| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Industrial Fasteners Market Size 2024 |

USD 2769.74 million |

| Brazil Industrial Fasteners Market, CAGR |

5.61% |

| Brazil Industrial Fasteners Market Size 2032 |

USD 4286.26 million |

Market Overview

The Brazil Industrial Fasteners Market is projected to grow from USD 2769.74 million in 2024 to an estimated USD 4286.26 million by 2032, with a compound annual growth rate (CAGR) of 5.61% from 2024 to 2032. This growth is driven by the expansion of key end-user industries such as automotive, construction, and manufacturing, which are experiencing increased demand for durable and high-performance fastening solutions.

Market drivers include the ongoing industrialization and infrastructure development in Brazil, leading to heightened demand for industrial fasteners. Trends such as the adoption of automation in manufacturing processes and the emphasis on quality and safety standards are further propelling market expansion. Additionally, the growth of the e-commerce sector has opened new distribution channels for fastener manufacturers, broadening their market reach.

Geographically, the Southeast region, encompassing major industrial hubs like São Paulo and Rio de Janeiro, dominates the market due to its concentration of manufacturing activities. Key players in the Brazilian industrial fasteners market include ArcelorMittal, Gerdau, and Würth Group, among others. These companies are focusing on product innovation and strategic partnerships to strengthen their market position and cater to the evolving needs of various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Brazil Industrial Fasteners Market is expected to grow from USD 1,763.45 million in 2024 to USD 2,099.20 million by 2032, with a CAGR of 2.20% from 2025 to 2032.

- Industrialization, infrastructure development, and the increasing demand from automotive and construction sectors are driving market growth.

- Innovations in fastener design and materials are improving performance, durability, and efficiency, contributing to market expansion.

- The rise of online distribution channels is expanding market access and offering new opportunities for fastener manufacturers.

- Fluctuations in raw material prices and intense competition from low-cost imports pose challenges for local fastener manufacturers.

- The Southeast region, with industrial hubs like São Paulo and Rio de Janeiro, accounts for the largest share of the market.

- Companies such as ArcelorMittal, Gerdau, and Würth Group are leading the market through innovation and strategic partnerships.

Report scope

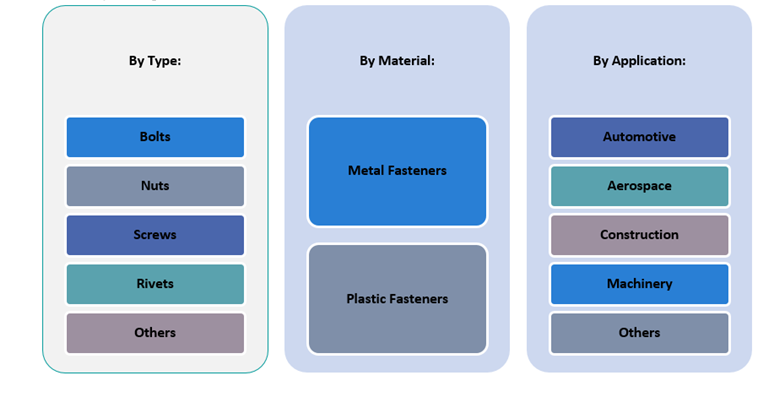

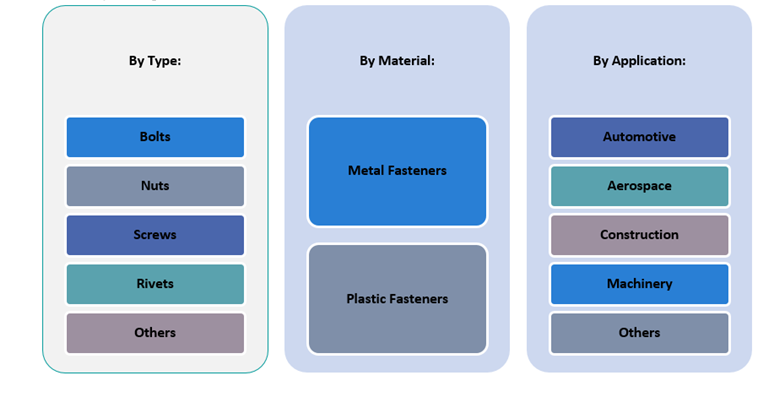

This report segments the Brazil Industrial Fasteners Market as follow:

Market Drivers

Technological Advancements in Fastener Design and Materials

The Brazil industrial fasteners market is benefiting from continuous advancements in fastener technology, which are improving the performance and efficiency of fasteners across a wide range of applications. Manufacturers are increasingly focusing on the development of high-performance fasteners that offer superior strength, resistance to corrosion, and better performance in challenging environments. The use of advanced materials such as stainless steel, titanium, and composite materials is becoming more common in the production of industrial fasteners, particularly for industries like aerospace, automotive, and oil and gas. These materials enhance the longevity and reliability of fasteners, meeting the demanding needs of critical applications. Furthermore, advancements in manufacturing techniques, such as 3D printing and automation, are making it possible to create more precise, cost-effective, and customized fasteners. These innovations are not only driving the demand for high-quality fasteners but also increasing the potential for market expansion.

Rising Focus on Quality and Safety Standards

The growing emphasis on safety and quality standards is another key driver for the Brazil industrial fasteners market. Industries such as aerospace, automotive, and construction require fasteners that adhere to stringent safety regulations and international quality standards. The increasing awareness of the need for high-quality fasteners to ensure the safety and reliability of products is prompting industries to invest in top-tier fastening solutions. Brazil’s regulatory environment is also evolving, with government agencies enforcing stricter compliance with industry standards for product performance, safety, and environmental impact. This trend is driving fastener manufacturers to innovate, develop more reliable products, and invest in quality assurance processes to meet these regulations. As industries continue to prioritize safety and product integrity, the demand for high-performance fasteners will continue to rise.

Growing Demand from the Automotive Industry

The automotive industry in Brazil is a significant driver of the industrial fasteners market. For instance, the sector’s emphasis on lightweighting and efficiency has led to a greater demand for advanced fastening solutions. Automotive manufacturers are focusing on using materials and designs that enhance vehicle safety and performance while reducing weight. This trend is particularly evident in the production of electric and hybrid vehicles, where specialized fasteners are required to meet specific assembly standards. As the automotive sector continues to grow, the need for high-quality, durable, and reliable fasteners is increasing, making this a key driver of market expansion. The automotive industry’s reliance on fasteners for structural integrity and safety underscores their importance in vehicle assembly and maintenance.

Infrastructure Development and Urbanization

Brazil’s rapid urbanization and infrastructure development projects are major contributors to the rising demand for industrial fasteners. For instance, government initiatives aimed at enhancing infrastructure, such as road construction and energy projects, necessitate the use of fasteners that ensure the durability and safety of structures. Additionally, private investments in commercial and residential buildings, particularly in urban centers like São Paulo and Rio de Janeiro, are boosting demand for fasteners. These developments are driving the need for both traditional fasteners, such as bolts and nuts, and specialized high-performance fastening solutions. As infrastructure projects accelerate, industrial fasteners are becoming increasingly crucial in ensuring the long-term performance and reliability of construction materials and machinery. The focus on infrastructure development highlights the critical role fasteners play in supporting Brazil’s economic growth.

Market Trends

Increased Adoption of Automation and Robotics in Manufacturing

The integration of automation and robotics is reshaping Brazil’s industrial fasteners market, driven by the need for efficiency and precision in manufacturing. Government initiatives, such as the Smart Factory Program, aim to modernize industries by digitizing small and medium-sized enterprises, enabling them to adopt advanced technologies like robotics and machine vision. This shift is particularly evident in sectors like automotive and aerospace, where robotics enhance production speed, quality, and safety. Leading manufacturers are leveraging these technologies for tasks ranging from material handling to quality control, reducing errors and ensuring product consistency. Brazil’s investments in industrial automation, supported by public-private collaborations, are fostering innovation and competitiveness in the fastener industry. The automotive sector, for instance, has embraced robotics for multi-model production lines, while other industries are adopting these systems to meet global standards. Despite challenges such as skilled labor shortages, the focus on Industry 4.0 technologies and AI-driven automation is positioning Brazil as a key player in smart manufacturing. These advancements are expected to sustain the demand for high-quality fasteners that align with precise industrial requirements.

Shift Toward Sustainable and Environmentally Friendly Fastener Solutions

Brazil’s industrial fasteners market is increasingly aligning with global sustainability trends, driven by both regulatory pressures and industry demand. The government’s Green Seal Program encourages manufacturers to adopt eco-friendly practices by certifying products that meet stringent environmental standards. This has led companies to innovate with recyclable materials like aluminum and steel while optimizing production processes to minimize carbon footprints. For instance, manufacturers are employing energy-efficient methods and sustainable supply chains to produce fasteners that cater to green building certifications. The automotive sector is particularly active in adopting these solutions as it moves toward sustainable mobility initiatives. Additionally, companies like Belenus are incorporating water reuse and emission reduction strategies into their operations, reflecting a broader commitment to environmental stewardship. These efforts not only address ecological concerns but also enhance the global competitiveness of Brazilian products. As industries prioritize sustainability in construction and manufacturing projects, demand for environmentally friendly fasteners is poised for significant growth.

Rising Demand for Custom and High-Performance Fasteners

A notable trend in the Brazil industrial fasteners market is the growing demand for custom-made and high-performance fasteners. As industries like automotive, aerospace, and energy become increasingly specialized, the need for customized fasteners that meet specific technical and material requirements is also on the rise. High-performance fasteners are designed to withstand extreme conditions, such as high temperatures, corrosion, or pressure, which are often found in critical applications. For instance, aerospace and defense sectors in Brazil require fasteners that are not only strong but also lightweight and resistant to environmental factors. Fastener manufacturers are increasingly offering tailored solutions, including the use of specialized materials and coatings, to meet the unique needs of their clients. This trend is driven by industries’ increasing focus on product reliability, safety, and performance, as well as the need for long-lasting and durable components in mission-critical applications. As Brazilian manufacturers strive to cater to a more demanding market, the production of custom and high-performance fasteners will continue to grow, providing opportunities for both innovation and market expansion.

Expansion of E-Commerce and Online Distribution Channels

The rapid expansion of e-commerce is another trend shaping the Brazil industrial fasteners market. Traditionally, industrial fasteners were purchased through physical distributors and wholesalers. However, with the rise of digitalization, there has been a marked shift toward online platforms for purchasing industrial components. This is particularly evident in the growing popularity of B2B e-commerce platforms that provide fastener manufacturers with an efficient channel to reach a broader customer base, both within Brazil and internationally. E-commerce enables businesses to access a wide range of fasteners, compare prices, and order custom-made products conveniently from the comfort of their offices. In Brazil, where the digital economy is growing rapidly, e-commerce is enhancing accessibility and convenience for industries that require fasteners in large quantities or specialized designs. Additionally, e-commerce platforms are driving down costs by cutting out traditional intermediaries and allowing manufacturers to engage directly with customers. This trend is reshaping the market by increasing competition and encouraging manufacturers to invest in digital solutions to enhance their product offerings and improve customer service.

Market Challenges

Volatility of Raw Material Prices

One of the major challenges facing the Brazil industrial fasteners market is the volatility of raw material prices. Fastener production relies heavily on materials such as steel, aluminum, and other metals, which are subject to global price fluctuations due to factors like supply chain disruptions, geopolitical tensions, and changes in demand. For instance, imported fasteners from countries like China have gained traction in Brazil, creating competitive pressure on local manufacturers who struggle with fluctuating input costs. According to surveys by industry associations, Brazilian manufacturers often face higher production costs due to dependency on imported raw materials, which makes them vulnerable to global price dynamics. Additionally, economic factors such as currency devaluation further exacerbate the cost pressures faced by domestic producers. These fluctuations not only impact production costs but also create uncertainty in pricing strategies, making it difficult for manufacturers to plan long-term profitability. In response, some companies are adopting strategies such as securing long-term contracts with suppliers or exploring alternative materials to mitigate risks. However, the inability to stabilize material costs limits competitiveness against global players who manage these challenges more effectively. This issue remains a significant barrier for Brazil’s fastener manufacturers in maintaining market share and profitability.

Intense Competition from Imported Fasteners

Another key challenge in the Brazil industrial fasteners market is the intense competition posed by imported fasteners. Brazil’s industrial fastener industry faces strong competition from global manufacturers, particularly those in low-cost production regions such as China and Southeast Asia. These international suppliers can often offer lower-priced fasteners due to cheaper labor costs and economies of scale, making it difficult for local manufacturers to compete on price alone. While the demand for high-quality, custom, or specialized fasteners remains strong, the overall market pressure from imported goods can lead to price-based competition, which affects local manufacturers’ profitability. Additionally, imported fasteners may come with advantages like more established global supply chains, better distribution networks, and a wider range of product offerings. For Brazilian manufacturers, staying competitive in terms of both price and quality requires ongoing investments in innovation, efficiency, and customer service. Furthermore, local manufacturers must navigate the complexities of Brazil’s regulatory environment, which may not always provide the same level of ease for foreign competitors, adding another layer of challenge for domestic producers.

Market Opportunities

Expansion of the Aerospace and Automotive Sectors

Brazil’s aerospace and automotive industries present significant growth opportunities for the industrial fasteners market. The aerospace sector is poised for continued expansion, driven by Brazil’s strong presence in aircraft manufacturing and growing investments in defense technologies. As the demand for lighter, more durable, and specialized fasteners increases, opportunities for high-performance fasteners will expand, particularly in Brazil’s aerospace hubs like São José dos Campos. Similarly, the automotive sector, including the rising electric vehicle (EV) market, offers considerable potential. Fasteners are critical in vehicle assembly, and with Brazil’s automotive industry focusing on advanced vehicle models and innovation, the demand for high-quality fasteners will remain robust. This growing demand across both sectors presents a key opportunity for manufacturers to develop specialized fastener solutions to meet evolving industry needs.

Infrastructure Development and Renewable Energy Projects

Brazil’s focus on large-scale infrastructure projects and renewable energy development provides a significant market opportunity for industrial fasteners. Government-backed investments in transportation, construction, and energy infrastructure, including wind and solar energy projects, are driving the demand for durable and reliable fasteners. As Brazil undertakes ambitious projects in urbanization and energy transition, there is an increasing need for fasteners in critical applications like construction, power plants, and energy storage systems. The demand for fasteners that meet high safety and performance standards in challenging environments is expected to grow as these projects progress, positioning the industrial fasteners market for long-term growth and diversification. Manufacturers who focus on supplying fasteners for infrastructure and renewable energy sectors can tap into these emerging opportunities for expansion.

Market Segmentation Analysis

By Product

The Brazil industrial fasteners market is segmented by product into externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, and aerospace-grade fasteners. Externally threaded fasteners, such as bolts and screws, dominate the market due to their widespread use in industries such as automotive, construction, and machinery. These fasteners are essential for joining components and ensuring the structural integrity of various products. Internally threaded fasteners, including nuts and inserts, are also significant, primarily used in automotive and machinery applications. Non-threaded fasteners, such as rivets and clips, are growing in demand, especially in industries where quick assembly and disassembly are needed. Aerospace-grade fasteners are specialized products used in the aerospace industry, characterized by high strength, lightweight, and resistance to extreme conditions. This segment is growing steadily with the increasing demand for advanced aerospace technologies and Brazil’s expanding aerospace sector.

By Raw Material

The raw material segment of the Brazil industrial fasteners market includes metal and plastic fasteners. Metal fasteners, primarily made from steel, aluminum, and other alloys, hold the largest market share due to their superior strength and durability. Metal fasteners are used extensively across all industries, including automotive, construction, and industrial machinery. The growing demand for corrosion-resistant fasteners is driving the use of stainless steel and galvanized metal fasteners, particularly in harsh environmental conditions. On the other hand, plastic fasteners are increasingly being used in industries where weight reduction and cost efficiency are prioritized, such as automotive and electronics. Plastic fasteners offer the advantage of being lightweight, resistant to corrosion, and cost-effective, although they are typically limited to applications where strength requirements are lower.

Segments

Based on Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

Based on Raw Material

- Metal fasteners

- Plastic Fasteners

Based on Application

- Automotive

- Aerospace

- Oil & Gas

- Building & Construction

- Others

Based on Distribution Channel

Based on Region

- Southeast region

- South region

- North region

- Northeast region

- Midwest region

Regional Analysis

Southeast Region (40%)

The Southeast region is the dominant player in the Brazil industrial fasteners market, contributing approximately 40% of the market share. This region includes major industrial hubs such as São Paulo, Rio de Janeiro, and Minas Gerais, which are home to a wide range of manufacturing sectors, including automotive, aerospace, machinery, and construction. São Paulo, in particular, is the leading industrial state, with a high concentration of automotive and machinery manufacturers that rely heavily on industrial fasteners for assembly. The growing aerospace sector in São José dos Campos, São Paulo, further supports the demand for specialized fasteners. Additionally, large-scale infrastructure projects in Rio de Janeiro and the region’s strong manufacturing capabilities drive ongoing demand for fasteners across various industries.

South Region (25%)

The South region accounts for around 25% of the market share, with key industrial states like Paraná, Santa Catarina, and Rio Grande do Sul. The region’s robust automotive and machinery manufacturing sectors, including leading companies in the automotive supply chain, contribute significantly to the demand for fasteners. Moreover, the South has a strong presence in the metalworking and consumer goods industries, further boosting the need for industrial fasteners. As Brazil’s manufacturing base continues to grow, the South is expected to maintain its position as a key player in the fasteners market, driven by its well-established industrial infrastructure.

Key players

- T. Fasteners

- Tecfix

- Indústria de Parafusos Jofix Ltda.

- Mota Parafusos

- Fastenal

Competitive Analysis

The Brazil industrial fasteners market is highly competitive, with key players focusing on product innovation, quality, and customer service to maintain their market positions. G.T. Fasteners is known for its broad product portfolio and strong market presence, while Tecfix specializes in providing high-performance fasteners, particularly for the automotive and construction industries. Indústria de Parafusos Jofix Ltda. focuses on the local manufacturing of fasteners, ensuring cost-effectiveness and supply chain efficiency, giving it a competitive edge in the domestic market. Mota Parafusos, with its extensive history in fastener manufacturing, maintains a strong reputation for reliability and customer trust. Fastenal, a global player, leverages its vast distribution network and diverse range of fasteners to cater to a wide array of industries, further intensifying competition. The competition in this market revolves around product quality, pricing strategies, innovation, and the ability to meet customer demands across various industrial sectors.

Recent Developments

- In December 2024, Nitto Seiko reported progress under its medium-term business plan “Mission G-second,” focusing on automation and electrification demands. Despite economic slowdowns in regions like the U.S. and Thailand, the company improved operating income through price adjustments for screw fastening machines.

- In December 2024, ARP launched an upgraded high-strength fastener kit for DART LS Next engine blocks. This kit uses 8740 chromoly steel, offering improved fatigue strength and reliability, catering to high-performance automotive applications.

- In February 2024, ITW reported its financial results for 2023, highlighting a 2% organic growth and a 130 basis point increase in operating margin to 25.1%. While the report emphasizes customer-focused innovation, it does not specifically detail advancements in fastener product lines.

- In 2024, Fastenal recorded $9.14 billion in revenue, with fasteners accounting for nearly 50% of total sales. They expanded their onsite industrial supply management services to 2,200 customer locations and deployed over 94,000 vending machines globally.

Market Concentration and Characteristics

The Brazil industrial fasteners market exhibits a moderate level of market concentration, with a mix of local and global players competing for market share. Key domestic manufacturers like G.T. Fasteners, Tecfix, and Indústria de Parafusos Jofix Ltda. dominate the market, focusing on cost-effective production, quality, and tailored solutions to meet the needs of the Brazilian manufacturing and construction sectors. However, global players such as Fastenal also hold a significant position, leveraging their extensive distribution networks and broad product portfolios. The market is characterized by diverse product offerings, including externally and internally threaded fasteners, aerospace-grade components, and specialized fasteners for industries like automotive, aerospace, and oil and gas. With growing infrastructure projects and increasing demand from specialized sectors, the market is becoming increasingly competitive, driven by innovation, product differentiation, and strategic partnerships aimed at enhancing customer satisfaction and expanding regional reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Raw Material, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The automotive industry in Brazil is expected to continue its growth, driving demand for fasteners in vehicle manufacturing. With an increasing focus on electric vehicles (EVs), the need for specialized fasteners will rise.

- Brazil’s expanding aerospace sector will lead to increased demand for high-performance, lightweight fasteners. Aerospace-grade fasteners will become more critical as the industry grows and modernizes.

- Ongoing infrastructure projects, particularly in energy and transportation, will drive the demand for industrial fasteners. As Brazil invests in new highways, bridges, and renewable energy projects, fastener usage will increase significantly.

- The growing emphasis on sustainability will lead to the development and use of environmentally friendly fasteners. Manufacturers will focus on producing recyclable and energy-efficient fasteners to meet green building standards.

- Technological innovations in automation and robotics will enhance fastener manufacturing processes. These advancements will improve production efficiency, reduce costs, and enable the creation of custom solutions for various industries.

- There will be a shift toward using advanced materials such as stainless steel, titanium, and composites in fastener production. This shift is driven by industries requiring corrosion-resistant, durable, and lightweight fasteners.

- The rise of online platforms will expand distribution channels for fasteners. Digital marketplaces and B2B e-commerce platforms will make fasteners more accessible, particularly for small and medium-sized enterprises.

- The Brazilian market will face intense competition from imported fasteners, particularly from low-cost producers in Asia. Local manufacturers will need to focus on product differentiation and quality to remain competitive.

- As industries become more specialized, there will be a growing demand for custom fasteners. Manufacturers will increasingly offer tailored solutions to meet specific technical and material requirements for niche sectors.

- The North, Northeast, and Midwest regions of Brazil will see increased demand for industrial fasteners, driven by local infrastructure projects and industrialization. These regions will offer significant opportunities for growth as Brazil’s economy diversifies.