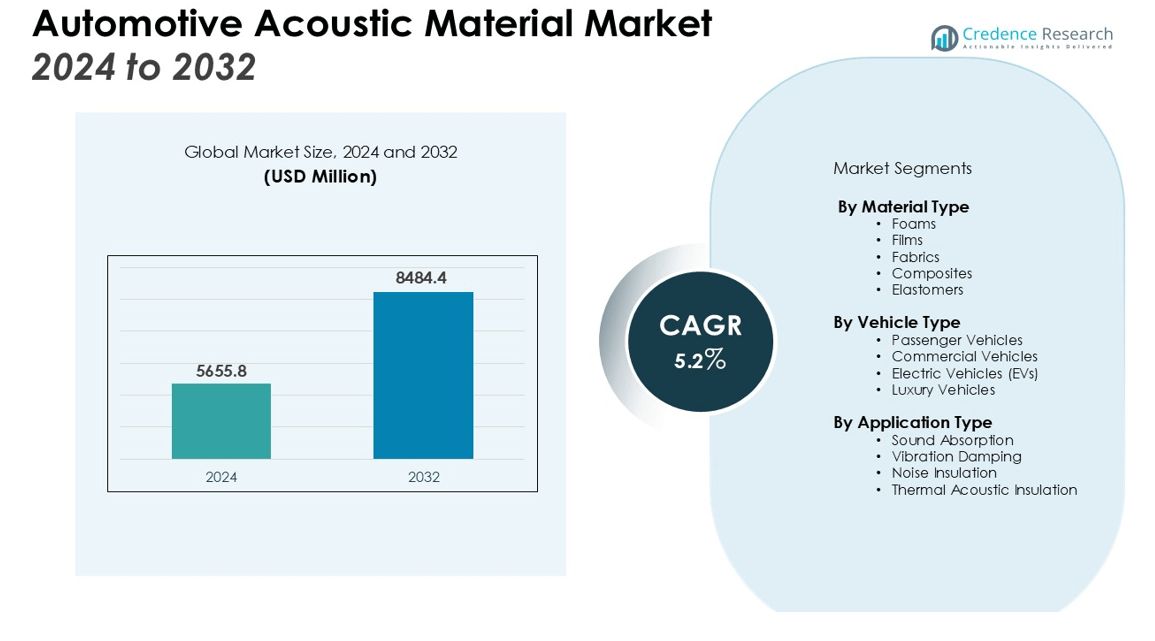

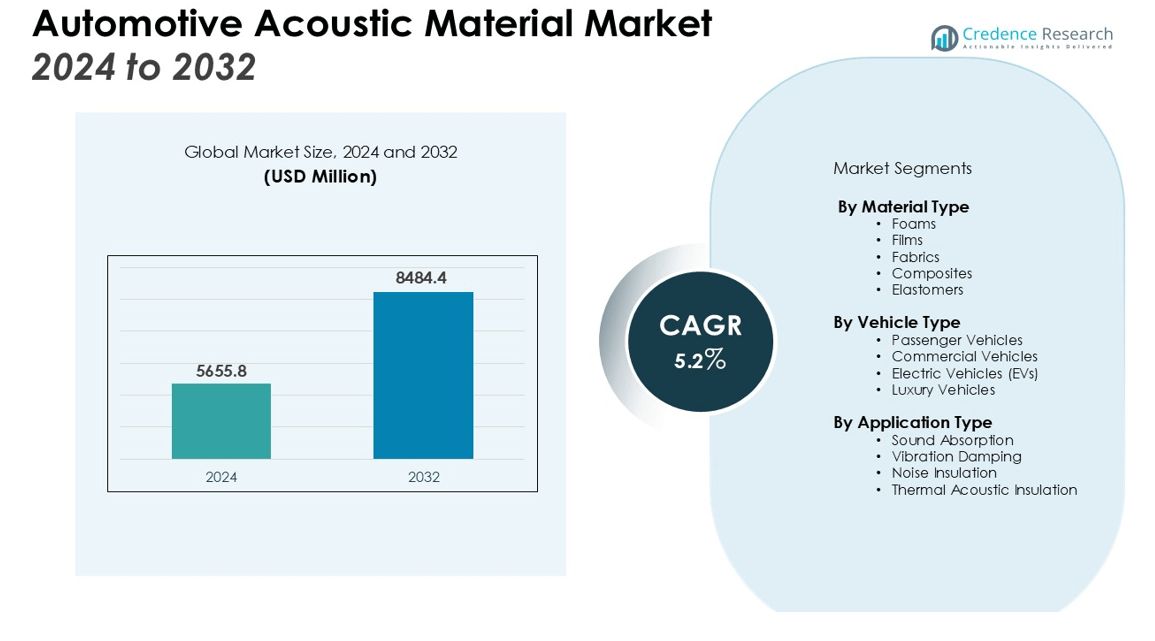

The Automotive Acoustic Material Market size was valued at USD 5655.8 million in 2024 and is anticipated to reach USD 8484.4 million by 2032, at a CAGR of 5.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Acoustic Material Market Size 2024 |

USD 5655.8 million |

| Automotive Acoustic Material Market, CAGR |

5.2% |

| Automotive Acoustic Material Market Size 2032 |

USD 8484.4 million |

Key drivers of the automotive acoustic material market include stringent government regulations on vehicle noise emissions, growing consumer preference for quieter vehicles, and technological advancements in material science. The need for improved fuel efficiency and lighter vehicles has further fueled the demand for high-performance acoustic materials such as foams, films, and fabrics. Additionally, the shift towards electric vehicles (EVs) has increased the demand for superior sound insulation materials due to the quieter operation of EV powertrains. Furthermore, the integration of advanced acoustic solutions in luxury and premium vehicles is driving market expansion.

Regionally, North America dominates the automotive acoustic material market due to stringent environmental regulations and high vehicle production in the U.S. Europe follows closely, with a focus on sustainability and noise reduction in automotive designs. The Asia-Pacific region is expected to witness the highest growth, driven by increasing automotive manufacturing, particularly in countries like China, India, and Japan, and rising consumer demand for premium vehicles. Additionally, rapid urbanization and the rising middle-class population in emerging markets are further accelerating the demand for advanced acoustic materials

.

.

Market Insights:

- The automotive acoustic material market is valued at USD 5655.8 million and is expected to reach USD 8484.4 million by 2032, growing at a CAGR of 5.2%.

- Stringent global regulations on vehicle noise emissions drive the demand for advanced acoustic materials to meet noise reduction requirements.

- Rising consumer demand for quieter vehicles, especially in premium segments, is increasing the adoption of acoustic materials to improve NVH performance.

- Technological innovations in material science have led to the development of lighter, more efficient acoustic materials, enhancing both noise insulation and vehicle performance.

- The growing adoption of electric vehicles has amplified the need for advanced acoustic solutions to ensure cabin comfort and meet NVH standards.

- The Asia-Pacific region leads the market with a 40% share, while North America and Europe follow with 30% and 25%, driven by high vehicle production and regulatory pressures.

- Rising raw material costs and the need for sustainable materials present challenges, requiring significant investment in eco-friendly and high-performance solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government Regulations on Vehicle Noise Emissions

Stringent government regulations concerning vehicle noise emissions drive the automotive acoustic material market. Governments across the globe are enforcing stricter noise pollution standards to mitigate environmental impacts. These regulations have led automakers to incorporate advanced acoustic materials to meet noise reduction requirements. By using noise-dampening materials, manufacturers can comply with these evolving standards while improving the comfort and performance of vehicles.

- For instance, Röchling Automotive’s acoustically effective A/C air ducts, made with low-weight reinforced thermoplastics, achieve a noise reduction of up to 10 decibels in critical frequency ranges.

Consumer Demand for Quieter Vehicles

Consumer preference for quieter, more comfortable driving experiences has become a significant driver for the automotive acoustic material market. Noise, vibration, and harshness (NVH) reduction are top priorities for consumers, especially in premium and luxury vehicles. With rising expectations for cabin comfort, automakers are increasingly adopting high-performance acoustic materials like foams, films, and soundproofing fabrics. The demand for quieter vehicles is particularly evident in markets with high competition, where NVH performance can differentiate brands.

- For instance, Hyundai’s Road Noise Active Noise Control (RANC) system analyzes road noise and produces an inverted soundwave in approximately 0.002 seconds, reducing in-cabin noise by 3 decibels.

Technological Advancements in Acoustic Materials

Technological innovations in material science have significantly contributed to the growth of the automotive acoustic material market. Continuous research and development efforts have led to the development of lighter, more efficient materials that enhance sound insulation without adding bulk. The application of new materials such as lightweight foams and composites improves vehicle performance and fuel efficiency while maintaining high acoustic standards. These advancements help automakers meet both regulatory requirements and consumer expectations for quiet vehicles.

Growth in Electric Vehicle (EV) Adoption

The rapid growth of electric vehicles (EVs) has created new demand for advanced acoustic materials in the automotive industry. Electric vehicles generate significantly less noise compared to traditional combustion engines, which increases the need for better sound insulation. This shift towards EVs has amplified the demand for acoustic materials that enhance vehicle cabin comfort. The quieter operation of EV powertrains makes it essential for manufacturers to incorporate soundproofing solutions to meet both NVH performance standards and consumer comfort preferences.

Market Trends:

Shift Towards Lightweight and Sustainable Acoustic Materials

One of the key trends in the automotive acoustic material market is the growing shift towards lightweight and sustainable materials. Automakers are increasingly focused on reducing the weight of vehicles to improve fuel efficiency and reduce carbon emissions. Lightweight acoustic materials, such as foams and composites, help reduce vehicle weight while maintaining high acoustic performance. This trend aligns with the broader automotive industry’s push toward sustainability, as manufacturers seek to adopt environmentally friendly materials. By incorporating sustainable acoustic solutions, automakers are also able to meet consumer preferences for eco-friendly products without compromising on noise reduction performance. This trend reflects the industry’s commitment to balancing environmental responsibility with high-quality vehicle design.

- For instance, Autoneum’s Ultra-Silent underbody systems are designed to be exceptionally lightweight and absorb sound, which can reduce vehicle noise by up to 2 decibels.

Integration of Advanced Acoustic Solutions in Electric Vehicles (EVs)

The integration of advanced acoustic materials into electric vehicles (EVs) is a significant trend driving the automotive acoustic material market. EVs operate much quieter than conventional vehicles due to the absence of internal combustion engines, highlighting the need for superior sound insulation to enhance cabin comfort. Manufacturers are increasingly incorporating advanced acoustic solutions to address this need, ensuring that soundproofing technologies align with the quieter operation of EV powertrains. Acoustic materials such as specialized foams, fabrics, and films are being used to reduce unwanted noise from road surfaces, wind, and mechanical components, offering a more refined driving experience. This trend is particularly prominent in premium and luxury EV models, where cabin comfort and NVH (Noise, Vibration, and Harshness) performance are a key differentiator.

- For instance, in engineering the new Ghost model, Rolls-Royce utilized more than 220 pounds of sound-absorbing materials in the car’s floor, roof, and trunk to create a near-silent interior cabin.

Market Challenges Analysis:

Rising Costs of Raw Materials and Manufacturing

One of the primary challenges in the automotive acoustic material market is the rising costs of raw materials and manufacturing processes. The increased demand for advanced acoustic materials such as foams, composites, and soundproof fabrics puts pressure on the supply chain, leading to higher costs. The volatility in the prices of petroleum-based products, which are used in the production of several acoustic materials, further exacerbates this issue. These rising costs can impact the overall cost of vehicle production, especially for automakers aiming to maintain competitive pricing in a cost-sensitive market. Manufacturers may struggle to balance the demand for high-quality materials with the need to keep production costs under control.

Regulatory Compliance and Environmental Constraints

Another challenge facing the automotive acoustic material market is the need to meet increasingly stringent regulatory and environmental standards. Governments worldwide are enforcing stricter regulations on vehicle noise emissions, driving the need for continuous innovation in acoustic materials. However, complying with these regulations often requires substantial investment in research and development, which can be costly. Furthermore, the automotive industry is under pressure to reduce its environmental footprint, prompting manufacturers to seek more sustainable materials. Finding eco-friendly alternatives that meet both acoustic and environmental standards presents a significant challenge for the market.

Market Opportunities:

Growth in Electric Vehicle (EV) Production and Adoption

The rapid expansion of electric vehicle (EV) production presents significant opportunities for the automotive acoustic material market. As EV adoption continues to rise, manufacturers are prioritizing noise, vibration, and harshness (NVH) performance due to the quieter nature of electric powertrains. This shift creates a demand for advanced acoustic materials that enhance cabin comfort and reduce road, wind, and mechanical noise. As more automakers focus on developing electric and hybrid vehicles, the need for high-quality soundproofing materials will increase, offering substantial growth prospects for acoustic material suppliers. The growing emphasis on premium EV models further supports this demand, as consumers expect enhanced comfort and quieter rides in these vehicles.

Technological Innovations and Sustainable Material Development

Technological advancements in material science open up significant opportunities in the automotive acoustic material market. The development of lighter, more efficient, and sustainable materials offers new avenues for growth. Innovations such as bio-based foams, recycled acoustic materials, and advanced composites align with the automotive industry’s push for sustainability. These materials not only help manufacturers reduce their environmental impact but also improve vehicle performance by lowering weight while maintaining excellent acoustic properties. By integrating these innovative solutions, automakers can meet consumer preferences for eco-friendly products while improving the overall driving experience, creating a promising future for the automotive acoustic material market.

Market Segmentation Analysis:

By Material Type

The market is primarily driven by foams, films, and fabrics. Foams are widely used for their excellent sound absorption properties, making them ideal for reducing cabin noise. Films are increasingly adopted for their lightweight nature and effective noise control. Fabrics are also gaining traction due to their ability to integrate seamlessly with vehicle interiors while providing superior acoustic insulation.

- For instance, BASF developed Elastofoam® I, a flexible polyurethane integral foam used for engine coverings in Volvo cars, which features a low component density of 140 kg/m³.

By Vehicle Type

The market is dominated by passenger vehicles, followed by commercial vehicles. Passenger vehicles require advanced acoustic materials for enhanced comfort, particularly in premium models, where noise reduction is a key selling point. The demand for quieter vehicles in commercial segments, including trucks and buses, is also increasing as manufacturers focus on improving driver and passenger comfort.

- For instance, an acoustic optimization of the EC145 Mercedes-Benz Style helicopter interior demonstrated a further noise reduction of 3 dB(A) compared to the medium soundproofed version.

By Application Type

The primary applications of automotive acoustic materials include sound absorption, vibration damping, and noise insulation. Sound absorption materials are crucial in reducing engine and road noise, while vibration damping solutions are vital for controlling vibrations from engine components and the road. Noise insulation is key to enhancing overall cabin comfort, particularly in electric vehicles, which operate more quietly than traditional combustion engines, creating a need for superior soundproofing solutions.

Segmentations:

- By Material Type

- Foams

- Films

- Fabrics

- Composites

- Elastomers

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Luxury Vehicles

- By Application Type

- Sound Absorption

- Vibration Damping

- Noise Insulation

- Thermal Acoustic Insulation

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Market Leader and Growth Driver

The Asia-Pacific region holds the largest share of the automotive acoustic material market, accounting for 40% of the global market. The region exhibits robust growth prospects, driven by substantial vehicle production in countries like China, Japan, South Korea, and India. The dominance of this region is attributed to the high volume of automotive manufacturing and the increasing demand for electric vehicles (EVs), which require advanced acoustic solutions to enhance cabin comfort. The growing emphasis on reducing noise, vibration, and harshness (NVH) in vehicles further propels the adoption of acoustic materials in this region.

North America: Established Market with Steady Growth

North America accounts for 30% of the automotive acoustic material market, supported by a well-established automotive industry and stringent regulatory standards on vehicle noise emissions. The United States, in particular, is a major contributor, with a high demand for premium vehicles that prioritize interior comfort and noise reduction. The market’s growth is further fueled by technological advancements and the presence of key manufacturers specializing in acoustic materials. However, the region faces challenges related to raw material costs and the need for continuous innovation to meet evolving consumer expectations.

Europe: Innovation Hub with Regulatory Influence

Europe holds 25% of the automotive acoustic material market, driven by stringent environmental regulations and a strong focus on sustainability. Countries like Germany, France, and the United Kingdom are at the forefront of adopting advanced acoustic technologies to comply with noise reduction standards and enhance vehicle comfort. The region’s emphasis on research and development fosters innovation in acoustic material solutions, catering to the growing demand for electric and hybrid vehicles. While the market faces challenges such as economic fluctuations and regulatory complexities, Europe’s commitment to environmental sustainability and technological advancement continues to drive the adoption of acoustic materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The automotive acoustic material market is highly competitive, with several key players focusing on innovation and product differentiation. Leading companies such as 3M, BASF SE, and Lear Corporation dominate the market by offering a wide range of noise, vibration, and harshness (NVH) solutions. These companies invest heavily in research and development to enhance the performance of acoustic materials, focusing on lightweight and sustainable options. Smaller players also contribute by offering specialized solutions, particularly for electric and luxury vehicles, which have higher demand for advanced acoustic materials. The increasing shift towards electric vehicles (EVs) further intensifies competition, as manufacturers seek to develop materials that improve cabin comfort and reduce noise. Partnerships, mergers, and acquisitions are common strategies among major companies to expand their product portfolios and geographical reach, strengthening their position in the automotive acoustic material market.

Recent Developments:

- In June 2025, Dow signed an agreement to sell its 50% ownership in the DowAksa Advanced Composites Holdings B.V. joint venture for approximately $125 million.

- In April 2025, BASF expanded its personal care portfolio by launching three new natural-based ingredients: Verdessence® Maize, Lamesoft® OP Plus, and Dehyton® PK45 GA/RA.

- In April 2025, BASF launched L-Menthol FCC rPCF, its first aroma ingredient with a reduced Product Carbon Footprint (rPCF).

Market Concentration & Characteristics:

The automotive acoustic material market is moderately concentrated, with a few key players dominating the industry. Major companies such as 3M, BASF SE, and Lear Corporation hold significant market shares due to their advanced product offerings and strong research and development capabilities. These companies focus on delivering high-performance materials that meet stringent regulatory requirements and enhance vehicle comfort. The market is characterized by continuous innovation, particularly in developing lightweight, sustainable, and cost-effective solutions. Smaller players also contribute by offering specialized products, particularly for emerging markets like electric vehicles (EVs), which have unique acoustic requirements. The market is highly competitive, with manufacturers competing on factors such as material quality, performance, and technological advancements. Strategic partnerships, acquisitions, and collaborations are common tactics used to expand product portfolios and strengthen market positions in this rapidly evolving industry.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Vehicle Type, Application Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for advanced acoustic materials will continue to rise as automakers focus on enhancing cabin comfort and reducing noise, vibration, and harshness (NVH).

- The shift towards electric vehicles (EVs) will drive innovation in acoustic materials, as quieter powertrains require superior soundproofing solutions.

- Technological advancements will lead to the development of lighter, more efficient materials that reduce vehicle weight while maintaining high acoustic performance.

- Increased focus on sustainability will push for the use of eco-friendly and recyclable materials in automotive acoustic applications.

- Consumer preference for quieter and more luxurious driving experiences will continue to fuel market growth, particularly in premium and luxury vehicle segments.

- Stringent government regulations on noise emissions will encourage automakers to adopt advanced acoustic materials to meet compliance standards.

- The Asia-Pacific region will maintain its strong growth due to increasing automotive production, particularly in China and India.

- North America and Europe will continue to dominate the market, driven by regulatory pressure and the high demand for premium vehicles.

- Partnerships and collaborations between automotive manufacturers and material suppliers will increase to meet the growing demand for specialized acoustic solutions.

- Research and development investments will accelerate to cater to the evolving acoustic needs of hybrid, electric, and autonomous vehicles.

.

.