Market Overview

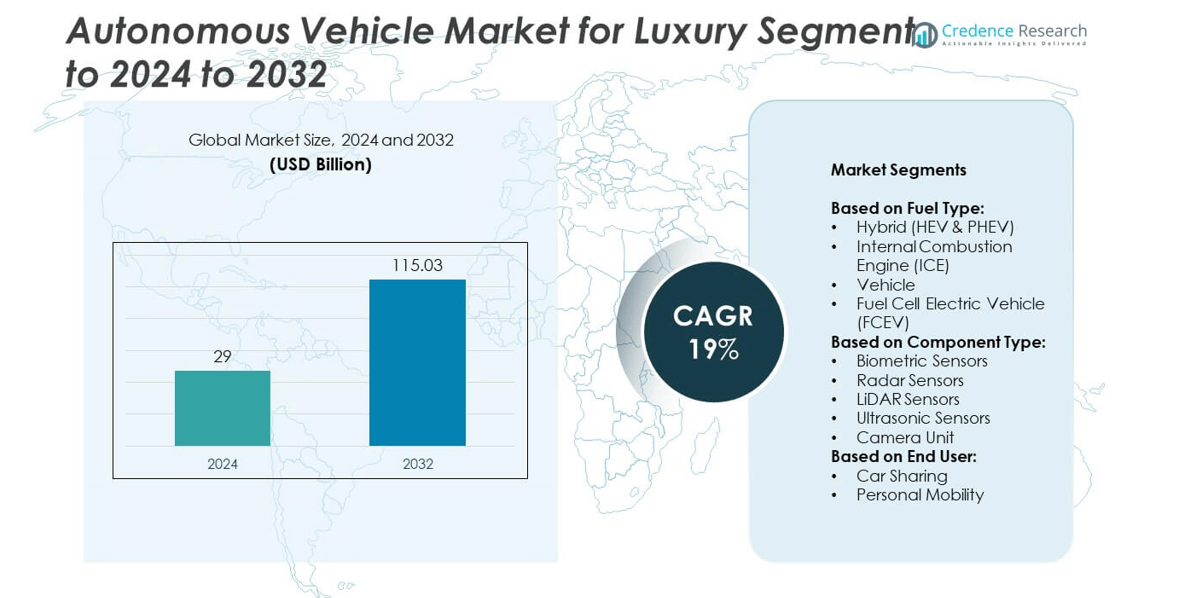

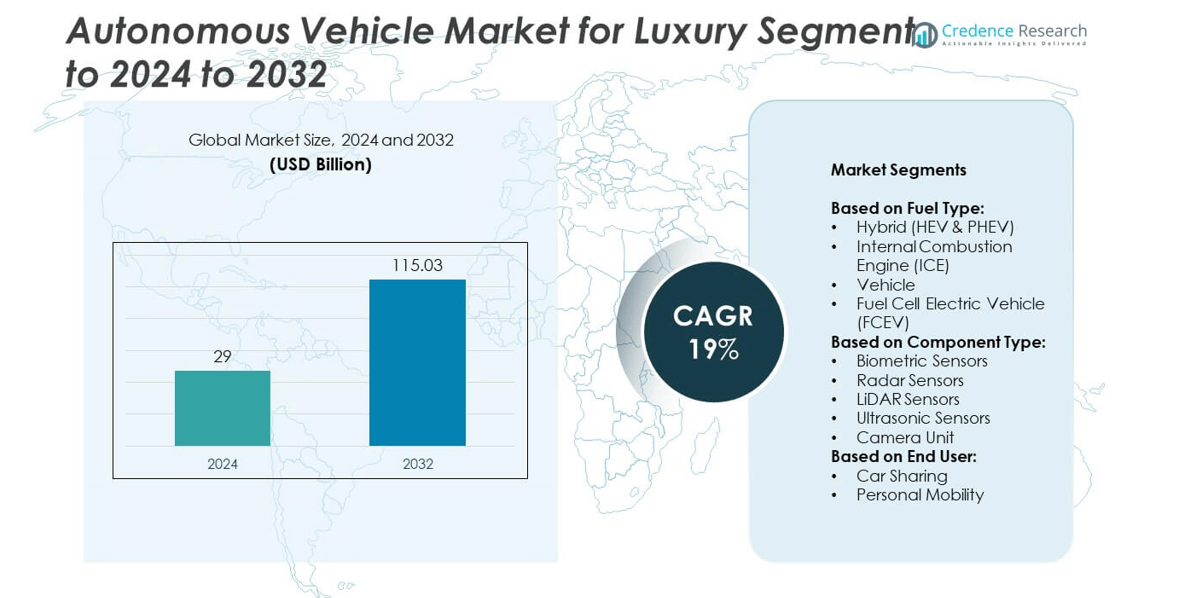

Autonomous Luxury Vehicle Market size was valued USD 29 Billion in 2024 and is anticipated to reach USD 115.03 Billion by 2032, at a CAGR of 19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Luxury Vehicle Market Size 2024 |

USD 29 Billion |

| Autonomous Luxury Vehicle Market, CAGR |

19% |

| Autonomous Luxury Vehicle Market Size 2032 |

USD 115.03 Billion |

The autonomous vehicle market for the luxury segment is led by major players such as BYD Company Ltd., Porsche AG, Waymo LLC, BMW AG, Mercedes-Benz Group AG, Tesla, Inc., and Audi AG, who are driving innovation through investments in AI, LiDAR, and advanced driver-assistance systems. These companies focus on integrating Level 3 and Level 4 autonomy with premium design and personalized in-car experiences. North America emerged as the leading region, commanding over 35% market share in 2024, supported by strong technology infrastructure, favorable regulations, and high consumer demand for luxury mobility solutions.

Market Insights

- The luxury autonomous vehicle market was valued at USD 29 Billion in 2024 and is projected to reach USD 115.03 Billion by 2032, growing at a CAGR of 19%.

- Rising demand for premium autonomous mobility, regulatory approvals for Level 3 and Level 4 autonomy, and increasing adoption of hybrid and electric platforms are key growth drivers.

- The market is witnessing trends such as AI-driven personalization, integration of LiDAR and radar for safety, and growing subscription-based ownership models.

- Competition is intense with automakers and tech firms focusing on partnerships, sensor innovation, and connected vehicle software to gain market share.

- North America leads with over 35% share, followed by Europe at nearly 30% and Asia Pacific at 25%, while hybrid (HEV & PHEV) remains the dominant segment with over 45% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fuel Type

Hybrid (HEV & PHEV) dominated the luxury autonomous vehicle market in 2024, accounting for over 45% share. Hybrid powertrains combine electric propulsion with traditional engines, offering extended driving range and reduced emissions, making them a preferred choice for premium customers. Strong demand for eco-friendly solutions, combined with government incentives for low-emission vehicles, drives adoption. Luxury brands are integrating advanced hybrid systems with autonomous driving features, enhancing efficiency and performance. The shift toward sustainability and consumer preference for smooth, quiet rides further supports hybrid segment growth over ICE and FCEV alternatives.

- For instance, the BMW 750e xDrive plug-in hybrid, part of the 7 Series lineup, has a system output of 483 hp. Its electric-only range under the WLTP is between 83 and 87 km. The M760e xDrive plug-in hybrid, also a 7 Series model, has a WLTP electric-only range of 77 to 85 km.

By Component Type

LiDAR sensors held the largest share in 2024, contributing more than 35% of total component revenue. LiDAR technology provides high-resolution 3D mapping, enabling precise object detection and safe navigation, which is crucial for luxury autonomous vehicles. Increasing demand for advanced driver-assistance systems (ADAS) and full automation supports the rising integration of LiDAR. Luxury automakers focus on multi-sensor fusion, combining LiDAR with radar and cameras to enhance reliability in all weather conditions. Falling LiDAR costs and partnerships between OEMs and sensor manufacturers accelerate adoption and position LiDAR as a core enabler for safe autonomy.

- For instance, Mercedes-Benz utilized Valeo SCALA 2 LiDAR in its DRIVE PILOT system, which initially enabled Level 3 autonomy at speeds up to 60 km/h in certain congested traffic conditions on approved German highways. As of December 2024, Mercedes-Benz received approval to increase the speed for its conditionally automated driving (Level 3) to 95 km/h on German motorways for some models.

By End User

Personal mobility was the leading end-user segment, holding over 60% market share in 2024. Luxury car buyers increasingly seek private, autonomous solutions for comfort, convenience, and safety. Demand is driven by high-net-worth individuals prioritizing personalized experiences and premium interiors that enable productivity during commutes. Car sharing adoption is growing but remains secondary, as affluent customers prefer ownership for privacy and exclusivity. Automakers are focusing on developing Level 3 and Level 4 autonomy tailored for private use, further boosting the personal mobility segment’s growth trajectory throughout the forecast period.

Market Overview

Key Growth Drivers

Growing Demand for Luxury Autonomous Mobility

Rising preference for comfort, safety, and convenience fuels luxury autonomous vehicle adoption. Wealthy consumers seek advanced features such as AI-driven navigation, adaptive cruise control, and self-parking. OEMs are integrating premium interiors, infotainment systems, and wellness features to attract high-net-worth buyers. Growing disposable income in emerging economies boosts purchases of technologically advanced vehicles. The ability of autonomous luxury cars to save time and enhance productivity during travel positions them as a status symbol and premium mobility solution, driving strong market growth globally.

- For instance, the NIO ET7 is equipped with the NOMI AI assistant and its Aquila Super Sensing system, which features 33 high-performance sensing units, enabling semi-autonomous navigation on highways in China as part of NIO Autonomous Driving (NAD).

Government Support and Regulatory Push

Government initiatives promoting road safety and reducing emissions support luxury autonomous vehicle deployment. Policies encouraging electrification, connected infrastructure, and ADAS adoption accelerate development. Incentives for hybrid and electric models strengthen demand in developed regions. Regulatory approvals for Level 3 and Level 4 autonomy in countries like Germany and Japan enable luxury automakers to expand offerings. Collaboration between OEMs, technology firms, and regulators speeds up commercialization, making autonomous luxury cars more accessible to consumers while enhancing their trust in these technologies.

- For instance, Honda became the first automaker to gain approval for Level 3 autonomy in Japan in 2021, deploying the Legend Hybrid EX with Traffic Jam Pilot.

Advancements in Autonomous Driving Technology

Continuous improvements in AI, LiDAR, radar, and camera systems enable safer and more reliable automation. Luxury automakers are investing in sensor fusion and machine learning to achieve near-human decision-making on roads. Integration of over-the-air updates ensures vehicles remain up to date with the latest software improvements. Collaborations with tech companies accelerate development cycles, reducing time-to-market. Enhanced computing power supports real-time object detection and predictive analytics, allowing luxury vehicles to offer smoother, safer, and more efficient autonomous driving experiences that attract premium buyers.

Key Trends & Opportunities

Shift Toward Electrified Luxury Autonomous Vehicles

Luxury brands are moving toward hybrid and fully electric platforms integrated with autonomous features. The transition aligns with global carbon-neutral targets and sustainability goals. Consumers in premium segments increasingly value eco-conscious mobility solutions that do not compromise on performance. Automakers are launching EV-based autonomous models with long range and fast-charging capabilities. The opportunity to combine electrification with autonomy allows OEMs to differentiate products and appeal to environmentally aware customers, further strengthening their market presence over traditional ICE-based luxury vehicles.

- For instance, Tesla’s Full Self-Driving (Supervised) system relies on a custom-built AI chip within the car’s computer, processing data from eight cameras and other sensors for real-time decision-making. The processing capability varies by the vehicle’s hardware generation, with older Hardware 3 (HW3) systems having 144 TOPS, while newer Hardware 4 (HW4) systems are significantly more powerful.

AI-Driven Personalization and In-Car Experience

Artificial intelligence enables personalized user experiences, a growing focus for luxury carmakers. Autonomous vehicles integrate AI to adjust climate, seat position, lighting, and entertainment preferences based on user profiles. Enhanced human–machine interfaces offer voice-controlled operations and predictive navigation. In-car productivity solutions such as video conferencing and augmented reality displays create new revenue streams. These innovations open opportunities for automakers to provide subscription-based services, making the luxury autonomous segment more profitable and attractive to tech-savvy and experience-focused customers.

- For instance, the updated Porsche Taycan Turbo S has a system power of up to 700 kW, or 952 PS, when using the overboost feature with Launch Control. The vehicle is capable of DC fast charging at up to 320 kW at 800-volt charging stations.

Key Challenges

High Cost of Development and Vehicles

Luxury autonomous vehicles involve significant R&D, sensor, and software costs, making them expensive. Advanced LiDAR, radar, and AI computing platforms raise production costs, limiting affordability. Premium pricing narrows the customer base to high-income groups, slowing mass adoption. Manufacturers must invest heavily in cybersecurity and safety validation, further increasing expenses. Balancing affordability with advanced features remains a major challenge for automakers looking to scale production and reach wider markets without compromising quality and performance expectations of luxury buyers.

Regulatory and Safety Concerns

Lack of unified global regulations for autonomous driving poses challenges for luxury automakers. Certification processes for Level 3 and Level 4 vehicles vary across regions, creating delays in deployment. Safety concerns regarding system failures, hacking risks, and accident liability affect consumer trust. Automakers must meet stringent testing requirements and collaborate with governments to ensure compliance. Building public confidence in fully autonomous luxury vehicles is essential, as hesitancy to adopt autonomous systems could slow market growth despite strong technological readiness.

Regional Analysis

North America

North America held the largest share of over 35% in the luxury autonomous vehicle market in 2024. The region benefits from strong adoption of advanced driver-assistance systems, robust technology infrastructure, and favorable testing regulations. Leading automakers and technology firms based in the U.S. invest heavily in research and development of Level 3 and Level 4 autonomous vehicles. Rising demand for luxury vehicles among affluent consumers and the presence of well-developed road networks support market growth. Government initiatives for connected and autonomous mobility further strengthen the region’s leadership position during the forecast period.

Europe

Europe accounted for nearly 30% of the global luxury autonomous vehicle market in 2024. Countries such as Germany, the UK, and France lead adoption due to strong luxury automotive manufacturing bases and progressive regulations. The EU’s push for vehicle safety and emission reduction supports deployment of advanced automation technologies. Increasing consumer interest in electrified and autonomous mobility solutions drives demand. Collaborations between automakers and technology providers accelerate testing and commercialization. The availability of smart infrastructure, such as connected highways, strengthens Europe’s position as a major hub for luxury autonomous vehicle development and deployment.

Asia Pacific

Asia Pacific captured around 25% share of the luxury autonomous vehicle market in 2024 and is expected to record the fastest growth. China, Japan, and South Korea are investing heavily in smart mobility solutions and autonomous technology infrastructure. Growing urbanization, rising disposable incomes, and strong demand for premium vehicles fuel adoption. Government initiatives supporting connected vehicles and electric mobility boost market prospects. Regional automakers are collaborating with global technology firms to develop advanced autonomous models, while rapid expansion of 5G networks improves connectivity, enabling wider deployment of luxury autonomous vehicles across metropolitan areas.

Middle East & Africa

The Middle East & Africa held a market share of nearly 5% in 2024, driven by rising demand for premium vehicles in the UAE and Saudi Arabia. Investments in smart city initiatives and autonomous transport projects fuel adoption in the luxury segment. Wealthy consumers in the region favor technologically advanced vehicles offering safety and comfort. However, limited infrastructure outside major cities slows expansion. Partnerships between automakers and governments to pilot autonomous mobility solutions are expected to create growth opportunities, particularly in countries focusing on diversifying their economies and improving public transport systems.

Latin America

Latin America accounted for approximately 5% share of the luxury autonomous vehicle market in 2024. Brazil and Mexico are leading adopters, supported by growing interest in luxury vehicles and government efforts to modernize urban transport. Economic growth and an expanding affluent population drive demand for premium autonomous solutions. Challenges such as limited infrastructure development and high vehicle costs restrain rapid adoption. Automakers are exploring partnerships to test autonomous technologies in major cities, with a focus on gradually increasing consumer awareness and improving readiness for Level 3 and Level 4 autonomous luxury vehicles in the region.

Market Segmentations:

By Fuel Type:

- Hybrid (HEV & PHEV)

- Internal Combustion Engine (ICE)

- Vehicle

- Fuel Cell Electric Vehicle (FCEV)

By Component Type:

- Biometric Sensors

- Radar Sensors

- LiDAR Sensors

- Ultrasonic Sensors

- Camera Unit

By End User:

- Car Sharing

- Personal Mobility

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The autonomous vehicle market for the luxury segment is characterized by strong competition among leading players such as BYD Company Ltd., Porsche AG, Waymo LLC, Renesas Electronics Corporation, BMW AG, Magna International Inc., ZF Friedrichshafen AG, Texas Instruments Incorporated, Mercedes-Benz Group AG, BAIC Motor Corporation Ltd., Infineon Technologies AG, NXP Semiconductors N.V., Audi AG, Tesla, Inc., Denso Corporation, NIO Inc., and Valeo SE. The market is highly innovation-driven, with companies investing heavily in AI algorithms, LiDAR integration, and advanced driver-assistance technologies to achieve Level 3 and Level 4 autonomy. Strategic partnerships with tech firms and semiconductor suppliers are enabling faster development cycles and cost optimization. Automakers focus on enhancing user experience through connected interiors, over-the-air updates, and predictive maintenance capabilities. Intense R&D efforts aim to improve safety, reduce system costs, and meet regulatory requirements, strengthening the competitive position of key players in this evolving luxury mobility segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BYD Company Ltd. (China)

- Porsche AG (Germany)

- Waymo LLC (USA)

- Renesas Electronics Corporation (Japan)

- BMW AG (Germany)

- Magna International Inc. (Canada)

- ZF Friedrichshafen AG (Germany)

- Texas Instruments Incorporated (USA)

- Mercedes-Benz Group AG (Germany)

- BAIC Motor Corporation Ltd. (China)

- Infineon Technologies AG (Germany)

- NXP Semiconductors N.V. (Netherlands)

- Audi AG (Germany)

- Tesla, Inc. (USA)

- Denso Corporation (Japan)

- NIO Inc. (China)

- Valeo SE (France)

Recent Developments

- In 2025, BYD Company Ltd. in announced “God’s Eye” driver-assistance tech will be standard across many models, including lower-cost ones.

- In 2025, Porsche AG revealed an 11-kW wireless charging system and premiered a new flagship 911 at IAA Mobility 2025.

- In 2025, Mercedes-Benz Group AG showcased the GLC EV with a large battery pack and advanced digital features, including an enhanced virtual assistant and large screen setup

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Component Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The luxury autonomous vehicle market will grow steadily with rising demand for premium mobility solutions.

- Hybrid and electric luxury autonomous cars will dominate due to sustainability goals and emission regulations.

- Level 3 and Level 4 autonomy adoption will expand as regulations become more supportive worldwide.

- Automakers will invest more in AI, LiDAR, and sensor fusion to enhance driving safety and precision.

- Personalized in-car experiences will gain importance, driving demand for connected and intelligent interiors.

- Strategic partnerships between automakers and tech firms will accelerate product development and market penetration.

- Asia Pacific will emerge as the fastest-growing region, supported by urbanization and government initiatives.

- Subscription-based ownership models will rise, offering flexibility to luxury car customers.

- Cybersecurity solutions will become a priority to ensure data safety in connected autonomous vehicles.

- Continuous cost optimization will help luxury automakers make autonomous technology more accessible.