Market Overview:

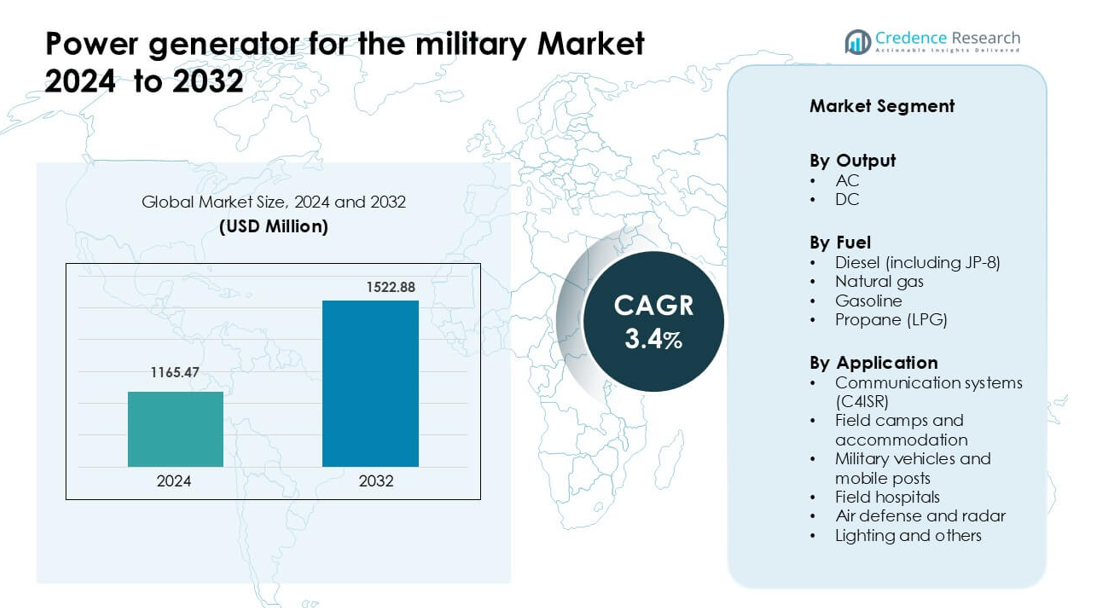

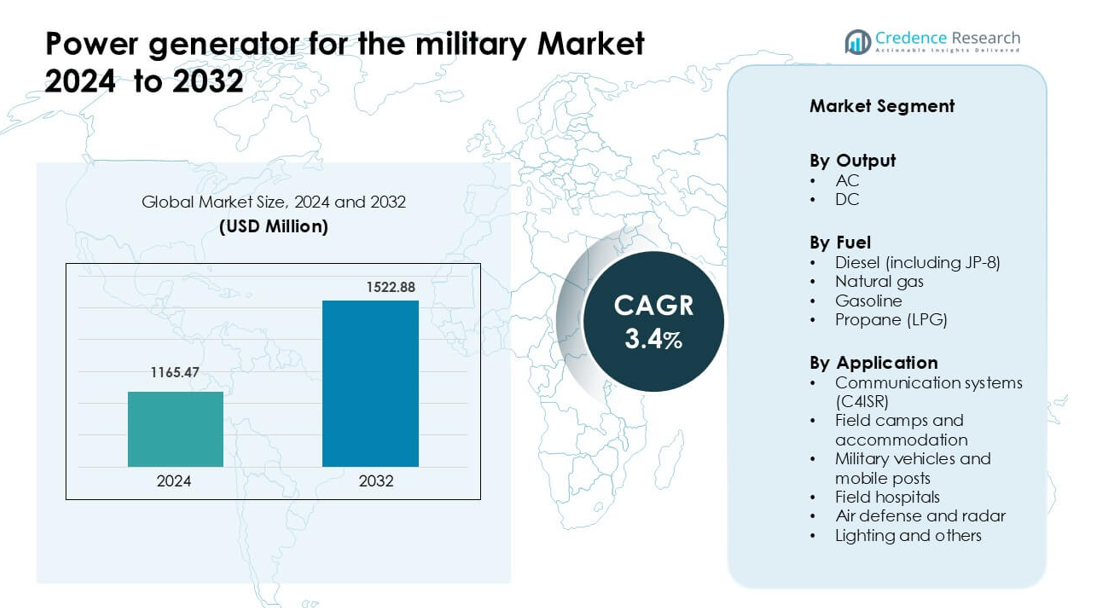

Power generator for the military Market was valued at USD 1165.47 million in 2024 and is anticipated to reach USD 1522.88 million by 2032, growing at a CAGR of 3.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Generator for the Military Market Size 2024 |

USD 1165.47 million |

| Power Generator for the Military Market, CAGR |

3.4% |

| Power Generator for the Military Market Size 2032 |

USD 1522.88 million |

The Power Generator for the Military Market is shaped by strong competition among KOHLER-SDMO, Rolls-Royce Power Systems (MTU), Wärtsilä, Atlas Copco, Himoinsa (Yanmar), Volvo Penta, Generac Power Systems, Caterpillar Inc., Cummins Inc., and Kirloskar Oil Engines. These companies focus on rugged diesel platforms, hybrid-ready systems, and rapid-deployment units that support modern communication networks, radar sites, and mobile field bases. North America remains the leading region with 36% share, driven by large defense budgets, continuous modernization, and high adoption of advanced tactical power solutions across multiple mission environments.

Market Insights

- Power generator for the military Market was valued at USD 1165.47 million in 2024 and is anticipated to reach USD 1522.88 million by 2032, growing at a CAGR of 3.4% during the forecast period.

- Strong demand for diesel-based units (68% share) drives growth, supported by rising reliance on digital C4ISR systems that require stable and continuous battlefield power.

- Hybrid and low-signature generator platforms gain traction as forces adopt energy-efficient, portable, and lightweight systems for rapid-deployment missions.

- Competition intensifies among KOHLER-SDMO, MTU, Wärtsilä, Atlas Copco, Himoinsa, Volvo Penta, Generac, Caterpillar, Cummins, and Kirloskar as they expand fuel-efficient, multi-fuel, and JP-8 compatible portfolios.

- North America leads with 36% share, followed by Europe at 27% and Asia Pacific at 23%, driven by modernization programs and high adoption of AC-output generators, which dominate the output segment with 72% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Output

AC output leads this segment with about 72% share in 2024. Defense units prefer AC generators because they support radar sites, communication hubs, and heavy logistics equipment. AC systems handle higher loads, offer smooth voltage delivery, and integrate well with hybrid power modules. DC generators serve niche roles in battery charging and small tactical gear. Growth in electronic warfare units, hardened shelters, and remote surveillance posts keeps AC demand strong.

- For instance, Rolls‑Royce Power Systems equips the German Navy’s F126 frigates with four mtu Series 4000 AC gensets, each capable of delivering between 1,600–4,000 kVA per unit, providing high load capacity and fast ramp-up suitable for demanding naval systems.

By Fuel

Diesel, including JP-8, dominates this segment with nearly 68% share. Military teams use diesel sets because the fuel is safe, widely available, and aligned with single-fuel policies adopted by NATO forces. Diesel units deliver strong torque, long runtime, and dependable ignition in extreme climates. Natural gas and propane see limited field use due to storage needs. Gasoline units stay relevant only for small portable loads.

- For instance, Cummins offers its AMMPS RMP tactical generator series (5–60 kW) that is certified to run on JP‑8 as well as diesel, and up to 16 of these units can be paralleled via Masterless Load Demand (MLD) to scale capacity.

By Application

ommunication systems (C4ISR) hold the largest share at about 33%. These systems require stable, uninterrupted power for sensors, encryption devices, and data links. Forces deploy high-reliability generators to ensure clean output for command posts and surveillance platforms. Field camps, vehicles, and hospitals follow due to sustained off-grid operations. Rising data traffic, advanced radar adoption, and expanded electronic command networks strengthen demand within the C4ISR category.

Key Growth Drivers

Rising Power Demand from Digitized Military Operations

Modern forces depend on digital tools that require stable electricity. Command networks now rely on sensors, secure radios, and encrypted data links that need clean and continuous power during missions. Military teams deploy more autonomous platforms, remote surveillance units, and electronic warfare systems, which increase the total power load across forward bases. Battlefield environments lack grid support, so mobile generator units remain essential for uninterrupted operations. Growth in high-bandwidth C4ISR systems expands generator adoption because advanced nodes cannot function under voltage drops. More electronic payloads on vehicles and shelters also push demand for stronger output classes. As forces strengthen real-time situational awareness, power reliability becomes a mission priority, driving long-term investment in durable and high-efficiency generator fleets.

- For instance, a U.S. Army study found that many of its tactical generators operate at only 30% of rated capacity, leading to inefficient under‑loading and increased fuel use a clear driver for more modern, demand‑responsive generation systems.

Expansion of Off-Grid and Rapid-Deployment Military Missions

Modern missions extend deeper into remote regions where grid power is unavailable. Forces require portable, rugged, and self-sufficient generators to sustain command posts, radar sites, field hospitals, and temporary accommodation units. Mobile brigades now move frequently, so generators must start quickly, operate under harsh climates, and run for long hours without failure. Humanitarian relief missions and peacekeeping operations also expand off-grid deployment needs. Military teams rely on generator units for lighting, communications, water systems, and medical equipment in these environments. The growing role of expeditionary forces strengthens demand for compact and reliable generator platforms that support mobility and endurance. Rising conflict intensity and border surveillance needs further accelerate procurement of tactical power systems that work independently of fixed infrastructure.

- For instance, Enginuity Power Systems’ RTG‑5H Hybrid generator, under a U.S. Army contract, delivers 2–5 kW of load-following hybrid power in a compact form, reducing the weight and footprint drastically for expeditionary missions.

Defense Modernization Programs and Fleet Replacement Cycles

Global defense budgets continue rising, and modernization programs prioritize next-generation power systems. Many countries replace outdated generator fleets with higher-efficiency models that support advanced electronics and hybrid integration. Legacy units struggle to meet new load requirements, which drives procurement of systems with digital control, noise reduction, and improved fuel efficiency. New military shelters, mobile radar platforms, and upgraded vehicle fleets also require compatible power sources, adding pressure to update generator inventories. Nations aligned with NATO standards adopt unified fuel logistics, pushing demand for JP-8 compatible diesel generator systems. Modernization cycles also encourage long-term contracts, domestic manufacturing, and local maintenance hubs. This wave of upgrades ensures steady market expansion as armies transition toward higher-capacity, smarter, and more fuel-efficient power solutions.

Key Trend & Opportunity

Rising Adoption of Hybrid, Solar-Assisted, and Low-Emission Power Systems

Defense forces explore hybrid generator systems to reduce fuel use and increase mission endurance. Battery-supported platforms cut runtime, heat signatures, and acoustic outputs, which improves stealth during sensitive operations. Solar-assisted kits now support remote sites by lowering diesel consumption and extending resupply intervals. As supply convoys face growing threats, militaries value power systems that reduce logistic strain. Many countries also emphasize low-emission technologies to align with sustainability goals and reduce dependence on fossil fuels during prolonged deployments. These shifts open strong opportunities for hybrid, renewable-linked generator systems designed for tactical operations. The trend accelerates as reliability improves and weight drops.

- For instance, Epsilor’s Tactical Hybrid Micro‑Grid system delivers up to 15 kW of available power and can cut diesel consumption by more than 50% by using a mix of solar, battery, and diesel.

Shift Toward Lightweight, Modular, and Rapid-Repair Generator Platforms

Forces demand compact and modular generators that improve mobility and reduce deployment time. Lightweight frames help soldiers transport units across rugged terrain without heavy vehicles. Modular architecture supports quick part replacement, reducing downtime during missions. This approach improves field readiness and lowers long-term maintenance costs. Growth in unmanned systems, portable command kits, and micro-power nodes increases the need for smaller tactical generators instead of large fixed units. Manufacturers gain opportunities by creating ultra-portable, multi-fuel, and plug-and-play models that integrate smoothly with shelters, drones, and autonomous platforms. Demand rises across infantry units, special forces, and border surveillance teams.

- For instance, Liquid Piston, under a U.S. Army contract, is integrating its rotary X‑Engine (XTS‑210) into a 10 kW heavy‑fuel generator set that is reportedly 75% lighter than traditional AMMPS units making it man‑portable and more agile for rapid-deployment missions.

Key Challenge

Fuel Supply Vulnerability and High Logistical Risk

Military generators depend heavily on diesel and JP-8 fuel, creating a major logistical burden. Fuel convoys face ambush threats, poor terrain, and long transport routes, reducing supply reliability. Any disruption affects communication networks, field hospitals, and command posts that rely on continuous power. Harsh climates further complicate resupply cycles and increase consumption rates. These risks force armies to stock higher fuel reserves, raising overall operational costs. As power demand grows across electronic platforms, the strain on fuel logistics becomes more severe. This challenge pushes militaries to explore hybrid systems but continues to affect generator operations globally.

High Maintenance Load and Reliability Issues in Aging Fleets

Many countries still operate large inventories of aging generator units. Older systems suffer frequent breakdowns, higher fuel consumption, and declining efficiency during long missions. Spare part shortages cause extended downtime and disrupt mission readiness. Harsh environments such as deserts, mountains, and coastal areas accelerate mechanical wear. Budget constraints often delay replacements, forcing units to rely on extensive maintenance cycles. These issues increase lifecycle costs and reduce long-term dependability of military power sources. As power loads increase, older generators struggle to support modern equipment, making reliability a critical challenge across global defense operations.

Regional Analysis

North America

North America leads the Power Generator for the Military Market with about 36% share in 2024. The U.S. drives most demand through large defense budgets, extensive overseas operations, and strong modernization programs across ground, air, and naval platforms. Forces deploy generators for radar sites, mobile command posts, and tactical communication networks. High investment in hybrid and low-signature systems strengthens replacement cycles. Canada adds demand through Arctic missions and mobile infrastructure upgrades. Strong domestic manufacturing and continuous R&D spending further secure the region’s dominant position.

Europe

Europe holds nearly 27% share of the global market, supported by active modernization across NATO members. Rising border surveillance, expanded field operations, and upgrades to digital command systems increase generator procurement. Countries such as the U.K., Germany, France, and Poland invest in low-noise and fuel-efficient units to support rapid-deployment brigades. Military commitments in Eastern Europe strengthen demand for mobile power at forward posts. The region also prioritizes hybrid energy adoption to reduce logistic strain and improve field resilience during extended missions.

Asia Pacific

Asia Pacific accounts for around 23% share, driven by rising defense spending and expanding ground operations across diverse terrains. China, India, South Korea, Japan, and Australia upgrade tactical power systems to support command centers, border security, and mobile radar deployments. High-intensity training cycles and wider use of electronic surveillance boost need for reliable generators. Countries also adopt lightweight and portable systems to support infantry mobility in mountainous and island regions. Rapid procurement and ongoing military expansion make Asia Pacific one of the fastest-growing markets.

Latin America

Latin America represents about 8% share, with demand shaped by remote-border operations, disaster relief missions, and modern communication upgrades. Countries like Brazil, Mexico, and Colombia rely on military generators for jungle patrol bases, coastal surveillance, and humanitarian deployments. Limited grid access in rural areas increases use of tactical generators for mobile posts and engineering units. Budget constraints slow large-scale modernization, yet steady procurement of durable, mid-capacity units keeps the region an emerging growth pocket.

Middle East & Africa

Middle East & Africa holds nearly 6% share, supported by conflict-zone deployments, border security needs, and harsh climate conditions. Armies in GCC countries invest in high-capacity generators for air defense sites, radar systems, and mobile communication units. African nations focus on rugged diesel-powered units for peacekeeping missions and remote operations. High temperatures and wide desert terrain increase reliance on robust and fuel-efficient generator platforms. Regional instability keeps demand stable despite limited budgets in several countries.

Market Segmentations:

By Output

By Fuel

- Diesel (including JP-8)

- Natural gas

- Gasoline

- Propane (LPG)

By Application

- Communication systems (C4ISR)

- Field camps and accommodation

- Military vehicles and mobile posts

- Field hospitals

- Air defense and radar

- Lighting and others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Power Generator for the Military Market features strong competition among global manufacturers that focus on durability, fuel efficiency, and multi-environment performance. Companies such as KOHLER-SDMO, Rolls-Royce Power Systems (MTU), Wärtsilä, Atlas Copco, Himoinsa (Yanmar), Volvo Penta, Generac Power Systems, Caterpillar Inc., Cummins Inc., and Kirloskar Oil Engines strengthen their presence through high-reliability diesel units, hybrid platforms, and rapid-deployment systems. Vendors invest in quieter engines, lower emissions, and smart control technologies to support digital command posts and mobile radar stations. Many firms develop JP-8 compatible models to meet NATO fuel guidelines. Strategic partnerships with defense agencies, long-term maintenance contracts, and expansion of regional service networks help companies secure recurring procurement cycles. The competitive environment remains intense as militaries prioritize rugged, fuel-efficient, and plug-and-play generator systems suited for harsh climates and off-grid missions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KOHLER-SDMO

- Rolls-Royce Power Systems (MTU)

- Wärtsilä

- Atlas Copco

- Himoinsa (Yanmar)

- Volvo Penta

- Generac Power Systems

- Caterpillar Inc.

- Cummins Inc.

- Kirloskar Oil Engines

Recent Developments

- In September 2024, Kohler announced the spin-off of its Energy business as “Rehlko,” keeping industrial and backup generator operations at the core and emphasizing mission-critical and resilient power, a focus that includes defense and microgrid applications.

- In June 2024, Rolls-Royce Power Systems (mtu) Rolls-Royce presented new mtu hybrid powerpack concepts and a 10-cylinder Series 199 engine (over 1,100 kW) for future military land vehicles, combining diesel and battery power to enable quieter operation and reduced thermal signature for tactical missions

Report Coverage

The research report offers an in-depth analysis based on Output, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Military forces will adopt more hybrid and battery-assisted generator systems to reduce fuel loads.

- Demand for low-noise and low-heat generators will increase to support stealth operations.

- Portable and lightweight generator units will gain wider use in rapid-deployment missions.

- Digital control and remote monitoring features will become standard across new generator models.

- Multi-fuel compatibility, especially JP-8 alignment, will remain a core procurement priority.

- Rugged generator designs will expand as missions extend into extreme and remote terrains.

- Renewable-linked power modules, including solar-assisted kits, will see stronger field adoption.

- Modernization programs will speed replacement of aging fleets with higher-efficiency platforms.

- More countries will localize manufacturing and maintenance centers to improve readiness.

- Rising electronic warfare and C4ISR growth will drive higher demand for stable tactical power.