Market Overview

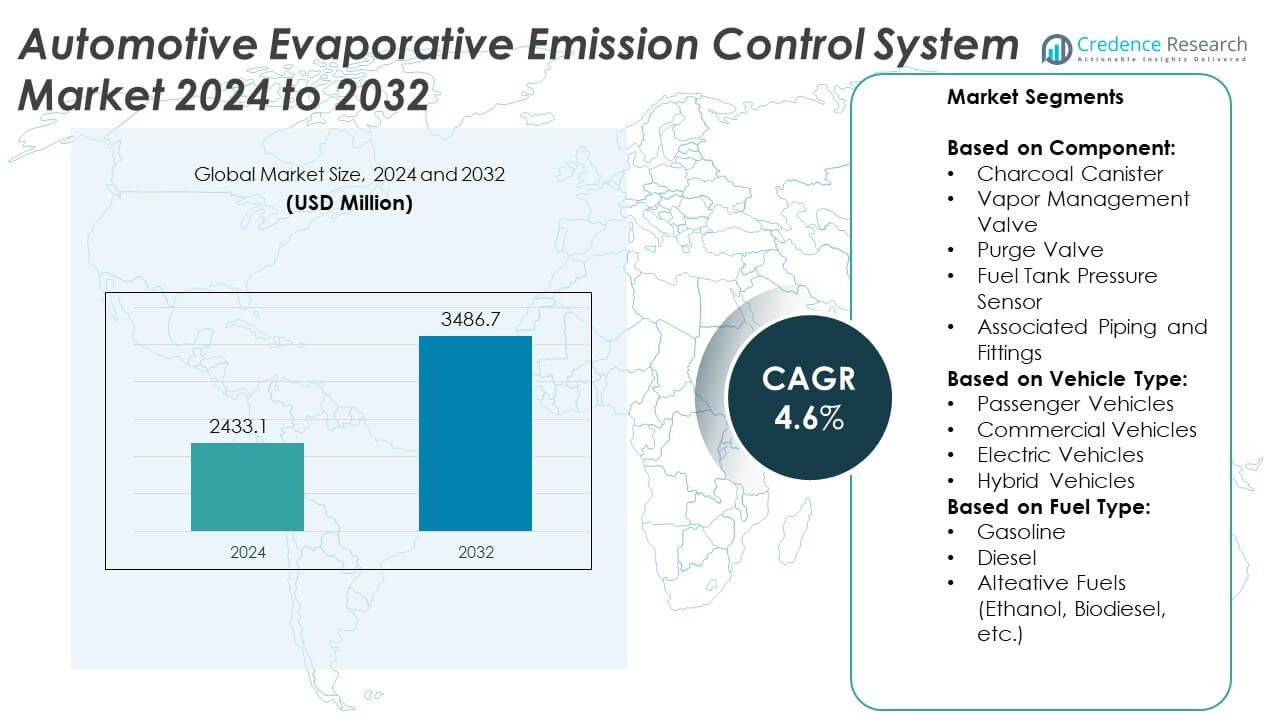

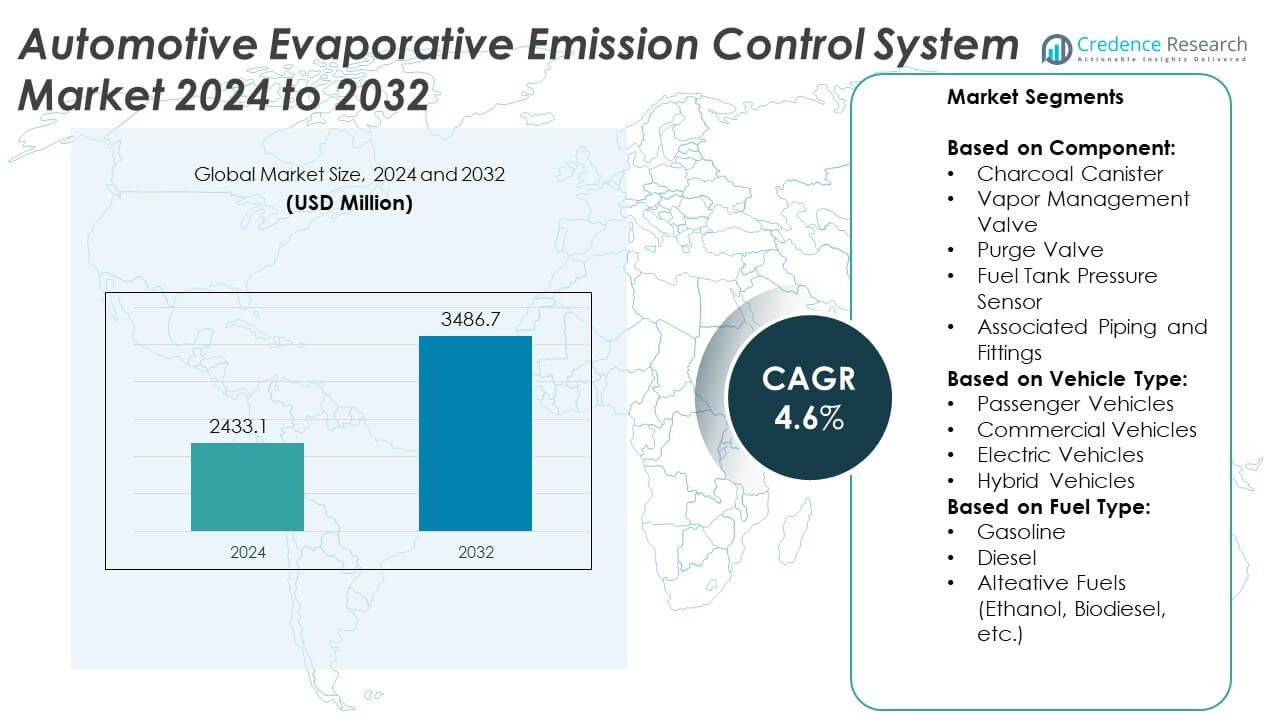

The Automotive Evaporative Emission Control System Market was valued at USD 2,433.1 million in 2024 and is expected to reach USD 3,486.7 million by 2032, growing at a compound annual growth rate of 4.6% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Evaporative Emission Control System Market Size 2024 |

USD 2,433.1 Million |

| Automotive Evaporative Emission Control System Market, CAGR |

4.6% |

| Automotive Evaporative Emission Control System Market Size 2032 |

USD 3,486.7 Million |

The Automotive Evaporative Emission Control System market grows driven by stringent global emission regulations and increasing adoption of electric and hybrid vehicles that demand advanced vapor management solutions. It benefits from rising consumer awareness about environmental impact and the push for improved fuel efficiency. Technological advancements in sensor integration, lightweight materials, and compact system designs further enhance performance and compliance. Growing automotive production in emerging markets and expanding regulatory frameworks create new opportunities.

The Automotive Evaporative Emission Control System market shows strong growth across North America, Europe, and Asia-Pacific, driven by stringent emission regulations and increasing vehicle production. North America and Europe lead with advanced regulatory frameworks and high demand for environmentally friendly vehicles, while Asia-Pacific experiences rapid expansion due to rising urbanization and industrialization. Key players driving the market include Robert Bosch, Delphi Technologies, TI Automotive, and The Plastic Omnium Group. These companies focus on innovation, quality, and strategic partnerships to deliver efficient emission control solutions and maintain competitive advantage in this evolving market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Evaporative Emission Control System market was valued at USD 2,433.1 million in 2024 and is expected to reach USD 3,486.7 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- Increasing global environmental regulations targeting hydrocarbon emissions drive the market, pushing automakers to adopt advanced evaporative emission control technologies for compliance.

- Growing demand for electric and hybrid vehicles supports the market, as these powertrains require specialized vapor management systems to optimize fuel efficiency and reduce emissions.

- Technological advancements such as integration of smart sensors, lightweight materials, and compact system designs enhance system performance and durability, fueling market growth.

- High development and production costs, coupled with challenges in adapting systems to diverse vehicle architectures, restrain market expansion, particularly in price-sensitive regions.

- North America, Europe, and Asia-Pacific dominate the market due to stringent emission standards, established automotive industries, and increasing vehicle production, while emerging markets show growing potential.

- Key competitors include Robert Bosch, Delphi Technologies, TI Automotive, and The Plastic Omnium Group, focusing on innovation, strategic collaborations, and expanding product portfolios to strengthen market presence.

Market Drivers

Stringent Environmental Regulations Driving Demand for Evaporative Emission Control Technologies

The Automotive Evaporative Emission Control System market experiences strong growth propelled by increasing global regulatory standards targeting vehicle emissions. Governments worldwide implement strict norms to limit hydrocarbon emissions from fuel systems, directly influencing manufacturers to adopt advanced evaporative control solutions. Compliance with standards such as the U.S. Environmental Protection Agency’s Tier 3 and Euro 6 regulations forces automakers to integrate efficient emission control systems. It ensures vehicles meet emission thresholds to reduce air pollution and protect public health. Regulatory agencies also enforce rigorous testing procedures, increasing the need for reliable and durable evaporative emission systems. This regulatory push compels continuous innovation and investment in emission control technologies within the automotive sector.

- For instance, Robert Bosch developed a charcoal canister with a vapor adsorption capacity exceeding 50 grams of hydrocarbons, enabling compliance with the most stringent evaporative emission norms worldwide.

Rising Adoption of Electric and Hybrid Vehicles with Enhanced Evaporative Control Features

The market benefits from the growing shift towards electric and hybrid vehicles, which incorporate advanced evaporative emission control components to meet both performance and environmental goals. Manufacturers focus on reducing evaporative losses in these vehicles to enhance fuel efficiency and minimize environmental impact. It supports sustainability initiatives and aligns with consumer demand for greener transportation options. Improved system designs that prevent fuel vapor leakage contribute to overall emission reductions. The integration of sophisticated sensors and canister technologies improves system responsiveness and durability. This trend encourages automakers to invest in research and development focused on lightweight and compact evaporative systems suitable for new vehicle architectures.

- For instance, The Plastic Omnium Group introduced a lightweight fuel vapor management system that reduces component weight by approximately 12%, contributing to overall vehicle weight reduction. This lighter system helps lower fuel consumption and CO2 emissions.

Increasing Consumer Awareness and Demand for Environmentally Friendly Vehicles

Consumer preference for environmentally responsible products significantly influences the Automotive Evaporative Emission Control System market. Growing awareness about climate change and air quality prompts buyers to prioritize vehicles with lower emission footprints. It creates market opportunities for automakers to differentiate products through compliance with stringent emission standards. Consumers seek vehicles that offer both performance and reduced environmental impact, pushing manufacturers to adopt advanced evaporative emission control solutions. Improved public perception of emission-controlled vehicles drives sales and brand loyalty. Market players leverage these preferences by enhancing system efficiency and durability, ensuring alignment with evolving consumer expectations.

Technological Advancements Enhancing Efficiency and Cost-Effectiveness of Emission Control Systems

Continuous innovation in materials, sensors, and system integration drives growth within the Automotive Evaporative Emission Control System market. New carbon canister designs and improved purge valve technologies optimize fuel vapor adsorption and release processes, increasing system efficiency. It reduces overall emissions while maintaining vehicle performance. Cost-effective manufacturing techniques and lightweight components enable wider adoption across vehicle segments. Integration with onboard diagnostics facilitates real-time monitoring and compliance verification. The focus on system miniaturization supports compatibility with compact vehicle designs. These technological developments reinforce the market’s ability to meet stringent emission norms while addressing cost and performance challenges.

Market Trends

Integration of Advanced Sensor Technologies to Improve System Accuracy and Efficiency

The Automotive Evaporative Emission Control System market is witnessing a significant trend towards integrating advanced sensor technologies that enhance system monitoring and control. Manufacturers incorporate high-precision sensors to detect fuel vapor leaks and optimize purge cycles. It enables real-time adjustments that improve overall emission control performance and vehicle fuel efficiency. Enhanced sensor integration supports compliance with stringent emission regulations and facilitates onboard diagnostics for fault detection. The adoption of smart sensors also reduces maintenance requirements and extends system lifespan. This trend drives manufacturers to focus on sensor miniaturization and improved data accuracy, supporting smarter and more reliable emission control solutions.

- For instance, Sensata Technologies developed a pressure sensor with an operational range up to 300 kPa and accuracy within ±0.25 kPa, ensuring precise detection of fuel tank pressure changes to enhance evaporative emission control.

Growing Adoption of Lightweight and Compact Designs to Support Vehicle Efficiency Goals

Market players increasingly emphasize the development of lightweight and compact evaporative emission control systems to align with automotive industry goals for vehicle weight reduction. It allows manufacturers to improve fuel economy and reduce carbon footprints. Advanced materials and innovative design techniques contribute to lowering system weight without compromising durability or performance. The trend supports the integration of evaporative emission systems in smaller and hybrid vehicles, where space and weight constraints are critical. This shift encourages continuous innovation in material science and system engineering. Lightweight systems also contribute to enhanced vehicle handling and reduced overall manufacturing costs.

- For instance, Standard Motor Products developed a compact and lightweight purge valve that weighs approximately 130 grams, featuring a high flow rate and enhanced durability.

Expansion of Market Opportunities in Emerging Economies Driven by Regulatory Adoption

The Automotive Evaporative Emission Control System market is expanding rapidly in emerging economies due to the adoption of stricter emission standards similar to developed regions. Countries in Asia-Pacific, Latin America, and the Middle East implement regulations aimed at reducing vehicular pollution in urban centers. It creates significant demand for compliant evaporative emission control technologies. Growing automotive production and rising environmental awareness in these regions further accelerate market growth. Local manufacturers collaborate with global technology providers to develop cost-effective solutions suited to regional requirements. This trend highlights the globalization of emission control efforts and increasing market penetration in developing markets.

Focus on Integration with Vehicle Electrification and Hybridization Trends

The market reflects a strong alignment with the global shift towards vehicle electrification and hybridization, influencing the design and application of evaporative emission control systems. It adapts to hybrid powertrains by optimizing fuel vapor management during varied engine operation modes. The system designs evolve to accommodate reduced fuel tank sizes and intermittent engine use. Integration with electric vehicle components supports efficient vapor recovery without compromising electric powertrain performance. This trend promotes collaboration between emission control system manufacturers and electric vehicle developers. It accelerates the development of versatile systems that meet evolving automotive technology demands.

Market Challenges Analysis

Complexity in Meeting Diverse Regulatory Standards Across Global Markets

The Automotive Evaporative Emission Control System market faces challenges in complying with a wide range of emission regulations that vary significantly by region. Manufacturers must design systems that meet stringent standards in developed markets while adapting to evolving norms in emerging economies. It increases engineering complexity and development costs due to the need for customizable solutions. Variations in testing procedures and certification requirements further complicate compliance efforts. The market struggles with balancing system performance, cost efficiency, and regulatory adherence across different geographies. These challenges demand continuous innovation and flexible manufacturing processes to address diverse regulatory landscapes. The need for harmonized standards remains a critical issue for sustained market growth.

High Cost of Advanced Technologies and Integration Constraints in Vehicle Design

The adoption of sophisticated materials, sensors, and control technologies in the Automotive Evaporative Emission Control System market drives up production costs, posing challenges for widespread implementation. It affects affordability, especially in price-sensitive segments and emerging markets. Integrating evaporative emission control systems into increasingly compact and electrified vehicle architectures presents design and packaging constraints. Limited space and weight restrictions require advanced engineering solutions that can increase development timelines and expenses. The market must balance innovation with cost-effectiveness to maintain competitive pricing while delivering compliance and durability. Addressing these cost and integration challenges remains essential for broader adoption across vehicle segments.

Market Opportunities

Expansion Potential in Emerging Markets Driven by Increasing Environmental Regulations

The Automotive Evaporative Emission Control System market presents significant growth opportunities in emerging economies where governments progressively enforce stricter emission norms. Rapid urbanization and rising vehicle ownership in regions such as Asia-Pacific, Latin America, and the Middle East create a strong demand for advanced emission control technologies. It enables manufacturers to introduce cost-effective, region-specific solutions tailored to local regulatory frameworks. Collaborations between global technology providers and regional players can accelerate market penetration and technology adoption. Growing environmental awareness among consumers further supports market expansion. These factors collectively offer a substantial opportunity for companies to establish a strong presence in high-growth regions.

Innovation in System Design Aligned with Electrification and Lightweight Vehicle Trends

The market benefits from opportunities to develop innovative evaporative emission control systems that complement the shift towards electrified and lightweight vehicles. It encourages investment in compact, efficient, and integrated system designs compatible with hybrid and electric powertrains. Advances in materials and sensor technologies allow manufacturers to reduce system weight and size while maintaining performance. This trend supports automakers in meeting fuel efficiency targets and emission regulations simultaneously. The focus on scalable solutions for diverse vehicle platforms opens avenues for product differentiation and technological leadership. Continued innovation enhances the market’s ability to address evolving automotive industry demands and consumer expectations.

Market Segmentation Analysis:

By Component:

It include charcoal canister, vapor management valve, purge valve, fuel tank pressure sensor, and associated piping and fittings. The charcoal canister dominates the segment due to its critical role in capturing and storing fuel vapors, preventing their release into the atmosphere. It utilizes activated carbon to adsorb hydrocarbons effectively, ensuring compliance with emission regulations. Vapor management valves and purge valves contribute to precise control of vapor flow between the fuel system and engine, optimizing emission reduction and fuel efficiency. Fuel tank pressure sensors monitor pressure variations to detect leaks and trigger appropriate system responses. Associated piping and fittings provide the necessary connections, ensuring system integrity and durability under varying operating conditions.

- For instance, Magna International manufacturer purge valve compatible with biodiesel blends upto B20 (20% biodiesel), with materials tested for corrosion resistance and durability over 200,000 kilometers under real-world driving conditions.

By Vehicle Type:

It covers passenger vehicles, commercial vehicles, electric vehicles, and hybrid vehicles. Passenger vehicles represent the largest share, driven by high production volumes and stringent emission standards targeting the mass consumer market. Commercial vehicles contribute significantly due to regulatory pressures aimed at reducing pollution from freight and transport sectors. Growth in electric and hybrid vehicles shapes the market by demanding specialized evaporative emission control systems adapted to unique fuel storage and vapor management requirements. It supports the automotive industry’s transition to low-emission mobility while maintaining regulatory compliance across diverse powertrain technologies.

- For instance, Robert Bosch engineered a lightweight charcoal canister that reduces weight, lowering it to approximately 1.2 kilograms from previous models. The canister maintains a hydrocarbon adsorption capacity of around 50 grams and demonstrates durability validated through over 150,000 kilometers of real-world driving conditions.

By Fuel Type:

It includes gasoline, diesel, and alternative fuels such as ethanol and biodiesel. Gasoline vehicles dominate the market due to their widespread use and higher volatility of gasoline fuel, which increases evaporative emissions risk. Diesel-powered vehicles require robust emission control systems to manage different vapor characteristics and meet evolving diesel-specific regulations. The rise of alternative fuels creates new demands for emission control technologies that accommodate fuel blends and bio-based fuels. It drives innovation in materials and system designs capable of handling diverse chemical properties and ensuring consistent performance across fuel types.

Segments:

Based on Component:

- Charcoal Canister

- Vapor Management Valve

- Purge Valve

- Fuel Tank Pressure Sensor

- Associated Piping and Fittings

Based on Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

- Hybrid Vehicles

Based on Fuel Type:

- Gasoline

- Diesel

- Alteative Fuels (Ethanol, Biodiesel, etc.)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Automotive Evaporative Emission Control System market, accounting for approximately 35% of the global market in 2024. The region benefits from stringent environmental regulations such as those enforced by the U.S. Environmental Protection Agency (EPA) and California Air Resources Board (CARB), which mandate rigorous emission control standards for vehicles. Automakers in this region prioritize the integration of advanced evaporative emission control systems to comply with these standards and improve fuel efficiency. The presence of leading automotive manufacturers and suppliers further drives market growth. It also supports continuous innovation in emission reduction technologies, including lightweight materials and smart sensor integration. Robust consumer demand for environmentally friendly vehicles reinforces the market’s strong position in North America.

Europe

Europe commands a considerable share of the Automotive Evaporative Emission Control System market, representing around 28% of the global market. The European Union’s strict emission regulations, including the Euro 6 and upcoming Euro 7 standards, push manufacturers to adopt sophisticated evaporative emission control technologies. Growing environmental awareness and government incentives encourage the use of low-emission vehicles, further driving demand. It supports the adoption of advanced components like carbon canisters and vapor management valves optimized for diverse fuel types. Europe’s established automotive industry and extensive research and development infrastructure contribute to technological advancements. The region’s focus on hybrid and electric vehicle integration also influences market dynamics, fostering innovations in evaporative system designs compatible with new vehicle architectures.

Asia-Pacific

Asia-Pacific holds a strong and rapidly growing share of the Automotive Evaporative Emission Control System market, accounting for approximately 30% of the market in 2024. Expanding automotive production in countries like China, India, Japan, and South Korea fuels this growth. The region’s increasing adoption of environmental regulations, aligned with global standards, drives the need for effective evaporative emission control solutions. It supports rising demand across both passenger and commercial vehicle segments. Rapid urbanization and growing environmental concerns encourage manufacturers to implement systems that reduce hydrocarbon emissions. Collaborations between local manufacturers and global technology providers enable cost-effective and region-specific product development. The increasing penetration of hybrid and electric vehicles in the region further accelerates market growth.

Latin America

Latin America accounts for approximately 5% of the Automotive Evaporative Emission Control System market share. The region experiences steady growth driven by emerging emission regulations and increasing automotive production. Countries such as Brazil and Mexico implement tighter environmental policies that encourage adoption of evaporative emission control technologies. It faces challenges related to infrastructure and cost sensitivity but shows strong potential through government initiatives and rising consumer awareness. The market focuses on affordable, durable system designs adapted to local vehicle fleets. Expanding public and private investment in clean vehicle technologies supports gradual market development in Latin America.

Middle East & Africa

The Middle East & Africa region holds a market share of around 2% in the Automotive Evaporative Emission Control System market. Growth in this region is slower due to relatively lenient emission regulations and lower automotive production volumes compared to other regions. However, increasing awareness of environmental issues and gradual implementation of emission standards open new opportunities. It encourages automakers to adopt basic evaporative emission control technologies in key urban centers. Investment in infrastructure and collaborations with global suppliers facilitate market expansion. The focus remains on cost-effective and reliable solutions suited to regional conditions, supporting steady but modest market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TI Automotive

- Robert Bosch

- Standard Motor Products Inc

- The Plastic Omnium Group

- Eagle Industry Co., Ltd

- Sentec Group

- Stant Corporation

- Delphi Technologies

- Padmini VNA Mechatronics Pvt Ltd

- Plastic Fuel Systems

- Didac International

Competitive Analysis

Key players in the Automotive Evaporative Emission Control System market include Robert Bosch, Delphi Technologies, TI Automotive, The Plastic Omnium Group, Eagle Industry Co., Ltd, and Standard Motor Products Inc. These companies lead the market through continuous innovation, extensive product portfolios, and strong global distribution networks. They focus on developing advanced evaporative emission control technologies that comply with evolving regulatory standards worldwide. Investment in research and development enables the introduction of lightweight, compact, and efficient components such as charcoal canisters, purge valves, and vapor management systems. Strategic partnerships and acquisitions further strengthen their market position and expand their technological capabilities. These players prioritize enhancing system reliability and durability while reducing manufacturing costs to meet diverse customer demands. Their ability to adapt to emerging trends, such as electrification and hybridization, supports sustained growth. By leveraging strong relationships with original equipment manufacturers (OEMs), they ensure wide adoption of their solutions across passenger, commercial, and alternative fuel vehicles. Continuous efforts to optimize product quality and compliance contribute to maintaining competitive advantages in this rapidly evolving market.

Recent Developments

- In 2025, TI Fluid Systems (TIFS) launched a new 12V Electric Coolant Pump (eCP) specifically designed for battery electric vehicles (BEVs). This eCP offers precise thermal control, improved energy efficiency, and an eco-friendly design.

- In 2025, Delphi Technologies contributed in many canisters, fuel tanks, and control valves in Automotive Evaporative Emission Control System Market.

- In 2022, Red Deer Exhaust Inc., operating as Flo~Pro Performance Exhaust and Thunder Diesel & Performance Company, reached an agreement to cease the sale of devices that circumvent or deactivate vehicle emissions control systems. As part of the settlement, they will also pay a $1.6 million forfeit to resolve allegations of violating the Clean Air Act (CAA).

Market Concentration & Characteristics

The Automotive Evaporative Emission Control System market demonstrates a moderately concentrated structure dominated by a few key players with extensive technological expertise and global reach. It features a competitive landscape where established companies invest heavily in research and development to innovate and comply with stringent environmental regulations. The market demands high-quality, reliable components such as charcoal canisters, purge valves, and vapor management systems, requiring significant capital investment and advanced manufacturing capabilities. Smaller and regional players often focus on niche applications or cost-effective solutions for emerging markets. It drives collaboration between suppliers and original equipment manufacturers (OEMs) to integrate systems seamlessly into diverse vehicle platforms, including passenger, commercial, hybrid, and electric vehicles. The market’s characteristics include continuous technological evolution, pressure to reduce system weight and cost, and the need to adapt to varied regulatory frameworks worldwide. It also reflects increasing demand for lightweight, compact designs and sensor integration to enhance efficiency and durability. This dynamic fosters innovation and strategic partnerships, shaping market growth and competitive positioning over the forecast period.

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle Type, Fuel Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow driven by stricter global emission regulations.

- Increasing adoption of hybrid and electric vehicles will boost demand.

- Advances in sensor technology will enhance system accuracy and efficiency.

- Lightweight and compact system designs will gain prominence.

- Emerging economies will offer new growth opportunities.

- Integration with onboard diagnostics will improve system monitoring.

- Collaboration between OEMs and suppliers will intensify.

- Development of cost-effective solutions will support market expansion.

- Focus on sustainable and recyclable materials will increase.

- Continuous innovation will remain critical to meet evolving regulatory standards.