| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Cheese Market Size 2024 |

USD 2,730.90 Million |

| Brazil Cheese Market, CAGR |

4.69% |

| Brazil Cheese Market Size 2032 |

USD 3,940.74 Million |

Market Overview

Brazil Cheese Market size was valued at USD 2,730.90 million in 2024 and is anticipated to reach USD 3,940.74 million by 2032, at a CAGR of 4.69% during the forecast period (2024-2032).

The Brazil Cheese market is driven by increasing consumer demand for diverse cheese varieties, including traditional and international options, due to shifting dietary preferences and the rising popularity of cheese-based dishes. Growth in the foodservice industry, particularly in restaurants and fast-food chains, is further boosting consumption. The demand for healthier and premium cheese options, such as low-fat and organic varieties, is on the rise, reflecting changing consumer attitudes towards nutrition and wellness. Additionally, the expansion of cheese offerings in retail outlets and e-commerce platforms has increased accessibility. The growth of local cheese production, alongside imports of specialty cheeses, is enhancing product variety. Urbanization and higher disposable income levels are contributing to a broader consumer base with greater purchasing power. These trends, along with the increasing incorporation of cheese into Brazilian cuisine, are expected to fuel the market’s expansion over the coming years.

The Brazil Cheese market is driven by regional consumption patterns, with the Southeast and South regions leading in demand due to higher urbanization and greater disposable incomes. Key players such as Grupo Lala, Nestlé S.A. (Brazil Operations), and Lactalis do Brasil dominate the market, offering a wide range of products catering to different consumer preferences, from premium and artisanal cheeses to mass-market options. Additionally, companies like Sigma Alimentos, Conaprole, and Gloria S.A. contribute to the market’s competitive landscape, each focusing on regional preferences and expanding distribution networks across Brazil. The presence of both local and international brands in the market is crucial in meeting the diverse needs of consumers, ranging from traditional cheeses to innovative, health-conscious options. With a growing middle class and increased demand for convenience, these players are strategically positioning themselves to capitalize on Brazil’s evolving cheese consumption trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Brazil Cheese market was valued at USD 2,730.90 million in 2024 and is expected to reach USD 3,940.74 million by 2032, growing at a CAGR of 4.69% during the forecast period (2024-2032).

- Increasing consumer demand for diverse cheese varieties, especially premium and healthier options, is driving market growth.

- Growth in the foodservice sector, particularly in restaurants and fast-food chains, is contributing significantly to the rise in cheese consumption.

- The trend towards healthier cheese options, such as low-fat and organic varieties, is gaining traction among health-conscious consumers.

- Competitive players like Grupo Lala, Nestlé S.A., and Lactalis do Brasil dominate the market, with a focus on expanding product portfolios and distribution networks.

- Supply chain challenges, including high transportation costs and logistical issues, hinder market growth in certain regions.

- The Southeast and South regions lead in cheese consumption, with urbanization and higher disposable income levels driving demand.

Report Scope

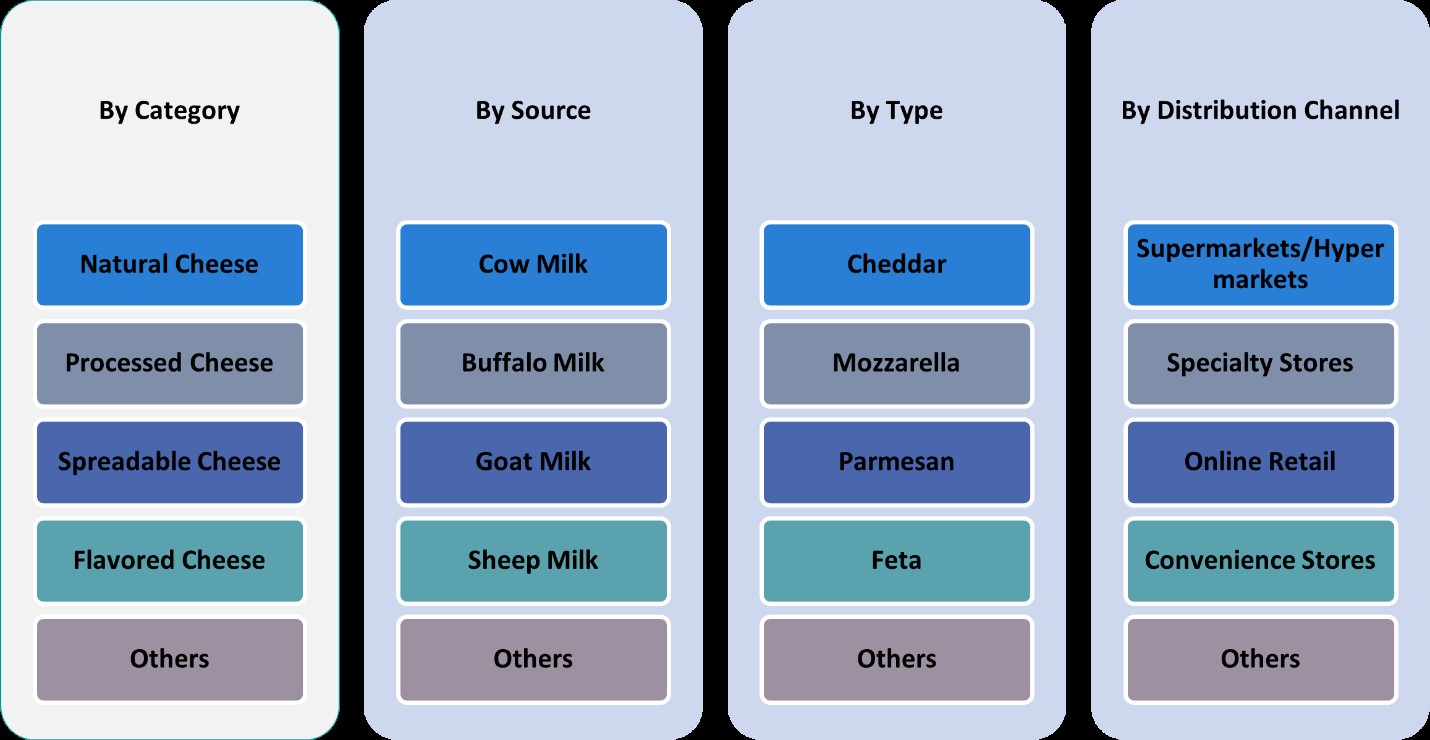

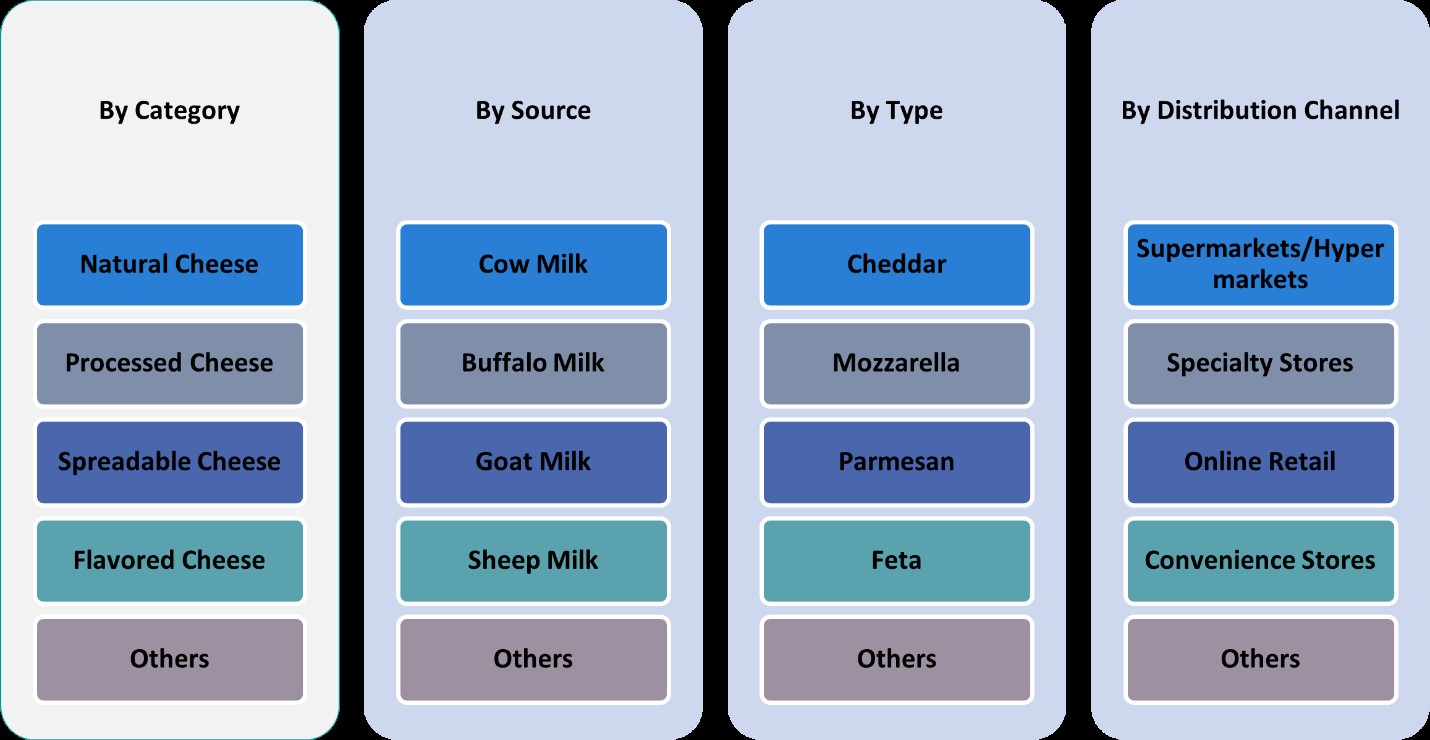

This report segments the Brazil Cheese Market as follows:

Market Drivers

Increasing Consumer Demand for Diverse Cheese Varieties

The Brazil Cheese market is experiencing a notable shift in consumer preferences, with growing demand for a wide range of cheese varieties. For instance, traditional Brazilian cheeses like Minas Gerais cheese remain popular, while international options such as mozzarella and gouda are increasingly sought after in urban centers like São Paulo and Rio de Janeiro. This trend is fueled by a greater culinary interest in cheese-based dishes, particularly as cheese is becoming a staple ingredient in everyday meals, snacks, and restaurant menus. The diversification of cheese offerings is catering to the changing taste profiles and dietary preferences of Brazilian consumers, which is significantly expanding the market.

Growth in the Foodservice Industry

The expanding foodservice sector in Brazil, including restaurants, hotels, and fast-food chains, plays a crucial role in driving cheese consumption. For instance, pizza chains like Domino’s and local fast-food outlets heavily incorporate mozzarella and cheddar into their menu offerings, boosting demand. Cheese is being incorporated into a variety of dishes, such as pizzas, sandwiches, and pasta, which has made it a key ingredient in the foodservice industry. This trend is further enhanced by the popularity of fast-food chains, which have adopted cheese as a core component of their menu offerings. The increasing number of restaurants and food outlets is boosting both domestic cheese consumption and its use in food preparation.

Rising Health Consciousness and Premium Cheese Options

A growing trend in Brazil is the increasing consumer focus on health and nutrition, which is driving the demand for healthier and premium cheese options. Many Brazilian consumers are becoming more health-conscious and are seeking low-fat, organic, or fortified cheese varieties that offer nutritional benefits without compromising on taste. The rise of wellness-focused diets, such as plant-based or low-sodium eating habits, has encouraged manufacturers to develop cheeses that meet these dietary needs. As consumers are willing to pay a premium for these healthier options, the market for organic, low-calorie, and functional cheeses is growing rapidly in Brazil, which is expected to continue fueling market growth.

Expansion of Retail and E-Commerce Platforms

The accessibility of cheese in Brazil has significantly improved with the expansion of retail channels and e-commerce platforms. Supermarkets, hypermarkets, and specialty grocery stores are increasingly stocking a variety of cheese brands, making it easier for consumers to access both local and international products. The growing popularity of e-commerce also plays a key role in market expansion, as online platforms allow for the delivery of specialty cheeses directly to consumers’ doors. The convenience of online shopping, coupled with a broader selection of products, is driving the consumption of cheese, particularly among urban dwellers and younger demographics. This expanded retail reach ensures that cheese is more widely available across Brazil, contributing to its market growth.

Market Trends

Shift Towards Healthier and Functional Cheese Products

One of the prominent trends in the Brazil Cheese market is the growing demand for healthier and functional cheese options. As Brazilian consumers become more health-conscious, there is an increasing interest in low-fat, low-sodium, and organic cheese varieties. Additionally, cheeses with added health benefits, such as those fortified with vitamins, probiotics, or calcium, are gaining traction. This trend reflects a broader global shift towards healthier eating habits and wellness-focused diets. Consumers are seeking cheeses that provide nutritional value while still satisfying their taste preferences. The market is witnessing innovation in product offerings to meet this demand, with brands focusing on enhancing the health profile of their cheeses without compromising on quality or flavor.

Expansion of Premium and Artisanal Cheese Varieties

There is a growing trend in Brazil towards premium and artisanal cheese varieties, as consumers increasingly seek high-quality, authentic products. For instance, artisanal cheeses like Serrano and Requeijão are gaining popularity for their unique flavors and traditional production methods. Brazilian cheese lovers are showing greater interest in specialty cheeses that offer unique flavors and textures, particularly those crafted using traditional methods. Artisanal cheeses, often produced in smaller batches with premium ingredients, are seen as a mark of authenticity and quality. As this trend gains momentum, both local and international cheese producers are expanding their portfolios to include gourmet options. This shift towards premium offerings is expected to continue, driven by the evolving tastes of Brazilian consumers who value craftsmanship and distinctiveness in their food choices.

Evolving Cheese Consumption Patterns in Urban Areas

Urbanization in Brazil is influencing consumption patterns, with city dwellers showing a greater affinity for convenience and variety in their food choices. For instance, metropolitan areas like São Paulo and Rio de Janeiro have seen increased demand for ready-to-eat cheese products, such as pre-sliced or pre-packaged options. These products cater to busy lifestyles and the growing preference for on-the-go meals. Additionally, the younger population in urban areas is more likely to experiment with different cheese varieties, driving interest in international cheeses. This trend is contributing to an increased consumption of cheese in cities, where people are more open to trying new flavors and incorporating cheese into a variety of meals, from sandwiches and salads to snack items.

Rise of E-Commerce and Online Grocery Shopping

The surge in e-commerce and online grocery shopping has significantly influenced the Brazil Cheese market, particularly in the post-pandemic era. Online shopping platforms have made it easier for consumers to purchase a wide range of cheeses, including premium and international varieties, from the comfort of their homes. This trend is especially prevalent in urban areas, where convenience is a key factor in purchasing decisions. E-commerce platforms allow consumers to access products that may not be readily available in local supermarkets, thus expanding their cheese choices. The growth of online grocery shopping is expected to continue, with more consumers preferring digital platforms for their food purchases, further fueling the demand for cheese in Brazil.

Market Challenges Analysis

Price Sensitivity and Economic Factors

One of the primary challenges facing the Brazil Cheese market is price sensitivity, particularly amidst economic fluctuations. For instance, economic instability and inflation in Brazil have led to increased costs for raw materials like milk, as reported by market research studies. As Brazil is a price-sensitive market, many consumers are inclined to opt for more affordable cheese options, limiting the demand for premium and specialty varieties. The high production costs of premium cheese, including factors such as raw material costs, labor, and transportation, contribute to higher retail prices, which can deter cost-conscious consumers. Moreover, economic instability or inflation can further strain consumer purchasing power, leading to a decline in overall cheese consumption. Producers must navigate these economic factors carefully, balancing cost-effective production with product quality to maintain competitiveness in a price-sensitive environment.

Supply Chain and Distribution Challenges

Another significant challenge in the Brazil Cheese market is the complexity of the supply chain and distribution network. Cheese, being a perishable product, requires efficient and timely distribution to ensure freshness and quality. However, logistical issues, such as inadequate infrastructure, long delivery times, and high transportation costs, can affect the availability of cheese in remote or rural areas. Additionally, variations in regional demand and fluctuating import/export regulations can create supply disruptions, particularly for imported cheeses. Local producers may face challenges in scaling up production to meet growing demand, while international brands may struggle with import tariffs and distribution hurdles. Overcoming these supply chain and distribution inefficiencies is crucial for expanding market reach and maintaining product availability across the country.

Market Opportunities

The Brazil Cheese market presents significant growth opportunities, particularly in the premium and specialty cheese segments. As consumer preferences evolve, there is a rising demand for artisanal, organic, and health-conscious cheese products. This shift towards high-quality, functional cheese options, such as low-fat, low-sodium, and probiotic-enriched varieties, offers producers the chance to cater to the health-conscious Brazilian population. Moreover, the increasing popularity of international cheese varieties, including gourmet and aged cheeses, provides an opportunity for both local and international brands to expand their product offerings. By tapping into these trends, cheese producers can create a niche for themselves in the growing premium segment, attracting discerning consumers who prioritize both flavor and nutrition.

Additionally, the expansion of e-commerce platforms presents a valuable opportunity for the Brazil Cheese market. The growing trend of online grocery shopping, accelerated by the pandemic, offers an avenue for cheese producers to reach a broader audience, especially in urban areas where convenience and variety are in high demand. By leveraging digital platforms, producers can offer a wide range of cheese products, including hard-to-find varieties, to consumers who may not have access to them in physical stores. This shift toward online shopping also provides an opportunity to increase brand visibility and consumer loyalty through targeted marketing and subscription models. As Brazilian consumers become more accustomed to purchasing groceries online, the e-commerce channel will continue to play a pivotal role in expanding market reach and driving sales for cheese producers.

Market Segmentation Analysis:

By Category:

The Brazil Cheese market can be segmented into various categories, each catering to distinct consumer preferences. Cheddar is one of the most popular cheese varieties in Brazil, driven by its versatile usage in cooking, sandwiches, and as a snack. The processed cheese segment is also growing, offering convenience and affordability, making it a popular choice in the retail and foodservice sectors. Spreadable cheese is gaining traction, particularly in urban areas, where consumers prefer easy-to-use products for quick meals and snacks. Flavored cheeses, which combine different herbs and spices, are becoming increasingly popular as Brazilian consumers explore new taste profiles. These cheeses are commonly used in gourmet cooking, adding variety and enhancing the culinary experience. Other cheese types, including mozzarella and local varieties, also contribute to market diversity, meeting the needs of traditional consumers who favor more familiar flavors. The growing demand across these categories reflects Brazil’s evolving cheese consumption habits, offering various growth opportunities for producers.

By Source:

The source of milk used in cheese production is another key segment in the Brazil Cheese market. Cow milk-based cheeses dominate the market due to their affordability, availability, and broad consumer appeal. Cow milk cheese is used in popular varieties such as cheddar, mozzarella, and processed cheeses. Buffalo milk cheeses are gaining popularity, particularly for their rich texture and higher fat content, which make them ideal for premium cheese products. Goat milk cheeses are a niche but growing segment, catering to health-conscious consumers and those seeking dairy alternatives due to lactose intolerance. These cheeses are often marketed as organic or gourmet products. Sheep milk cheeses, such as manchego, are also emerging in the Brazilian market, attracting consumers who enjoy strong, distinct flavors. Other milk sources, including camel and plant-based milk options, are being explored as innovative alternatives, though they currently represent a smaller portion of the market. This segmentation provides opportunities to cater to diverse consumer preferences and dietary requirements.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Southeast Region

- South Region

- Northeast Region

- Midwest Region

- North Region

Regional Analysis

Southeast Region

The Southeast Region holds the largest market share in the Brazil Cheese market, accounting for approximately 45% of the total market. This dominance can be attributed to the region’s large population, urbanization, and higher disposable income levels. Major cities like São Paulo and Rio de Janeiro drive significant demand for a wide range of cheese varieties, including premium and international options. The growth of the foodservice sector, particularly in restaurants and fast-food chains, further boosts cheese consumption in this region. Additionally, the presence of established distribution networks and retail outlets ensures that cheese products are widely available, contributing to the Southeast’s leading market share.

South Region

The South Region follows closely, contributing around 25% to the overall market. This region is known for its strong dairy production, especially in states like Paraná, Santa Catarina, and Rio Grande do Sul. Local cheese production is high, and consumers in this region show a preference for traditional Brazilian cheese varieties such as queijo minas and colonial cheese. The South’s robust dairy industry has supported a steady demand for both local and processed cheeses. The expanding middle class and increasing interest in international cheese varieties also contribute to the market’s growth in this region, positioning it as a key player in Brazil’s cheese industry.

Northeast Region

The Northeast Region accounts for approximately 15% of the Brazil Cheese market. The demand for cheese in this region is growing steadily, driven by improvements in income levels and a shift towards more Westernized diets. Although traditionally not a major cheese-consuming region, the Northeast is experiencing a rise in the consumption of processed and flavored cheeses, particularly in urban areas. The region’s expanding retail sector, with increased availability of both local and imported cheese products, is further driving market growth. However, the Northeast still lags behind other regions in terms of overall consumption, with traditional Brazilian cheeses being the primary demand driver.

Midwest and North Regions

The Midwest and North Regions have relatively smaller market shares, contributing about 10% and 5%, respectively. These regions face challenges such as lower population density and fewer urban centers, which result in slower adoption of cheese consumption compared to more developed regions. However, there are opportunities for growth as these areas experience gradual urbanization and improvements in infrastructure. The growing middle class in cities like Brasília in the Midwest and Manaus in the North is expected to drive demand for cheese, particularly processed and spreadable varieties. As these regions continue to develop economically, the cheese market is likely to expand, albeit at a slower pace than in the Southeast and South.

Key Player Analysis

- Grupo Lala

- Nestlé S.A. (Brazil Operations)

- Alpina Productos Alimenticios

- Lactalis do Brasil

- Sigma Alimentos

- Conaprole

- Gloria S.A.

- Cooperativa Central Aurora Alimentos

- Polenghi Industria Alimentícia

- Laive

Competitive Analysis

The Brazil Cheese market is highly competitive, with several key players leading the market. These include Grupo Lala, Nestlé S.A. (Brazil Operations), Lactalis do Brasil, Sigma Alimentos, Conaprole, Gloria S.A., Cooperativa Central Aurora Alimentos, Polenghi Industria Alimentícia, and Laive. These companies dominate the landscape by offering a wide range of cheese products tailored to the diverse tastes and preferences of Brazilian consumers. Leading players focus on catering to both mass-market and premium cheese consumers, offering a wide variety of products that include processed, spreadable, and flavored cheeses. These companies leverage strong distribution networks to reach urban and rural consumers, ensuring broad product availability. Market leaders prioritize product innovation, particularly in response to the growing demand for healthier, low-fat, and organic cheese options. They are also capitalizing on the increasing popularity of premium and artisanal cheeses, targeting health-conscious consumers and those seeking gourmet alternatives. Additionally, many companies are expanding their portfolios to include plant-based cheese varieties, tapping into the rising trend of vegetarian and vegan diets. Competition is intensified by the need to adapt to regional preferences, with some companies focusing on traditional Brazilian cheese varieties while others aim to introduce international flavors to diversify the market. To stay competitive, players are focusing on enhancing their product offerings, optimizing supply chains, and strengthening brand recognition through marketing and customer loyalty programs. This diverse competitive landscape ensures continuous innovation and market growth.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The Brazil Cheese market exhibits a moderate level of concentration, with several large players dominating the landscape alongside smaller regional producers. The market is characterized by a diverse range of cheese products, including mass-market options such as processed and spreadable cheeses, as well as premium varieties like artisanal and specialty cheeses. Large companies hold a significant market share, benefiting from robust distribution networks, economies of scale, and strong brand recognition. However, local producers also play a crucial role, catering to regional tastes and preferences with traditional Brazilian cheese varieties. The market is characterized by innovation, as companies continuously introduce new products to meet the growing demand for healthier, low-fat, organic, and plant-based cheeses. The increasing trend towards premium products, along with the expansion of the foodservice sector, drives competition, pushing both large and small producers to focus on product differentiation, quality, and consumer engagement to maintain their competitive position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Brazil Cheese market is expected to continue growing, driven by increasing urbanization and disposable income.

- Demand for premium, artisanal, and specialty cheeses is likely to rise as consumers seek more diverse and high-quality products.

- Health-conscious consumers will drive the demand for low-fat, organic, and functional cheese options.

- E-commerce and online grocery shopping will become more important channels for cheese sales, expanding market reach.

- The foodservice sector, particularly in restaurants and fast food, will continue to be a significant growth driver.

- Local cheese producers will focus on diversifying their product offerings to meet regional tastes and preferences.

- Plant-based and vegan cheese options will see growth due to the rise of vegetarian and vegan diets.

- Technological advancements in production and packaging will improve efficiency and reduce costs for producers.

- Increased awareness of cheese’s health benefits, such as probiotic and gut-health properties, will further boost demand.

- Competitive pressure will lead to more innovation in flavors and product formats, ensuring continued market dynamism.