Market Overview

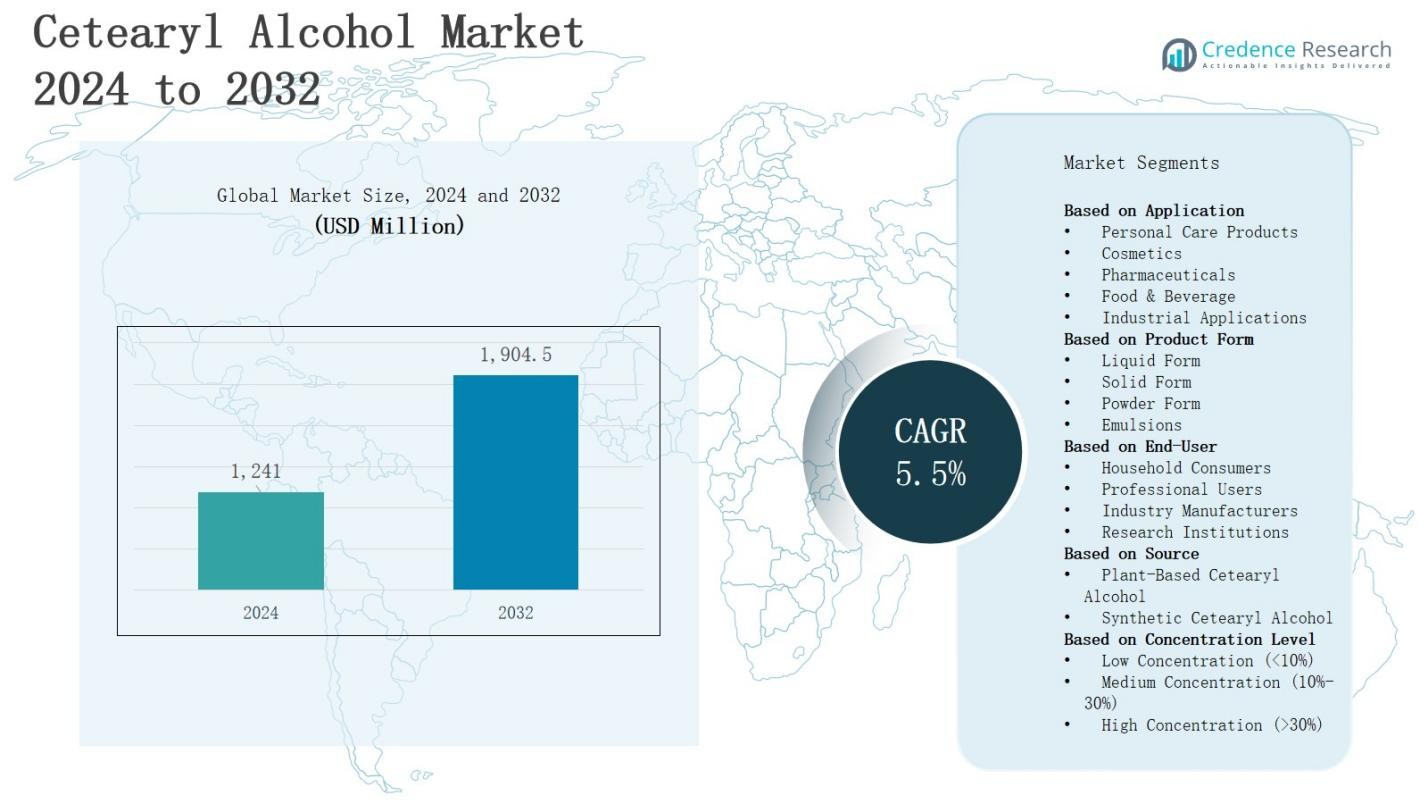

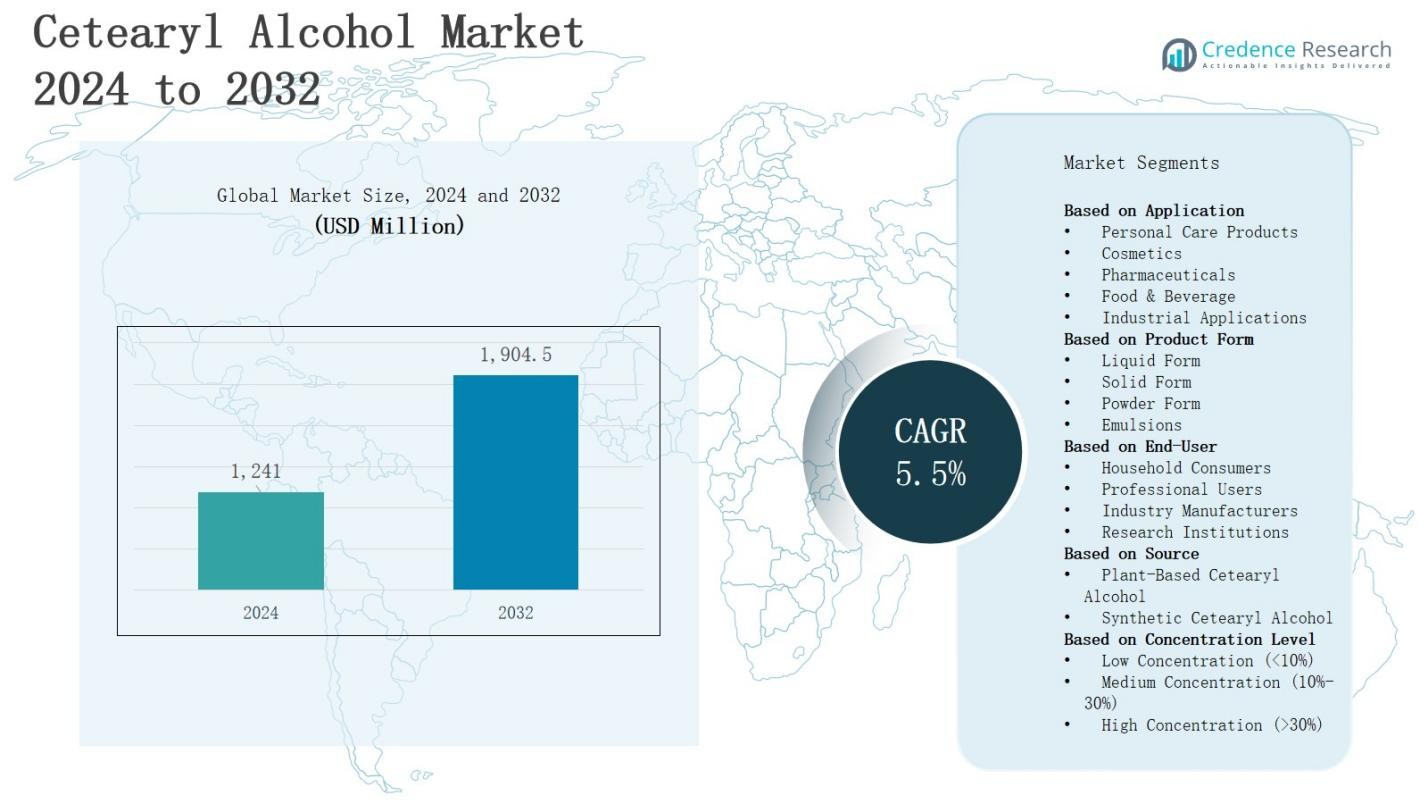

The cetearyl alcohol market is projected to grow from USD 1,241 million in 2024 to USD 1,904.5 million by 2032, registering a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cetearyl Alcohol Market Size 2024 |

USD 1,241 Million |

| Cetearyl Alcohol Market, CAGR |

5.5% |

| Cetearyl Alcohol Market Size 2032 |

USD 1,904.5 Million |

Market growth in the cetearyl alcohol sector is driven by rising demand for personal care and cosmetic products, where it serves as an effective emulsifier, thickener, and emollient. Expanding applications in hair conditioners, skin creams, and pharmaceutical formulations are boosting adoption, supported by consumer preference for natural and plant-derived ingredients. The shift toward sustainable and eco-friendly raw materials is influencing production practices, while advancements in formulation technology enhance product stability and performance. Growing disposable incomes, urbanization, and evolving beauty standards in emerging markets are creating new opportunities, while increasing R&D in multifunctional ingredients shapes the industry’s future direction.

The cetearyl alcohol market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each contributing to global growth through distinct demand patterns. North America and Europe lead with strong personal care and pharmaceutical sectors, while Asia-Pacific shows rapid expansion driven by urbanization and rising incomes. Latin America benefits from growing mid-range and premium beauty markets, and the Middle East & Africa see increasing adoption in premium and affordable segments. Key players include KLK OLEO, HallStar Company, Croda, Lubrizol, Ashland Inc, BASF, Chemyunion, SEPPIC, and Lonza Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cetearyl alcohol market is projected to grow from USD 1,241 million in 2024 to USD 1,904.5 million by 2032, at a CAGR of 5.5%, driven by its multifunctional role in personal care, cosmetics, and pharmaceuticals.

- Rising demand for natural and plant-derived variants supports clean-label trends and boosts adoption in hair conditioners, skin creams, and therapeutic formulations.

- Pharmaceutical applications benefit from its stabilizing and emollient properties, improving product texture, spreadability, and patient comfort.

- Sustainable sourcing from coconut and palm oil, coupled with eco-friendly manufacturing, strengthens brand positioning and regulatory compliance.

- Volatile raw material prices and supply chain disruptions pose challenges, alongside increasing scrutiny on palm oil’s environmental impact.

- North America holds 32% market share, followed by Europe at 28% and Asia-Pacific at 27%, with Latin America and Middle East & Africa holding 7% and 6% respectively.

- Key players include KLK OLEO, HallStar Company, Croda, Lubrizol, Ashland Inc, BASF, Chemyunion, SEPPIC, and Lonza Group, focusing on innovation, sustainability, and regional market expansion.

Market Drivers

Rising Demand from Personal Care and Cosmetics Industry

The cetearyl alcohol market is experiencing strong demand from the personal care and cosmetics industry due to its multifunctional role as an emulsifier, thickener, and emollient. It improves texture, enhances stability, and boosts the sensory appeal of creams, lotions, and hair conditioners. Consumer preference for premium and natural formulations is increasing its use in plant-derived variants. It supports the development of products catering to sensitive skin, expanding its relevance in global beauty markets.

- For instance, Elementis offers BENTONE HYDROLUXE™ 360, a product that utilizes cetearyl alcohol to enhance texture and stability in creams and lotions, delivering a smooth, hydrating feel.

Growing Adoption in Pharmaceutical Formulations

Pharmaceutical manufacturers are increasingly using cetearyl alcohol in topical creams, ointments, and medicated lotions for its stabilizing and emollient properties. It enhances drug delivery efficiency by improving consistency and spreadability. Rising demand for dermatology and therapeutic skincare products is fueling consumption. It plays a crucial role in ensuring product shelf stability and patient comfort. The expanding pharmaceutical sector, particularly in emerging economies, is strengthening market opportunities for this versatile ingredient.

- For instance, BASF’s Kolliphor CS A, a cetostearyl alcohol-based excipient, is widely utilized as an emulsifier to enhance the stability and texture of dermatological formulations.

Shift Toward Sustainable and Plant-Derived Raw Materials

Growing awareness of environmental impact is pushing manufacturers toward sustainable sourcing of cetearyl alcohol from natural feedstocks such as coconut and palm oil. It aligns with clean-label and eco-friendly trends, meeting rising consumer expectations for transparency in product ingredients. Brands are promoting responsibly sourced variants to strengthen market positioning. Regulatory focus on biodegradable and non-toxic ingredients is driving innovation in green manufacturing. This shift is influencing procurement strategies across multiple industries.

Expanding Applications in Hair and Skin Care Solutions

Cetearyl alcohol is gaining traction in advanced hair and skin care solutions for its conditioning, moisturizing, and softening effects. It helps create rich textures and provides long-lasting hydration without greasiness. It supports the development of anti-aging creams, sun protection products, and high-performance conditioners. Growing disposable incomes and changing grooming habits in emerging markets are boosting demand. The versatility of this ingredient enables manufacturers to cater to diverse consumer needs efficiently.

Market Trends

Increasing Demand for Natural and Organic Ingredient Integration

The cetearyl alcohol market is witnessing a strong shift toward natural and organic ingredient integration in personal care, cosmetics, and pharmaceuticals. Brands are focusing on plant-derived sources such as coconut and palm oil to meet clean-label requirements and appeal to eco-conscious consumers. It aligns with the broader industry push for sustainability and reduced chemical content. Rising regulatory scrutiny over synthetic additives is encouraging adoption of bio-based variants, strengthening product positioning and consumer trust.

- For instance, Croda International emphasizes sourcing cetearyl alcohol from renewable vegetable oils like coconut and palm oil to meet eco-conscious consumer demand while adhering to regulatory standards for bio-based ingredients.

Innovation in Multifunctional Product Formulations

Manufacturers are developing multifunctional formulations incorporating cetearyl alcohol to enhance performance and reduce the need for multiple additives. It offers thickening, emulsifying, and moisturizing benefits in a single ingredient, supporting cost-efficiency and simplified product labels. Demand for minimalistic beauty products is accelerating this trend. Companies are investing in R&D to create advanced blends that improve texture, stability, and sensory experience, catering to evolving consumer expectations in global personal care markets.

- For instance, Kao Corporation integrates cetearyl alcohol in its personal care chemicals range to stabilize formulations and provide emollient benefits, improving skin and hair softness alongside creamy product textures.

Expansion of Premium and Specialized Personal Care Segment

Premium skincare, hair care, and therapeutic products are driving demand for high-quality cetearyl alcohol. It is increasingly featured in anti-aging creams, luxury hair conditioners, and specialized dermatological solutions for sensitive skin. Growth in disposable incomes and willingness to pay for superior quality are fueling this segment. Brands are using targeted marketing strategies to highlight the benefits of cetearyl alcohol in achieving superior product performance, aligning with evolving beauty and wellness standards worldwide.

Adoption of Advanced Manufacturing and Processing Technologies

Advancements in extraction, purification, and processing technologies are improving the quality and functional properties of cetearyl alcohol. It enables manufacturers to produce high-purity grades suitable for sensitive formulations and premium applications. Automation and precision control in manufacturing enhance consistency and scalability. Companies are also exploring low-energy and eco-friendly production methods to meet environmental goals. These technological improvements are expanding its application scope and strengthening competitiveness in global ingredient markets.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Vulnerabilities

The cetearyl alcohol market faces challenges from volatile raw material prices, particularly for coconut and palm oil, which are the primary feedstocks. It is highly dependent on agricultural yield, weather conditions, and geopolitical factors affecting supply stability. Disruptions in global logistics can delay deliveries and increase costs for manufacturers. The dependence on specific regions for raw material sourcing adds further risk. Price fluctuations can pressure profit margins, forcing companies to adopt cost optimization strategies without compromising quality.

Regulatory Compliance and Environmental Concerns

Stringent environmental regulations and sustainability requirements present another challenge for the cetearyl alcohol market. It must meet compliance standards related to ingredient safety, biodegradability, and ethical sourcing, which can increase operational costs. Growing scrutiny on palm oil cultivation due to deforestation and ecological impact influences buyer preferences. Companies need to invest in traceable, certified supply chains to maintain market credibility. Balancing regulatory demands with competitive pricing and consistent product performance remains a significant industry hurdle.

Market Opportunities

Rising Demand in Emerging Personal Care and Pharmaceutical Markets

The cetearyl alcohol market has significant opportunities in emerging economies where rising disposable incomes and urbanization are boosting demand for personal care and pharmaceutical products. It is increasingly used in skincare, hair care, and therapeutic formulations due to its multifunctional benefits. Expanding retail networks and e-commerce platforms are making these products more accessible to wider consumer bases. Local manufacturing investments can reduce costs and enhance supply stability. Targeted product innovation for regional preferences can further strengthen market penetration.

Expansion of Sustainable and Premium Product Segments

Growing consumer preference for eco-friendly, ethically sourced, and high-quality ingredients creates a strong growth pathway for the cetearyl alcohol market. It benefits from the shift toward clean-label formulations in premium beauty and wellness products. Manufacturers adopting sustainable sourcing and low-impact production methods can gain a competitive advantage. Collaborations with cosmetic and pharmaceutical brands to develop certified natural and organic lines can increase value-added opportunities. Premium positioning supported by transparent sourcing and quality certifications can attract environmentally conscious and high-income consumer segments.

Market Segmentation Analysis:

By Application

The cetearyl alcohol market is segmented into personal care products, cosmetics, pharmaceuticals, food and beverage, and industrial applications. Personal care and cosmetics account for the largest share due to its role as an emulsifier, thickener, and emollient in skincare and hair care products. It is widely used in pharmaceutical creams and ointments for improved texture and stability. Food and beverage applications focus on its role as a stabilizer, while industrial uses leverage its functional properties in lubricants and coatings.

- For instance, Godrej Industries Ltd. manufactures cetearyl alcohol used extensively in personal care and pharmaceutical products, leveraging its emulsifying and thickening properties to enhance creams and lotions.

By Product Form

Based on product form, the market includes liquid, solid, powder, and emulsions. Solid form dominates due to its ease of handling, stability, and suitability for a wide range of formulations. Liquid form finds application in specialized cosmetic and pharmaceutical products requiring fast blending. Powder form caters to industries needing precise dosing, while emulsions support ready-to-use formulations. It offers flexibility across forms, enabling manufacturers to tailor solutions to specific performance and formulation requirements.

By End-User

End-users include household consumers, professional users, industry manufacturers, and research institutions. Household consumers drive demand through personal care and cosmetic purchases, while professional users such as salons and dermatology clinics prefer high-performance, concentrated formulations. Industry manufacturers utilize it in large-scale production of personal care, pharmaceutical, and industrial goods. Research institutions explore its functional and formulation properties for innovation. Each segment benefits from its versatility, safety profile, and adaptability to varied application needs across consumer and industrial markets.

- For instance, P&G’s Olay introduced the Super Serum in 2023, combining five serum benefits into one product that quickly became the top-selling serum in the U.S., propelled by advanced skincare ingredients developed at P&G’s Singapore innovation hub.

Segments:

Based on Application

- Personal Care Products

- Cosmetics

- Pharmaceuticals

- Food & Beverage

- Industrial Applications

Based on Product Form

- Liquid Form

- Solid Form

- Powder Form

- Emulsions

Based on End-User

- Household Consumers

- Professional Users

- Industry Manufacturers

- Research Institutions

Based on Source

- Plant-Based Cetearyl Alcohol

- Synthetic Cetearyl Alcohol

Based on Concentration Level

- Low Concentration (<10%)

- Medium Concentration (10%-30%)

- High Concentration (>30%)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 32% share of the cetearyl alcohol market, driven by high demand for premium personal care, cosmetics, and pharmaceutical products. The region benefits from a mature beauty industry, strong R&D capabilities, and established manufacturing infrastructure. It is supported by consumer preference for natural, plant-derived ingredients and advanced formulations. Regulatory compliance with safety and quality standards enhances market trust. Expanding clean-label product lines and sustainable sourcing initiatives strengthen growth opportunities. The presence of leading global brands and innovation-focused SMEs fuels competitive market dynamics.

Europe

Europe accounts for 28% of the cetearyl alcohol market, supported by stringent cosmetic regulations and strong demand for sustainable, eco-friendly ingredients. The region’s advanced skincare and hair care sectors drive steady consumption. It benefits from high adoption of organic and vegan-certified products, with a focus on transparency and traceability in sourcing. Local manufacturing capabilities and a strong export base further enhance its position. Key markets like Germany, France, and the UK lead in innovation and premium product development. Regulatory alignment across the EU ensures consistent product quality and safety.

Asia-Pacific

Asia-Pacific captures 27% share of the cetearyl alcohol market, fueled by rapid urbanization, rising disposable incomes, and expanding beauty and wellness sectors. It experiences growing demand for affordable yet high-quality skincare and hair care solutions. Local and multinational brands are investing in manufacturing facilities to cater to diverse consumer preferences. It benefits from large-scale raw material availability, particularly in coconut and palm oil production hubs. Markets such as China, Japan, South Korea, and India are emerging as key innovation and consumption centers. E-commerce expansion accelerates regional product penetration.

Latin America

Latin America holds 7% share of the cetearyl alcohol market, driven by the growth of mid-range and premium personal care products. Brazil and Mexico lead regional demand, supported by strong domestic manufacturing and export capabilities. It benefits from rising awareness of ingredient safety and sustainable sourcing. Growing investments by global brands in local production facilities are improving accessibility and affordability. Seasonal product demand, particularly in hair care, supports consistent sales. Regulatory developments promoting transparency are shaping market practices.

Middle East & Africa

The Middle East & Africa region represents 6% share of the cetearyl alcohol market, with growth driven by increasing urban populations and rising spending on beauty and healthcare products. Gulf Cooperation Council countries lead in premium product consumption, while African markets show growing adoption of affordable solutions. It benefits from gradual expansion of manufacturing and distribution networks. Demand for heat- and humidity-resistant formulations is influencing product innovation. International brands are strengthening presence through partnerships and localized offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HallStar Company

- Croda

- KLK OLEO

- Lubrizol

- Ashland Inc

- Joshi Group

- Chemyunion

- BASF

- Straetmans

- SEPPIC

- Shanghai Saifu Chemical Development

- Lonza Group

- VVF L.L.C

Competitive Analysis

The cetearyl alcohol market is characterized by strong competition among global and regional players focusing on product quality, sustainable sourcing, and innovation in formulations. It is driven by the strategic initiatives of companies such as KLK OLEO, HallStar Company, Croda, Lubrizol, Ashland Inc, Joshi Group, Chemyunion, BASF, Dr. Straetmans, SEPPIC, Shanghai Saifu Chemical Development, Lonza Group, and VVF L.L.C. These companies invest in R&D to enhance functional properties, expand application versatility, and meet rising demand for natural and plant-derived variants. Partnerships with cosmetic and pharmaceutical brands strengthen product positioning, while certifications for ethical sourcing improve brand credibility. Expansion into emerging markets through localized production and distribution enables wider market reach. Technological advancements in extraction and refining processes are improving purity levels and formulation compatibility. Sustainability-focused players gain competitive advantage by aligning with consumer demand for eco-friendly and traceable supply chains. The competitive landscape reflects a balance of established multinational corporations and agile regional manufacturers leveraging market trends to capture growth opportunities across diverse end-user segments.

Recent Developments

- In November 2024, BASF partnered with Acies Bio to develop sustainable fermentation technology that converts renewable methanol into fatty alcohols, a key raw material for home and personal care products.

- On December 3, 2024, Sasol Chemicals unveiled a rapeseed-derived stearyl alcohol (NACOL 18‑98), developed as a palm‑oil‑free, bio‑based alternative that complies with the EU Deforestation Regulation, intended for use in conditioners and moisturizers.

- In June 2025, Croda launched Crodacol™ 1618, a cetearyl alcohol that serves as an economical emulsion stabilizer and emulsifier, suitable for sensitive skin formulations such as antiperspirants, deodorants, skincare, and hair treatments

- In February 2025, BASF launched LANETTE® O, a cetearyl alcohol–based consistency factor tailored to regulate viscosity in oil‑in‑water emulsions used in products like sunscreens, hair conditioners, and mother-&‑baby care formulations.

Market Concentration & Characteristics

The cetearyl alcohol market exhibits a moderately consolidated structure, with a mix of multinational corporations and regional manufacturers competing on product quality, sustainability, and cost efficiency. It is characterized by steady demand from personal care, cosmetics, and pharmaceutical sectors, supported by the ingredient’s multifunctional properties. Leading players such as KLK OLEO, HallStar Company, Croda, Lubrizol, BASF, Chemyunion, SEPPIC, and Lonza Group focus on innovation in plant-derived variants, advanced formulations, and sustainable sourcing practices. It benefits from long-term supply contracts with major cosmetic and healthcare brands, enhancing market stability. Regulatory compliance, eco-friendly manufacturing, and traceable sourcing remain critical competitive factors. The market shows high product substitutability within certain applications, but its established safety profile and versatility maintain consistent demand. Regional growth patterns vary, with developed markets emphasizing premium and certified organic products, while emerging markets prioritize affordability and accessibility, creating diverse opportunities for both established and new entrants.

Report Coverage

The research report offers an in-depth analysis based on Application, Product Form, Source, Concentration Level, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-derived and sustainable cetearyl alcohol will continue to rise in personal care and cosmetic formulations.

- Pharmaceutical applications will expand with growing demand for advanced dermatology and therapeutic skincare products.

- Innovation in multifunctional formulations will drive wider use across multiple end-use industries.

- Regulatory compliance will remain a key factor shaping sourcing and production practices.

- Technological advancements in refining processes will enhance purity and performance in premium applications.

- Emerging markets will contribute significantly to volume growth through rising consumer spending on beauty and wellness.

- Strategic partnerships between ingredient suppliers and global brands will increase product reach and innovation speed.

- E-commerce growth will boost market penetration, especially in developing regions.

- Ethical sourcing and transparency will gain greater importance in influencing consumer purchasing decisions.

- Competition will intensify as both multinational and regional players focus on differentiation through sustainability and product innovation.