Market Overview

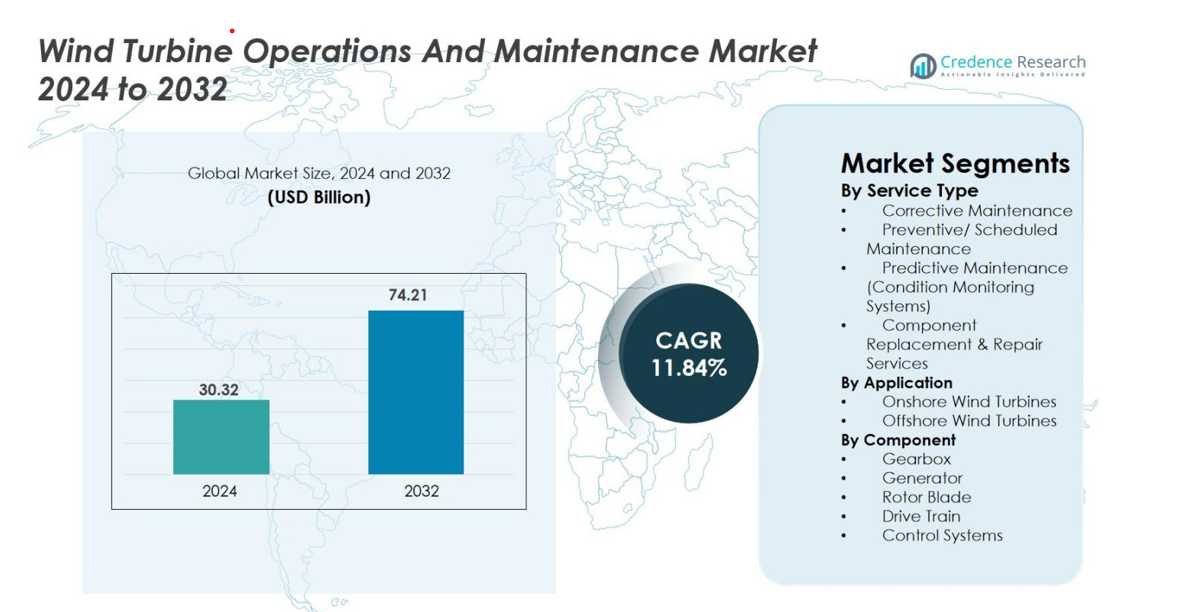

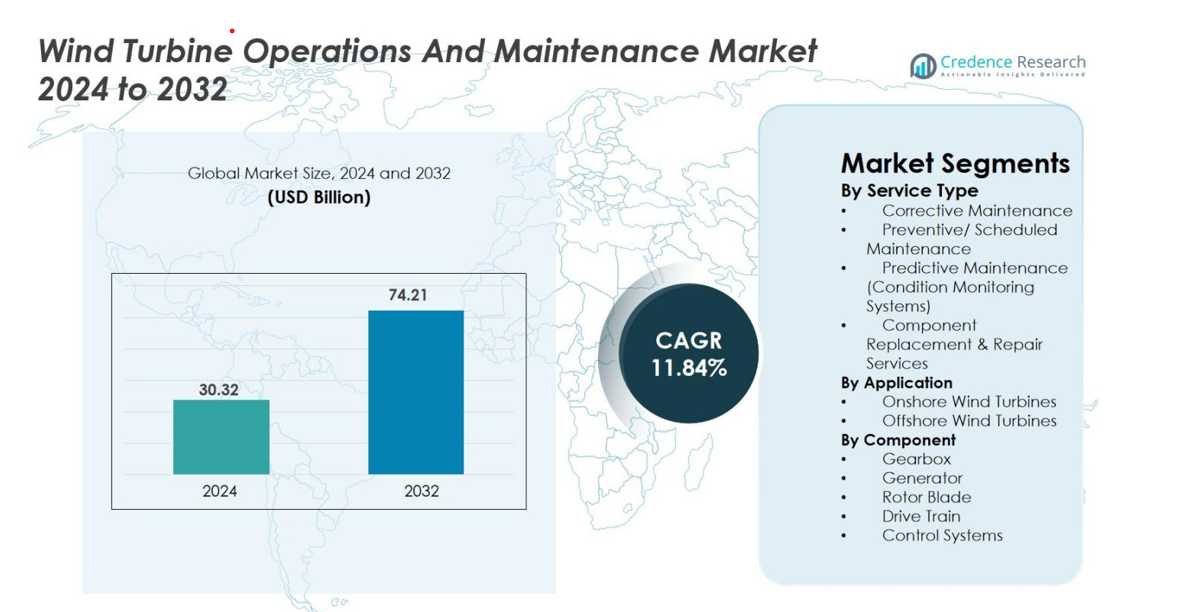

Wind Turbine Operations and Maintenance Market size was valued at USD 30.32 billion in 2024 and is anticipated to reach USD 74.21 billion by 2032, at a CAGR of 11.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wind Turbine Operations and Maintenance Market Size 2024 |

USD 30.32 billion |

| Wind Turbine Operations and Maintenance Market, CAGR |

11.84% |

| Wind Turbine Operations and Maintenance Market Size 2032 |

USD 74.21 billion |

The Wind Turbine Operations and Maintenance Market is driven by major players such as Vestas, Siemens Gamesa Renewable Energy, GE Renewable Energy, Nordex SE, Goldwind, Ming Yang Smart Energy, ENERCON GmbH, Suzlon, Dongfang Electric Corporation, and Sinovel, each leveraging advanced diagnostic systems, long-term service contracts, and multi-brand maintenance capabilities to strengthen their global presence. Europe remains the leading region with a 37.2% market share, supported by its extensive onshore and offshore wind fleet, followed by Asia-Pacific at 28.6%, driven by large-scale installations in China and India. North America contributes 24.8%, benefiting from aging turbine assets and expanding digital monitoring adoption.

Market Insights

- The Wind Turbine Operations and Maintenance Market was valued at USD 30.32 billion in 2024 and is projected to reach USD 74.21 billion by 2032, registering a CAGR of 11.84%.

- The market is driven by aging turbine fleets, rising onshore installations, and increased adoption of predictive maintenance technologies that enhance uptime and reduce lifecycle costs.

- Key trends include the rapid expansion of offshore wind requiring specialized O&M solutions, and growing use of digital tools, robotics, and AI-based diagnostics for faster, safer, and more accurate maintenance.

- Major players such as Vestas, Siemens Gamesa Renewable Energy, GE Renewable Energy, and Goldwind strengthen their positions through long-term service agreements, advanced monitoring systems, and multi-brand support capabilities.

- Europe leads with a 37.2% share, followed by Asia-Pacific at 28.6% and North America at 24.8%, while preventive maintenance dominates the service segment with a 42.6% share due to its cost-efficiency and reliability advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Service Type

The Wind Turbine Operations and Maintenance Market is led by preventive/scheduled maintenance, accounting for 42.6% of the market in 2024, driven by the growing need to reduce downtime, extend turbine life, and comply with operational safety norms. Regular servicing helps operators avoid costly failures in gearboxes, blades, and generators, making preventive strategies more cost-effective than corrective repairs. Meanwhile, predictive maintenance is rapidly gaining traction due to the adoption of IoT-enabled sensors and condition monitoring systems. Corrective maintenance and component repair services remain essential but are increasingly minimized as wind farm owners prioritize reliability and lifecycle efficiency.

- For instance, the Vestas AOM 4000 contract offers a time-based availability guarantee covering full lifecycle maintenance, including all parts, consumables and major components, with a compensation clause if turbine downtime drops below the guaranteed threshold.

By Application

The onshore wind turbines segment dominated with a 71.3% share in 2024, supported by the widespread deployment of onshore farms, lower maintenance complexity, and accessible infrastructure. Onshore installations benefit from reduced service costs, easier logistics, and mature O&M frameworks, enabling faster response times and optimized turbine uptime. However, the offshore segment is growing at a faster rate due to government-backed offshore expansions and large-scale turbine installations. Offshore O&M is driven by the need for high-performance components, remote monitoring, and vessels for specialized servicing in harsh marine environments.

- For instance, Vestas has documented that its onshore service teams can complete major corrective tasks within significantly shorter windows due to easier site access compared with offshore locations.

By Component

The gearbox segment held the largest share at 36.8% in 2024, as gearboxes face the highest mechanical stress and are among the most failure-prone components in wind turbines. Frequent wear, lubrication issues, and torque fluctuations make gearbox maintenance a critical cost driver, boosting demand for replacements, predictive monitoring, and performance optimization solutions. Rotor blades and generators also represent substantial O&M expenditure due to material fatigue, erosion, and electrical failures. Meanwhile, drive trains and control systems experience steady demand for maintenance upgrades as operators adopt advanced SCADA tools, digital diagnostics, and lifecycle-extension services.

Key Growth Drivers

Rising Wind Energy Installations and Aging Turbine Fleet

The Wind Turbine Operations and Maintenance Market is strongly driven by the rapid expansion of global wind installations and the growing fleet of aging turbines that require frequent servicing. A large share of turbines installed over the past decade has entered mid-life, where component fatigue and mechanical stress significantly increase maintenance demand. As countries accelerate renewable energy adoption, new onshore and offshore wind farms continue to expand operational capacity. Aging turbines experience higher failure risks, boosting the need for preventive and corrective maintenance, component replacements, and performance optimization. Extended operating lifespans—now reaching 25 to 30 years—further intensify the need for continuous monitoring, diagnostic tools, and reliability-focused upgrades. These factors collectively ensure sustained demand for O&M services throughout the turbine lifecycle.

- For instance, Ørsted and other industry players have observed that some early offshore turbines, as they exceed 15 years of operation towards their typical 25-year design life, require significant maintenance, which can include targeted blade reinforcement and major component exchanges like nacelle refurbishment, to ensure continued safe and efficient output.

Increasing Adoption of Predictive Maintenance and Digital Monitoring

Digital transformation is reshaping the market, with operators prioritizing predictive maintenance powered by IoT sensors, SCADA systems, digital twins, and AI-based analytics. These technologies help detect anomalies such as vibration fluctuations, lubrication issues, and component degradation long before failures occur. Predictive monitoring improves turbine uptime, reduces maintenance costs, and minimizes manual inspections—especially valuable for large wind farms and remote offshore sites. Cloud-based analytics allow seamless remote oversight, strengthening operational efficiency. As turbine sizes increase and offshore portfolios expand, data-driven O&M becomes essential for reducing unplanned outages, optimizing asset longevity, and maximizing energy yield.

- For instance, GE Vernova’s Digital Wind Farm platform uses advanced SCADA analytics to detect anomalies across gearbox and generator systems, enabling proactive interventions that have documented reductions in unplanned downtime.

Government Policies Supporting Renewable Energy Expansion

Supportive government policies, renewable energy targets, and financial incentives are significant drivers elevating O&M demand. Countries across Europe, Asia-Pacific, and North America are advancing large-scale wind installations through subsidies, tax incentives, power purchase agreements, and grid modernization programs. Regulations promoting operational safety, performance reporting, and environmental compliance further increase reliance on structured O&M activities. Offshore wind—backed by seabed leasing programs and public investment in marine infrastructure—adds to long-term service opportunities due to its complex maintenance needs. As global economies commit to net-zero emissions, sustaining turbine performance through systematic O&M becomes crucial, strengthening long-term market growth.

Key Trends & Opportunities

Expansion of Offshore Wind Farms and Specialized O&M Services

Offshore wind expansion is a defining trend creating high-value opportunities for advanced O&M players. Offshore turbines, generally larger and more complex, require specialized maintenance approaches, including autonomous drones, service vessels, robotics, and advanced diagnostics. The rise of floating wind farms adds unique challenges related to mooring, anchoring, and structural stability, intensifying demand for expert servicing. Governments in the UK, China, Japan, and the U.S. are accelerating offshore development, boosting long-term O&M requirements. As turbine ratings exceed 12–15 MW, precision maintenance becomes vital to ensure operational continuity, reduce lifecycle costs, and maintain high energy output, opening strong opportunities for OEMs and ISPs.

- For instance, as part of the AIRTuB‑ROMI initiative in the Netherlands, automated “resident” inspection drones (and crawlers) are being developed to monitor turbine blades: sensors embedded in blades detect anomalies, then trigger drones to inspect and locate damage enabling faster fault detection and reducing manual offshore inspections.

Rising Use of Robotics, Automation, and AI for Maintenance Efficiency

Automation and AI-driven innovation are redefining maintenance efficiency across the wind energy sector. Robotic blade inspection systems, climbing robots, and autonomous drones are replacing time-intensive manual inspections, significantly improving safety and reducing operational downtime. AI-enabled diagnostic tools analyze vibration patterns, detect micro-cracks, predict gearbox issues, and optimize lubrication cycles. Machine learning algorithms enhance long-term performance insights using historical and real-time datasets. These technologies reduce labor dependency, improve precision, and cut overall maintenance costs. As wind farms scale in size, automation becomes central to achieving cost-effective, reliable, and timely O&M operations.

- For instance, Sulzer Schmid using their 3DX™ Blade Platform, Sulzer Schmid has deployed autonomous drone-based blade inspections that dramatically shorten inspection time and eliminate the need for rope access or manual climbing.

Key Challenges

High Cost of Offshore Maintenance and Logistic Complexities

A major challenge in the market is the high cost and logistical difficulty of maintaining offshore wind turbines. Servicing activities require specialized jack-up vessels, crew transfer ships, and trained technicians capable of operating in harsh marine environments. Unpredictable sea conditions frequently delay maintenance schedules, increasing downtime and operational risk. Larger offshore turbines and deeper installations add complexity, requiring advanced equipment and skilled teams. These factors drive up O&M expenses, making cost optimization a persistent challenge. Although remote monitoring and automation mitigate some risks, the inherent unpredictability of offshore environments remains a significant operational barrier.

Shortage of Skilled Workforce and Increasing Technical Complexity

The market faces a growing shortage of skilled technicians capable of managing the advanced mechanical, electrical, and digital systems used in modern wind turbines. As turbines incorporate AI-driven monitoring tools, high-capacity generators, advanced control systems, and complex electronics, the demand for multi-disciplinary expertise increases sharply. Workforce training programs have not kept pace with technology advancements, leading to skill shortages and higher labor costs. Offshore installations require additional safety certifications, further narrowing the talent pool. This skills gap causes delays, reduces operational efficiency, and limits the scalability of O&M services, posing a significant challenge to industry growth.

Regional Analysis

North America

North America held a significant 24.8% share of the Wind Turbine Operations and Maintenance Market in 2024, driven by large-scale onshore wind installations across the U.S. and Canada. The region benefits from strong grid infrastructure, aging turbine fleets, and increasing investments in predictive maintenance technologies. The U.S. remains the dominant contributor, supported by Production Tax Credits (PTC) and extended operating lifespans of wind projects. Rising adoption of digital monitoring, SCADA systems, and condition-based servicing further enhances O&M demand. Growing offshore developments along the East Coast are expected to accelerate market expansion over the forecast period.

Europe

Europe dominated the global market with a 37.2% share in 2024, supported by mature onshore wind fleets and the world’s largest offshore wind deployment. Countries such as Germany, Denmark, the UK, and Spain have extensive installed capacity requiring continuous maintenance, upgrades, and repowering activities. Strong government decarbonization policies and stringent operational performance standards fuel the need for structured O&M services. Offshore installations in the North Sea, Baltic Sea, and the UK waters significantly contribute to demand due to their complex and high-maintenance nature. Europe’s adoption of digital diagnostics, robotics, and advanced monitoring tools further strengthens regional market penetration.

Asia-Pacific

Asia-Pacific accounted for 28.6% of the market in 2024, emerging as the fastest-growing region due to massive wind energy expansions in China, India, Japan, and Australia. China leads regional growth with extensive onshore and rapidly increasing offshore capacity requiring large-scale servicing. India’s aging turbine base and growing emphasis on performance optimization also boost O&M demand. Favorable policy frameworks, grid modernization, and increasing investments in renewable infrastructure support regional growth. As turbine sizes increase and remote installations expand, demand for predictive maintenance, digital condition monitoring, and component replacement services continues to rise across Asia-Pacific markets.

Latin America

Latin America captured a 5.1% share in 2024, with Brazil, Mexico, and Chile driving the majority of installations requiring ongoing O&M services. Growth is supported by expanding renewable energy targets, large onshore wind farms, and favorable investment incentives. Brazil remains the dominant market with strong project pipelines and rising demand for gearbox repairs, blade maintenance, and predictive monitoring solutions. Despite limited offshore development, the region shows strong potential due to aging infrastructure and increasing private sector participation. Growing demand for independent service providers (ISPs) and cost-efficient maintenance strategies is expected to strengthen regional O&M activities.

Middle East & Africa

The Middle East & Africa region accounted for 4.3% of the market in 2024, driven by emerging wind energy programs in South Africa, Morocco, Egypt, and Saudi Arabia. Although installed capacity remains lower than other regions, rising energy diversification initiatives support long-term O&M demand. Harsh climatic conditions, including sand, heat exposure, and fluctuating wind patterns, increase maintenance frequency and the need for robust monitoring systems. Government-backed renewable energy targets and foreign investments in utility-scale wind projects are accelerating market development. Growing adoption of remote diagnostics and performance optimization solutions is expected to elevate O&M requirements in the coming years.

Market Segmentations

By Service Type

- Corrective Maintenance

- Preventive/ Scheduled Maintenance

- Predictive Maintenance (Condition Monitoring Systems)

- Component Replacement & Repair Services

By Application

- Onshore Wind Turbines

- Offshore Wind Turbines

By Component

- Gearbox

- Generator

- Rotor Blade

- Drive Train

- Control Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wind Turbine Operations and Maintenance Market is characterized by the strong presence of global OEMs and an expanding ecosystem of independent service providers (ISPs) competing to deliver cost-efficient, high-performance maintenance solutions. Leading players such as Vestas, Siemens Gamesa Renewable Energy, GE Renewable Energy, Nordex SE, Goldwind, Ming Yang Smart Energy, Suzlon, ENERCON GmbH, Dongfang Electric Corporation, and Sinovel dominate the market through extensive service portfolios, long-term maintenance contracts, and advanced digital monitoring capabilities. OEMs leverage proprietary technologies, remote diagnostics, and component expertise to maintain competitive advantage, while ISPs focus on flexibility, reduced service costs, and multi-brand support to capture market share. The competitive environment is further shaped by growing demand for predictive maintenance, data analytics, and robotics-based inspection systems, encouraging companies to invest in digitalization and turbine performance optimization. As global wind fleets expand and age, players increasingly pursue strategic partnerships, repowering initiatives, and regional service network expansions to strengthen market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, FairWind entered a strategic partnership with Japanese turbine-O&M specialist Wind Energy Partners (WEP), marking a cross-border collaboration in wind turbine operations and maintenance

- In November 2025, Inox Green Energy Services (via Inox Wind Limited) signed an MoU with KP Energy Ltd and related KP-Group companies to jointly develop 5 GW of wind and solar capacity under this deal Inox Green will lead O&M services for all planned wind turbine assets.

- In September 2025, RES signed a long-term independent wind turbine O&M contract with Artıbir Enerji for its Yeniköy and Yılmaz wind farms in Türkiye (≈ 30 MW capacity – 8 Siemens-Gamesa turbines).

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth as global wind capacity expands and aging turbines require more frequent servicing.

- Predictive maintenance adoption will accelerate as AI, IoT sensors, and digital twins become standard in wind farm operations.

- Offshore wind expansion will significantly increase demand for specialized vessels, robotics, and remote monitoring technologies.

- Operators will increasingly rely on automation and drones to reduce inspection time, labor costs, and safety risks.

- Repowering projects will rise as older turbines reach the end of their lifecycle, boosting demand for component replacements.

- Independent service providers will gain market share by offering cost-efficient multi-brand maintenance solutions.

- OEMs will invest more in long-term service contracts to secure recurring revenue and strengthen fleet management.

- Blade erosion management and gearbox optimization will remain critical focus areas due to high failure rates.

- Digital platforms will enhance real-time performance analytics and streamline maintenance planning.

- Emerging regions will increase investments in wind infrastructure, driving long-term O&M expansion globally.