Market Overview

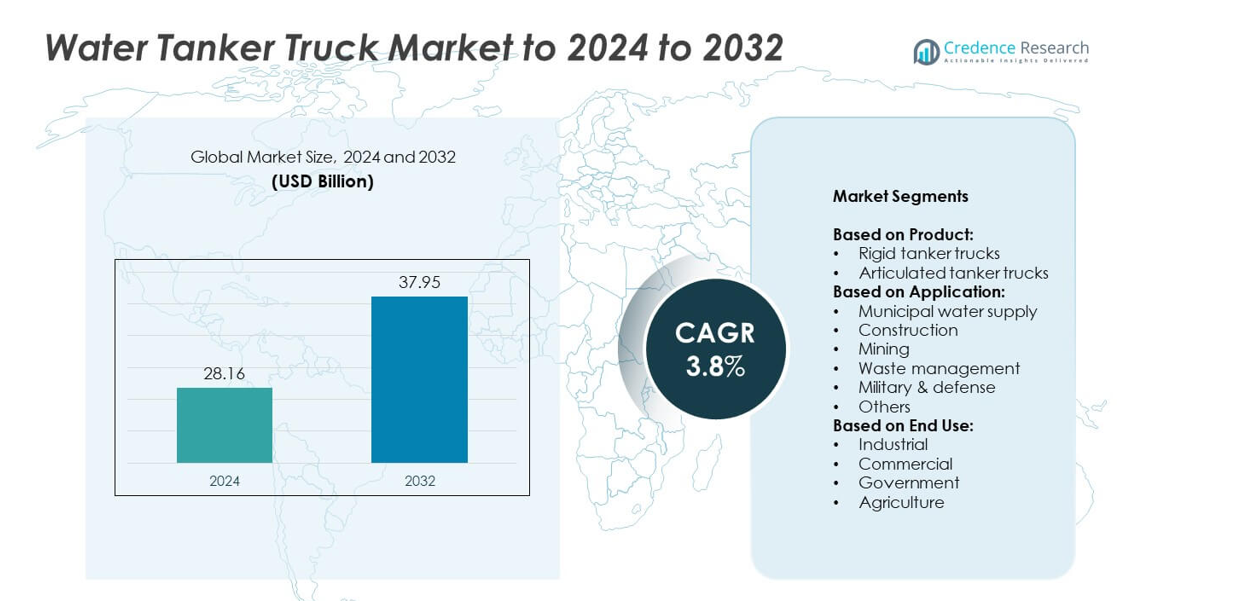

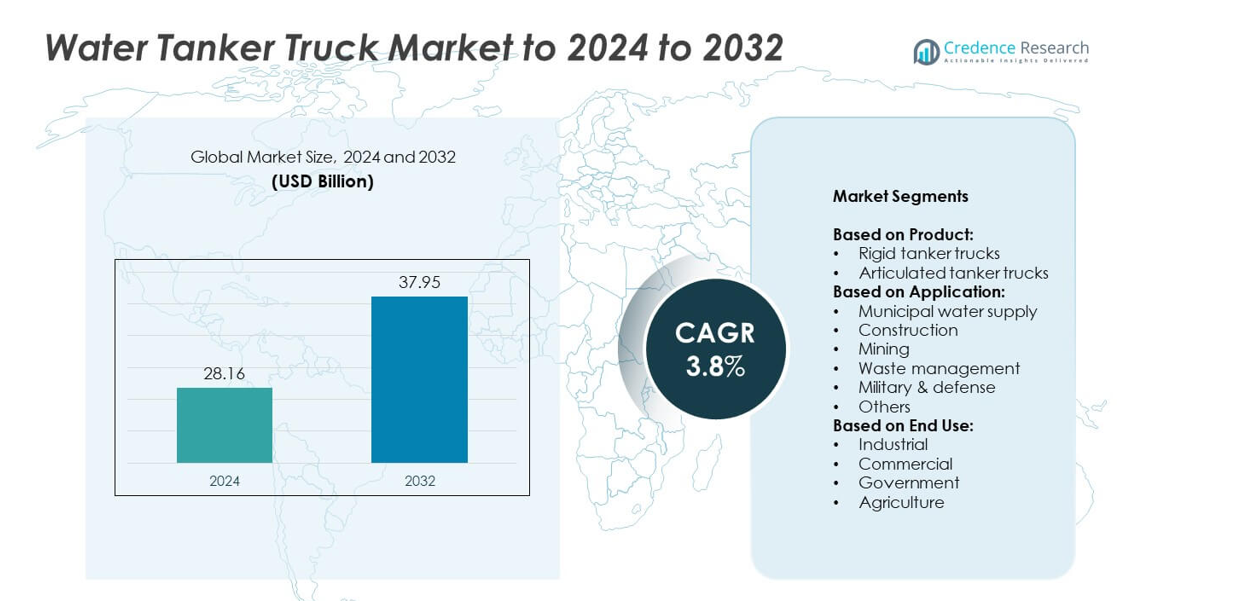

Water Tanker Truck Market size was valued at USD 28.16 Billion in 2024 and is anticipated to reach USD 37.95 Billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Tanker Truck Market Size 2024 |

USD 28.16 Billion |

| Water Tanker Truck Market, CAGR |

3.8% |

| Water Tanker Truck Market Size 2032 |

USD 37.95 Billion |

The water tanker truck market is shaped by major players such as Dongfeng Motor Corporation, Caterpillar, Tata Motors Limited, Hyundai Motor Company, Scania AB, and Volvo, who collectively focus on expanding product portfolios and integrating advanced technologies to meet growing demand. These companies emphasize manufacturing durable, high-capacity trucks and offering efficient aftersales services to strengthen market presence. North America leads the global market with around 33% share in 2024, driven by strong municipal water distribution systems, fleet modernization initiatives, and increasing use in infrastructure projects. Asia-Pacific follows closely, supported by rapid urbanization, construction activities, and government investments in water security programs.

Market Insights

- The water tanker truck market was valued at USD 28.16 Billion in 2024 and is projected to reach USD 37.95 Billion by 2032, growing at a CAGR of 3.8%.

- Demand is fueled by rising municipal water distribution needs, growing infrastructure and construction projects, and increased usage in industrial and mining sectors.

- Market trends include adoption of telematics for fleet management, shift toward lightweight tank materials, and growing interest in hybrid and low-emission trucks.

- The market is moderately fragmented with key players focusing on product innovation, fleet expansion, and strategic partnerships to strengthen their presence.

- North America led the market with 33% share in 2024, followed by Asia-Pacific at 28%; municipal water supply was the largest application segment with over 40% share, while rigid tanker trucks dominated product type with more than 65% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Rigid tanker trucks dominated the water tanker truck market in 2024, accounting for over 65% share due to their cost-effectiveness, durability, and suitability for short- to medium-haul applications. These trucks are widely preferred for municipal and industrial water distribution, as they offer higher payload capacity and simpler maintenance compared to articulated models. Rising demand for reliable water transport in urban and semi-urban areas further boosts adoption. Articulated tanker trucks, while holding a smaller share, are gaining traction in remote mining operations and large-scale construction sites where long-distance transport is necessary.

- For instance, Quality Carriers deployed ISAAC telematics on over 2,500 tankers and saw a significant improvement in the reliability of their in-cab tablets, which reduced their failure rate to below 5%

By Application

Municipal water supply led the market with more than 40% share in 2024, driven by increasing demand for potable water transport and emergency supply services in urban and rural areas. Water scarcity challenges and aging municipal infrastructure push local authorities to rely on tanker trucks for distribution. Construction applications also contributed significantly, supported by infrastructure projects requiring dust suppression and on-site water storage. Mining, waste management, and military applications form niche but steadily growing segments, with higher adoption in regions experiencing rapid industrialization and frequent drought conditions.

- For instance, Den Hartogh Logistics introduced lightweight composite tank containers, developed with Tankwell (Netherlands), that increased the payload by up to 2 metric tons per trip and allowed reducing freight cost per trip by 5 to 10%. This innovation resulted in fewer transports to move the same amount of product.

By End Use

Government end-users held the largest share at over 35% in 2024, driven by municipal bodies, disaster management agencies, and defense departments procuring tanker trucks for public water distribution and emergency relief operations. The industrial sector follows closely, with rising demand for process water in manufacturing, power generation, and mining activities. Commercial end-users, including private water suppliers and construction firms, are expanding fleets to serve residential complexes and infrastructure projects. Agricultural use is growing steadily, particularly in drought-prone regions where farms rely on water tankers for irrigation during dry seasons.

Key Growth Drivers

Rising Demand for Municipal Water Distribution

Increasing urbanization and water scarcity are driving municipal authorities to invest in water tanker trucks. These trucks ensure continuous supply to regions with inadequate pipeline infrastructure and serve as emergency response assets during water shortages. The growing focus on improving public water distribution networks is boosting demand. Governments are allocating funds for fleet expansion to meet rising population needs, which is expected to sustain market growth over the coming years.

- For instance, the Jal Jeevan Mission prioritizes providing functional household tap connections (FHTCs) to every rural household, moving away from public water points and tankers. As of February 1, 2025, the mission had provided tap water connections to over 44 crorerural households across India. The program’s goal is to supply at least 55 liters of water per person per day (lpcd) through these connections.

Expanding Construction and Infrastructure Projects

Large-scale construction projects, roadworks, and infrastructure developments require constant water supply for dust suppression and concrete mixing. Water tanker trucks provide a flexible and mobile solution for these needs, reducing downtime on job sites. Rapid urban development across Asia-Pacific and Middle Eastern countries is fueling demand. Private contractors and rental service providers are expanding their fleets to meet increasing project volumes, supporting consistent market growth in this segment.

- For instance, Omni Tanker and Mick Murray Welding built a composite triple road-train tanker able to carry 98 tonnes payload, boosting payload by 15% over typical stainless steel tanks.

Industrial and Mining Sector Growth

Rising demand from industries and mining operations is a major driver for the market. Water tanker trucks are essential for transporting process water, cooling water, and for dust control in mining operations. Growth in metal extraction activities and new industrial plant setups are increasing procurement of specialized tanker trucks. These sectors favor heavy-duty, high-capacity models, leading manufacturers to introduce robust designs and advanced features to serve demanding environments effectively.

Key Trends & Opportunities

Adoption of Smart Fleet Management Systems

Manufacturers and fleet operators are increasingly integrating telematics and GPS tracking systems into water tanker trucks. These solutions help monitor routes, optimize water delivery schedules, and reduce operational costs. Fleet digitalization enhances efficiency and ensures compliance with regulatory standards for water transport. Companies adopting smart monitoring solutions can improve service reliability, which opens opportunities for aftermarket telematics providers and digital service platforms.

- For instance, Geotab Inc. has grown its subscriptions to more than 5 million units globally, showing scale in telematics adoption among fleets. It serves over 55,000 customers.

Shift Toward Sustainable and Efficient Designs

The market is witnessing a trend toward fuel-efficient engines and lightweight tank materials to reduce carbon emissions. Demand is growing for stainless steel and composite tanks that offer durability and reduce vehicle weight. Opportunities exist for manufacturers offering hybrid or electric tanker trucks, especially in regions with stringent emission regulations. Sustainability-focused innovations are expected to become a differentiating factor in supplier selection.

- For instance, Pune Municipal Corporation (PMC) data showed that between January and March 2024-2025, over 126,110 water tanker trips were recorded, a significant increase from the same period the previous year. The reliance on tankers in newly merged zones is a primary driver for this increase, with peak monthly demand reaching around 40,000 to 45,000 trips during the summer months of April and May 2025.

Key Challenges

High Operating and Maintenance Costs

Water tanker truck operations involve significant expenses related to fuel, regular maintenance, and driver wages. Rising fuel prices are increasing the total cost of ownership for fleet operators, particularly in emerging markets. Small-scale contractors may find it challenging to maintain profitability while competing with established service providers. This cost burden may slow fleet expansion among budget-sensitive buyers, restraining overall market growth.

Stringent Regulatory Compliance

Compliance with water quality and transport regulations is becoming increasingly strict. Authorities require proper sanitization of tanker trucks and documentation for potable water delivery, increasing operational complexity. Non-compliance can result in fines or suspension of services, affecting service providers’ credibility. Companies must invest in regular inspections and training to meet standards, which adds to their operational cost and limits profit margins.

Regional Analysis

North America

North America held the largest share of the water tanker truck market in 2024, accounting for around 33%. The region benefits from well-established municipal water infrastructure, but increasing water scarcity in western states is boosting demand for tanker trucks to support emergency distribution. The U.S. leads the market with fleet modernization initiatives and growing adoption of smart fleet management solutions. Industrial and construction applications also contribute significantly, driven by ongoing infrastructure investment programs. Canada follows with rising demand for potable water delivery in remote communities and support for mining operations in resource-rich provinces.

Europe

Europe accounted for nearly 27% of the market share in 2024, supported by growing adoption of efficient and sustainable tanker truck solutions. Countries such as Germany, France, and the UK are focusing on fleet upgrades to meet strict emission norms, driving demand for fuel-efficient models. The region’s construction and infrastructure development projects, particularly in Eastern Europe, are generating steady demand for water distribution trucks. Increased municipal spending on rural water access and emergency relief operations is further supporting growth. Fleet operators are also adopting telematics to enhance route planning and comply with safety regulations across the region.

Asia-Pacific

Asia-Pacific captured around 28% of the market share in 2024, emerging as one of the fastest-growing regions. Rapid urbanization, population growth, and rising infrastructure projects in China, India, and Southeast Asia are driving significant demand for water tanker trucks. The construction sector is a key contributor, requiring trucks for dust suppression and concrete mixing at large-scale projects. Governments in drought-prone areas are deploying fleets to ensure water security for rural populations. Growing mining activities in Australia and Indonesia also contribute to demand. The region is witnessing increasing preference for cost-effective rigid tanker trucks and low-emission vehicles.

Latin America

Latin America accounted for roughly 7% of the market share in 2024, supported by demand from municipal water supply and agricultural irrigation applications. Brazil and Mexico dominate the regional market with investments in rural water delivery and infrastructure projects. Rising urbanization and industrialization are driving procurement of medium-capacity tanker trucks for both public and private operators. Water scarcity in arid regions of Chile and Peru is further encouraging the use of tanker trucks for potable water transport. However, limited funding for fleet modernization and high fuel costs remain challenges for smaller fleet owners in the region.

Middle East & Africa

The Middle East & Africa represented nearly 5% of the global market share in 2024, with strong demand driven by arid climate conditions and limited natural water resources. Gulf countries such as Saudi Arabia and the UAE rely heavily on water tanker trucks to supplement desalination plants and meet municipal water needs. Construction of mega infrastructure projects and mining activities in Africa are further boosting demand. Government contracts for fleet procurement dominate the market, while private players are expanding services to meet seasonal requirements. High-capacity trucks are particularly favored in this region to reduce delivery frequency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Rigid tanker trucks

- Articulated tanker trucks

By Application:

- Municipal water supply

- Construction

- Mining

- Waste management

- Military & defense

- Others

By End Use:

- Industrial

- Commercial

- Government

- Agriculture

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the water tanker truck market is characterized by the presence of leading players such as Dongfeng Motor Corporation, Custom Truck One Source, Caterpillar, Iveco, Tata Motors Limited, The Knapheide Manufacturing Company, Hyundai Motor Company, Mercedez (Daimler), NWC, Man, Re:Group, Scania AB, and Volvo. The market is moderately fragmented, with manufacturers focusing on expanding production capabilities and offering a wide range of truck configurations to meet diverse end-user requirements. Companies are investing in advanced engineering, lightweight tank designs, and fuel-efficient engines to enhance performance and reduce operating costs. Strategic partnerships with municipal authorities and private contractors are strengthening supply networks, while digital fleet management solutions are being integrated to improve operational efficiency. Several players are also introducing hybrid and low-emission models to align with evolving environmental regulations. Continuous investment in aftersales services and maintenance support further helps strengthen customer loyalty and long-term market presence.

Key Player Analysis

Recent Developments

- In 2025, Caterpillar introduced an autonomous water truck for improved safety and efficiency in mining and construction.

- In 2025, NWC expanded its fleet with trucks for sewer line maintenance.

- In 2024, Re:Group partnered with Scania to deploy the world’s first autonomous fleet and Scania’s first electric water truck for Element 25’s Butcherbird Mine in Western Australia, with commercial operations set to begin in late 2025.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for water tanker trucks will rise with growing urbanization and water scarcity challenges.

- Municipal authorities will expand fleets to support emergency and routine water distribution.

- Construction and infrastructure projects will continue to drive strong adoption for on-site water needs.

- Mining and industrial sectors will invest in heavy-duty trucks for process water transport.

- Adoption of GPS and telematics will improve operational efficiency and route optimization.

- Manufacturers will focus on lightweight tank materials and fuel-efficient engines.

- Hybrid and electric tanker trucks will gain traction in emission-regulated markets.

- Rental and leasing services will expand to meet short-term and seasonal demand.

- Emerging economies in Asia-Pacific will show the fastest growth in fleet deployment.

- Aftermarket services and maintenance contracts will see higher demand from fleet operators.