Market Overview:

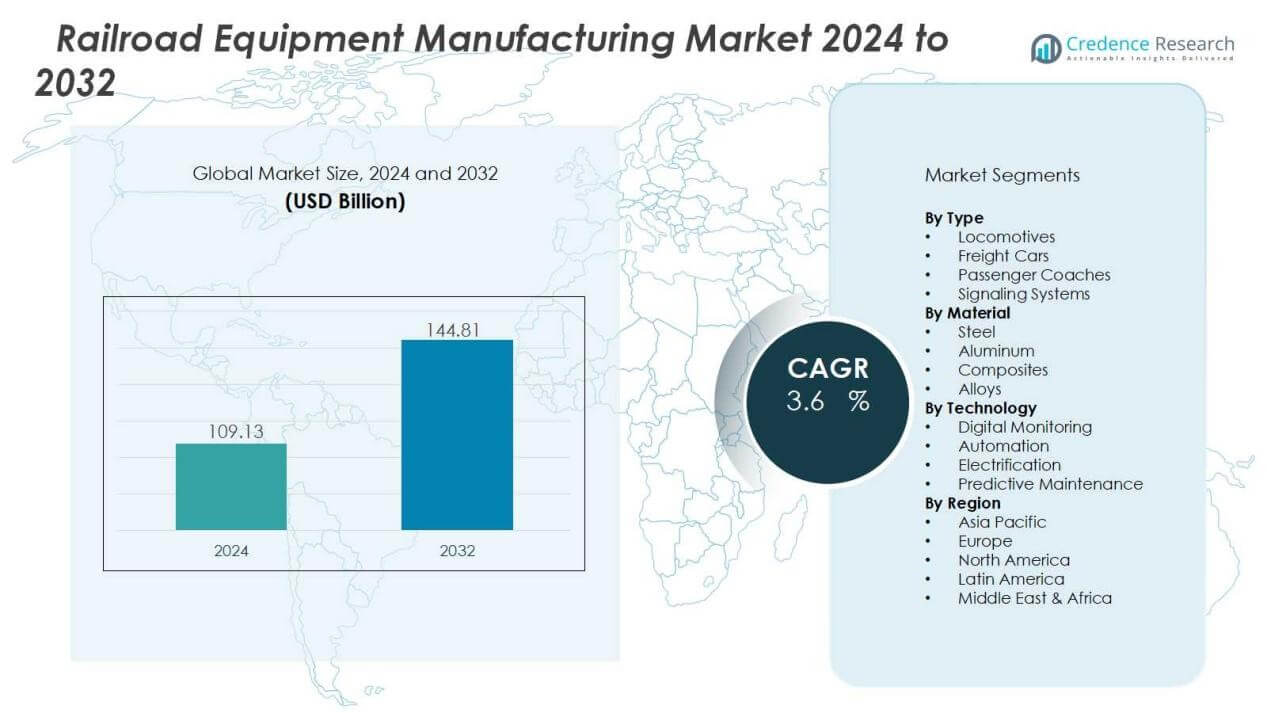

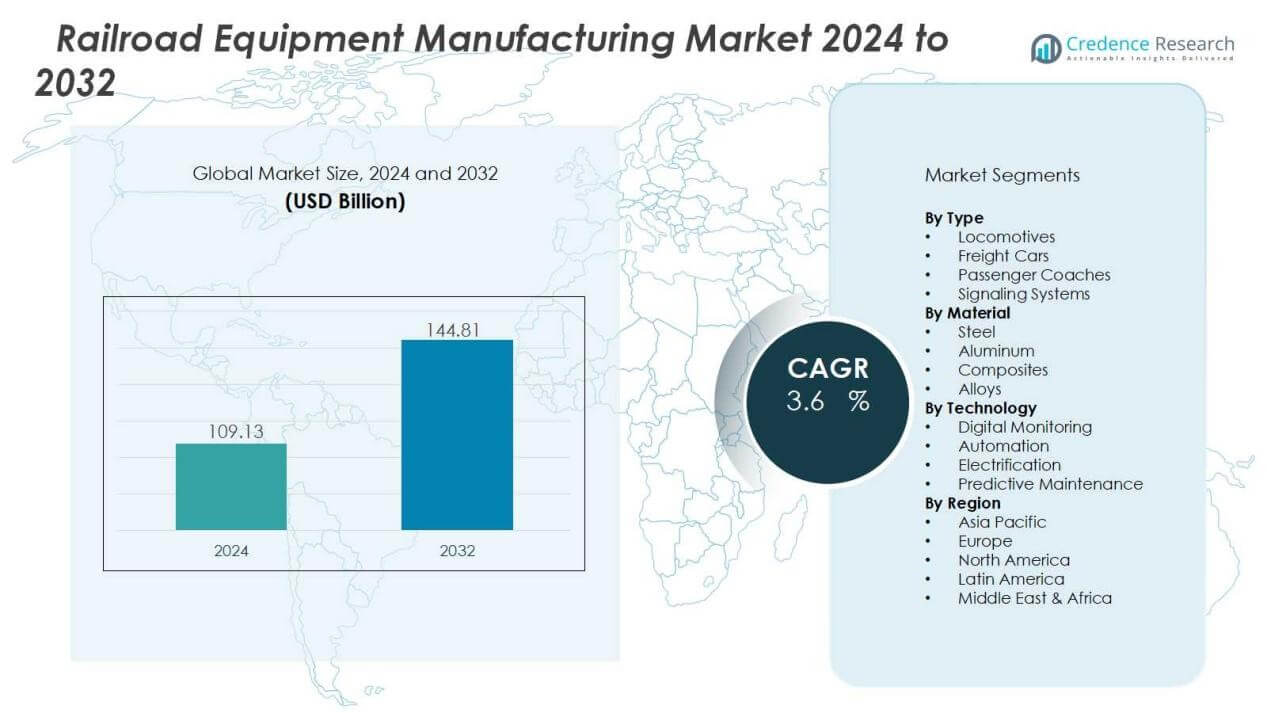

The railroad equipment manufacturing market size was valued at USD 109.13 billion in 2024 and is anticipated to reach USD 144.81 billion by 2032, at a CAGR of 3.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Railroad Equipment Manufacturing Market Size 2024 |

USD 109.13 Billion |

| Railroad Equipment Manufacturing Market, CAGR |

3.6% |

| Railroad Equipment Manufacturing Market Size 2032 |

USD 144.81 Billion |

Key drivers shaping the market include growing freight volumes, the push toward sustainable and low-emission transport, and the need for advanced signaling and safety technologies. Rapid urbanization and government focus on expanding metro and high-speed rail networks further strengthen demand. Technological innovations, including digital monitoring, automation, and predictive maintenance systems, are enabling operators to improve efficiency, reduce downtime, and enhance passenger experience.

Regionally, North America and Europe hold significant shares due to established rail networks, high investment in modernization, and stringent safety regulations. Asia-Pacific is expected to emerge as the fastest-growing region, fueled by large-scale infrastructure projects in China, India, and Southeast Asia, along with rising urban commuter demand. Meanwhile, Latin America and the Middle East & Africa are gradually adopting advanced rail solutions, supported by government-led infrastructure development and cross-border trade expansion.

Market Insights:

Market Insights:

- The railroad equipment manufacturing market was valued at USD 109.13 billion in 2024 and is projected to reach USD 144.81 billion by 2032, growing at a CAGR of 3.6%.

- Rising freight volumes and growing passenger demand are pushing governments and operators to expand rail capacity, making rail a cost-efficient and safe mode of transport.

- Government-led infrastructure modernization projects, including metro expansion, freight corridor upgrades, and high-speed rail initiatives, are driving long-term demand for advanced locomotives, wagons, and signaling systems.

- Technological innovations such as automation, predictive maintenance, and digital monitoring are transforming efficiency, reducing risks, and improving operational reliability.

- Sustainability goals are encouraging adoption of electric and hybrid locomotives, lightweight materials, and energy-efficient braking systems, supporting emission reduction targets.

- The market faces challenges from high capital investment requirements, complex regulatory frameworks, supply chain disruptions, and shortages of skilled labor.

- North America held 32% market share in 2024, followed by Europe with 29% and Asia-Pacific with 28%, while Latin America and the Middle East & Africa together accounted for 11%, reflecting steady global expansion with regional variations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Freight and Passenger Rail Transport:

The railroad equipment manufacturing market benefits from increasing reliance on rail for freight and passenger movement. Global trade growth and rising urban populations are pushing governments and operators to expand rail capacity. Rail transport offers cost efficiency, safety, and reduced congestion compared to road transport. It supports both bulk commodity movement and high-capacity passenger transit, fueling steady equipment demand.

- For instance, in passenger rail, German national rail operator Deutsche Bahn (DB) carried approximately 1.8 billion passengers in 2023.

Government Investments in Infrastructure Modernization:

Large-scale infrastructure projects are driving demand in the railroad equipment manufacturing market. Governments are allocating funds to expand metro systems, upgrade freight corridors, and introduce high-speed rail lines. Modernization includes replacing outdated rolling stock, improving electrification, and enhancing track resilience. These initiatives ensure long-term demand for advanced locomotives, wagons, and supporting components.

- For instance, a high-performance variant of Siemens Mobility’s Vectron electric locomotive series delivers a continuous power output of 6.4 MW, enabling high-capacity freight and cross-border passenger services with a top speed of 200 km/h.

Technological Advancements in Rail Systems and Safety:

Innovation is shaping the railroad equipment manufacturing market through digital monitoring, automation, and smart safety systems. Advanced signaling, predictive maintenance, and real-time diagnostics improve efficiency and reduce operational risks. Automation enhances driver assistance, fuel efficiency, and scheduling accuracy. Such advancements are critical for meeting rising expectations of safety and performance.

Focus on Sustainability and Emission Reduction:

Environmental concerns are influencing the railroad equipment manufacturing market, pushing manufacturers toward sustainable solutions. Electric and hybrid locomotives, lightweight materials, and energy-efficient braking systems reduce emissions and fuel costs. Rail transport is already greener compared to road and air alternatives, making it a preferred choice for sustainability goals. Manufacturers aligning with these initiatives strengthen long-term growth opportunities.

Market Trends:

Integration of Digital Technologies and Smart Rail Solutions:

The railroad equipment manufacturing market is experiencing strong momentum from the adoption of digital and smart technologies. Operators are investing in predictive maintenance systems, IoT-enabled monitoring, and real-time data analytics to reduce downtime and improve efficiency. Smart signaling and automated train control systems enhance safety while enabling higher network capacity. Digital ticketing and passenger information systems are also becoming standard, improving service quality. Manufacturers are focusing on intelligent locomotives and advanced communication systems that align with evolving smart city infrastructure. It is driving efficiency, reliability, and stronger customer satisfaction across global rail networks.

- For Instance, Thales’s Trusted Service Hub digital ticketing solution enables the mobile version of Hong Kong’s Octopus card, which is part of the broader Octopus system that handles over 15 million daily transactions and is known for reducing passenger boarding times and streamlining fare collection through its contactless technology.

Expansion of Sustainable Rail Solutions and High-Speed Projects:

Sustainability is emerging as a central trend in the railroad equipment manufacturing market. Demand for electric and hybrid locomotives is growing, supported by emission regulations and government climate goals. Lightweight materials and energy-efficient braking systems are gaining traction, reducing operational costs while supporting environmental targets. High-speed rail projects in Asia, Europe, and North America are creating significant opportunities for advanced rolling stock and infrastructure. Rail freight operators are also shifting toward greener solutions to meet customer requirements for sustainable logistics. It reflects a long-term transformation of the sector toward eco-friendly and performance-driven rail systems.

- For instance, in January 2025, Canadian National Railway (CN), in collaboration with Knoxville Locomotive Works, launched a medium horsepower hybrid electric locomotive powered by a 2.4MWh-700HP battery-diesel engine, designed to reduce fuel consumption by approximately 50% compared to conventional models.

Market Challenges Analysis:

High Capital Costs and Complex Regulatory Environment:

The railroad equipment manufacturing market faces challenges due to high capital requirements and strict regulations. Developing advanced locomotives, freight cars, and signaling systems demands significant investment, which limits entry for smaller manufacturers. Compliance with safety, environmental, and emission standards raises production costs and extends development timelines. Frequent updates in regulatory frameworks across regions add complexity for global suppliers. It pressures manufacturers to balance innovation with affordability while ensuring compliance with diverse regional standards.

Supply Chain Disruptions and Skilled Workforce Shortages:

The railroad equipment manufacturing market is also affected by supply chain instability and labor shortages. Dependence on steel, electronics, and critical components makes production vulnerable to raw material price fluctuations and delivery delays. Global disruptions can halt manufacturing schedules, impacting timely project execution. Limited availability of skilled engineers and technicians further slows adoption of advanced technologies. It reduces the ability of companies to scale quickly and meet rising demand. Manufacturers must invest in workforce development and resilient sourcing strategies to address these structural challenges.

Market Opportunities:

Growth Potential in Emerging Economies and Urban Transit Development:

The railroad equipment manufacturing market holds strong opportunities in emerging economies where urbanization and industrial expansion are accelerating. Governments in Asia, Latin America, and Africa are investing heavily in metro networks, freight corridors, and regional connectivity projects. Rising populations and growing trade volumes demand efficient and affordable rail infrastructure. Expansion of high-speed rail projects in China and India further strengthens equipment demand. It creates favorable conditions for manufacturers to supply rolling stock, signaling systems, and modern locomotives. Companies able to deliver cost-effective and scalable solutions can capture significant market share.

Advancements in Green Technologies and Digital Rail Solutions:

The railroad equipment manufacturing market also benefits from opportunities linked to sustainability and digital transformation. Demand for electric and hybrid locomotives is rising as countries implement stricter emission standards. Adoption of smart monitoring, predictive maintenance, and automation technologies is expanding globally, creating a strong market for digital solutions. Lightweight materials and energy-efficient systems improve performance and reduce operational costs, attracting both freight and passenger operators. It enables manufacturers to align with sustainability goals while providing competitive advantages. Long-term prospects remain strong for companies innovating in green and digital rail solutions.

Market Segmentation Analysis:

By Type:

The railroad equipment manufacturing market is segmented into locomotives, freight cars, passenger coaches, and signaling systems. Locomotives hold a dominant position due to increasing freight demand and modernization of fleets. Freight cars are expanding steadily, driven by bulk commodity transport and global trade. Passenger coaches benefit from investments in metro and high-speed rail projects. Signaling systems are gaining importance with rising focus on automation and safety standards. It reflects balanced growth across all product categories, supported by infrastructure upgrades.

- For instance, by 2025, Wabtec will have modernized over 1,030 Union Pacific locomotives, improving fuel efficiency by 18% and increasing haulage capacity by 55%.

By Material:

Materials used include steel, aluminum, composites, and alloys. Steel remains the most widely used due to durability and cost efficiency. Aluminum and composites are gaining share, driven by demand for lightweight solutions that improve efficiency. Composites also enhance resistance to wear and corrosion, reducing lifecycle costs. Alloy-based components are applied in specialized rail systems requiring strength and precision. It highlights a shift toward advanced materials aligned with sustainability goals.

- For instance, Tata Steel manufactures steel rails up to 216 meters long with hardness values above 400 HB, using advanced heat treatment processes that result in exceptionally low residual stress, supporting high-speed and heavy-haul rail operations with superior durability and wear resistance.

By Technology:

The market incorporates digital monitoring, automation, electrification, and predictive maintenance technologies. Digital solutions improve efficiency by reducing downtime and optimizing fleet management. Electrification is expanding as countries prioritize low-emission and sustainable transport. Predictive maintenance supports safety and cost savings by identifying faults early. Automation in signaling and train control enhances capacity and reliability. It shows technology as a central factor shaping competitive advantage in the industry.

Segmentations:

By Type:

- Locomotives

- Freight Cars

- Passenger Coaches

- Signaling Systems

By Material:

- Steel

- Aluminum

- Composites

- Alloys

By Technology:

- Digital Monitoring

- Automation

- Electrification

- Predictive Maintenance

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America and Europe:

North America accounted for 32% market share in the railroad equipment manufacturing market in 2024, while Europe held 29%. Both regions benefit from advanced rail infrastructure, established freight corridors, and strong regulatory frameworks. The United States and Canada lead investments in freight rolling stock and digital rail technologies, driven by rising trade volumes. Europe continues to modernize its passenger and high-speed rail networks, supported by sustainability goals and emission reduction targets. It fosters demand for energy-efficient locomotives, advanced signaling systems, and lightweight materials. Market expansion in these regions is further strengthened by ongoing replacement of aging equipment fleets.

Asia-Pacific:

Asia-Pacific accounted for 28% market share in the railroad equipment manufacturing market in 2024, making it the fastest-growing region. China leads with large-scale investments in high-speed rail and urban metro networks, supported by government policies. India is expanding freight corridors and urban transit systems to meet rising demand. Southeast Asian countries are accelerating infrastructure projects to support economic growth and trade connectivity. It drives significant opportunities for manufacturers of locomotives, wagons, and signaling technologies. The region’s growing urban population and industrial base ensure sustained demand for advanced rail solutions.

Latin America and Middle East & Africa:

Latin America held 6% market share in the railroad equipment manufacturing market in 2024, while the Middle East & Africa accounted for 5%. Brazil and Mexico are leading modernization projects to strengthen freight transport and passenger connectivity. GCC countries are investing in cross-border rail networks to support trade diversification and logistics development. Africa is adopting rail infrastructure projects backed by government initiatives and foreign investment. It creates growth avenues for suppliers of cost-effective and durable equipment. Demand in these regions is expected to grow steadily with economic expansion and infrastructure priorities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The railroad equipment manufacturing market is highly competitive, shaped by global and regional players with strong portfolios. Key companies include Central Japan Railway Company, SNCF Group, Union Pacific Corporation, OAO RZD (Russian Railways), BNSF Railway, Indian Railways, Deutsche Bahn, and JSC Russian Railways. These players focus on expanding rail capacity, upgrading fleets, and introducing advanced technologies to meet rising demand. Strategic priorities include investment in electrification, high-speed rail, and sustainable locomotives to align with emission reduction goals. It fosters innovation in materials, automation, and digital monitoring systems to enhance efficiency and reliability. Partnerships with governments and infrastructure developers support long-term projects across freight and passenger networks. Competitive positioning is driven by technological expertise, global reach, and the ability to deliver cost-effective, reliable solutions tailored to regional needs.

Recent Developments:

- In February 2025, Central Japan Railway Company launched the “Wonderful Dreams Shinkansen” special train featuring full-train design based on Fantasy Springs at Tokyo DisneySea, marking the first such design on the Tokaido Shinkansen line.

- In July 2025, Kontron Transportation signed a large contract with SNCF France to deploy the Future Railway Mobile Communication System (FRMCS) as part of the transition from GSM-R.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The railroad equipment manufacturing market will see rising demand for sustainable locomotives powered by electric and hybrid technologies.

- Digital transformation will accelerate with adoption of predictive maintenance, automation, and IoT-enabled monitoring systems.

- High-speed rail projects will expand in Asia-Pacific and Europe, driving long-term demand for advanced rolling stock.

- Urbanization will push governments to invest in metro and commuter rail systems, creating new opportunities.

- Lightweight materials and energy-efficient braking systems will gain traction, reducing operational costs for operators.

- Freight rail modernization will continue as industries seek cost-effective and eco-friendly logistics solutions.

- Global supply chain resilience will become a priority, encouraging localized manufacturing and diversified sourcing strategies.

- Public-private partnerships will increase, supporting large-scale rail infrastructure development across emerging economies.

- Integration of AI and digital twins will strengthen performance optimization and safety management.

- The industry will see stronger competition with companies focusing on innovation, green technology, and digital solutions to capture market share.

Market Insights:

Market Insights: