| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Water Pump Market Size 2023 |

USD 1,560.80 Million |

| Brazil Water Pump Market, CAGR |

3.7% |

| Brazil Water Pump Market Size 2032 |

USD 2,165.00 Million |

Market Overview:

Brazil Water Pump Market size was valued at USD 1,560.80 million in 2023 and is anticipated to reach USD 2,165.00 million by 2032, at a CAGR of 3.7% during the forecast period (2023-2032).

Several factors contribute to the robust growth of Brazil’s water pump market. The government’s commitment to enhancing water supply and sanitation infrastructure, exemplified by initiatives like the National Basic Sanitation Plan, aims to achieve universal access to clean water and sewage services. This commitment necessitates the deployment of advanced water pumping solutions. Agriculture, a cornerstone of Brazil’s economy, increasingly relies on efficient irrigation systems to boost productivity. The adoption of modern irrigation techniques, including drip and sprinkler systems, has escalated the demand for specialized water pumps. Additionally, the industrial sector’s focus on water recycling and wastewater treatment, driven by environmental regulations and sustainability goals, further propels the market. The integration of energy-efficient and IoT-enabled pumping technologies aligns with these objectives, enhancing operational efficiency and compliance.

Regionally, Brazil’s water pump market exhibits varied dynamics. States such as São Paulo, Minas Gerais, and Rio de Janeiro lead in demand due to their dense industrial activities and urban populations. These areas prioritize advanced water management systems to support both residential and industrial needs. In contrast, the agricultural regions of the Northeast and Central-West are experiencing increased adoption of water pumps, particularly solar-powered variants, to support irrigation in remote areas. Government subsidies and initiatives promoting renewable energy solutions have facilitated this transition. Furthermore, the southern states, including Rio Grande do Sul and Paraná, are investing in flood control and drainage infrastructure, necessitating robust pumping systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Brazil’s water pump market was valued at USD 1,560.80 million in 2023 and is projected to reach USD 2,165.00 million by 2032, growing at a CAGR of 3.7%.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Government initiatives like the National Basic Sanitation Plan are driving large-scale infrastructure upgrades, creating consistent demand for high-capacity pumping systems.

- Agricultural irrigation is a major growth driver, especially in the Central-West and Northeast regions, where adoption of solar and automated pumps is expanding rapidly.

- The industrial and commercial sectors are increasingly adopting advanced water pumps to support water reuse, wastewater treatment, and HVAC systems in urban developments.

- Technological advancements, including IoT integration, smart sensors, and energy-efficient designs, are reshaping market preferences across industries and municipalities.

- Market growth faces challenges such as high initial investment costs, limited access in remote regions, and a shortage of trained technical personnel.

- Regionally, São Paulo, Minas Gerais, and Rio de Janeiro lead in demand, while the South and Central-West are emerging due to their agricultural and infrastructure development focus.

Market Drivers:

Infrastructure Development and Government Initiatives

Brazil’s significant investments in infrastructure modernization have become a major catalyst for the water pump market. The government’s National Basic Sanitation Plan (PLANSAB) outlines ambitious targets to provide universal access to water supply and sewage services by 2033. For instance, the German development agency GIZ has partnered with Brazilian utilities to implement energy efficiency improvements in water supply systems. This initiative has stimulated demand for efficient and high-capacity water pumping systems across municipalities, particularly in underserved rural and semi-urban regions. As local and federal authorities allocate funds toward the construction and rehabilitation of water treatment facilities, reservoirs, and sewage systems, the need for reliable pumping solutions continues to grow. Furthermore, public-private partnerships are playing a crucial role in accelerating the deployment of advanced pump technologies to support these infrastructure projects.

Agricultural Irrigation Demand

Agriculture remains one of the most vital sectors in Brazil’s economy, accounting for a substantial share of GDP and employment. To sustain crop yields and combat seasonal water scarcity, the adoption of modern irrigation systems has increased. Efficient water pumps, particularly submersible and centrifugal variants, are critical to these irrigation setups. The Central-West and Northeast regions, where agribusiness is rapidly expanding, have witnessed a surge in demand for robust and energy-efficient pumping systems to support sugarcane, soybean, and corn cultivation. Additionally, government-backed rural electrification programs and subsidies for sustainable farming practices are facilitating the uptake of automated and solar-powered water pumps among small- and medium-scale farmers. For instance, the More Water Program (Programa Mais Água) by Brazil’s Ministry of Agriculture provides subsidies and technical support for the installation of solar-powered irrigation pumps in drought-prone regions like the Northeast.

Industrial and Commercial Sector Growth

Brazil’s industrial sector has also emerged as a prominent contributor to the rising demand for water pumps. Industries such as mining, food and beverage, pulp and paper, and petrochemicals rely heavily on water management systems for operations including cooling, processing, and waste discharge. As these industries modernize their infrastructure to comply with environmental regulations and improve operational efficiency, they are increasingly investing in technologically advanced water pump solutions. The trend towards water reuse and zero-liquid discharge processes further reinforces the need for specialized pumping equipment in industrial plants. Moreover, commercial developments such as shopping malls, office complexes, and high-rise residential buildings are fueling demand for compact, noise-reducing, and energy-efficient pumps for HVAC and water supply systems.

Sustainability and Technological Advancements

Environmental concerns and the global push for sustainability are influencing Brazil’s water pump market dynamics. The integration of energy-efficient and environmentally friendly pump technologies is gaining momentum, particularly among industries and municipalities aiming to reduce energy consumption and carbon emissions. Manufacturers are focusing on innovations such as variable frequency drives (VFDs), smart sensors, and Internet of Things (IoT)-based monitoring systems to enhance pump performance and automate maintenance processes. In addition, the country’s increasing interest in solar-powered water pumps aligns with its broader renewable energy goals. These innovations not only support regulatory compliance but also reduce operational costs, thereby encouraging adoption across sectors. As digital transformation reshapes infrastructure and utility operations, the water pump market in Brazil is positioned to benefit significantly from the convergence of sustainability and technology.

Market Trends:

Surge in Positive Displacement Pump Adoption

The Brazilian water pump market is experiencing a noticeable increase in the adoption of positive displacement pumps. These pumps are gaining preference in sectors that require precise fluid handling, such as oil and gas, food processing, and pharmaceuticals. Their ability to maintain constant flow regardless of pressure variations makes them suitable for specialized applications. This trend marks a gradual shift from the dominance of traditional centrifugal pumps, indicating evolving operational needs across industrial processes.

Integration of Smart Pumping Technologies

Technological innovation continues to influence the Brazilian water pump market, with an increasing number of industries and municipalities adopting smart pumping systems. The integration of Internet of Things (IoT) features and automation tools enables real-time monitoring and diagnostics, which help prevent equipment failure and optimize energy usage. For instance, Saneago, a major water and wastewater company in Brazil, implemented ABB’s smart drives, motors, and sensors, achieving a 25% reduction in energy costs at four key pumping stations. These advancements are particularly relevant in sectors where operational continuity and efficiency are critical. As digital transformation progresses, smart water pumps are becoming a standard component in modern infrastructure systems.

Expansion of Residential Water Pump Applications

Residential applications are contributing to the evolving demand landscape for water pumps in Brazil. As urban and semi-urban areas grow, households seek efficient solutions for domestic water supply, pressure boosting, rainwater harvesting, and small-scale irrigation. For instance, Grundfos introduced the SCALA2 pump system in Brazilian residential markets, offering constant water pressure, low-noise operation, and automatic speed adjustment based on household demand. Compact design, low noise levels, and energy efficiency have become key considerations among consumers. In response, manufacturers are focusing on user-friendly and low-maintenance residential pump models that cater to daily household requirements.

Emphasis on Energy Efficiency and Regulatory Compliance

Environmental awareness and regulatory oversight are shaping product development strategies in the water pump market. There is a growing emphasis on manufacturing pumps that minimize energy consumption while maintaining durability and performance. Companies are aligning their offerings with national energy efficiency standards and environmental guidelines, ensuring their products meet compliance expectations. This focus on sustainability not only supports environmental goals but also helps end users manage long-term operational costs, reinforcing the value of energy-conscious pumping systems across sectors.

Market Challenges Analysis:

High Initial Investment and Installation Costs

One of the primary restraints in the Brazil water pump market is the high upfront cost associated with the procurement and installation of advanced pumping systems. While energy-efficient and smart pumps offer long-term operational benefits, their initial pricing can deter adoption, especially among small-scale farmers and residential users. The cost of integrating automation technologies, sensors, and IoT-based monitoring tools further adds to the financial burden. For budget-constrained segments, these expenses limit the transition from conventional systems to modern pump technologies.

Limited Access in Remote and Underdeveloped Regions

Despite the growing demand for water pumps across various sectors, accessibility remains a major challenge in remote and underdeveloped regions of Brazil. For example, the Brazilian Cisterns Program has installed rainwater harvesting systems with electric pumps to improve water access in riverine communities. However poor infrastructure, inconsistent electricity supply, and limited distribution networks hinder the effective deployment and maintenance of water pump systems. In regions where agriculture heavily depends on irrigation, these limitations reduce efficiency and productivity. Additionally, logistical challenges contribute to higher transportation costs and delay in equipment servicing, further affecting market penetration in these areas.

Shortage of Skilled Technical Workforce

The operation and maintenance of advanced water pumping systems require a skilled technical workforce, which remains insufficient in certain parts of Brazil. As manufacturers introduce more complex systems involving automation and digital monitoring, the need for trained professionals becomes more pronounced. The lack of adequate training programs and technical support services impedes optimal usage, increases downtime, and leads to inefficient operations. This skills gap presents a barrier to technology adoption and limits the benefits that modern water pump solutions can offer.

Fluctuations in Raw Material Prices

Volatility in the prices of raw materials such as stainless steel, aluminum, and plastic affects the manufacturing cost of water pumps. These fluctuations impact production planning and profitability, compelling manufacturers to adjust pricing strategies, which can, in turn, influence customer purchasing behavior and slow market growth.

Market Opportunities:

The Brazil water pump market presents significant opportunities driven by the country’s expanding urban infrastructure and ongoing improvements in water management systems. As municipalities work toward enhancing access to clean water and sanitation under national initiatives, the demand for efficient water pumping solutions is expected to increase. Urbanization and the development of smart cities create favorable conditions for the integration of intelligent pump systems that support real-time monitoring and energy optimization. These dynamics provide an opening for manufacturers to introduce technologically advanced, energy-efficient pumps tailored for municipal and residential applications.

In addition, the growing emphasis on sustainable agriculture and renewable energy opens further opportunities within the agricultural segment. The increasing adoption of solar-powered water pumps offers a sustainable and cost-effective solution for irrigation in remote and off-grid areas, aligning with government goals to reduce reliance on conventional energy sources. Brazil’s diverse climate and vast agricultural landscape present strong potential for market expansion through the deployment of specialized irrigation systems. Companies that invest in localized manufacturing, product customization, and training services can tap into this unmet demand and build a strong presence in both rural and semi-urban markets.

Market Segmentation Analysis:

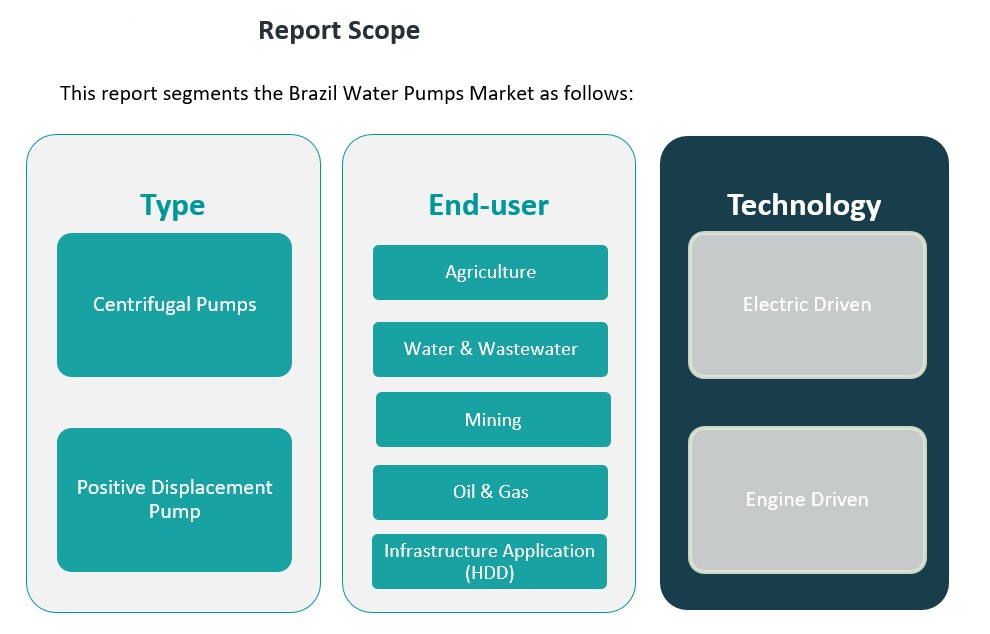

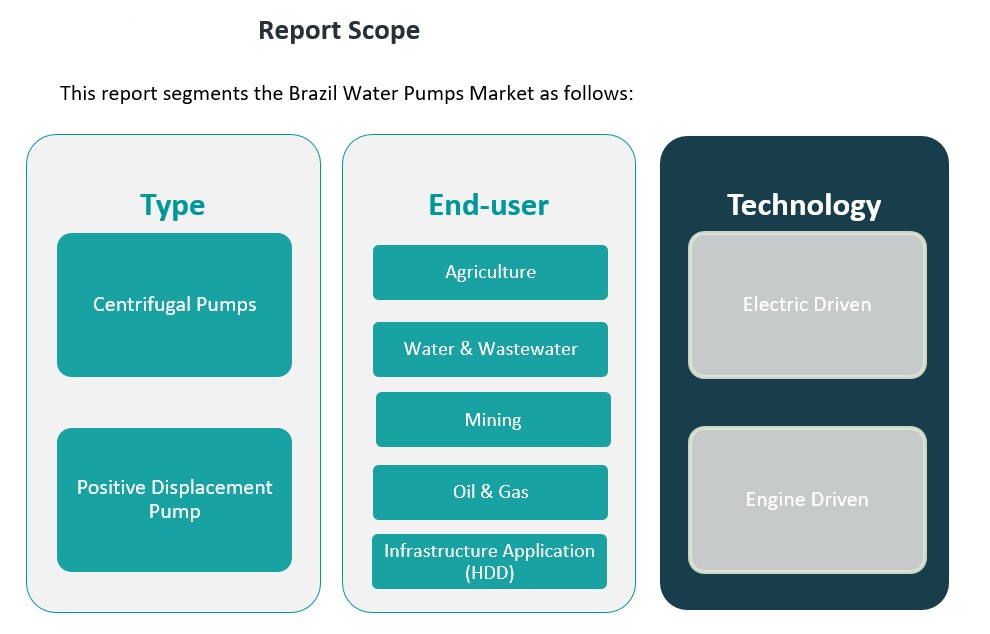

The Brazil water pump market is segmented by type, end-user, and technology, each contributing uniquely to the overall market dynamics.

By type, centrifugal pumps dominate the landscape due to their broad applicability in water transfer, irrigation, and wastewater treatment. Their ease of operation and cost-effectiveness make them suitable for both residential and municipal uses. However, positive displacement pumps are gaining traction in industries requiring consistent flow rates, such as oil & gas and food processing, where precision and pressure control are critical.

By end-user, agriculture remains a key segment, with widespread use of pumps for irrigation and livestock watering. The water and wastewater segment also commands a substantial share, driven by public and private investments in sanitation infrastructure. The mining and oil & gas sectors rely on heavy-duty pumps to manage dewatering, slurry handling, and fluid transfer, which demands robust and durable systems. Additionally, the infrastructure application segment, particularly horizontal directional drilling (HDD), is emerging as a niche area with growing pump requirements for trenchless utility installations.

By technology perspective, electric-driven pumps lead the market due to their efficiency, reliability, and compatibility with grid infrastructure in urban and peri-urban areas. These systems are preferred for residential, municipal, and industrial installations. Engine-driven pumps, however, serve as an essential solution in remote regions and during emergency or off-grid operations, particularly in agricultural and mining sites. As technology evolves, hybrid models and solar-integrated systems are expected to gain momentum, diversifying the technological landscape of Brazil’s water pump market.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

Brazil’s water pump market exhibits distinct regional dynamics, influenced by varying levels of industrialization, agricultural activity, and infrastructure development across the country.

Southeast Region

The Southeast region, encompassing states like São Paulo, Rio de Janeiro, and Minas Gerais, stands as the most significant contributor to the water pump market. This region’s advanced industrial base, extensive urban infrastructure, and substantial investments in water and wastewater management drive the demand for both centrifugal and positive displacement pumps. The concentration of manufacturing industries and urban centers necessitates efficient water management systems, bolstering the market’s growth in this area.

South Region

The South region, including Paraná, Santa Catarina, and Rio Grande do Sul, holds a notable share of the market. This area’s robust agricultural sector, particularly in grain and livestock production, relies heavily on efficient irrigation systems, thereby increasing the demand for water pumps. Additionally, the region’s commitment to sustainable practices and renewable energy sources, such as solar-powered pumps, further stimulates market growth.

Central-West Region

The Central-West region, comprising Mato Grosso, Mato Grosso do Sul, Goiás, and the Federal District, is experiencing rapid growth in the water pump market. This expansion is primarily driven by the region’s agricultural activities, especially in soybean and corn cultivation, which require advanced irrigation solutions. The adoption of modern farming techniques and the development of agribusiness infrastructure contribute to the increasing demand for water pumps in this area.

Northeast Region

The Northeast region, including states like Bahia, Pernambuco, and Ceará, presents emerging opportunities in the water pump market. Despite facing challenges such as water scarcity and limited infrastructure, initiatives aimed at improving water access and agricultural productivity are fostering the adoption of water pumping solutions. The implementation of government programs focused on rural development and water resource management is expected to enhance market penetration in this region.

North Region

The North region, encompassing states like Amazonas, Pará, and Rondônia, currently represents a smaller portion of the water pump market. However, ongoing efforts to develop infrastructure, improve water supply systems, and support sustainable agriculture are anticipated to gradually increase the demand for water pumps in this area. The region’s vast natural resources and emphasis on environmental conservation may also drive the adoption of energy-efficient and eco-friendly pumping technologies.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- EBARA Corporation

- Ruhrpumpen

- Wilo Brasil

Competitive Analysis:

The Brazil water pump market is characterized by intense competition among both domestic and international players, each striving to strengthen their market presence through product innovation, strategic partnerships, and geographic expansion. Leading global manufacturers focus on introducing energy-efficient and technologically advanced pumps to meet evolving consumer demands across industrial, municipal, and agricultural sectors. Companies such as Grundfos, Xylem Inc., KSB, and Sulzer maintain a strong footprint by leveraging their extensive distribution networks and after-sales services. Meanwhile, regional players contribute significantly by offering cost-effective solutions tailored to local requirements. The competitive landscape is further shaped by investments in R&D and digital integration, as manufacturers prioritize smart pumping systems and sustainability-driven offerings. As the market evolves, companies that align with regulatory standards, environmental goals, and customer-centric innovations are expected to retain a competitive edge and expand their market share across Brazil’s diverse regional segments.

Recent Developments:

- In April 2025, the Brazilian government announced plans to auction a public-private partnership (PPP) for the São Francisco River Integration Project in November 2025. This project involves a private sector investment of $2.76 billion to expand water transfer infrastructure in the Northeast region. The initiative aims to boost pumping capacity and streamline operations, marking a significant step in Brazil’s water infrastructure development.

- In January 2024, Atlas Copco completed the acquisition of Kracht GmbH, a global manufacturer specializing in external gear pumps, fluid measurement systems, valves, hydraulic drives, and dosing systems. This acquisition enhances Atlas Copco’s portfolio in the water pump market by integrating Kracht GmbH’s expertise into its operations.

- On December 11, SLB secured an $800 million integrated services contract with Petrobras to oversee the construction of over 100 deepwater wells in offshore Brazil. This three-year contract, starting in April 2025, will utilize advanced drilling and cementing technologies across multiple basins, emphasizing local content and operational efficiency

Market Concentration & Characteristics:

The Brazil water pump market displays a moderately concentrated structure, with a mix of established multinational corporations and regional manufacturers operating across various segments. While a few leading players dominate in terms of technology, distribution reach, and brand recognition, a significant portion of the market remains fragmented due to the presence of local firms catering to specific regional and sectoral needs. The market is highly driven by end-user diversity, with applications spanning agriculture, municipal water supply, wastewater treatment, and industrial processing. Product differentiation, energy efficiency, and compliance with environmental regulations are key competitive characteristics. Additionally, customer preferences increasingly favor pumps that offer automation, low maintenance, and long operational life. With rising demand across rural and urban sectors, the market encourages innovation and localized manufacturing. Overall, the Brazil water pump market reflects a dynamic landscape shaped by both large-scale industrial demand and growing adoption in decentralized, small-scale applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Technological advancements will drive the adoption of smart and automated water pump systems.

- Expansion of solar-powered pumps will support sustainable agricultural irrigation.

- Increasing urbanization will boost demand for efficient municipal water and wastewater solutions.

- Infrastructure development projects will create consistent demand across residential and commercial sectors.

- Government initiatives targeting water access and sanitation will enhance public sector procurement.

- Industrial sectors such as oil & gas and mining will require more specialized, high-capacity pumps.

- Rising energy efficiency standards will accelerate the shift toward eco-friendly pump models.

- Improved access to electricity in rural areas will support the growth of electric-driven pump installations.

- Local manufacturing capabilities are expected to expand, supporting price competitiveness and customization.

- Growth in e-commerce and digital distribution will improve pump availability across remote regions.