Market Overview:

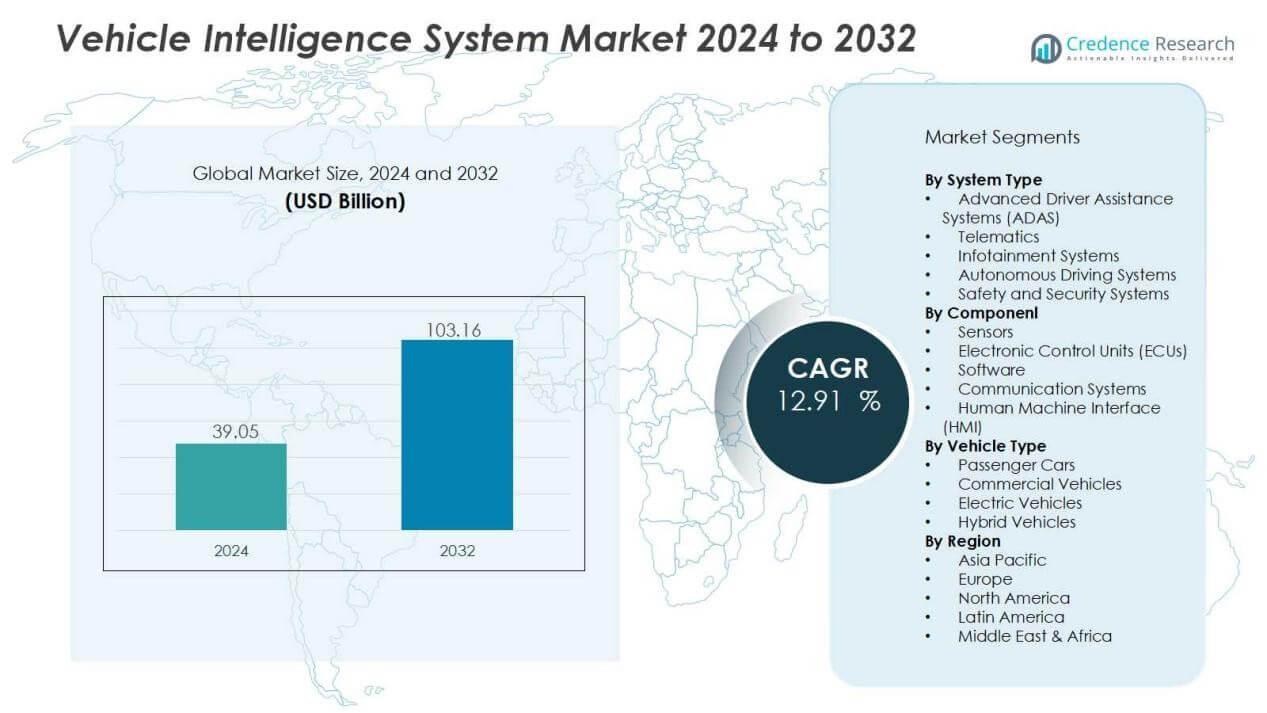

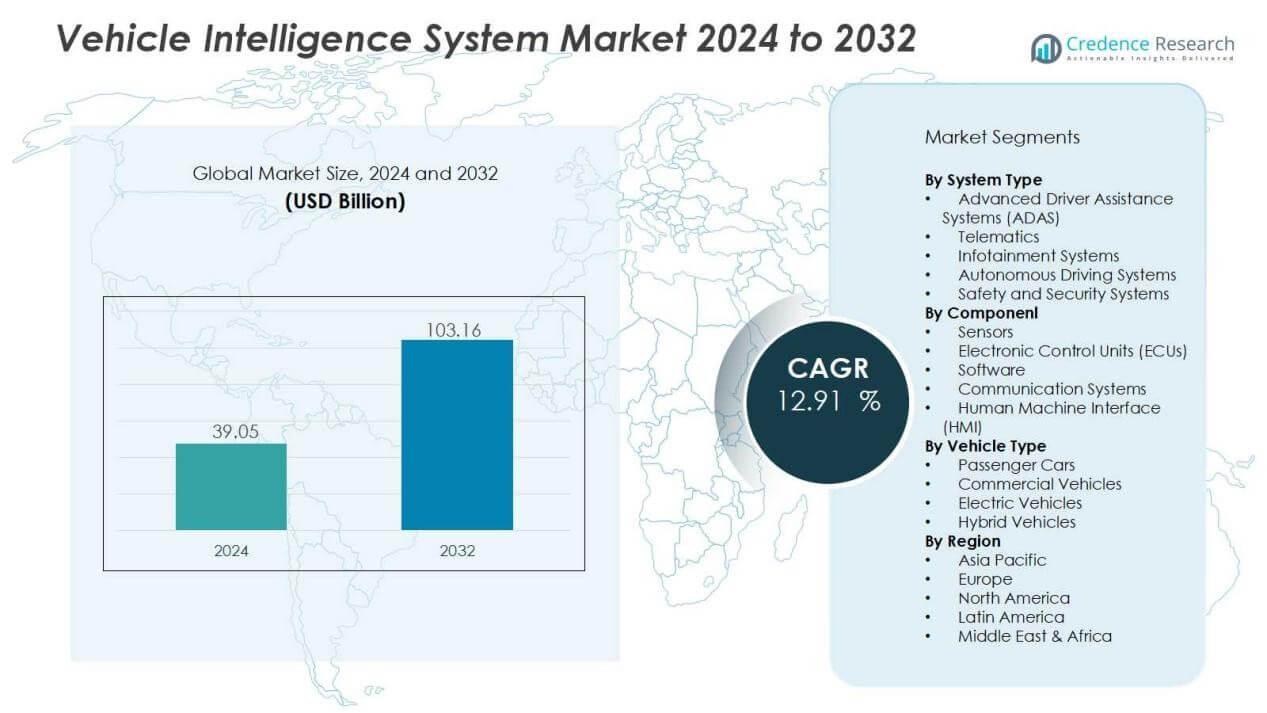

The vehicle intelligence system market size was valued at USD 39.05 billion in 2024 and is anticipated to reach USD 103.16 billion by 2032, at a CAGR of 12.91 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Intelligence System Market Size 2024 |

USD 39.05 Billion |

| Vehicle Intelligence System Market, CAGR |

12.91% |

| Vehicle Intelligence System Market Size 2032 |

USD 103.16 Billion |

Key drivers of the market include the rising adoption of connected vehicles, growth in autonomous driving research, and stringent government regulations promoting road safety. Rising consumer preference for in-vehicle connectivity, predictive maintenance, and real-time data analysis also boosts adoption. Automakers are investing heavily in AI, machine learning, and IoT-based systems to enhance vehicle performance and customer satisfaction. Growing demand for electric vehicles further accelerates the role of intelligence systems, as manufacturers focus on energy efficiency and advanced monitoring features.

Regionally, North America leads the vehicle intelligence system market, driven by advanced automotive infrastructure, high R&D investments, and strong regulatory frameworks. Europe follows, supported by leading automakers, strict safety mandates, and rapid adoption of autonomous mobility technologies. The Asia-Pacific region is expected to grow fastest, propelled by rising vehicle production, increasing disposable incomes, and government initiatives supporting smart mobility in China, Japan, and India. Emerging regions such as Latin America and the Middle East also show growing potential through gradual adoption of connected and intelligent vehicle systems.

Market Insights:

Market Insights:

- The vehicle intelligence system market was valued at USD 39.05 billion in 2024 and is projected to reach USD 103.16 billion by 2032, growing at a CAGR of 12.91%.

- Rising adoption of connected vehicles, autonomous driving research, and strict government safety regulations drive market expansion.

- Consumer demand for predictive maintenance, in-vehicle connectivity, and real-time data analysis accelerates system adoption.

- Automakers invest heavily in AI, machine learning, and IoT platforms to enhance performance and customer satisfaction.

- High implementation costs and complex integration remain barriers, particularly for smaller automakers and entry-level models.

- Cybersecurity and data privacy risks create challenges, pushing firms to strengthen encryption and detection systems.

- North America leads with 38% market share, followed by Europe at 30%, while Asia-Pacific grows fastest at 24%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Road Safety and Accident Prevention:

The vehicle intelligence system market is strongly driven by the global focus on road safety. Governments and regulatory bodies enforce strict mandates to reduce traffic accidents and fatalities. It integrates features such as collision avoidance, adaptive cruise control, and lane departure warnings that minimize risks. Consumers increasingly value safety technologies when choosing vehicles. This shift makes intelligent systems a standard rather than an optional feature.

- For Instance, According to Tesla’s Q2 2025 Vehicle Safety Report, a crash was recorded every 6.69 million miles for vehicles using Autopilot. The report compares this to the 2023 U.S. national average of one crash every 702,000 miles.

Growing Integration of Connectivity and Smart Features:

Connectivity is a major driver of the vehicle intelligence system market, with demand rising for real-time communication. It enables predictive maintenance, remote diagnostics, and over-the-air updates. Consumers expect advanced infotainment, navigation, and driver-assist features integrated seamlessly into their vehicles. Automakers invest in AI and IoT technologies to deliver personalized experiences. This integration improves vehicle performance and customer satisfaction.

- For instance, General Motors’ OnStar system uses IoT to provide real-time navigation, emergency assistance, remote diagnostics, and predictive maintenance alerts, monitoring millions of vehicles continuously.

Expansion of Electric and Autonomous Vehicles:

The rapid growth of electric and autonomous vehicles fuels demand for intelligent systems. The vehicle intelligence system market benefits from EV adoption, where efficiency and monitoring are critical. It supports energy management, battery diagnostics, and automated driving functions. Autonomous mobility relies heavily on advanced sensors, cameras, and data processing. These requirements push manufacturers to embed intelligence across vehicle platforms.

Supportive Government Regulations and Industry Investments:

Strict regulations on emissions, safety, and technology adoption create strong momentum for intelligent systems. The vehicle intelligence system market gains from incentives and policies promoting smart mobility. It is also shaped by high R&D investments from automakers and technology firms. Partnerships between automotive manufacturers and tech companies accelerate product development. This collaborative ecosystem ensures continuous innovation and market expansion.

Market Trends:

Increasing Adoption of AI and Data-Driven Vehicle Intelligence:

Artificial intelligence and machine learning are becoming core trends in the vehicle intelligence system market. Automakers rely on predictive algorithms to improve decision-making, from collision avoidance to energy management. It enables vehicles to learn driver behavior, optimize fuel or battery use, and respond to road conditions. Data-driven insights also enhance fleet management, allowing predictive maintenance and real-time performance tracking. Automakers integrate advanced sensors and high-speed processors to handle growing data volumes. The shift toward intelligent, self-adapting systems creates a foundation for safer and more efficient mobility.

- For instance, Motional, a joint venture between Aptiv and Hyundai, has provided over 130,000 self-driven rides with zero at-fault incidents through AI-enabled autonomous driving systems equipped with LiDAR, radar, and cameras.

Growing Role of Connected Ecosystems and Smart Mobility Solutions

The vehicle intelligence system market is also shaped by the rise of connected mobility. It integrates with cloud platforms, traffic systems, and smart infrastructure to deliver real-time updates. Consumers demand seamless connectivity that supports infotainment, remote diagnostics, and personalized driving experiences. Automakers and technology providers develop ecosystems that link vehicles with smart cities and energy networks. Expansion of electric and autonomous vehicles further strengthens the need for integrated intelligence systems. This trend highlights the growing importance of digital ecosystems in defining the future of mobility.

- For instance, the city of Detroit improved its public transport dispatch and maintenance system using Digi’s WR44 R mobile cellular router, which enabled real-time tracking of over 300 buses, resulting in preventative maintenance that saved an estimated $70,000 annually by reducing breakdowns and major repairs.

Market Challenges Analysis:

High Costs and Complex Integration Barriers:

The vehicle intelligence system market faces significant challenges due to high implementation costs and integration complexity. Advanced sensors, processors, and AI platforms require heavy investment, making it difficult for mid-tier automakers to adopt at scale. It also demands compatibility across different vehicle architectures, which complicates deployment. Smaller manufacturers struggle to balance affordability with technological advancement. Consumer adoption slows when higher prices limit availability in entry-level models. These cost barriers remain a key obstacle to mass-market penetration.

Cybersecurity Risks and Data Privacy Concerns:

Cybersecurity represents another major challenge in the vehicle intelligence system market. It processes and transmits vast amounts of real-time data, increasing exposure to potential cyberattacks. Unauthorized access can compromise vehicle safety, performance, and driver privacy. Regulators push for stronger security frameworks, but achieving global standards remains difficult. Automakers must invest in encryption, intrusion detection, and resilient software systems to address these risks. Failure to manage security concerns may slow adoption and affect consumer trust.

Market Opportunities:

Expansion of Autonomous and Electric Vehicle Adoption:

The vehicle intelligence system market holds strong opportunities with the rising adoption of autonomous and electric vehicles. It supports advanced navigation, energy optimization, and driverless capabilities, making it essential in next-generation mobility. Governments worldwide promote EV adoption through incentives and infrastructure investments, which accelerates demand for intelligent systems. Automakers can capitalize on this trend by integrating AI-driven platforms and predictive analytics. The shift creates a pathway for high-value solutions that enhance efficiency and sustainability. Growing partnerships between technology providers and OEMs further expand innovation in this space.

Integration with Smart Cities and Connected Ecosystems:

Opportunities also emerge from the integration of vehicles with smart city initiatives and connected mobility ecosystems. The vehicle intelligence system market benefits as urban centers invest in intelligent transport systems and 5G networks. It enables vehicles to connect seamlessly with traffic management platforms, charging stations, and cloud services. Real-time data sharing opens new avenues for safety, efficiency, and user personalization. Automakers and technology firms can develop ecosystem-based services that strengthen consumer engagement. This trend positions vehicle intelligence as a central component of future mobility solutions.

Market Segmentation Analysis:

By System Type:

The vehicle intelligence system market by system type is driven by the rising adoption of advanced driver assistance systems (ADAS), telematics, and infotainment platforms. It supports collision avoidance, navigation, and real-time communication, which enhance both safety and comfort. Growing integration of autonomous driving functions is creating strong demand for adaptive systems. Consumers expect connected experiences, making telematics and infotainment essential features across multiple segments. This shift ensures system-level innovation remains central to market expansion.

- For instance, BMW introduced its Level 2+ automated driving feature in the BMW 7 Series in April 2023, providing hands-free driving at speeds of up to 130 km/h on selected highways using the “BMW Highway Assistant” system.

By Component:

The market by component highlights sensors, electronic control units (ECUs), and software as the backbone of intelligent systems. It relies heavily on high-performance sensors for monitoring road conditions, traffic, and vehicle status. ECUs manage data processing, while advanced software enables predictive analysis and automation. Rising investment in AI-driven platforms strengthens software adoption across all vehicle categories. Automakers focus on creating balanced hardware-software ecosystems to optimize efficiency and accuracy.

- For instance, Bosch deployed its long-range radar sensor technology in Mercedes-Benz vehicles, achieving detection ranges of up to 250 meters for adaptive cruise control and collision avoidance features in 2024.

By Vehicle Type:

The vehicle intelligence system market by vehicle type shows strong growth across passenger cars, commercial vehicles, and electric vehicles. It gains significant traction in passenger cars due to rising demand for driver-assist and infotainment features. Commercial vehicles adopt these systems for telematics, fleet management, and predictive maintenance. Electric vehicles rely on intelligent platforms for battery diagnostics, energy efficiency, and connectivity. Expansion across all categories ensures broad market penetration and long-term adoption.

Segmentations:

By System Type:

- Advanced Driver Assistance Systems (ADAS)

- Telematics

- Infotainment Systems

- Autonomous Driving Systems

- Safety and Security Systems

By Component:

- Sensors

- Electronic Control Units (ECUs)

- Software

- Communication Systems

- Human Machine Interface (HMI)

By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- Hybrid Vehicles

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America:

North America holds 38% market share in the vehicle intelligence system market, making it the leading region. The dominance is driven by advanced automotive infrastructure, high R&D spending, and strong regulatory frameworks supporting road safety and emissions standards. It benefits from rapid adoption of connected and autonomous vehicle technologies across the United States and Canada. Major automakers collaborate with technology providers to enhance AI, IoT, and telematics solutions. Consumers in this region also show high demand for premium vehicles equipped with intelligent systems. Government initiatives promoting smart transportation further reinforce the region’s leadership.

Europe:

Europe accounts for 30% market share in the vehicle intelligence system market, reflecting its strong automotive heritage and regulatory environment. The European Union enforces strict safety and emissions policies that accelerate adoption of intelligent vehicle systems. It is supported by leading automakers in Germany, France, and the UK, who prioritize innovation and advanced mobility solutions. Investment in autonomous driving research and EV integration further boosts regional growth. Consumers increasingly favor vehicles with intelligent connectivity and advanced driver-assist features. Collaborations between automotive and tech companies strengthen the competitive landscape across the continent.

Asia-Pacific:

Asia-Pacific represents 24% market share in the vehicle intelligence system market, and it is projected to grow fastest through 2032. Rising vehicle production in China, Japan, and India drives strong demand for intelligent technologies. It benefits from government initiatives that promote EV adoption and smart mobility infrastructure. The region’s growing middle-class population seeks safer and more connected driving experiences. Automakers are heavily investing in R&D centers to enhance AI-based mobility solutions tailored for local markets. Rapid urbanization and expansion of 5G networks further accelerate adoption across Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BorgWarner Inc.

- Valeo, Infineon Technologies AG

- Mobileye

- Atos SE

- Continental AG

- DENSO CORPORATION

- Magna International Inc.

- Autoliv Inc.

- VEHiQA

- Robert Bosch GmbH

- WABCO Holdings Inc.

- NVIDIA Corporation

Competitive Analysis:

The vehicle intelligence system market is highly competitive, with leading companies focusing on innovation, partnerships, and advanced technology integration. Key players include BorgWarner Inc., Valeo, Infineon Technologies AG, Mobileye, Atos SE, Continental AG, DENSO CORPORATION, Magna International Inc., Autoliv Inc., and VEHiQA. It is shaped by continuous investment in artificial intelligence, machine learning, and sensor technology to deliver safer and smarter mobility solutions. Companies aim to strengthen product portfolios by addressing rising demand for autonomous driving, connected vehicles, and advanced driver assistance features. Strategic collaborations between automakers and technology providers drive faster adoption and enhance system performance. Competitive intensity is further reinforced by regulatory mandates, which push manufacturers to prioritize safety and sustainability in their offerings. The evolving landscape ensures ongoing innovation, making advanced intelligence systems a defining feature of the global automotive industry.

Recent Developments:

- In July 2025, Atos SE launched the Atos Polaris AI Platform, a comprehensive AI agent system designed to accelerate digital transformation with autonomous orchestration of business workflows.

- In September 2024, DENSO CORPORATION expanded its inverter production for electrification at the Fukushima plant to support the automotive industry’s shift to sustainable mobility solutions.

Report Coverage:

The research report offers an in-depth analysis based on System Type, Component, Vehicle Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growing demand for autonomous driving technologies will continue to accelerate adoption of vehicle intelligence systems.

- Integration of AI and machine learning will enhance decision-making and predictive vehicle performance.

- Connected ecosystems linking vehicles, infrastructure, and smart cities will expand, driving real-time data utilization.

- Electric vehicle adoption will increase reliance on intelligence systems for energy management and diagnostics.

- Cybersecurity solutions will gain importance to address rising risks of connected mobility platforms.

- Consumer preference for advanced driver-assist features will make intelligent systems standard across vehicle segments.

- Collaborations between automakers and technology providers will strengthen innovation pipelines and product development.

- Regulatory support for road safety and emission reduction will stimulate greater system integration.

- Growth in fleet and logistics applications will boost demand for predictive maintenance and telematics.

- Global investments in R&D and 5G infrastructure will shape the evolution of vehicle intelligence solutions.

Market Insights:

Market Insights: