Market Overview

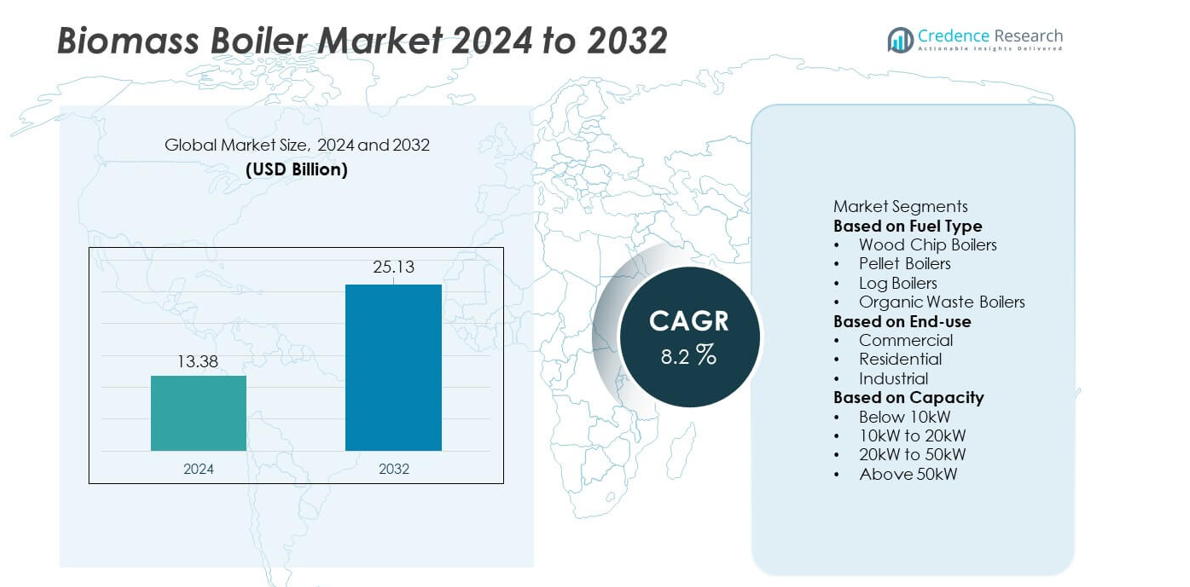

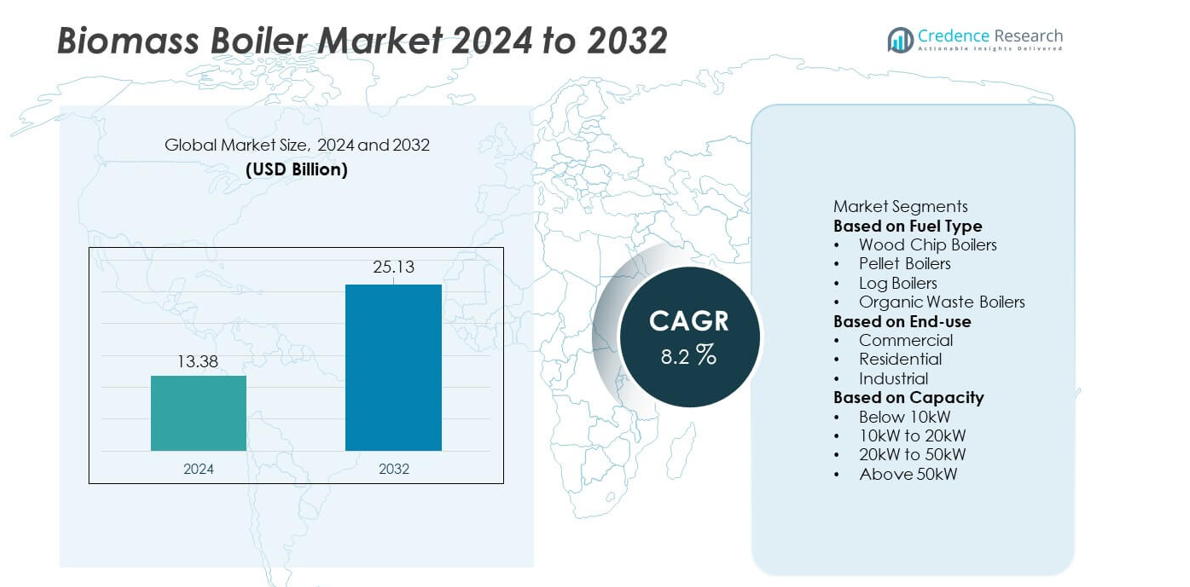

The Biomass Boiler market reached USD 13.38 billion in 2024. The market is expected to grow to USD 25.13 billion by 2032, supported by a CAGR of 8.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biomass Boiler Market Size 2024 |

USD 13.38 billion |

| Biomass Boiler Market, CAGR |

8.2% |

| Biomass Boiler Market Size 2032 |

USD 25.13 billion |

The top players in the Biomass Boiler market include INNASOL GROUP LTD., ATMOS, ANDRITZ, ÖkoFEN, Säätötuli Canada Enterprises Inc., HARGASSNER Ges mbH, Justsen Energiteknik A/S, TATANO s.n.c., Thermax Limited, and Isgec Heavy Engineering Ltd. These companies strengthen market presence through high-efficiency combustion technologies, multi-fuel boiler systems, and large installation networks that serve industrial, commercial, and residential users. Europe leads the market with a 39% share, supported by strict emission rules and strong renewable-energy adoption. North America follows with a 34% share, driven by clean-energy incentives, while Asia Pacific holds 21%, supported by rising industrialization and growing demand for biomass-based heating solutions.

Market Insights

- The Biomass Boiler market reached USD 13.38 billion in 2024 and will grow at a CAGR of 8.2 percent through 2032, supported by rising demand for renewable heating systems.

- Growing focus on low-carbon energy drives adoption of pellet boilers, which lead the market with a 43 percent share due to high efficiency and automated operation.

- Advanced combustion systems, multi-fuel capabilities, and digital monitoring tools shape key market trends as industries modernize heating infrastructure.

- Competition among INNASOL, ATMOS, ANDRITZ, ÖkoFEN, Säätötuli, HARGASSNER, Justsen, TATANO, Thermax, and Isgec increases innovation, while high installation costs and fuel-supply variability remain major restraints.

- Europe leads with a 39 percent share, followed by North America at 34 percent and Asia Pacific at 21 percent, while the industrial segment dominates end-use demand with a 49 percent market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentation Analysis:

By Fuel Type

Pellet boilers lead the market with a 43% share, driven by their high combustion efficiency, automated feeding systems, and suitability for both residential and commercial installations. Their consistent fuel quality and lower emissions make them a preferred choice in regions promoting clean heating solutions. Wood chip boilers follow due to strong adoption in industrial and district heating applications where large-scale heat output is required. Log boilers remain relevant in rural areas with access to low-cost wood resources. Organic waste boilers gain traction as industries use agricultural residues and biomass waste to cut fuel costs and reduce carbon footprints.

- For instance, ÖkoFEN is a prominent Austrian manufacturer that provides commercial pellet systems with automated fuel delivery and large-capacity storage solutions tailored to specific project requirements

By End-use

The industrial sector dominates the market with a 49% share, supported by rising demand for renewable heat in food processing, chemicals, textiles, and manufacturing. Industries adopt biomass boilers to reduce fossil fuel dependence and comply with emission regulations. The commercial segment grows steadily as hotels, schools, hospitals, and office buildings shift toward low-carbon heating systems. Residential demand remains strong in rural and semi-urban areas where biomass fuels are accessible and cost-effective. Government incentives, subsidies, and carbon-reduction targets continue to drive adoption across all end-use sectors.

- For instance, Hargassner is a global player in sustainable biomass heating systems for various applications, including industrial and commercial enterprises. Their modern wood chip and pellet boilers are designed for high efficiency and low emissions, combining comfort with advanced technology.

By Capacity

Biomass boilers with capacities above 50kW hold a 46% market share, driven by strong demand from industrial and commercial facilities requiring high heat output and continuous operation. These systems support district heating networks, large manufacturing plants, and institutional buildings. The 20kW to 50kW category grows as small industries and commercial establishments adopt mid-range boilers for reliable heating. Residential users and small farms contribute to rising adoption in the 10kW to 20kW segment. Below 10kW units remain niche but relevant for small homes and off-grid applications seeking cost-efficient renewable heating solutions.

Key Growth Drivers

Rising Demand for Renewable and Low-Carbon Heating Solutions

The shift toward renewable heating accelerates biomass boiler adoption as industries, commercial buildings, and residential users seek to reduce reliance on fossil fuels. Biomass boilers offer a lower carbon footprint and align with global decarbonization goals. Governments promote renewable heat through subsidies, tax credits, and clean-energy mandates. Industries adopt biomass systems to meet strict emission standards while achieving long-term cost savings. Growing availability of biomass fuels such as pellets, chips, and organic waste further supports market expansion across multiple end-use sectors.

- For instance, Justsen Energiteknik delivered a complete 2 MW biomass plant for dry fuel (primarily wood pellets) to a Danish heating plant, Arden Varmeværk, in 2022, a project that improved capacity and aimed to reduce reliance on natural gas.

Increasing Adoption in Industrial and District Heating Applications

Industrial facilities increasingly adopt biomass boilers to meet high heat demand while reducing operational costs and greenhouse-gas emissions. Sectors such as food processing, textiles, paper, and chemicals rely on biomass systems for steam generation and process heat. District heating networks deploy high-capacity biomass boilers to supply energy to residential and commercial clusters. Supportive policies, carbon pricing mechanisms, and rising fuel prices for oil and gas strengthen the shift toward biomass. These installations also benefit from advanced combustion technologies that improve efficiency and lower emissions.

- For instance, ANDRITZ supplied a biomass-fired boiler with a 75 MW thermal capacity to a district heating plant in Denmark. Performance tests showed a steam production rate of 113 tons per hour at 84 bar.

Government Incentives and Supportive Regulatory Frameworks

Strong regulatory support drives biomass boiler adoption through renewable heat incentives, reduced emission targets, and clean-energy transition policies. Many countries offer grants, rebates, and favorable financing to encourage installation across industrial and residential sectors. Governments also promote sustainable biomass supply chains to maintain fuel availability and reduce environmental impact. Stricter air-quality regulations incentivize users to replace older heating systems with advanced, low-emission biomass boilers. These policy measures accelerate deployment and enhance the long-term growth outlook of the market.

Key Trends & Opportunities

Expansion of Automated and High-Efficiency Biomass Boiler Technologies

echnological advancements improve combustion efficiency, automation, and ease of operation in modern biomass boilers. Automated feeding systems, advanced heat exchangers, and real-time monitoring enhance performance and reduce manual intervention. Smart controls optimize fuel usage, emissions, and maintenance schedules. Manufacturers develop biomass boilers compatible with multiple fuel types, creating new opportunities in sectors adopting flexible heating solutions. Rising interest in hybrid renewable systems combining biomass with solar or heat pumps further strengthens market adoption.

- For instance, Herz Energietechnik deployed a biomass system that is designed to use an economizer for heat recovery, a common practice in such systems. The use of an economizer allows for the preheating of a fluid, which reduces energy consumption and consequently lowers the temperature of the flue gas exiting the system.

Growing Use of Agricultural and Organic Waste as Fuel Sources

The use of agricultural residues, forest byproducts, and organic waste grows as industries seek cost-effective and sustainable fuel alternatives. Farmers and agro-industries increasingly invest in biomass boilers to process waste internally, lowering fuel costs and reducing disposal challenges. Circular-economy initiatives support the conversion of organic waste into usable heat energy. Governments promote waste-to-energy solutions to minimize landfill use and improve sustainability. This trend creates strong opportunities for biomass boiler suppliers offering systems designed for diverse and non-conventional fuel sources.

- For instance, Säätötuli has supplied biomass heating systems to various Canadian facilities, including a 400kW boiler startup at a factory in Quebec, and containerized 200kW and 300kW plants for municipal heating, all designed to operate with a wide variety of solid fuels like woodchips, wood industry residues, and agricultural residues.

Key Challenges

High Installation Costs and Limited Affordability for Small Users

Biomass boilers require significant upfront investment for equipment, fuel-storage systems, and installation infrastructure. Small businesses and residential users often struggle to adopt these systems despite long-term cost benefits. Additional expenses such as flue systems, maintenance contracts, and space requirements increase the financial burden. In regions with low subsidies or limited financing options, adoption rates remain slow. Addressing affordability through improved financing, leasing options, and cost-optimized designs is essential to broaden market penetration.

Fuel Supply Variability and Logistical Constraints

Reliable biomass fuel supply remains a major challenge, particularly in regions with poor distribution networks or seasonal availability. Variability in moisture content, quality, and pricing affects boiler efficiency and performance. Transportation and storage costs increase overall operational expenses. Industries depending on continuous heat output face risks when fuel availability fluctuates. Strengthening biomass supply chains, improving fuel-quality standards, and enhancing storage infrastructure are critical to ensuring consistent performance and sustaining long-term market growth.

Regional Analysis

North America

North America holds a 34% market share, driven by strong adoption of renewable heating technologies across industrial, commercial, and institutional facilities. The region benefits from supportive clean-energy policies, carbon-reduction targets, and incentives that encourage replacement of fossil-fuel boilers with biomass systems. Industries such as food processing, agriculture, and manufacturing invest in high-capacity biomass boilers to reduce operating costs and improve sustainability performance. Growing availability of wood pellets and agricultural residues strengthens fuel supply reliability. The integration of automated combustion systems and emissions-control technologies further strengthens biomass boiler deployment across the U.S. and Canada.

Europe

Europe accounts for a 39% market share, supported by strict emission regulations, strong government incentives, and high public commitment to renewable energy adoption. Countries such as Germany, Austria, Sweden, and the U.K. lead deployment due to advanced district-heating networks and well-structured biomass supply chains. Commercial buildings, residential complexes, and industrial units increasingly shift to biomass boilers to meet carbon-neutrality targets. The region also benefits from widespread pellet production, sustainable forest management, and energy-efficiency programs. Continuous policy support and strong environmental awareness sustain Europe’s leading position in the global biomass boiler market.

Asia Pacific

Asia Pacific holds a 21% market share, driven by expanding industrialization, rising energy demand, and increasing adoption of biomass heating in manufacturing and agro-processing sectors. Countries such as China, India, Japan, and Indonesia invest in biomass boilers to reduce reliance on coal and lower emissions. Agricultural residues such as rice husk, palm waste, and sugarcane bagasse are widely used as affordable fuel sources. Government programs promoting clean energy and rural biomass utilization strengthen adoption. Growing awareness of sustainable heating and the need for low-cost energy solutions support long-term market growth across the region.

Latin America

Latin America represents a 4% market share, supported by strong biomass availability from agriculture and forestry sectors. Countries including Brazil, Argentina, Chile, and Colombia adopt biomass boilers to support industrial heat requirements in food processing, sugar mills, and agro-industries. Government-led renewable energy programs encourage the shift from fossil-fuel heating to biomass-based systems. However, limited technological integration and inconsistent fuel logistics slow widespread adoption. Despite these challenges, improving infrastructure and increasing interest in waste-to-energy solutions support steady growth across the region.

Middle East & Africa

The Middle East & Africa region holds a 2% market share, driven by gradual adoption of biomass boilers in agro-industries, rural communities, and small manufacturing units. Limited forest resources restrict large-scale deployment, but agricultural residues such as date waste, wood scraps, and crop byproducts support localized biomass heating. Countries including South Africa, Morocco, and Egypt show rising interest in renewable heating technologies. Government efforts to reduce carbon emissions and improve energy diversification support incremental adoption. Despite supply-chain challenges, emerging clean-energy initiatives create opportunities for biomass boiler expansion in the region.

Market Segmentations:

By Fuel Type

- Wood Chip Boilers

- Pellet Boilers

- Log Boilers

- Organic Waste Boilers

By End-use

- Commercial

- Residential

- Industrial

By Capacity

- Below 10kW

- 10kW to 20kW

- 20kW to 50kW

- Above 50kW

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as INNASOL GROUP LTD., ATMOS, ANDRITZ, ÖkoFEN, Säätötuli Canada Enterprises Inc., HARGASSNER Ges mbH, Justsen Energiteknik A/S, TATANO s.n.c., Thermax Limited, and Isgec Heavy Engineering Ltd. These players strengthen their market position by offering advanced biomass boiler technologies designed for high efficiency, low emissions, and automated operation. Many manufacturers focus on developing multi-fuel boilers that support pellets, wood chips, and agricultural waste to meet diverse industry needs. Companies invest in R&D to enhance combustion systems, digital monitoring capabilities, and heat-exchange performance. Strategic partnerships with industrial facilities, EPC contractors, and energy service providers expand installation networks and project execution capacity. Growing emphasis on renewable heating across Europe, North America, and Asia Pacific drives competition, pushing suppliers to enhance product reliability, reduce maintenance requirements, and align with global environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INNASOL GROUP LTD.

- ATMOS

- ANDRITZ

- ÖkoFEN

- Säätötuli Canada Enterprises Inc.

- HARGASSNER Ges mbH

- Justsen Energiteknik A/S

- TATANO s.n.c.

- Thermax Limited

- Isgec Heavy Engineering Ltd.

Recent Developments

- In March 2025, ANDRITZ completed a biomass power plant project for a sugar producer in Hungary — delivering a turnkey boiler plant capable of producing 32 tons/hour steam from wood chips.

- In September 2024, Boccard acquired Leroux & Lotz Technologies (LLT), a well-established French industrial boiler manufacturer, positioning itself as a European leader in renewable thermal energy

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, End-use, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of biomass boilers will rise as industries reduce dependence on fossil-fuel heating.

- Pellet and wood-chip boilers will gain stronger demand due to stable fuel supply and high efficiency.

- Governments will expand incentives to support clean-heat transitions across commercial and residential sectors.

- Industrial users will invest in high-capacity biomass systems to meet emission-reduction targets.

- Smart controls and automation will improve energy management and operational efficiency.

- Multi-fuel boiler designs will grow as users switch to cost-effective agricultural and organic waste fuels.

- District heating networks will integrate more biomass systems for sustainable heat delivery.

- Manufacturers will enhance combustion technology to lower emissions and improve thermal output.

- Emerging markets will adopt biomass boilers as low-cost renewable alternatives to coal and oil.

- Investments in biomass supply chains will strengthen fuel availability and long-term system reliability.