Market Overview

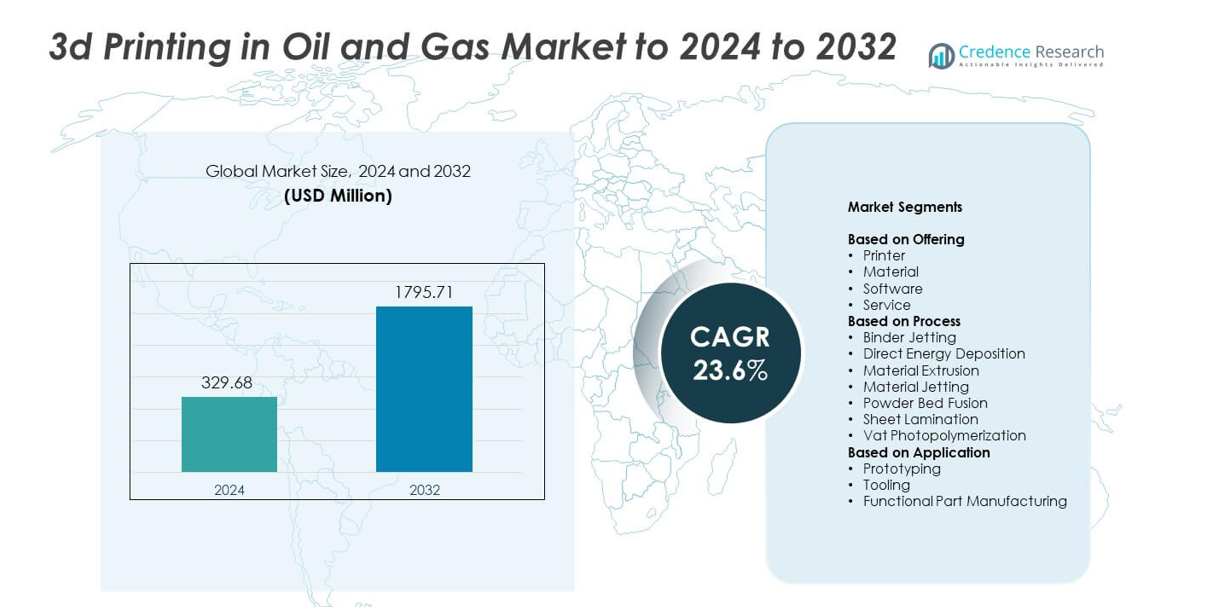

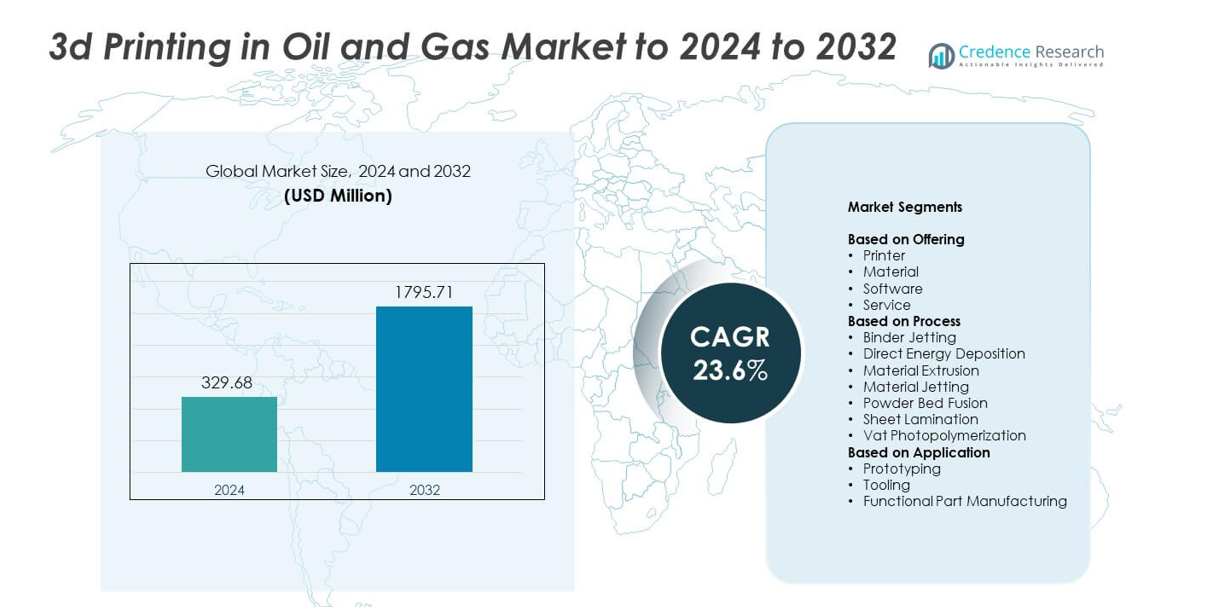

3d Printing in Oil and Gas Market size was valued at USD 329.68 million in 2024 and is anticipated to reach USD 1795.71 million by 2032, at a CAGR of 23.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printing in Oil and Gas Market Size 2024 |

USD 329.68 million |

| 3D Printing in Oil and Gas Market, CAGR |

23.6% |

| 3D Printing in Oil and Gas Market Size 2032 |

USD 1795.71 million |

The 3d Printing in Oil and Gas Market is shaped by key players such as Proto Labs, Inc., Voxeljet AG, Stratasys Ltd., Materialise NV, Optomec Inc., Envisiontec GmbH, The Exone Company, Arcam Group, 3D Systems Corporation, and SLM Solutions Group AG. These companies enhance adoption through advanced metal printing systems, improved design software, and stronger service capabilities tailored for demanding oilfield environments. North America led the market in 2024 with about 38% share, supported by strong technological infrastructure and higher investment in digital manufacturing. Europe followed with nearly 27% share, driven by offshore development and rapid industrial innovation.

Market Insights

- The 3d Printing in Oil and Gas Market was valued at USD 329.68 million in 2024 and is projected to reach USD 1795.71 million by 2032, growing at a CAGR of 23.6%.

- Demand rises as operators use additive manufacturing to cut lead times and speed prototyping, with printers holding about 46% share due to strong use in tool design and field maintenance.

- Powder bed fusion remains a major trend with nearly 39% share because it supports high-strength metal parts for drilling and refinery operations.

- Competition intensifies as major players invest in stronger metal materials and advanced printing systems to improve accuracy, durability, and on-site production capabilities.

- North America led with about 38% share in 2024, followed by Europe at nearly 27%, while prototyping dominated applications with about 48% share as companies accelerated design cycles and reduced downtime across upstream and midstream activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

Printers dominated the 3D Printing in Oil and Gas Market in 2024 with about 46% share. Oilfield operators favored advanced printers because they support rapid production of complex geometries for drilling tools, pump parts, and refinery components. Printers also help reduce lead times for replacements during field maintenance. Materials and software grew steadily as companies improved metal powders, polymers, and simulation platforms for harsh environments. Service-based offerings expanded with rising demand for outsourced additive manufacturing, but hardware sales remained the core revenue driver due to continuous upgrades in industrial-grade printer capabilities.

- For instance, Baker Hughes utilizes additive manufacturing to improve and simplify the supply chain and has developed over 1,500 qualified part numbers.

By Process

Powder bed fusion led the process segment in 2024 with nearly 39% share. Energy firms adopted this process widely because it delivers high-strength metal parts needed for high-pressure and high-temperature oilfield conditions. Powder bed fusion supports intricate internal channels, making it suitable for valves, downhole tools, and heat-resistant components. Binder jetting and material extrusion gained traction for low-cost and fast prototyping, while direct energy deposition advanced in repair applications. Despite growth across processes, powder bed fusion remained the preferred option due to superior precision and material compatibility.

- For instance, TotalEnergies deployed a WAAM-produced waterbushing on its EIG well, a pressure-containing component about 1.2 meters high and 220 kilograms that passed more than 150 qualification tests before offshore installation in 2021.

By Application

Prototyping dominated the application segment in 2024 with about 48% share. Companies used additive manufacturing to speed product development for drilling tools, flow equipment, and safety devices. Prototyping reduced design cycles and allowed engineers to test complex shapes before mass deployment. Tooling and functional part manufacturing increased as metal additive systems matured, enabling production of durable components for rigs and refineries. Functional part manufacturing showed strong momentum, but prototyping stayed ahead because it required lower cost, faster iterations, and supported innovation efforts across upstream and midstream operations.

Key Growth Drivers

Rising demand for rapid prototyping and reduced lead times

The market grows as energy companies depend on additive manufacturing to speed design cycles and reduce long wait periods for critical components. Rapid prototyping helps engineers test new geometries, improve part performance, and cut delays in drilling and refinery operations. This demand strengthens adoption because operators face rising pressure to optimize maintenance and minimize downtime. Faster turnaround also supports innovation in tool design, making this factor one of the strongest growth drivers in the 3D Printing in Oil and Gas Market.

- For instance, JOME Engineering replaced casting with robotic metal 3D printing for stainless-steel sampling valves, cutting production time from 60 days to under 48 hours by printing a 20.5-kilogram valve body rated to 5 bar in about 7.5 hours.

Growing adoption of lightweight and complex components

Oil and gas firms increasingly use 3D printing to create complex and lightweight metal parts that cannot be produced through conventional manufacturing. These components improve flow efficiency, reduce equipment loads, and enhance durability in harsh operating environments. The shift toward weight reduction and precision engineering drives steady adoption across upstream and midstream activities. As companies search for improved performance, the capability to fabricate intricate internal channels and optimized structures becomes a major driver for the 3D Printing in Oil and Gas Market.

- For instance, Siemens tested 3D-printed turbine blades for its SGT-400 gas turbine, running the blades at around 13,000 revolutions per minute in gas temperatures near 1,250 degrees Celsius on a 13-megawatt machine while validating intricate internal cooling channels.

Rising digitalization and integration with advanced design tools

Digital transformation pushes operators to integrate additive manufacturing with simulation, digital twins, and automated design platforms. This integration helps companies customize parts faster, optimize production workflows, and improve operational reliability. Digital tools also support predictive maintenance by allowing rapid on-demand production of replacement components. The strong link between digital strategy and advanced manufacturing makes this a key growth driver for the 3D Printing in Oil and Gas Market.

Key Trends and Opportunities

Expansion of metal additive manufacturing capabilities

Advances in metal powders, high-temperature alloys, and industrial printers create new opportunities for producing robust components used in drilling systems and refinery plants. Operators seek stronger and more corrosion-resistant parts to manage extreme field conditions, pushing metal AM adoption forward. As supply chains shift toward localized production, the ability to manufacture heavy-duty metal components near operation sites becomes a major trend in the 3D Printing in Oil and Gas Market.

- For instance, F3nice reported supplying recycled metal feedstock for Equinor, which produced 4,000 additively manufactured parts from fully recycled material

Increasing use of additive manufacturing for part repair and refurbishment

A growing trend involves using direct energy deposition and similar processes to rebuild worn components rather than replacing them. This shift helps companies reduce material waste, extend equipment life, and cut procurement delays. Refurbishment supports cost-effective maintenance in remote fields where replacement parts are difficult to source. The opportunity to lower operational expenses while improving equipment readiness strengthens this trend within the 3D Printing in Oil and Gas Market.

- For instance, Kongsberg Ferrotech integrated subsea additive repair into its Nautilus IMR robot, designed to rebuild damaged metal structures layer by layer on pipelines at sea depths up to 1,500 meters under Norway’s PETROMAKS 2 program.

Growth of distributed and on-site manufacturing models

Energy operators increasingly explore decentralized production setups using compact industrial printers at or near field locations. These setups enable quick access to spare parts, reduced inventory loads, and improved resilience against supply chain disruptions. Offshore rigs, desert fields, and remote pipelines benefit most from this model. As interest in localized production rises, distributed manufacturing becomes an important opportunity in the 3D Printing in Oil and Gas Market.

Key Challenges

High material and equipment costs

Additive manufacturing systems, specialty metal powders, and high-temperature alloys remain expensive compared with traditional machining. These costs slow adoption among operators with limited capital budgets or lower production volumes. Maintenance, calibration, and post-processing requirements add further expenses to overall operating costs. The financial burden keeps many firms cautious, making high cost a major challenge for the 3D Printing in Oil and Gas Market.

Limited standardization and certification frameworks

The sector struggles with inconsistent standards and slow approval processes for safety-critical printed components. Oil and gas operations require strict material testing, durability checks, and regulatory validation, which can delay deployment. Limited certification pathways also restrict large-scale adoption across drilling, refining, and pipeline operations. This lack of unified standards remains a key challenge for the 3D Printing in Oil and Gas Market and slows wider commercial use.

Regional Analysis

North America

North America held the leading position in the 3d Printing in Oil and Gas Market in 2024 with about 38% share. Strong adoption came from major operators in the United States and Canada who used additive manufacturing to support rapid prototyping, downhole tool optimization, and localized production of replacement parts. The region benefited from advanced industrial 3D printing infrastructure and deeper integration of digital engineering tools. Growing shale activity, higher investment in complex metal printing, and strong collaboration between oilfield service firms and technology suppliers continued to strengthen regional dominance.

Europe

Europe accounted for around 27% share of the 3d Printing in Oil and Gas Market in 2024. Regional growth was supported by strong research capabilities and early adoption of advanced metal printing technologies across North Sea operations. Energy companies focused on lightweight, corrosion-resistant components for offshore platforms and subsea systems. Strict sustainability goals also encouraged localized production to reduce logistics emissions. Partnerships between equipment makers, engineering firms, and additive manufacturing specialists helped expand applications in prototyping, tooling, and functional part fabrication across major oil-producing countries in the region.

Asia Pacific

Asia Pacific held nearly 24% share of the 3d Printing in Oil and Gas Market in 2024. The region grew due to expanding upstream investment in China, India, and Southeast Asia, where operators sought faster part turnaround and reduced dependency on imported components. Adoption increased as national oil companies integrated additive systems into maintenance and tooling operations. Improvements in metal powder manufacturing and government support for industrial 3D printing strengthened the ecosystem. Rising offshore exploration activity and higher demand for customized drilling tools further supported regional expansion.

Latin America

Latin America captured about 7% share of the 3d Printing in Oil and Gas Market in 2024. Growth was driven by modernization efforts in Brazil, Mexico, and Argentina, where companies adopted additive manufacturing to reduce equipment delays and improve field maintenance. Offshore projects in Brazil encouraged the use of advanced metal printing for high-strength components. Adoption remained slower compared with larger regions due to budget limitations, but interest increased as operators recognized benefits in prototyping and localized production. Gradual technology integration supported steady market progress.

Middle East and Africa

Middle East and Africa accounted for roughly 4% share of the 3d Printing in Oil and Gas Market in 2024. National oil companies in the Gulf region explored additive manufacturing for spare parts, drilling tools, and high-temperature components to support refinery and upstream operations. Countries like Saudi Arabia and the UAE invested in industrial 3D printing hubs to enhance supply chain resilience. Adoption in Africa remained limited but showed potential in offshore fields. Despite a smaller share, rising digital transformation initiatives supported long-term regional growth.

Market Segmentations:

By Offering

- Printer

- Material

- Software

- Service

By Process

- Binder Jetting

- Direct Energy Deposition

- Material Extrusion

- Material Jetting

- Powder Bed Fusion

- Sheet Lamination

- Vat Photopolymerization

By Application

- Prototyping

- Tooling

- Functional Part Manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The 3d Printing in Oil and Gas Market features major players such as Proto Labs, Inc., Voxeljet AG, Stratasys Ltd., Materialise NV, Optomec Inc., Envisiontec GmbH, The Exone Company, Arcam Group, 3D Systems Corporation, and SLM Solutions Group AG. These companies compete by advancing metal additive technologies, improving design software, and expanding industrial-grade printer capabilities tailored for harsh oilfield conditions. Their strategies focus on enhancing accuracy, material strength, and reliability to meet upstream and refinery requirements. Many players invest in research to support high-temperature alloys and corrosion-resistant materials. Partnerships with oilfield service firms and engineering contractors help expand adoption across prototyping, tooling, and functional part manufacturing. Firms also strengthen service portfolios through on-site printing support and digital integration, aiming to reduce downtime and improve operational efficiency for energy operators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Proto Labs, Inc.

- Voxeljet AG

- Stratasys Ltd.

- Materialise NV

- Optomec Inc.

- Envisiontec GmbH

- The Exone Company

- Arcam Group

- 3D Systems Corporation

- SLM Solutions Group AG

Recent Developments

- In 2025, 3D Systems advanced its presence in the oil and gas sector through its joint venture NAMI with Dussur, deploying advanced 3D printing solutions across Saudi Arabia’s energy sector.

- In 2025, Nikon SLM Solutions partnered with ExxonMobil and LSU Engineering students, along with Howco Additive, to redesign a critical machinery component using metal 3D printing for oil and gas applications.

- In April 2025, 3D Systems announce the new scanning technology module for its EXT 1070 Titan Pellet and EXT 1270 Titan Pellet printers.

Report Coverage

The research report offers an in-depth analysis based on Offering, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as operators adopt additive manufacturing for faster part production.

- Metal printing demand will rise due to growing need for durable and heat-resistant components.

- On-site and distributed manufacturing models will gain wider acceptance in remote fields.

- Digital integration will strengthen as companies link 3D printing with simulation and digital twins.

- Prototyping usage will increase as firms accelerate design cycles for drilling and refinery tools.

- Repair and refurbishment applications will grow with better deposition and rebuilding technologies.

- Supply chains will shift toward localized production to reduce delays and dependency on imports.

- New materials will emerge to improve corrosion resistance and performance in harsh conditions.

- Collaboration between oilfield service providers and technology firms will intensify.

- Certification standards will develop further, enabling broader use of printed functional parts.