Market Overview:

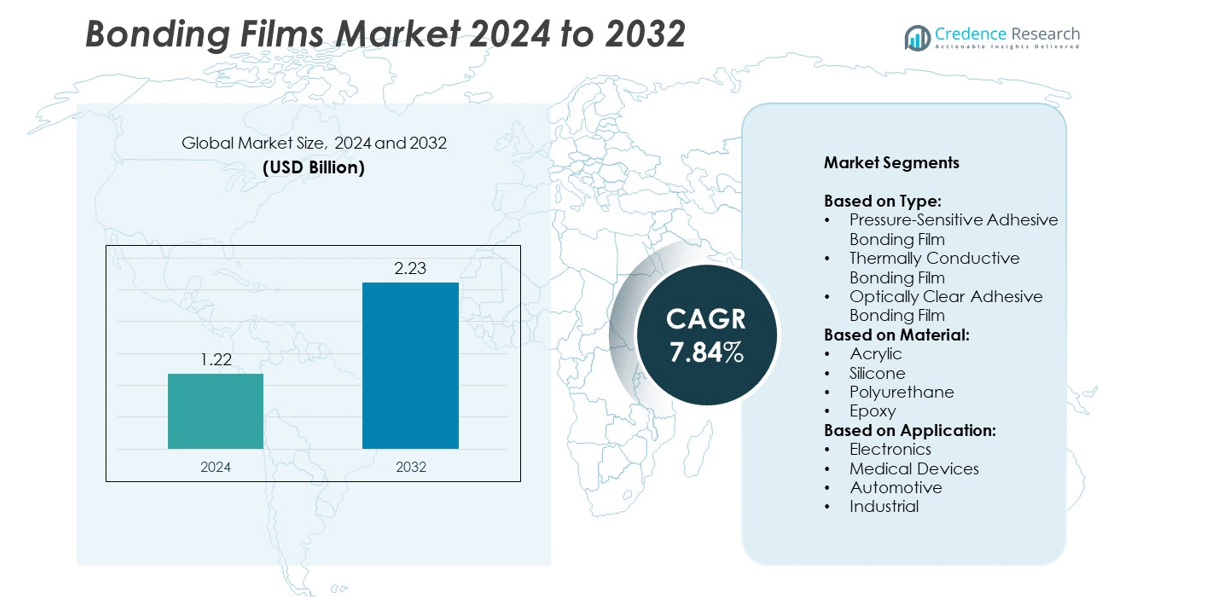

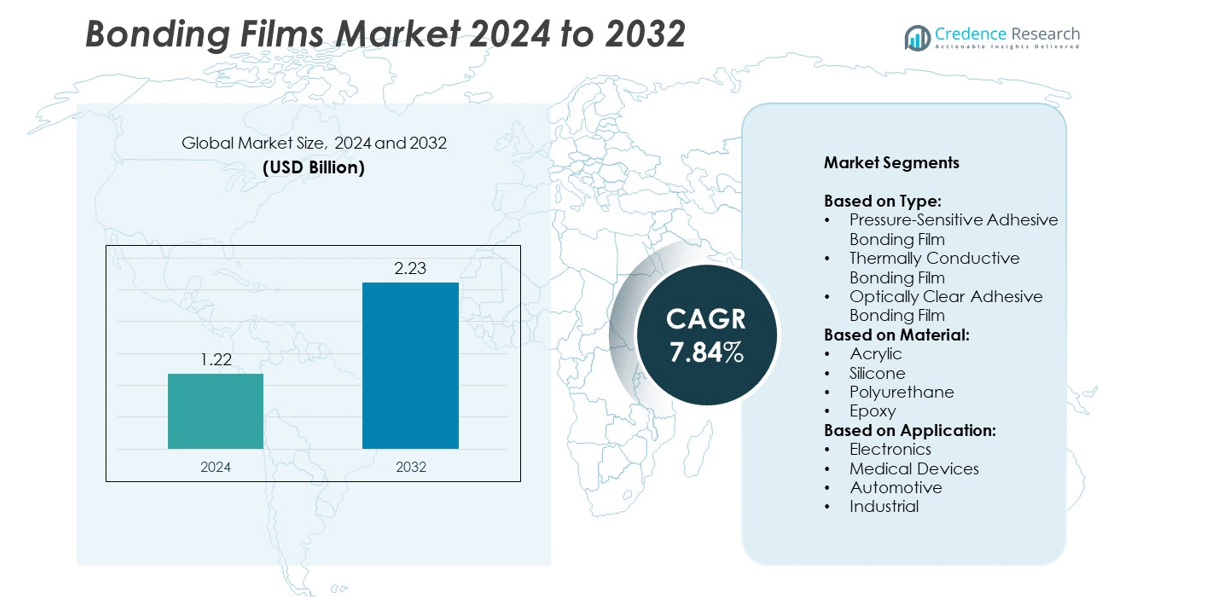

The bonding films market size was valued at USD 1.22 billion in 2024 and is projected to reach USD 2.23 billion by 2032, growing at a CAGR of 7.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bonding Films Market Size 2024 |

USD 1.22 billion |

| Bonding Films Market, CAGR |

7.84% |

| Bonding Films Market Size 2032 |

USD 2.23 billion |

The bonding films market is driven by leading players such as Kuraray, Toray, Ashland Holdings, Sumitomo Chemical, Henkel, DowDuPont, Avery Dennison, Mitsubishi Chemical, Nitto Denko, Toyobo, DuPont, Arkema, Eastman Chemical, 3M, and SABIC. These companies focus on expanding their product portfolios, developing thermally conductive and optically clear adhesive films, and forming partnerships with OEMs to strengthen market reach. Asia-Pacific leads the market with over 40% share in 2024, supported by large-scale electronics production and EV manufacturing. North America follows with more than 35% share, driven by semiconductor packaging, aerospace applications, and medical device assembly growth.

Market Insights

- The bonding films market was valued at USD 1.22 billion in 2024 and is expected to reach USD 2.23 billion by 2032, growing at a CAGR of 7.84%.

- Rising demand from electronics, EV battery manufacturing, and medical device production is a key driver for market growth.

- Adoption of sustainable, low-VOC adhesive solutions and automation-friendly films is a major trend shaping future developments.

- The market is competitive with global players focusing on R&D, strategic partnerships, and expanding product portfolios to strengthen their position.

- Asia-Pacific leads with over 40% share in 2024, followed by North America at 35%, while pressure-sensitive adhesive bonding films dominate by type with more than 40% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Pressure-sensitive adhesive bonding films dominate the market, accounting for over 40% share in 2024. Their ease of application, reworkability, and suitability for high-volume production make them the preferred choice in electronics assembly and automotive interior components. Thermally conductive bonding films are gaining traction due to rising demand for efficient heat dissipation in electric vehicles and LED modules. Optically clear adhesive bonding films see strong adoption in display panels and touchscreens. The growth of consumer electronics and miniaturized devices continues to drive the expansion of all bonding film types globally.

- For instance, Henkel’s Loctite TLB 9300 APSi, a thermally conductive adhesive used in EV battery systems, delivers thermal conductivity of 3 W/m·K, along with good electrical insulation and structural bonding.

By Material

Acrylic-based bonding films hold the largest market share, exceeding 35% in 2024, supported by their excellent adhesion, chemical resistance, and cost-effectiveness. Acrylic films are widely used across automotive and industrial applications due to their durability and UV stability. Silicone bonding films are gaining popularity in electronics and medical applications for their thermal stability and biocompatibility. Polyurethane and epoxy films are preferred where flexibility and high-strength bonding are required. The increasing focus on lightweight assemblies and reliable adhesive performance drives adoption of advanced material formulations across industries.

- For instance, Dow’s DOWSIL™ SE 9152 HT silicone adhesive maintains tensile strength of 270 psi (≈1.9 MPa) and elongation of 280%, while withstanding sustained exposure at 275 °C.

By Application

Electronics remain the leading application segment, capturing over 45% of the market share in 2024, driven by demand for compact, high-performance consumer devices and semiconductor packaging solutions. Medical devices are a fast-growing application area, with bonding films enabling precise, biocompatible assembly of diagnostic equipment and wearables. Automotive applications benefit from bonding films in lightweight structural bonding and EV battery modules. Industrial uses include general assembly and protective lamination. Rapid advancements in 5G devices, IoT-enabled equipment, and electric mobility are key drivers boosting bonding film consumption across these applications.

Market Overview

Rising Electronics and Semiconductor Demand

Growing demand for miniaturized consumer electronics and semiconductor packaging is a key growth driver for the bonding films market. Pressure-sensitive and optically clear adhesive films are essential for assembling displays, touchscreens, and microelectronic components. Expanding production of smartphones, wearables, and 5G devices fuels consumption across Asia-Pacific and North America. The shift toward lightweight, compact, and high-performance devices increases the need for reliable adhesive solutions with thermal and electrical properties. Continuous innovation in semiconductor packaging technologies further boosts market growth, as bonding films provide precision, durability, and compatibility with high-speed automated assembly processes.

- For instance, 3M offers over 120 different OCA (optically clear adhesive) formulations for rigid, flexible, and foldable OLED displays.

Electric Vehicle and Battery Manufacturing Expansion

The rapid adoption of electric vehicles acts as a key growth driver, driving demand for bonding films in battery packs, sensors, and interior components. Thermally conductive bonding films enable effective heat dissipation, ensuring safe operation and longer battery life. Major EV-producing regions such as Asia-Pacific, Europe, and North America are investing heavily in battery gigafactories and EV assembly lines, increasing adhesive film consumption. Lightweight bonding solutions also replace mechanical fasteners, reducing vehicle weight and improving efficiency. The trend aligns with sustainability targets and government incentives supporting electric mobility across major automotive markets worldwide.

- For instance, Henkel’s conductive electrode coatings facilitate dry-mix manufacturing, which offers significant process efficiencies compared to traditional wet mixing. According to company press releases from 2024, dry-mix technology reduces energy demand by up to 25% and has the potential to decrease the electrode production floor space required by up to 60%.

Growth of Medical Device Manufacturing

Rising healthcare infrastructure investment and growing demand for diagnostic and wearable medical devices represent another key growth driver. Bonding films are used in precise assembly of sensors, catheters, and monitoring equipment, offering biocompatibility and reliability. The shift toward minimally invasive and portable devices increases the need for high-performance adhesives that can withstand sterilization and harsh operating conditions. Regulatory compliance with ISO and FDA standards further encourages manufacturers to adopt certified adhesive films. Expansion of medical electronics and point-of-care diagnostic equipment production strengthens the market presence of bonding films in healthcare applications globally.

Key Trends & Opportunities

Adoption of Sustainable and Low-VOC Bonding Films

A key trend shaping the market is the development of eco-friendly bonding films with reduced volatile organic compound emissions. Regulatory frameworks in Europe and North America are pushing manufacturers toward recyclable and solvent-free adhesive solutions. End-users increasingly prefer products that align with sustainability goals and green manufacturing practices. Bio-based bonding films and water-based formulations are gaining attention in industrial and automotive applications. This shift supports both environmental compliance and corporate ESG commitments, creating opportunities for innovation and differentiation among key bonding film producers competing for eco-conscious customers.

- For instance, Nitto introduced their No. 515 thick, solvent-free double-sided adhesive tape with very low VOC emissions. It bonds plastics and metals firmly, offering a solution for interior fixtures that reduces harmful emissions.

Integration of Automation and Smart Manufacturing

Automation in assembly processes presents a major opportunity for bonding film suppliers. The rise of Industry 4.0 and smart manufacturing requires adhesives that are compatible with robotic dispensing and automated lamination equipment. High-speed production lines in electronics, EV, and medical device manufacturing benefit from films with consistent thickness, quick cure times, and precise alignment properties. Suppliers developing digital-ready, process-optimized bonding solutions gain a competitive edge. As more factories adopt AI-driven quality control and predictive maintenance, the demand for high-performance adhesive films tailored for automation continues to grow.

- For instance, Scheugenpflug’s DosP DP2001 high-performance piston dispenser dispenses 1-component (1C) materials from 0.06 ml to 20 ml and 2-component (2C) materials from 0.1 ml to 40 ml. It features a volumetric dispensing principle for accuracy and can dispense highly viscous and filled materials.

Key Challenges

Price Volatility of Raw Materials

One of the key challenges for the bonding films market is the volatility in raw material prices, particularly for acrylics, epoxies, and silicones. Fluctuations in crude oil prices directly affect production costs, impacting profit margins for manufacturers. Supply chain disruptions, especially in Asia-Pacific, further contribute to uncertainty and lead to longer lead times. Companies must adopt strategies such as backward integration, long-term supplier contracts, or alternative material sourcing to mitigate these risks. Price instability also affects customers’ purchasing decisions, leading to pressure on bonding film producers to maintain competitive pricing.

Technical Limitations in High-Temperature Applications

Another key challenge is the limited performance of some bonding films in extreme temperature and harsh environmental conditions. Applications in aerospace, automotive under-the-hood components, and industrial equipment require films that maintain adhesion and durability under heat, vibration, and chemical exposure. Current materials may degrade over time, leading to reliability issues. Manufacturers must invest in R&D to develop high-temperature resistant films with improved mechanical and thermal properties. Meeting these performance demands without compromising cost efficiency is a challenge, especially as industries push for higher performance and miniaturization simultaneously.

Regional Analysis

North America

North America accounts for over 35% share of the bonding films market in 2024, driven by strong demand from electronics, aerospace, and automotive sectors. The United States leads growth, supported by semiconductor manufacturing, EV production, and R&D investments in advanced materials. Canada contributes with rising adoption in aerospace assembly and medical devices. The region benefits from a focus on lightweight assemblies, regulatory compliance, and high-performance adhesives. Expanding EV battery production and the presence of major OEMs sustain growth momentum. Continuous technological innovation and automation adoption further strengthen the demand for bonding films across diverse applications in this region.

Europe

Europe holds nearly 30% of the global bonding films market in 2024, with Germany, France, and the UK leading adoption. Strong demand comes from automotive OEMs, EV battery manufacturers, and industrial equipment producers. Strict environmental and sustainability regulations push the use of low-VOC and recyclable adhesive solutions. Growth in medical device production and precision electronics assembly further boosts demand. The region’s focus on digital manufacturing and Industry 4.0 initiatives drives adoption of automation-compatible adhesive films. Rising investments in renewable energy and electrification projects also create opportunities for bonding film suppliers catering to high-performance and eco-friendly requirements.

Asia-Pacific

Asia-Pacific leads the bonding films market with over 40% share in 2024, driven by rapid growth in China, Japan, South Korea, and India. The region benefits from large-scale electronics manufacturing, EV production, and semiconductor packaging. Low-cost manufacturing and government support for local production strengthen supply chains. High adoption of optically clear bonding films in displays and smartphones fuels growth. Rising investment in EV battery gigafactories and consumer electronics accelerates consumption. Asia-Pacific remains the fastest-growing region, supported by strong domestic demand and export-oriented production. Expanding industrial applications and infrastructure projects will continue to boost regional bonding film requirements.

Latin America

Latin America represents close to 8% share of the bonding films market in 2024, with Brazil and Mexico as key contributors. The automotive industry drives demand, supported by investments in EV assembly and lightweight vehicle components. Electronics manufacturing growth in Mexico fuels consumption of pressure-sensitive and thermally conductive bonding films. Industrial and packaging applications also support steady adoption. Economic reforms and trade agreements encourage foreign investment, strengthening regional manufacturing capacity. Though challenges such as infrastructure gaps persist, rising healthcare device production and industrial automation initiatives create opportunities for bonding film suppliers in this growing market.

Middle East & Africa

The Middle East & Africa account for nearly 7% share of the bonding films market in 2024, with the UAE, Saudi Arabia, and South Africa as key markets. Demand is driven by diversification initiatives and investment in local manufacturing across automotive, aerospace, and construction sectors. Industrial bonding applications and electronics assembly are gradually expanding. Growing healthcare infrastructure and medical equipment production boost adoption of biocompatible bonding films. While market penetration is lower compared to other regions, ongoing infrastructure development and economic diversification are expected to create significant opportunities for bonding film manufacturers seeking to expand their presence.

Market Segmentations:

By Type:

- Pressure-Sensitive Adhesive Bonding Film

- Thermally Conductive Bonding Film

- Optically Clear Adhesive Bonding Film

By Material:

- Acrylic

- Silicone

- Polyurethane

- Epoxy

By Application:

- Electronics

- Medical Devices

- Automotive

- Industrial

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The bonding films market is characterized by the presence of leading players such as Kuraray, Toray, Ashland Holdings, Sumitomo Chemical, Henkel, DowDuPont, Avery Dennison, Mitsubishi Chemical, Nitto Denko, Toyobo, DuPont, Arkema, Eastman Chemical, 3M, and SABIC. The market remains highly competitive, with companies focusing on expanding product portfolios and offering advanced adhesive solutions to meet the growing demand from electronics, automotive, and medical device industries. Strategies include investments in R&D to develop high-performance, thermally conductive, and optically clear films for next-generation applications. Partnerships with OEMs and expansion into emerging markets are also common, ensuring better regional reach. Manufacturers are prioritizing sustainable and low-VOC products to align with tightening environmental regulations. Digital integration and automation-friendly bonding solutions are gaining momentum to support Industry 4.0 manufacturing lines. The competitive intensity is expected to remain strong as players compete on innovation, cost-efficiency, and supply chain reliability over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kuraray

- Toray

- Ashland Holdings

- Sumitomo Chemical

- Henkel

- DowDuPont

- Avery Dennison

- Mitsubishi Chemical

- Nitto Denko

- Toyobo

- DuPont

- Arkema

- Eastman Chemical

- 3M

- SABIC

Recent Developments

- In 2025, Kuraray announced the expansion of production facilities for optical-use Poval film, a base material for polarizing films in liquid crystal displays (LCDs), at its Saijo Plant in Japan.

- In 2024, 3M updated the adhesive chemistry of its Wrap Film Series 2080. It lowered initial tack to give installers more repositioning time while maintaining ultimate bond strength.

- In 2024, Toray commercialized a new PFAS-free mold release film that reduces process contamination and boosts the capacity utilization rates for advanced semiconductor products.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The bonding films market will see strong growth driven by electronics miniaturization and semiconductor packaging demand.

- Electric vehicle adoption will boost usage of thermally conductive films in battery packs and sensors.

- Medical device production expansion will increase demand for biocompatible and sterilization-resistant adhesive solutions.

- Sustainable, low-VOC, and recyclable bonding films will gain wider acceptance due to regulatory pressure.

- Automation-ready bonding films will be developed to support Industry 4.0 and smart manufacturing trends.

- Asia-Pacific will remain the fastest-growing region, driven by large-scale electronics and EV production.

- Strategic partnerships with OEMs will enhance supplier relationships and expand market presence.

- Technological innovation will focus on high-temperature resistance and improved thermal conductivity.

- Increased investments in R&D will drive the development of lightweight, multifunctional adhesive films.

- Competitive intensity will grow as players focus on product differentiation and global supply chain strength.