| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Naphtha Market Size 2024 |

USD 10,005.2 million |

| Brazil Naphtha Market, CAGR |

3.66% |

| Brazil Naphtha Market Size 2032 |

USD 13,318.8 million |

Market Overview:

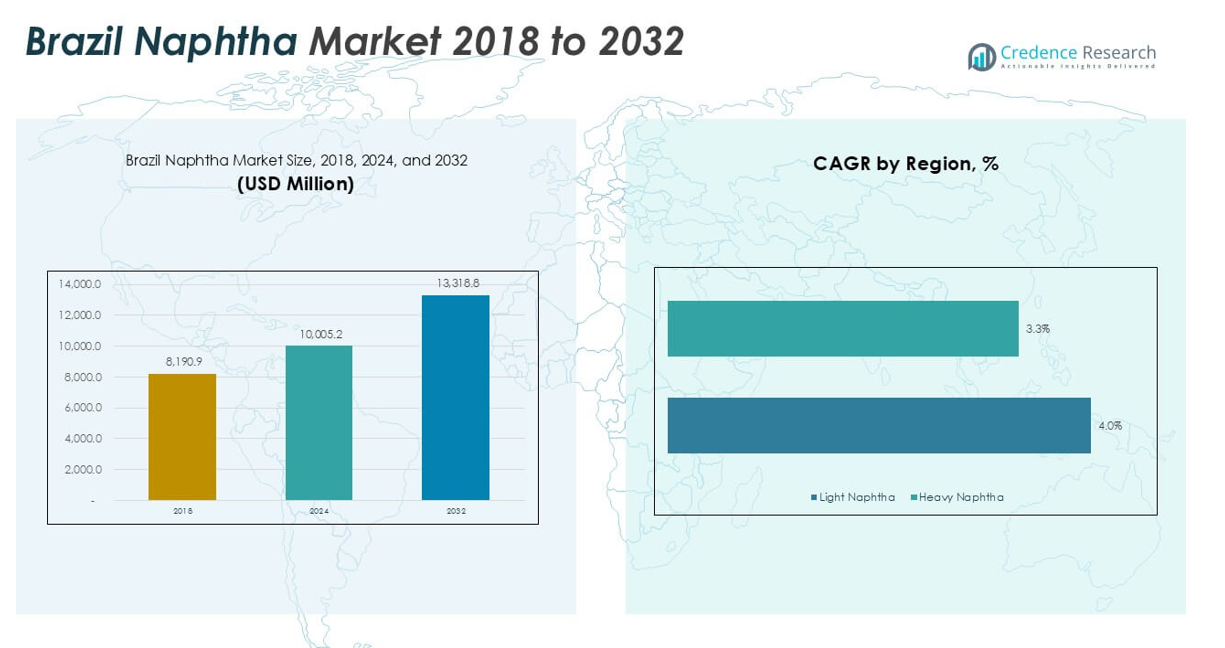

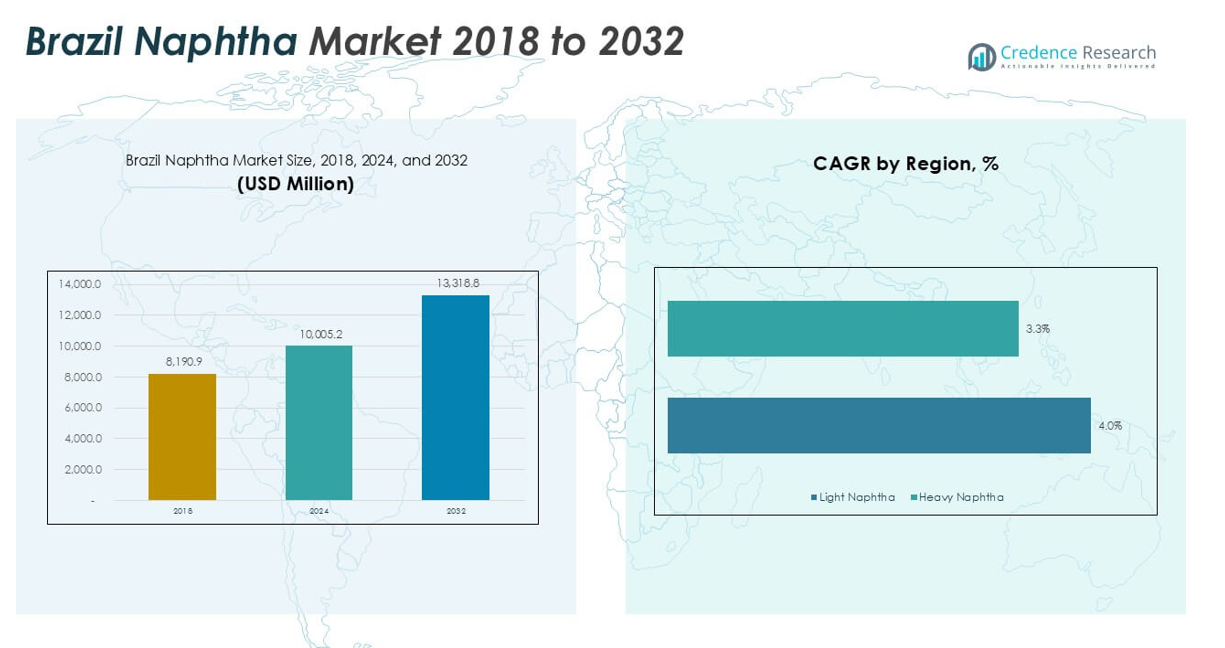

The Brazil Naphtha market size was valued at USD 8,190.9 million in 2018, reached USD 10,005.2 million in 2024, and is anticipated to reach USD 13,318.8 million by 2032, at a CAGR of 3.66% during the forecast period.

The Brazil Naphtha market is led by prominent players such as Petrobras, BP p.l.c., ADNOC, Chevron Corporation, Exxon Mobil Corporation, Reliance Industries, Shell, CNPC, PetroChina Company Limited, and Sinopec Corp. Petrobras maintains a dominant position through its extensive domestic refinery network and strong market integration. International companies strengthen their presence via advanced technologies and strategic alliances. The Southeast region stands out as the leading market, accounting for 46% of total market share in 2024, driven by its concentration of petrochemical complexes and well-established industrial infrastructure. This regional dominance supports ongoing investment and innovation among top industry participants.

Market Insights

- The Brazil Naphtha market reached USD 10,005.2 million in 2024 and is expected to grow to USD 13,318.8 million by 2032, reflecting a CAGR of 3.66% over the forecast period.

- Strong demand from the petrochemical industry, especially for light naphtha used as a feedstock, remains the primary market driver, with the segment holding approximately 62% share in 2024.

- Market trends highlight ongoing investments in refinery modernization and feedstock flexibility, as well as a shift toward advanced technologies to enhance production efficiency and environmental performance.

- The competitive landscape is shaped by major players such as Petrobras, BP p.l.c., Shell, Exxon Mobil Corporation, and Reliance Industries, all focusing on capacity expansions, strategic partnerships, and technological upgrades to secure market presence.

- The Southeast region leads with a 46% market share in 2024, followed by the South (19%) and Northeast (15%), while growth in less industrialized regions remains restrained by limited infrastructure and slower industrial development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

In the Brazil Naphtha market, Light Naphtha holds the dominant market share, accounting for approximately 62% of total volume in 2024. This sub-segment benefits from robust demand in petrochemical processing, particularly in the production of ethylene and propylene. Light Naphtha’s lower boiling range and high paraffin content make it a preferred choice for steam crackers. Growth in the country’s petrochemical industry, along with increasing investments in upgrading refinery infrastructure, further supports the expansion of this segment.

- For instance, Petrobras has invested in modernizing the Paulínia refinery (REPLAN) with a new distillation column capable of processing 434,000 barrels per day, enabling higher yield of light naphtha for ethylene crackers.

By Application:

Petrochemical Feedstock emerges as the leading application segment in the Brazil Naphtha market, representing nearly 72% of market share by volume in 2024. The widespread use of naphtha as a primary raw material in the manufacture of olefins and aromatics drives this dominance. The surging demand for plastics, synthetic fibers, and resins in both domestic and export markets reinforces the strategic importance of naphtha as a petrochemical feedstock. This segment’s growth is also propelled by ongoing expansion projects in Brazil’s downstream sector.

- For instance, Braskem operates a petrochemical complex in Camaçari that consumes 2.6 million tons of naphtha annually for production of ethylene and propylene.

By End-User:

The Petrochemical Industry is the principal end-user of naphtha in Brazil, commanding over 68% market share in 2024. Extensive consumption of naphtha for steam cracking and chemical manufacturing underlines this segment’s prominence. The rapid growth of Brazil’s plastics and chemicals sector, supported by favorable regulatory frameworks and investment incentives, continues to drive demand. Oil & Gas companies also utilize naphtha for gasoline blending and energy production, but their share remains secondary to the petrochemical industry’s requirements.

Market Overview

Strong Petrochemical Industry Expansion

The expansion of Brazil’s petrochemical sector serves as a primary growth driver for the naphtha market. Rising demand for plastics, synthetic resins, and specialty chemicals has led to increased consumption of naphtha as a key feedstock. Large-scale investments in new and upgraded petrochemical facilities, particularly in São Paulo and other industrial hubs, further accelerate this trend. The country’s growing role as a major supplier of basic chemicals to Latin American and global markets enhances the significance of naphtha in supporting downstream production capacity.

- For instance, Braskem completed an expansion at its Triunfo facility, increasing polyethylene production by 450,000 tons per year.

Growing Automotive Fuel Demand

An increase in automotive fuel requirements, particularly gasoline blending, is fueling naphtha demand across Brazil. As urbanization advances and vehicle ownership rises, refineries and blenders are leveraging naphtha to enhance fuel quality and meet tightening environmental standards. Government policies promoting cleaner fuels and advanced refinery technologies also stimulate growth in this segment. The evolving mobility landscape, coupled with rising fuel consumption in logistics and transportation, strengthens naphtha’s role in Brazil’s energy matrix.

- For instance, Petrobras’ REVAP refinery processes over 250,000 barrels of crude oil daily, blending naphtha to supply gasoline for major urban centers.

Favorable Regulatory and Investment Climate

Supportive regulatory frameworks and investment incentives provided by the Brazilian government have encouraged significant capital inflows into refining and petrochemical infrastructure. Streamlined permitting processes, tax benefits, and initiatives to attract foreign direct investment make Brazil an attractive destination for global chemical manufacturers. These factors collectively create a robust environment for capacity expansion, modernization of aging refineries, and integration of advanced technologies, all of which drive sustained growth in naphtha consumption.

Key Trends & Opportunities

Shift Toward Feedstock Flexibility

A major trend in the Brazil Naphtha market is the increasing adoption of flexible feedstock strategies by petrochemical producers. Companies are investing in technologies that allow seamless switching between naphtha, natural gas liquids, and alternative raw materials, optimizing costs and production yields. This trend enhances supply chain resilience, helps manage price volatility, and aligns with the industry’s drive for operational efficiency in response to dynamic market conditions.

- For instance, Shell’s Deer Park refinery has integrated a hydrocracking unit with a capacity of 70,000 barrels per day to process both naphtha and alternative feedstocks, supporting flexible production schedules.

Opportunities in Specialty Chemical Applications

Emerging opportunities for naphtha lie in its expanding use for specialty chemical production and value-added derivatives. As Brazilian manufacturers diversify their product portfolios, demand is rising for high-purity naphtha grades suitable for advanced applications, including solvents, specialty polymers, and performance materials. The development of downstream sectors and export-oriented chemical clusters further opens up avenues for market participants to capture higher margins in niche applications.

- For instance, Braskem has invested in a specialty chemicals unit capable of producing 120,000 tons of high-purity naphtha annually for solvents and pharmaceutical intermediates.

Key Challenges

Volatile Crude Oil Prices

Volatility in global crude oil prices remains a key challenge for the Brazil Naphtha market, as naphtha pricing is closely tied to oil benchmarks. Sudden fluctuations can disrupt procurement strategies, impact refinery margins, and lead to supply chain uncertainties. This volatility creates difficulties for market participants in planning production, budgeting, and maintaining long-term contracts, especially during periods of geopolitical instability or market shocks.

Competitive Pressure from Alternative Feedstocks

Brazilian naphtha producers face rising competitive pressure from alternative feedstocks, such as natural gas liquids and bio-based materials. The increasing adoption of ethane and propane in petrochemical production, driven by their cost-effectiveness and availability, threatens naphtha’s share in steam cracking applications. Companies must innovate and adapt to maintain competitiveness in the evolving feedstock landscape and respond to the industry’s focus on decarbonization and sustainability.

Environmental and Regulatory Compliance

Stringent environmental regulations regarding emissions, waste management, and fuel quality standards pose ongoing challenges for naphtha producers and end-users in Brazil. Compliance with evolving rules requires continuous investment in cleaner technologies, monitoring systems, and reporting mechanisms. Failure to adapt to stricter policies could result in financial penalties, operational restrictions, or reputational risks, making regulatory agility critical for long-term business viability.

Regional Analysis

Southeast Region

The Southeast region holds the largest share of the Brazil naphtha market, accounting for approximately 46% of the total, with a 2018 market value of USD 4,120 million. The region benefits from advanced petrochemical complexes and a high concentration of automotive and manufacturing industries, driving demand for both light and heavy naphtha. Light naphtha in this region grows at a robust CAGR of 4.00%, while heavy naphtha records a CAGR of 3.32%. Ongoing investments in infrastructure and technology further consolidate the Southeast as the market leader, leveraging port access and industrial integration for supply chain efficiency.

South Region

Representing nearly 19% of the national market, the South region posted a market value of USD 1,703 million in 2018. The area’s diversified manufacturing base, especially in chemicals and plastics, sustains solid demand for both light and heavy naphtha. Light naphtha demand advances at a 4.00% CAGR, with heavy naphtha following at 3.32%. Industrial modernization, coupled with effective logistics and regional investments, positions the South region for steady expansion. These dynamics ensure stable supply and support growing consumption across core industries, reinforcing the region’s important standing in Brazil’s naphtha landscape.

Northeast Region

The Northeast region comprises about 14% of the Brazil naphtha market, with a 2018 market value of USD 1,255 million. The chemical manufacturing and plastics sectors are primary growth engines, with light naphtha usage increasing at a CAGR of 4.00% and heavy naphtha at 3.32%. Strategic coastal location facilitates import and export activity, while government-backed industrial development programs continue to drive demand. As investments in new facilities rise, the region’s significance within the national naphtha supply chain grows, making it a focal point for future downstream expansion.

Midwest Region

Accounting for nearly 12% of national market value, the Midwest region recorded USD 1,076 million in 2018. The region’s agrochemical, packaging, and plastics industries are key consumers, with light naphtha showing a CAGR of 4.00% and heavy naphtha 3.32%. Infrastructure improvements and increased connectivity to upstream and downstream sectors bolster the Midwest’s role in the national supply network. The region’s industrial growth supports stable demand, enhancing its contribution to the broader Brazilian naphtha market and ensuring reliable supply to neighboring areas.

North Region

The North region holds around 9% market share, with a 2018 market value of USD 808 million. Light naphtha grows at a 4.00% CAGR, while heavy naphtha registers 3.32%, reflecting increasing consumption in energy and extractive industries. The region benefits from proximity to natural resource reserves and expanding industrialization, with recent infrastructure investments aimed at optimizing naphtha logistics and distribution. These efforts reinforce the North’s participation in the national market, ensuring continued supply chain integration and moderate but consistent market growth.

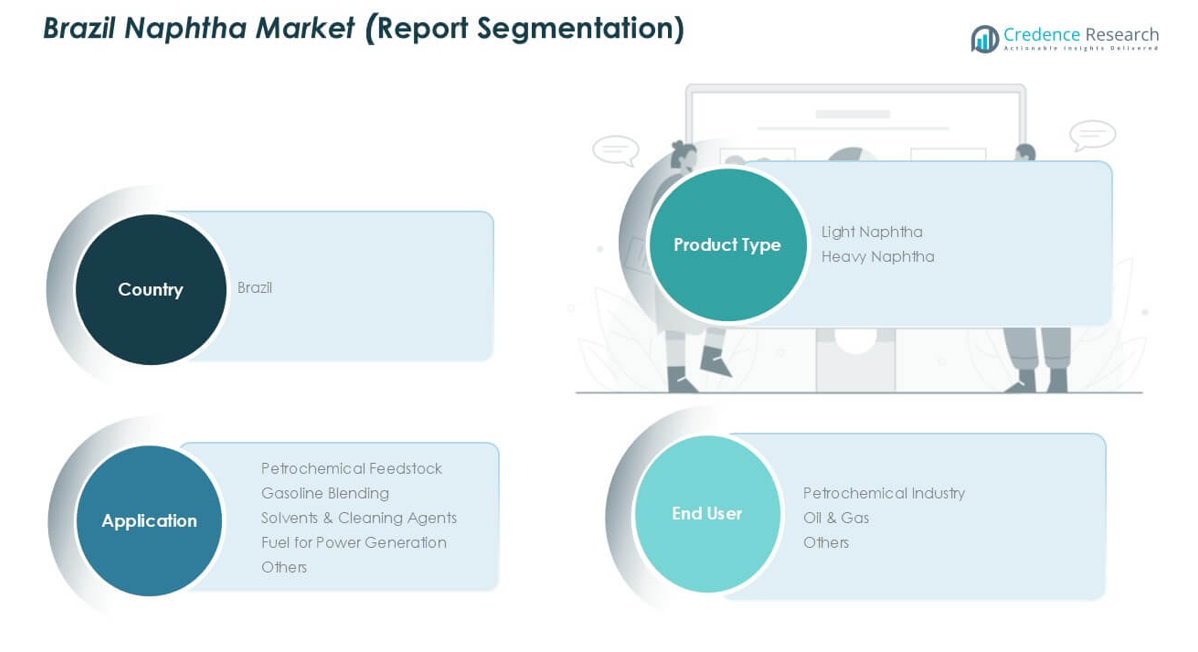

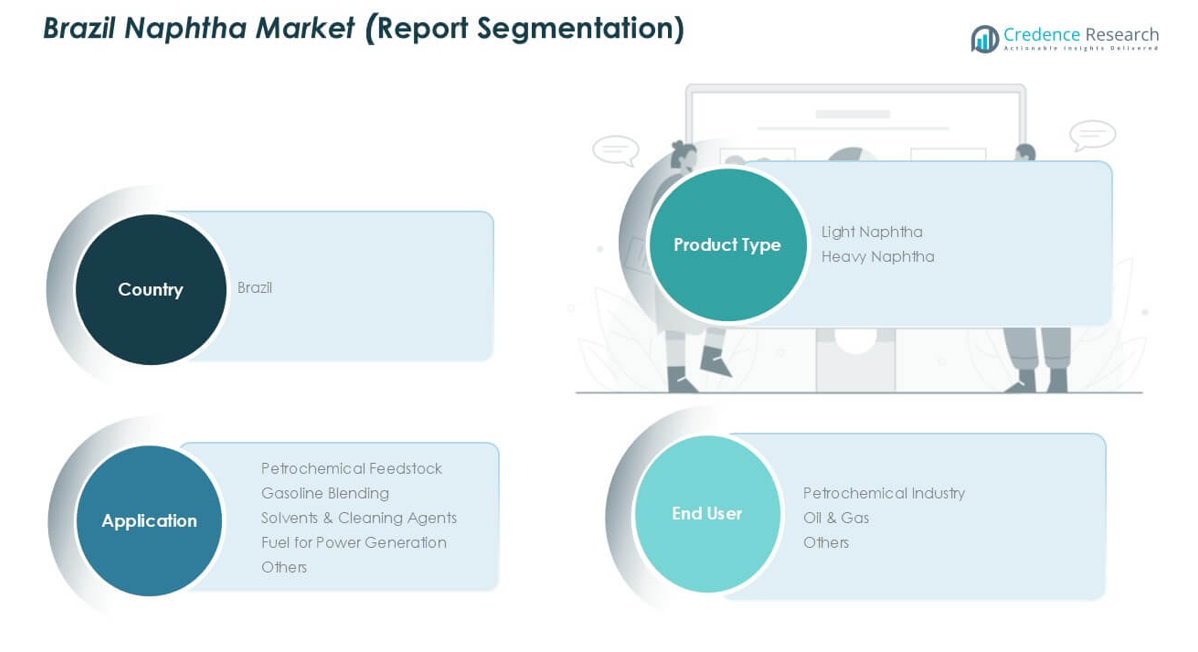

Market Segmentations:

By Product Type:

- Light Naphtha

- Heavy Naphtha

By Application:

- Petrochemical Feedstock

- Gasoline Blending

- Solvents & Cleaning Agents

- Fuel for Power Generation

- Others

By End-User:

- Petrochemical Industry

- Oil & Gas

- Others

By Geography:

- Southeast Region

- South Region

- Northeast Region

- Midwest Region

- North Region

Competitive Landscape

The competitive landscape of the Brazil Naphtha market is characterized by the presence of major global and regional players that command significant market influence through integrated operations and robust supply chains. Leading companies such as BP p.l.c., ADNOC, Petrobras, Chevron Corporation, CNPC, Exxon Mobil Corporation, PetroChina Company Limited, Reliance Industries, Shell, and Sinopec Corp. compete based on product quality, production capacity, and distribution reach. Petrobras, as the country’s flagship energy company, leverages its strong domestic refinery network and deep-rooted industry relationships to maintain market leadership. International firms focus on technological advancements and strategic partnerships to optimize refinery output and enhance supply reliability. Ongoing investments in capacity expansions, feedstock flexibility, and sustainability initiatives are central to maintaining competitive advantage. The market also witnesses increased collaboration between local and international players, which enhances operational efficiency and accelerates the adoption of advanced technologies across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BP p.l.c.

- ADNOC

- Petrobras

- Chevron Corporation

- CNPC

- Exxon Mobil Corporation

- PetroChina Company Limited

- Reliance Industries

- Shell

- Sinopec Corp.

Recent Developments

- In June 2025, Petrobras and ExxonMobil formed a consortium that successfully bid for and secured ten blocks in the Foz do Amazonas basin during a Brazilian oil and gas auction. Petrobras and ExxonMobil will be equal partners in these ten blocks, with each company operating five blocks. Additionally, a Chevron-led consortium, including China’s CNPC, also won nine blocks in the same auction.

- In June 2025, CNPC, alongside Chevron, acquired nine blocks in Brazil’s Foz do Amazonas basin. This acquisition signifies a notable expansion of CNPC’s presence in Brazil’s upstream oil and gas sector. The Foz do Amazonas basin is part of Brazil’s Equatorial Margin, which is considered a promising area for exploration due to its geological similarities with the prolific fields in Guyana.

- In June 2025, Petrobras led consortia that secured multiple offshore exploration blocks in Brazil’s Foz do Amazonas basin, a region considered resource-rich and strategically important for future feedstock supply, including naphtha.

- In June 2024, BP announced its intention to explore the production of second-generation ethanol and sustainable aviation fuel in Brazil, marking a significant shift towards renewable energy sources. This move, following BP’s acquisition of Bunge’s stake in their joint biofuel venture, BP Bunge Bioenergia, signals a strategic pivot away from traditional naphtha-based operations.

Market Concentration & Characteristics

The Brazil Naphtha market demonstrates a moderate to high level of market concentration, with a small group of multinational and domestic companies controlling a significant share of production and distribution. Leading industry participants such as Petrobras, BP p.l.c., Shell, Exxon Mobil Corporation, and Reliance Industries leverage integrated operations, extensive refinery networks, and established supply chains to maintain competitive advantage. The market features strong vertical integration, with major players involved from feedstock sourcing through to end-user delivery, which supports cost efficiency and supply reliability. Regional demand patterns reflect the concentration of Brazil’s industrial and petrochemical infrastructure, with the Southeast region accounting for the largest share due to its advanced manufacturing base and proximity to key ports. Product differentiation remains limited, with most competition centered on pricing, production capacity, and logistical efficiency. Investments in refinery modernization and advanced processing technologies shape the competitive dynamics, while regulatory standards and environmental requirements increasingly influence strategic decision-making in the sector.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Brazil’s naphtha market is projected to witness steady expansion driven by continued growth in petrochemical output.

- Companies will focus on enhancing feedstock flexibility to optimize costs and adapt to variable oil markets.

- Refinery upgrades and capacity expansions will support increased naphtha production and quality improvements.

- Leading players will implement advanced processing technologies to meet tightening environmental regulations.

- Strategic partnerships between domestic and international firms will accelerate innovation and infrastructure development.

- Growing demand for specialty-grade naphtha will create opportunities in high-value chemical applications.

- Investment in downstream logistics will improve supply efficiency and reduce delivery lead times.

- The Southeast region will maintain dominance, but emerging regional hubs will gain traction through targeted infrastructure projects.

- Digitalization and automation will increase operational efficiency across the naphtha value chain.

- Companies will place greater emphasis on sustainability initiatives, including emissions reduction and clean energy integration.