Market Overview

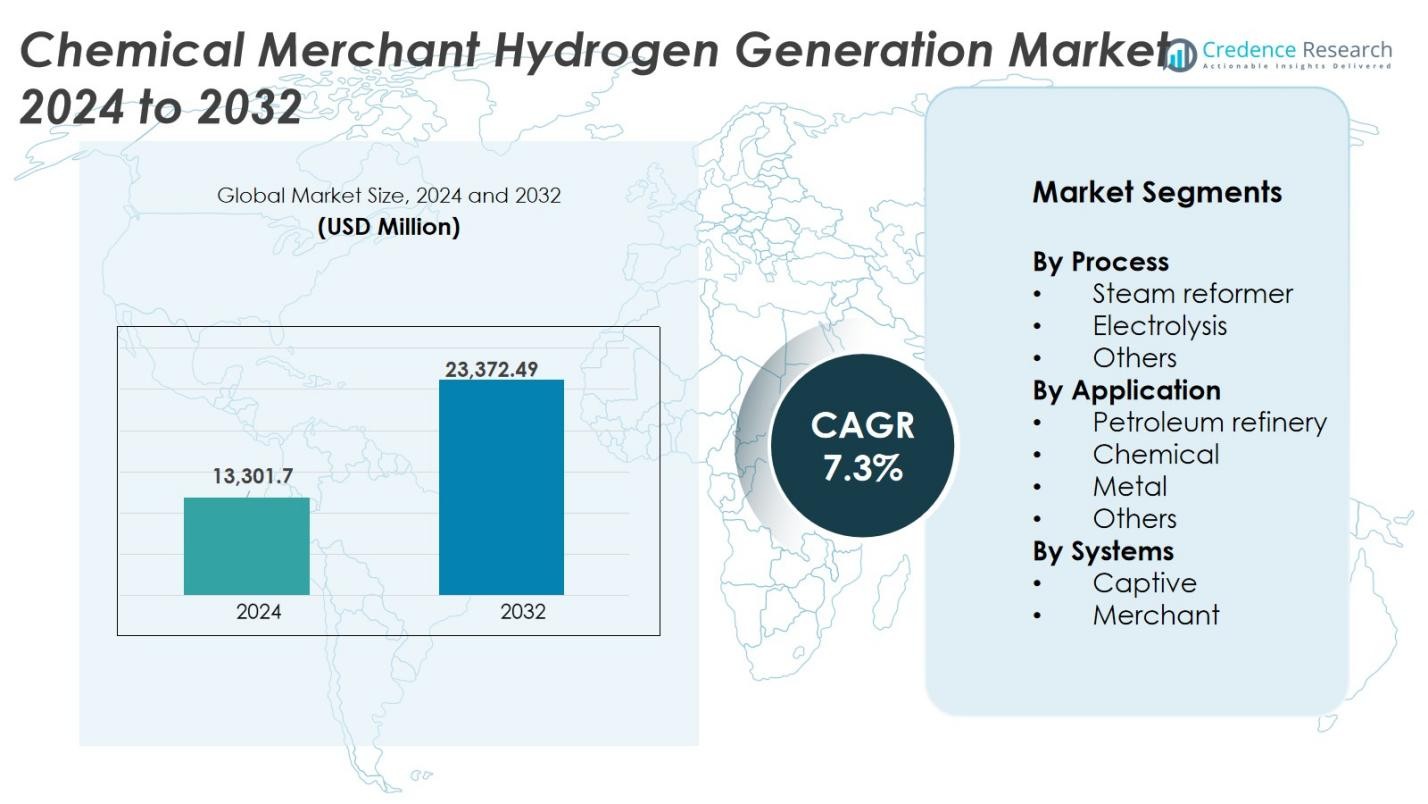

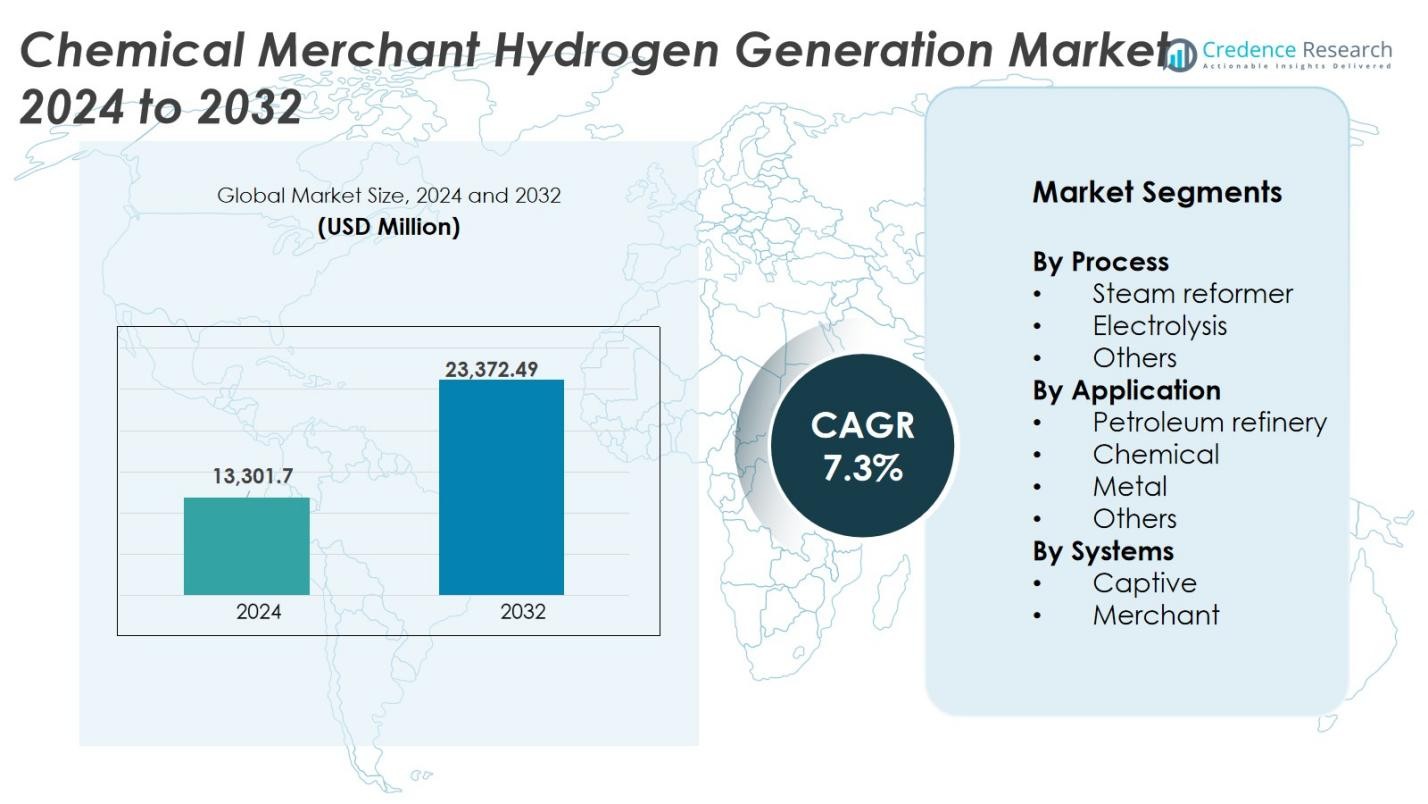

Chemical Merchant Hydrogen Generation Market size was valued at USD 13,301.7 million in 2024 and is anticipated to reach USD 23,372.49 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical Merchant Hydrogen Generation Market Size 2024 |

USD 13,301.7 Million |

| Chemical Merchant Hydrogen Generation Market, CAGR |

7.3% |

| Chemical Merchant Hydrogen Generation Market Size 2032 |

USD 23,372.49 Million |

The Chemical Merchant Hydrogen Generation market is dominated by global industrial gas suppliers that operate large production plants and extensive delivery networks. Key players include Air Liquide International S.A, Air Products and Chemicals, Inc., Linde Plc, INOX Air Products Ltd., Iwatani Corporation, Messer, SOL Group, Matheson Tri-Gas, Hydrogenics Corporation, and Tokyo Gas Chemicals Co., Ltd. These companies secure long-term contracts with refineries, chemical plants, metal producers, and electronics manufacturers to ensure steady demand. Asia Pacific remains the leading region with a 34% market share, supported by rapid industrial growth, refinery expansion, and rising investment in renewable hydrogen and fuel cell applications.

Market Insights

- The Chemical Merchant Hydrogen Generation market was valued at USD 13,301.7 million in 2024 and is projected to reach USD 23,372.49 million by 2032, growing at a CAGR of 7.3% during the forecast period.

- Growing demand from refineries and chemical industries drives market expansion, as hydrogen supports desulfurization, hydrocracking, fertilizer production, and high-purity chemical synthesis.

- Green hydrogen and electrolysis-based supply chains are gaining traction, supported by renewable energy integration, carbon-neutral targets, and government incentives across major economies.

- The market remains competitive, led by companies such as Air Liquide, Linde Plc, Air Products and Chemicals, INOX Air Products, Iwatani Corporation, and Messer, which rely on large-scale distribution and long-term industrial contracts.

- Asia Pacific holds the largest regional share at 34%, while the steam reformer process segment dominates the market due to cost efficiency and large-scale output required by petroleum refining and chemical manufacturing companies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Process

Steam reformer dominates the Chemical Merchant Hydrogen Generation market with over 60% share, driven by low production costs and strong adoption in industrial operations. Refineries and chemical plants prefer steam reforming because it delivers large-volume hydrogen output with reliable efficiency. Electrolysis holds around 25% share, gaining traction as industries invest in cleaner supply chains and renewable energy-based hydrogen. The segment benefits from government incentives for green hydrogen and falling renewable power costs. Other processes collectively account for about 15%, including gasification and partial oxidation, which serve niche applications where feedstock flexibility or distributed generation is required.

- For instance, the United States produces around 9-10 million tons of hydrogen annually mainly through steam reforming, supporting industries like ammonia production.

By Application

Petroleum refinery holds over 45% share in the application segment, supported by continuous demand for hydrogen in hydrocracking and desulfurization processes. Refineries rely on consistent hydrogen supply to meet clean fuel regulations and improve output quality. The chemical industry accounts for nearly 30% share, using hydrogen in ammonia, methanol, and specialty chemicals production. Metal processing contributes around 15%, as industries adopt hydrogen for annealing, reduction, and furnace atmospheres. Other applications collectively represent about 10%, including food processing, electronics, and fuel cell supply chains, which are expanding due to rising investments in low-carbon technologies.

- For instance, ArcelorMittal employs hydrogen-based direct reduction to lower CO2 emissions substantially in steel production.

By Systems

Merchant systems lead the segment with over 65% share, driven by the rising preference for outsourced hydrogen supply. Users choose merchant hydrogen to avoid capital costs of production units and ensure uninterrupted deliveries through pipelines, cylinders, or tankers. Captive systems hold 35% share, adopted by large plants requiring stable, high-volume production within facility boundaries. Refineries and chemical plants invest in captive units to reduce long-term supply risks and operational downtime. The shift toward distributed hydrogen supply models continues to strengthen merchant system demand.

Key Growth Drivers

Expanding Demand from Refineries and Chemical Industries

Refineries and chemical plants represent the largest buyers of merchant hydrogen, driving significant market expansion. Hydrogen remains essential for hydrocracking, desulfurization, fertilizer production, methanol synthesis, and specialty chemicals. Stricter regulations for cleaner fuels increase hydrogen consumption in refineries, especially in developing regions with rising fuel demand. Chemical producers rely on hydrogen to ensure high process efficiency and product purity, which strengthens long-term procurement contracts with merchant suppliers. Rapid industrial growth in Asia Pacific and the Middle East supports higher adoption of outsourced hydrogen supply, as many facilities prefer merchant deliveries to avoid high capital spending on captive units.

- For instance, Abu Dhabi-based Ocior Energy secured a 25-year contract in 2025 to supply 5,000 tonnes annually of green hydrogen to Hindustan Petroleum’s Visakhapatnam refinery, reflecting a strategic move towards cleaner fuel production in Indian refineries.

Shift Toward Flexible and Cost-Efficient Hydrogen Supply Models

Many industries now prefer merchant hydrogen due to lower upfront investment and reliable access to large-volume supply. Merchant models eliminate the need for on-site production equipment, maintenance, and utility integration, making them suitable for refineries, steel mills, electronics manufacturers, and semiconductor facilities. Companies receive hydrogen through pipelines, cylinders, or tankers based on consumption levels, ensuring operational continuity without production downtime risks. As hydrogen infrastructure expands across industrial clusters, merchant supply becomes more competitive and accessible. The trend is further supported by partnerships between industrial gas suppliers and manufacturing plants that aim to secure long-term supply contracts.

- For instance, Ocior Energy won a contract to supply 5,000 tonnes yearly of green hydrogen to HPCL’s Visakhapatnam refinery under a build-own-operate model, illustrating merchant hydrogen’s role in refineries with guaranteed supply contracts.

Rising Investments in Green Hydrogen and Clean Energy Initiatives

Growing sustainability targets and emission regulations are encouraging industries to procure low-carbon hydrogen through electrolysis and renewable power sources. Governments in Europe, North America, and Asia Pacific are offering tax credits, funding programs, and renewable hydrogen mandates to support cleaner procurement. Merchant suppliers are investing in electrolysis plants and renewable integration to meet future demand from refineries, chemicals, mobility, and energy storage applications. Green hydrogen demand is rising in steelmaking, ammonia production, and fuel cell technologies, which rely on outsourced supply for pilot and commercial projects. Companies that lack on-site green hydrogen production capabilities depend on merchant deliveries to transition toward decarbonized operations.

Key Trends & Opportunities

Expansion of Hydrogen Supply Networks and Distribution Infrastructure

Hydrogen distribution networks continue to expand with new pipelines, bulk storage systems, and high-capacity transport fleets, making merchant delivery more flexible and cost-efficient. Industrial clusters in refining, chemicals, and steel industries benefit from shared distribution corridors that reduce logistics constraints. Companies are also building liquid hydrogen terminals, compressor stations, and tube-trailer fleets to serve large industrial buyers and mobility users. These developments open new revenue streams in regions where establishing captive units remains costly. The availability of scalable supply chains attracts new end-users, including energy storage, electronics, and data centers seeking clean fuel alternatives.

- For instance, Deutsche ReGas and Höegh-LNG’s development of the world’s first floating import terminal for hydrogen at the port of Lubmin, Germany, capable of producing about 30,000 tons of hydrogen per year and feeding it into the national hydrogen network, supporting industrial decarbonization in 2026.

Growing Adoption of Hydrogen in Metal Processing and Emerging Sectors

Industries beyond refining and chemicals are accelerating hydrogen use, opening significant opportunities for merchant suppliers. Metal producers adopt hydrogen for annealing, sintering, furnace atmospheres, and carbon-free iron reduction. Food processing, glass manufacturing, semiconductors, and electronics also require high-purity merchant hydrogen. Fuel cell systems in buses, trucks, and industrial vehicles rely on delivered hydrogen instead of on-site production. As countries scale clean hydrogen mobility and distributed power generation pilots, merchant suppliers can serve these emerging customer groups. Expanding demand across diverse applications strengthens market penetration beyond traditional heavy industries.

- For instance, Companies like Outokumpu are advancing the use of hydrogen in stainless steel production by developing high-strength stainless steel capable of withstand high pressure and cryogenic temperatures, suitable for hydrogen storage and transport.

Key Challenges

High Logistics and Transport Costs for Large-Scale Supply

Transporting hydrogen—especially in liquefied or high-pressure form remains expensive due to specialized storage tanks, tube trailers, cryogenic equipment, and safety compliance. Long-distance deliveries increase operational costs and limit competitive pricing in regions without established hydrogen infrastructure. Small and medium industries often face higher delivery charges, discouraging them from switching to hydrogen-based processes. Limited hydrogen pipeline networks also restrict bulk movement in many countries, making merchant supply dependent on fleets of road tankers. Without wider pipeline networks and lower transport overheads, market scalability can be slower in emerging regions.

Capital-Intensive Production and Dependence on Fossil-Based Feedstocks

Merchant hydrogen production through steam reforming requires high-cost reformers, purification systems, and energy supply, creating financial barriers for new entrants. Fossil-based hydrogen also generates carbon emissions, leading to regulatory scrutiny in regions with strict climate policies. Although electrolysis provides a cleaner alternative, renewable power and electrolyzer units remain costlier than traditional reforming. Carbon capture systems can reduce emissions but add additional investment and operational complexity. These cost pressures challenge supplier profitability and hinder rapid transition toward low-carbon merchant hydrogen production.

Regional Analysis

North America

North America holds a significant share of the Chemical Merchant Hydrogen Generation market, driven by strong demand from refineries, chemical industries, and emerging fuel cell applications. The United States leads the region with advanced hydrogen infrastructure and large industrial gas suppliers supporting merchant deliveries. Increasing investments in low-carbon hydrogen and carbon capture integration strengthen long-term adoption. Growing deployment in steel, food processing, and semiconductor manufacturing also contributes to steady demand. The region accounts for 28% of the market share as industries prefer outsourced supply over captive units to reduce operating costs and ensure continuous production.

Europe

Europe commands 31% of the market share, supported by aggressive environmental policies, renewable hydrogen mandates, and expansion of industrial hydrogen networks. Refineries, ammonia producers, and green steel projects rely on merchant suppliers for high-purity hydrogen. Germany, France, the Netherlands, and the UK are investing in new electrolysis plants and cross-border hydrogen corridors that enhance supply access for industrial clusters. Merchant firms benefit from strict decarbonization targets, which accelerate adoption of green hydrogen across chemicals, metals, and clean mobility sectors. Strong government funding and infrastructure development continue to boost regional consumption.

Asia Pacific

Asia Pacific leads the Chemical Merchant Hydrogen Generation market with the highest share of 34%, fueled by rapid industrial growth in China, Japan, South Korea, and India. Refineries, petrochemicals, fertilizers, and electronics manufacturers represent the largest buyers of merchant hydrogen. Many facilities prefer outsourced supply due to high capital costs of captive plants and rising consumption linked to fuel quality regulations. Expanding renewable projects and hydrogen mobility initiatives further support merchant deliveries. The region also witnesses significant investment in electrolysis capacity and liquefaction, strengthening supply chains for industrial and energy storage applications.

Middle East & Africa

The Middle East & Africa account for 4% of the market, supported by refinery modernization, petrochemical expansion, and growing clean hydrogen initiatives. Countries such as Saudi Arabia, the UAE, and Qatar are investing in merchant hydrogen facilities to meet refinery demand and support low-carbon ammonia exports. Industrial clusters rely on pipeline and tanker-based supply to reduce operational downtime. Pilot renewable hydrogen projects in the UAE and Saudi Arabia enhance long-term opportunities for merchant suppliers. Mining and metal industries in Africa also adopt hydrogen for reduction and processing, gradually increasing regional consumption.

Latin America

Latin America holds 3% of the market share, led by refinery upgrades, fertilizer production, and rising investment in clean fuel technologies. Brazil, Argentina, and Chile are developing hydrogen supply networks to support chemical production and pilot fuel cell applications. Merchant delivery is preferred by industrial users that avoid high capital investment for captive units. Chile’s renewable hydrogen initiatives and ammonia projects create additional opportunities for suppliers. Adoption in metals and food processing continues to expand, although infrastructure limitations and higher logistics cost pose challenges, keeping the regional share relatively small compared to other markets.

Market Segmentations

By Process

- Steam reformer

- Electrolysis

- Others

By Application

- Petroleum refinery

- Chemical

- Metal

- Others

By Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Chemical Merchant Hydrogen Generation market features strong competition among global industrial gas suppliers and regional producers serving refineries, chemical plants, electronics, and metal industries. Leading players such as Air Liquide, Linde Plc, Air Products and Chemicals, INOX Air Products, and Iwatani Corporation operate large-scale production sites supported by extensive distribution networks, pipelines, bulk tankers, and cylinder fleets. Many companies form long-term supply contracts with industrial customers to ensure predictable revenue and stable delivery volumes. Competitors are also investing in renewable-based hydrogen production through electrolysis, supported by government incentives and carbon reduction mandates. Partnerships with refineries, steel producers, and ammonia manufacturers help expand regional coverage, particularly in Asia Pacific, Europe, and North America. Technology upgrades, including advanced liquefaction, high-pressure storage, automation, and carbon capture integration, enhance operational efficiency and product purity. As hydrogen consumption rises across new applications such as fuel cells and zero-carbon steel, competitive intensity continues to increase.

Key Player Analysis

- Tokyo Gas Chemicals Co., Ltd.

- Messer

- Air Liquide International S.A

- Iwatani Corporation

- SOL Group

- Hydrogenics Corporation

- Matheson Tri-Gas, Inc.

- INOX Air Products Ltd.

- Air Products and Chemicals, Inc

- Linde Plc

Recent Developments

- In May 2025, Electric Hydrogen completed the acquisition of Ambient Fuels, a hydrogen project development company, to expand its merchant hydrogen generation portfolio.

- In August 2024, Air Products & Chemicals agreed to acquire the hydrogen-production assets of Saneg at the Fergana Oil Refinery in Uzbekistan for US$140 million.

- In June 2024, TotalEnergies signed a 15-year agreement with Air Products & Chemicals for the annual delivery of ~70 000 tons of green hydrogen to its Northern European refineries starting in 2030.

- In June 2024, Eletrobras signed a memorandum of understanding with Prumo to produce green hydrogen at Brazil’s Port of Açu, initiating a pilot plant assessing up to 10 MW capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Process, Application, System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Merchant hydrogen supply will expand as refineries and chemical plants increase consumption for cleaner fuel production.

- Green hydrogen demand will rise with more electrolysis projects supported by renewable energy.

- Companies will invest in large-scale liquefaction, storage, and high-pressure delivery systems to reach distant industries.

- Hydrogen use in steelmaking and metal processing will grow as industries shift toward low-carbon production.

- Fuel cell applications in buses, trucks, and industrial vehicles will create new merchant supply opportunities.

- Carbon capture integration with reformers will reduce emissions and support compliance with climate regulations.

- Industrial clusters will expand shared hydrogen pipelines and bulk terminals for cost-efficient distribution.

- Digital monitoring and automation will improve plant efficiency and reduce operational downtime.

- Partnerships between gas suppliers and industrial users will increase to secure long-term supply contracts.

- Developing regions will witness higher adoption as infrastructure improves and industrial capacity expands.