| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Feminine Hygiene Products Market Size 2023 |

USD 661.15 Million |

| Brazil Feminine Hygiene Products Market, CAGR |

6.68% |

| Brazil Feminine Hygiene Products Market Size 2032 |

USD 1,184.00 Million |

Market Overview:

Brazil Feminine Hygiene Products Market size was valued at USD 661.15 million in 2023 and is anticipated to reach USD 1,184.00 million by 2032, at a CAGR of 6.68% during the forecast period (2023-2032).

Key drivers of the Brazilian feminine hygiene market include the expanding female workforce, rising disposable incomes, and increased awareness of menstrual health. As more women enter the workforce and attain financial independence, there is a greater inclination towards purchasing quality hygiene products, which enhances market growth. Additionally, urbanization and improved access to information have led to heightened awareness about menstrual hygiene, further propelling market demand. The growing preference for sustainable and eco-friendly products, such as biodegradable sanitary pads and menstrual cups, also contributes to market growth. Women’s increasing focus on health and wellness, paired with the introduction of innovative products, is further fueling the demand for feminine hygiene products. Furthermore, the rising participation of women in social and professional activities has led to a significant shift in purchasing habits, with many opting for high-quality, premium hygiene products.

Regionally, the Southeast and South regions of Brazil dominate the feminine hygiene market, attributed to their higher population densities, urbanization levels, and economic development. These areas exhibit greater consumer purchasing power and access to a variety of hygiene products, resulting in higher sales volumes. Major urban centers such as São Paulo and Rio de Janeiro lead the demand, where consumers are more likely to prioritize personal hygiene and adopt new products. Conversely, the North and Northeast regions, while showing growth potential, face challenges such as lower income levels, limited access to hygiene education, and less developed retail infrastructure. These factors can hinder the penetration of feminine hygiene products in rural areas and smaller cities. However, ongoing governmental and non-governmental initiatives aimed at improving menstrual health awareness, such as subsidized product distribution and education campaigns, are gradually addressing these disparities. As awareness improves and more affordable product options become available, market growth is expected to accelerate across these underserved regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Brazil Feminine Hygiene Products market was valued at USD 661.15 million in 2023 and is expected to reach USD 1,184.00 million by 2032, growing at a CAGR of 6.68% during the forecast period.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Key drivers include the increasing participation of women in the workforce, rising disposable incomes, and greater awareness of menstrual health, leading to higher demand for quality hygiene products.

- Growing urbanization and improved access to information have further contributed to heightened awareness of menstrual hygiene, driving product adoption across the country.

- The demand for eco-friendly products such as biodegradable sanitary pads and menstrual cups is rising due to increased sustainability concerns among Brazilian women.

- Regional disparities exist, with the Southeast and South regions showing higher demand for hygiene products due to urbanization, higher disposable incomes, and better infrastructure.

- The North and Northeast regions present growth opportunities, as awareness campaigns and improved access to affordable products are expected to accelerate market growth in these areas.

- The market faces challenges such as price sensitivity in lower-income segments, limited awareness in rural areas, and cultural taboos surrounding menstruation, which may hinder growth in underserved regions.

Market Drivers:

Growing Female Workforce and Financial Independence

The increasing participation of women in the Brazilian workforce plays a significant role in driving the demand for feminine hygiene products. As more women become financially independent, their purchasing power expands, making them more inclined to invest in high-quality personal care products. The shift towards higher disposable incomes, particularly among women in urban areas, enables them to make informed decisions and choose products that align with their personal preferences and health priorities. This growing trend contributes to the increasing adoption of premium and specialized feminine hygiene products such as organic, eco-friendly, and high-performance sanitary items, further stimulating market growth.

Rising Awareness and Health Education

Increased awareness around menstrual health has become a crucial driver for the feminine hygiene market in Brazil. Over the past few years, there has been a notable rise in the availability of menstrual health education, with both governmental and non-governmental organizations playing an active role in spreading awareness. Programs focusing on menstrual hygiene management, the importance of using safe and clean products, and understanding the risks of unhygienic practices are significantly improving consumers’ knowledge. For example, the National Health Surveillance Agency (ANVISA) regulates the manufacturing and sale of feminine hygiene products, ensuring they meet strict hygiene and safety standards before reaching the market. This shift is encouraging Brazilian women to invest in better-quality sanitary products and has led to an increased focus on health and hygiene, thus positively impacting the market. Moreover, educational campaigns have also contributed to the de-stigmatization of menstruation, further promoting healthier menstrual practices.

Sustainability and Eco-Consciousness

A strong trend towards sustainability is evident in Brazil’s feminine hygiene market, with consumers increasingly preferring eco-friendly alternatives. As concerns about environmental impact grow, many Brazilian women are shifting towards biodegradable and reusable options such as organic cotton sanitary pads, menstrual cups, and period underwear. These products not only appeal to environmentally conscious consumers but also align with the growing preference for natural and chemical-free personal care items. The demand for such products is further amplified by the increasing awareness of the environmental footprint of conventional sanitary products. Consequently, manufacturers are responding by innovating and offering products that cater to the eco-friendly consumer, thus boosting market growth.

Evolving Socio-Cultural Factors

Socio-cultural changes in Brazil, particularly in urban areas, have further fueled the market for feminine hygiene products. For instance, in 2023, the city of São Paulo implemented the “Dignidade Íntima” (Intimate Dignity) program, distributing free sanitary pads to over 300,000 students in public schools, which not only increased access but also normalized conversations around menstrual health. The rising acceptance of menstrual health as a part of overall wellness and personal care has encouraged women to explore a broader range of products. With more women engaging in public and professional life, there is a greater need for convenient and comfortable hygiene solutions, which has led to an uptick in the demand for high-performance sanitary products. Furthermore, the growing trend of women seeking more diverse and customizable products, including organic, chemical-free, and hypoallergenic options, has resulted in product diversification. As the market matures, these cultural shifts will continue to create opportunities for innovation, allowing manufacturers to meet evolving consumer demands. The expansion of distribution channels, including e-commerce platforms, also plays a crucial role in increasing product accessibility, allowing for greater market penetration across Brazil.

Market Trends:

Shift Toward Organic and Natural Products

One of the key trends shaping the Brazilian feminine hygiene products market is the increasing consumer preference for organic and natural products. For instance, leading companies such as Procter & Gamble, Johnson & Johnson, and Kimberly-Clark have responded to this demand by developing and launching eco-friendly and organic feminine hygiene products in Brazil. Brazilian consumers are becoming more aware of the chemicals and synthetic materials in traditional sanitary products and are now opting for organic cotton pads, tampons, and menstrual cups. This shift is driven by concerns over skin sensitivity, allergies, and environmental impact. Many women are seeking products free from pesticides, bleaches, and artificial fragrances, which have gained significant traction in the market. This trend is supported by the rise of brands offering eco-friendly alternatives that cater to health-conscious consumers, contributing to the steady expansion of this segment.

Growth of E-Commerce Platforms

E-commerce is rapidly becoming a dominant sales channel for feminine hygiene products in Brazil. The growing adoption of online shopping, particularly in the wake of the COVID-19 pandemic, has transformed how consumers purchase these products. E-commerce offers convenience, privacy, and access to a wider range of products, making it an attractive option for many Brazilian consumers. Furthermore, the ability to compare prices, read reviews, and have products delivered directly to their doorstep has enhanced the appeal of online shopping. As a result, major e-retailers and specialized online stores are expanding their presence, thereby increasing market accessibility and driving growth in the online sales of feminine hygiene products.

Personalization and Customization

Personalization is another emerging trend in the Brazilian feminine hygiene market. Consumers are increasingly looking for products tailored to their specific needs, whether that be based on skin sensitivity, menstrual flow, or lifestyle preferences. For example, some companies provide options for women to choose between different absorbency levels and organic cotton variants, ensuring a more tailored and comfortable experience. This trend has led to the rise of subscription-based services and customizable product kits, where consumers can select products based on their unique requirements. Many brands are offering a more personalized approach to hygiene, allowing women to choose from a variety of product combinations, such as different absorbency levels or organic cotton options. This trend reflects a broader shift toward products that cater to individual preferences and a more personalized shopping experience.

Rise in Menstrual Cup Usage

The adoption of menstrual cups is witnessing an upward trend in Brazil, as more women are discovering the long-term cost savings and environmental benefits associated with these products. Menstrual cups, which are reusable and made from medical-grade silicone, offer an alternative to traditional sanitary products like pads and tampons. The growing awareness of the environmental impact of disposable products is prompting women to consider more sustainable options. Additionally, menstrual cups are gaining popularity due to their convenience and comfort, as they can be worn for up to 12 hours. As these products become more widely available through both physical and online retailers, their usage is expected to continue to rise, further shaping the market dynamics in Brazil.

Market Challenges Analysis:

Price Sensitivity and Affordability

One of the primary challenges faced by the Brazilian feminine hygiene market is price sensitivity, particularly in lower-income segments. While premium and organic products are gaining popularity, their higher price points can limit accessibility for a large portion of the population, especially in rural or economically disadvantaged areas. Many consumers still opt for more affordable, conventional options, which could impede the growth of higher-end and eco-friendly product categories. Despite rising disposable incomes in urban areas, affordability remains a critical barrier to widespread adoption of premium feminine hygiene products across the country.

Limited Awareness in Rural Areas

Although awareness of menstrual health is improving in urban areas, there is still a lack of education and access in rural regions of Brazil. Women in less developed areas may not have the same level of knowledge regarding the importance of proper menstrual hygiene or the availability of safer, more effective products. For instance, the “Menstrual Poverty in Brazil” study by UNFPA and UNICEF found that four million students lack access to basic menstrual care items in schools, and approximately 713,000 girls do not have access to a bathroom or shower at home. This limited awareness often leads to the continued use of unhygienic alternatives, such as cloth or leaves, which poses significant health risks. Overcoming these challenges will require substantial investments in educational campaigns and product distribution to ensure that rural populations can access quality feminine hygiene products.

Cultural Taboos and Stigma

Despite progress in education and awareness, menstrual health is still a taboo subject in many parts of Brazilian society. This cultural stigma can discourage women from seeking or purchasing feminine hygiene products, especially in conservative areas where discussing menstruation openly is considered inappropriate. The stigma surrounding menstruation may also impact women’s willingness to engage in discussions about their needs and seek out healthier or more sustainable options. Breaking down these cultural barriers will be crucial for expanding the market and improving menstrual health practices across all demographic segments.

Regulatory Challenges and Product Standards

The Brazilian market is also affected by regulatory challenges and the lack of uniform standards for feminine hygiene products. While there are regulations in place to ensure the safety and quality of these products, inconsistent enforcement and lack of standardization can create uncertainties for both manufacturers and consumers. As the market grows, stricter regulations and clearer guidelines are necessary to ensure the safety and reliability of feminine hygiene products across all product categories.

Market Opportunities:

The Brazilian feminine hygiene products market presents significant opportunities for growth, driven by the increasing focus on health and wellness among consumers. As awareness surrounding menstrual health continues to rise, there is a growing demand for high-quality, safe, and eco-friendly products. The expanding middle class and increasing disposable incomes in urban areas provide a solid foundation for the adoption of premium and organic feminine hygiene products. Additionally, the shift towards sustainable, biodegradable, and reusable products, such as menstrual cups and organic cotton pads, offers a valuable growth opportunity for brands to cater to the eco-conscious consumer. Companies that innovate in this space, offering environmentally friendly and health-focused alternatives, are well-positioned to capture the attention of a rising segment of Brazilian women seeking better menstrual care options.

Another key opportunity lies in the untapped potential of rural and underserved areas. Although awareness and access to feminine hygiene products are growing, significant gaps remain in the distribution and education of these products, particularly in more remote regions. There is a clear opportunity for market players to expand their reach by partnering with local distributors, government initiatives, and NGOs to improve product availability and awareness in these areas. Furthermore, digital platforms and e-commerce present new avenues to reach broader audiences, offering convenience and privacy to consumers who may feel uncomfortable purchasing feminine hygiene products in physical stores. By capitalizing on these growth areas, companies can not only increase their market share but also contribute to improving menstrual health standards across Brazil.

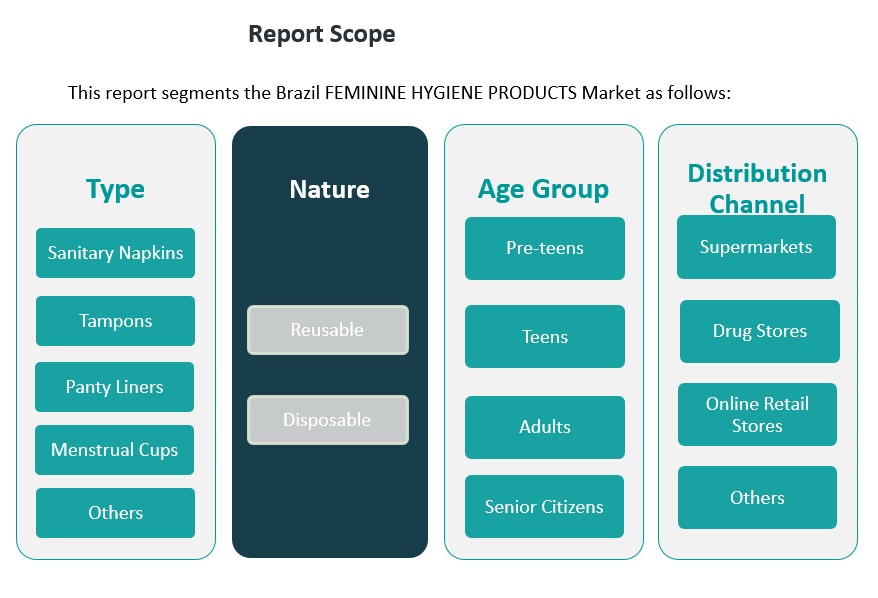

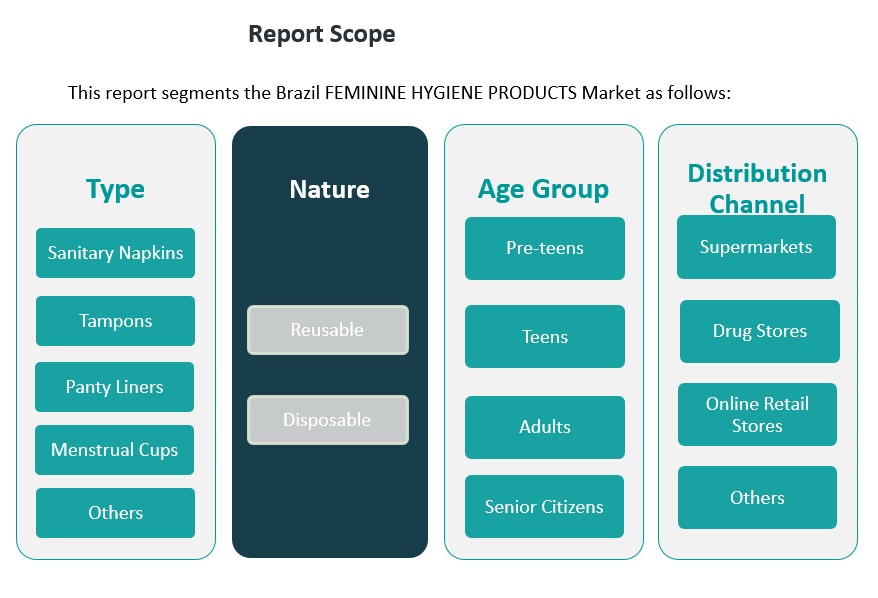

Market Segmentation Analysis:

The Brazilian feminine hygiene products market is divided into several key segments, each with distinct consumer preferences and growth drivers.

By Type, sanitary napkins dominate the market, owing to their widespread use and convenience. Tampons and panty liners also hold substantial shares, driven by changing consumer preferences for comfort and discretion. Menstrual cups, though still emerging, are gaining popularity due to their sustainability and cost-effectiveness over time. Other product types, such as reusable cloth pads, also cater to eco-conscious consumers.

By Nature, the market is primarily driven by disposable products, which offer convenience and accessibility. However, the demand for reusable products, such as menstrual cups and cloth pads, is rising due to growing environmental awareness. This segment is expected to expand as more women seek sustainable alternatives to traditional feminine hygiene products.

By Age-Group, adults represent the largest consumer base, driven by regular menstruation cycles and a preference for reliable hygiene solutions. The pre-teens and teens segment is also significant, as parents and guardians seek safe and gentle products for young users. Senior citizens are a growing segment, particularly those experiencing health issues related to menopause and incontinence, creating a niche market for specialized products.

By Distribution Channel, supermarkets and drug stores remain the dominant outlets for feminine hygiene products due to their broad accessibility. However, the rise of online retail stores has significantly increased, driven by convenience, privacy, and better product variety. Other channels, including specialized stores and pharmacies, contribute to the market’s growth by offering targeted products.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

The Brazilian feminine hygiene products market exhibits regional disparities influenced by economic development, cultural norms, and access to education and infrastructure. Understanding these regional dynamics is crucial for stakeholders aiming to optimize market strategies and product distribution.

Southeast Region

The Southeast region, encompassing states like São Paulo, Rio de Janeiro, and Minas Gerais, leads the Brazilian feminine hygiene market. This dominance is attributed to its substantial urban population, higher disposable incomes, and well-established retail infrastructure. Consumers in this region exhibit a strong preference for premium and eco-friendly products, reflecting a growing awareness of menstrual health and sustainability. The concentration of manufacturing facilities and distribution networks further enhances market accessibility and product availability.

South Region

The South region, including Paraná, Santa Catarina, and Rio Grande do Sul, follows closely in market share. Economic stability and a high standard of living contribute to a steady demand for feminine hygiene products. While urban areas mirror the Southeast’s consumption patterns, rural areas are witnessing increased product penetration due to targeted awareness campaigns and improved distribution channels.

Northeast Region

The Northeast region, comprising states like Bahia, Pernambuco, and Ceará, presents a mixed market landscape. While urban centers such as Salvador and Recife show growing adoption of feminine hygiene products, rural areas face challenges related to lower income levels, limited access to education, and traditional menstrual practices. However, ongoing governmental and non-governmental initiatives are gradually improving awareness and product accessibility, indicating a positive trajectory for market growth in this region.

North Region

The North region, including states like Amazonas, Pará, and Acre, exhibits the lowest market penetration. Geographical remoteness, lower economic development, and limited infrastructure pose significant barriers to the widespread adoption of feminine hygiene products. Despite these challenges, there is a growing recognition of the importance of menstrual health, and efforts are underway to enhance product availability and awareness through mobile health initiatives and community outreach programs.

Central-West Region

The Central-West region, comprising Goiás, Mato Grosso, and Mato Grosso do Sul, serves as a strategic agricultural hub with emerging urban centers. While the market is currently smaller compared to other regions, it is poised for growth due to increasing urbanization, improved economic conditions, and rising awareness of menstrual hygiene. Efforts to expand retail networks and educational campaigns are expected to drive market expansion in this region.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Bingbing Paper Co., Ltd

Competitive Analysis:

The Brazilian feminine hygiene products market is highly competitive, with both domestic and international brands vying for market share. Leading global players such as Procter & Gamble, Kimberly-Clark, and Johnson & Johnson dominate the market, offering a wide range of sanitary napkins, tampons, and panty liners. These companies leverage strong distribution networks, brand recognition, and significant marketing budgets to maintain their positions. Local brands, including products from Brazilian companies like Onix and EcoCaring, are also gaining traction, particularly in the eco-friendly segment. These brands focus on sustainability, offering biodegradable and organic alternatives, capitalizing on the growing demand for environmentally conscious products. Additionally, the rise of e-commerce platforms has opened new avenues for smaller and niche players, allowing them to reach a broader audience. To remain competitive, companies are focusing on product innovation, sustainability, and expanding distribution channels to meet evolving consumer preferences in Brazil.

Recent Developments:

- In October 2024, Ontex Group NV signed an agreement to sell its Brazilian business to Softys S.A. for approximately €110 million (about BRL 671 million). This acquisition marks a significant move for Softys, a leading personal hygiene company in Latin America, and aligns with Ontex’s strategy to focus on its partner brands and healthcare business. The closing of this deal is expected in the first half of 2025, pending regulatory approval from Brazilian authorities.

- In July 2024, Essity announced an associate partnership with the World Economic Forum as part of the Forum’s Global Alliance for Women’s Health. Through this partnership, Essity is taking a leading role in advancing menstrual health on a global scale, aiming to measure and close gaps in menstrual health and well-being. While this partnership is global, Essity’s brands such as Libresse, Saba, and Nosotras are present in Latin America, including Brazil, and the company’s efforts are expected to influence the menstrual health agenda in the region.

Market Concentration & Characteristics:

The Brazilian feminine hygiene products market is characterized by moderate concentration, with a mix of dominant multinational corporations and emerging local brands. Major international players such as Procter & Gamble, Kimberly-Clark, and Johnson & Johnson maintain significant market shares, leveraging extensive distribution networks and strong brand recognition. These companies continue to lead in product innovation and marketing strategies. Local brands are gaining traction, particularly in the eco-friendly segment, by offering sustainable and organic alternatives to traditional products. This trend aligns with the growing consumer demand for environmentally conscious options. The market is also witnessing increased competition from direct-to-consumer platforms and e-commerce channels, which provide consumers with greater access to a diverse range of products. This dynamic landscape fosters innovation and responsiveness to consumer preferences, contributing to the market’s overall growth and evolution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Brazilian feminine hygiene products market is expected to continue growing, driven by increasing awareness of menstrual health.

- Demand for organic, eco-friendly products like biodegradable pads and menstrual cups will rise due to growing environmental concerns.

- E-commerce platforms will play a larger role in expanding market access, particularly in rural and underserved areas.

- Product innovation, such as advancements in comfort, absorbency, and sustainability, will propel market expansion.

- Growing disposable incomes in urban centers will support the adoption of premium hygiene products.

- The rise of subscription services offering personalized product deliveries will cater to convenience-driven consumers.

- The market will see a shift towards more inclusive and diverse product offerings for various age groups and health needs.

- Rural regions will experience increasing penetration due to targeted education and product distribution initiatives.

- Increased government and NGO initiatives will further support menstrual health awareness and access to products.

- Competitors will intensify efforts to differentiate products and expand their market share through strategic partnerships and marketing campaigns.