Market Overview

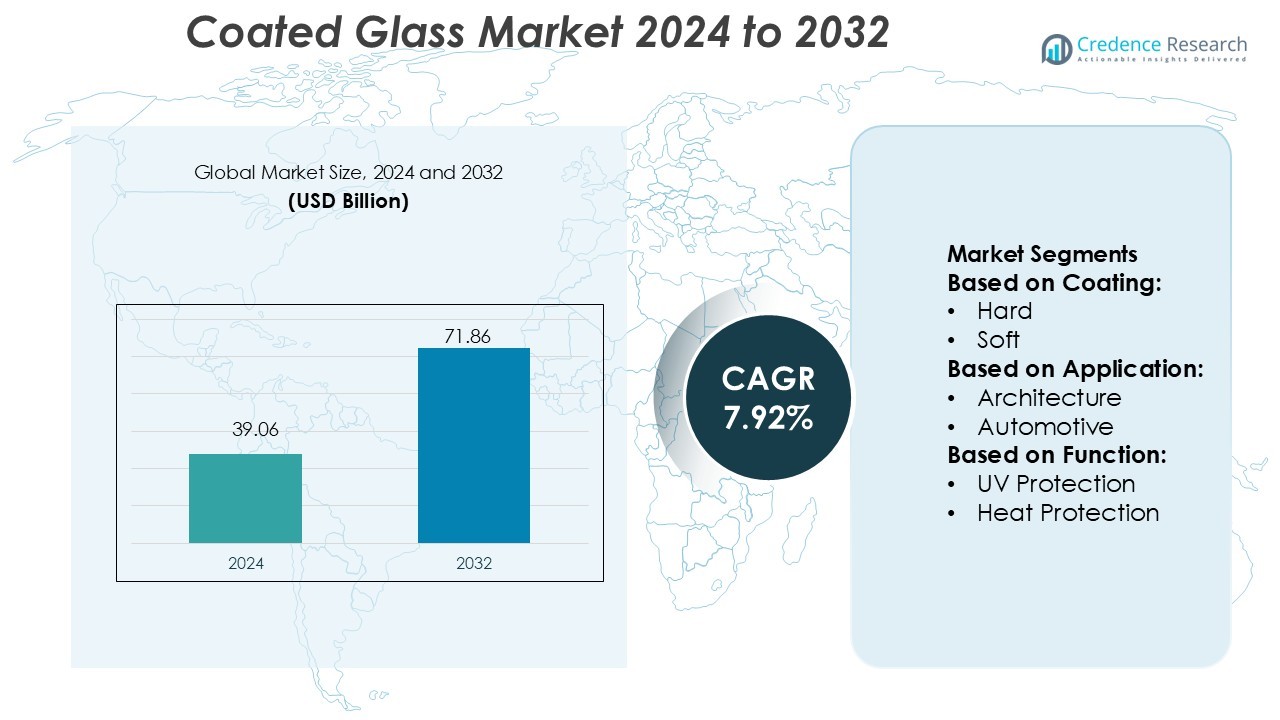

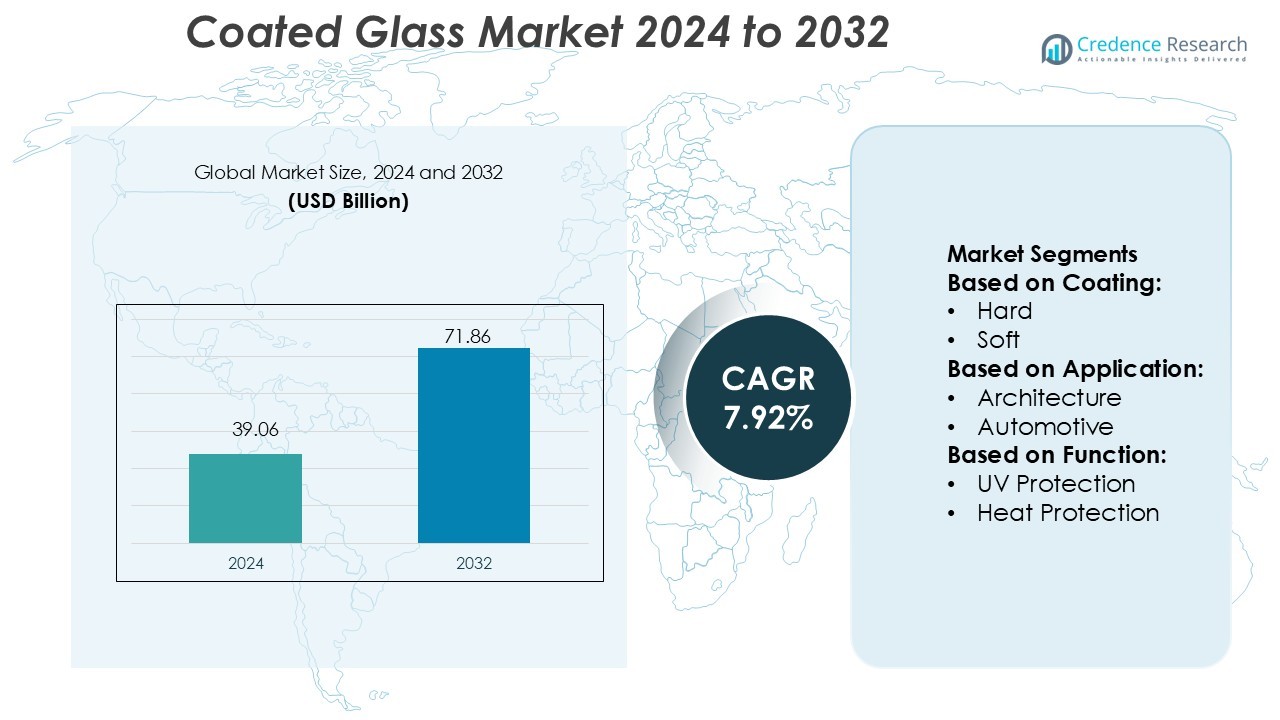

Coated Glass Market size was valued USD 39.06 billion in 2024 and is anticipated to reach USD 71.86 billion by 2032, at a CAGR of 7.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Encryption Software Market Size 2024 |

USD 39.06 Billion |

| Cloud Encryption Software Market, CAGR |

7.92% |

| Cloud Encryption Software Market Size 2032 |

USD 71.86 Billion |

The Coated Glass Market includes major players such as AGC Inc., Saint-Gobain, Guardian Industries, Nippon Sheet Glass Co., Ltd., SCHOTT AG, Fuyao Glass Industry Group Co., Ltd., Central Glass Co. Ltd., Euroglas, CEVITAL GROUP, and China Glass Holding, Ltd. These companies operate advanced sputtering and chemical vapor deposition coating lines to supply low-E, solar-control, and self-cleaning glass for construction, automotive, and solar applications. Europe leads the market with 32% share, driven by strict energy-efficiency standards, strong adoption of green buildings, and large-scale commercial façade projects. Continuous innovation in thermal insulation, UV protection, and optical clarity keeps competition strong and supports market expansion across developed and emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Coated Glass Market size was valued at USD 39.06 billion in 2024 and is expected to reach USD 71.86 billion by 2032, growing at a 7.92% CAGR.

- Growing demand for low-E and solar-control coated glass in commercial and residential buildings drives market growth, supported by green building codes and energy-saving regulations.

- Europe holds 32% share, leading global demand due to strict efficiency standards, while Asia Pacific records fast growth driven by urbanization and skyscraper construction.

- Key players such as AGC Inc., Saint-Gobain, and Guardian Industries focus on advanced sputtering lines and multifunction coatings to improve durability, UV protection, and thermal insulation.

- High production costs, price sensitivity in developing markets, and limited adoption of premium coatings in low-income construction projects remain key market restraints, though rising automotive and solar applications continue to create long-term opportunities.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Coating

Hard-coated glass leads the coating segment with the highest market share due to long durability, strong chemical resistance, and stable performance in outdoor environments. Hard coatings withstand extreme temperatures and physical stress, making them suitable for large construction projects and commercial façades. Soft-coated glass grows steadily because it offers better insulation and higher energy efficiency for modern green buildings. The shift toward low-emissivity architectural designs increases demand for soft coatings, especially in urban infrastructure. Rising construction in Asia-Pacific and government regulations on energy savings support adoption across both coating types.

- For instance, Guardian Glass has developed its “UltraClear®” low-iron soda-lime float glass with an average iron content of just 0.01 % and visible light transmittance exceeding 91 %.

By Application

Architecture remains the dominant application with the largest market share, driven by commercial buildings, residential complexes, and smart infrastructure. Coated glass reduces heat gain, blocks UV rays, and supports modern façade designs with aesthetic appeal. Developers prefer energy-efficient glazing to meet green building standards, which boosts demand in skyscrapers, airports, and malls. Automotive applications grow as manufacturers integrate coated glass to enhance cabin comfort and reduce sun load. Optical uses expand in display screens, solar panels, and lenses, supported by rising consumer electronics production and renewable energy deployment.

- For instance, Schott uses its proprietary micro-float process to produce specialty glass with exceptional flatness and mirror-like surfaces. The process involves precise temperature control, with the glass floating on a tin bath at temperatures around 600°C.

By Function

Heat protection holds the highest share within the function segment because energy-efficient glass cuts cooling loads in hot climates and improves indoor comfort. UV protection coatings gain adoption in residences, vehicles, and commercial spaces to prevent fabric fading and protect occupants from harmful rays. Shatter protection rises in safety applications, including automotive and high-traffic buildings. Self-cleaning coatings find traction in skylights and solar installations where reduced maintenance is important. Graffiti-resistant coatings grow in public infrastructure projects to lower cleaning and replacement costs. Government sustainability rules and rising urban construction drive segment growth.

Key Growth Drivers

Rising Demand for Energy-Efficient Infrastructure

Energy-efficient construction gains momentum as commercial and residential builders look for solutions that reduce power consumption. Coated glass lowers heat transfer, improves insulation, and supports green building certifications. Builders adopt low-emissivity coatings to meet strict regulations on carbon reduction. Governments in North America, Europe, and Asia-Pacific offer incentives for sustainable materials, encouraging wider use of coated glazing in new projects. Rapid urbanization and large public infrastructure spending further expand adoption, especially in airports, offices, and metro stations.

- For instance, Ardagh Group’s glass division invested in a “NextGen” furnace at its Obernkirchen, Germany facility that transitions the energy input from ~90% natural gas to ~80% renewable electricity and ~20% gas, a change which is calculated to reduce Scope 1/2/3 CO₂ emissions at that site by 65-70%.

Expanding Automotive Production and Safety Standards

Automakers adopt coated glass to enhance passenger comfort and safety. Solar control coatings reduce heat load, improve energy savings, and enhance visibility by minimizing glare. Laminated and heat-treated coated glass helps prevent shattering during accidents, aligning with growing vehicle safety rules. Electric vehicle manufacturers use coated windshields and windows to improve thermal management and maximize battery efficiency. Rising vehicle production in China, India, and Southeast Asia increases market demand, supported by OEM investments in advanced glazing systems.

- For instance, Corning’s Gorilla® Glass Victus® 2 survived drops up to 1 metre onto concrete-simulating surfaces, while competitive aluminosilicate glasses failed from ~0.5 metre.

Growing Adoption in Solar and Electronics Applications

Solar panel producers use coated glass to increase light transmission and boost photovoltaic efficiency. Anti-reflective and self-cleaning coatings help solar farms operate in dusty or humid regions with reduced maintenance costs. In consumer electronics, optical coatings improve display clarity and durability in smartphones, televisions, and smart devices. The expansion of 5G networks and digital screens in public spaces supports additional demand. Manufacturers invest in nanotechnology-based coatings to enhance scratch resistance and thermal stability.

Key Trends & Opportunities

Rising Shift Toward Smart and Self-Cleaning Glass

Smart glass uses electrochromic and photochromic coatings to change transparency, offering privacy and better heat control. Self-cleaning coated glass finds high demand in skylights, solar installations, and high-rise façades where labor costs for cleaning are high. This trend supports premium pricing and long-term maintenance savings. The technology remains attractive for commercial projects, luxury housing, and transport hubs, opening new investment opportunities for coating innovators and material suppliers.

- For instance, Stoelzle reports that in autumn 2020 they began producing white glass using at least 20 % post-consumer recycled (PCR) cullet, which resulted in about 20 % natural raw material savings, 4 % energy savings and approx. 16 % CO₂ reduction.

Growth of Advanced Nanocoating and Anti-Graffiti Solutions

Nanostructured coatings offer superior scratch resistance, water repellence, and longer product life. Cities adopt anti-graffiti coated glass in public transport stations, retail storefronts, and government buildings to reduce cleaning costs. Manufacturers develop multilayer coatings that block UV rays while allowing high visible light transmission. Growing focus on vandalism protection and maintenance reduction strengthens demand for graffiti-resistant and nano-enhanced coated glass in urban infrastructure.

- For instance, CooperVision clariti® 1 day multifocal 3 Add lens is available in power ranges from +8.00 D to −12.00 D. It also achieved a fitting success rate of 98%, with patients using two lens pairs or fewer in a clinical trial.

Key Challenges

High Production Costs and Complex Manufacturing

Coated glass requires advanced vacuum deposition, magnetron sputtering, and specialized handling. High raw material prices and energy consumption increase production costs. Small manufacturers struggle to adopt expensive equipment and maintain quality consistency, which limits overall market penetration. Supply chain fluctuations in metals used for coatings further increase operational challenges. These factors make premium coated products costlier than conventional glass.

Durability Issues in Harsh Weather Conditions

Some coated glass types degrade when exposed to high humidity, salt air, or chemical pollutants. Soft-coated low-e glass needs careful installation and edge sealing to avoid corrosion. Building owners in coastal and industrial regions demand stronger protective layers, raising technical requirements. Failure to meet durability expectations leads to replacement costs and warranty claims. Manufacturers continue investing in reinforced coatings to tackle long-term stability and weather resistance concerns.

Regional Analysis

North America

North America holds 28% share of the Coated Glass Market due to strong demand from energy-efficient building projects, automotive glass production, and commercial renovations. The U.S. invests heavily in green construction codes and solar panel installations, which boost sales of low-emissivity and solar-control coated glass. Growing electric vehicle production also supports usage of heat-reflective coated glass in windshields and sunroofs. Leading manufacturers expand local coating lines and upgrade sputtering equipment to improve product durability and optical clarity. Canada follows with steady growth in smart cities, modern office complexes, and eco-certified residential buildings.

Europe

Europe accounts for 32% share, making it the leading region in the global coated glass market. Strict EU energy-efficiency regulations and rapid adoption of zero-emission buildings drive strong consumption of soft-coated low-E glass. Demand rises in Germany, France, Italy, and the UK for commercial façades, trains, and automotive glazing. Manufacturers invest in anti-reflective and self-cleaning architectural glass to meet sustainability goals and longer lifecycle standards. Solar farms in Spain and Germany increase use of high-transmission coated glass modules. Local production capacity and automation upgrades maintain Europe’s leadership in product innovation and export volume.

Asia Pacific

Asia Pacific holds 27% share and remains the fastest-growing regional market. China, Japan, India, and South Korea invest in skyscrapers, smart cities, and affordable housing projects that require energy-efficient coated glass for façades and interior partitions. Automotive OEMs use solar-control glass for electric cars and luxury vehicles, rising demand for laminated, reflective, and UV-shielding coatings. Rapid industrialization pushes installation of solar power plants and greenhouse structures that prefer high-transmission coated glass. Local manufacturers expand sputtering lines and low-E coatings to serve export and domestic needs at competitive prices, strengthening regional competitiveness.

Latin America

Latin America holds 6% share of the coated glass market. Construction activity in Brazil, Mexico, Chile, and Colombia drives adoption of reflective and low-E coated façade glass for office towers, transportation hubs, and shopping centers. Automakers apply coated glass to improve vehicle comfort and UV protection. Solar panel installations expand in Chile and Brazil, supporting demand for anti-reflective coatings. Market growth remains moderate due to import dependence and currency challenges, but rising urbanization and government efficiency standards gradually boost product adoption across commercial and residential building projects.

Middle East & Africa

The Middle East & Africa region accounts for 7% share. Harsh climate conditions in the UAE, Saudi Arabia, and Qatar drive demand for solar-control and heat-reflective glass to reduce air-conditioning loads in commercial towers, airports, and hotels. Government sustainability programs increase LEED-certified buildings and rooftop solar installations, boosting need for low-E and anti-reflective coatings. African countries gradually adopt coated glass for modern urban infrastructure and commercial malls. International manufacturers supply high-performance products through partnerships and distribution networks, while local processing units expand to meet construction growth.

Market Segmentations:

By Coating:

By Application:

By Function:

- UV Protection

- Heat Protection

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Coated Glass Market includes major players such as Fuyao Glass Industry Group Co., Ltd., SCHOTT AG, Central Glass Co. Ltd., Saint-Gobain, China Glass Holding, Ltd., CEVITAL GROUP, Guardian Industries, Nippon Sheet Glass Co., Ltd., Euroglas, and AGC Inc. The Coated Glass Market features strong rivalry among global manufacturers focused on high-performance architectural and automotive applications. Companies compete through advanced sputtering technology, multi-layer low-E coatings, and improved optical clarity. R&D efforts center on solar-control, UV-shielding, and self-cleaning surfaces that support sustainable building standards and smart façade designs. Production expansion in Asia, Europe, and the Middle East helps meet growing demand from skyscrapers, smart cities, and electric vehicle glazing. Many producers partner with construction firms and OEMs to secure long-term supply contracts. Continuous innovation in durability, energy efficiency, and lightweight design keeps competition intense across global markets.

Key Player Analysis

Recent Developments

- In January 2025, AGC Glass Europe announced a significant investment in a new production line for its FINEO ultra-thin insulating vacuum glass at the Lodelinsart facility in Belgium. The investment is intended to increase manufacturing capacity to meet customer demand for innovative glass solutions.

- In March 2024, Saint-Gobain, through a collaboration with SCZONE and Saint-Gobain Egypt, held a groundbreaking ceremony for a new flat glass factory in Sokhna, Egypt, and inaugurated a new solar farm at the site.

- In November 2023, Nippon Sheet Glass Co., Ltd. announced a new production line for solar glass in Malaysia as it started operations. Existing production line was converted into a TCO glass (transparent conductive oxide) production line.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Coating, Application, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low-E and solar-control coatings will rise due to green building rules.

- Smart façades and sensor-integrated glass will gain wider adoption in commercial projects.

- Electric vehicles will drive higher use of lightweight coated glass for heat and UV control.

- Solar farms will increase consumption of anti-reflective coated glass for better energy output.

- Self-cleaning and anti-fog coatings will expand in hospitals, airports, and high-rise buildings.

- Manufacturers will invest in automated sputtering lines to improve clarity and durability.

- Asia Pacific will record faster growth supported by rapid construction and urbanization.

- Architectural retrofitting projects will boost replacement demand for coated window panels.

- Partnerships between coating suppliers and OEMs will strengthen global supply networks.

- New multifunction coatings will combine heat rejection, shatter protection, and optical performance.

Market Segmentation Analysis:

Market Segmentation Analysis: