Market Overview

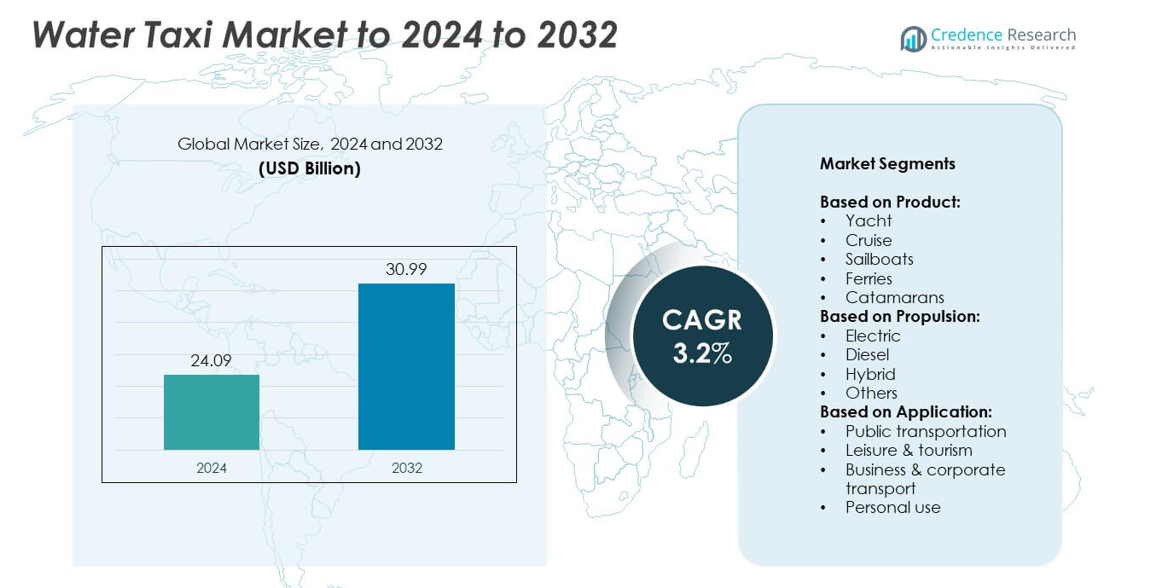

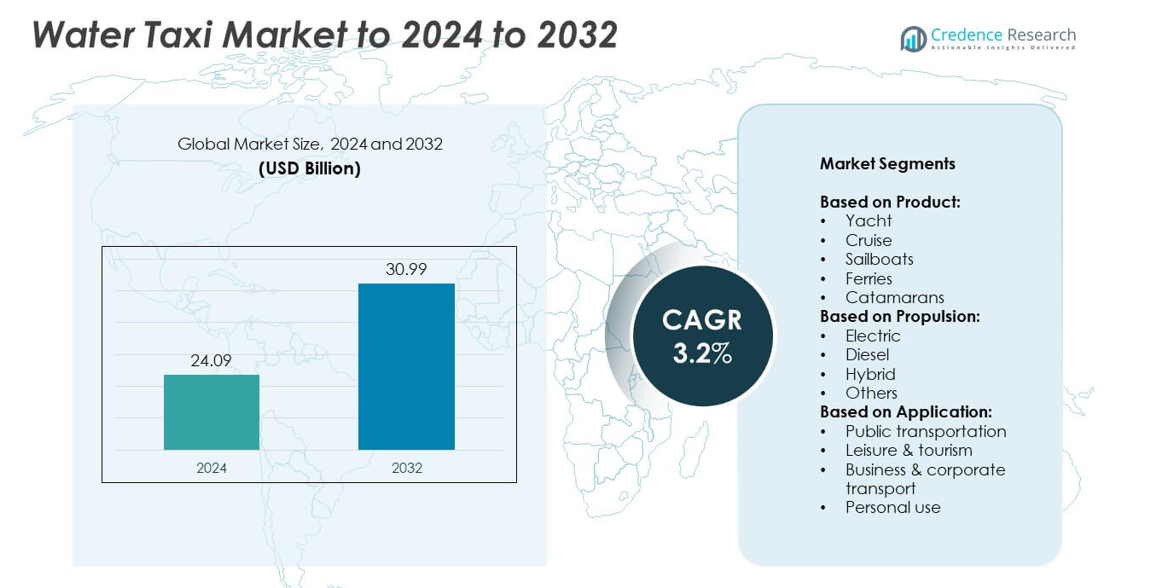

Water Taxi Market size was valued at USD 24.09 Billion in 2024 and is anticipated to reach USD 30.99 Billion by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Water Taxi Market Size 2024 |

USD 24.09 Billion |

| Water Taxi Market, CAGR |

3.2% |

| Water Taxi Market Size 2032 |

USD 30.99 Billion |

The water taxi market is driven by major players including Royal Caribbean Group, Catalina Yachts, Artemis Technologies, Azimut Benetti S.p.A., Princess Cruise Lines, Seabubbles, Beneteau Group, Disney Cruise Line, FERRETTI SPA, Austal, Bavaria Yachtbau, Carnival Corporation & Plc, and Candela. These companies focus on fleet expansion, adoption of electric and hybrid propulsion systems, and digital solutions to improve operational efficiency. North America led the market in 2024 with over 35% share, supported by robust water transport infrastructure and government-backed sustainability initiatives. Europe followed with around 30% share, driven by stringent emission regulations and strong demand for electric ferries.

Market Insights

- The water taxi market was valued at USD 24.09 Billion in 2024 and is projected to reach USD 30.99 Billion by 2032, growing at a CAGR of 3.2% during the forecast period.

- Rising demand for urban water transport and government investment in ferry systems are driving growth, along with increasing tourism activities and adoption of electric and hybrid propulsion systems.

- Trends include fleet modernization, development of electric ferries, and integration of smart booking and navigation technologies to enhance passenger convenience and reduce emissions.

- The market is competitive with global players focusing on sustainable propulsion, strategic partnerships with port authorities, and expansion of leisure and public transport fleets to strengthen market presence.

- North America leads with over 35% share, followed by Europe at nearly 30%, while Asia Pacific is the fastest-growing region; ferries dominate the product segment with more than 48% share due to their capacity and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The water taxi market by product includes yachts, cruises, sailboats, ferries, and catamarans. Ferries dominated the segment in 2024 with over 48% share, driven by their ability to transport large numbers of passengers and vehicles efficiently on short routes. Ferries are widely used in urban coastal cities as a reliable, low-cost, and eco-friendly public transit option. Catamarans are gaining traction in tourist destinations for their stability and speed, while yachts and cruises cater to premium and leisure markets. Rising government investment in ferry infrastructure and terminal development is further boosting ferry adoption worldwide.

- For instance, Damen ,its 2023 annual report stated that the company delivered nearly 100 new ships in total across all segments. In recent years, Damen has had several contracts for hybrid and electric ferries, including orders in 2024 for four fully electric ferries for BC Ferries in Canada and two fully electric ferries for the City of Toronto.

By Propulsion

Propulsion segmentation covers electric, diesel, hybrid, and other systems. Diesel-powered water taxis held the largest share of nearly 60% in 2024, supported by their proven technology, long operating range, and well-established refueling infrastructure. However, electric propulsion is witnessing the fastest growth due to global initiatives to reduce maritime emissions and operational costs. Hybrid systems are increasingly used for mid-range routes, balancing fuel efficiency and performance. Ongoing advancements in battery capacity and charging infrastructure are expected to accelerate the shift toward electric and hybrid water taxis, particularly in Europe and North America.

- For instance, BC Ferries ordered four new Island-Class fully electric-ready vessels in January 2024. These vessels, based on the Damen Road Ferry 8117 E3 design, will each carry up to 47 vehicles and 390 passengers.

By Application

The application segment includes public transportation, leisure and tourism, business and corporate transport, and personal use. Public transportation dominated in 2024 with over 50% market share, driven by rising demand for cost-effective and sustainable mobility solutions in coastal cities. Governments are focusing on reducing road congestion and promoting water-based mass transit systems. Leisure and tourism applications are growing steadily as water taxis are popular for sightseeing, resort transfers, and recreational activities. Business and personal use segments cater to premium services, supported by rising demand for luxury and chartered water transport options.

Key Growth Drivers

Rising Demand for Urban Water Transport

Growing urban congestion is pushing governments to adopt water-based public transport systems. Ferries and water taxis offer an efficient, low-emission alternative to road travel in coastal and river cities. Cities like New York and Bangkok have invested heavily in water transit networks, driving steady demand. The focus on reducing road traffic and greenhouse gas emissions supports adoption, making this the most significant growth driver for the market.

- For instance, NYC Ferry recorded over 7.4 million boardings in 2024, its highest annual ridership so far.

Growth in Tourism and Leisure Activities

The expansion of global tourism is boosting demand for yachts, catamarans, and leisure cruises. Tour operators prefer water taxis for sightseeing and resort transfers due to flexibility and low operating cost. Coastal destinations are developing marina infrastructure to attract more visitors. Rising disposable incomes and interest in experiential travel continue to encourage private and group charters, strengthening the market outlook for leisure-based water transport solutions.

- For instance, the Kochi Water Metro, planned to eventually use 78 zero-emission vessels, began Phase-1 with a fleet of 23 electric ferries. The project aims for a daily ridership of 34,000 passengers upon the full completion of Phase-1 and projects an annual carbon emissions reduction of 44,000 tonnes once fully operational.

Technological Advancements in Propulsion

Rapid innovation in electric and hybrid propulsion systems is transforming the market. These technologies reduce fuel consumption, lower emissions, and comply with global maritime regulations. Governments and operators are adopting electric ferries for short routes to meet sustainability goals. Improvements in battery efficiency and charging infrastructure are making operations more cost-effective. This technological shift is creating long-term opportunities for fleet modernization and green maritime transport.

Key Trends & Opportunities

Electrification and Green Mobility Initiatives

The transition toward electric and hybrid water taxis is a major trend shaping the industry. Operators are aligning with global emission targets and regulatory mandates such as IMO decarbonization goals. This shift opens opportunities for battery manufacturers, charging infrastructure providers, and shipbuilders to introduce innovative solutions. Electrification also reduces operating costs, making services more profitable over time.

- For instance, Candela’s P-12 hydrofoil ferry in Stockholm uses electric propulsion with hydrofoil wings. Energy consumption is reduced by ~80% compared with conventional vessels.

Integration of Smart Navigation Systems

Digitalization is enabling safer and more efficient water taxi operations. Advanced navigation systems, GPS tracking, and remote monitoring are improving route optimization and fuel efficiency. Operators are adopting ticketing apps and smart booking platforms to enhance passenger experience. This trend is creating opportunities for technology providers to develop integrated platforms that combine fleet management, safety monitoring, and customer engagement.

- For instance, Zeam’s autonomous electric ferry in Stockholm, powered by Zeabuz technology, supports auto-docking and uses an advanced sensor suite including lidar, radar, cameras, AI, and GPS for collision avoidance. The ferry, which began service in 2023, carries up to 24 passengers.

Key Challenges

High Initial Capital and Maintenance Costs

The adoption of water taxis requires significant investment in vessels, docking facilities, and supporting infrastructure. Electric and hybrid boats often have higher upfront costs compared to diesel-powered ones. Additionally, regular maintenance, battery replacement, and compliance with safety regulations add to operating expenses. These factors limit participation by small operators and may slow large-scale adoption in emerging economies.

Regulatory and Environmental Constraints

Water taxi operations face strict regulations regarding emissions, safety, and navigational routes. Compliance with international maritime standards and local licensing can be time-consuming and costly. Environmental concerns such as water pollution, noise emissions, and ecosystem impact can delay project approvals. These regulatory hurdles can hinder fleet expansion and route development, particularly in environmentally sensitive or protected areas.

Regional Analysis

North America

North America led the water taxi market in 2024 with a market share of over 35%, driven by strong adoption of ferries and catamarans for public transportation and leisure purposes. The U.S. and Canada are investing heavily in upgrading coastal and inland waterway transport systems to reduce road congestion. Tourism-focused cities such as New York, Miami, and Vancouver are promoting water taxis as sustainable mobility options. The presence of key operators and rapid adoption of electric ferries also support growth. Government incentives for green transportation are expected to further accelerate market expansion in the coming years.

Europe

Europe accounted for nearly 30% share of the water taxi market in 2024, supported by advanced maritime infrastructure and strict environmental regulations encouraging the shift toward electric and hybrid propulsion. Countries such as Norway, the Netherlands, and Italy are pioneers in implementing zero-emission ferries for public transit. Rising demand for water-based leisure transport in coastal cities and island destinations is driving growth. EU funding for sustainable waterborne mobility projects continues to boost investments. The region is expected to maintain steady growth as fleet modernization programs expand across key ports and tourist-heavy waterways.

Asia Pacific

Asia Pacific held around 22% share of the market in 2024 and is projected to grow at the fastest rate during the forecast period. Rapid urbanization in countries like China, India, and Thailand is driving investments in water transport to reduce urban congestion. The growth of coastal tourism and government-backed initiatives to improve inland waterways are key contributors. Affordable labor and rising disposable incomes are encouraging private water taxi operators. Expanding port infrastructure and the introduction of hybrid and electric vessels in major cities are likely to further boost adoption in this high-growth region.

Latin America

Latin America represented approximately 8% share of the water taxi market in 2024, driven by demand in tourist destinations such as Brazil, Mexico, and Argentina. Water taxis are widely used for resort transfers and sightseeing services, particularly in coastal and island locations. Investments in maritime tourism infrastructure and eco-friendly vessels are supporting market growth. However, limited funding for public transport projects and slower adoption of advanced propulsion technologies restrict expansion. The market is expected to show moderate growth, supported by the rising popularity of sustainable tourism and government efforts to enhance connectivity in key regions.

Middle East & Africa

The Middle East & Africa region held nearly 5% share in 2024, supported by increasing adoption of luxury yachts and ferries for tourism and hospitality sectors. Countries like the UAE and South Africa are focusing on building waterfront developments and marina facilities to attract international visitors. The demand for water taxis is growing in high-end leisure destinations, with operators offering premium services. Limited public transportation integration and high vessel costs pose challenges, but government-backed tourism initiatives and luxury travel demand are expected to drive steady market growth across key cities and coastal areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

- Yacht

- Cruise

- Sailboats

- Ferries

- Catamarans

By Propulsion:

- Electric

- Diesel

- Hybrid

- Others

By Application:

- Public transportation

- Leisure & tourism

- Business & corporate transport

- Personal use

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The water taxi market is shaped by key players such as Royal Caribbean Group, Catalina Yachts, Artemis Technologies, Azimut Benetti S.p.A., Princess Cruise Lines, Seabubbles, Beneteau Group, Disney Cruise Line, FERRETTI SPA, Austal, Bavaria Yachtbau, Carnival Corporation & Plc, and Candela. These companies focus on expanding their fleets, adopting sustainable propulsion systems, and introducing innovative designs to meet rising demand for efficient water transport. Strategic collaborations with governments and port authorities are helping them secure long-term projects in urban and tourist routes. Many players are investing in electric and hybrid technologies to comply with global emission regulations and reduce operational costs. Digital solutions such as smart ticketing, route optimization, and remote fleet management are gaining attention to improve passenger experience and operational efficiency. Continuous R&D investment and product launches are enabling these companies to strengthen their market position and maintain competitiveness in a rapidly evolving marine transport industry.

Key Player Analysis

- Royal Caribbean Group

- Catalina Yachts

- Artemis Technologies

- Azimut Benetti S.p.A.

- Princess Cruise Lines

- Seabubbles

- Beneteau Group

- Disney Cruise Line

- FERRETTI SPA

- Austal

- Bavaria Yachtbau

- Carnival Corporation & Plc

- Candela

Recent Developments

- In 2024, SeaBubbles unveiled the larger “Smart Bubble” water taxi. This updated model increased passenger capacity from four to seven, improved cruising speed, and featured a new electric drive system with retractable carbon fiber foils.

- In 2024, Candela launched the world’s first all-electric hydrofoil ferry line in Stockholm. The P-12 is designed to travel above the water on computer-guided wings, consuming 80% less energy than conventional ferries and enabling high-speed travel with minimal wake.

- In 2023, Artemis Technologies EF-24 passenger ferry won a commercial project at the Foiling Awards. The 24-meter ferry can carry up to 150 passengers and was set to be launched in Belfast.

Report Coverage

The research report offers an in-depth analysis based on Product, Propulsion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as cities expand water-based public transport networks.

- Electric and hybrid water taxis will gain popularity due to stricter emission regulations.

- Tourism-focused regions will increase adoption of ferries and catamarans for leisure services.

- Governments will invest in waterfront infrastructure and terminals to support water transit.

- Digital booking platforms and smart navigation systems will enhance passenger experience.

- Fleet modernization programs will replace old diesel boats with sustainable propulsion systems.

- Private operators will expand luxury and charter water taxi services in premium destinations.

- Emerging economies will adopt water taxis to reduce road congestion in urban areas.

- Battery technology improvements will make electric vessels more cost-efficient and practical.

- Partnerships between operators and local authorities will drive long-term market expansion globally.