Market overview

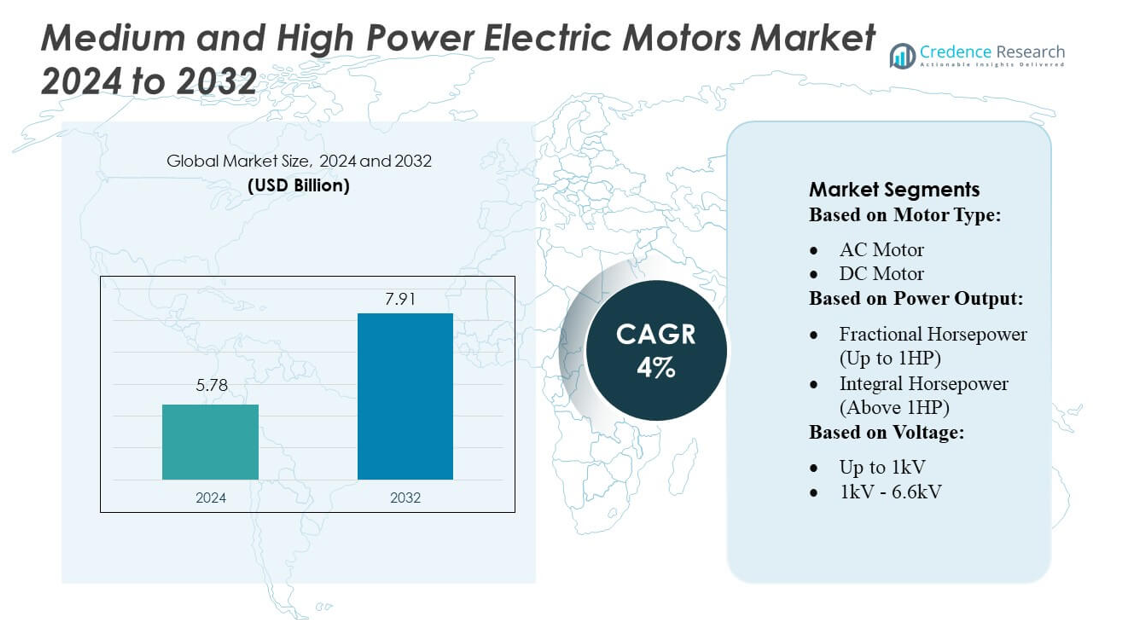

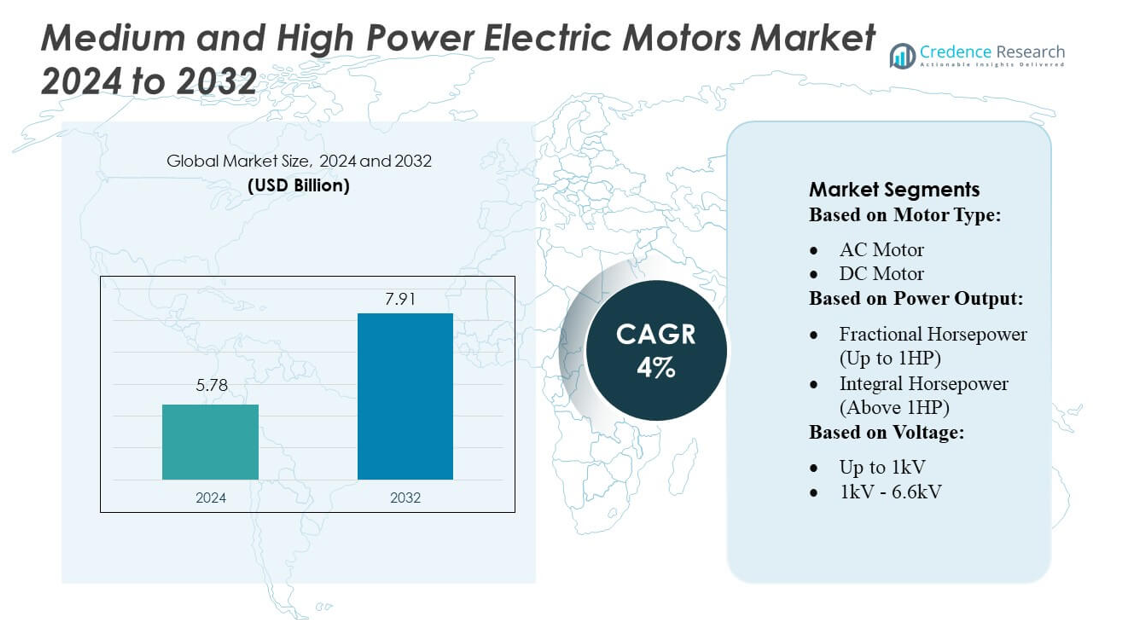

Medium and High Power Electric Motors Market size was valued USD 5.78 billion in 2024 and is anticipated to reach USD 7.91 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium and High Power Electric Motors Market Size 2024 |

USD 5.78 billion |

| Medium and High Power Electric Motors Market, CAGR |

4% |

| Medium and High Power Electric Motors Market Size 2032 |

USD 7.91 billion |

The Medium and High Power Electric Motors Market is shaped by technologically advanced manufacturers that compete through high-efficiency designs, expanded product portfolios, and strong global distribution networks. Leading companies focus on improving torque density, thermal management, and digital monitoring capabilities to address the rising demand from industrial automation, energy systems, and heavy-duty machinery. Asia-Pacific stands as the dominant regional market, holding approximately 45% share due to large-scale manufacturing activities, rapid industrial expansion, and strong adoption of electrification initiatives across China, India, and Southeast Asia. This regional leadership is reinforced by continuous investments in production capacity, supportive energy-efficiency policies, and the region’s growing deployment of smart industrial infrastructure.

Market Insights

- The Medium and High Power Electric Motors Market was valued at USD 5.78 billion in 2024 and is projected to reach USD 7.91 billion by 2032, registering a 4% CAGR during the forecast period.

- Rising industrial automation, expanding renewable energy projects, and the need for energy-efficient machinery continue to drive strong adoption of medium and high-power motors across manufacturing, utilities, and processing industries.

- Advanced trends—including higher torque density, improved thermal efficiency, and IoT-enabled monitoring—are reshaping product development as manufacturers enhance performance and reduce lifecycle costs.

- Competitive intensity strengthens as global players expand product portfolios, invest in smart motor technologies, and increase R&D spending, although high initial costs and complex integration requirements remain key restraints.

- Asia-Pacific leads the market with about 45% share, supported by extensive manufacturing output and rapid electrification, while the medium-power segment holds the largest share due to widespread use in industrial and infrastructure applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Motor Type

The Medium and High Power Electric Motors Market demonstrates strong adoption across motor categories, with AC motors holding the dominant share of nearly 62%. Their leadership stems from high efficiency, robust speed-control capabilities, and wide suitability across industrial pumps, compressors, HVAC systems, and large-scale manufacturing equipment. DC motors maintain relevance in controlled-torque applications, while hermetic motors gain traction in refrigeration and sealed-environment systems. The expansion of smart industrial automation, coupled with rising demand for energy-optimized drive systems, strengthens AC motor dominance across both medium- and high-power operational environments.

- For instance, Regal Rexnord’s SyMAX® permanent-magnet AC motors offer higher power density and increased efficiency compared to traditional NEMA Premium induction motors. SyMAX motors can be up to 43% more efficient than equivalent induction motors at half speed and run up to 25 to 30% cooler.

By Power Output

Across power-rating segments, integral horsepower motors (Above 1HP) account for approximately 68% of the market, driven by their extensive deployment in heavy machinery, process industries, oil & gas operations, and high-capacity pumping systems. Their ability to deliver continuous power under demanding load cycles strengthens adoption across utilities and large manufacturing units. Fractional horsepower motors serve conveyors, small compressors, and precision equipment, but their share remains secondary due to lower output capabilities. Increasing investments in industrial modernization, process automation, and electrification initiatives reinforce the strong demand for integral horsepower motors.

- For instance, ORIENTAL MOTOR USA CORP. recently expanded its BMU Series brushless motor lineup with high-output drivers capable of delivering a maximum speed of 4,000 rpm.

By Voltage

In voltage classifications, motors rated between 1kV and 6.6kV dominate the market with nearly 57% share, supported by their optimal balance of power delivery, energy efficiency, and compatibility with large industrial loads. These motors are widely used in refineries, mining operations, chemical plants, and high-capacity mechanical drives. The “Up to 1kV” segment grows steadily in mid-scale manufacturing and commercial infrastructure, while the “Above 6.6kV” category caters to highly specialized heavy-duty operations. Rising emphasis on operational reliability, reduced downtime, and optimized power consumption continues to drive demand for 1kV–6.6kV motors.

Key Growth Drivers

Industrial Automation and Large-Scale Electrification

Industrial automation remains one of the strongest growth drivers in the Medium and High Power Electric Motors Market as manufacturing plants, processing facilities, and logistics networks transition toward automated, digitally controlled operations. Medium and high power motors enable stable torque, improved energy efficiency, and consistent performance for conveyors, compressors, extruders, and robotic systems. The shift toward electrified industrial processes—driven by cost optimization, safety improvements, and sustainability mandates—continues to accelerate demand for higher-capacity motors capable of supporting continuous-duty cycles in harsh operating environments.

- For instance, Franklin Electric’s TEFC (Totally Enclosed Fan Cooled) industrial motors typically integrate Class F insulation, which is rated for a maximum total operating temperature of 155°C (311°F).

Expansion of Heavy Industries and Infrastructure Projects

The expansion of heavy industries such as oil & gas, mining, power generation, steel, and cement strongly supports market growth. These sectors rely on medium and high power motors for high-load applications including drilling rigs, crushers, pumps, mills, and mechanical drives. Global infrastructure development—particularly in emerging economies—further fuels demand for motors that ensure reliable, high-output performance in large construction and utilities projects. Increasing investments in rail networks, water treatment facilities, and renewable energy assets continue to boost adoption across mission-critical industrial operations.

- For instance, Siemens’ SIMOTICS HV Series motors deliver continuous output levels in the multi-megawatt range, with the highest power synchronous models reaching up to 100 MW or more. Shaft heights for some specific asynchronous slipring models can reach up to 1,000 mm.

Energy-Efficiency Regulations and Motor Upgradation

Stringent energy-efficiency regulations encourage industries to replace aging motors with high-efficiency IE3, IE4, and permanent magnet variants. These upgraded systems reduce electricity consumption, cut operational costs, and enhance process reliability for continuous-duty workflows. Government incentives for energy-efficient equipment, tighter emission targets, and corporate sustainability commitments further accelerate fleet modernization. Growing awareness of lifecycle cost advantages and predictive maintenance capabilities reinforces the shift toward advanced, smart-enabled motor technologies that extend asset life while aligning with environmental compliance requirements.

Key Trends & Opportunities

Adoption of Smart and IoT-Integrated Motors

The market experiences strong momentum toward smart, IoT-integrated motors equipped with real-time monitoring, condition diagnostics, and predictive maintenance analytics. These systems help reduce downtime, optimize energy usage, and improve asset health across heavy industrial environments. The integration of sensors, cloud platforms, and AI-driven algorithms offers new opportunities for performance optimization and remote operations. As industries accelerate digitalization initiatives, demand for intelligent motor systems continues to expand, positioning connected motors as a major growth avenue across manufacturing, mining, utilities, and process industries.

- For instance, TDK InvenSense’s SmartMotion platform is a comprehensive development kit that utilizes motion sensors and a Microchip SAM G55 microcontroller running at up to 120 MHz to facilitate rapid evaluation and software development for advanced motion-sensing solutions.

Rising Penetration of High-Efficiency Permanent Magnet Motors

Permanent magnet motors gain traction as industries prioritize high power density, reduced energy losses, and superior speed-torque characteristics. Their increasing use in compressors, pumps, HVAC units, and high-performance industrial machinery reflects a broader shift toward technologies that support energy conservation and process stability. Manufacturers invest in new magnet materials, optimized rotor designs, and advanced cooling techniques to enhance performance under demanding operating conditions. The growing focus on sustainable production and long-term operational savings positions permanent magnet technologies as a key opportunity in the market.

- For instance, Schneider Electric’s Lexium BSH and BMH three-phase permanent magnet motors are high-performance servo motors. The BSH series offers nominal speeds up to 6,000 rpm, while the BMH series has continuous stall torque values that can reach up to 84 N·m in certain high-load configurations.

Growth Opportunities in Renewable Energy and Electrified Systems

Wind energy, hydropower installations, and emerging hydrogen projects expand opportunities for medium and high power motors designed for high-load, continuous-duty performance. Motors play a critical role in turbine pitch systems, cooling pumps, and auxiliary equipment in renewable generation facilities. Electrification of heavy machinery, transport systems, and industrial utilities further broadens the addressable market. As countries scale clean-energy infrastructure and integrate grid modernization programs, demand grows for durable, high-efficiency motors capable of supporting large-scale sustainable energy operations.

Key Challenges

High Initial Costs and Complexity of Advanced Motor Systems

High upfront investment associated with high-efficiency and smart-enabled motor systems poses a major challenge, particularly for cost-sensitive industries and small to mid-sized facilities. Advanced motors require specialized components, sophisticated control systems, and precise installation practices, increasing overall project costs. The need for compatible drives, monitoring platforms, and upgraded electrical infrastructure further adds to financial burden. These constraints slow adoption despite long-term savings, creating hesitancy among users that operate older but functional motor fleets.

Supply Chain Disruptions and Dependence on Critical Materials

The market faces supply chain vulnerabilities associated with copper, aluminum, electrical steel, and rare-earth magnets used in high-performance motors. Fluctuations in raw material prices, geopolitical uncertainties, and limited availability of rare-earth elements impact production timelines and cost structures. Manufacturers also encounter challenges related to logistics bottlenecks, component shortages, and extended lead times for specialized motor designs. These disruptions hinder timely deliveries, create capacity imbalances, and increase procurement risks for industries operating with mission-critical continuous-duty applications.

Regional Analysis

North America

North America holds around 27% of the Medium and High Power Electric Motors Market, supported by strong industrial automation, established manufacturing bases, and high penetration of energy-efficient technologies. The U.S. leads demand due to substantial deployment across oil & gas, mining, and advanced processing industries that require high-capacity, continuous-duty motors. Increasing investments in smart factories, electrified industrial systems, HVAC upgrades, and water infrastructure modernization further strengthen adoption. Replacement of aging motor fleets with IE3 and IE4 models also drives growth as industries align with federal energy-efficiency mandates and digital machinery standards.

Europe

Europe accounts for nearly 24% of the global market, driven by stringent energy-efficiency regulations, rapid modernization of industrial equipment, and advanced engineering capabilities across Germany, Italy, and the UK. The region benefits from strong adoption of high-efficiency permanent magnet motors and automated drive systems in manufacturing, chemicals, and food processing. EU-wide decarbonization policies accelerate demand for motors that reduce energy losses and support sustainable operations. The emphasis on intelligent monitoring, predictive maintenance, and Industry 4.0 integration continues to shift end users toward advanced medium and high power motor solutions.

Asia Pacific

Asia Pacific dominates the market with approximately 41% share, fueled by large-scale industrialization, rapid infrastructure expansion, and significant investments in power generation, metals, mining, and heavy manufacturing. China and India remain core growth engines as they expand construction activity, rail networks, water treatment systems, and renewable energy installations requiring medium and high power motors. The region’s strong shift toward electrified industrial operations, coupled with government incentives for efficient equipment, accelerates adoption. Growing penetration of automation in automotive, semiconductor, and process industries further solidifies Asia Pacific’s leadership.

Latin America

Latin America represents around 5% of the market, with steady demand driven by mining, oil & gas exploration, and industrial modernization projects across Brazil, Mexico, and Chile. The region increasingly adopts medium and high power motors for conveyor systems, large pumps, compressors, and material handling equipment operating in heavy-duty environments. Investments in renewable energy, particularly wind and hydropower, add new opportunities for high-capacity motor deployment. However, economic fluctuations and slow modernization cycles moderate overall growth, making energy-efficient upgrades and digital motor control systems key focus areas for long-term improvement.

Middle East & Africa

The Middle East & Africa hold about 6% market share, largely driven by oil & gas operations, large-scale desalination plants, mining activities, and expanding industrial zones. Countries such as Saudi Arabia, the UAE, and South Africa invest heavily in high-capacity motors for drilling rigs, refinery machinery, pumps, and high-load mechanical systems. The region’s strategic push toward industrial diversification and renewable energy development—especially wind and solar auxiliary systems—supports market expansion. Despite challenges related to supply chain constraints and capital expenditure variability, rising automation adoption strengthens demand for durable medium and high power motors.

Market Segmentations:

By Motor Type:

By Power Output:

- Fractional Horsepower (Up to 1HP)

- Integral Horsepower (Above 1HP)

By Voltage:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Medium and High Power Electric Motors Market features a competitive landscape shaped by global manufacturers such as Regal Rexnord Corporation, ORIENTAL MOTOR USA CORP., Franklin Electric, Siemens, Johnson Electric Holdings Limited, Nidec Motor Corporation, Schneider Electric, Allied Motion, Inc., AMETEK, Inc., and ABB. The Medium and High Power Electric Motors Market is defined by continuous innovation, stringent efficiency standards, and the growing need for robust motor solutions across industrial, commercial, and energy sectors. Leading manufacturers focus on developing high-efficiency motors equipped with advanced cooling mechanisms, improved torque density, and smart monitoring features to meet rising performance expectations. Companies increasingly prioritize R&D investments to enhance motor durability, reduce lifecycle costs, and support electrification initiatives in applications such as manufacturing automation, renewable energy systems, and heavy-duty machinery. Market participants also strengthen their presence through strategic partnerships, regional expansions, and digital service platforms that enable predictive maintenance and real-time performance optimization. As demand shifts toward energy-efficient and digitally integrated systems, competitive intensity continues to rise, driving firms to differentiate through technology mastery, application-specific designs, and enhanced customer support capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, ABB, a major market participant declared that the company had signed an agreement with Aurora Motors, one of the key companies in vertical pump motors. The acquisition is projected to enhance ABB’s existing portfolio and strengthen its global footprint.

- In September 2024, WEG, a major electric motor manufacturer, signed an agreement to acquire Turkish company Volt Electric Motors, a manufacturer of commercial and industrial electric motors. This acquisition is part of WEG’s strategy to expand its presence in Turkey and Europe.

- In September 2023, Rockwell Automation announced a partnership with Infinitum, a company that specializes in sustainable air core motor. Both the companies agreed to jointly develop and distribute new motor technology having high efficiency and integrated low voltage drive.

Report Coverage

The research report offers an in-depth analysis based on Motor Type, Power Output, Voltage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance rapidly as industries adopt high-efficiency motors to meet stricter global energy-saving regulations.

- Manufacturers will integrate more IoT-enabled monitoring systems to improve predictive maintenance and reduce equipment downtime.

- Demand will rise across renewable energy applications, particularly in wind, hydro, and grid-stabilizing infrastructure.

- Electrification of industrial machinery and heavy-duty vehicles will accelerate the need for robust medium and high-power motor solutions.

- Motor designs will continue to shift toward higher torque density and compact construction to support space-constrained applications.

- Digital service platforms will gain prominence as end users prioritize real-time performance insights and lifecycle optimization.

- The market will witness increased use of advanced insulation materials to enhance thermal performance and extend motor lifespan.

- Emerging economies will strengthen their manufacturing capabilities, boosting regional production and competitive pricing.

- Companies will expand investment in variable-speed technologies to improve operational efficiency across diverse applications.

- Sustainability initiatives will drive greater adoption of recyclable materials and eco-efficient motor manufacturing processes.