Market Overview

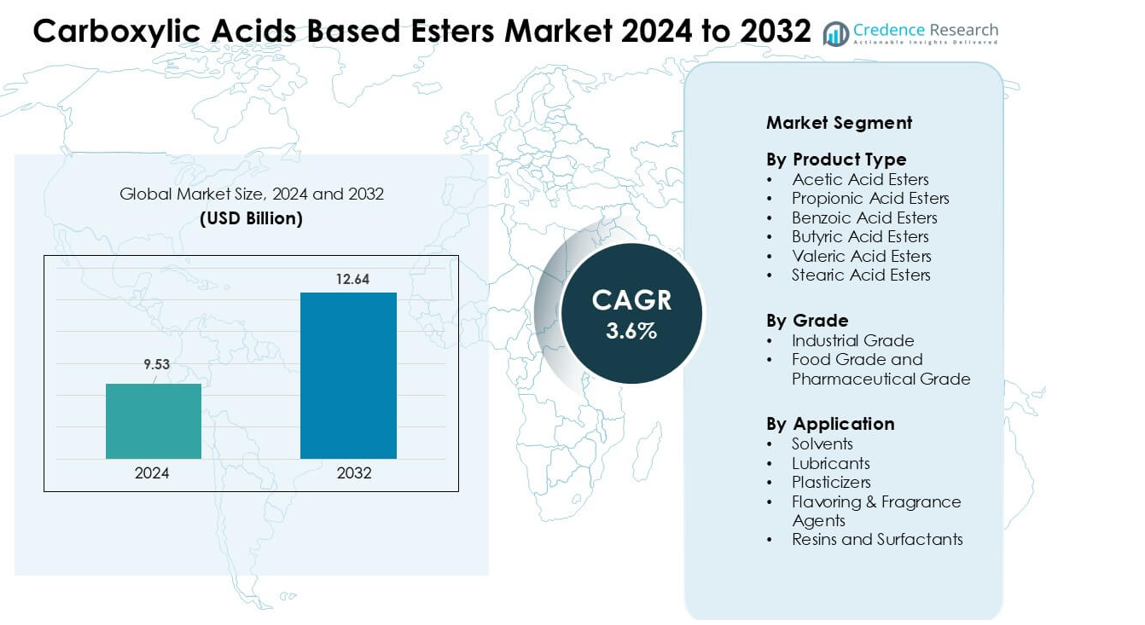

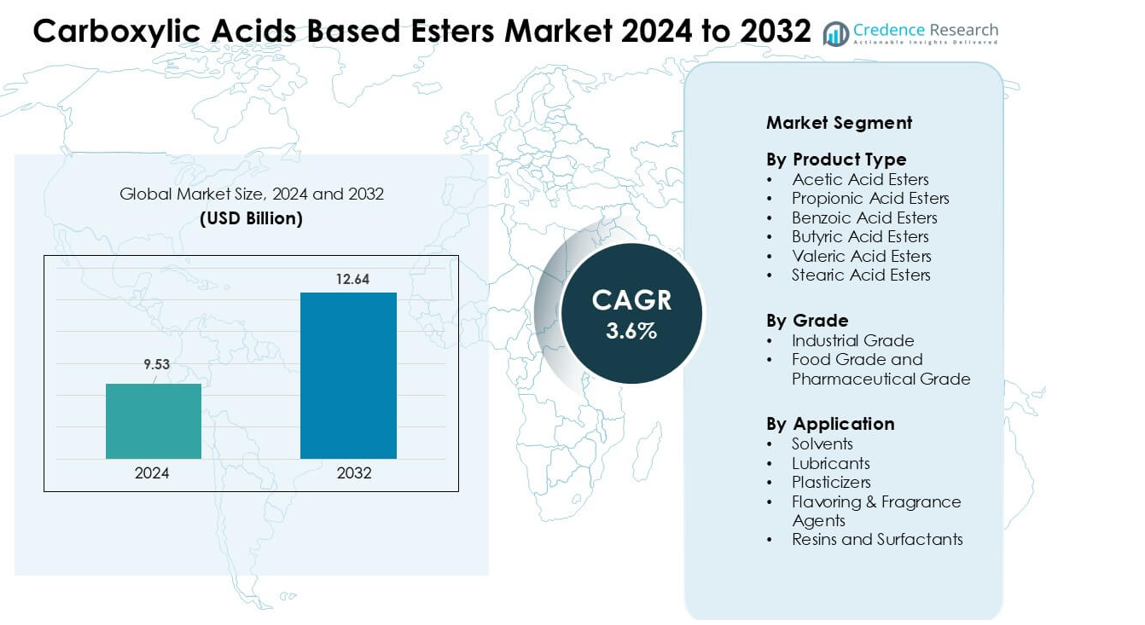

Carboxylic Acids Based Esters Market was valued at USD 9.53 billion in 2024 and is anticipated to reach USD 12.64 billion by 2032, growing at a CAGR of 3.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Carboxylic Acids Based Esters Market Size 2024 |

USD 9.53 billion |

| Carboxylic Acids Based Esters Market, CAGR |

3.6% |

| Carboxylic Acids Based Esters Market Size 2032 |

USD 12.64 billion |

The Carboxylic Acids Based Esters Market is shaped by major companies including Perstorp Holding AB, Yip’s Chemical Holdings Limited, Dow Inc., BASF SE, Jiangsu SOPO (Group) Co., Ltd., Celanese Corporation, Sasol, Wacker Chemie AG, Eastman Chemical Company, and LyondellBasell Industries N.V. These players compete through broad ester portfolios, strong global distribution, and steady investment in high-purity, low-VOC, and bio-based formulations. Their focus on coatings, lubricants, flavoring agents, and personal care applications strengthens market presence across industries. Asia-Pacific remained the leading region in 2024 with about 36% share, driven by large chemical production bases, expanding manufacturing activity, and strong demand across packaging, automotive, and consumer goods sectors.

Market Insights

- The Carboxylic Acids Based Esters Market was valued at USD 9.53 billion in 2024 and is projected to reach USD 12.64 billion by 2032, growing at a CAGR of 3.6%.

- Demand grows as solvents lead the segment with about 48% share due to strong use in coatings, adhesives, and inks across construction, packaging, and automotive industries.

- Bio-based ester production and high-purity specialty formulations continue as key trends, driven by sustainability targets and rising demand from food, personal care, and lubricant applications.

- Major companies compete through capacity expansion, renewable feedstock integration, and performance-focused ester portfolios, strengthening supply across industrial and consumer chemical markets.

- Asia-Pacific held the largest regional share at 36% in 2024, followed by North America at 32%, supported by strong chemical manufacturing, expanding packaging demand, and growing consumption of solvent and specialty esters

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Acetic acid esters dominated the product type segment in 2024 with about 42% share, supported by broad use in coatings, inks, and adhesives. These esters offer strong solvency, fast evaporation rates, and compatibility with resins used in packaging and automotive applications. Benzoic and propionic acid esters grew in personal care and food-contact uses due to stable performance and regulatory acceptance. Butyric, valeric, and stearic acid esters expanded in niche lubricant and plasticizer demand. Rising production of flexible packaging and industrial coatings continued to push consumption of acetic acid esters.

- For instance, Celanese Corporation ranks among the world’s largest acetic-acid producers, operating major plants in Clear Lake, Nanjing, and Singapore. The company reports global acetic-acid capacity exceeding 2 million tonnes per year, supporting large-scale production of downstream esters for coatings and adhesive applications.

By Grade

Industrial grade led the grade segment in 2024 with nearly 67% share, driven by heavy use in paints, coatings, adhesives, and cleaning chemicals. This grade benefits from strong growth in construction, packaging, and automotive manufacturing that require high-volume solvent systems. Food and pharmaceutical grade esters increased due to stricter purity standards, clean-label demand, and wider use in flavors, fragrances, and topical formulations. Expanding processed food output and rapid growth in cosmetic formulations supported this grade’s adoption. Industrial grade retained leadership due to large-scale chemical and manufacturing demand.

- For instance, Eastman Chemical Company is a major global producer of acetate-esters and supplies high-purity ethyl acetate across coatings, inks, and adhesives markets. The company offers multiple commercial grades, including Spectro-grade ethyl acetate with 99.9% purity, supporting stringent industrial and specialty-chemical formulations.

By Application

Solvents dominated the application segment in 2024 with about 48% share as manufacturers relied on carboxylic acid esters for controlled evaporation, low toxicity, and strong solvency in coatings, inks, and adhesives. Lubricants grew due to rising demand for synthetic esters in high-temperature and biodegradable formulations. Plasticizers expanded in flexible PVC and packaging applications, while flavoring and fragrance agents gained traction in food and personal care. Resins and surfactants showed steady growth in cleaning and industrial formulations. Solvent demand stayed strongest due to the scale of global coatings and printing markets.

Key Growth Drivers

Growing Use of Esters in Coatings, Adhesives, and Inks

Demand for carboxylic acid–based esters continues to rise as manufacturers expand their use in coatings, adhesives, printing inks, and solvent systems. These esters offer strong solvency, controlled evaporation, and compatibility with acrylic, alkyd, and polyurethane resins. Growth in construction, automotive refinishing, industrial machinery, and packaging boosts consumption of ester-based solvents that enhance flow, gloss, and drying speed. The packaging sector also supports demand as converters upgrade printing systems for better adhesion and lower odor. Environmental pressure to replace harsh solvents encourages companies to adopt esters with lower toxicity profiles, strengthening long-term uptake.

- For instance, BASF SE is recognized as a leading global supplier of ester-based solvents used in paints, coatings, printing inks, and adhesives. BASF produces key esters such as butyl acetate and ethyl acetate at integrated sites like Ludwigshafen, where purity levels routinely exceed 99% to meet industrial coating and ink requirements.

Rising Demand from Food, Personal Care, and Pharmaceutical Applications

Food and pharmaceutical uses are expanding due to the safe profile, neutral odor, and consistent purity of food- and pharma-grade carboxylic acid esters. Flavor and fragrance applications use esters for sweet, fruity, and floral notes that support bakery, beverage, and confectionery launches. Personal care brands rely on esters for emollients, spreadability, and skin-feel enhancement in creams, lotions, and hair products. Clean-label expectations, stricter purity rules, and increased R&D in functional ingredients are encouraging broader adoption. As processed food output grows in Asia-Pacific and premium personal care demand rises in North America and Europe, these esters gain a stronger base.

- For instance, Croda International Plc is a major producer of bio-based and specialty esters used across global beauty and personal-care markets. Croda manufactures emollient esters such as cetyl ethylhexanoate and caprylic/capric triglycerides at facilities that support high-purity cosmetic-grade production, enabling brands to achieve consistent sensory and skin-feel performance.

Shift Toward Biodegradable and High-Performance Lubricant Esters

The lubricant sector is becoming a major driver as industries adopt synthetic ester-based fluids for high-temperature stability, biodegradability, and low volatility. Carboxylic acid esters support performance in aviation oils, compressor fluids, metalworking fluids, and automotive engine oils. Companies seek lubricants that meet environmental rules while maintaining film strength and oxidation resistance. Demand grows further as electric vehicles require advanced thermal-management fluids with better stability and dielectric properties. Industrial automation and wind-energy installations also create strong intake for long-life synthetic lubricants made from high-purity esters.

Key Trends & Opportunities

Expansion of Bio-Based and Renewable Ester Production

Producers are shifting toward bio-based ester manufacturing as industries raise sustainability targets and governments tighten regulations on petrochemical solvents. Bio-derived acetic, propionic, and butyric esters offer lower carbon footprints and align with circular-economy programs across packaging, coatings, and personal care. Higher investment in biomass conversion, enzymatic esterification, and renewable feedstocks expands capacity in Europe, Japan, and the United States. This transition creates opportunities for partnerships with biorefineries and additive manufacturers seeking greener portfolios. Growing corporate commitments to low-VOC and non-hazardous ingredients further accelerate adoption.

- For instance, Cargill strengthened its bio-based esters and solvent portfolio after acquiring Croda’s Performance Technologies and Industrial Chemicals business in 2022, adding high-purity esters and surfactants used in coatings and industrial cleaning. The acquisition expanded Cargill’s bioindustrial platform, enabling broader supply of renewable ester chemistries for large-volume industrial applications.

Technological Advancements in High-Purity and Specialty Esters

Producers are developing high-purity and specialty ester grades with tighter specifications, better oxidative stability, and tailored functional properties. Innovations support sectors such as advanced coatings, EV fluids, medical formulations, and agrochemical delivery systems. Automated purification, continuous esterification, and catalyst optimization improve consistency and lower production costs. This creates opportunities for suppliers to introduce performance-focused ester categories that meet strict purity and sensory needs. Growth in high-value formulations across electronics, aerospace, and premium personal care boosts demand for specialized ester chemistries.

- For instance, Sulzer Chemtech supplies industrial reactive-distillation systems that combine reaction and distillation in one column, a configuration widely used for esterification and hydrolysis processes. The company reports that such integrated systems can improve product purity and reduce energy demand compared to conventional multi-step setups, supporting large-scale production of high-quality esters.

Key Challenges

Volatility in Raw Material Prices and Supply Chains

Producers face frequent price swings in feedstocks such as acetic acid, butyric acid, ethanol, and methanol due to fluctuations in crude oil, natural gas, and agricultural outputs. Geopolitical instability, trade restrictions, and regional supply disruptions increase procurement risks. These factors affect production margins and force manufacturers to adjust pricing strategies. Complex supply chains across Asia-Pacific and Europe add delays, while transportation bottlenecks raise logistics costs. Maintaining stable supply becomes difficult when demand spikes in coatings, lubricants, and personal care markets occur simultaneously.

Regulatory Pressure on VOC Emissions and Safety Compliance

Regulatory bodies continue tightening rules on volatile organic compounds, workplace exposure, and environmental safety. Coating and ink producers face strict limits on solvent emissions in North America and Europe, affecting certain ester formulations. Compliance with REACH, EPA standards, and food-grade safety rules requires constant reformulation and testing. Producers must invest in safer chemistries, improved manufacturing controls, and alternative esters with reduced toxicity. These pressures increase development costs and can slow product approvals, especially in food, pharma, and fragrance applications.

Regional Analysis

North America

North America held about 32% share in 2024, supported by strong demand from coatings, adhesives, lubricants, and personal care manufacturing. The United States drove most consumption due to large-scale construction, packaging, and automotive sectors that rely on ester-based solvents and performance additives. Food-grade and pharmaceutical-grade esters expanded due to rising processed food output and strict purity standards. Growth in renewable and biodegradable ester formulations also strengthened market stability as producers aligned with tightening VOC and sustainability regulations. Canada showed steady uptake in industrial lubricants and specialty chemicals.

Europe

Europe captured nearly 28% share in 2024, driven by high adoption of specialty esters across coatings, automotive lubricants, and premium personal care products. Germany, France, and the U.K. led consumption due to advanced manufacturing bases and strict regulatory focus on low-VOC and bio-based chemicals. Producers invested in renewable feedstock technologies and high-purity ester production to meet REACH and sustainability goals. Expanding demand for flavoring and fragrance esters in food processing and cosmetics strengthened regional growth. Eastern Europe added moderate volume due to rising industrial activity.

Asia-Pacific

Asia-Pacific dominated the global market with about 36% share in 2024, supported by rapid industrialization, large chemical production bases, and expanding packaging and automotive manufacturing in China, India, Japan, and South Korea. Strong demand for ester solvents in paints, coatings, and adhesives boosted growth, while rising personal care and processed food consumption increased use of flavoring and emollient esters. The region also benefited from growing investments in bio-based chemical production. Export-oriented manufacturing hubs strengthened their share due to competitive feedstock availability and expanding downstream industries.

Latin America

Latin America held around 3% share in 2024, driven by stable growth in food processing, packaging, and industrial manufacturing across Brazil, Mexico, and Argentina. Ester demand increased in coatings, adhesives, and lubricants used in construction and automotive repair sectors. Rising consumer spending supported wider use of flavoring and fragrance esters in beverages, bakery products, and personal care items. However, slower industrial expansion and currency fluctuations limited faster growth. Investments in cleaner and low-VOC solvent systems gained interest as regional regulations strengthened.

Middle East & Africa

The Middle East & Africa accounted for about 1% share in 2024, supported by demand from construction, automotive maintenance, and expanding food and personal care markets. GCC countries increased use of ester-based solvents in coatings and adhesives linked to infrastructure development. South Africa and Nigeria showed rising consumption of flavoring and pharmaceutical-grade esters due to growing urban demand. Limited local production and reliance on imports restricted higher market penetration, while regulatory changes encouraged adoption of safer and more efficient ester formulations.

Market Segmentations:

By Product Type

- Acetic Acid Esters

- Propionic Acid Esters

- Benzoic Acid Esters

- Butyric Acid Esters

- Valeric Acid Esters

- Stearic Acid Esters

By Grade

- Industrial Grade

- Food Grade and Pharmaceutical Grade

By Application

- Solvents

- Lubricants

- Plasticizers

- Flavoring & Fragrance Agents

- Resins and Surfactants

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Carboxylic Acids Based Esters Market includes key companies such as Perstorp Holding AB, Yip’s Chemical Holdings Limited, Dow Inc., BASF SE, Jiangsu SOPO (Group) Co., Ltd., Celanese Corporation, Sasol, Wacker Chemie AG, Eastman Chemical Company, and LyondellBasell Industries N.V. These companies compete through large-scale production capacities, diverse ester portfolios, and strong supply chains serving coatings, adhesives, lubricants, food, and personal care industries. Leading producers invest in bio-based feedstocks, high-purity ester technologies, and low-VOC formulations to meet global sustainability and regulatory requirements. Strategic mergers, regional capacity expansions, and long-term partnerships with downstream manufacturers strengthen market reach. Rising demand for solvent esters, specialty esters, and food-grade formulations drives companies to enhance R&D, improve process efficiency, and introduce performance-driven variants tailored to industrial, cosmetic, and pharmaceutical applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Perstorp formally launched a new portfolio of saturated synthetic polyol esters under the Synthetic‑EF brand (Synthetic‑EF 5, Synthetic‑EF 15, Synthetic‑EF 22), aimed at the lubricant industry. These are biodegradable, REACH‑registered, and designed for high performance across temperature ranges.

- In May 2025, Wacker Chemie AG started hybrid polymer production at its Nünchritz, Germany site, expanding binder capacity for high-performance adhesives and sealants used in construction and industrial coatings based on carboxylic acid ester chemistry.

- In March 2025, BASF’s Coatings division expanded production capacity at its Caojing plant (Shanghai, China) increasing capacity for polyester and polyurethane resins (used in automotive coatings). This expansion may indirectly support ester‑based resin demand in Asia-Pacific.

Report Coverage

The research report offers an in-depth analysis based on ProductType, Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for solvent esters will rise as coatings and adhesives production expands.

- Bio-based ester development will accelerate due to global sustainability goals.

- High-purity esters will gain traction in pharmaceutical and personal care formulations.

- Synthetic ester lubricants will see stronger adoption in EVs and industrial automation.

- Regulatory pressure will push producers toward low-VOC and safer chemical alternatives.

- Asia-Pacific will strengthen its role as the primary manufacturing hub for ester chemicals.

- Advanced ester technologies will support growth in specialty coatings and engineered materials.

- Flavor and fragrance esters will grow with rising processed food and cosmetic demand.

- Capacity expansion and regional integration will shape competitive strategies.

- Partnerships in renewable feedstocks and green chemistry will influence long-term market direction.