Market Overview:

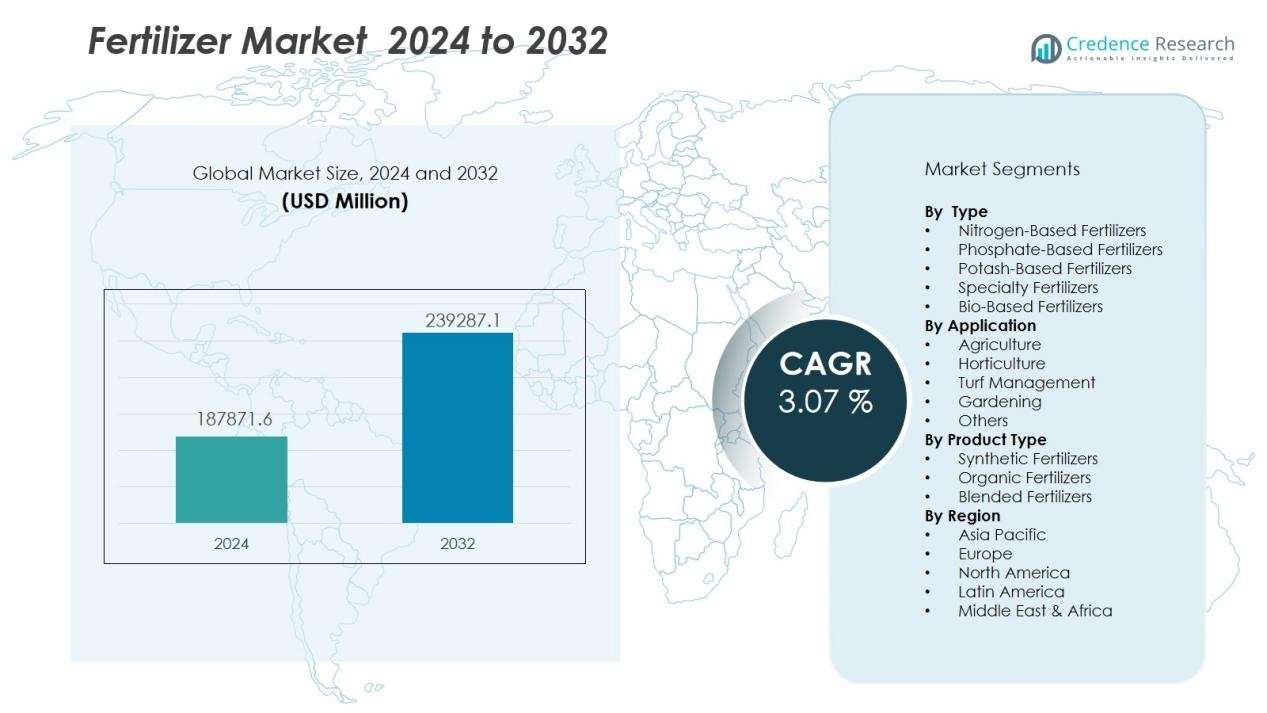

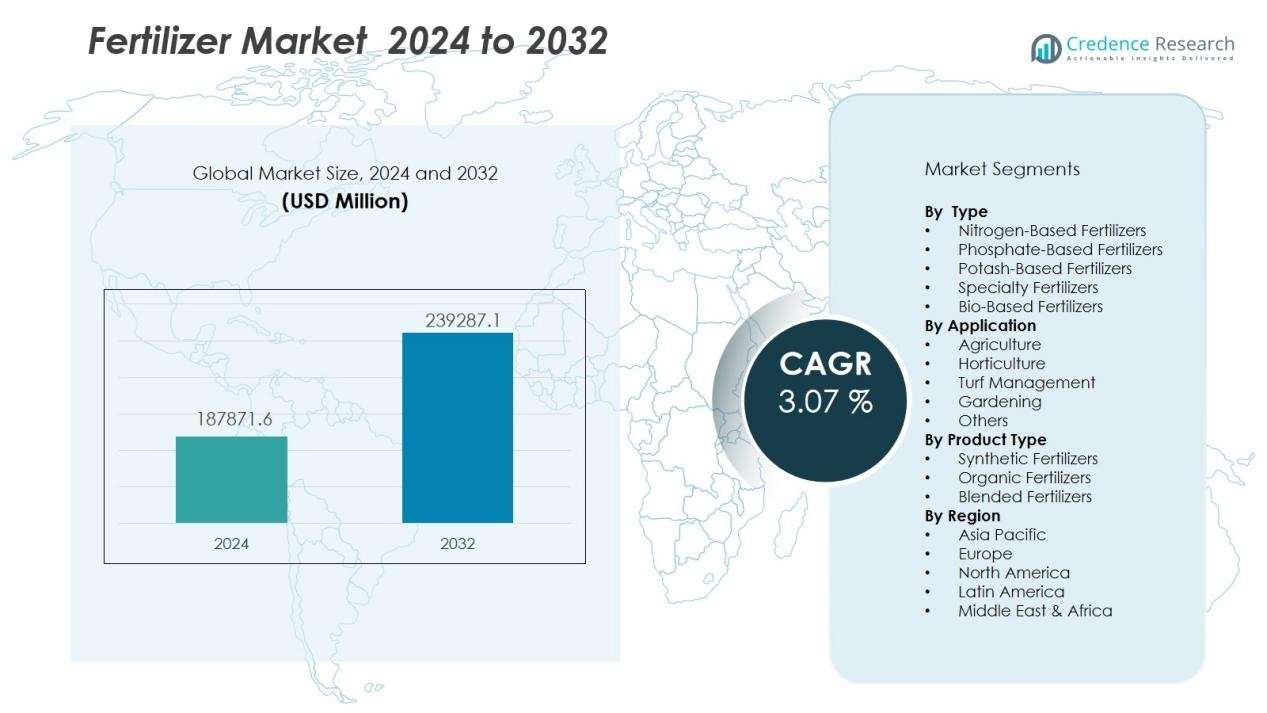

The fertilizer market size was valued at USD 187871.6 million in 2024 and is anticipated to reach USD 239287.1 million by 2032, at a CAGR of 3.07 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fertilizers Market Size 2024 |

USD 187871.6 Million |

| Fertilizers Market, CAGR |

3.07 % |

| Fertilizers Market Size 2032 |

USD 239287.1 Million |

Market growth is primarily driven by the rising global population, which continues to increase food demand, thereby intensifying agricultural production requirements. Technological advancements in fertilizer formulation, such as slow-release and bio-based variants, are improving nutrient efficiency and reducing environmental impact. Additionally, government initiatives promoting balanced fertilizer use, coupled with the adoption of precision farming techniques, are fueling demand. Expanding horticulture and commercial crop cultivation further contribute to market expansion.

Regionally, Asia-Pacific dominates the fertilizer market due to its large agricultural base, high crop diversity, and strong government support for productivity enhancement in countries like China and India. North America and Europe show steady growth, driven by advanced farming practices and a shift toward sustainable inputs. Emerging markets in Latin America and Africa present significant growth opportunities due to increasing arable land utilization and improving agricultural infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The fertilizer market was valued at USD 187,871.6 million in 2024 and is expected to reach USD 239,287.1 million by 2032, growing at a CAGR of 3.07% during 2024–2032.

- Rising global population and urbanization are driving higher agricultural output, increasing the demand for efficient nutrient application to maximize yields from limited farmland.

- Adoption of eco-friendly and specialty fertilizers, including bio-based, slow-release, and micronutrient-enriched variants, is expanding due to sustainability goals and stricter regulations.

- Government subsidies, training programs, and balanced nutrient application policies are enhancing accessibility and promoting modern agricultural practices.

- Precision agriculture technologies such as GPS mapping, automated spreaders, and soil testing are improving application efficiency and reducing waste.

- Raw material price volatility and supply chain disruptions remain key challenges, impacting production costs and farmer affordability in several regions.

- Asia-Pacific holds 58% market share, North America 18%, and Europe 15%, with Asia-Pacific leading due to large agricultural output and strong government support, while North America and Europe focus on advanced farming and sustainable fertilizer solutions.

Market Drivers:

Rising Global Population and Increasing Food Demand:

The fertilizer market is witnessing strong demand driven by the steady growth of the global population, which is projected to surpass 9 billion by 2050. Higher population levels require increased agricultural productivity to ensure food security. Fertilizers play a crucial role in replenishing essential soil nutrients and improving crop yields. It supports large-scale production of staple crops such as wheat, rice, and maize, which are essential to feeding growing populations. Expanding urbanization is also reducing available farmland, making efficient nutrient application critical to maximizing output from limited agricultural land.

- For instance, the fertilizer market is witnessing strong demand driven by the steady growth of the global population, which is projected to surpass 9 billion by 2050. Higher population levels require increased agricultural productivity to ensure food security.

Shift Toward Sustainable and Specialty Fertilizer Solutions:

Growing environmental concerns and stricter regulations are accelerating the adoption of eco-friendly fertilizers, including bio-based and slow-release formulations. Farmers and agribusinesses are increasingly adopting products that reduce nutrient runoff and improve soil health. The fertilizer market is adapting to these changes by investing in advanced formulations that deliver nutrients more efficiently. It is driving innovation in micronutrient blends and water-soluble variants that align with sustainable farming practices. This shift ensures long-term soil productivity while minimizing ecological impact.

- For instance, a 2022 study demonstrated that fully biodegradable poly(3-hydroxybutyrate) (P3HB)-coated calcium ammonium nitrate pellets released only 20% of their ammonium nitrate content after 76 days in water, showcasing a high level of controlled nutrient release and reduced leaching risk.

Government Policies and Agricultural Support Programs:

Government subsidies, grants, and educational initiatives are boosting fertilizer adoption across both developed and developing regions. Many countries are implementing programs to promote balanced nutrient application and discourage overuse. The fertilizer market benefits from such interventions, as they improve access to quality inputs and promote efficient agricultural practices. It enables smallholder farmers to adopt modern crop management techniques. These policies are critical in ensuring consistent demand and supporting rural economic growth.

Expansion of Precision Agriculture and Advanced Farming Technologies:

The rise of precision agriculture is transforming fertilizer application methods through data-driven decision-making. Farmers are now using GPS mapping, soil testing, and automated spreaders to optimize nutrient delivery. The fertilizer market is leveraging this trend by offering products compatible with variable-rate application systems. It enhances yield potential while reducing input costs and environmental waste. Integration with digital agriculture platforms further strengthens efficiency and market adoption.

Market Trends:

Growing Adoption of Bio-Based and Specialty Fertilizers:

The fertilizer market is experiencing a significant shift toward bio-based, organic, and specialty formulations to meet sustainability goals and regulatory requirements. Rising awareness of soil health and environmental preservation is encouraging farmers to reduce reliance on conventional chemical fertilizers. Manufacturers are introducing innovative products such as controlled-release, water-soluble, and micronutrient-enriched fertilizers to improve nutrient efficiency. It is driving demand in high-value crop segments, including fruits, vegetables, and horticulture. The adoption of biofertilizers is also supported by government incentives and organic farming certifications. This trend aligns with global efforts to reduce greenhouse gas emissions and mitigate the environmental footprint of agriculture.

- For instance, Novozymes BioAg’s BioniQ® biofertilizer increased wheat yields by 3.8 bushels per acre on average across 35 field trials conducted over four years.

Integration of Digital Technologies and Precision Agriculture:

Technological advancements are reshaping fertilizer production, distribution, and application processes. The fertilizer market is embracing precision agriculture tools that utilize GPS, drones, and IoT-enabled sensors to optimize nutrient application. Farmers are increasingly using data analytics and soil mapping to tailor fertilizer use according to crop-specific needs, improving yield and reducing waste. It enhances cost efficiency while addressing sustainability concerns. Integration with digital platforms also facilitates real-time monitoring and automated application, further streamlining operations. Growing collaborations between agri-tech companies and fertilizer producers are accelerating innovation and improving market penetration. This trend positions technology-driven fertilizer solutions as a cornerstone of modern agriculture.

- For instance, OCP Group partnered with data scientists at MIT and UM6P to develop analytics platforms for African farmers, directly supporting more precise fertilizer usage and contributing to higher food production at scale.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Disruptions:

The fertilizer market faces significant pressure from fluctuating prices of key raw materials such as natural gas, phosphate rock, and potash. Geopolitical tensions, trade restrictions, and transportation bottlenecks often disrupt supply availability and cost stability. It impacts production planning and creates uncertainties for both manufacturers and end-users. Sudden price spikes can lead to reduced affordability for farmers, particularly in developing regions. Dependence on imports for critical inputs further exposes the market to foreign exchange risks. Managing these challenges requires strategic sourcing and greater investment in local production capacities.

Environmental Regulations and Sustainability Pressures:

Stricter environmental regulations on nutrient runoff, emissions, and chemical usage are challenging conventional fertilizer production and application methods. The fertilizer market must adapt to evolving compliance requirements that demand innovation in eco-friendly formulations. It increases R&D costs and can slow product approvals in certain regions. Farmers are also under pressure to adopt sustainable practices, which may limit the use of certain high-impact fertilizers. Balancing productivity goals with environmental safeguards remains a complex task. Companies must invest in sustainable technologies to meet both regulatory and consumer expectations while maintaining profitability.

Market Opportunities:

Rising Demand for Specialty and Value-Added Fertilizers:

The fertilizer market has significant growth potential in the specialty and value-added segment, including controlled-release, water-soluble, and micronutrient-enriched products. Increasing adoption of high-value crops such as fruits, vegetables, and ornamental plants is driving the need for targeted nutrient solutions. It enables farmers to optimize yields while maintaining soil health and reducing environmental impact. Expanding organic farming practices and consumer demand for chemical-free produce are boosting opportunities for biofertilizers. Manufacturers that innovate in nutrient efficiency and crop-specific formulations can capture strong market share. Government incentives for sustainable agriculture further enhance this opportunity.

Expansion in Emerging Agricultural Economies:

Rapid agricultural development in emerging markets offers substantial opportunities for fertilizer producers. Countries in Asia-Pacific, Africa, and Latin America are investing in modern farming infrastructure, irrigation systems, and precision agriculture technologies. The fertilizer market benefits from these developments through increased adoption of advanced nutrient solutions. It also gains from rising awareness of balanced fertilizer use among smallholder farmers. Strategic partnerships with local distributors and governments can improve accessibility and brand presence. Increasing export potential for high-quality fertilizers in these regions strengthens long-term growth prospects.

Market Segmentation Analysis:

By Type:

The fertilizer market is segmented into nitrogen-based, phosphate-based, potash-based, and specialty fertilizers. Nitrogen-based fertilizers hold the largest share due to their critical role in promoting rapid crop growth and high yield. Phosphate-based fertilizers are widely used for root development and flowering, particularly in cereal and horticultural crops. Potash-based fertilizers support plant water regulation and disease resistance, while specialty fertilizers, including bio-based and micronutrient-enriched variants, are gaining traction for sustainable farming. It is witnessing increasing demand for controlled-release and water-soluble formulations across high-value crop segments.

- For instance, K+S Potash Canada’s Bethune mine is set to expand its production capacity from approximately 2 million tonnes to 4 million tonnes annually to meet rising demand in sustainable agriculture.

By Application:

Applications include agriculture, horticulture, and others such as turf management and gardening. Agriculture dominates due to the large-scale cultivation of staple crops like wheat, rice, and maize that require intensive nutrient replenishment. Horticulture is expanding with the rising demand for fruits, vegetables, and ornamental plants, boosting specialty fertilizer adoption. It is also benefiting from growth in urban gardening and landscaping, supported by consumer interest in fresh and locally grown produce.

- For instance, CF Industries’ Donaldsonville complex now captures and sequesters up to 2 million metric tons of CO₂ each year, reducing site emissions by 17% and enabling production of 1.9 million tons of low-carbon ammonia annually, a milestone achieved through collaboration with ExxonMobil and EnLink Midstream.

By Product Type:

Product types cover synthetic fertilizers and organic fertilizers. Synthetic fertilizers remain the primary choice for large-scale commercial farming due to their high nutrient concentration and quick results. Organic fertilizers are growing in demand, driven by environmental regulations, organic certification programs, and consumer preference for chemical-free produce. It is also seeing blended product innovations that combine the efficiency of synthetic inputs with the sustainability benefits of organic components.

Segmentations:

By Type:

- Nitrogen-Based Fertilizers

- Phosphate-Based Fertilizers

- Potash-Based Fertilizers

- Specialty Fertilizers

- Bio-Based Fertilizers

By Application:

- Agriculture

- Horticulture

- Turf Management

- Gardening

- Others

By Product Type:

- Synthetic Fertilizers

- Organic Fertilizers

- Blended Fertilizers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 58% market share in the global fertilizer market, driven by its vast agricultural land and high crop diversity. China and India are the largest consumers, supported by strong government policies promoting yield enhancement and food security. The region benefits from extensive cultivation of rice, wheat, and cash crops requiring high nutrient inputs. It experiences steady demand growth from both large-scale farms and smallholder farmers. Adoption of balanced nutrient application and water-soluble fertilizers is increasing due to awareness programs. Strong domestic production capacity and expanding export opportunities further strengthen the region’s leadership.

North America :

North America accounts for 18% market share in the fertilizer market, supported by its highly mechanized and technology-driven agriculture sector. The United States and Canada lead in the adoption of precision farming, enabling efficient fertilizer usage. Demand is driven by large-scale corn, soybean, and wheat cultivation requiring consistent nutrient replenishment. It also benefits from strong research capabilities and innovations in controlled-release and specialty fertilizers. Regulatory frameworks encourage sustainable practices, influencing product development. Stable supply chains and high farmer purchasing power sustain growth momentum in the region.

Europe :

Europe holds 15% market share in the fertilizer market, with strong emphasis on eco-friendly and low-impact nutrient solutions. The European Union’s environmental regulations and Green Deal policies are accelerating the transition to bio-based and specialty fertilizers. Demand is concentrated in countries like France, Germany, and the Netherlands with intensive agricultural practices. It is witnessing growth in organic farming and reduced reliance on conventional fertilizers. Collaboration between fertilizer producers and agri-tech companies supports innovation in nutrient efficiency. Strong export links with Eastern Europe and Africa enhance regional competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bunge Ltd.

- EuroChem Group AG

- GUBRETAS

- CF Industries Holdings Inc.

- Israel Chemicals Ltd.

- Haifa Negev technologies Ltd.

- KS Aktiengesellschaft

- Indian Farmers Fertiliser Cooperative Ltd.

- Nufarm Ltd.

- OCP Group

- Nutrien Ltd.

- PhosAgro Group of Companies

- Sumitomo Chemical Co. Ltd.

- SQM S.A.

Competitive Analysis:

The fertilizer market is characterized by intense competition among global and regional players offering diverse product portfolios and advanced nutrient solutions. Key companies include Bunge Ltd., EuroChem Group AG, GUBRETAS, CF Industries Holdings Inc., Israel Chemicals Ltd., Haifa Negev Technologies Ltd., KS Aktiengesellschaft, Indian Farmers Fertiliser Cooperative Ltd., and Nufarm Ltd. Leading players focus on expanding production capacities, investing in sustainable and specialty fertilizer innovations, and strengthening distribution networks to enhance market reach. It is also witnessing strategic mergers, acquisitions, and partnerships aimed at improving product efficiency and meeting evolving regulatory requirements. Companies are leveraging precision agriculture technologies and bio-based formulations to differentiate their offerings. Strong R&D capabilities, global supply chain integration, and adaptability to raw material price fluctuations remain critical competitive advantages in sustaining growth and market leadership.

Recent Developments:

- In July 2025, CF Industries began operations at its new carbon dioxide (CO2) dehydration and compression unit at the Donaldsonville Complex, Louisiana, enabling permanent geological sequestration of up to 2million metric tons of CO2 annually in partnership with ExxonMobil.

- In May 2025, Haifa Negev Technologies Ltd. launched a new decentralized power station with a 10MW capacity in partnership with OPC ENERGY, diversifying supply and boosting sustainability for its plant in Israel’s south.

- In June 2024, IFFCO completed the sale of its entire 49% stake in Triumph Offshore Private Ltd. to Swan Energy Ltd. for ₹440 crore, making TOPL a wholly-owned subsidiary of Swan Energy.

Market Concentration & Characteristics:

The fertilizer market displays a moderately consolidated structure, with a mix of global leaders and strong regional players competing for market share. It is characterized by high entry barriers due to capital-intensive production, strict regulatory requirements, and the need for established distribution networks. Leading companies maintain a competitive edge through large-scale manufacturing, diversified product portfolios, and continuous R&D investment in eco-friendly and specialty formulations. The market is highly sensitive to raw material price fluctuations, influencing profitability and pricing strategies. Strategic partnerships, mergers, and acquisitions are common to expand geographical reach and product innovation. Demand patterns remain closely linked to agricultural cycles, climate conditions, and government policies promoting sustainable farming practices.

Report Coverage:

The research report offers an in-depth analysis based on Type Application, Product Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising global food demand will continue to drive the adoption of advanced and sustainable fertilizers.

- Integration of precision agriculture technologies will improve nutrient efficiency and reduce environmental impact.

- Bio-based and organic fertilizers will gain a larger share due to regulatory support and consumer preference for chemical-free produce.

- Expansion of high-value crop cultivation will increase demand for specialty and water-soluble fertilizers.

- Governments will strengthen initiatives promoting balanced nutrient application and soil health management.

- Innovations in controlled-release and micronutrient-enriched formulations will enhance crop productivity.

- Digital platforms will play a greater role in supply chain management and farmer outreach.

- Emerging markets in Asia-Pacific, Africa, and Latin America will present strong growth opportunities through modernization of farming practices.

- Strategic collaborations between fertilizer manufacturers and agri-tech firms will accelerate product development and market penetration.

- Climate change and resource constraints will intensify the focus on sustainable, low-emission fertilizer solutions.