Market Overview:

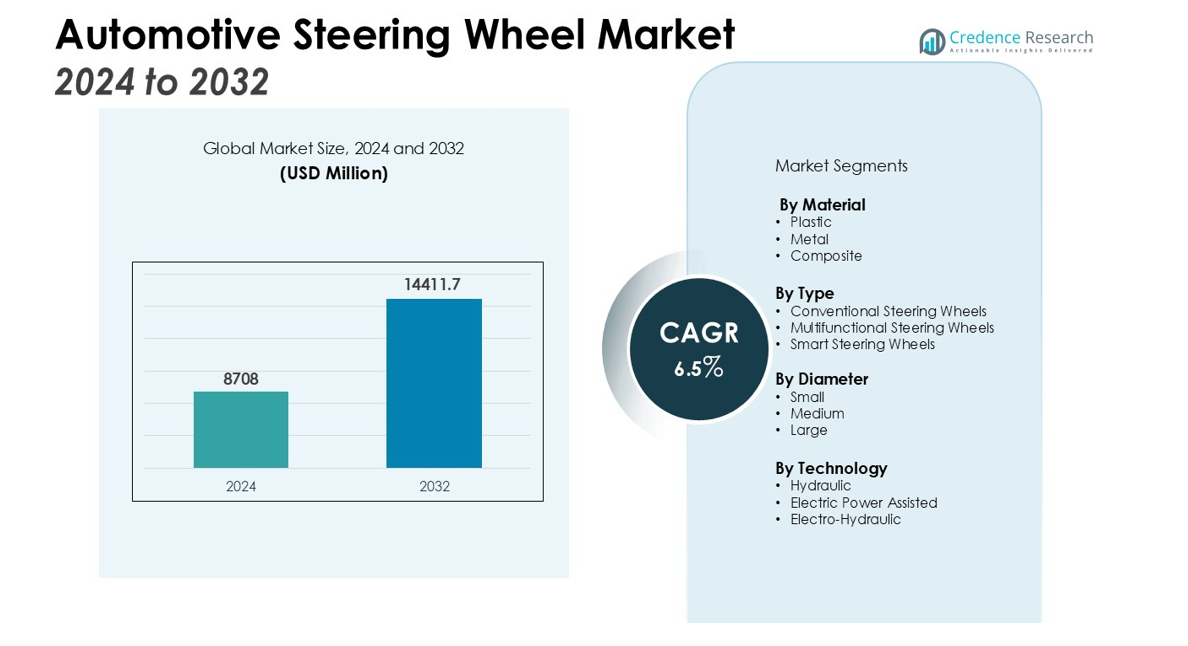

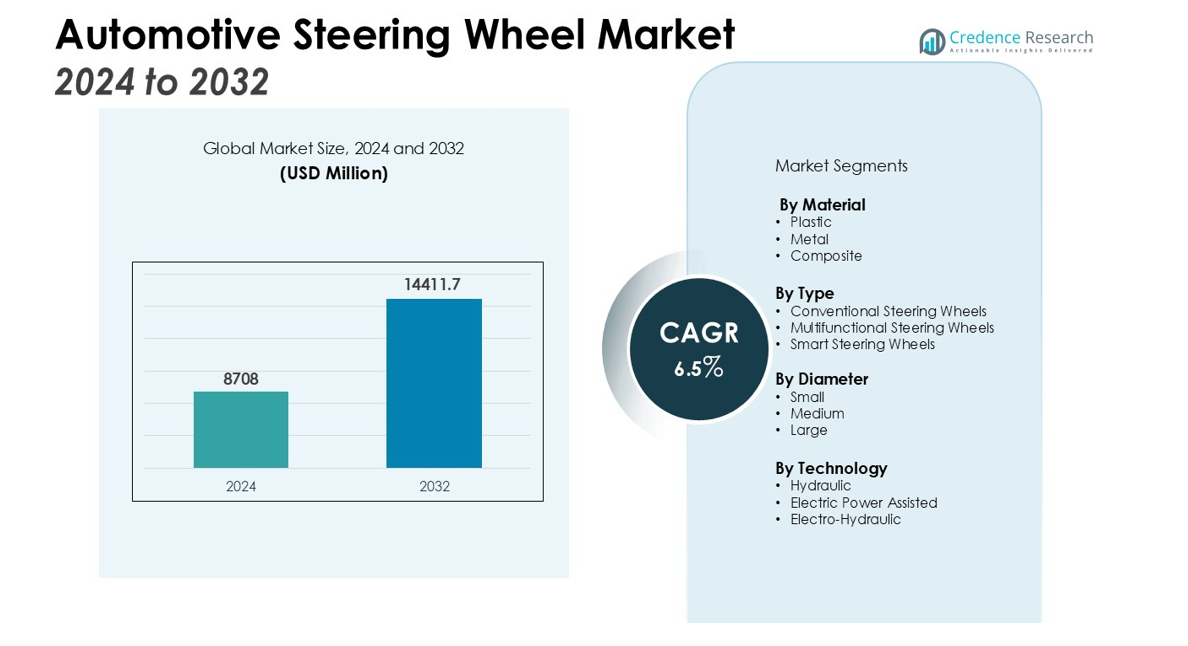

The Automotive Steering Wheel Market size was valued at USD 8708 million in 2024 and is anticipated to reach USD 14411.7 million by 2032, at a CAGR of 6.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Steering Wheel Market Size 2024 |

USD 8708 million |

| Automotive Steering Wheel Market, CAGR |

6.5% |

| Automotive Steering Wheel Market Size 2032 |

USD 14411.7 million |

Growth in the market is primarily driven by rising demand for enhanced driver comfort, safety, and convenience. The adoption of electric vehicles is fueling the need for steering systems designed with lightweight materials, smart connectivity, multifunctional controls, and haptic feedback. Stricter safety regulations are also encouraging manufacturers to incorporate advanced features such as integrated airbags and electronic driver-assist controls into steering wheel designs. These developments are aimed at improving user experience while meeting regulatory compliance standards. Furthermore, increasing consumer preference for premium and luxury vehicles equipped with technologically advanced steering systems is adding significant momentum to market expansion.

Asia-Pacific dominates the market due to rapid vehicle manufacturing, strong EV adoption, and expanding automotive infrastructure. North America remains a key market for advanced, high-spec steering technologies, influenced by stringent safety norms and growing demand for driver-assistance systems. Europe continues to contribute significantly, with automakers focusing on lightweight, ergonomic, and high-performance steering solutions to enhance vehicle efficiency and driving dynamics.

Market Insights:

- The Automotive Steering Wheel Market is valued at USD 8708 million and is projected to reach USD 14411.7 million by 2032, registering a CAGR of 6.5%.

- Rising demand for enhanced driver comfort, safety, and convenience is accelerating the adoption of multifunctional steering wheels with integrated controls.

- Electric vehicle growth is creating opportunities for lightweight, connected, and customizable steering systems optimized for energy efficiency.

- Stricter safety regulations are driving integration of advanced features such as airbags, haptic feedback, and lane-keeping assistance into steering designs.

- Increasing preference for premium and luxury vehicles is boosting demand for high-quality materials, heated functions, and bespoke configurations.

- Asia-Pacific leads the market with 48% share, followed by North America at 26% and Europe at 20%, reflecting strong manufacturing, innovation, and regulatory support in these regions.

- High production costs and rapid technological changes remain key challenges, while sustainable materials and advanced manufacturing offer long-term growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Enhanced Driver Comfort and Convenience

The Automotive Steering Wheel Market is witnessing strong growth driven by increasing consumer expectations for comfort, ergonomics, and ease of use. Manufacturers are introducing steering wheels with multifunctional controls, enabling drivers to operate various in-car features without distraction. Integration of features such as audio controls, cruise control, and touch-sensitive buttons is improving overall driving experience. It is also promoting brand differentiation, particularly in premium and mid-range vehicle segments.

- For instance, Porsche has transformed the steering wheel in its 911 RSR race car into a comprehensive control center, allowing the driver to manage 30 different vehicle functions without removing their hands from the wheel.

Impact of Electric Vehicle Adoption on Steering Wheel Innovation

The global shift toward electric mobility is creating demand for steering systems that align with modern vehicle architectures. The Automotive Steering Wheel Market is adapting to the EV segment through lightweight materials, customizable designs, and advanced electronic integration. This trend is enabling better energy efficiency and supporting the unique cabin layouts of electric vehicles. It is also encouraging collaborations between steering system manufacturers and EV makers to deliver next-generation solutions.

Stringent Safety Regulations Driving Technological Advancements

Tighter safety regulations are compelling automakers to integrate airbags, driver-assist features, and advanced control systems into steering wheel designs. The Automotive Steering Wheel Market is benefitting from these mandates, as safety compliance directly influences consumer trust and market adoption. Manufacturers are incorporating haptic feedback, lane-keeping alerts, and collision warnings to enhance driver awareness. It is reinforcing the role of the steering wheel as a critical safety component.

- For instance, Honda’s Lane Keeping Assist System (LKAS) is designed to provide steering input to help keep the vehicle centered in a detected lane, operating at speeds between 45 and 90 mph.

Growth of Premium and Luxury Vehicle Segments Boosting Demand

Rising sales of high-end vehicles are accelerating the demand for advanced steering wheel technologies. The Automotive Steering Wheel Market is expanding as luxury automakers focus on premium materials, heated steering functions, and customizable configurations. These enhancements are increasing customer appeal and brand loyalty. It is also leading to the adoption of innovative manufacturing techniques to meet the quality standards expected in the luxury segment.

Market Trends:

Integration of Advanced Technologies and Smart Features

The Automotive Steering Wheel Market is experiencing a shift toward technology-driven designs that enhance both functionality and safety. Manufacturers are integrating features such as touch-sensitive controls, gesture recognition, and haptic feedback to improve driver interaction. The growing use of embedded sensors supports functions like lane-keeping assistance, adaptive cruise control, and driver monitoring systems. It is also enabling seamless connectivity with infotainment platforms, allowing drivers to control navigation, entertainment, and communication tools without losing focus. The demand for such multifunctional steering solutions is particularly strong in electric and autonomous vehicles, where the steering wheel serves as both a control interface and a design focal point. This integration is reinforcing the steering wheel’s role as a central hub for vehicle operation.

- For instance, a multi-touch steering wheel concept developed by Keio University utilizes 120 infrared sensors embedded around the wheel to recognize various hand gestures at any position.

Focus on Lightweight Materials and Sustainable Manufacturing Practices

The push for fuel efficiency and sustainability is influencing design and production trends in the Automotive Steering Wheel Market. Manufacturers are adopting lightweight composites, eco-friendly materials, and recycled components to reduce overall vehicle weight and environmental impact. It is also driving investment in advanced manufacturing techniques such as 3D printing, which enables precision engineering and material optimization. The trend aligns with global regulatory pressures to lower emissions and meet stringent environmental standards. Premium and mass-market automakers alike are prioritizing steering wheels that combine durability with reduced ecological footprint. This shift is expected to strengthen the market’s competitiveness and align with broader industry goals for sustainable mobility.

- For instance, the Cadillac CELESTIQ is manufactured with over 130 3D-printed components, including the steering wheel’s metal center décor, which is GM’s largest production part made with this technology.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Requirements

The Automotive Steering Wheel Market faces challenges from rising production costs driven by advanced technology integration and premium material usage. Incorporating features such as multifunctional controls, embedded sensors, and haptic feedback requires precision engineering and costly manufacturing processes. It also demands specialized supply chains and skilled labor, increasing operational expenses for manufacturers. Fluctuations in raw material prices, especially for high-grade composites and electronics, add further pressure on profit margins. These cost constraints can limit adoption in budget and mid-range vehicle segments, slowing overall market penetration.

Regulatory Compliance and Rapid Technological Obsolescence

Meeting stringent global safety and environmental regulations presents a significant hurdle for the Automotive Steering Wheel Market. Manufacturers must constantly update designs to comply with evolving crash safety standards, airbag integration requirements, and emissions-related material guidelines. It also faces the risk of rapid technological obsolescence, as innovations in autonomous driving and digital interfaces may alter steering system requirements. Adapting to these shifts demands continuous R&D investment, which can strain smaller players. Balancing regulatory compliance with the need for rapid innovation remains a persistent industry challenge.

Market Opportunities:

Expansion Potential in Electric and Autonomous Vehicle Segments

The Automotive Steering Wheel Market holds significant growth potential through its alignment with the expanding electric and autonomous vehicle sectors. The transition to EVs is driving demand for lightweight, energy-efficient steering systems with integrated digital controls. It also creates opportunities for modular and retractable steering designs suited for semi-autonomous and fully autonomous driving modes. Collaborations between steering system suppliers and EV manufacturers can accelerate the development of innovative solutions tailored to advanced mobility platforms. The rise of shared mobility and premium EV brands further supports the adoption of feature-rich, connected steering wheels.

Rising Demand for Premium and Customizable Designs

Increasing consumer preference for personalization presents an opportunity for the Automotive Steering Wheel Market to introduce customizable, high-quality designs. Luxury and performance vehicle manufacturers are seeking steering wheels with premium materials, ergonomic contours, and advanced functionalities. It also benefits from the trend toward integrating ambient lighting, biometric sensors, and touch-based controls for an elevated driving experience. Expanding aftermarket customization services can cater to niche consumer demands and brand-specific enhancements. The ability to deliver differentiated, user-focused steering solutions can strengthen brand positioning and profitability across global markets.

Market Segmentation Analysis:

By Material

The Automotive Steering Wheel Market is segmented into plastic, metal, and composite materials. Composite and lightweight alloys are gaining traction due to their strength, durability, and contribution to fuel efficiency. Leather and premium finishes are increasingly used in high-end vehicles to enhance comfort and aesthetics. It is also seeing greater adoption of eco-friendly and recycled materials, aligning with sustainability goals in automotive manufacturing.

- For instance, the RWB Genuine Leather Quali Steering Wheel is manufactured with a diameter of 350mm and a spoke concavity depth of 55mm.

By Type

The market includes conventional steering wheels, multifunctional steering wheels, and smart steering wheels integrated with advanced electronics. Multifunctional variants dominate demand, driven by their ability to centralize controls for audio, navigation, and driver-assistance features. The Automotive Steering Wheel Market is also witnessing growth in smart steering wheels designed for semi-autonomous vehicles, offering features like driver monitoring sensors and haptic alerts.

- For instance, Toyota models allow the driver to select from 3 different following distances for the dynamic radar cruise control directly from a button on the steering wheel.

By Diameter

The market is classified into small, medium, and large sizes, tailored to vehicle type and driving application. Passenger cars commonly feature medium-diameter wheels, balancing comfort and control, while performance and sports vehicles favor smaller diameters for responsive handling. It is also experiencing demand for larger-diameter wheels in commercial and heavy-duty vehicles to improve maneuverability and driver comfort during extended operations.

Segmentations:

By Material

By Type

- Conventional Steering Wheels

- Multifunctional Steering Wheels

- Smart Steering Wheels

By Diameter

By Technology

- Hydraulic

- Electric Power Assisted

- Electro-Hydraulic

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Leading with Strong Manufacturing and EV Adoption

Asia-Pacific holds 48% share of the Automotive Steering Wheel Market, driven by its strong automotive manufacturing capacity and rapid electric vehicle adoption in China, Japan, South Korea, and India. The region benefits from a well-developed automotive supply chain, skilled labor force, and substantial government incentives for clean mobility. It also sees consistent demand from both domestic brands and international manufacturers with local production facilities. Continuous investment in R&D and manufacturing technologies supports the development of advanced steering systems. Rising disposable incomes and expanding middle-class demographics further reinforce market growth across the region.

North America Advancing with Technology-Driven Demand

North America accounts for 26% share of the Automotive Steering Wheel Market, supported by high adoption of advanced driver-assistance systems and strong demand for premium vehicles. The market in this region is driven by integration of digital controls, haptic feedback, and connected features in steering systems. It also benefits from growth in electric and hybrid vehicle production, particularly in the U.S. and Canada. Leading OEMs and technology suppliers continue to invest in innovative safety and performance-focused designs. Strong regulatory requirements ensure that manufacturers prioritize advanced safety and compliance features in steering wheel development.

Europe Sustaining Growth Through Innovation and Regulation

Europe represents 20% share of the Automotive Steering Wheel Market, sustained by its leading automakers and commitment to performance, safety, and sustainability. The region’s regulatory framework mandates continuous innovation in vehicle safety and environmental compliance. It also fosters advancements in lightweight materials, ergonomic designs, and adaptive steering functionalities, particularly in luxury and sports vehicle segments. Manufacturers focus on integrating advanced driver-assist features and premium finishing to meet consumer expectations. Demand from both domestic markets and exports helps maintain steady growth across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Autoliv

- Toyoda Gosei Co Ltd.

- Emdet Engineer

- TRW Sun Steering Wheels Pvt. Ltd.

- Rane TRW

- KSS Abhishek

- Joyson Safety Systems

Competitive Analysis:

The Automotive Steering Wheel Market is highly competitive, with global and regional players focusing on innovation, quality, and cost efficiency. Leading companies are investing in advanced technologies such as haptic feedback, driver monitoring systems, and multifunctional controls to enhance safety and user experience. It is witnessing strategic collaborations between OEMs and component manufacturers to accelerate the integration of smart and connected steering solutions. Key players are also expanding their product portfolios with lightweight materials and customizable designs to meet evolving consumer preferences. Strong emphasis on regulatory compliance, sustainability, and premium aesthetics is driving competition in both mass-market and luxury vehicle segments. Continuous R&D investment and geographic expansion strategies are enabling companies to strengthen market presence and secure long-term growth in an evolving automotive landscape.

Recent Developments:

- In May 2025, Toyoda Gosei launched a horizontal recycling technology to recover high-quality plastic from end-of-life vehicles.

- In April 2025, Autoliv entered into a multi-year partnership with the ABB FIA Formula E World Championship, becoming the electric racing series’ Official Mobility Safety Partner.

- In May 2024, Joyson Safety Systems upgraded its Supplier Relationship Management (SRM) solution by migrating from an on-premise system to the QAD Cloud to enhance its strategic sourcing and supplier management capabilities.

Market Concentration & Characteristics:

The Automotive Steering Wheel Market demonstrates a moderate to high level of concentration, with a few global manufacturers holding significant market shares due to advanced technology capabilities, strong OEM relationships, and extensive distribution networks. It is characterized by continuous innovation, driven by the integration of multifunctional controls, smart connectivity, and safety-enhancing features. Competitive differentiation is influenced by material quality, ergonomic design, regulatory compliance, and adaptability to electric and autonomous vehicle platforms. The market also reflects a mix of large multinational players and specialized regional manufacturers, creating a dynamic balance between standardized mass production and customized premium offerings. Sustainability trends, lightweight construction, and increasing demand for luxury vehicle components are further shaping its competitive landscape.

Report Coverage:

The research report offers an in-depth analysis based on Material, Type, Diameter, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of multifunctional and smart steering wheels will accelerate with the growth of connected and autonomous vehicles.

- Demand for lightweight materials will increase as manufacturers prioritize fuel efficiency and environmental sustainability.

- Integration of advanced safety features such as haptic alerts, lane-keeping assistance, and collision warnings will become standard in premium and mid-range segments.

- Electric vehicle expansion will drive design innovations, including customizable layouts and retractable steering systems for autonomous driving modes.

- Collaboration between OEMs and technology providers will intensify to develop AI-enabled and sensor-integrated steering solutions.

- Growth in the luxury vehicle segment will boost demand for premium materials, bespoke designs, and enhanced ergonomics.

- Regulatory pressure for improved safety compliance will continue to influence product design and material selection.

- Aftermarket customization services will expand, catering to consumers seeking unique aesthetics and added functionalities.

- Emerging markets will witness increased adoption due to rising vehicle production and infrastructure development.

- Continuous investment in R&D will strengthen competitive differentiation and support long-term innovation in the Automotive Steering Wheel Market.